XOMA Royalty Acquires Pulmokine for $20 Million Adding the Royalty and Milestone Interest in Seralutinib, a Phase 3 Asset, to Its Portfolio

December 02 2024 - 7:30AM

XOMA Royalty Corporation (NASDAQ: XOMA) announced today it now owns

an economic interest in seralutinib, a Phase 3 asset being studied

in pulmonary arterial hypertension (PAH), through its acquisition

of Pulmokine Inc., a privately held company. In 2017,

Pulmokine licensed seralutinib to Gossamer Bio, Inc., and in 2024,

Gossamer Bio signed a global collaboration and license agreement

with Chiesi Farmaceutici S.p.A.

“We acquired Pulmokine to add seralutinib, a Phase 3 asset with

strong mechanistic rationale in PAH, to our growing royalty and

milestone portfolio while creating a favorable outcome for

Pulmokine’s founders and stockholders. In addition, we

believe seralutinib has the potential to address several

cardio-respiratory conditions beyond PAH in the future,” stated

Brad Sitko, Chief Investment Officer of XOMA Royalty. “This

transaction marks the second whole-company acquisition we have

completed in 2024. We continue to offer creative royalty

capital solutions to access assets with the potential to deliver

attractive returns to XOMA Royalty’s diverse portfolio.”

TermsXOMA Royalty acquired all outstanding

shares of Pulmokine for a $20 million cash payment at closing.

In addition, XOMA Royalty will pay success-based

consideration contingent on future development and commercial

events to Pulmokine stockholders. XOMA Royalty’s net

royalties will range from the low to mid-single digits on

commercial sales; additionally, the Company will retain up to $25

million of the milestone payments.

AdvisorsXOMA Royalty was represented by Gibson,

Dunn & Crutcher LLP.

About XOMA Royalty CorporationXOMA Royalty is a

biotechnology royalty aggregator playing a distinctive role in

helping biotech companies achieve their goal of improving human

health. XOMA Royalty acquires the potential future economics

associated with pre-commercial therapeutic candidates that have

been licensed to pharmaceutical or biotechnology companies.

When XOMA Royalty acquires the future economics, the seller

receives non-dilutive, non-recourse funding they can use to advance

their internal drug candidate(s) or for general corporate

purposes. The Company has an extensive and growing portfolio

of assets (asset defined as the right to receive potential future

economics associated with the advancement of an underlying

therapeutic candidate). For more information about XOMA

Royalty and its portfolio, please visit www.xoma.com or follow the

Company on LinkedIn.

Forward-Looking Statements/Explanatory Notes

Certain statements contained in this press release are

forward-looking statements, including statements regarding the

potential indications for and therapeutic benefits of seralutinib

and its potential to generate financial returns. In some

cases, you can identify such forward-looking statements by

terminology such as “anticipate,” “intend,” “believe,” “estimate,”

“plan,” “seek,” “project,” “expect,” “may,” “will,” “would,”

“could” or “should,” the negative of these terms or similar

expressions. These forward-looking statements are not a

guarantee of XOMA Royalty’s performance, and you should not

place undue reliance on such statements. These statements are

based on assumptions that may not prove accurate, and actual

results could differ materially from those anticipated due to

certain risks inherent in the biotechnology industry, including

those related to the fact that our product candidates subject to

out-license agreements are still being developed, and our licensees

may require substantial funds to continue development which may not

be available; we do not know whether there will be, or will

continue to be, a viable market for the products in which we have

an ownership or royalty interest; if the therapeutic product

candidates to which we have a royalty interest do not receive

regulatory approval, and our third-party licensees will not be able

to market them. Other potential risks to XOMA Royalty meeting

these expectations are described in more detail in XOMA Royalty's

most recent filing on Form 10-Q and in other filings with the

Securities and Exchange Commission. Consider such risks

carefully when considering XOMA Royalty's prospects. Any

forward-looking statement in this press release represents XOMA

Royalty's beliefs and assumptions only as of the date of this press

release and should not be relied upon as representing its views as

of any subsequent date. XOMA Royalty disclaims any obligation

to update any forward-looking statement, except as required by

applicable law.

EXPLANATORY NOTE: Any references to “portfolio” in this press

release refer strictly to milestone and/or royalty rights

associated with a basket of drug products in development. Any

references to “assets” in this press release refer strictly to

milestone and/or royalty rights associated with individual drug

products in development.

As of the date of this press release, the commercial assets in

XOMA Royalty’s milestone and royalty portfolio are VABYSMO®

(faricimab-svoa), OJEMDA™ (tovorafenib), MIPLYFFA™ (arimoclomol),

XACIATO™ (clindamycin phosphate) vaginal gel 2%, IXINITY®

[coagulation factor IX (recombinant)], and DSUVIA® (sufentanil

sublingual tablet). All other assets in the milestone and

royalty portfolio are investigational compounds. Efficacy and

safety have not been established. There is no guarantee that

any of the investigational compounds will become commercially

available.

| XOMA

Royalty Investor Contact |

XOMA

Royalty Media Contact |

| Juliane Snowden |

Kathy Vincent |

| XOMA Royalty Corporation |

KV Consulting & Management |

| +1 646-438-9754 |

+1 310-403-8951 |

| juliane.snowden@xoma.com |

kathy@kathyvincent.com |

1

https://ir.gossamerbio.com/news-releases/news-release-details/gossamer-bio-announces-third-quarter-2024-financial-results-and

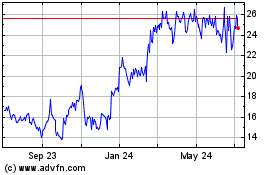

XOMA Royalty (NASDAQ:XOMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

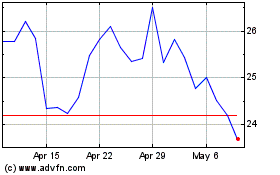

XOMA Royalty (NASDAQ:XOMA)

Historical Stock Chart

From Dec 2023 to Dec 2024