CoreSite Realty Corporation (NYSE: COR), provider of network

dense, cloud enabled data center solutions, today announced

financial results for the second quarter ended June 30, 2013.

Quarterly Highlights

- Reported second-quarter funds from

operations (“FFO”) of $0.45 per diluted share and unit,

representing a 21.6% increase year-over-year

- Reported second-quarter operating

revenue of $57.7 million, representing a 13.9% increase

year-over-year

- Executed new and expansion data center

leases representing $5.8 million of annualized GAAP rent at a rate

of $188 of annualized GAAP rent per square foot

- Realized rent growth on signed renewals

of 5.4% on a cash basis and 11.7% on a GAAP basis and rental churn

of 2.0%

- Commenced 42,672 net rentable square

feet of new and expansion leases with annualized GAAP rent of $147

per square foot

Tom Ray, CoreSite’s Chief Executive Officer, commented, “We are

pleased to record a solid quarter of growth for CoreSite, and

importantly, one that reflects the continued success we are seeing

in our network-centric, differentiated strategy. We remain focused

upon continuing to increase the number and quality of customer

deployments in our portfolio and enhancing the value proposition of

the CoreSite Mesh. We executed 115 new and expansion leases in the

quarter including agreements with 33 new customers. Additionally,

we are pleased with the continued evolution we saw in our sales

mix, recording an increasing number of leases bringing high-value

applications to our platform.” Mr. Ray continued, “Regarding

growth, we continue to invest to meet customer demand, with four

data center projects under way. We believe that we have

considerable upside embedded in our portfolio as we increase the

utilization of existing and new inventory, positively mark to

market expiring capacity, and most importantly, continue to drive

increased network density and valuable customer communities across

our data centers.”

Financial Results

CoreSite reported FFO attributable to shares and units of $21.1

million for the three months ended June 30, 2013, a 22.0% increase

year-over-year and an increase of 9.6% sequential

quarter-over-quarter. On a per diluted share and unit basis, FFO

increased 21.6% to $0.45 for the three months ended June 30, 2013,

as compared to $0.37 per diluted share and unit for the three

months ended June 30, 2012. Total operating revenue for the three

months ended June 30, 2013, was $57.7 million, a 13.9% increase

year-over-year. CoreSite reported net income for the three months

ended June 30, 2013, of $7.9 million and net income attributable to

common shares of $2.6 million, or $0.12 per diluted share.

Sales Activity

CoreSite executed new and expansion data center leases

representing $5.8 million of annualized GAAP rent during the

quarter, comprised of 30,810 NRSF at a weighted average GAAP rate

of $188 per NRSF.

CoreSite’s renewal leases signed in the second quarter totaled

44,702 NRSF at a weighted average GAAP rate of $166 per NRSF,

reflecting a 5.4% increase in rent on a cash basis and an 11.7%

increase on a GAAP basis. The second quarter rental churn rate was

2.0%.

CoreSite’s second quarter data center lease commencements

totaled 42,672 NRSF at a weighted average GAAP rental rate of $147

per NRSF, which represents $6.3 million of annualized GAAP

rent.

Development Activity

CoreSite had 236,673 NRSF of data center space under

construction at four key locations as of June 30, 2013. The

projects under construction include new data centers at SV5 (San

Francisco Bay area), VA2 (Northern Virginia area), NY2 (New York)

and additional inventory at LA2 (Los Angeles). As of June 30, 2013,

CoreSite had incurred $59.4 million of the estimated $188.0 million

required to complete these projects.

Balance Sheet and

Liquidity

As of June 30, 2013, CoreSite had $132.0 million of total

long-term debt equal to 1.2x annualized adjusted EBITDA and

long-term debt and preferred stock equal to 2.3x annualized

adjusted EBITDA.

At quarter end, CoreSite had $2.8 million of cash available on

its balance sheet and $324.5 million of available capacity under

its credit facility.

Dividend

On May 24, 2013, CoreSite announced a dividend of $0.27 per

share of common stock and common stock equivalents for the second

quarter of 2013. The dividend was paid on July 15, 2013, to

shareholders of record on June 28, 2013.

CoreSite also announced on May 24, 2013, a dividend of $0.4531

per share of Series A preferred stock for the period April 15,

2013, to July 14, 2013. The preferred dividend was paid on July 15,

2013, to shareholders of record on June 28, 2013.

2013 Guidance

CoreSite is increasing and narrowing its FFO per share and OP

unit guidance to $1.76 to $1.84 from the prior range of $1.72 to

$1.82.

This outlook is predicated on current economic conditions,

internal assumptions about CoreSite’s customer base, and the supply

and demand dynamics of the markets in which CoreSite operates. The

guidance does not include the impact of any future financing,

investment or disposition activities.

Upcoming Conferences and

Events

CoreSite will participate in Bank of America’s 2013 Global Real

Estate Conference from September 11 through September 12 in New

York, New York.

Conference Call Details

CoreSite will host a conference call July 25, 2013, at 12:00

p.m., Eastern time (10:00 a.m. Mountain time), to discuss its

financial results, current business trends and market

conditions.

The call can be accessed live over the phone by dialing

877-407-3982 for domestic callers or 201-493-6780 for international

callers. A replay will be available shortly after the call and can

be accessed by dialing 877-870-5176 for domestic callers or

858-384-5517 for international callers. The passcode for the replay

is 416873. The replay will be available until August 1, 2013.

Interested parties may also listen to a simultaneous webcast of

the conference call by logging on to the company’s website at

www.CoreSite.com and clicking on the “Investors” tab. The on-line

replay will be available for a limited time beginning immediately

following the call.

About CoreSite

CoreSite Realty Corporation (NYSE: COR) is the data center

provider chosen by more than 750 of the world's leading carriers

and mobile operators, content and cloud providers, media and

entertainment companies, and global enterprises to run their

performance-sensitive applications and to connect and do business.

CoreSite propels customer growth and long-term competitive

advantage through the CoreSite Mesh by connecting the Internet,

private networking, mobility, and cloud communities within and

across its 14 high-performance data center campuses in eight

markets in North America. With direct access to 275+ carriers and

ISPs, over 180 leading cloud and IT service providers, inter-site

connectivity, and the nation's first Open Cloud Exchange that

provides access to thousands of lit buildings and multiple key

cloud on-ramps, CoreSite provides easy, efficient and valuable

gateways to global business opportunities. For more information,

visit www.CoreSite.com.

Forward Looking Statements

This earnings release and accompanying supplemental information

may contain forward-looking statements within the meaning of the

federal securities laws. Forward-looking statements relate to

expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. In some cases, you can

identify forward-looking statements by the use of forward-looking

terminology such as “believes,” “expects,” “may,” “will,” “should,”

“seeks,” “approximately,” “intends,” “plans,” “pro forma,”

“estimates” or “anticipates” or the negative of these words and

phrases or similar words or phrases that are predictions of or

indicate future events or trends and that do not relate solely to

historical matters. Forward-looking statements involve known and

unknown risks, uncertainties, assumptions and contingencies, many

of which are beyond CoreSite’s control, that may cause actual

results to differ significantly from those expressed in any

forward-looking statement. These risks include, without limitation:

the geographic concentration of the company’s data centers in

certain markets and any adverse developments in local economic

conditions or the demand for data center space in these markets;

fluctuations in interest rates and increased operating costs;

difficulties in identifying properties to acquire and completing

acquisitions; significant industry competition; the company’s

failure to obtain necessary outside financing; the company’s

failure to qualify or maintain its status as a REIT; financial

market fluctuations; changes in real estate and zoning laws and

increases in real property tax rates; and other factors affecting

the real estate industry generally. All forward-looking statements

reflect the company’s good faith beliefs, assumptions and

expectations, but they are not guarantees of future performance.

Furthermore, the company disclaims any obligation to publicly

update or revise any forward-looking statement to reflect changes

in underlying assumptions or factors, of new information, data or

methods, future events or other changes. For a further discussion

of these and other factors that could cause the company’s future

results to differ materially from any forward-looking statements,

see the section entitled “Risk Factors” in the company’s most

recent annual report on Form 10-K, and other risks described in

documents subsequently filed by the company from time to time with

the Securities and Exchange Commission.

Consolidated Balance Sheets (in thousands)

June 30,

2013

December 31,

2012

Assets: Investments in real estate: Land $ 76,227 $

85,868 Building and building improvements 652,142 596,405 Leasehold

improvements 91,175 85,907

819,544 768,180 Less: Accumulated depreciation and

amortization (129,038 ) (105,433 ) Net

investment in operating properties 690,506 662,747 Construction in

progress 104,963 61,328

Net investments in real estate 795,469

724,075 Cash and cash equivalents 2,803 8,130

Accounts and other receivables, net 7,930 9,901 Lease intangibles,

net 14,154 19,453 Goodwill 41,191 41,191 Other assets

45,312 42,582

Total assets

$ 906,859 $

845,332 Liabilities and equity:

Liabilities Revolving credit facility 73,000 - Mortgage

loans payable 59,000 59,750 Accounts payable and accrued expenses

50,127 50,624 Deferred rent payable 5,725 4,329 Acquired

below-market lease contracts, net 7,520 8,539 Prepaid rent and

other liabilities 11,590 11,317

Total liabilities 206,962

134,559 Stockholders' equity Series A

cumulative preferred stock 115,000 115,000 Common stock, par value

$0.01 208 207 Additional paid-in capital 263,479 259,009

Distributions in excess of net income (43,078

) (35,987 ) Total stockholders' equity 335,609 338,229

Noncontrolling interests 364,288

372,544

Total equity 699,897

710,773

Total liabilities and equity

$ 906,859 $

845,332 Consolidated Statement of

Operations (in thousands, except share and per share data)

Three Months Ended:

Six Months Ended:

June 30,

2013

March 31,

2013

June 30,

2012

June 30,

2013

June 30,

2012

Operating revenues:

Rental revenue $ 34,205 $ 33,102 $ 30,604 $ 67,307 $ 60,234 Power

revenue 14,486 13,529 12,939 28,015 25,313 Interconnection revenue

7,053 6,572 5,436 13,625 9,091 Tenant reimbursement and other

1,923 1,888 1,657

3,811 3,282 Total operating revenues

57,667 55,091 50,636 112,758 97,920

Operating expenses:

Property operating and maintenance 15,118 14,527 15,274 29,645

29,669 Real estate taxes and insurance 2,304 2,220 2,132 4,524

4,146 Depreciation and amortization 16,261 15,949 15,947 32,210

31,408 Sales and marketing 3,936 3,789 2,581 7,725 4,710 General

and administrative 6,177 7,003 6,036 13,180 12,388 Rent 4,756 4,793

4,691 9,549 9,268 Transaction costs 249

5 161 254 283

Total operating expenses 48,801 48,286

46,822 97,087 91,872

Operating income 8,866 6,805 3,814 15,671 6,048

Interest income 2 2 5 4 7 Interest expense (783 )

(439 ) (1,309 ) (1,222 ) (2,327 ) Income

before income taxes 8,085 6,368 2,510 14,453 3,728 Income tax

expense (206 ) (173 ) (662 ) (379 )

(537 ) Net income 7,879 6,195 1,848 14,074 3,191 Net income

attributable to noncontrolling interests 3,176

2,262 1,022 5,438

1,765 Net income attributable to CoreSite Realty Corporation

4,703 3,933 826 8,636 1,426 Preferred dividends

(2,085 ) (2,084 ) - (4,169 ) -

Net income attributable to common shares $ 2,618

$ 1,849 $ 826 $ 4,467 $ 1,426

Net income per share attributable to common shares: Basic $ 0.13 $

0.09 $ 0.04 $ 0.22 $ 0.07 Diluted $ 0.12 $ 0.09 $

0.04 $ 0.21 $ 0.07 Weighted average common

shares outstanding: Basic 20,829,375 20,673,896 20,532,930

20,752,065 20,494,402 Diluted 21,445,875 21,314,779 20,914,686

21,412,289 20,801,050

Reconciliation of Net Income

to FFO (in thousands, except share and per share data)

Three Months Ended Six Months

Ended

June 30,

2013

March 31,

2013

June 30,

2012

June 30,

2013

June 30,

2012

Net income $ 7,879 $ 6,195 $ 1,848 $ 14,074 $ 3,191 Real estate

depreciation and amortization 15,309 15,142

15,437 30,451 30,445 FFO $

23,188 $ 21,337 $ 17,285 $ 44,525 $ 33,636 Preferred stock

dividends (2,085 ) (2,084

) - (4,169 ) - FFO

available to common shareholders and OP unit holders

$ 21,103 $ 19,253 $ 17,285

$ 40,356 $ 33,636 Weighted average

common shares outstanding - diluted 21,445,875 21,314,779

20,914,686 21,412,289 20,801,050 Weighted average OP units

outstanding - diluted 25,353,709 25,353,709

25,346,097 25,353,709 25,345,590

Total weighted average shares and units outstanding - diluted

46,799,584 46,668,488 46,260,783 46,765,998 46,146,640 FFO per

common share and OP unit - diluted $ 0.45 $ 0.41

$ 0.37 $ 0.86 $ 0.73

Funds from Operations “FFO” is a supplemental measure of our

performance which should be considered along with, but not as an

alternative to, net income and cash provided by operating

activities as a measure of operating performance and liquidity. We

calculate FFO in accordance with the standards established by the

National Association of Real Estate Investment Trusts (“NAREIT”).

FFO represents net income (loss) (computed in accordance with

GAAP), excluding gains (or losses) from sales of property and

impairment write-downs of depreciable real estate, plus real estate

related depreciation and amortization (excluding amortization of

deferred financing costs) and after adjustments for unconsolidated

partnerships and joint ventures.

Our management uses FFO as a supplemental performance measure

because, in excluding real estate related depreciation and

amortization and gains and losses from property dispositions, it

provides a performance measure that, when compared year over year,

captures trends in occupancy rates, rental rates and operating

costs.

We offer this measure because we recognize that FFO will be used

by investors as a basis to compare our operating performance with

that of other REITs. However, because FFO excludes depreciation and

amortization and captures neither the changes in the value of our

properties that result from use or market conditions, nor the level

of capital expenditures and capitalized leasing commissions

necessary to maintain the operating performance of our properties,

all of which have real economic effect and could materially impact

our financial condition and results from operations, the utility of

FFO as a measure of our performance is limited. FFO is a non-GAAP

measure and should not be considered a measure of liquidity, an

alternative to net income, cash provided by operating activities or

any other performance measure determined in accordance with GAAP,

nor is it indicative of funds available to fund our cash needs,

including our ability to pay dividends or make distributions. In

addition, our calculations of FFO are not necessarily comparable to

FFO as calculated by other REITs that do not use the same

definition or implementation guidelines or interpret the standards

differently from us. Investors in our securities should not rely on

these measures as a substitute for any GAAP measure, including net

income.

Reconciliation of Net Income to EBITDA and

Adjusted EBITDA (in thousands)

Three

Months Ended: Six Months Ended:

June 30,

2013

March 31,

2013

June 30,

2012

June 30,

2013

June 30,

2012

Net income $ 7,879 $ 6,195 $ 1,848 $ 14,074 $ 3,191 Adjustments:

Interest expense, net of interest income 781 437 1,304 1,218 2,320

Income taxes 206 173 662 379 537 Depreciation and amortization

16,261 15,949

15,947 32,210 31,408

EBITDA $ 25,127 $ 22,754 $ 19,761 $ 47,881 $ 37,456 Non-cash

compensation 1,683 1,895 1,779 3,578 2,526 Transaction costs /

litigation 399 105

161 504 1,733 Adjusted

EBITDA $ 27,209 $ 24,754 $

21,701 $ 51,963 $ 41,715

EBITDA is defined as earnings before interest, taxes,

depreciation and amortization. We calculate adjusted EBITDA by

adding our non-cash compensation expense, transaction costs and

litigation expense to EBITDA as well as adjusting for the impact of

gains or losses on early extinguishment of debt. Management uses

EBITDA and adjusted EBITDA as indicators of our ability to incur

and service debt. In addition, we consider EBITDA and adjusted

EBITDA to be appropriate supplemental measures of our performance

because they eliminate depreciation and interest, which permits

investors to view income from operations without the impact of

non-cash depreciation or the cost of debt. However, because EBITDA

and adjusted EBITDA are calculated before recurring cash charges

including interest expense and taxes, and are not adjusted for

capital expenditures or other recurring cash requirements of our

business, their utilization as a cash flow measurement is

limited.

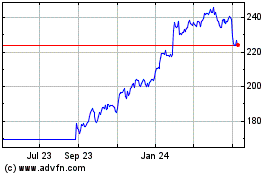

Cencora (NYSE:COR)

Historical Stock Chart

From May 2024 to Jun 2024

Cencora (NYSE:COR)

Historical Stock Chart

From Jun 2023 to Jun 2024