Current Report Filing (8-k)

November 07 2022 - 4:23PM

Edgar (US Regulatory)

0000712034false00007120342022-11-072022-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2022

ACCO BRANDS CORPORATION

(Exact name of registrant as specified in its charter)

____________________________

|

|

|

Delaware |

001-08454 |

36-2704017 |

(State or other jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

Four Corporate Drive

Lake Zurich, Illinois 60047

(Address of Registrant’s Principal Executive Office, Including Zip Code)

Registrant's telephone number, including area code: (847) 541-9500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8‑K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a‑12 under the Exchange Act (17 CFR 240.14a‑12)

☐ Pre-commencement communications pursuant to Rule 14d‑2(b) under the Exchange Act (17 CFR 240.14d‑2(b))

☐ Pre-commencement communications pursuant to Rule 13e‑4(c) under the Exchange Act (17 CFR 240.13e‑4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

ACCO |

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 - Registrant's Business and Operations

Item 1.01. Entry into a Material Definitive Agreement

Effective November 7, 2022, ACCO Brands Corporation (the “Company”) entered into a Sixth Amendment (the “Sixth Amendment”) to its Third Amended and Restated Credit Agreement, as amended (the “Credit Agreement”) among the Company, certain subsidiaries of the Company, Bank of America, N.A., as administrative agent, and the other lenders party thereto. Pursuant to the Sixth Amendment, the Credit Agreement was amended to, among other things:

•increase the maximum consolidated leverage ratio financial covenant from current levels for each of the five fiscal quarters beginning December 31, 2022, and ending December 31, 2023, as follows:

|

|

Quarter Ended |

Maximum Consolidated Leverage Ratio |

December 2022 |

4.50 : 1.00 |

March 2023 |

5.00 : 1.00 |

June 2023 |

5.00 : 1.00 |

September 2023 |

4.75 : 1.00 |

December 2023 |

4.25 : 1.00 |

•modify the maximum consolidated leverage ratio financial covenant for all first and second fiscal quarters after December 31, 2023, from the current level of 4.00x to 4.50x, while maintaining the current level of 4.00x for all third and fourth fiscal quarters;

•limit the maximum consolidated leverage ratio to 5.00:1.00 at any time, thereby capping any material acquisition step ups for the fiscal quarters ending March 31, 2023, June 30, 2023 and September 30, 2023;

•increase the Company’s flexibility under the restricted payments baskets;

•remove the anti-cash hoarding provision; and

•replace the U.S. dollar reference rate from LIBOR based pricing to SOFR based pricing, with no changes to existing margins.

The foregoing summary of the Sixth Amendment does not purport to be complete and is qualified in its entirety by reference to the Sixth Amendment, a copy of which is filed as Exhibit 10.1 and incorporated by reference herein.

Section 2 - Financial Information

Item 2.02. Results of Operations and Financial Condition

On November 7, 2022, ACCO Brands Corporation (the "Company") announced its results for the period ended September 30, 2022. Attached as Exhibit 99.1 is a copy of the press release relating to the Company's results, which is incorporated herein by reference.

The information included or incorporated by reference in this Current Report on Form 8-K under this Item 2.02 is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Section 9 - Financial Statements and Exhibits

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

|

|

|

10.1 |

|

Sixth Amendment to Third Amended and Restated Credit Agreement, dated as of November 7, 2022, among the Company, certain subsidiaries of the Company, Bank or America, N.A., as administrative agent, and the other lenders party thereto. |

|

|

|

99.1 |

|

Press release of the Company announcing results for the period ended September 30, 2022. |

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Forward-Looking Statements

Statements contained herein, other than statements of historical fact, particularly those anticipating future financial performance, business prospects, growth, strategies, business operations and similar matters, results of operations, liquidity and financial condition, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management based on information available to us at the time such statements are made. These statements, which are generally identifiable by the use of the words “will,” “believe,” “expect,” “intend,” “anticipate,” “estimate,” “forecast,” “project,” “plan,” and similar expressions, are subject to certain risks and uncertainties, are made as of the date hereof, and we undertake no duty or obligation to update them. Because actual results may differ materially from those suggested or implied by such forward-looking statements, you should not place undue reliance on them when deciding whether to buy, sell or hold the company’s securities.

Our outlook is based on certain assumptions, which we believe to be reasonable under the circumstances. These include, without limitation, assumptions regarding the impact of the COVID-19 pandemic and the war in Ukraine; changes in the competitive landscape, including ongoing uncertainties in the traditional office products channels; as well as the impact of inflation and global economic uncertainties, fluctuations in foreign currency exchange rates and acquisitions; and the other factors described below.

Among the factors that could cause our actual results to differ materially from our forward-looking statements are: our ability to improve profitability and adjusted free cash flow in the near-term by curtailing hiring, reducing inventory and limiting discretionary spending and capital expenditures; our ability to obtain additional price increases and realize longer-term cost reductions; the ongoing impact of the COVID-19 pandemic; a relatively limited number of large customers account for a significant percentage of our sales; issues that influence customer and consumer discretionary spending during periods of economic uncertainty or weakness; risks associated with foreign currency exchange rate fluctuations; challenges related to the highly competitive business environment in which we operate; our ability to develop and market innovative products that meet consumer demands and to expand into new and adjacent product categories that are experiencing higher growth rates; our ability to successfully expand our business in emerging markets and the exposure to greater financial, operational, regulatory, compliance and other risks in such markets; the continued decline in the use of certain of our products; risks associated with seasonality; the sufficiency of investment returns on pension assets, risks related to actuarial assumptions, changes in government regulations and changes in the unfunded liabilities of a multi-employer pension plan; any impairment of our intangible assets; our ability to secure, protect and maintain our intellectual property rights, and our ability to license rights from major gaming console makers and video game publishers to support our gaming business; continued disruptions in the global supply chain; risks associated with changes in the cost or availability of raw materials, transportation, labor, and other necessary supplies and services and the cost of finished goods; the continued global shortage of microchips which are needed in our gaming and computer accessories businesses; risks associated with outsourcing production of certain of our products, information technology systems and other administrative functions; the failure, inadequacy or interruption of our information technology systems or its supporting infrastructure; risks associated with a cybersecurity incident or information security breach, including that related to a disclosure of personally identifiable information; our ability to grow profitably through acquisitions; our ability to successfully integrate acquisitions and achieve the financial and other results anticipated at the time of acquisition, including planned synergies; risks associated with our indebtedness, including limitations imposed by restrictive covenants, our debt service obligations, and our ability to comply with financial ratios and tests; a change in or discontinuance of our stock repurchase program or the payment of dividends; product liability claims, recalls or

regulatory actions; the impact of litigation or other legal proceedings; our failure to comply with applicable laws, rules and regulations and self-regulatory requirements, the costs of compliance and the impact of changes in such laws; our ability to attract and retain qualified personnel; the volatility of our stock price; risks associated with circumstances outside our control, including those caused by public health crises, such as the occurrence of contagious diseases like COVID-19, severe weather events, war, terrorism and other geopolitical incidents; and other risks and uncertainties described in “Part I, Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021, and in other reports we file with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

ACCO Brands Corporation (Registrant) |

Date: |

November 7, 2022 |

By: |

/s/ Deborah A. O'Connor |

|

|

|

Name: Deborah A. O'Connor |

|

|

|

Title: Executive Vice President |

|

|

|

and Chief Financial Officer |

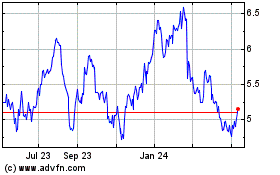

Acco Brands (NYSE:ACCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

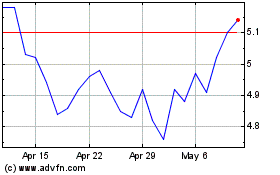

Acco Brands (NYSE:ACCO)

Historical Stock Chart

From Jul 2023 to Jul 2024