Strong Sales Growth and Margin Expansion Continue; Capacity

Expansion On-Track; Announcing Goal to Reach 1 Billion Pounds of

Recycle Annually; Raising Full-Year Fiscal 2021 Outlook

FIRST QUARTER FISCAL 2021 HIGHLIGHTS

- Consolidated net sales increased 27.8% year-over-year to $212.3

million

- Residential segment net sales increased 36.8% year-over-year to

$185.6 million

- Net income of $10.2 million, driven by sales growth, margin

expansion and lower interest expense; Net Margin of 4.8%

- Adjusted EBITDA increased 43.3% year-over-year to $48.5

million; Adjusted EBITDA Margin expanded 240 basis points to

22.8%

OUTLOOK HIGHLIGHTS

- Raising Fiscal 2021 Outlook – Expecting consolidated net sales

growth of 14% to 18% year-over-year and Adjusted EBITDA growth of

19% to 23% year-over-year, an increase compared to our previous

expectation of 10% to 14% net sales growth and mid-teens Adjusted

EBITDA growth

- Second Quarter Fiscal 2021 Outlook – Expecting consolidated net

sales growth of 13% to 15% year-over-year and Adjusted EBITDA

growth of 18% to 22% year-over-year

The AZEK Company Inc. (the “Company” or “AZEK”) (NYSE: AZEK), an

industry-leading manufacturer of beautiful, low-maintenance and

sustainable residential and commercial building products, today

announced financial results for the first quarter ended December

31, 2020 of its fiscal year 2021.

CEO COMMENTS

“Demand trends have continued their momentum, enabling us to

deliver strong first quarter sales growth as well as increased

confidence in our outlook for the remainder of the year,” commented

Jesse Singh, AZEK’s Chief Executive Officer. “Our team continues to

do an excellent job of executing against our key strategic

initiatives, including new product launches as well as our capacity

expansion and recycling programs, which is evident in our robust

growth profile and significant margin improvement during the

quarter. Our capacity expansion program remains on track as we

execute against the second phase of implementation and finalize

site selection for our new western U.S. facility.”

“Consistent with our mission to accelerate the use of recycled

materials and further divert plastic waste from landfills, we are

announcing a goal of utilizing 1 billion pounds of recycled scrap

and waste annually by the end of 2026. We believe in

revolutionizing outdoor living to build a more sustainable future.

We are also honored to have recently been recognized as a 2021

Green Innovation of the Year award winner in recognition of our

FULL-CIRCLE PVC Recycling Program by Green Builder Media and are

excited about the increasing momentum around the program. Finally,

our continued focus on innovation is demonstrated by the recent

launch of our new high-performance TimberTech AZEK Landmark

Collection which is the latest extension of our premium capped

polymer decking and leverages advanced technology to create the

most natural on-trend look of rustic, reclaimed wood. The

combination of unique design and cascading colors creates a

stunning, nature-inspired visual that’s never been seen in the

industry,” concluded Mr. Singh.

FIRST QUARTER FISCAL 2021 CONSOLIDATED RESULTS

Net sales for the first quarter of fiscal 2021 increased by

$46.2 million, or 27.8%, to $212.3 million from $166.0 million for

the first quarter of fiscal 2020. The increase was driven by higher

sales growth in our Residential segment. Net sales for the

Residential segment increased by 36.8%, and net sales for the

Commercial segment decreased by 12.3%, in each case as compared to

the prior year period.

Gross profit for the first quarter of fiscal 2021 increased by

$21.7 million, or 42.3%, to $73.0 million from $51.3 million for

the first quarter of fiscal 2020. Gross margin increased 350 basis

points to 34.4%, compared to 30.9% for the prior year period. The

increase in gross margin was primarily driven by the strong results

in the Residential segment during the quarter as well as overhead

leverage on fixed costs. Adjusted Gross Profit Margin increased 180

basis points to 41.8%, compared to 40.0% for the prior year

period.

Selling, general and administrative expenses increased by $9.6

million to $53.0 million, or 25.0% of net sales, for the first

quarter of fiscal 2021 from $43.5 million, or 26.2% of net sales,

for the first quarter of fiscal 2020. The increase was primarily

attributable to stock-based compensation expense, ongoing public

company expenses and personnel costs.

Net income was $10.2 million, or $0.07 per share, for the first

quarter of fiscal 2021 as compared to net loss of ($9.8) million,

or ($0.09) per share, for the first quarter of fiscal 2020,

primarily due to an increase in net sales and a decrease in

interest expense resulting from the reduced principal amount

outstanding under the Term Loan Agreement and 2021 Senior Notes.

Net margin was 4.8% for the first quarter of fiscal 2021 as

compared to net margin of (5.9%) for the first quarter of fiscal

2020.

Adjusted Net Income was $23.0 million, or $0.15 per diluted

share, for the first quarter of fiscal 2021 as compared to Adjusted

Net Income of $3.6 million, or $0.03 per diluted share, for the

first quarter of fiscal 2020.

Adjusted EBITDA for the first quarter of fiscal 2021 increased

by $14.6 million, or 43.3%, to $48.5 million from $33.8 million for

the first quarter of fiscal 2020. The increase was mainly driven by

sales growth in the Residential segment and higher gross margin

partially offset by higher selling, general and administrative

expenses. Adjusted EBITDA Margin expanded 240 basis points to 22.8%

from 20.4% for the prior year period.

FIRST QUARTER FISCAL 2021 SEGMENT RESULTS

Residential Segment

Net sales for the first quarter of fiscal 2021 increased by

$50.0 million, or 36.8%, to $185.6 million from $135.7 million for

the first quarter of fiscal 2020. The increase was primarily

attributable to higher sales in our Deck, Rail & Accessories

and Exteriors businesses.

Segment Adjusted EBITDA for the first quarter of fiscal 2021

increased by $19.9 million, or 51.0% to $58.8 million from $38.9

million for the first quarter of fiscal 2020. The increase was

mainly driven by higher sales, partially offset by higher selling,

general and administrative expenses. Segment Adjusted EBITDA Margin

expanded 300 basis points to 31.7% from 28.7% for the prior year

period.

Commercial Segment

Net sales were $26.6 million for the first quarter of fiscal

2021 compared to $30.4 million for the first quarter of fiscal

2020, a decrease of $3.7 million, or 12.3%. The Commercial segment

has greater exposure to the broader economy, and the decrease was

primarily attributable to declining net sales in our Scranton

Products and Vycom businesses as the effects of COVID-19 continued

to impact certain end markets demand during the quarter.

Segment Adjusted EBITDA was $3.3 million for the first quarter

of fiscal 2021, compared to $3.0 million for the first quarter of

fiscal 2020. The slight increase was primarily driven by lower

manufacturing and selling, general and administrative expenses

offset by declining net sales. Segment Adjusted EBITDA Margin was

12.4% for the first quarter of fiscal 2021 as compared to 10.0% for

the prior year period.

BALANCE SHEET, CASH FLOW and LIQUIDITY

As of December 31, 2020, the Company had cash and cash

equivalents of $210.0 million and approximately $143.3 million

available for future borrowings under our Revolving Credit

Facility. Total debt as of December 31, 2020 was $463.3

million.

Net cash provided by operating activities was $20.1 million for

the three months ended December 31, 2020 versus a use of $56.4

million in the prior year first quarter.

OUTLOOK

“We believe that the strength and flexibility of our business

model position us well to deliver long term value and

outperformance in various market environments. As we look ahead to

the remainder of our fiscal 2021, we have increased our outlook as

steady demand continues across our Residential segment. We have

improved visibility on channel inventory levels and downstream

demand from our pre-season or “early buy” program, balanced by a

macro-economic environment that continues to carry a level of

uncertainty. Our second fiscal quarter is historically one where

inventory is manufactured and positioned in the channel ahead of

the building season. In fiscal 2021, we expect this staging to

extend more into the third fiscal quarter given demand and

production timing. We continue to see steady demand within our

Residential segment across both our Deck, Rail & Accessories

and Exteriors businesses supported by favorable repair and remodel,

material conversion and outdoor living tailwinds, partially offset

by reduced demand within our Commercial segment, which has been

adversely impacted by the macro-environment,” added Mr. Singh.

AZEK is raising its outlook for the full year fiscal 2021. AZEK

now expects consolidated net sales growth of 14% to 18%

year-over-year and Adjusted EBITDA growth in the 19% to 23% range

year-over-year. From a segment perspective, AZEK expects

Residential segment net sales growth in the 17% to 21% range

year-over-year, partially offset by a mid-single digit decline in

Commercial segment net sales, which is consistent with prior

guidance.

For the second quarter fiscal 2021 guidance, AZEK expects

consolidated net sales growth in the 13% to 15% range

year-over-year, driven by strong Residential segment growth in the

high-teens range, partially offset by an expected high-teens

decline in the Commercial segment. AZEK is expecting Adjusted

EBITDA growth in the 18% to 22% range year-over-year.

CONFERENCE CALL INFORMATION

AZEK will hold a conference call to discuss the results today,

Thursday, February 11, 2021 at 9:00 a.m. (CT).

To access the live conference call, please register for the call

in advance by visiting

http://www.directeventreg.com/registration/event/1291887.

Registration will also be available during the call. After

registering, a confirmation e-mail will be sent including dial-in

details and unique conference call codes for entry. To ensure you

are connected for the full call please register at least 10 minutes

before the start of the call.

Interested investors and other parties can also listen to a

webcast of the live conference call by logging onto the Investor

Relations section of the Company's website at

https://investors.azekco.com/events-and-presentations/.

For those unable to listen to the live conference call, a replay

will be available approximately two hours after the call through

the archived webcast on the AZEK website or by dialing (800)

585-8367 or (416) 621-4642. The conference ID for the replay is

1291887. The replay will be available until 10:59 p.m. (CT) on

February 25, 2021.

ABOUT THE AZEK® COMPANY

The AZEK® Company Inc. is an industry-leading designer and

manufacturer of beautiful, low-maintenance residential and

commercial building products and is committed to innovation,

sustainability and research & development. Headquartered in

Chicago, Illinois, the company operates manufacturing facilities in

Ohio, Pennsylvania and Minnesota. For additional information,

please visit azekco.com.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This earnings release contains forward-looking statements within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. All statements

other than statements of historical facts contained in this

earnings release, including statements regarding future operations

are forward-looking statements. In some cases, forward looking

statements may be identified by words such as "believe," "may,"

"will," "estimate," "continue," "anticipate," "intend," "could,"

"would," "expect," "objective," "plan," "potential," "seek,"

"grow," "target," "if," and similar expressions intended to

identify forward-looking statements. In particular, statements

about potential new products and product innovation, statements

regarding the potential impact of the COVID-19 pandemic, statements

about the markets in which we operate, including growth of our

various markets and growth in the use of engineered products, and

our expectations, beliefs, plans, strategies, objectives,

prospects, assumptions or future events or performance contained in

this earnings release are forward-looking statements. We have based

these forward-looking statements primarily on our current

expectations and projections about future events and trends that we

believe may affect our financial condition, results of operations,

business strategy, short-term and long-term business operations and

objectives and financial needs. These forward-looking statements

are subject to a number of risks, uncertainties and assumptions,

including those described in the section titled "Risk Factors" set

forth in Part II, Item 1A of the Quarterly Report on Form 10-Q for

our first quarter of fiscal 2021 and in our other filings with the

U.S. Securities and Exchange Commission (“SEC”), including our

Annual Report on Form 10-K for fiscal 2020. Moreover, we operate in

a very competitive and rapidly changing environment. New risks

emerge from time to time. It is not possible for our management to

predict all risks, nor can we assess the impact of all factors on

our business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statements we may make. In light

of these risks, uncertainties and assumptions, the future events

and trends discussed in this earnings release may not occur and

actual results may differ materially and adversely from those

anticipated or implied in the forward-looking statements. You

should read this earnings release with the understanding that our

actual future results, levels of activity, performance and events

and circumstances may be materially different from what we

expect.

These statements are based on information available to us as of

the date of this earnings release. While we believe that such

information provides a reasonable basis for these statements, such

information may be limited or incomplete. Our statements should not

be read to indicate that we have conducted an exhaustive inquiry

into, or review of, all relevant information. We disclaim any

intention and undertake no obligation to update or revise any of

our forward-looking statements after the date of this release to

reflect actual results or future events or circumstances whether as

a result of new information, future events or otherwise, except as

required by law. Given these risks and uncertainties, readers are

cautioned not to place undue reliance on such forward-looking

statements.

NON-GAAP FINANCIAL MEASURES

To supplement our earnings release and consolidated financial

statements prepared and presented in accordance with generally

accepted accounting principles in the United States, or (“GAAP”),

we use certain non-GAAP performance financial measures, as

described within this earnings release, to provide investors with

additional useful information about our financial performance, to

enhance the overall understanding of our past performance and

future prospects and to allow for greater transparency with respect

to important metrics used by our management for financial and

operational decision-making. We are presenting these non-GAAP

financial measures to assist investors in seeing our financial

performance from management’s view and because we believe they

provide an additional tool for investors to use in comparing our

core financial performance over multiple periods with other

companies in our industry. Our GAAP financial results include

significant expenses that are not indicative of our ongoing

operations as detailed within this earnings release.

However, non-GAAP financial measures have limitations in their

usefulness to investors because they have no standardized meaning

prescribed by GAAP and are not prepared under any comprehensive set

of accounting rules or principles. In addition, non-GAAP financial

measures may be calculated differently from, and therefore may not

be directly comparable to, similarly titled measures used by other

companies. As a result, non-GAAP financial measures should be

viewed as supplementing, and not as an alternative or substitute

for, our earnings release and our consolidated financial statements

prepared and presented in accordance with GAAP.

We define Adjusted Gross Profit as gross profit before

depreciation and amortization, business transformation costs and

acquisition costs as described below. Adjusted Gross Profit Margin

is equal to Adjusted Gross Profit divided by net sales.

We define Adjusted Net Income as net income (loss) before

amortization, share-based compensation costs, business

transformation costs, acquisition costs, initial public offering

costs and certain other costs as described below.

We define Adjusted Diluted EPS as Adjusted Net Income divided by

weighted average common shares outstanding – diluted, to reflect

the conversion or exercise, as applicable, of all outstanding

shares of restricted stock awards, restricted stock units and

options to purchase shares of our common stock.

We define Adjusted EBITDA as net income (loss) before interest

expense, net, income tax (benefit) expense and depreciation and

amortization and by adding to or subtracting therefrom items of

expense and income as described above.

Adjusted EBITDA Margin is equal to Adjusted EBITDA divided by

net sales. Net Leverage is equal to gross debt less cash and cash

equivalents, divided by trailing twelve month Adjusted EBITDA. We

believe Adjusted Gross Profit, Adjusted Gross Profit Margin,

Adjusted Net Income, Adjusted Diluted EPS, Adjusted EBITDA,

Adjusted EBITDA Margin and Net Leverage are useful to investors

because they help identify underlying trends in our business that

could otherwise be masked by certain expenses that can vary from

company to company depending on, among other things, its financing,

capital structure and the method by which its assets were acquired,

and can also vary significantly from period to period. We also add

back depreciation and amortization and share-based compensation

because we do not consider them indicative of our core operating

performance. We believe their exclusion facilitates comparisons of

our operating performance on a period-to-period basis. Therefore,

we believe that showing gross profit and net income, as adjusted to

remove the impact of these expenses, is helpful to investors in

assessing our gross profit and net income performance in a way that

is similar to the way management assesses our performance.

Additionally, EBITDA and EBITDA margin are common measures of

operating performance in our industry, and we believe they

facilitate operating comparisons. Our management also uses Adjusted

Gross Profit, Adjusted Gross Profit Margin, Adjusted EBITDA and

Adjusted EBITDA Margin in conjunction with other GAAP financial

measures for planning purposes, including as a measure of our core

operating results and the effectiveness of our business strategy,

and in evaluating our financial performance. Management considers

Adjusted Gross Profit and Adjusted Net Income as useful measures

because our cost of sales includes the depreciation of property,

plant and equipment used in the production of products and the

amortization of various intangibles related to our manufacturing

processes. Further, management considers Net Leverage as a useful

measure to assess our borrowing capacity.

Adjusted Gross Profit, Adjusted Gross Profit Margin, Adjusted

Net Income, Adjusted Diluted EPS, Adjusted EBITDA, Adjusted EBITDA

Margin and Net Leverage have limitations as analytical tools, and

you should not consider them in isolation or as a substitute for

analysis of our results as reported under GAAP. Some of these

limitations are:

- These measures do not reflect our cash expenditures, future

requirements for capital expenditures or contractual

commitments;

- These measures do not reflect changes in, or cash requirements

for, our working capital needs;

- Adjusted EBITDA and Adjusted EBITDA Margin do not reflect the

significant interest expense, or the cash requirements necessary to

service interest or principal payments, on our debt;

- Adjusted EBITDA and Adjusted EBITDA Margin do not reflect our

income tax expense or the cash requirements to pay our taxes;

- Adjusted Gross Profit, Adjusted Net Income, Adjusted Diluted

EPS and Adjusted EBITDA exclude the expense of depreciation, in the

case of Adjusted Gross Profit and Adjusted EBITDA, and

amortization, in each case, of our assets, and, although these are

non-cash expenses, the assets being depreciated may have to be

replaced in the future;

- Adjusted Net Income, Adjusted Diluted EPS and Adjusted EBITDA

exclude the expense associated with our equity compensation plan,

although equity compensation has been, and will continue to be, an

important part of our compensation strategy;

- Adjusted Gross Profit, Adjusted Net Income, Adjusted Diluted

EPS and Adjusted EBITDA exclude certain business transformation

costs, acquisition costs and other costs, each of which can affect

our current and future cash requirements; and

- Other companies in our industry may calculate Adjusted Gross

Profit, Adjusted Gross Profit Margin, Adjusted Net Income, Adjusted

Diluted EPS, Adjusted EBITDA, Adjusted EBITDA Margin and Net

Leverage differently than we do, limiting their usefulness as

comparative measures.

Because of these limitations, none of these metrics should be

considered indicative of discretionary cash available to us to

invest in the growth of our business or as measures of cash that

will be available to us to meet our obligations.

Segment Adjusted EBITDA

Depending on certain circumstances, Segment Adjusted EBITDA may

be calculated differently, from time to time, than our Adjusted

EBITDA and Adjusted EBITDA Margin, which are further discussed

under the heading “Non-GAAP Financial Measures.” Segment Adjusted

EBITDA represents a measure of segment profit reported to our chief

operating decision maker for the purpose of making decisions about

allocating resources to a segment and assessing its performance.

For more information regarding how Segment Adjusted EBITDA is

determined, see our Consolidated Financial Statements and related

notes included in our Quarterly Report on Form 10-Q for the first

quarter of fiscal 2021 filed with the SEC.

The AZEK Company Inc.

Consolidated Balance

Sheets

(In thousands of U.S. dollars,

except for share and per share amounts)

(Unaudited)

December 31, 2020

September 30, 2020

ASSETS:

Current assets:

Cash and cash equivalents

$

210,034

$

215,012

Trade receivables, net of allowances

41,234

70,886

Inventories

166,151

130,070

Prepaid expenses

11,412

8,367

Other current assets

161

360

Total current assets

428,992

424,695

Property, plant and equipment, net

279,183

261,774

Goodwill

951,390

951,390

Intangible assets, net

279,731

292,374

Other assets

1,608

1,623

Total assets

$

1,940,904

$

1,931,856

LIABILITIES AND STOCKHOLDERS’

EQUITY:

Current liabilities:

Accounts payable

$

38,179

$

42,059

Accrued rebates

35,754

30,362

Accrued interest

1,089

1,103

Current portion of long-term debt

obligations

─

─

Accrued expenses and other liabilities

39,408

50,516

Total current liabilities

114,430

124,040

Deferred income taxes

24,168

21,260

Finance lease obligations — less current

portion

10,886

10,910

Long-term debt — less current portion

463,308

462,982

Other non-current liabilities

9,009

8,776

Total liabilities

621,801

627,968

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.001 par value;

1,000,000 shares

authorized and no shares issued and

outstanding at

December 31, 2020 and at September 30,

2020,

respectively

─

─

Class A common stock, $0.001 par value;

1,100,000,000

shares authorized, 154,735,617 shares

issued and

outstanding at December 31, 2020, and

154,637,240

shares issued and outstanding at September

30, 2020

155

155

Class B common stock, $0.001 par value;

100,000,000

shares authorized, 100 shares issued and

outstanding

at December 31, 2020 and at September 30,

2020,

respectively

─

─

Additional paid‑in capital

1,592,240

1,587,208

Accumulated deficit

(273,292)

(283,475)

Total stockholders’ equity

1,319,103

1,303,888

Total liabilities and stockholders’

equity

$

1,940,904

$

1,931,856

The AZEK Company Inc.

Consolidated Statements of

Comprehensive Income (Loss)

(In thousands of U.S. dollars,

except for share and per share amounts)

(Unaudited)

Three Months Ended December

31,

2020

2019

Net sales

$

212,278

$

166,043

Cost of sales

139,302

114,752

Gross profit

72,976

51,291

Selling, general and administrative

expenses

53,029

43,473

Other general expenses

─

1,978

Loss (gain) on disposal of plant, property

and equipment

212

(73)

Operating income (loss)

19,735

5,913

Other expenses:

Interest expense

6,196

19,759

Total other expenses

6,196

19,759

Income (loss) before income taxes

13,539

(13,846)

Income tax expense (benefit)

3,356

(4,000)

Net income (loss)

$

10,183

$

(9,846)

Net income (loss) per common share:

Basic

$

0.07

$

(0.09)

Diluted

0.07

(0.09)

Comprehensive income (loss)

$

10,183

$

(9,846)

Weighted average shares used in

calculating net income (loss) per common share:

Basic

153,226,378

108,162,741

Diluted

156,018,731

108,162,741

The AZEK Company Inc.

Consolidated Statements of

Cash Flows

(In thousands of U.S.

dollars)

(Unaudited)

Three Months Ended December

31,

2020

2019

Operating activities:

Net income (loss)

$

10,183

$

(9,846)

Adjustments to reconcile net income (loss)

to net cash flows provided by (used in) operating activities:

Depreciation expense

11,627

10,283

Amortization expense

12,643

13,858

Non-cash interest expense

467

997

Deferred income tax provision

(benefit)

2,908

(2,653)

Non-cash compensation expense

2,878

1,056

Loss (gain) on disposition of property,

plant and equipment

212

(73)

Changes in certain assets and

liabilities:

Trade receivables

29,652

(2,923)

Inventories

(36,081)

(23,926)

Prepaid expenses and other current

assets

(2,846)

296

Accounts payable

(5,097)

(25,042)

Accrued expenses and interest

(6,537)

(17,460)

Other assets and liabilities

106

(928)

Net cash provided by (used in) operating

activities

20,115

(56,361)

Investing activities:

Purchases of property, plant and

equipment

(27,021)

(19,131)

Proceeds from sale of property, plant and

equipment

17

113

Net cash provided by (used in) investing

activities

(27,004)

(19,018)

Financing activities:

Payments on long-term debt obligations

─

(2,076)

Proceeds (repayments) of finance lease

obligations

(243)

(193)

Exercise of vested stock options

2,364

─

Payments of initial public offering

related costs

(210)

(3,630)

Redemption of capital contributions prior

to initial

public offering

─

(2,201)

Net cash provided by (used in) financing

activities

1,911

(8,100)

Net increase (decrease) in cash and cash

equivalents

(4,978)

(83,479)

Cash and cash equivalents at beginning of

period

215,012

105,947

Cash and cash equivalents at end of

period

$

210,034

$

22,468

Supplemental cash flow

disclosure:

Cash paid for interest, net of amounts

capitalized

$

5,847

$

25,045

Cash paid for income taxes, net of

refunds

(56)

6

Supplemental non-cash investing and

financing disclosure:

Capital expenditures in accounts payable

at end of period

$

4,035

$

2,007

Property, plant and equipment acquired

under finance leases

334

446

Segment Results from Operations

Residential Segment

The following table summarizes certain financial information

relating to the Residential segment results that have been derived

from our unaudited Condensed Consolidated Financial Statements for

the three months ended December 31, 2020 and 2019.

Three Months Ended December

31,

(U.S. dollars in thousands)

2020

2019

$ Variance

% Variance

Net sales

$ 185,640

$ 135,668

$ 49,972

36.8%

Segment Adjusted EBITDA

58,776

38,915

19,861

51.0

Segment Adjusted EBITDA Margin

31.7%

28.7%

N/A

N/A

Commercial Segment

The following table summarizes certain financial information

relating to the Commercial segment results that have been derived

from our unaudited Condensed Consolidated Financial Statements for

the three months ended December 31, 2020 and 2019.

Three Months Ended December

31,

(U.S. dollars in thousands)

2020

2019

$ Variance

% Variance

Net sales

$ 26,638

$ 30,375

$ (3,737)

(12.3%)

Segment Adjusted EBITDA

3,316

3,023

293

9.7

Segment Adjusted EBITDA Margin

12.4%

10.0%

N/A

N/A

Adjusted EBITDA and Adjusted EBITDA Margin

Reconciliation

Three Months Ended December

31,

(In thousands)

2020

2019

Net income (loss)

$ 10,183

$ (9,846)

Interest expense

6,196

19,759

Depreciation and amortization

24,270

24,141

Tax expense (benefit)

3,356

(4,000)

Stock-based compensation costs

2,980

685

Business transformation costs (1)

─

163

Acquisition costs (2)

─

565

Initial public offering

─

1,978

Other costs (3)

1,467

361

Total adjustments

38,269

43,652

Adjusted EBITDA

$ 48,452

$ 33,806

Three Months Ended December

31,

2020

2019

Net margin

4.8%

(5.9)%

Interest expense

2.9

11.9

Depreciation and amortization

11.4

14.6

Tax expense (benefit)

1.6

(2.4)

Stock-based compensation costs

1.4

0.4

Business transformation costs

─

0.1

Acquisition costs

─

0.3

Initial public offering

─

1.2

Other costs

0.7

0.2

Total adjustments

18.0

26.3

Adjusted EBITDA Margin

22.8%

20.4%

____________________________

(1)

Business transformation costs

reflect consulting and other costs related to the transformation of

the senior management team of $0.2 million in the three months

ended December 31 2019.

(2)

Acquisition costs reflect costs

directly related to completed acquisitions $0.6 million in the

three months ended December 31, 2019.

(3)

Other costs include costs for

legal expense of $0.5 million for the three months ended December

31, 2020 and costs related to an incentive plan and other ancillary

expenses associated with the initial public offering of $1.0

million and $0.4 million for the three months ended December 31,

2020 and December 31, 2019, respectively.

Adjusted Gross Profit and Adjusted Gross Profit Margin

Reconciliation

Three Months Ended December

31,

(In thousands)

2020

2019

Gross profit

$ 72,976

$ 51,291

Depreciation and amortization (1)

15,796

15,151

Adjusted Gross Profit

$ 88,772

$ 66,442

Three Months Ended December

31,

2020

2019

Gross margin

34.4 %

30.9%

Depreciation and amortization

7.4

9.1

Adjusted Gross Profit Margin

41.8%

40.0%

____________________________

(1)

Depreciation and amortization for

the three months ended December 31, 2020 and 2019 consists of $10.3

million and $8.9 million, respectively, of depreciation and $5.5

million and $6.2 million, respectively, of amortization of

intangible assets relating to our manufacturing process.

Adjusted Net Income and Adjusted Diluted EPS

Reconciliation

Three Months Ended December

31,

(In thousands)

2020

2019

Net income (loss)

$ 10,183

$ (9,846)

Amortization (1)

12,643

13,858

Stock-based compensation costs (2)

2,686

685

Business transformation costs (3)

─

163

Acquisition costs (4)

─

565

Initial public offering

─

1,978

Other costs (5)

1,467

361

Tax impact of adjustments (6)

(3,950)

(4,146)

Adjusted Net Income

$ 23,029

$ 3,618

Three Months Ended December

31,

2020

2019

Net income (loss)

$ 0.07

$ (0.09)

Amortization

0.08

0.13

Stock-based compensation costs

0.02

0.01

Business transformation costs

─

─

Acquisition costs

─

─

Initial public offering

─

0.02

Other costs

0.01

─

Tax impact of adjustments

(0.03)

(0.04)

Adjusted Diluted EPS (7)

$ 0.15

$ 0.03

____________________________

(1)

Effective as of September 30,

2020, we revised the definition of Adjusted Net Income to remove

depreciation expense. The prior periods have been recast to reflect

the change.

(2)

Stock-based compensation costs

reflect expenses related to our initial public offering. Expense

related to our recurring long-term incentive plan is excluded from

the Adjusted Net Income reconciliation.

(3)

Business transformation costs

reflect consulting and other costs related to the transformation of

the senior management team of $0.2 million in the three months

ended December 31, 2019.

(4)

Acquisition costs reflect costs

directly related to completed acquisitions $0.6 million in the

three months ended December 31, 2019.

(5)

Other costs include costs for

legal expense of $0.5 million for the three months ended December

31, 2020 and costs related to an incentive plan and other ancillary

expenses associated with the initial public offering of $1.0

million and $0.4 million for the three months ended December 31,

2020 and December 31, 2019, respectively.

(6)

Tax impact of adjustments are

based on applying a combined U.S. federal and state statutory tax

rate of 24.5% for both the three months ended December 31, 2020 and

2019.

(7)

Weighted average common shares

outstanding used in computing diluted net income (loss) per common

share of 156,018,731 and 108,162,741 for the three months ended

December 31, 2020 and 2019, respectively.

Net Leverage Reconciliation

Three Months Ended December

31,

Three Months Ended December

31,

Twelve Months Ended September

30,

Twelve Months Ended December

31,

2020

2019

2020

2020

(In thousands)

Net income (loss)

$

10,183

$

(9,846)

$

(122,233)

$

(102,204)

Interest expense

6,196

19,759

71,179

57,616

Depreciation and amortization

24,270

24,141

99,781

99,910

Tax expense (benefit)

3,356

(4,000)

(8,278)

(922)

Stock-based compensation costs

2,980

685

120,517

122,812

Business transformation costs

─

163

594

431

Acquisition costs

─

565

1,596

1,031

Initial public offering costs

─

1,978

8,616

6,638

Other costs

1,467

361

4,154

5,260

Capital structure transaction costs

─

─

37,587

37,587

Total adjustments

38,269

43,652

335,746

330,363

Adjusted EBITDA

$

48,452

$

33,806

$

213,513

$

228,159

Long-term debt—less current portion

$

463,308

Unamortized deferred financing fees

3,874

Unamortized original issue discount

472

Gross debt

467,654

Cash and cash equivalents

(210,034)

Net debt

257,620

Net Leverage

1.1x

Outlook

We have not reconciled Adjusted EBITDA guidance to its most

comparable GAAP measure as a result of the uncertainty regarding,

and the potential variability of, reconciling items such as the

variability in the provision for income taxes, the estimates for

warranty and rebate accruals and timing of the gain or loss on

disposal of property, plant and equipment. Such reconciling items

that impact Adjusted EBITDA have not occurred, are outside of our

control or cannot be reasonably predicted. Accordingly, a

reconciliation of Adjusted EBITDA to its most comparable GAAP

measure is not available without unreasonable effort. However, it

is important to note that material changes to these reconciling

items could have a significant effect on our Adjusted EBITDA

guidance and future GAAP results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210211005264/en/

Investor Relations: Solebury Trout 312-809-1093 ir@azekco.com

Media: Lisa Wolford 917-846-0881 lwolford@soleburytrout.com

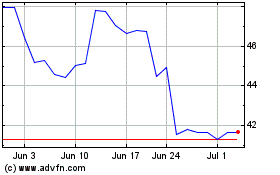

AZEK (NYSE:AZEK)

Historical Stock Chart

From Oct 2024 to Nov 2024

AZEK (NYSE:AZEK)

Historical Stock Chart

From Nov 2023 to Nov 2024