Current Report Filing (8-k)

November 06 2020 - 6:31AM

Edgar (US Regulatory)

FALSE000151428100015142812020-11-062020-11-060001514281us-gaap:CommonStockMember2020-11-062020-11-060001514281mitt:SeriesCumulativeReedmablePreferredStockMember2020-11-062020-11-060001514281mitt:SeriesBCumulativeReedmablePreferredStockMember2020-11-062020-11-060001514281mitt:SeriesCFixedToFloatingRateCumulativeRedeemablePreferredMember2020-11-062020-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 6, 2020 (November 5, 2020)

AG Mortgage Investment Trust, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

001-35151

|

27-5254382

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

245 Park Avenue, 26th floor

New York, New York 10167

(Address of principal executive offices)

Registrant's telephone number, including area code: (212) 692-2000

Not Applicable

(Former Name or Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class:

|

|

Trading Symbols:

|

|

Name of each exchange on which registered:

|

|

Common Stock, $0.01 par value per share

|

|

MITT

|

|

New York Stock Exchange

|

(NYSE)

|

|

8.25% Series A Cumulative Redeemable Preferred Stock

|

|

MITT PrA

|

|

New York Stock Exchange

|

(NYSE)

|

|

8.00% Series B Cumulative Redeemable Preferred Stock

|

|

MITT PrB

|

|

New York Stock Exchange

|

(NYSE)

|

|

8.000% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

|

MITT PrC

|

|

New York Stock Exchange

|

(NYSE)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2020, AG Mortgage Investment Trust, Inc. (the "Company") issued a press release announcing its financial results for the fiscal quarter ended September 30, 2020 (the “Release”).

Pursuant to the rules and regulations of the Securities and Exchange Commission, the Release is attached to this Report as Exhibit 99.1 and the information contained in the Release is incorporated into this Item 2.02 by this reference. The information contained in this Item 2.02 is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and shall not be deemed to be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange Act, except as otherwise expressly stated in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensating Arrangements of Certain Officers.

Alison Halpern, the Chief Accounting Officer and Principal Accounting Officer of the Company, is on maternity leave. On November 5, 2020, the Board of Directors of the Company (the "Board") appointed Anthony Rossiello, the Company’s Controller, to serve in a temporary capacity as the acting Principal Accounting Officer of the Company during the term of Ms. Halpern’s maternity leave. Mr. Rossiello, 33, joined the finance team of Angelo, Gordon & Co., L.P., the parent of the Company's external manager ("Angelo Gordon"), as the Controller of the Company in August 2020. Prior to joining Angelo Gordon, Mr. Rossiello was a Senior Manager at Ernst & Young LLP, and has more than 11 years of accounting and finance experience working with publicly traded companies within the banking and mortgage REIT industry. Mr. Rossiello holds a B.S. in Accounting from the State University of New York at Albany and is a Certified Public Accountant.

As of the time of the filing of this report, the Company has not entered into any material plan, contract or arrangement to which Mr. Rossiello is a party or in which he participates, or any material amendment thereof, in connection with the appointment described above. In the event of such a material plan, contract or arrangement, or material amendment thereof, the registrant will file an amendment to this report within four business days thereof.

There is no arrangement or understanding between Mr. Rossiello and any other persons pursuant to which Mr. Rossiello was selected as acting Principal Accounting Officer. There are no family relationships between Mr. Rossiello and any of the Company's directors, executive officers or other key personnel reportable under Item 401(d) of Regulation S-K. There are no related party transactions between the Company and Mr. Rossiello reportable under Item 404(a) of Regulation S-K.

Item 8.01 Other Events.

The Company announced that the Board has approved, and the Company has declared and set apart for payment on December 17, 2020, the next regular payment date, all accrued and unpaid cash dividends on its 8.25% Series A Cumulative Redeemable Preferred Stock, 8.00% Series B Cumulative Redeemable Preferred Stock, and 8.000% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock that were in arrears as well as the full dividends payable on the preferred stock for the fourth quarter of 2020 in the amount of $1.54689, $1.50 and $1.50 per share, respectively. The dividends will be paid on December 17, 2020 to holders of record on November 30, 2020.

As of September 30, 2020, the Company's book value does not include any accrual of accumulated, unpaid, or undeclared dividends on its Cumulative Redeemable Preferred Stock. As such, the Company's book value will decrease by the amount of the dividends declared during the fourth quarter.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL)

|

FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K includes "forward-looking statements" within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995 related to dividends, book value, our investments, our business and investment strategy, investment returns, return on equity, liquidity, financing, taxes, our assets, our interest rate sensitivity, and our views on certain macroeconomic trends and conditions, among others. Forward-looking statements are based on estimates, projections, beliefs and assumptions of management of the Company at the time of such statements and are not guarantees of future performance. Forward-looking statements involve risks and uncertainties in predicting future results and conditions. Actual results could differ materially from those projected in these forward-looking statements due to a variety of factors, including, without limitation, the uncertainty and economic impact of the COVID-19 pandemic and of responsive measures implemented by various governmental authorities, businesses and other third parties; changes in our business and investment strategy; our ability to predict and control costs; changes in interest rates and the fair value of our assets, including negative changes resulting in margin calls relating to the financing of our assets; changes in the yield curve; changes in prepayment rates on the loans we own or that underlie our investment securities; increased rates of default or delinquencies and/or decreased recovery rates on our assets; our ability to obtain and maintain financing arrangements on terms favorable to us or at all, particularly in light of the current disruption in the financial markets; changes in general economic conditions, in our industry and in the finance and real estate markets, including the impact on the value of our assets; conditions in the market for Agency RMBS, Residential Investments and Commercial Investments; legislative and regulatory actions by the U.S. Department of the Treasury, the Federal Reserve and other agencies and instrumentalities in response to the economic effects of the COVID-19 pandemic; how COVID-19 may affect us, our operations and personnel; the forbearance program included in the Coronavirus Aid, Relief, and Economic Security Act (the "CARES Act"); our ability to reinstate quarterly dividends on our common stock and to make distributions to our stockholders in the future; our ability to maintain our qualification as a REIT for federal tax purposes; and our ability to qualify for an exemption from registration under the Investment Company Act of 1940, as amended. Additional information concerning these and other risk factors are contained in the Company's filings with the Securities and Exchange Commission ("SEC"), including its most recent Annual Report on Form 10-K and subsequent filings, including its quarterly report on Form 10-Q for the three months ended September 30, 2020 and its Current Reports on Form 8-K. Copies are available free of charge on the SEC's website, http://www.sec.gov/. All information in this Current Report on Form 8-K is as of November 6, 2020. The Company undertakes no duty to update any forward looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Date: November 6, 2020

|

AG MORTGAGE INVESTMENT TRUST, INC.

|

|

|

|

|

|

|

By:

|

/s/ RAUL E. MORENO

|

|

|

|

Name: Raul E. Moreno

|

|

|

|

Title: General Counsel and Secretary

|

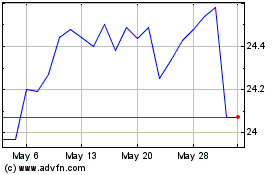

AG Mortgage Investment (NYSE:MITT-C)

Historical Stock Chart

From Jun 2024 to Jul 2024

AG Mortgage Investment (NYSE:MITT-C)

Historical Stock Chart

From Jul 2023 to Jul 2024