Amended Tender Offer Statement by Issuer (sc To-i/a)

August 25 2020 - 4:46PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement Under Section

14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 1)

AG Mortgage Investment Trust, Inc.

(Name of Subject Company (Issuer) and

Filing Person (Offeror))

|

Title of Class of Securities

|

|

CUSIP Number of Class of Securities

|

|

8.25% Series A Cumulative Redeemable Preferred Stock

|

|

001228204

|

|

8.00% Series B Cumulative Redeemable Preferred Stock

|

|

001228303

|

8.000% Series C Fixed-to-Floating Rate Cumulative Redeemable

Preferred

Stock

|

|

001228402

|

Raul E. Moreno, Esq.

General Counsel and Secretary

AG Mortgage Investment Trust, Inc.

245 Park Avenue, 26th Floor

New York, New York 10167

(212) 692-2000

(Name, Address and Telephone Number of

Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

|

Ellen J. Odoner, Esq.

Corey Chivers, Esq.

Ade K. Heyliger, Esq.

Weil, Gotshal & Manges LLP

767 Fifth Avenue

New York, New York 10153

(212) 310-8000 (Phone)

(212) 310-8007 (Fax)

|

|

Robert K. Smith, Esq.

James V. Davidson, Esq.

Hunton Andrews Kurth LLP

2200 Pennsylvania Avenue NW

Washington, DC 20037

(202) 955-1500

|

|

Philip Richter, Esq.

Fried, Frank, Harris, Shriver &

Jacobson LLP

One New York Plaza

New York, NY 10004-1980

(212) 859-8000

|

Calculation of Filing Fee

|

Transaction

Valuation(1)

|

Amount

of Filing Fee(2)

|

|

$20,100,495.80

|

$2,609.04

|

|

|

(1)

|

Estimated solely for purpose of calculating the filing fee. This Tender Offer Statement on Schedule TO relates to an exchange

offer through which AG Mortgage Investment Trust, Inc. (the “Company”) is offering to holders of up to 250,470

validly tendered and accepted shares of 8.25% Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share (“Series

A Preferred”), up to 556,600 validly tendered and accepted shares of 8.00% Series B Cumulative Redeemable Preferred Stock,

par value $0.01 per share (“Series B Preferred”), and up to 556,600 validly tendered and accepted shares of

8.000% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, par value $0.01 per share (“Series C Preferred”

and, together with the Series A Preferred and the Series B Preferred, the “Preferred Stock”), to exchange 5

shares of the Company’s newly issued common stock, par value $0.01 (the “Common Stock”) for each such

validly tendered and accepted share of Preferred Stock. The transaction valuation was calculated in accordance with Rule 0-11 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as follows: the transaction valuation

was determined by using the average of the high and low prices of the Preferred Stock of all series as reported on the New York

Stock Exchange on August 7, 2020, which was $14.74.

|

|

|

(2)

|

The Amount of Filing Fee calculated in accordance with Rule 0-11(b) of the Exchange Act, equals $129.80 for each $1,000,000

of the value of the transaction.

|

|

|

x

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting

fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and date of its

filing.

|

|

|

Amount Previously Paid: $2,609.04

|

Filing Party: AG Mortgage Investment Trust, Inc.

|

|

|

Form or Registration No.: Schedule TO

|

Date Filed: August 14, 2020

|

|

|

o

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below

to designate any transactions to which the statement relates:

|

|

o

|

third-party tender offer subject to Rule 14d-1.

|

|

|

x

|

issuer tender offer subject to Rule 13e-4.

|

|

|

o

|

going-private transaction subject to Rule 13e-3.

|

|

|

o

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing

is a final amendment reporting the results of the tender offer: o

If applicable, check the appropriate

box(es) below to designate the appropriate rule provision(s) relied upon:

|

|

o

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer).

|

|

|

o

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer).

|

SCHEDULE TO

This Amendment No. 1 amends and supplements

the Tender Offer Statement on Schedule TO (“Tender Offer Statement”) filed with the Securities and Exchange

Commission on August 14, 2020, relating to an offer (the “Original Exchange Offer”) by AG Mortgage Investment

Trust, Inc., a Maryland corporation (the “Company”), to exchange up to 6,818,350 newly issued shares of the

Company’s common stock for up to an aggregate of 1,363,670 shares of the Company’s Preferred Stock, par value $0.01

per share (the “Preferred Stock”), without regard to series. The Company is amending the Original Exchange Offer

(as so amended, the “Exchange Offer”) to specify that it is offering to purchase up to 250,470 shares of its

8.25% Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share, up to 556,600 shares of its 8.00% Series B Cumulative

Redeemable Preferred Stock, par value $0.01 per share, and up to 556,600 shares of its 8.000% Series C Fixed-to-Floating Rate Cumulative

Redeemable Preferred Stock, par value $0.01 per share, with any necessary proration to be made on a series by series basis. The

Exchange Offer is being made pursuant to the terms and subject to the conditions described in the Offer to Exchange, dated August

14, 2020, as supplemented by means of the Supplement dated August 25, 2020 (the “Supplement to Offer to Exchange”),

filed as Exhibit (a)(1)(B) hereto.

This Tender Offer Statement is intended to

satisfy the reporting requirements of Rule 13e-4 under the Securities Exchange Act of 1934, as amended.

Items 1 through

11.

Items

1 through 11 of the Tender Offer Statement, which incorporate by reference the information contained in the Original Offer to Exchange,

are hereby amended and supplemented in the manner set forth in the Supplement to Offer to Exchange, attached hereto as Exhibit

(a)(1)(B).

Item 12. Exhibits.

Item

12 of the Tender Offer Statement is hereby amended and supplemented as follows:

|

(a)(1)(B)

|

Supplement to Offer to Exchange, dated August 25, 2020.

|

|

(a)(5)(B)

|

Press release dated August 25, 2020.

|

Item 13. Information

Required by Schedule 13E-3

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

AG MORTGAGE INVESTMENT TRUST, INC.

|

|

|

|

|

|

|

Date: August 25, 2020

|

By:

|

/s/ Raul E. Moreno

|

|

|

|

|

Name:

|

Raul E. Moreno

|

|

|

|

|

Title:

|

General Counsel and Secretary

|

|

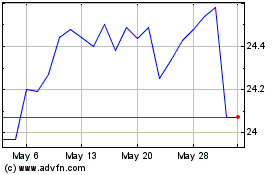

AG Mortgage Investment (NYSE:MITT-C)

Historical Stock Chart

From Jun 2024 to Jul 2024

AG Mortgage Investment (NYSE:MITT-C)

Historical Stock Chart

From Jul 2023 to Jul 2024