false

0001843714

0001843714

2024-01-29

2024-01-29

0001843714

WNNR:UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnehalfOfOneRedeemablePublicWarrantMember

2024-01-29

2024-01-29

0001843714

WNNR:ClassOrdinaryShares0.0001ParValueMember

2024-01-29

2024-01-29

0001843714

WNNR:PublicWarrantsEachWholeWarrantExercisableForOneClassaOrdinaryShareEachAtExercisePriceOf11.50PerShareMember

2024-01-29

2024-01-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

___________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

January 29, 2024

Andretti Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Cayman Islands |

001-41218 |

98-1578373 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

|

7615 Zionsville Road

Indianapolis, Indiana 46268 |

| (Address of principal executive offices, including zip code) |

(317)

872-2700

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Units, each consisting of one Class A ordinary share, $0.0001 par value,

and one-half of one redeemable public warrant |

|

WNNR.U |

|

New York Stock Exchange |

| Class A ordinary shares, $0.0001 par value |

|

WNNR |

|

New York Stock Exchange |

| Public warrants, each whole warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share |

|

WNNR WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

On January 29, 2024, Andretti Acquisition Corp.

(“Andretti”) issued a press release announcing the date of its upcoming extraordinary general meeting of shareholders. A copy

of the press release is filed as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

Certain statements included in this Current

Report on Form 8-K (the “Current Report”), and certain oral statements made from time to time by representatives of Andretti

or Zapata Holdings, Inc. (“Zapata”), that are not historical facts are forward-looking statements for purposes of the safe

harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied

by words such as “believe,” “may,” “will,” “intend,” “expect,” “should,”

“would,” “plan,” “predict,” “potential,” “seem” “seek” “future”

“outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical

matters.

These statements are based on various assumptions,

whether or not identified in this Current Report, and on the current expectations of the management of Zapata and Andretti, as the case

may be, and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and

are not intended to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. Actual events and circumstances are beyond the control of Zapata and Andretti. These forward-looking statements

are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and

legal conditions, the inability of Zapata or Andretti to successfully or timely consummate the proposed business combination of Zapata

and a wholly owned subsidiary of Andretti (the “Business Combination”), the occurrence of any event, change or other circumstances

that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the Business Combination;

the outcome of any legal proceedings that may be instituted against Andretti, Zapata, the Surviving Company or others following the announcement

of the Business Combination and any definitive agreements with respect thereto; the inability to complete the Business Combination due

to the failure to obtain approval of the shareholders of Andretti, the ability to meet stock exchange listing standards following the

consummation of the Business Combination; the risk that the Business Combination disrupts current plans and operations of Zapata as a

result of the announcement and consummation of the Business Combination. If any of these risks materialize or our assumptions prove incorrect,

actual results could differ materially from the results implied by these forward-looking statements. In addition, forward-looking statements

reflect Zapata’s expectations, plans or forecasts of future events and views as of the date of this Current Report. Zapata anticipates

that subsequent events and developments will cause Zapata’s assessments to change. Neither Andretti nor Zapata undertakes or accepts

any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations

or any change in events, conditions or circumstances on which any such statement is based. These forward-looking statements should not

be relied upon as representing Andretti’s or Zapata’s assessments of any date subsequent to the date of this Current Report.

Accordingly, undue reliance should not be placed upon the forward-looking statements.

Additional Information and Where to Find It

In

connection with the contemplated transaction, Andretti filed a Registration Statement, which includes a proxy statement/prospectus,

with the SEC. Additionally, Andretti will file other relevant materials with the SEC in connection with the transaction. A

definitive proxy statement/final prospectus will also be sent to the shareholders of Andretti, seeking any required shareholder

approval. This Current Report is not a substitute for the Registration Statement, the definitive proxy statement/final prospectus,

or any other document that Andretti will send to its shareholders. Before making any voting or investment decision, investors and

security holders of Andretti are urged to carefully read the entire Registration Statement and proxy statement/prospectus and any

other relevant documents filed with the SEC as well as any amendments or supplements to these documents, because they contain

important information about the transaction. Shareholders also can obtain copies of such documents, without charge, at the

SEC’s website at www.sec.gov. In addition, the documents filed by Andretti may be obtained free of charge from Andretti at

andrettiacquisition.com. Alternatively, these documents can be obtained free of charge from Andretti upon written request to

Andretti Acquisition Corp., 7615 Zionsville Road, Indianapolis, Indiana 46268, or by calling (317) 872-2700.

The information contained on, or that may be accessed through, the websites referenced in this Current Report is not incorporated by

reference into, and is not a part of, this Current Report.

Participants

in the Solicitation

Andretti, Andretti’s

sponsors, Zapata and certain of their respective directors and executive officers may be deemed to be participants in the solicitation

of proxies from the shareholders of Andretti, in connection with the Business Combination. Information regarding Andretti’s directors

and executive officers is contained in Andretti’s Annual Report on Form 10-K for the year ended December 31, 2022, which is filed

with the SEC. Additional information regarding the interests of those participants, the directors and executive officers of Zapata and

other persons who may be deemed participants in the transaction may be obtained by reading the Registration Statement and the proxy statement/prospectus

and other relevant documents filed with the SEC. Free copies of these documents may be obtained as described above.

No Offer

or Solicitation

This Current

Report is for informational purposes only and shall not constitute a proxy statement or solicitation of a proxy, consent, or authorization

with respect to any securities or in respect of the Business Combination. This Current Report shall also not constitute an offer to sell

or a solicitation of an offer to buy any securities, nor shall there be any sale, issuance, or transfer of securities in any state or

jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act or an exemption therefrom.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: January 29,

2024

| |

ANDRETTI ACQUISITION CORP. |

|

| |

|

|

|

By: |

/s/ William M. Brown |

|

| |

|

Name: |

William M. Brown |

|

| |

|

Title: |

President and Chief Financial Officer |

|

EXHIBIT

99.1

Andretti

Acquisition Corp. Announces Effectiveness of Registration Statement and February 13, 2024 Extraordinary General Meeting of Shareholders

to Approve Business Combination with Zapata AI

INDIANAPOLIS

/ BOSTON – (January 29, 2024)

— Andretti Acquisition Corp. (“Andretti”) (NYSE: WNNR), a publicly traded special purpose acquisition company, announced

today that its registration statement on Form S-4 (the “Registration Statement”) relating to the previously announced proposed

business combination between Andretti and Zapata Computing, Inc. (“Zapata AI”), the Industrial Generative AI software company

developing solutions and applications to solve enterprises’ hardest problems, has been declared effective by the U.S. Securities

and Exchange Commission (the “SEC”). An Extraordinary General Meeting of Shareholders of Andretti (the “Special Meeting”)

to approve the proposed business combination is scheduled to be held on February 13, 2024 at 10:00 am Eastern Time.

Andretti

shareholders as of the close of business on January 4, 2024 will receive the definitive proxy statement/prospectus (the “Proxy

Statement”) in connection with Andretti’s solicitation of proxies for the Special Meeting. The Proxy Statement contains

a notice and proxy card relating to the Special Meeting. A copy of the Proxy Statement can be accessed via the SEC’s website

at https://www.sec.gov/Archives/edgar/data/1843714/000119312524018153/0001193125-24-018153-index.htm.

The

Special Meeting is to be held virtually and can be accessed at www.proxydocs.com/WNNR. If the proposals at the Special Meeting are approved,

Andretti and Zapata AI anticipate that the business combination will close and shares of common stock and warrants of the combined entity

will commence trading shortly thereafter on the New York Stock Exchange (NYSE) under the new symbols “ZPTA” and “ZPTA.WS”,

respectively, subject to the satisfaction or waiver, as applicable, of all other closing conditions.

Every

shareholder’s vote counts, regardless of the number of shares held. Accordingly, Andretti requests that each shareholder complete,

sign, date and return a proxy card (or cast their vote by telephone or internet as provided on each proxy card) as soon as possible and,

if by mail, phone or internet, no later than 5:00 p.m. New York City time on February 12, 2024, to ensure that such shareholder's shares

will be represented at the Special Meeting.

Shareholders

who hold shares in “street name” through a broker, bank or other nominee should contact their broker, bank or nominee to

ensure that their shares are voted at the Special Meeting.

If

any Andretti shareholder does not receive the Proxy Statement, such shareholder should (i) confirm their Proxy Statement’s status

with their broker or (ii) contact MacKenzie Partners, Inc., Andretti’s proxy solicitor, for assistance via e-mail at proxy@mackenziepartners.com

or toll-free call at (800) 322-2885.

Advisors

Cohen

& Company Capital Markets, a division of J.V.B. Financial Group, LLC (“CCM”), is serving as exclusive financial advisor

and lead capital markets advisor to Andretti Acquisition Corp. Paul, Weiss, Rifkind, Wharton & Garrison LLP is serving as legal counsel

to Andretti Acquisition Corp. Foley Hoag LLP is serving as legal counsel to Zapata.

About

Zapata

Zapata

AI is the Industrial Generative AI company, revolutionizing how enterprises solve their hardest problems with its powerful suite of Generative

AI software. By combining numerical and text-based solutions, Zapata AI empowers industrial-scale enterprises to leverage large language

models and numerical generative models better, faster, and more efficiently—delivering solutions to drive growth, savings and unprecedented

insight. With proprietary science and engineering techniques and the Orquestra® platform, Zapata AI is accelerating Generative AI’s

impact in Industry. The Company was founded in 2017 and is headquartered in Boston, Massachusetts. To learn more, visit: https://www.zapata.ai

About

Andretti Acquisition Corp.

Andretti

Acquisition Corp. is a special purpose acquisition company formed for the purpose of effecting a business combination with one or more

businesses or entities. Two key members of the management team are racing legends Mario and Michael Andretti. To learn more, visit: https://www.andrettiacquisition.com/.

Forward-Looking

Statements

Certain

statements made herein are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under The

Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,”

“may,” “will,” “intend,” “expect,” “should,” “would,” “plan,”

“predict,” “potential,” “seem,” “seek,” “future,” “outlook,”

and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking

statements include, but are not limited to, statements regarding future events, the likelihood and ability of the parties to successfully

consummate the transaction, and other statements that are not historical facts. These statements are based on the current expectations

of Andretti Acquisition Corp.’s and Zapata AI’s management and are not predictions of actual performance. These forward-looking

statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on, by any investor as

a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. These statements are subject to a number of

risks and uncertainties regarding Zapata AI’s businesses and the transaction, and actual results may differ materially. These risks

and uncertainties include, but are not limited to, ability to meet the closing conditions to the transaction, including approval by stockholders

of Andretti Acquisition Corp. on the expected terms and schedule; delay in closing the transaction or failure to close the transaction

within the period permitted under its governing documents; and those factors discussed in Andretti Acquisition Corp.’s Form 10-K

for the year ended December 31, 2022, under Risk Factors in Part I, Item 1A, Registration Statement on Form S-4, as amended, first filed

with the SEC on October 27, 2023, and other documents of Andretti Acquisition Corp. filed, or to be filed, with the SEC.

If

any of these risks materialize or if assumptions prove incorrect, actual results could differ materially from the results implied by

these forward-looking statements. There may be additional risks that Andretti Acquisition Corp. or Zapata AI presently do not know or

that Andretti Acquisition Corp. or Zapata AI currently believe are immaterial that could also cause actual results to differ from those

contained in the forward-looking statements. In addition, forward-looking statements provide Andretti Acquisition Corp.’s or Zapata

AI’s expectations, plans, or forecasts of future events and views as of the date of this communication. Andretti Acquisition Corp.

or Zapata AI anticipate that subsequent events and developments will cause their assessments to change. However, while Andretti Acquisition

Corp. or Zapata AI may elect to update these forward-looking statements at some point in the future, Andretti Acquisition Corp. or Zapata

AI specifically disclaim any obligation to do so. These forward-

|

|

|

|

looking

statements should not be relied upon as representing Andretti Acquisition Corp.’s or Zapata AI’s assessments as of any date

subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Important

Additional Information and Where to Find It

In

connection with the contemplated transaction, Andretti Acquisition Corp. has filed a registration statement on Form S-4 (the “Registration

Statement”) with the SEC, which includes the Proxy Statement. Additionally, Andretti Acquisition Corp. has filed and will file

other relevant materials with the SEC in connection with the transaction. A definitive proxy statement/final prospectus will also be

sent to the stockholders of Andretti Acquisition Corp., seeking the required stockholder approval. This communication is not a substitute

for the Registration Statement, the Proxy Statement, or any other document that Andretti Acquisition Corp. will send to its stockholders.

Before making any voting or investment decision, investors and security holders of Andretti Acquisition Corp. are urged to carefully

read the entire Registration Statement and Proxy Statement, and any other relevant documents filed with the SEC as well as any amendments

or supplements to these documents, because they will contain important information about the transaction. Stockholders will also be able

to obtain copies of such documents, without charge, once available, at the SEC’s website at www.sec.gov.

In

addition, the documents filed by Andretti Acquisition Corp. may be obtained free of charge from Andretti Acquisition Corp. at andrettiacquisition.com.

Alternatively, these documents can be obtained free of charge from Andretti Acquisition Corp. upon written request to Andretti Acquisition

Corp., 7615 Zionsville Road, Indianapolis, Indiana 46268, or by calling (317) 872-2700. The information contained on, or that may be

accessed through, the websites referenced in this press release is not incorporated by reference into, and is not a part of, this press

release.

Participants

in the Solicitation

Andretti

Acquisition Corp., Andretti Acquisition Corp.’s sponsors, Zapata AI and certain of their respective directors and executive officers

may be deemed to be participants in the solicitation of proxies from the stockholders of Andretti Acquisition Corp., in connection with

the proposed transaction. Information regarding Andretti Acquisition Corp.’s directors and executive officers is contained in Andretti

Acquisition Corp.’s Annual Report on Form 10-K for the year ended December 31, 2022, which is filed with the SEC. Additional information

regarding the interests of those participants, the directors and executive officers of Zapata AI and other persons who may be deemed

participants in the transaction may be obtained by reading the Registration Statement and the Proxy Statement and other relevant documents

filed with the SEC. Free copies of these documents may be obtained as described above.

No

Offer or Solicitation

This

press release is for informational purposes only and shall not constitute a proxy statement or solicitation of a proxy, consent, or authorization

with respect to any securities or in respect of the proposed transaction. This press release shall also not constitute an offer to sell

or a solicitation of an offer to buy any securities, nor shall there be any sale, issuance, or transfer of securities in any state or

jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Zapata

Contacts

Investors:

investors@zapata.ai

Media:

press@zapata.ai

Andretti

Acquisition Corp. Contacts

Investors

Eduardo

Royes, ICR

ir@andrettiacquisition.com

Media

Matthew

Chudoba, ICR

pr@andrettiacquisition.com

v3.24.0.1

Cover

|

Jan. 29, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 29, 2024

|

| Entity File Number |

001-41218

|

| Entity Registrant Name |

Andretti Acquisition Corp.

|

| Entity Central Index Key |

0001843714

|

| Entity Tax Identification Number |

98-1578373

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

7615 Zionsville Road

|

| Entity Address, City or Town |

Indianapolis

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46268

|

| City Area Code |

317

|

| Local Phone Number |

872-2700

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable public warrant |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share, $0.0001 par value,

and one-half of one redeemable public warrant

|

| Trading Symbol |

WNNR.U

|

| Security Exchange Name |

NYSE

|

| Class A ordinary shares, $0.0001 par value |

|

| Title of 12(b) Security |

Class A ordinary shares, $0.0001 par value

|

| Trading Symbol |

WNNR

|

| Security Exchange Name |

NYSE

|

| Public warrants, each whole warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Public warrants, each whole warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share

|

| Trading Symbol |

WNNR WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WNNR_UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnehalfOfOneRedeemablePublicWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WNNR_ClassOrdinaryShares0.0001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WNNR_PublicWarrantsEachWholeWarrantExercisableForOneClassaOrdinaryShareEachAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

Andretti Acquisition (NYSE:WNNR)

Historical Stock Chart

From Apr 2024 to May 2024

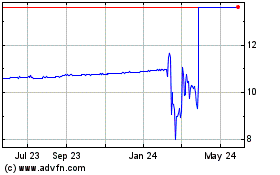

Andretti Acquisition (NYSE:WNNR)

Historical Stock Chart

From May 2023 to May 2024