KPN Slashes Dividend as Net Profit Falls

July 24 2012 - 2:43AM

Dow Jones News

Ailing telecommunications operator Royal KPN NV (KPN.AE) Tuesday

posted a significant drop in profit and slashed its dividend,

saying it continues to be squeezed by tough market conditions in

its Dutch home market.

Net profit fell to EUR315 million ($382 million) in the three

months to June, from EUR414 million a year earlier, hurt by weak

margins, especially in its Dutch mobile consumer business. KPN's

sales were down 3% to EUR3.19 billion.

With smartphone penetration in the Netherlands higher than in

most other European countries, at more than 50%, KPN's traditional

revenue from voice calls and text messages is being eroded by

Internet services like WhatsApp, a smartphone messaging service, or

Microsoft Corp.'s (MSFT) Skype, which offers free Internet phone

calls.

As some investors already feared, KPN will drastically lower its

dividend for 2012 to EUR0.35 per share. It previously intended to

pay EUR0.90 a share for 2012, more than the EUR0.85 a share for

2011.

"We don't take this preemptive step lightly," Chief Executive

Eelco Blok said in a statement. "The economic prospects in the

Netherlands continue to be difficult. Today, it is even more

important to strike the right balance between a prudent financial

framework, continued investments and sustainable shareholder

remuneration. This will support our credit ratings and enhance our

financial flexibility," he added.

To counteract falling revenue and profit Mr. Blok is slashing

costs and plans to cut 4,000 to 5,000 jobs by the end of next year.

KPN competes with Vodafone Group Plc (VOD) and Deutsche Telekom

AG's T-Mobile in the Netherlands, but it also has a lucrative

mobile operation E-Plus in Germany and another in Belgium.

Last month, Mexican telecommunications giant America Movil

raised its stake in KPN to 27.7% from 4.8%, investing invested more

than EUR2 billion in the company. The Mexican company said last

month it will also raise its stake in Telekom Austria AG (TKA.VI)

for an estimated EUR747 million.

"We will continue a constructive dialogue with our new large

shareholder, America Movil. We will explore diligently any

potential areas of cooperation that are viable, value accretive, in

line with our strategy and in the interests of all shareholders and

other stakeholders," Mr. Blok said.

KPN's mobile operations abroad, Base in Belgium and E-Plus in

Germany, did well, with E-Plus revenue up 4.9%, while Base posted a

6.7% increase in sales.

Still, KPN intends to sell Base and also tried to sell E-Plus to

Telefonica SA (TEF) in an unsuccessful attempt to thwart America

Movil's bid which management said under-valued the company. America

Movil has 246 million mobile subscribers in 18 countries.

Tuesday, KPN, said it is on track to hit its targets for 2012

for a free cash-flow between EUR1.6 billion and EUR1.8 billion and

earnings before interest, taxes, depreciation and amortization, or

Ebitda, in a EUR4.7 billion to EUR4.9 billion range, excluding the

cost of shedding 4,000 to 5,000 jobs.

Write to Archibald Preuschat;

archibald.preuschat@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

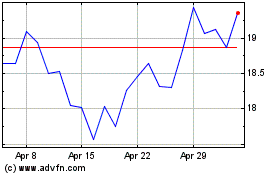

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Sep 2024 to Oct 2024

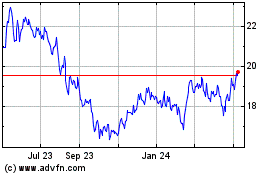

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Oct 2023 to Oct 2024