false

0001169770

0001169770

2024-01-25

2024-01-25

0001169770

us-gaap:CommonStockMember

2024-01-25

2024-01-25

0001169770

banc:DepositarySharesEachRepresenting140Member

2024-01-25

2024-01-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

in

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 25, 2024

BANC OF CALIFORNIA, INC.

(Exact name of registrant as specified in its

charter)

| Maryland |

001-35522 |

04-3639825 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

11611

San Vicente Boulevard, Suite 500 |

|

| Los Angeles,

California |

90049 |

| (Address

of principal executive offices) |

(Zip

Code) |

Registrant’s telephone number, including

area code: (855) 361-2262

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

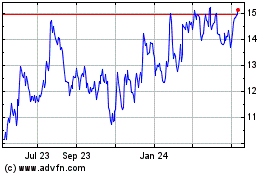

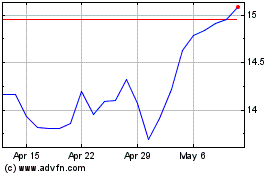

| Common Stock, par value

$0.01 per share |

|

BANC |

|

New York Stock Exchange |

| Depositary Shares, each representing a 1/40th interest

in a share of 7.75% fixed rate reset non-cumulative perpetual preferred stock, Series F |

|

BANC/PF |

|

New York Stock Exchange |

Item 2.02 Results of Operations and Financial Condition.

On January 25, 2024, Banc of California, Inc. (the “Company”)

issued a press release announcing 2023 fourth quarter financial results.

A copy of the press release is attached to this report as Exhibit

99.1 and is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

The Company will host a conference call to discuss its fourth

quarter results at 10:00 A.M. Pacific Time on Thursday, January 25, 2024. Interested parties may attend the conference call by

dialing (888) 317-6003, and referencing event code 4864870. A live audio webcast will be available through the webcast link to be

posted on the Company’s Investor Relations website at www.bancofcal.com/investor, in addition to the slide presentation

for investor review prior to the call. A copy of the presentation materials is attached to this report as Exhibit 99.2 and is

incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| 104 | Cover Page Interactive Data File (embedded within the Inline

XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BANC OF CALIFORNIA,

INC. |

| |

|

| January 25, 2024 |

/s/

Joseph Kauder |

| |

Joseph Kauder |

| |

Executive Vice President and Chief Financial

Officer |

Exhibit 99.1

Banc

of California, Inc. Reports Fourth Quarter 2023 Financial Results Following Completion of Transformational Merger with PacWest Bancorp

Company Release - 1/25/2024

LOS ANGELES, Calif.--(BUSINESS WIRE)--Banc of California, Inc.

(NYSE: BANC) (“Banc of California”), parent of wholly-owned subsidiary Banc of California (the “Bank”), today

reported financial results for the fourth quarter and year ended December 31, 2023. On November 30, 2023, Banc of California

and PacWest Bancorp closed their transformational merger, creating California’s premier business bank. As of December 31,

2023, Banc of California had total assets of $38.5 billion.

Fourth quarter highlights include:

| ● | As

a result of the impact of the merger and the balance sheet repositioning, total assets

of $38.5 billion increased $1.7 billion and total loans increased $3.6 billion, or 16% from

the prior quarter, resulting in a year-end loans to deposits ratio of 84%. |

| ● | Total

deposits of $30.4 billion increased $3.8 billion, an increase of 14% from the prior quarter,

and noninterest-bearing deposits of $7.8 billion increased $2.2 billion, or 39% from the

prior quarter. Borrowings decreased $3.4 billion, or 54% from the prior quarter. |

“Following the merger with PacWest, we have

created California’s premier relationship-focused business bank.”

– Jared

Wolff

President & CEO

| ● | Completed

asset sales of $6.1 billion and completed paydown of $8.6 billion high-cost funding related

to the balance sheet repositioning, which improved the mix of earning assets and reduced

higher cost funding. Wholesale fundings as a percentage of total assets down to 17%, compared

to 28% in the prior quarter. |

| ● | Improved

overall deposit mix, with the period-end noninterest-bearing deposit percentage increasing

from 21% of total deposits at the prior quarter-end to 26% at year-end and brokered time

deposits decreasing from 15% of total deposits at the prior quarter-end to 12% at year-end. |

| ● | Significant

decrease in unrealized losses on securities, with unrealized losses in accumulated other

comprehensive income (“AOCI”) of $434 million at year-end compared to $879 million

at the prior quarter-end, resulting from security sales and decreased market forward rates

in the fourth quarter. |

| ● | High

liquidity levels, with immediately available on-balance sheet liquidity and unused borrowing

capacity of $17.2

billion, which was 2.5 times greater than uninsured and uncollateralized deposits. Cash as

a percentage of total assets was 14%, down from 17% in the prior quarter. |

| 1 |

| ● | Strong

capital ratios well above the regulatory thresholds for "well capitalized"

banks, including an estimated 16.40%

Total risk-based capital ratio, 12.42% Tier

1 capital ratio, 10.12% CET1 capital ratio and 9.00%

Tier 1 leverage ratio. |

| ● | Allowance

for credit losses of 1.22%, up from 1.15% at the prior quarter-end after a provision

for credit losses of $47.0 million, which includes a $22.2 million initial provision related

to non-purchased credit deteriorated (“non-PCD”) loan balances. |

| ● | Strong

credit quality, with year-end nonperforming loans to total loans at 0.29%, down from

0.57% at the prior quarter-end. |

| ● | Increased

stockholders’ equity as a result of the merger, with total stockholders’

equity increasing by $1.0 billion in the fourth quarter resulting in book value per share

of $17.12

and tangible book value per share(1) of

$14.96. |

| (1) | Non-GAAP

measure; refer to section 'Non-GAAP Measures' |

Jared Wolff, President & CEO of Banc of California,

commented, "Since closing our transformational merger with PacWest Bancorp on November 30, 2023, we have made excellent progress

on the integration and the balance sheet repositioning actions that we indicated at the time of the merger announcement. As a result,

we have created the well capitalized, highly-liquid financial institution we envisioned, with significant earnings potential and a strong

position in key California markets.”

Mr. Wolff continued, “As we move through

2024, we will realize more of the benefits of our balance sheet repositioning, which will positively impact our net interest margin,

as well as steadily reduce our noninterest expense as we complete the system conversion in the second quarter of 2024 and consolidate

some of our branches that are in close proximity to each other. While we will remain conservative in our new loan production until economic

conditions improve, we are already seeing the positive benefits of being a larger, stronger financial institution on our business development

efforts. Given the strength of our franchise and the superior level of service, solutions and expertise that we can provide, we believe

we have great opportunities to consistently add attractive client relationships that provide both operating deposit accounts and high

quality loans, particularly given the significant changes we have seen over the past two years in the California banking landscape with

many competitors exiting or significantly pulling back from the market. We believe we are well-positioned to deliver strong financial

performance for our shareholders in 2024, as well as capitalize on the strong market position we have created in California to greatly

enhance the value of our franchise in the coming years.”

Presentation of Results – PacWest Bancorp

Merger

On November 30, 2023, PacWest Bancorp merged

with and into Banc of California (the “Merger”), with Banc of California continuing as the surviving legal corporation and

Banc of California concurrently closed a $400 million equity capital raise. The Merger was accounted for as a reverse merger using the

acquisition method of accounting, therefore, PacWest Bancorp was deemed the acquirer for financial reporting purposes, even though Banc

of California was the legal acquirer. The Merger was an all-stock transaction and has been accounted for as a business combination. Banc

of California’s financial results for all periods ended prior to November 30, 2023 reflect PacWest Bancorp results only on

a standalone basis. In addition, Banc of California’s reported financial results for the three months and year ended December 31,

2023 reflect PacWest Bancorp financial results only on a standalone basis until the closing of the Merger on November 30, 2023,

and results of the combined company for the month of December 2023. The number of shares issued and outstanding, earnings per share,

and all references to share quantities or metrics of Banc of California have been retrospectively restated to reflect the equivalent

number of shares issued in the Merger as the Merger was accounted for as a reverse merger. Under the reverse merger method of accounting,

the assets and liabilities of legacy Banc of California as of November 30, 2023 were recorded at their respective estimated fair

values.

The Company recorded a net loss of $492.9

million, or a loss of $4.55 per diluted common share, for the fourth

quarter of 2023. This compares to a net loss of $33.3

million, or a loss of $0.42 per diluted common share, for the third

quarter of 2023. The fourth quarter of

2023 included pre-tax amounts of $442.4 million of losses on

security sales relating to our previously announced balance sheet repositioning strategy, merger costs of $111.8 million, an FDIC special

assessment of $32.7 million, and an initial credit provision on acquired loans of $22.2 million, in each case in connection with our

merger with PacWest Bancorp. The fourth quarter also included borrowing facility and termination fees of $19.5 million, additional expenses

related to the HOA business of $16.8 million, and various nonrecurring expenses of approximately $8.7 million.

| 2 |

INCOME STATEMENT HIGHLIGHTS

| | |

Three

Months Ended | | |

Year Ended | |

| | |

December 31, | | |

September 30, | | |

December 31, | | |

December 31, | |

| Summary Income Statement | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

(In thousands) | |

| Total interest income | |

$ | 467,240 | | |

$ | 446,084 | | |

$ | 473,023 | | |

$ | 1,971,000 | | |

$ | 1,556,489 | |

| Total interest expense | |

| 316,189 | | |

| 315,355 | | |

| 150,084 | | |

| 1,223,872 | | |

| 265,727 | |

| Net interest income | |

| 151,051 | | |

| 130,729 | | |

| 322,939 | | |

| 747,128 | | |

| 1,290,762 | |

| Provision for credit losses | |

| 47,000 | | |

| - | | |

| 10,000 | | |

| 52,000 | | |

| 24,500 | |

| (Loss) gain on sale of loans | |

| (3,526 | ) | |

| (1,901 | ) | |

| 388 | | |

| (161,346 | ) | |

| 518 | |

| Loss on sale of securities | |

| (442,413 | ) | |

| - | | |

| (49,302 | ) | |

| (442,413 | ) | |

| (50,321 | ) |

| Other noninterest income | |

| 45,537 | | |

| 45,709 | | |

| 29,958 | | |

| 155,474 | | |

| 124,630 | |

| Total noninterest (loss) income | |

| (400,402 | ) | |

| 43,808 | | |

| (18,956 | ) | |

| (448,285 | ) | |

| 74,827 | |

| Total revenue | |

| (249,351 | ) | |

| 174,537 | | |

| 303,983 | | |

| 298,843 | | |

| 1,365,589 | |

| Goodwill impairment | |

| - | | |

| - | | |

| 29,000 | | |

| 1,376,736 | | |

| 29,000 | |

| Acquisition,

integration and reorganization costs | |

| 111,800 | | |

| 9,925 | | |

| 5,703 | | |

| 142,633 | | |

| 5,703 | |

| Other noninterest expense | |

| 251,838 | | |

| 191,178 | | |

| 192,129 | | |

| 938,812 | | |

| 738,818 | |

| Total noninterest expense | |

| 363,638 | | |

| 201,103 | | |

| 226,832 | | |

| 2,458,181 | | |

| 773,521 | |

| (Loss) earnings before income taxes | |

| (659,989 | ) | |

| (26,566 | ) | |

| 67,151 | | |

| (2,211,338 | ) | |

| 567,568 | |

| Income tax (benefit) expense | |

| (177,034 | ) | |

| (3,222 | ) | |

| 17,642 | | |

| (312,201 | ) | |

| 143,955 | |

| Net (loss) earnings | |

| (482,955 | ) | |

| (23,344 | ) | |

| 49,509 | | |

| (1,899,137 | ) | |

| 423,613 | |

| Preferred stock dividends | |

| 9,947 | | |

| 9,947 | | |

| 9,947 | | |

| 39,788 | | |

| 19,339 | |

| Net (loss) earnings

available to common and equivalent stockholders | |

$ | (492,902 | ) | |

$ | (33,291 | ) | |

$ | 39,562 | | |

$ | (1,938,925 | ) | |

$ | 404,274 | |

Net Interest Income

Q4-2023 vs Q3-2023

Net interest income increased by $20.3

million, or 15.5%, to $151.1 million for

the fourth quarter due primarily to a change in the interest-earning asset mix combined with net

interest margin expansion.

Average interest-earning assets of $35.4

billion decreased by $0.4 billion from the prior quarter due to the

sales of loans and securities, partially offset by acquired legacy Banc of California interest-earning assets. The net interest

margin increased by 24 basis points to 1.69% for the fourth quarter as the yield on average interest-earning assets increased by 29 basis

points, while the cost of average total funds increased by 7 basis points. The net interest margin for the month of December 2023

was 2.15% and the estimated spot net interest margin at December 31, 2023 was 2.75%.

The yield on average interest-earning

assets increased by 29 basis points to 5.23% for the fourth quarter from

4.94% in the third quarter due mainly to the change in the interest-earning

asset mix driven by the increase in the balance of average loans and leases as a percentage of average interest-earning assets from 62%

to 67%, the decrease in the balance of average investment securities as a percentage of average interest-earning assets from 19% to 17%,

and the balance of average deposits in financial institutions as a percentage of average interest-earning assets from 19% to 16%. The

yield on average loans and leases increased by 28 basis points to 5.82% during the fourth

quarter as a result of higher discount accretion income and changes in portfolio mix from loan sales and

acquired loans and leases.

| 3 |

The cost of average total funds increased

by 7 basis points to 3.68% for the fourth quarter from 3.61%

in the third quarter due mainly to higher market interest rates on borrowings.

The cost of average total deposits decreased by 4 basis points to 2.94% for the fourth quarter

compared to 2.98% in the third quarter.

The cost of average interest-bearing liabilities increased by 17 basis points to 4.51% for

the fourth quarter from 4.34% in the third quarter.

Average noninterest-bearing deposits increased by $0.5 billion for the fourth quarter compared

to the third quarter and average total deposits increased by $0.6 billion.

The estimated spot rates, or exit run-rates, at December 31,

2023 were 6.18% for loans and leases and 5.63% for interest-earning assets. The spot rates at December 31, 2023 were 2.69%

for total deposits and 2.99% for the total cost of funds.

Full Year 2023 vs Full

Year 2022

Net interest income

decreased by $543.6 million, or 42.1%, to $747.1 million

for the year ended December 31, 2023 from

the same period in 2022, due primarily to higher funding costs from higher market interest rates,

changes in the balance sheet mix, and the enhanced liquidity management strategies in the first half of 2023 due to the operating environment.

The net interest margin decreased by

151 basis points to 1.98% as the cost of average total funds increased by 260 basis

points, while the yield on average interest-earning assets increased by 101 basis points.

The yield on average interest-earning

assets increased by 101 basis points to 5.21% for the year ended December 31,

2023 from 4.20% for the same period in 2022 due

mainly to higher market interest rates, partially offset by the changes in the mix of average interest-earning assets. The yield on average

loans and leases increased by 85 basis points to 5.92% for the

year ended December 31, 2023 compared to the year

ended December 31, 2022. The yield on average investment securities

increased by 20 basis points to 2.56% for the same period. Average loans and leases represented 67%

of average interest-earnings assets for the year ended December 31,

2023 compared to 70% for the year ended December 31,

2022. Average loans and leases decreased by $714.1 million due mainly

to loan sales during the year to increase liquidity to fund potential deposit outflows.

The cost of average total funds increased by 260 basis points to 3.34%

for the year ended December 31, 2023 from 0.74% for the year ended December 31, 2022 due mainly to higher market interest rates

and changes in the balance sheet mix. The cost of average total deposits increased by 202 basis points to 2.61% for the year ended December 31,

2023 compared to the same period in 2022. The cost of average interest-bearing liabilities increased by 296 basis points to 4.14% for

the year ended December 31, 2023 compared to 1.18% for the same period in 2022 driven primarily by a 249 basis point increase in

the cost of average interest-bearing deposits to 3.46% from 0.97% for the same period in 2022. The increase in the cost of these funding

sources was due mainly to the impact of higher market interest rates. Average noninterest-bearing deposits decreased by $6.5 billion

for the year ended December 31, 2023 compared to the same period in 2022 and average total deposits decreased by $5.6 billion. Average

noninterest-bearing deposits represented 25% of total average deposits for the year ended December 31, 2023 compared to 40% for

the same period in 2022.

| 4 |

Provision For Credit Losses

Q4-2023 vs Q3-2023

The provision for credit losses was $47.0

million for the fourth quarter and included an initial provision of $22.2 million for acquired legacy

Banc of California non-PCD loans. Outside this initial provision, the quarter’s expense was driven

by $13.2 million of net charge-offs and a need for increased quantitative reserves resulting from revising the economic forecast to reflect

a 60% probability weighting on recessionary scenarios and updating expected prepayment speeds based on a high interest rate environment.

There was no provision for credit losses for the third quarter which included an $8.0 million

provision for loan losses related to higher qualitative reserves on office loans, offset by an $8.0

million reversal of the provision for credit losses related to lower unfunded loan commitments.

Full Year 2023 vs Full Year 2022

During the year ended December 31,

2023, the provision for credit losses was $52.0 million and included

a $113.5 million provision for loan losses, offset partially by a $61.5 million reversal

of the provision for credit losses related to lower unfunded loan commitments. The provision for loan losses included an initial provision

of $22.2 million for acquired legacy Banc of California non-PCD loans. The provision for credit losses was $23.0 million during

the year ended December 31, 2022, and included a $5.0 million

provision for loan losses and an $18.0 million provision related to higher unfunded loan commitments.

Noninterest Income

Q4-2023 vs Q3-2023

Noninterest income decreased by $444.2

million to a loss of $400.4 million for the fourth quarter due

almost entirely to an increase in the loss on sale of securities of $442.4 million. As part of our balance sheet repositioning strategy,

we sold $2.7 billion of legacy PacWest available-for-sale securities in the fourth quarter resulting in losses of $442.4 million. Additionally,

we sold $0.8 billion of legacy Banc of California available-for-sale securities in December 2023 resulting in no gain or loss as

these securities were marked to fair value at the close of the merger.

Full Year 2023 vs Full Year 2022

Noninterest income for the year

ended December 31, 2023 decreased by $523.1 million to

a loss of $448.3 million compared to the same period in 2022 due

mainly to a $392.1 million increase in the loss on the sale of securities and a $161.9 million increase in the loss on the sale

of loans, offset partially by higher dividends and gains from equity investments, higher leased equipment

income, and higher other income primarily from legal settlements totaling $22.1 million.

| 5 |

Noninterest Expense

Q4-2023 vs Q3-2023

Noninterest expense increased by $162.5

million to $363.6 million for the fourth quarter compared

to the third quarter. The increase was due mainly to acquisition, integration and reorganization

costs of $111.8 million related to our merger with PacWest, an increase in insurance and assessments expense of $21.7 million, which

includes $32.7 million for the FDIC special assessment, an increase of $18.9 million in customer related expense, and higher compensation

expense of $17.7 million.

Full Year 2023 vs Full Year 2022

Noninterest expense for the year

ended December 31, 2023 increased by $1.7 billion to

$2.5 billion compared to the same period in 2022. The increase

was due mainly to higher (i) goodwill impairment of $1.3 billion, (ii) acquisition, integration

and reorganization costs of $136.9 million, (iii) regulatory assessments of $110.2 million

due to the special FDIC assessment and the generally-applicable FDIC increased assessment rates in 2023,

(iv) customer related expense of $68.8 million, and (v) other expense of $96.8 million,

including $106.8 million of unfunded commitments fair value loss adjustments, offset partially by

lower compensation expense of $74.5 million.

Income Taxes

Q4-2023 vs Q3-2023

An income tax benefit of $177.0 million was recorded for the fourth

quarter resulting in an effective tax rate of 26.8% compared to a benefit of $3.2 million for the third quarter and an effective tax

rate of 12.1%.

Full Year 2023 vs Full Year 2022

Income tax benefit totaled $312.2 million for the year ended December 31,

2023, representing an effective tax rate of 14.1%, compared to tax expense of $144.0 million and an effective tax rate of 25.4% for the

year ended December 31, 2022. The lower effective tax rate in 2023 was primarily due to the effect of the non-deductible goodwill

impairment.

| 6 |

BALANCE SHEET HIGHLIGHTS

| | |

December 31, | | |

September 30, | | |

December 31, | | |

Increase

(Decrease) | |

| Selected Balance Sheet Items | |

2023 | | |

2023 | | |

2022 | | |

CQ vs PQ | | |

CQ vs PYQ | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(In thousands) | |

| Cash and cash equivalents | |

$ | 5,377,576 | | |

$ | 6,069,667 | | |

$ | 2,240,222 | | |

$ | (692,091 | ) | |

$ | 3,137,354 | |

| Securities available-for-sale | |

| 2,346,864 | | |

| 4,487,172 | | |

| 4,843,487 | | |

| (2,140,308 | ) | |

| (2,496,623 | ) |

| Securities held-to-maturity | |

| 2,287,291 | | |

| 2,282,586 | | |

| 2,269,135 | | |

| 4,705 | | |

| 18,156 | |

| Loan held for

investment, net of deferred fees | |

| 25,489,687 | | |

| 21,920,946 | | |

| 28,609,129 | | |

| 3,568,741 | | |

| (3,119,442 | ) |

| Total assets | |

| 38,534,064 | | |

| 36,877,833 | | |

| 41,228,936 | | |

| 1,656,231 | | |

| (2,694,872 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Noninterest-bearing deposits | |

$ | 7,774,254 | | |

$ | 5,579,033 | | |

$ | 11,212,357 | | |

$ | 2,195,221 | | |

$ | (3,438,103 | ) |

| Total deposits | |

| 30,401,769 | | |

| 26,598,681 | | |

| 33,936,334 | | |

| 3,803,088 | | |

| (3,534,565 | ) |

| Borrowings | |

| 2,911,322 | | |

| 6,294,525 | | |

| 1,764,030 | | |

| (3,383,203 | ) | |

| 1,147,292 | |

| Total liabilities | |

| 35,143,299 | | |

| 34,478,556 | | |

| 37,278,405 | | |

| 664,743 | | |

| (2,135,106 | ) |

| Total stockholders' equity | |

| 3,390,765 | | |

| 2,399,277 | | |

| 3,950,531 | | |

| 991,488 | | |

| (559,766 | ) |

Securities

The balance of securities held-to-maturity

(“HTM”) remained consistent through the fourth quarter and totaled $2.3 billion at December 31,

2023. As of December 31, 2023, HTM securities had aggregate unrealized

net after-tax losses in AOCI of $181.4 million remaining from the balance established at the time of transfer on June 1,

2022. These HTM unrealized losses are related to changes in overall interest rates.

Securities available-for-sale (“AFS”)

decreased by $2.1 billion during the fourth quarter to $2.3

billion at December 31, 2023, due primarily to legacy PacWest securities sales of $2.7 billion,

offset partially by a reduction in the unrealized net pre-tax losses. The decrease in unrealized

net losses was due to the impact of lower market interest rate forward curves. AFS securities had aggregate

unrealized net after-tax losses in AOCI of $252.2 million. These AFS unrealized net losses related

primarily to changes in overall interest rates and spreads and the resulting impact on valuations.

| 7 |

Loans

The following table sets forth the composition, by

loan category, of our loan portfolio as of the dates indicated:

| | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | |

| Composition of Loans and Leases | |

2023 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(Dollars in thousands) | |

| Real estate mortgage: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Commercial | |

$ | 5,026,497 | | |

$ | 3,526,308 | | |

$ | 3,610,320 | | |

$ | 3,808,751 | | |

$ | 3,846,831 | |

| Multi-family | |

| 6,025,179 | | |

| 5,279,659 | | |

| 5,304,544 | | |

| 5,523,320 | | |

| 5,607,865 | |

| Other residential | |

| 5,060,309 | | |

| 5,228,524 | | |

| 5,373,178 | | |

| 6,075,540 | | |

| 6,275,628 | |

| Total real estate

mortgage | |

| 16,111,985 | | |

| 14,034,491 | | |

| 14,288,042 | | |

| 15,407,611 | | |

| 15,730,324 | |

| Real estate construction and land: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Commercial | |

| 759,585 | | |

| 465,266 | | |

| 415,997 | | |

| 910,327 | | |

| 898,592 | |

| Residential | |

| 2,399,684 | | |

| 2,272,271 | | |

| 2,049,526 | | |

| 3,698,113 | | |

| 3,253,580 | |

| Total real estate

construction and land | |

| 3,159,269 | | |

| 2,737,537 | | |

| 2,465,523 | | |

| 4,608,440 | | |

| 4,152,172 | |

| Total real estate | |

| 19,271,254 | | |

| 16,772,028 | | |

| 16,753,565 | | |

| 20,016,051 | | |

| 19,882,496 | |

| Commercial: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Asset-based | |

| 2,189,085 | | |

| 2,287,893 | | |

| 2,357,098 | | |

| 2,068,327 | | |

| 5,140,209 | |

| Venture capital | |

| 1,446,362 | | |

| 1,464,160 | | |

| 1,723,476 | | |

| 2,058,237 | | |

| 2,033,302 | |

| Other commercial | |

| 2,129,860 | | |

| 1,002,377 | | |

| 1,014,212 | | |

| 1,102,543 | | |

| 1,108,451 | |

| Total commercial | |

| 5,765,307 | | |

| 4,754,430 | | |

| 5,094,786 | | |

| 5,229,107 | | |

| 8,281,962 | |

| Consumer | |

| 453,126 | | |

| 394,488 | | |

| 409,859 | | |

| 427,223 | | |

| 444,671 | |

| Total

loans and leases held for investment, net of deferred fees | |

$ | 25,489,687 | | |

$ | 21,920,946 | | |

$ | 22,258,210 | | |

$ | 25,672,381 | | |

$ | 28,609,129 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total unfunded loan commitments | |

$ | 5,578,907 | | |

$ | 5,289,221 | | |

$ | 5,845,375 | | |

$ | 9,776,789 | | |

$ | 11,110,264 | |

| Composition as % of Total

| |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | |

| Loans and Leases | |

2023 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | |

| Real estate mortgage: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Commercial | |

| 20 | % | |

| 16 | % | |

| 16 | % | |

| 15 | % | |

| 13 | % |

| Multi-family | |

| 23 | % | |

| 24 | % | |

| 24 | % | |

| 21 | % | |

| 20 | % |

| Other residential | |

| 20 | % | |

| 24 | % | |

| 24 | % | |

| 24 | % | |

| 22 | % |

| Total real estate

mortgage | |

| 63 | % | |

| 64 | % | |

| 64 | % | |

| 60 | % | |

| 55 | % |

| Real estate construction and land: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Commercial | |

| 3 | % | |

| 2 | % | |

| 2 | % | |

| 4 | % | |

| 3 | % |

| Residential | |

| 9 | % | |

| 10 | % | |

| 9 | % | |

| 14 | % | |

| 11 | % |

| Total

real estate construction and land | |

| 12 | % | |

| 12 | % | |

| 11 | % | |

| 18 | % | |

| 14 | % |

| Total real estate | |

| 75 | % | |

| 76 | % | |

| 75 | % | |

| 78 | % | |

| 69 | % |

| Commercial: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Asset-based | |

| 9 | % | |

| 10 | % | |

| 11 | % | |

| 8 | % | |

| 18 | % |

| Venture capital | |

| 6 | % | |

| 7 | % | |

| 8 | % | |

| 8 | % | |

| 7 | % |

| Other commercial | |

| 8 | % | |

| 5 | % | |

| 4 | % | |

| 4 | % | |

| 4 | % |

| Total commercial | |

| 23 | % | |

| 22 | % | |

| 23 | % | |

| 20 | % | |

| 29 | % |

| Consumer | |

| 2 | % | |

| 2 | % | |

| 2 | % | |

| 2 | % | |

| 2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total

loans and leases held for investment, net of deferred fees | |

| 100 | % | |

| 100 | % | |

| 100 | % | |

| 100 | % | |

| 100 | % |

| 8 |

Total loans and leases ended the fourth quarter of 2023 at $25.5 billion,

up $3.6 billion from $21.9 billion at September 30, 2023, due primarily to the addition of $6.1 billion of legacy Banc of California

loans at fair value, partially offset by sales of legacy Banc of California loans totaling $2.2 billion in December as part of the

balance sheet repositioning. The loan sales consisted of $1.5 billion of single-family loans and $0.7 billion of multi-family loans.

Loan fundings were $212.2 million in the fourth quarter at a weighted-average rate of 7.37%.

Deposits and Client Investment Funds

The following table sets forth

the composition of our deposits at the dates indicated:

| | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | |

| Composition of Deposits | |

2023 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(Dollars in thousands) | |

| Noninterest-bearing checking | |

$ | 7,774,254 | | |

$ | 5,579,033 | | |

$ | 6,055,358 | | |

$ | 7,030,759 | | |

$ | 11,212,357 | |

| Interest-bearing: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Checking | |

| 7,808,764 | | |

| 7,038,808 | | |

| 7,112,807 | | |

| 5,360,622 | | |

| 7,938,911 | |

| Money market | |

| 6,187,889 | | |

| 5,424,347 | | |

| 5,678,323 | | |

| 8,195,670 | | |

| 9,469,586 | |

| Savings | |

| 1,997,989 | | |

| 1,441,700 | | |

| 897,277 | | |

| 671,918 | | |

| 577,637 | |

| Certificates of deposit: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-brokered | |

| 3,139,270 | | |

| 3,038,005 | | |

| 2,725,265 | | |

| 2,502,914 | | |

| 2,434,414 | |

| Brokered | |

| 3,493,603 | | |

| 4,076,788 | | |

| 5,428,053 | | |

| 4,425,678 | | |

| 2,303,429 | |

| Total certificates

of deposit | |

| 6,632,873 | | |

| 7,114,793 | | |

| 8,153,318 | | |

| 6,928,592 | | |

| 4,737,843 | |

| Total interest-bearing | |

| 22,627,515 | | |

| 21,019,648 | | |

| 21,841,725 | | |

| 21,156,802 | | |

| 22,723,977 | |

| Total deposits | |

$ | 30,401,769 | | |

$ | 26,598,681 | | |

$ | 27,897,083 | | |

$ | 28,187,561 | | |

$ | 33,936,334 | |

| | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | |

| Composition as % of Total Deposits | |

2023 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | |

| Noninterest-bearing checking | |

| 26 | % | |

| 21 | % | |

| 22 | % | |

| 25 | % | |

| 33 | % |

| Interest-bearing: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Checking | |

| 26 | % | |

| 27 | % | |

| 26 | % | |

| 19 | % | |

| 23 | % |

| Money market | |

| 20 | % | |

| 20 | % | |

| 20 | % | |

| 29 | % | |

| 28 | % |

| Savings | |

| 6 | % | |

| 5 | % | |

| 3 | % | |

| 2 | % | |

| 2 | % |

| Certificates of deposit: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-brokered | |

| 10 | % | |

| 12 | % | |

| 10 | % | |

| 9 | % | |

| 7 | % |

| Brokered | |

| 12 | % | |

| 15 | % | |

| 19 | % | |

| 16 | % | |

| 7 | % |

| Total certificates

of deposit | |

| 22 | % | |

| 27 | % | |

| 29 | % | |

| 25 | % | |

| 14 | % |

| Total interest-bearing | |

| 74 | % | |

| 79 | % | |

| 78 | % | |

| 75 | % | |

| 67 | % |

| Total deposits | |

| 100 | % | |

| 100 | % | |

| 100 | % | |

| 100 | % | |

| 100 | % |

Total deposits

increased by $3.8 billion during the fourth quarter of

2023 to $30.4 billion at December 31, 2023,

due primarily to balances acquired in the merger, partially offset by a decrease in brokered deposits.

Noninterest-bearing checking totaled

$7.77 billion and represented 26% of total deposits at December 31,

2023, compared to $5.58 billion, or 21% of

total deposits, at September 30, 2023. Period-end noninterest-bearing deposit balance and percentage

both increased in the quarter primarily due to balances acquired in the merger.

Insured deposits of $23.1 billion

represented 76% of total deposits at December 31, 2023,

compared to insured deposits of $21.6 billion or 81% of total

deposits at September 30, 2023.

| 9 |

In addition to deposit products, we also offer alternative, non-depository

corporate treasury solutions for select clients to invest excess liquidity. These alternative options include investments managed by

BofCal Asset Management Inc. (“BAM”), our registered investment advisor subsidiary, and third-party sweep products. Total off-balance

sheet client investment funds were $0.7 billion as of September 30, 2023 and decreased to $0.6 billion at December 31, 2023,

of which $0.2 billion was managed by BAM.

Borrowings

Borrowings decreased by $3.4 billion from $6.3 billion

at September 30, 2023, to $2.9 billion at year-end as proceeds from asset sales were used to pay down the Bank Term Funding Program

balance by $2.3 billion and pay off a $1.3 billion repurchase agreement. We chose to carry higher on-balance sheet liquidity while we

executed the balance sheet repositioning and have the ability to strategically pay down or pay off the $2.6 billion remaining Bank Term

Funding Program balance at our discretion.

Equity

During the fourth quarter,

total stockholders’ equity increased by $1.0 billion to $3.4 billion and

tangible common equity(1) increased by $651.6 million to $2.5 billion at

December 31, 2023. The increase in total stockholders’ equity for the fourth quarter

resulted from Banc of California shares issued in exchange for PacWest Bancorp shares as Merger consideration

and shares issued in connection with the $400 million capital raise and lower accumulated other comprehensive loss, partially offset

by the net loss in the fourth quarter and by dividends declared and paid.

At December 31, 2023, book value

per common share decreased to $17.12, compared to $24.12 at September 30, 2023, which was retrospectively restated under

the reverse merger method of accounting. The linked-quarter change in book value per share reflects Banc

of California shares issued as Merger consideration in exchange for PacWest Bancorp shares and in connection with the $400 million capital

raise, the net loss in the fourth quarter and lower accumulated other comprehensive loss. Tangible book value per common share(1) decreased

to $14.96, compared to $23.81 restated at September 30, 2023, mainly as a result of Banc of California shares issued in exchange

for PacWest Bancorp shares as Merger consideration and shares issued in connection with the $400 million capital raise combined with

$199 million of goodwill and $145 million of core deposit intangible assets added through the merger.

| (1) | Non-GAAP

measures; refer to section 'Non-GAAP Measures' |

| 10 |

CAPITAL AND LIQUIDITY

Capital ratios remain strong with total

risk-based capital at 16.40% and a tier 1 leverage ratio of 9.00% at

December 31, 2023. The following table sets forth our regulatory capital ratios as of the dates

indicated:

| | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | |

| Capital Ratios | |

2023 (1) | | |

2023 | | |

2023 | | |

2023 | | |

2022 | |

| Banc of California, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total risk-based capital

ratio | |

| 16.40 | % | |

| 17.83 | % | |

| 17.61 | % | |

| 14.21 | % | |

| 13.61 | % |

| Tier 1 risk-based capital ratio | |

| 12.42 | % | |

| 13.84 | % | |

| 13.70 | % | |

| 11.15 | % | |

| 10.61 | % |

| Common equity tier 1 capital ratio | |

| 10.12 | % | |

| 11.23 | % | |

| 11.16 | % | |

| 9.21 | % | |

| 8.70 | % |

| Tier 1 leverage capital ratio | |

| 9.00 | % | |

| 8.65 | % | |

| 7.76 | % | |

| 8.33 | % | |

| 8.61 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Banc of California | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total risk-based capital ratio | |

| 15.73 | % | |

| 16.37 | % | |

| 16.07 | % | |

| 12.94 | % | |

| 12.34 | % |

| Tier 1 risk-based capital ratio | |

| 13.24 | % | |

| 13.72 | % | |

| 13.48 | % | |

| 10.89 | % | |

| 10.32 | % |

| Common equity tier 1 capital ratio | |

| 13.24 | % | |

| 13.72 | % | |

| 13.48 | % | |

| 10.89 | % | |

| 10.32 | % |

| Tier 1 leverage capital ratio | |

| 9.62 | % | |

| 8.57 | % | |

| 7.62 | % | |

| 8.14 | % | |

| 8.39 | % |

(1) Capital information

for December 31, 2023 is preliminary.

At December 31, 2023,

immediately available cash and cash equivalents were $5.2 billion, a decrease of $0.7 billion

from September 30, 2023. Combined with total available borrowing

capacity of $12.0 billion, total liquid assets and unused borrowing capacity of $17.2 billion was

2.5 times greater than total uninsured and uncollateralized deposits of $6.9 billion.

| 11 |

CREDIT QUALITY

| | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | |

| Asset Quality Information and Ratios | |

2023 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(Dollars in thousands) | |

| Delinquent

loans and leases held for investment: | |

| | | |

| | | |

| | | |

| | | |

| | |

| 30 to 89 days delinquent | |

$ | 113,307 | | |

$ | 49,970 | | |

$ | 57,428 | | |

$ | 144,431 | | |

$ | 105,845 | |

| 90+ days delinquent | |

| 30,882 | | |

| 77,327 | | |

| 62,322 | | |

| 49,936 | | |

| 70,922 | |

| Total delinquent

loans and leases | |

$ | 144,189 | | |

$ | 127,297 | | |

$ | 119,750 | | |

$ | 194,367 | | |

$ | 176,767 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total delinquent

loans and leases to loans and leases held for investment | |

| 0.57 | % | |

| 0.58 | % | |

| 0.54 | % | |

| 0.76 | % | |

| 0.62 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nonperforming

assets, excluding loans held for sale: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nonaccrual loans and leases | |

$ | 62,527 | | |

$ | 125,396 | | |

$ | 104,886 | | |

$ | 87,124 | | |

$ | 103,778 | |

| 90+

days delinquent loans and still accruing | |

| 11,750 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Total nonperforming

loans and leases ("NPLs") | |

| 74,277 | | |

| 125,396 | | |

| 104,886 | | |

| 87,124 | | |

| 103,778 | |

| Foreclosed assets,

net | |

| 7,394 | | |

| 6,829 | | |

| 8,426 | | |

| 2,135 | | |

| 5,022 | |

| Total

nonperforming assets ("NPAs") | |

$ | 81,671 | | |

$ | 132,225 | | |

$ | 113,312 | | |

$ | 89,259 | | |

$ | 108,800 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allowance for loan and lease losses | |

$ | 281,687 | | |

$ | 222,297 | | |

$ | 219,234 | | |

$ | 210,055 | | |

$ | 200,732 | |

| Allowance for

loan and lease losses to NPLs | |

| 379.24 | % | |

| 177.28 | % | |

| 209.02 | % | |

| 241.10 | % | |

| 193.42 | % |

| NPLs to loans

and leases held for investment | |

| 0.29 | % | |

| 0.57 | % | |

| 0.47 | % | |

| 0.34 | % | |

| 0.36 | % |

| NPAs to total assets | |

| 0.21 | % | |

| 0.36 | % | |

| 0.30 | % | |

| 0.20 | % | |

| 0.26 | % |

At December 31, 2023,

total delinquent loans and leases were $144.2 million, compared to $127.3 million at September 30,

2023. The increase was due mostly to delinquent Civic loans and leases acquired from legacy Banc of California. Total delinquent loans

and leases as a percentage of total loans and leases declined to 0.57% at December 31, 2023, as compared to 0.58% at September 30,

2023.

At December 31, 2023,

nonperforming loans were $74.3 million, and included $31.0 million of

other residential loans (mostly Civic), $27.4 million of CRE loans, $14.0 million of

commercial and industrial loans, $1.0 million of multi-family loans and $0.8 million of

consumer loans. During the fourth quarter, nonperforming loans decreased by $51.1 million

due to transfers to held for sale of $44.0 million, payoffs and paydowns of $26.6 million, net charge-offs

of $7.9 million, and borrowers that became current of $2.0 million,

offset partially by additions (including acquired loans) of $29.5 million. Nonperforming loans and

leases as a percentage of total loans and leases declined to 0.29% at December 31, 2023 compared to 0.57% at September 30,

2023.

At December 31, 2023,

nonperforming assets included $7.4 million of other real estate owned, consisting entirely of single-family

residences.

| 12 |

ALLOWANCE FOR CREDIT LOSSES - LOANS

| | |

Three

Months Ended | | |

Year Ended | |

| | |

December 31, | | |

September 30, | | |

December 31, | | |

December 31, | |

| Allowance for Credit Losses - Loans | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(Dollars in thousands) | |

| Allowance for loan and lease losses ("ALLL"): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at beginning of period | |

$ | 222,297 | | |

$ | 219,234 | | |

$ | 189,327 | | |

$ | 200,732 | | |

$ | 200,564 | |

| Initial ALLL on acquired PCD loans | |

| 25,623 | | |

| - | | |

| - | | |

| 25,623 | | |

| - | |

| Charge-offs | |

| (14,628 | ) | |

| (6,695 | ) | |

| (3,352 | ) | |

| (63,428 | ) | |

| (14,037 | ) |

| Recoveries | |

| 1,395 | | |

| 1,758 | | |

| 757 | | |

| 5,260 | | |

| 9,205 | |

| Net charge-offs | |

| (13,233 | ) | |

| (4,937 | ) | |

| (2,595 | ) | |

| (58,168 | ) | |

| (4,832 | ) |

| Provision for

loan losses | |

| 47,000 | (1) | |

| 8,000 | | |

| 14,000 | | |

| 113,500 | | |

| 5,000 | |

| Balance at end of period | |

$ | 281,687 | | |

$ | 222,297 | | |

$ | 200,732 | | |

$ | 281,687 | | |

$ | 200,732 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Reserve for unfunded loan commitments ("RUC"): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at beginning of period | |

$ | 29,571 | | |

$ | 37,571 | | |

$ | 95,071 | | |

$ | 91,071 | | |

$ | 73,071 | |

| (Negative provision)

provision for credit losses | |

| - | | |

| (8,000 | ) | |

| (4,000 | ) | |

| (61,500 | ) | |

| 18,000 | |

| Balance at end of period | |

$ | 29,571 | | |

$ | 29,571 | | |

$ | 91,071 | | |

$ | 29,571 | | |

$ | 91,071 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allowance for credit losses ("ACL") - Loans: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at beginning of period | |

$ | 251,868 | | |

$ | 256,805 | | |

$ | 284,398 | | |

$ | 291,803 | | |

$ | 273,635 | |

| Initial ALLL on acquired PCD loans | |

| 25,623 | | |

| - | | |

| - | | |

| 25,623 | | |

| - | |

| Charge-offs | |

| (14,628 | ) | |

| (6,695 | ) | |

| (3,352 | ) | |

| (63,428 | ) | |

| (14,037 | ) |

| Recoveries | |

| 1,395 | | |

| 1,758 | | |

| 757 | | |

| 5,260 | | |

| 9,205 | |

| Net charge-offs | |

| (13,233 | ) | |

| (4,937 | ) | |

| (2,595 | ) | |

| (58,168 | ) | |

| (4,832 | ) |

| Provision for

credit losses | |

| 47,000 | (1) | |

| - | | |

| 10,000 | | |

| 52,000 | | |

| 23,000 | |

| Balance at end of period | |

$ | 311,258 | | |

$ | 251,868 | | |

$ | 291,803 | | |

$ | 311,258 | | |

$ | 291,803 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| ALLL to loans and leases held for investment | |

| 1.11 | % | |

| 1.01 | % | |

| 0.70 | % | |

| 1.11 | % | |

| 0.70 | % |

| ACL to loans and leases held for investment | |

| 1.22 | % | |

| 1.15 | % | |

| 1.02 | % | |

| 1.22 | % | |

| 1.02 | % |

| ACL to NPLs | |

| 419.05 | % | |

| 200.86 | % | |

| 281.18 | % | |

| 419.05 | % | |

| 281.18 | % |

| ACL to NPAs | |

| 381.11 | % | |

| 190.48 | % | |

| 268.20 | % | |

| 381.11 | % | |

| 268.20 | % |

| Annualized net charge-offs to average loans and leases | |

| 0.22 | % | |

| 0.09 | % | |

| 0.04 | % | |

| 0.23 | % | |

| 0.02 | % |

(1) Includes

$22.2 million initial provision related to non-PCD loans acquired during the period.

The allowance for credit losses, which

includes the reserve for unfunded loan commitments, totaled $311.3 million, or 1.22% of

total loans and leases, at December 31, 2023, compared to $251.9 million,

or 1.15% of total loans and leases, at September 30, 2023.

The $59.4 million increase in the allowance includes the addition of $25.6 million related to legacy

Banc of California PCD loans booked at the Merger’s close and did not affect the income statement. The ACL provision for the fourth

quarter was $47.0 million, which includes an initial provision of $22.2 million for acquired legacy

Banc of California non-PCD loans. Outside this initial provision, the quarter’s expense was driven

by $13.2 million of net charge-offs and a need for increased quantitative reserves resulting from revising the economic forecast to reflect

a 60% probability weighting on recessionary scenarios and updating expected prepayment speeds based on a high interest rate environment.

The ACL coverage of nonperforming loans was 419% at December 31, 2023 compared

to 201% at September 30, 2023.

| 13 |

Net charge-offs were 0.22% of

average loans and leases (annualized) for the fourth quarter of 2023, compared to 0.09% for the third quarter of 2023. The increase in

net charge-offs in the fourth quarter of 2023 was due primarily to $5.3 million of charge-offs related to the transfer of Civic loans

to held for sale. At December 31, 2023, nonperforming assets were $81.7 million, or 0.21% of total assets, compared to $132.2 million,

or 0.36% of total assets, as of September 30, 2023.

Conference Call

The Company will host a conference call to discuss its fourth quarter

2023 financial results at 10:00 a.m. Pacific Time (PT) on Thursday, January 25, 2023. Interested parties are welcome to attend

the conference call by dialing (888) 317-6003 and referencing event code 4864870. A live audio webcast will also be available and the

webcast link will be posted on the Company’s Investor Relations website at www.bancofcal.com/investor. The slide presentation for

the call will also be available on the Company's Investor Relations website prior to the call. A replay of the call will be made available

approximately one hour after the call has ended on the Company’s Investor Relations website at www.bancofcal.com/investor

or by dialing (877) 344-7529 and referencing event code 7597241.

About Banc of California, Inc.

Banc of California, Inc. (NYSE: BANC) is a bank holding company

headquartered in Los Angeles with one wholly-owned banking subsidiary, Banc of California (the “bank”). Banc of California

is one of the nation’s premier relationship-based business banks focused on providing banking and treasury management services

to small-, middle-market, and venture-backed businesses. Banc of California offers a broad range of loan and deposit products and services

through more than 90 full-service branches throughout California and in Denver, Colorado, and Durham, North Carolina, as well as full-stack

payment processing solutions through its subsidiary, Deepstack Technologies. Banc of California also serves the Community Association

Management industry nationwide with its technology-forward platform SmartStreet™. The bank is committed to its local communities

by supporting organizations that provide financial literacy and job training, small business support, affordable housing, and more. For

more information, please visit us at www.bancofcal.com.

Forward-Looking Statements

This press release includes forward-looking statements within the

meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Words or phrases such as

“believe,” “will,” “should,” “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimate,” “project,” “plans,” “strategy,”

or similar expressions are intended to identify these forward-looking statements. You are cautioned not to place undue reliance on any

forward-looking statements. These statements are necessarily subject to risk and uncertainty and actual results could differ materially

from those anticipated due to various factors, including those set forth from time to time in the documents filed or furnished by Banc

of California, Inc. (the “Company”) with the Securities and Exchange Commission (“SEC”). The Company undertakes

no obligation to revise or publicly release any revision or update to these forward-looking statements to reflect events or circumstances

that occur after the date on which such statements were made, except as required by law.

| 14 |

Factors that could cause actual results to differ

materially from the results anticipated or projected include, but are not limited to: (i) changes in general economic conditions,

either nationally or in our market areas, including the impact of supply chain disruptions, and the risk of recession or an economic

downturn; (ii) changes in the interest rate environment, including the recent and potential future increases in the FRB benchmark

rate, which could adversely affect our revenue and expenses, the value of assets and obligations, the availability and cost of capital

and liquidity, and the impacts of continuing inflation; (iii) the credit risks of lending activities, which may be affected by deterioration

in real estate markets and the financial condition of borrowers, and the operational risk of lending activities, including the effectiveness

of our underwriting practices and the risk of fraud, any of which may lead to increased loan delinquencies, losses, and non-performing

assets, and may result in our allowance for credit losses not being adequate; (iv) fluctuations in the demand for loans, and fluctuations

in commercial and residential real estate values in our market area; (v) the quality and composition of our securities portfolio;

(vi) our ability to develop and maintain a strong core deposit base, including among our venture banking clients, or other low cost

funding sources necessary to fund our activities particularly in a rising or high interest rate environment; (vii) the rapid withdrawal

of a significant amount of demand deposits over a short period of time; (viii) the costs and effects of litigation; (ix) risks

related to the Company’s acquisitions, including disruption to current plans and operations; difficulties in customer and employee

retention; fees, expenses and charges related to these transactions being significantly higher than anticipated; and our inability to

achieve expected revenues, cost savings, synergies, and other benefits; and in the case of our recent acquisition of PacWest Bancorp

(“PacWest”), reputational risk, regulatory risk and potential adverse reactions of the Company's or PacWest's customers,

suppliers, vendors, employees or other business partners; (x) results of examinations by regulatory authorities of the Company and

the possibility that any such regulatory authority may, among other things, limit our business activities, restrict our ability to invest

in certain assets, refrain from issuing an approval or non-objection to certain capital or other actions, increase our allowance for

credit losses, result in write-downs of asset values, restrict our ability or that of our bank subsidiary to pay dividends, or impose

fines, penalties or sanctions; (xi) legislative or regulatory changes that adversely affect our business, including changes in tax

laws and policies, accounting policies and practices, privacy laws, and regulatory capital or other rules; (xii) the risk that our

enterprise risk management framework may not be effective in mitigating risk and reducing the potential for losses; (xiii) errors

in estimates of the fair values of certain of our assets and liabilities, which may result in significant changes in valuation; (xiv) failures

or security breaches with respect to the network, applications, vendors and computer systems on which we depend, including due to cybersecurity

threats; (xv) our ability to attract and retain key members of our senior management team; (xvi) the effects of climate change,

severe weather events, natural disasters, pandemics, epidemics and other public health crises, acts of war or terrorism, and other external

events on our business; (xvii) the impact of bank failures or other adverse developments at other banks on general investor sentiment

regarding the stability and liquidity of banks; (xviii) the possibility that our recorded goodwill could become impaired, which

may have an adverse impact on our earnings and capital; (xix) our existing indebtedness, together with any future incurrence of

additional indebtedness, could adversely affect our ability to raise additional capital and to meet our debt obligations; (xx) the

risk that we may incur significant losses on future asset sales; and (xxi) other economic, competitive, governmental, regulatory,

and technological factors affecting our operations, pricing, products and services and the other risks described in this press release

and from time to time in other documents that we file with or furnish to the SEC.

| 15 |

| Investor

Relations Inquiries: |

| Banc

of California, Inc. |

| (855)

361-2262 |

| Jared

Wolff, (310) 424-1230 |

Joe Kauder,

(310) 844-5224 |

William

Black, (919) 597-7466 |

| |

| Media

Contact: |

| Debora

Vrana, Banc of California |

| (213)

999-4141 |

| Deb.Vrana@bancofcal.com |

| Source:

Banc of California, Inc. |

| 16 |

BANC

OF CALIFORNIA, INC.

CONSOLIDATED

STATEMENTS OF FINANCIAL CONDITION (UNAUDITED)

| | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | |

| | |

2023 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(Dollars

in thousands) | |

| ASSETS: | |

| | |

| | |

| | |

| | |

| |

| Cash and due from

banks | |

$ | 202,427 | | |

$ | 182,261 | | |

$ | 208,300 | | |

$ | 218,830 | | |

$ | 212,273 | |

| Interest-earning

deposits in financial institutions | |

| 5,175,149 | | |

| 5,887,406 | | |

| 6,489,847 | | |

| 6,461,306 | | |

| 2,027,949 | |

| Total

cash and cash equivalents | |

| 5,377,576 | | |

| 6,069,667 | | |

| 6,698,147 | | |

| 6,680,136 | | |

| 2,240,222 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Securities available-for-sale | |

| 2,346,864 | | |

| 4,487,172 | | |

| 4,708,519 | | |

| 4,848,607 | | |

| 4,843,487 | |

| Securities held-to-maturity | |

| 2,287,291 | | |

| 2,282,586 | | |

| 2,278,202 | | |

| 2,273,650 | | |

| 2,269,135 | |

| FRB and

FHLB stock | |

| 126,346 | | |

| 17,250 | | |

| 17,250 | | |

| 147,150 | | |

| 34,290 | |

| Total investment

securities | |

| 4,760,501 | | |

| 6,787,008 | | |

| 7,003,971 | | |

| 7,269,407 | | |

| 7,146,912 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans

held for sale | |

| 122,757 | | |

| 188,866 | | |

| 478,146 | | |

| 2,796,208 | | |

| 65,076 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross loans and leases held

for investment | |

| 25,534,730 | | |

| 21,969,789 | | |

| 22,311,292 | | |

| 25,770,912 | | |

| 28,726,016 | |

| Deferred

fees, net | |

| (45,043 | ) | |

| (48,843 | ) | |

| (53,082 | ) | |

| (98,531 | ) | |

| (116,887 | ) |

| Total

loans and leases held for investment, net of deferred fees | |

| 25,489,687 | | |

| 21,920,946 | | |

| 22,258,210 | | |

| 25,672,381 | | |

| 28,609,129 | |

| Allowance

for loan and lease losses | |

| (281,687 | ) | |

| (222,297 | ) | |

| (219,234 | ) | |

| (210,055 | ) | |

| (200,732 | ) |

| Total

loans and leases held for investment, net | |

| 25,208,000 | | |

| 21,698,649 | | |

| 22,038,976 | | |

| 25,462,326 | | |

| 28,408,397 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Equipment leased to others under

operating leases | |

| 344,325 | | |

| 352,330 | | |

| 380,022 | | |

| 399,972 | | |

| 404,245 | |

| Premises and equipment, net | |

| 146,798 | | |

| 50,236 | | |

| 57,078 | | |

| 60,358 | | |

| 54,315 | |

| Foreclosed assets, net | |

| 7,394 | | |

| 6,829 | | |

| 8,426 | | |

| 2,135 | | |

| 5,022 | |

| Goodwill | |

| 198,627 | | |

| - | | |

| - | | |

| - | | |

| 1,376,736 | |

| Core deposit and customer relationship

intangibles, net | |

| 165,477 | | |

| 24,192 | | |

| 26,581 | | |

| 28,970 | | |

| 31,381 | |

| Deferred tax asset, net | |

| 739,111 | | |

| 506,248 | | |

| 426,304 | | |

| 342,557 | | |

| 281,848 | |

| Other assets | |

| 1,463,498 | | |

| 1,193,808 | | |

| 1,219,599 | | |

| 1,260,912 | | |

| 1,214,782 | |

| Total

assets | |

$ | 38,534,064 | | |

$ | 36,877,833 | | |

$ | 38,337,250 | | |

$ | 44,302,981 | | |

$ | 41,228,936 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| LIABILITIES: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Noninterest-bearing deposits | |

$ | 7,774,254 | | |

$ | 5,579,033 | | |

$ | 6,055,358 | | |

$ | 7,030,759 | | |

$ | 11,212,357 | |

| Interest-bearing

deposits | |

| 22,627,515 | | |

| 21,019,648 | | |

| 21,841,725 | | |

| 21,156,802 | | |

| 22,723,977 | |

| Total

deposits | |

| 30,401,769 | | |

| 26,598,681 | | |

| 27,897,083 | | |

| 28,187,561 | | |

| 33,936,334 | |

| Borrowings | |

| 2,911,322 | | |

| 6,294,525 | | |

| 6,357,338 | | |

| 11,881,712 | | |

| 1,764,030 | |

| Subordinated debt | |

| 936,599 | | |

| 870,896 | | |

| 870,378 | | |

| 868,815 | | |

| 867,087 | |

| Accrued

interest payable and other liabilities | |

| 893,609 | | |

| 714,454 | | |

| 679,256 | | |

| 593,416 | | |

| 710,954 | |

| Total

liabilities | |

| 35,143,299 | | |

| 34,478,556 | | |

| 35,804,055 | | |

| 41,531,504 | | |

| 37,278,405 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| STOCKHOLDERS' EQUITY: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Preferred stock | |

| 498,516 | | |

| 498,516 | | |

| 498,516 | | |

| 498,516 | | |

| 498,516 | |

| Voting and non-voting common

stock (1) | |

| 1,690 | | |

| 1,231 | | |

| 1,233 | | |

| 1,232 | | |

| 1,230 | |

| Additional paid-in-capital | |

| 3,840,974 | | |

| 2,798,611 | | |

| 2,799,357 | | |

| 2,792,536 | | |

| 2,821,064 | |

| Retained earnings | |

| (518,301 | ) | |

| (25,399 | ) | |

| 7,892 | | |

| 215,253 | | |

| 1,420,624 | |

| Accumulated

other comprehensive loss, net | |

| (432,114 | ) | |

| (873,682 | ) | |

| (773,803 | ) | |

| (736,060 | ) | |

| (790,903 | ) |

| Total

stockholders’ equity | |

| 3,390,765 | | |

| 2,399,277 | | |

| 2,533,195 | | |

| 2,771,477 | | |

| 3,950,531 | |

| Total

liabilities and stockholders’ equity | |

$ | 38,534,064 | | |

$ | 36,877,833 | | |

$ | 38,337,250 | | |

$ | 44,302,981 | | |

$ | 41,228,936 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common shares outstanding | |

| 168,951,632 | | |

| 78,806,969 | | |

| 78,939,024 | | |

| 78,988,424 | | |

| 78,973,869 | |

(1) Includes

non-voting common equivalents of $108.

| 17 |

BANC

OF CALIFORNIA, INC.

CONSOLIDATED

STATEMENTS OF EARNINGS (LOSS) (UNAUDITED)

| | |

Three

Months Ended | | |

Year Ended | |

| | |

December 31, | | |

September 30, | | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(In thousands, except per share

amounts) | |

| Interest income: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans and leases | |

$ | 346,308 | | |

$ | 310,392 | | |

$ | 404,985 | | |

$ | 1,496,357 | | |

$ | 1,312,580 | |

| Investment securities | |

| 41,280 | | |

| 45,326 | | |

| 50,292 | | |

| 174,996 | | |

| 209,751 | |

| Deposits in financial institutions | |

| 79,652 | | |

| 90,366 | | |

| 17,746 | | |

| 299,647 | | |

| 34,158 | |

| Total interest income | |

| 467,240 | | |

| 446,084 | | |

| 473,023 | | |

| 1,971,000 | | |

| 1,556,489 | |

| Interest expense: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| 207,760 | | |

| 205,982 | | |

| 117,591 | | |

| 748,423 | | |

| 200,449 | |

| Borrowings | |

| 92,474 | | |

| 94,234 | | |

| 19,962 | | |

| 416,744 | | |

| 25,645 | |

| Subordinated debt | |

| 15,955 | | |

| 15,139 | | |

| 12,531 | | |

| 58,705 | | |

| 39,633 | |

| Total interest expense | |

| 316,189 | | |

| 315,355 | | |

| 150,084 | | |

| 1,223,872 | | |

| 265,727 | |

| Net interest income | |

| 151,051 | | |

| 130,729 | | |

| 322,939 | | |

| 747,128 | | |

| 1,290,762 | |

| Provision for credit losses | |

| 47,000 | | |

| - | | |

| 10,000 | | |

| 52,000 | | |

| 24,500 | |

| Net interest

income after provision for credit losses | |

| 104,051 | | |

| 130,729 | | |

| 312,939 | | |

| 695,128 | | |

| 1,266,262 | |

| Noninterest income: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service charges on deposit accounts | |

| 4,562 | | |

| 4,018 | | |

| 3,178 | | |

| 16,468 | | |

| 13,991 | |

| Other commissions and fees | |

| 8,860 | | |

| 7,641 | | |

| 11,208 | | |

| 38,086 | | |

| 43,635 | |

| Leased equipment income | |

| 12,369 | | |

| 14,554 | | |

| 12,322 | | |

| 63,167 | | |

| 50,586 | |

| (Loss) gain on sale of loans and leases | |

| (3,526 | ) | |

| (1,901 | ) | |

| 388 | | |

| (161,346 | ) | |

| 518 | |

| Loss on sale of securities | |

| (442,413 | ) | |

| - | | |

| (49,302 | ) | |

| (442,413 | ) | |

| (50,321 | ) |

| Dividends and gains (losses) on

equity investments | |

| 8,138 | | |

| 3,837 | | |

| 661 | | |

| 15,731 | | |

| (3,389 | ) |

| Warrant (loss) income | |

| (173 | ) | |

| (88 | ) | |

| (46 | ) | |

| (718 | ) | |

| 2,490 | |

| LOCOM HFS adjustment | |

| 3,175 | | |

| 307 | | |

| - | | |

| (8,461 | ) | |

| - | |

| Other income | |

| 8,606 | | |

| 15,440 | | |

| 2,635 | | |

| 31,201 | | |

| 17,317 | |

| Total noninterest (loss) income | |

| (400,402 | ) | |

| 43,808 | | |

| (18,956 | ) | |

| (448,285 | ) | |

| 74,827 | |

| Noninterest expense: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Compensation | |

| 89,354 | | |

| 71,642 | | |

| 106,124 | | |

| 332,353 | | |

| 406,839 | |

| Occupancy | |

| 15,925 | | |

| 15,293 | | |

| 14,922 | | |

| 61,668 | | |

| 60,964 | |

| Data processing | |

| 11,247 | | |

| 11,104 | | |

| 9,722 | | |

| 44,252 | | |

| 38,177 | |

| Other professional services | |

| 2,980 | | |

| 5,597 | | |

| 6,924 | | |

| 24,623 | | |

| 30,278 | |

| Insurance and assessments | |

| 60,016 | | |

| 38,298 | | |

| 7,205 | | |

| 135,666 | | |

| 25,486 | |

| Intangible asset amortization | |

| 4,230 | | |

| 2,389 | | |

| 2,629 | | |

| 11,419 | | |

| 13,576 | |

| Leased equipment depreciation | |

| 7,447 | | |

| 8,333 | | |

| 8,627 | | |

| 34,243 | | |

| 35,658 | |

| Foreclosed assets expense (income), net | |

| 1,764 | | |

| (609 | ) | |

| (108 | ) | |

| 1,520 | | |

| (3,737 | ) |

| Acquisition, integration and reorganization

costs | |

| 111,800 | | |

| 9,925 | | |

| 5,703 | | |

| 142,633 | | |

| 5,703 | |

| Customer related expense | |

| 45,826 | | |

| 26,971 | | |

| 18,197 | | |

| 124,104 | | |

| 55,273 | |

| Loan expense | |

| 4,446 | | |

| 4,243 | | |

| 6,150 | | |

| 20,458 | | |

| 24,572 | |

| Goodwill impairment | |

| - | | |

| - | | |

| 29,000 | | |

| 1,376,736 | | |

| 29,000 | |

| Other expense | |

| 8,603 | | |

| 7,917 | | |

| 11,737 | | |

| 148,506 | | |

| 51,732 | |

| Total noninterest expense | |

| 363,638 | | |

| 201,103 | | |

| 226,832 | | |

| 2,458,181 | | |

| 773,521 | |

| (Loss) earnings before income taxes | |

| (659,989 | ) | |

| (26,566 | ) | |

| 67,151 | | |

| (2,211,338 | ) | |

| 567,568 | |

| Income tax (benefit) expense | |

| (177,034 | ) | |

| (3,222 | ) | |

| 17,642 | | |

| (312,201 | ) | |

| 143,955 | |

| Net (loss) earnings | |

| (482,955 | ) | |

| (23,344 | ) | |

| 49,509 | | |

| (1,899,137 | ) | |

| 423,613 | |

| Preferred stock dividends | |

| 9,947 | | |

| 9,947 | | |

| 9,947 | | |

| 39,788 | | |

| 19,339 | |

| Net (loss)

earnings available to common and equivalent stockholders | |

$ | (492,902 | ) | |

$ | (33,291 | ) | |

$ | 39,562 | | |

$ | (1,938,925 | ) | |

$ | 404,274 | |

| Basic and diluted (loss) earnings

per common share (1) | |

$ | (4.55 | ) | |

$ | (0.42 | ) | |

$ | 0.50 | | |

$ | (22.71 | ) | |

$ | 5.14 | |

| Basic and diluted weighted average

number of common shares outstanding (1) | |