APPLIED INDUSTRIAL TECHNOLOGIES, INC.

RETIREMENT SAVINGS PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

FOR THE YEAR ENDED DECEMBER 31, 2020

|

|

|

|

|

|

|

|

|

2020

|

|

Additions to net assets attributed to:

|

|

|

Contributions:

|

|

|

Participants

|

$

|

23,209,319

|

|

|

Participants' rollovers

|

5,743,618

|

|

|

Employer

|

2,231,257

|

|

|

Total contributions

|

31,184,194

|

|

|

|

|

|

Investment Income:

|

|

|

Interest, Dividends, and Other

|

8,461,503

|

|

|

|

|

|

Net realized and unrealized gains in fair value of investments

|

79,593,072

|

|

|

|

|

|

Total investment income

|

88,054,575

|

|

|

|

|

|

Interest on participant notes receivable

|

400,591

|

|

|

|

|

|

Total additions

|

119,639,360

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

Distributions to participants

|

(55,895,081)

|

|

|

Administrative expenses

|

(599,474)

|

|

|

Total deductions

|

(56,494,555)

|

|

|

|

|

|

Net increase in net assets

|

63,144,805

|

|

|

|

|

|

Net assets available for benefits:

|

|

|

Beginning of year

|

533,376,249

|

|

|

End of year

|

$

|

596,521,054

|

|

|

|

|

|

|

|

|

See notes to financial statements.

|

|

APPLIED INDUSTRIAL TECHNOLOGIES, INC. RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2020 AND 2019

1. DESCRIPTION OF THE PLAN

The following description of the Applied Industrial Technologies, Inc. Retirement Savings Plan (the “Plan”) is provided for general purposes only. Participants and users of the financial statements should refer to the Plan document for more complete information.

General - The Plan was established for the purpose of encouraging and assisting eligible domestic employees of Applied Industrial Technologies, Inc. and its subsidiaries (the “Company”) to provide long-term, tax-deferred savings for retirement. The Plan is subject to reporting and disclosure requirements, minimum participation and vesting standards, and fiduciary responsibility requirements of the Employee Retirement Income Security Act of 1974 (“ERISA”).

Administration - The Plan is administered by the Company. The Company's powers and duties relate to making participant and employer contributions to the Plan, establishing investment options, authorizing disbursements from the Plan, and resolving any questions of Plan interpretation. The record keeper and trustee for the assets of the Plan is Principal Trust Company ("Principal").

Participant Accounts - Each participant's account is credited with the participant's contributions and allocations of (a) the Company's contributions and (b) Plan earnings (losses), and (c) administrative expenses. Allocated expenses are based on participant contributions, account balances, or can be per capita, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant's vested portion of their account.

Participation and Contributions - All eligible employees may participate in the Plan upon their hire with the Company. Eligible employees may elect to make pre-tax or after-tax contributions to the Plan ranging from 1% to 50% of compensation, subject to limitations under the Internal Revenue Code. Highly compensated employees are restricted to maximum contributions of 15% of compensation. All newly eligible employees are automatically enrolled into the Plan with an initial contribution rate of 4% after 30 days of employment if they have not made an affirmative election already or have not made an election to opt out of contributing. The initial contribution rate was amended from 3% to 4% in 2020.

The Company may make additional discretionary matching contributions limited to 50% of the aggregate participant pre-tax and after-tax contributions up to 6% of the participant's eligible compensation for that period. Employer matching contributions are paid each pay period and the participant must be employed during the period to receive the match. The employer matching contribution was suspended starting the second quarter of 2020.

The Plan permits catch-up contributions for participants who are age 50 or older and defer the maximum

amount allowed under the Plan.

The Plan provides for rollover contributions (amounts distributed to participants from certain other tax-qualified plans) and transfer contributions (amounts transferred from certain other tax-qualified plans) by or on behalf of an employee in accordance with procedures established by the Company.

Certain participant contributions in 2020 were paid after the time frame required by the Department of Labor. The Company remitted the 2020 contributions and related lost earnings in 2020 and 2021.

APPLIED INDUSTRIAL TECHNOLOGIES, INC. RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2020 AND 2019

Investment of Contributions - The Plan provides that, in accordance with the investment objectives established by the Company, the trustee of the Plan shall hold, invest, reinvest, manage and administer all assets of the Plan as a trust fund for the exclusive benefit of participants and their beneficiaries. Participants elect investment of matching and pre-tax contributions in 1% increments to any of several investment funds or options. The portion of the Plan that is invested in the Applied Industrial Technologies, Inc. Stock Fund is intended to be an Employee Stock Ownership Plan (“ESOP”) under Code Section 4975 (e)(7) and ERISA Section 407 (d)(6).

Participants may elect to change their investment elections as to future contributions and may also elect to reallocate a portion or all of their account balances among the investment choices in increments of 1% of the total amount to be reallocated. All such elections are filed with the trustee of the Plan and become effective daily.

Vesting and Distributions - Each participant is immediately and fully vested in their participant contributions and earnings thereon. Participants vest in employer contributions at a rate of 25% for each year of eligible service, becoming completely vested after four years, or at death, termination of employment due to physical or mental disability (determined by the Company upon the basis of a written certificate of a physician selected by it), or normal retirement as defined in the Plan.

Upon termination of employment, participants may receive lump-sum or installment distributions of their vested account balances as soon as administratively possible. Distributions are made in the form of cash. The Plan permits hardship withdrawals, if the hardship criteria are met, or in-service distributions at age 59 1/2. Hardship withdrawals and in-service distributions can be taken from participant rollovers, salary deferrals, and catch-up contributions.

Forfeitures - Forfeitures of nonvested amounts are used to first reduce future matching employer contributions and second, to pay eligible plan expenses. The balance in the forfeiture account was $171,832 and $13,841 at December 31, 2020 and 2019, respectively. The Company used approximately $95,000 from the forfeitures to offset contributions for the year ended December 31, 2020.

Participant Notes Receivable - Participants may borrow (from their pre-tax contributions, rollover contributions and transferred contributions) a minimum of $1,000 up to a maximum equal to the lesser of $50,000 or 50% of the aggregate sum of the participant's accounts. Participant notes receivable terms range from 1-5 years or up to 10 years if used for the purchase of a primary residence. Participant notes receivable that originated from merged plans are also reflected in participant notes receivable in the Plan's financial statements; these participant notes receivable are to be repaid to the Plan in accordance with their original terms. Participant notes receivable are collateralized by the balance in the participant's accounts and bear interest at market rates prevailing at the time the participant note receivable originated. Principal and interest are paid ratably through bi-weekly payroll deductions. Funds cannot be borrowed from Company contributions.

Plan Termination - The Plan was adopted with the expectation that it will continue indefinitely. The Company may, however, terminate the Plan at any time and may amend the Plan from time to time. In the event of termination of the Plan, all participants will immediately become fully vested in their accounts.

APPLIED INDUSTRIAL TECHNOLOGIES, INC. RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2020 AND 2019

Tax Status of the Plan - The Plan obtained its latest determination letter dated July 12, 2017, in which the Internal Revenue Service stated that the Plan, as then designed, was in compliance with the applicable requirements of the Internal Revenue Code. Although the Plan has been amended since receiving this determination letter, the Plan administrator believes that the Plan is designed and is currently being operated in compliance with the applicable requirements of the Internal Revenue Code. Therefore, no provision for income taxes has been included in the Plan's financial statements. The Plan is no longer subject to income tax examinations for the years prior to 2017.

Party-in-interest Transactions - The Plan invests in shares of the Company's common stock. The Company is the Plan sponsor; therefore, these transactions qualify as party-in-interest transactions as defined under ERISA guidelines. For the year ended December 31, 2020, transactions involving the Company's stock included sales of approximately $19,100,000 and purchases of approximately $5,600,000.

CARES Act - The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was passed by Congress on March 27, 2020. The Plan adopted the provisions under the CARES Act allowing for certain withdrawals of up to $50,000 without early withdrawal penalties and deferral of note receivable payments for up to a year during the window provided in the CARES Act. These special withdraws can be taken through December 31, 2020 and may be repaid with three years of the date of the withdraw.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed in the preparation of the Plan's financial statements.

Basis of Accounting - The accompanying financial statements have been prepared on the accrual basis of accounting.

Use of Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Valuation of Investments - Investments are accounted for at cost on the trade date and are reported in the Statements of Net Assets Available for Benefits at fair value. The Common collective trust fund is valued at net asset value per share (or its equivalent) of the fund, which is based on the fair value of the fund's underlying net assets. There were no unfunded commitments or redemption restrictions on the common collective trust fund. The investment in Applied Industrial Technologies, Inc. common stock is valued using the year-end closing price listed by the New York Stock Exchange. Mutual funds are stated at values using quoted market prices for each of the funds. See Note 3, “Fair Value Measurements” for additional disclosures relative to the fair value of the investments held in the Plan.

Participant Notes Receivable - Participant notes receivable are recorded at their unpaid principal balances plus any accrued interest. Participant notes receivable are written off when deemed uncollectible.

Benefit Payments - Distributions to participants are recorded by the Plan when payments are made.

Administrative Expenses - Administrative expenses of the Plan are paid by the Plan.

APPLIED INDUSTRIAL TECHNOLOGIES, INC. RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2020 AND 2019

Risks and Uncertainties - In general, investment securities are exposed to various risks, such as interest rate, credit and overall market volatility risks. Due to the level of risk associated with investment securities, it is reasonably possible that changes in the values of investment securities could occur in the near term, and such changes could materially affect the amounts reported in the financial statements.

3. FAIR VALUE MEASUREMENTS

Accounting standards require certain assets and liabilities be reported at fair value in the financial statements and provide a framework for establishing that fair value. The framework for determining fair value is based on a hierarchy that prioritizes the inputs and valuation techniques used to measure fair value.

The Plan estimates the fair value of financial instruments using available market information and generally accepted valuation methodologies. Fair value is defined as the price that would be received to sell an asset or be paid to transfer a liability in an orderly transaction between market participants at the measurement date. The inputs used to measure fair value are classified into three tiers. These tiers include: Level 1, defined as observable inputs such as quoted prices in active markets; Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.

In instances where inputs used to measure fair value fall into different levels of the fair value hierarchy, fair value measurements in their entirety are categorized based on the lowest level input that is significant to the valuation. The Plan's assessment of the significance of particular inputs to these fair value measurements require judgment and considers factors specific to each asset or liability.

Financial assets and liabilities measured at fair value on a recurring basis are as follows. There are currently no items categorized as Level 2 or 3 within the fair value hierarchy.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements at 12/31/20

|

|

|

|

Recorded Value

|

|

Quoted Prices in Active Markets for Identical Instruments

|

|

|

|

December 31, 2020

|

|

Level 1

|

|

Assets:

|

|

|

|

|

|

Applied Industrial Technologies, Inc. Stock Fund

|

|

|

|

|

|

Common Stock

|

|

$

|

89,292,092

|

|

|

$

|

89,292,092

|

|

|

Mutual Funds

|

|

430,497,009

|

|

|

430,497,009

|

|

|

Total

|

|

$

|

519,789,101

|

|

|

$

|

519,789,101

|

|

|

|

|

|

|

|

|

Investments measured at NAV:

|

|

|

|

|

|

Common/collective trust fund: Stable value

|

|

$

|

69,772,501

|

|

|

|

|

|

|

|

|

|

|

Total investments at fair value

|

|

$

|

589,561,602

|

|

|

|

APPLIED INDUSTRIAL TECHNOLOGIES, INC. RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2020 AND 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements at 12/31/19

|

|

|

|

Recorded Value

|

|

Quoted Prices in Active Markets for Identical Instruments

|

|

|

|

December 31, 2019

|

|

Level 1

|

|

Assets:

|

|

|

|

|

|

Applied Industrial Technologies, Inc. Stock Fund

|

|

|

|

|

|

Common Stock

|

|

$

|

90,007,824

|

|

|

$

|

90,007,824

|

|

|

Mutual Funds

|

|

377,463,975

|

|

|

377,463,975

|

|

|

Total

|

|

467,471,799

|

|

|

467,471,799

|

|

|

|

|

|

|

|

|

Investments measured at NAV:

|

|

|

|

|

|

Common/collective trust fund: Stable value

|

|

58,483,879

|

|

|

|

|

|

|

|

|

|

|

Total investments at fair value

|

|

525,955,678

|

|

|

|

4. SUBSEQUENT EVENTS

On January 28, 2021, the Company announced that the Company's 401K match would be restored during the first quarter of 2021.

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

RETIREMENT SAVINGS PLAN

Employer ID Number: 34-0117420

Plan Number: 003

SCHEDULE H LINE 4(i) - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

FOR THE YEAR ENDED DECEMBER 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

|

|

Identity of Issuer, Borrower,

|

|

|

Current

|

|

|

Lessor or Similar Party

|

Description of Investment

|

Cost

|

Value

|

|

*

|

Applied Industrial Technologies, Inc. Stock:

|

|

|

|

|

|

Applied Industrial Technologies, Inc.

|

Common Stock - 1,144,917 shares

|

**

|

$

|

89,292,092

|

|

|

|

|

|

|

|

|

|

Common/Collective Trust Fund

|

|

|

|

|

|

Stable Principal Fund

|

|

|

|

|

|

Vanguard Retirement Savings Trust

|

|

**

|

69,772,501

|

|

|

|

|

|

|

|

|

|

Fixed Income Funds

|

|

|

|

|

|

Bond Fund

|

|

|

|

|

|

Baird Aggregate Bond Institutional Fund

|

Mutual Fund - 892,545 shares

|

**

|

10,505,257

|

|

|

|

Western Asset Core Bond Fund

|

Mutual Fund - 775,931 shares

|

**

|

10,602,054

|

|

|

|

American Funds Bond Fund of America R6 Fund

|

Mutual Fund - 509,996 shares

|

**

|

7,032,839

|

|

|

|

John Hancock Investment Grade Bond R6 Fund

|

Mutual Fund - 628,234 shares

|

**

|

7,036,223

|

|

|

|

Total Fixed Income Funds

|

|

|

35,176,373

|

|

|

|

|

|

|

|

|

|

Mutual Funds - Equity

|

|

|

|

|

|

Large Value Stock Fund

|

|

|

|

|

|

American Funds Washington Mutual Investors R6 Fund

|

Mutual Fund - 120,793 shares

|

**

|

6,061,416

|

|

|

|

Vanguard Value Index Institutional Fund

|

Mutual Fund - 169,695 shares

|

**

|

7,875,551

|

|

|

|

Large Core Stock Fund

|

|

|

|

|

|

Columbia Large Cap Enhanced Core Fund

|

Mutual Fund - 297,749 shares

|

**

|

8,006,480

|

|

|

|

American Funds Fundamental Investor R6 Fund

|

Mutual Fund - 234,737 shares

|

**

|

16,229,737

|

|

|

|

Vanguard Growth & Income Admiral Fund

|

Mutual Fund - 87,792 shares

|

**

|

8,227,834

|

|

|

|

Vanguard Institutional Index Institutional Fund

|

Mutual Fund - 51,612 shares

|

**

|

17,097,012

|

|

|

|

Large Growth Stock Fund

|

|

|

|

|

|

Harbor Capital Appreciation Inst Fund

|

Mutual Fund - 225,830 shares

|

**

|

23,535,969

|

|

|

|

JP Morgan Growth Advantage R5 Fund

|

Mutual Fund - 734,203 shares

|

**

|

23,971,719

|

|

|

|

Vanguard Growth Index Institutional Fund

|

Mutual Fund - 184,310 shares

|

**

|

24,046,536

|

|

|

|

Mid Cap Value Stock Fund

|

|

|

|

|

|

JP Morgan Mid Cap Value L Fund

|

Mutual Fund - 112,717 shares

|

**

|

4,163,756

|

|

|

|

Vanguard Mid-Cap Value Index Admiral Fund

|

Mutual Fund - 34,506 shares

|

**

|

2,125,963

|

|

|

|

Mid Cap Core Stock Fund

|

|

|

|

|

|

Vanguard Mid Cap Index Institutional Fund

|

Mutual Fund - 61,033 shares

|

**

|

3,456,928

|

|

|

|

Vanguard Strategic Equity Inv Fund

|

Mutual Fund - 64,376 shares

|

**

|

2,332,351

|

|

|

|

Mid Cap Growth Stock Fund

|

|

|

|

|

|

T. Rowe Price Instl Mid-Cap Equity Growth Fund

|

Mutual Fund - 400,816 shares

|

**

|

29,061,500

|

|

|

|

Small Cap Value Stock Fund

|

|

|

|

|

|

American Beacon Small Cap Value R5 Fund

|

Mutual Fund - 226,611 shares

|

**

|

5,685,673

|

|

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

RETIREMENT SAVINGS PLAN

Employer ID Number: 34-0117420

Plan Number: 003

SCHEDULE H LINE 4(i) - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

FOR THE YEAR ENDED DECEMBER 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

|

|

Identity of Issuer, Borrower,

|

|

|

Current

|

|

|

Lessor or Similar Party

|

Description of Investment

|

Cost

|

Value

|

|

|

Small Cap Core Stock Fund

|

|

|

|

|

|

Vanguard Small Cap Index Admiral Fund

|

Mutual Fund - 21,025 shares

|

**

|

1,959,953

|

|

|

|

Small Cap Growth Stock Fund

|

|

|

|

|

|

Vanguard Russell 2000 Growth Index Instl Fund

|

Mutual Fund - 25,165 shares

|

**

|

9,994,047

|

|

|

|

Victory RS Small Cap Growth R6 Fund

|

Mutual Fund - 45,436 shares

|

**

|

4,698,980

|

|

|

|

Baron Discovery R6 Fund

|

Mutual Fund - 140,095 shares

|

**

|

4,875,289

|

|

|

|

Foreign Stock Fund

|

|

|

|

|

|

American Funds EuroPacific Growth R6 Fund

|

Mutual Fund - 302,192 shares

|

**

|

20,941,880

|

|

|

|

Vanguard Total International Stock Index Institutional Fund

|

Mutual Fund - 88,796 shares

|

**

|

11,524,770

|

|

|

|

Vanguard Growth Index Institutional Fund

|

Mutual Fund - 93,451 shares

|

**

|

12,192,571

|

|

|

|

Vanguard Institutional Index Institutional Fund

|

Mutual Fund - 49,479 shares

|

**

|

16,400,879

|

|

|

|

Vanguard Mid Cap Index Institutional Fund

|

Mutual Fund - 47,937 shares

|

**

|

2,715,158

|

|

|

|

Vanguard Small Cap Index Admiral Fund

|

Mutual Fund - 28,263 shares

|

**

|

2,634,716

|

|

|

|

Vanguard Value Index Institutional Fund

|

Mutual Fund - 55,603 shares

|

**

|

2,580,537

|

|

|

|

Vanguard Total International Stock Index Institutional Fund

|

Mutual Fund - 29,370 shares

|

**

|

3,811,943

|

|

|

|

Total Mutual Funds

|

|

|

276,209,148

|

|

|

|

|

|

|

|

|

|

Retirement-Year Based Funds

|

|

|

|

|

|

Vanguard Target Retirement Income Fund

|

Mutual Fund - 217,298 shares

|

**

|

5,286,856

|

|

|

|

Vanguard Target Retirement Institutional Fund 2015

|

Mutual Fund - 103,039 shares

|

**

|

2,530,647

|

|

|

|

Vanguard Target Retirement Institutional Fund 2020

|

Mutual Fund - 447,254 shares

|

**

|

11,740,428

|

|

|

|

Vanguard Target Retirement Institutional Fund 2025

|

Mutual Fund - 698,326 shares

|

**

|

19,169,053

|

|

|

|

Vanguard Target Retirement Institutional Fund 2030

|

Mutual Fund - 739,786 shares

|

**

|

20,810,175

|

|

|

|

Vanguard Target Retirement Institutional Fund 2035

|

Mutual Fund - 565,814 shares

|

**

|

16,255,824

|

|

|

|

Vanguard Target Retirement Institutional Fund 2040

|

Mutual Fund - 361,822 shares

|

**

|

10,619,489

|

|

|

|

Vanguard Target Retirement Institutional Fund 2045

|

Mutual Fund - 257,416 shares

|

**

|

7,694,160

|

|

|

|

Vanguard Target Retirement Institutional Fund 2050

|

Mutual Fund - 313,557 shares

|

**

|

9,397,306

|

|

|

|

Vanguard Target Retirement Institutional Fund 2055

|

Mutual Fund - 157,300 shares

|

**

|

4,726,851

|

|

|

|

Vanguard Target Retirement Institutional Fund 2060

|

Mutual Fund - 89,184 shares

|

**

|

2,688,001

|

|

|

|

Vanguard Target Retirement 2060 Investment Fund

|

Mutual Fund - 62 shares

|

**

|

2,694

|

|

|

|

Vanguard Target Retirement Institutional Fund 2065

|

Mutual Fund - 17,207 shares

|

**

|

474,748

|

|

|

|

Total Retirement-Year Based Funds

|

|

|

111,396,232

|

|

|

|

|

|

|

|

|

|

Balanced Funds

|

|

|

|

|

|

Vanguard Wellesley Income Admiral Fund

|

Mutual Fund - 33,412 shares

|

**

|

2,289,521

|

|

|

|

T. Rowe Price Spectrum Conservative Allocation Fund

|

Mutual Fund - 72,484 shares

|

**

|

1,555,513

|

|

|

|

Hartford Balanced Income R6 Fund

|

Mutual Fund - 147,005 shares

|

**

|

2,319,743

|

|

|

|

TIAA-CREF Lifestyle Conservative Institutional Fund

|

Mutual Fund - 112,926 shares

|

**

|

1,550,479

|

|

|

|

|

|

|

|

|

|

Total Investments

|

|

|

589,561,602

|

|

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

RETIREMENT SAVINGS PLAN

Employer ID Number: 34-0117420

Plan Number: 003

SCHEDULE H LINE 4(i) - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

FOR THE YEAR ENDED DECEMBER 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

|

|

Identity of Issuer, Borrower,

|

|

|

Current

|

|

|

Lessor or Similar Party

|

Description of Investment

|

Cost

|

Value

|

|

|

|

|

|

|

|

|

Notes Receivable From Participants

|

|

|

|

|

*

|

Participant notes receivable (with interest rates ranging from 4.25% to 10.90% and maturity dates ranging from January 2021 to February 2027)

|

-

|

6,959,452

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

$

|

596,521,054

|

|

|

|

|

|

|

|

|

*

|

Represents a party-in-interest

|

|

|

|

|

**

|

Indicates a participant-directed fund. The cost disclosure is not required.

|

|

|

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

RETIREMENT SAVINGS PLAN

Employer ID Number: 34-0117420

Plan Number: 003

SCHEDULE H LINE 4(a) - SCHEDULE OF DELINQUENT PARTICIPANT CONTRIBUTIONS

FOR THE YEAR ENDED DECEMBER 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participant Contributions Transferred Late to the Plan

|

Total that Constitute Nonexempt Prohibited Transactions

|

Total Fully Corrected Under VFCP and PTE 2002-51

|

|

|

Check here if Late Participant Loan Repayments are included:

|

Contributions Not Corrected

|

Contributions Corrected Outside VFCP

|

Contributions Pending Correction in VFCP

|

|

2020

|

—

|

|

$

|

2,072.94

|

|

—

|

|

$

|

28,337.33

|

|

—

|

|

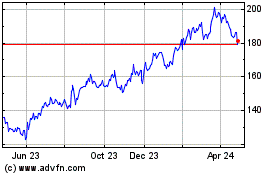

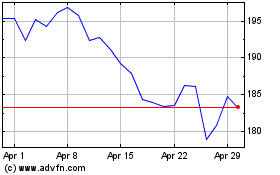

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

From Jul 2023 to Jul 2024