UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February 2024

Commission File Number: 001-36158

Wix.com Ltd.

(Translation of registrant’s name into English)

5 Yunitsman St.,

Tel Aviv, Israel, 6936025

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

EXPLANATORY NOTE

On February 21, 2024, Wix.com Ltd. (NASDAQ: WIX) issued a press release titled “Wix Reports Fourth Quarter and Full Year 2023 Results”. A copy of this press release is attached to this Form 6-K as Exhibit 99.1.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 21, 2024

WIX.COM LTD.

By: /s/ Naama Kaenan

Name: Naama Kaenan

Title: General Counsel

EXHIBIT INDEX

The following exhibit is filed as part of this Form 6-K: Exhibit 99.1

Wix Reports Fourth Quarter and Full Year 2023 Results

Outperformance of 2023 targets as well as anticipated acceleration of top-line growth and overachievement of 2024 targets in three-year plan underpin expectation to significantly surpass the Rule of 40 in 2025

•Capped off a year of strong growth with total revenue of $404 million in the fourth quarter, up 14% y/y driven by continued growth acceleration in the Partners business

◦Partners1 revenue totaled $130.1 million in Q4, up 38% y/y, as more Partners joined Wix, monetization continued to increase and Studio uptake exceeded expectations

•Robust growth paired with solid operating leverage drove Wix to outperform the 2023 targets outlined in three-year plan

◦Achieved positive full year GAAP net income two years earlier than anticipated

◦Q4 FCF2 margin was a record 22% and full year FCF2 margin was 16%, meaningfully above 13% margin target

•Strong bookings and revenue growth anticipated for 2024 driven by momentum from milestone product launches of 2023, solid business fundamentals and stable and positively-trending macro environment

◦Expect 2024 bookings growth of 12-14% y/y with acceleration through the year to 15% y/y growth in 2H24; expect full year revenue growth of 11-13% y/y

◦Expect FCF2 margin of 21-23% in 2024, driven by growth and continued operational efficiency benefits

•Completed $300 million share repurchase plan in February and in the process of pursuing the necessary approvals for $225 million in additional share repurchases

NEW YORK, February 21, 2024 -- Wix.com Ltd. (Nasdaq: WIX), the leading SaaS website builder platform globally3, today reported financial results for the fourth quarter and full year of 2023. In addition, the Company provided its initial outlook for the first quarter and full year 2024. Please visit the Wix Investor Relations website at https://investors.wix.com/ to view the Q4'23 Shareholder Update and other materials.

“We wrapped up an outstanding year of accelerating growth and record profitability with a strong fourth quarter underpinned by robust business fundamentals and anchored by incredible momentum in our Partners business,” said Avishai Abrahami, Wix Co-founder and CEO. “Additionally, 2023 was a milestone year for innovation at Wix. Wix Studio has proven to be our highest-performing product release in recent history. In just six months, more than 500,000 agencies and freelancers have created Studio accounts, driving the number of Studio premium subscriptions to be ahead of plan. Most excitingly, nearly half of these Studio accounts were created by new Partners – a powerful indication that Studio is successfully winning a new market of large agencies who had not built on Wix before. AI was another major focus of innovation in 2023, building on nearly a decade of leading AI research and development at Wix. We introduced a suite of new genAI and AI tools, including AI Chat Experience for Business, AI Code Assistant and, most recently, AI Site Generator, which has been in the hands of many of our users for a couple of months and is already generating fantastic feedback.

Both Self Creators and Partners have shown excellent engagement with our AI products over the past year, with the majority of new users today using or interacting with at least one AI tool on their web creation journey. We expect continued momentum and ramping benefits from these milestone products coupled with our upcoming product pipeline to propel accelerating growth in 2024.”

“Q4 capped off an incredibly strong year of sustained profitable growth with revenue in the fourth quarter increasing 14% y/y, driven by incredible Partners revenue growth of 38% y/y,” added Lior Shemesh, CFO at Wix. “On top of this outperformance in 2023, I am extremely confident in our ability to comfortably beat our three-year plan – let me walk you through my reasoning:

“First, we expect to drive accelerating profitable growth in 2024 and see a number of indicators of growth momentum today, including (1) improved visibility from a stable and positively-trending macro environment; (2) continued strong cohort behavior, particularly in our Partners business; and (3) ramping benefits from Studio and the milestone AI initiatives launched in 2023. Because of this visibility and confidence, we are reintroducing bookings guidance, which we expect to accelerate to 12-14% y/y growth in 2024 with 15% y/y growth in 2H.

“Second, this bookings acceleration in 2024, which we expect will primarily be driven by improved Creative Subscriptions performance, will position us for revenue acceleration in 2025. Higher revenue growth coupled with continued efficient business operations will, we anticipate, allow us to exceed the 2024 targets we shared in our August 2023 Analyst Day.

“Finally, outperformance of our 2023 targets as well as this anticipated top-line acceleration and overachievement of our profitability targets in 2024 gives us confidence that we will not just reach, but actually exceed our three-year plan and significantly surpass the Rule of 40 in 2025.”

Q4 2023 Financial Results

•Total revenue in the fourth quarter of 2023 was $403.8 million, up 14% y/y

◦Creative Subscriptions revenue in the fourth quarter of 2023 was $296.2 million, up 12% y/y

◦Creative Subscriptions ARR increased to $1.19 billion as of the end of the quarter, up 10% y/y

•Business Solutions revenue in the fourth quarter of 2023 was $107.6 million, up 20% y/y

◦Transaction revenue4 was $46.6 million, up 20% y/y

•Partners revenue1 in the fourth quarter of 2023 was $130.1 million, up 38% y/y

•Total bookings in the fourth quarter of 2023 were $395.0 million, up 6% y/y; excluding long-term bookings associated with B2B partnership agreements, total bookings grew 10% y/y

◦Creative Subscriptions bookings in the fourth quarter of 2023 were $283.5 million, up 1% y/y; excluding long-term bookings associated with B2B partnership agreements, Creative Subscriptions bookings grew 5% y/y

◦Business Solutions bookings in the fourth quarter of 2023 were $111.5 million, up 24% y/y

•Total gross margin on a GAAP basis in the fourth quarter of 2023 was 69%

◦Creative Subscriptions gross margin on a GAAP basis was 82%

◦Business Solutions gross margin on a GAAP basis was 32%

•Total non-GAAP gross margin in the fourth quarter of 2023 was 70%

◦Creative Subscriptions gross margin on a non-GAAP basis was 83%

◦Business Solutions gross margin on a non-GAAP basis was 33%

•GAAP net income in the fourth quarter of 2023 was $3.0 million, or $0.05 per basic and diluted share

•Non-GAAP net income in the fourth quarter of 2023 was $74.0 million, or $1.29 per basic share or $1.22 per diluted share

•Net cash provided by operating activities for the fourth quarter of 2023 was $90.4 million, while capital expenditures totaled $10.0 million, leading to free cash flow of $80.4 million

•Excluding one-time cash restructuring charges and the capital expenditures and other expenses associated with the build out of our new corporate headquarters free cash flow for the fourth quarter of 2023 would have been $90.1 million, or 22% of revenue

•Executed $59 million in repurchases of ordinary shares

FY 2023 Financial Results

•Total revenue for the full year 2023 was $1.56 billion, up 13% y/y

◦Creative Subscriptions revenue for the full year 2023 was $1.15 billion, up 11% y/y

◦Business Solutions revenue for the full year 2023 was $409.7 million, up 18% y/y

•Transaction4 revenue for the full year was $177.5 million, up 20% y/y

•Partners1 revenue for the full year 2023 was $468.5 million, up 35% y/y

•Total bookings for the full year 2023 were $1.60 billion, up 9% y/y; excluding long-term bookings associated with B2B partnership agreements, total bookings grew 11% y/y

◦Creative Subscriptions bookings for the full year 2023 were $1.17 billion, up 5% y/y; excluding long-term bookings associated with B2B partnership agreements, Creative Subscriptions bookings grew 8% y/y

◦Business Solutions bookings for the full year 2023 were $422.7 million, up 21% y/y

•Total gross margin on a GAAP basis for the full year 2023 was 67%

◦Creative Subscriptions gross margin on a GAAP basis was 81%

◦Business Solutions gross margin on a GAAP basis was 27%

•Total non-GAAP gross margin for the full year 2023 was 68%

◦Creative Subscriptions gross margin on a non-GAAP basis was 82%

◦Business Solutions gross margin on a non-GAAP basis was 29%

•GAAP net income for the full year 2023 was $33.1 million, or $0.58 per basic share or $0.57 per diluted share

•Non-GAAP net income for the full year 2023 was $268.3 million, or $4.72 per basic share or $4.39 per diluted share

•Net cash provided by operating activities for the full year 2023 was $248.2 million, while capital expenditures totaled $66.0 million, leading to free cash flow of $182.2 million

•Excluding the capex investment associated with our new headquarters office build out, free cash flow for the full year 2023 would have been $246.1 million, or 16% of revenue

•Executed $127 million in repurchases of ordinary shares as we remained committed to share count management and returning value to shareholders

•Added 189 thousand net premium subscriptions in full year 2023 to reach nearly 6.3 million total premium subscriptions as of December 31, 2023

•Registered users as of December 31, 2023 were 263 million, representing an 8% increase compared to December 31, 2022

•Total employee headcount as of December 31, 2023 of 5,302, down 4% from the end of 2022

____________________

1 Partners revenue is defined as revenue generated through agencies and freelancers that build sites or applications for other users as well as revenue generated through B2B partnerships, such as LegalZoom or Vistaprint, and enterprise partners. We identify agencies and freelancers building sites or applications for others using multiple criteria, including but not limited to, the number of sites built, participation in the Wix Partner Program and/or the Wix Marketplace or Wix products used (incl. Wix Studio). Partners revenue includes revenue from both the Creative Subscriptions and Business Solutions businesses.

2 Free cash flow excluding one-time cash restructuring charges, if applicable, and expenses associated with the buildout of our new corporate headquarters.

3 Based on number of active live sites as reported by competitors' figures, independent third-party-data and internal data as of Q2 2023.

4 Transaction revenue is a portion of Business Solutions revenue, and we define transaction revenue as all revenue generated through transaction facilitation, primarily from Wix Payments as well as Wix POS, shipping solutions and multi-channel commerce and gift card solutions.

Financial Outlook

Coming off of a strong year of significant product launches and strengthening fundamentals, we believe our business will experience strong top line growth of bookings in 2024 and more significantly in the second half of the year. This positive trend in bookings growth is expected to translate into y/y revenue growth acceleration in 2025.

This growth, paired with improved profitability targets due to a high degree of operating efficiency, leads to our expectation that our financial performance in 2024 and in 2025 will surpass the three-year plan we shared at our Analyst & Investor Day in August.

We now expect to significantly exceed the Rule of 40 in 2025.

We are reintroducing bookings guidance as we enter 2024 with improved visibility and a tremendous amount of confidence in our business as a result of a stable and positively-trending macro environment, strong cohort behavior, particularly in our Partners business, and most notably, ramping benefits from Studio and the milestone AI initiatives launched in 2023.

Our outlook for the full year 2024 is as follows:

We expect total bookings of $1.78 - $1.81 billion, up 12 - 14% y/y, an acceleration from 2023. We expect y/y growth of total bookings to accelerate in the second half of 2024 to 15% at the high end of the guidance range, positioning the business to achieve accelerating y/y revenue growth in 2025.

In particular, the acceleration is expected to be primarily in Creative Subscription bookings, bringing it to double digit y/y growth in the 2H24.

We expect total revenue to be $1.73 - $1.76 billion, up 11 - 13% y/y.

We expect total revenue in Q1 2024 of $415 - $419 million, up 11 - 12% y/y.

We continue to operate the business in an efficient manner as evidenced by the meaningful operating leverage -- on both a GAAP and non-GAAP basis -- generated throughout 2023 compared to 2022. We plan to operate with the same efficiency in 2024 and expect strong gross profit growth due to gross margin improvements on a y/y basis as well as minimal incremental operating expenses this year.

We expect non-GAAP total gross margin of 68 - 69% with non-GAAP business solutions gross margin to exceed 30% for the full year.

We expect non-GAAP operating expenses to be 51 - 52% of revenue for the full year, with non-GAAP sales and marketing to remain similar to 2023 at roughly 23 - 24% of revenue.

We believe we are ahead of our plan to achieve GAAP profitability. We expect GAAP operating profit in 2024 as well as a second consecutive year of GAAP net income.

We expect to generate free cash flow, excluding headquarters costs, of $370 - $400 million, or 21 - 23% of revenue in 2024.

As we continue to responsibly manage dilution, we expect stock-based compensation expenses to decline as a percent of revenue for the third consecutive year to approximately 13% of revenue in 2024, in line with our three-year plan.

We expect capital expenditures, excluding costs associated with our new headquarters build out, of approximately $7 - $10 million in 2024. We will incur the final costs for our new headquarters in the first half of the year and anticipate them to be roughly $8 - $10 million.

Conference Call and Webcast Information

Wix will host a conference call to discuss the results at 8:30 a.m. ET on Wednesday, February 21, 2024. To participate on the live call, analysts and investors should register and join at https://register.vevent.com/register/BIefc01e3fb58f409e9a256960e4651d01. A replay of the call will be available through February 20, 2025 via the registration link.

Wix will also offer a live and archived webcast of the conference call, accessible from the "Investor Relations" section of the Company’s website at https://investors.wix.com/.

About Wix.com Ltd.

Wix is the leading SaaS website builder platform globally3 to create, manage and grow a digital presence. What began as a website builder in 2006 is now a complete platform providing users with enterprise-grade performance, security and a reliable infrastructure. Offering a wide range of commerce and business solutions, advanced SEO and marketing tools, Wix enables users to take full ownership of their brand, their data and their relationships with their customers. With a focus on continuous innovation and delivery of new features and products, anyone can build a powerful digital presence to fulfill their dreams on Wix.

For more about Wix, please visit our Press Room

Investor Relations:

ir@wix.com

Media Relations:

pr@wix.com

Non-GAAP Financial Measures and Key Operating Metrics

To supplement its consolidated financial statements, which are prepared and presented in accordance with U.S. GAAP, Wix uses the following non-GAAP financial measures: bookings, cumulative cohort bookings, bookings on a constant currency basis, revenue on a constant currency basis, non-GAAP gross margin, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss), non-GAAP net income (loss) per share, free cash flow, free cash flow, as adjusted, free cash flow margins, free cash flow per share, non-GAAP R&D expenses, non-GAAP S&M expenses, non-GAAP G&A expenses, non-GAAP operating expenses, non-GAAP cost of revenue expense, non-GAAP financial expense, non-GAAP tax expense (collectively the "Non-GAAP financial measures"). Measures presented on a constant currency or foreign exchange neutral basis have been adjusted to exclude the effect of y/y changes in foreign currency exchange rate fluctuations. Bookings is a non-GAAP financial measure calculated by adding the change in deferred revenues and the change in unbilled contractual obligations for a particular period to revenues for the same period. Bookings include cash receipts for premium subscriptions purchased by users as well as cash we collect from business solutions, as well as payments due to us under the terms of contractual agreements for which we may have not yet received payment. Cash receipts for premium subscriptions are deferred and recognized as revenues over the terms of the subscriptions. Cash receipts for payments and the majority of the additional products and services (other than Google Workspace) are recognized as revenues upon receipt. Committed payments are recognized as revenue as we fulfill our obligation under the terms of the contractual agreement. Bookings and Creative Subscriptions Bookings are also presented on a further non-GAAP basis by excluding, in each case, bookings associated with long term B2B partnership agreements. Bookings and Creative Subscriptions Bookings are also presented on a further non-GAAP basis by excluding, in each case, bookings associated with long term B2B partnership agreements. Non-GAAP gross margin represents gross profit calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization, divided by revenue. Non-GAAP operating income (loss) represents operating income (loss) calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, amortization, acquisition-related expenses and sales tax expense accrual and other G&A expenses (income). Non-GAAP net income (loss) represents net loss calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, amortization, sales tax expense accrual and other G&A expenses (income), amortization of debt discount and debt issuance costs and acquisition-related expenses and non-operating foreign exchange expenses (income). Non-GAAP net income (loss) per share represents non-GAAP net income (loss) divided by the weighted average number of shares used in computing GAAP loss per share. Free cash flow represents net cash provided by (used in) operating activities less capital expenditures. Free cash flow, as adjusted, represents free cash flow further adjusted to exclude one-time cash restructuring charges and the capital expenditures and other expenses associated with the buildout of our new corporate headquarters. Free cash flow margins represent free cash flow divided by revenue. Free cash flow per share represents free cash flow, as adjusted, divided by total outstanding shares on a fully diluted basis. Non-GAAP cost of revenue represents cost of revenue calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP R&D expenses represent R&D expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP S&M expenses represent S&M expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP G&A expenses represent G&A expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP operating expenses represent operating expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization.

Non-GAAP financial expense represents financial expense calculated in accordance with GAAP as adjusted for unrealized gains of equity investments, amortization of debt discount and debt issuance costs and non-operating foreign exchange expenses. Non-GAAP tax expense represents tax expense calculated in accordance with GAAP as adjusted for provisions for income tax effects related to non-GAAP adjustments.

The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The Company uses these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. The Company believes that these measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making.

For more information on the non-GAAP financial measures, please see the reconciliation tables provided below. The accompanying tables have more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related reconciliations between these financial measures. The Company is unable to provide reconciliations of free cash flow, free cash flow, as adjusted, cumulative cohort bookings, non-GAAP gross margin, and non-GAAP tax expense to their most directly comparable GAAP financial measures on a forward-looking basis without unreasonable effort because items that impact those GAAP financial measures are out of the Company's control and/or cannot be reasonably predicted. Such information may have a significant, and potentially unpredictable, impact on our future financial results.

Wix also uses Creative Subscriptions Annualized Recurring Revenue (ARR) as a key operating metric. Creative Subscriptions ARR is calculated as Creative Subscriptions Monthly Recurring Revenue (MRR) multiplied by 12. Creative Subscriptions MRR is calculated as the total of (i) all Creative Subscriptions in effect on the last day of the period, multiplied by the monthly revenue of such Creative Subscriptions, other than domain registrations; (ii) the average revenue per month from domain registrations in effect on the last day of the period; and (iii) monthly revenue from other partnership agreements and enterprise partners.

Forward-Looking Statements

This document contains forward-looking statements, within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. Such forward-looking statements may include projections regarding our future performance, including, but not limited to revenue, bookings and free cash flow, and may be identified by words like “anticipate,” “assume,” “believe,” “aim,” “forecast,” “indication,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “outlook,” “future,” “will,” “seek” and similar terms or phrases. The forward-looking statements contained in this document, including the quarterly and annual guidance, are based on management’s current expectations, which are subject to uncertainty, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Important factors that could cause our actual results to differ materially from those indicated in the forward-looking statements include, among others, our expectation that we will be able to attract and retain registered users and generate new premium subscriptions, in particular as we continuously adjust our marketing strategy and as the macro-economic environment continues to be turbulent;

our expectation that we will be able to increase the average revenue we derive per premium subscription, including through our partners; our expectations related to our ability to develop relevant and required products using Artificial Intelligence (“AI”), the regulatory environment impacting AI-related activities including privacy and intellectual property aspects, and potential competition from third-party AI tools which may impact our business; our expectation that new products and developments, as well as third-party products we will offer in the future within our platform, will receive customer acceptance and

satisfaction, including the growth in market adoption of our online commerce solutions; our assumption that historical user behavior can be extrapolated to predict future user behavior, in particular during the current turbulent macro-economic environment; our expectation regarding the successful impact of our previously announced Cost-Efficiency Plan and other cost saving measures we may take in the future; our prediction of the future revenues and/or bookings generated by our user cohorts and our ability to maintain and increase such revenue growth, as well as our ability to generate and maintain elevated levels of free cash flow and profitability; our expectation to maintain and enhance our brand and reputation; our expectation that we will effectively execute our initiatives to improve our user support function through our Customer Care team, and that our recent downsizing of our Customer Care team will not affect our ability to continue attracting registered users and increase user retention, user engagement and sales; our plans to successfully localize our products, including by making our product, support and communication channels available in additional languages and to expand our payment infrastructure to transact in additional local currencies and accept additional payment methods; our expectation regarding the impact of fluctuations in foreign currency exchange rates, interest rates, potential illiquidity of banking systems, and other recessionary trends on our business; our expectations relating to the repurchase of our ordinary shares and/or Convertible Notes pursuant to our repurchase program; our expectation that we will effectively manage our infrastructure; our expectations regarding the outcome of any regulatory investigation or litigation, including class actions; our expectations regarding future changes in our cost of revenues and our operating expenses on an absolute basis and as a percentage of our revenues, as well as our ability to achieve and maintain profitability; our expectations regarding changes in the global, national, regional or local economic, business, competitive, market, and regulatory landscape, including as a result of the Israel-Hamas war and/or the Ukraine-Russia war and any escalations thereof; our planned level of capital expenditures and our belief that our existing cash and cash from operations will be sufficient to fund our operations for at least the next 12 months and for the foreseeable future; our expectations with respect to the integration and performance of acquisitions; our ability to attract and retain qualified employees and key personnel; and our expectations about entering into new markets and attracting new customer demographics, including our ability to successfully attract new partners large enterprise-level users and to grow our activities with these customer types as anticipated and other factors discussed under the heading “Risk Factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2022 filed with the Securities and Exchange Commission on March 30, 2023. The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. Any forward-looking statement made by us in this press release speaks only as of the date hereof. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise.

| | |

| Wix.com Ltd. |

| CONSOLIDATED STATEMENTS OF OPERATIONS - GAAP |

| (In thousands, except loss per share data) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | (unaudited) | | (unaudited) |

| Revenues | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Creative Subscriptions | | | | | | | | | | | | | | | | | | | | | $ | 296,154 | | | $ | 265,268 | | | $ | 1,152,007 | | | $ | 1,039,479 | |

| Business Solutions | | | | | | | | | | | | | | | | | | | | | 107,617 | | | 89,772 | | | 409,658 | | | 348,187 | |

| | | | | | | | | | | | | | | | | | | | | 403,771 | | | 355,040 | | | 1,561,665 | | | 1,387,666 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of Revenues | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Creative Subscriptions | | | | | | | | | | | | | | | | | | | | | 52,794 | | | 58,427 | | | 215,515 | | | 251,587 | |

| Business Solutions | | | | | | | | | | | | | | | | | | | | | 73,319 | | | 70,337 | | | 297,013 | | | 274,640 | |

| | | | | | | | | | | | | | | | | | | | | 126,113 | | | 128,764 | | | 512,528 | | | 526,227 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Profit | | | | | | | | | | | | | | | | | | | | | 277,658 | | | 226,276 | | | 1,049,137 | | | 861,439 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Research and development | | | | | | | | | | | | | | | | | | | | | 125,743 | | | 120,994 | | | 481,293 | | | 482,861 | |

| Selling and marketing | | | | | | | | | | | | | | | | | | | | | 103,642 | | | 97,944 | | | 399,577 | | | 492,886 | |

| General and administrative | | | | | | | | | | | | | | | | | | | | | 43,401 | | | 39,941 | | | 160,033 | | | 171,045 | |

| Impairment, restructuring and other costs | | | | | | | | | | | | | | | | | | | | | 3,103 | | | — | | | 32,614 | | | — | |

| Total operating expenses | | | | | | | | | | | | | | | | | | | | | 275,889 | | | 258,879 | | | 1,073,517 | | | 1,146,792 | |

| Operating income (loss) | | | | | | | | | | | | | | | | | | | | | 1,769 | | | (32,603) | | | (24,380) | | | (285,353) | |

| Financial income (expenses), net | | | | | | | | | | | | | | | | | | | | | 6,461 | | | (13,256) | | | 62,474 | | | (183,513) | |

| Other income (expenses) | | | | | | | | | | | | | | | | | | | | | 44 | | | 788 | | | (255) | | | 1,023 | |

| Income (loss) before taxes on income | | | | | | | | | | | | | | | | | | | | | 8,274 | | | (45,071) | | | 37,839 | | | (467,843) | |

| Income tax expenses (benefit) | | | | | | | | | | | | | | | | | | | | | 5,320 | | | (6,096) | | | 4,702 | | | (42,980) | |

| Net income (loss) | | | | | | | | | | | | | | | | | | | | | 2,954 | | | (38,975) | | | 33,137 | | | (424,863) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic net income (loss) per share | | | | | | | | | | | | | | | | | | | | | $ | 0.05 | | | $ | (0.67) | | | $ | 0.58 | | | $ | (7.33) | |

| Basic weighted-average shares used to compute net income (loss) per share | | | | | | | | | | | | | | | | | | | | | 57,317,815 | | 58,189,246 | | 56,829,962 | | 57,993,364 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diluted net income (loss) per share | | | | | | | | | | | | | | | | | | | | | $ | 0.05 | | | $ | (0.67) | | | $ | 0.57 | | | $ | (7.33) | |

| Diluted weighted-average shares used to compute net income (loss) per share | | | | | | | | | | | | | | | | | | | | | 59,085,757 | | 58,189,246 | | 58,408,331 | | 57,993,364 |

| | |

| Wix.com Ltd. |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (In thousands) |

| | | | | | | | | | | | | | | | | |

| | | | | | | Period ended |

| | | | | | | | December 31, | | December 31, |

| | | | | | | | 2023 | | 2022 |

| Assets | | | | | | | (unaudited) | | (audited) |

| Current Assets: | | | | | | | | | |

| Cash and cash equivalents | | | | | | | $ | 609,622 | | | $ | 244,686 | |

| Short-term deposits | | | | | | | 212,709 | | | 526,328 | |

| Restricted deposits | | | | | | | 2,125 | | | 13,669 | |

| Marketable securities | | | | | | | 140,563 | | | 292,449 | |

| Trade receivables | | | | | | | 57,394 | | | 42,086 | |

| Prepaid expenses and other current assets | | | | | | | 57,423 | | | 28,519 | |

| Total current assets | | | | | | | 1,079,836 | | | 1,147,737 | |

| | | | | | | | | |

| Long-Term Assets: | | | | | | | | | |

| Prepaid expenses and other long-term assets | | | | | | | 25,809 | | | 23,027 | |

| Property and equipment, net | | | | | | | 136,928 | | | 108,738 | |

| Marketable securities | | | | | | | 64,806 | | | 194,964 | |

| Intangible assets and goodwill, net | | | | | | | 77,339 | | | 83,293 | |

| Operating lease right-of-use assets | | | | | | | 420,562 | | | 200,608 | |

| Total long-term assets | | | | | | | 725,444 | | | 610,630 | |

| | | | | | | | | |

| Total assets | | | | | | | $ | 1,805,280 | | | $ | 1,758,367 | |

| | | | | | | | | | |

| Liabilities and Shareholders' Deficiency | | | | | | | | | |

| Current Liabilities: | | | | | | | | | |

| Trade payables | | | | | | | $ | 39,449 | | | $ | 96,071 | |

| Employees and payroll accruals | | | | | | | 56,581 | | | 86,113 | |

| Deferred revenues | | | | | | | 592,608 | | | 529,205 | |

| Current portion of convertible notes, net | | | | | | | — | | | 361,621 | |

| Accrued expenses and other current liabilities | | | | | | | 76,556 | | | 88,194 | |

| Operating lease liabilities | | | | | | | 24,981 | | | 29,268 | |

| Total current liabilities | | | | | | | 790,175 | | | 1,190,472 | |

| Long Term Liabilities: | | | | | | | | | |

| Long-term deferred revenues | | | | | | | 83,384 | | | 70,594 | |

| Long-term deferred tax liability | | | | | | | 7,167 | | | 14,902 | |

| Convertible notes, net | | | | | | | 569,714 | | | 566,566 | |

| Other long-term liabilities | | | | | | | 7,699 | | | 6,093 | |

| Long-term operating lease liabilities | | | | | | | 401,626 | | | 172,982 | |

| Total long-term liabilities | | | | | | | 1,069,590 | | | 831,137 | |

| | | | | | | | | |

| Total liabilities | | | | | | | 1,859,765 | | | 2,021,609 | |

| | | | | | | | | | |

| Shareholders' Deficiency | | | | | | | | | |

| Ordinary shares | | | | | | | 106 | | | 108 | |

| Additional paid-in capital | | | | | | | 1,539,952 | | | 1,274,968 | |

| Treasury Stock | | | | | | | (558,871) | | | (431,862) | |

| Accumulated other comprehensive loss | | | | | | | 4,192 | | | (33,455) | |

| Accumulated deficit | | | | | | | (1,039,864) | | | (1,073,001) | |

| Total shareholders' deficiency | | | | | | | (54,485) | | | (263,242) | |

| | | | | | | | | |

| Total liabilities and shareholders' deficiency | | | | | | | $ | 1,805,280 | | | $ | 1,758,367 | |

| | |

| Wix.com Ltd. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | (unaudited) | | (unaudited) |

| OPERATING ACTIVITIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | | | | | | | | | | | | | | | | | | | | $ | 2,954 | | | $ | (38,975) | | | $ | 33,137 | | | $ | (424,863) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation | | | | | | | | | | | | | | | | | | | | | 6,725 | | | 5,209 | | | 20,492 | | | 16,611 | |

| Amortization | | | | | | | | | | | | | | | | | | | | | 1,489 | | | 1,511 | | | 5,955 | | | 6,246 | |

| Share based compensation expenses | | | | | | | | | | | | | | | | | | | | | 58,195 | | | 59,917 | | | 224,625 | | | 236,836 | |

| Amortization of debt discount and debt issuance costs | | | | | | | | | | | | | | | | | | | | | 789 | | | 1,305 | | | 4,194 | | | 5,213 | |

| Changes in accrued interest and exchange rate on short term and long term deposits | | | | | | | | | | | | | | | | | | | | | (586) | | | (93) | | | (2,415) | | | (86) | |

| Non-cash impairment, restructuring and other costs | | | | | | | | | | | | | | | | | | | | | 3,567 | | | — | | | 26,699 | | | — | |

| Amortization of premium and discount and accrued interest on marketable securities, net | | | | | | | | | | | | | | | | | | | | | 4,237 | | | 2,447 | | | 8,346 | | | 6,252 | |

| Remeasurement loss (gain) on Marketable equity | | | | | | | | | | | | | | | | | | | | | (10,296) | | | 3,955 | | | (30,608) | | | 200,338 | |

| Changes in deferred income taxes, net | | | | | | | | | | | | | | | | | | | | | (2,035) | | | (11,997) | | | (8,784) | | | (57,865) | |

| Changes in operating lease right-of-use assets | | | | | | | | | | | | | | | | | | | | | 7,174 | | | 18,724 | | | 27,231 | | | 45,440 | |

| Changes in operating lease liabilities | | | | | | | | | | | | | | | | | | | | | 16,701 | | | (11,204) | | | (31,333) | | | (45,051) | |

| Increase in trade receivables | | | | | | | | | | | | | | | | | | | | | (2,794) | | | (6,290) | | | (15,308) | | | (11,719) | |

| Decrease (increase) in prepaid expenses and other current and long-term assets | | | | | | | | | | | | | | | | | | | | | (11,989) | | | 26,713 | | | (21,249) | | | (5,912) | |

| Increase (decrease) in trade payables | | | | | | | | | | | | | | | | | | | | | 16,263 | | | (22,667) | | | (51,312) | | | (18,514) | |

| Increase (decrease) in employees and payroll accruals | | | | | | | | | | | | | | | | | | | | | (8,307) | | | 17,506 | | | (29,532) | | | 2,862 | |

| Increase in short term and long term deferred revenues | | | | | | | | | | | | | | | | | | | | | 2,788 | | | 4,081 | | | 76,193 | | | 55,387 | |

| Increase in accrued expenses and other current liabilities | | | | | | | | | | | | | | | | | | | | | 5,505 | | | 3,092 | | | 11,915 | | | 25,977 | |

| Net cash provided by operating activities | | | | | | | | | | | | | | | | | | | | | 90,380 | | | 53,234 | | | 248,246 | | | 37,152 | |

| INVESTING ACTIVITIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from short-term deposits and restricted deposits | | | | | | | | | | | | | | | | | | | | | 131,754 | | | 308,379 | | | 625,495 | | | 644,809 | |

| Investment in short-term deposits and restricted deposits | | | | | | | | | | | | | | | | | | | | | (99,725) | | | (317,869) | | | (297,917) | | | (766,021) | |

| Investment in marketable securities | | | | | | | | | | | | | | | | | | | | | (837) | | | — | | | (4,962) | | | (202,611) | |

| Proceeds from marketable securities | | | | | | | | | | | | | | | | | | | | | 31,920 | | | 98,244 | | | 249,190 | | | 290,113 | |

| Purchase of property and equipment and lease prepayment | | | | | | | | | | | | | | | | | | | | | (9,582) | | | (14,434) | | | (63,021) | | | (68,554) | |

| Capitalization of internal use of software | | | | | | | | | | | | | | | | | | | | | (408) | | | (215) | | | (3,028) | | | (2,110) | |

| Investment in other assets | | | | | | | | | | | | | | | | | | | | | — | | | — | | | (111) | | | (580) | |

| Proceeds from sale of equity securities | | | | | | | | | | | | | | | | | | | | | 19,203 | | | 48,403 | | | 68,671 | | | 51,596 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Purchases of investments in privately held companies | | | | | | | | | | | | | | | | | | | | | (76) | | | (40) | | | (7,603) | | | (1,300) | |

| Net cash provided by (used in) investing activities | | | | | | | | | | | | | | | | | | | | | 72,249 | | | 122,468 | | | 566,714 | | | (54,658) | |

| FINANCING ACTIVITIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from exercise of options and ESPP shares | | | | | | | | | | | | | | | | | | | | | 898 | | | 917 | | | 39,660 | | | 42,710 | |

| Purchase of treasury stock | | | | | | | | | | | | | | | | | | | | | (58,698) | | | (231,873) | | | (127,017) | | | (231,873) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Repayment of convertible notes | | | | | | | | | | | | | | | | | | | | | — | | | — | | | (362,667) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net cash used in financing activities | | | | | | | | | | | | | | | | | | | | | (57,800) | | | (230,956) | | | (450,024) | | | (189,163) | |

| INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | | | | | | | | | | | | | | | | | | | 104,829 | | | (55,254) | | | 364,936 | | | (206,669) | |

| CASH AND CASH EQUIVALENTS—Beginning of period | | | | | | | | | | | | | | | | | | | | | 504,793 | | | 299,940 | | | 244,686 | | | 451,355 | |

| CASH AND CASH EQUIVALENTS—End of period | | | | | | | | | | | | | | | | | | | | | $ | 609,622 | | | $ | 244,686 | | | $ | 609,622 | | | $ | 244,686 | |

| | | | | | |

| Wix.com Ltd. |

| KEY PERFORMANCE METRICS |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | (unaudited) | | (unaudited) |

| Creative Subscriptions | | | | | | | | | | | | | | | | | | | | | 296,154 | | | 265,268 | | | 1,152,007 | | | 1,039,479 | |

| Business Solutions | | | | | | | | | | | | | | | | | | | | | 107,617 | | | 89,772 | | | 409,658 | | | 348,187 | |

| Total Revenues | | | | | | | | | | | | | | | | | | | | | $ | 403,771 | | | $ | 355,040 | | | $ | 1,561,665 | | | $ | 1,387,666 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Creative Subscriptions | | | | | | | | | | | | | | | | | | | | | 283,501 | | | 281,766 | | | 1,174,776 | | | 1,121,411 | |

| Business Solutions | | | | | | | | | | | | | | | | | | | | | 111,503 | | | 90,047 | | | 422,727 | | | 350,708 | |

| Total Bookings | | | | | | | | | | | | | | | | | | | | | $ | 395,004 | | | $ | 371,813 | | | $ | 1,597,503 | | | $ | 1,472,119 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Free Cash Flow | | | | | | | | | | | | | | | | | | | | | $ | 80,390 | | | $ | 38,585 | | | $ | 182,197 | | | $ | (33,512) | |

| Free Cash Flow excluding HQ build out and restructuring costs | | | | | | | | | | | | | | | | | | | | | $ | 90,125 | | | $ | 51,990 | | | $ | 246,058 | | | $ | 32,408 | |

| Creative Subscriptions ARR | | | | | | | | | | | | | | | | | | | | | $ | 1,192,814 | | | $1,080,824 | | $ | 1,192,814 | | | $ | 1,080,824 | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF REVENUES TO BOOKINGS |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | (unaudited) | | (unaudited) |

| Revenues | | | | | | | | | | | | | | | | | | | | | $ | 403,771 | | | $ | 355,040 | | | $ | 1,561,665 | | | $ | 1,387,666 | |

| Change in deferred revenues | | | | | | | | | | | | | | | | | | | | | 2,788 | | | 4,081 | | | 76,193 | | | 55,387 | |

| Change in unbilled contractual obligations | | | | | | | | | | | | | | | | | | | | | (11,555) | | | 12,692 | | (40,355) | | | 29,066 | |

| Bookings | | | | | | | | | | | | | | | | | | | | | $ | 395,004 | | | $ | 371,813 | | | $ | 1,597,503 | | | $ | 1,472,119 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| B2B Partnership long-term bookings | | | | | | | | | | | | | | | | | | | | | — | | | (12,094) | | | — | | | (37,926) | |

| Bookings excluding B2B Partnership long-term bookings | | | | | | | | | | | | | | | | | | | | | $ | 395,004 | | | $ | 359,719 | | | $ | 1,597,503 | | | $ | 1,434,193 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Y/Y growth | | | | | | | | | | | | | | | | | | | | | 10 | % | | | | 11 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | (unaudited) | | (unaudited) |

| Creative Subscriptions Revenues | | | | | | | | | | | | | | | | | | | | | $ | 296,154 | | | $ | 265,268 | | | $ | 1,152,007 | | | $ | 1,039,479 | |

| Change in deferred revenues | | | | | | | | | | | | | | | | | | | | | (1,098) | | | 3,806 | | | 63,124 | | | 52,866 | |

| Change in unbilled contractual obligations | | | | | | | | | | | | | | | | | | | | | (11,555) | | | 12,692 | | | (40,355) | | | 29,066 | |

| Creative Subscriptions Bookings | | | | | | | | | | | | | | | | | | | | | $ | 283,501 | | | $ | 281,766 | | | $ | 1,174,776 | | | $ | 1,121,411 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| B2B Partnership long-term bookings | | | | | | | | | | | | | | | | | | | | | — | | | (12,094) | | | — | | | (37,926) | |

| Creative Subscriptions Bookings excluding B2B Partnership long-term bookings | | | | | | | | | | | | | | | | | | | | | $ | 283,501 | | | $ | 269,672 | | | $ | 1,174,776 | | | $ | 1,083,485 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Y/Y growth | | | | | | | | | | | | | | | | | | | | | 5 | % | | | | 8 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | (unaudited) | | (unaudited) |

| Business Solutions Revenues | | | | | | | | | | | | | | | | | | | | | $ | 107,617 | | | $ | 89,772 | | | $ | 409,658 | | | $ | 348,187 | |

| Change in deferred revenues | | | | | | | | | | | | | | | | | | | | | 3,886 | | | 275 | | | 13,069 | | | 2,521 | |

| Business Solutions Bookings | | | | | | | | | | | | | | | | | | | | | $ | 111,503 | | | $ | 90,047 | | | $ | 422,727 | | | $ | 350,708 | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF COHORT BOOKINGS |

| (In millions) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Year Ended |

| | | | | | | | | | | | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 |

| | | | | | | | | | | | | | | (unaudited) |

| Q1 Cohort revenues | | | | | | | | | | | | | | | | | | | | | | | | | $ | 45 | | | $41 |

| Q1 Change in deferred revenues | | | | | | | | | | | | | | | | | | | | | | | | | 15 | | | 15 |

| Q1 Cohort Bookings | | | | | | | | | | | | | | | | | | | | | | | | | $ | 60 | | | $ | 56 | |

| | |

| Wix.com Ltd. |

| RECONCILIATION OF REVENUES AND BOOKINGS EXCLUDING FX IMPACT |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three Months Ended |

| | | | | | | | | | | | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 |

| | | | | | | | | | | | | | | | | (unaudited) |

| Revenues | | | | | | | | | | | | | | | | | | | | | $ | 403,771 | | | $ | 355,040 | |

| FX impact on Q4/23 using Y/Y rates | | | | | | | | | | | | | | | | | | | | | | | | | (1,494) | | | — | |

| Revenues excluding FX impact | | | | | | | | | | | | | | | | | | | | | | | | | $ | 402,277 | | | $ | 355,040 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Y/Y growth | | | | | | | | | | | | | | | | | | | | | | | | | 13 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | Three Months Ended |

| | | | | | | | | | | | | | | | | | | December 31, |

| | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 |

| | | | | | | | | | | | | | | | | | | | | | | (unaudited) |

| Bookings | | | | | | | | | | | | | | | | | | | | | $ | 395,004 | | | $ | 371,813 | |

| FX impact on Q4/23 using Y/Y rates | | | | | | | | | | | | | | | | | | | | | | | | | (4,325) | | | — | |

| Bookings excluding FX impact | | | | | | | | | | | | | | | | | | | | | | | | | $ | 390,679 | | | $ | 371,813 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Y/Y growth | | | | | | | | | | | | | | | | | | | | | | | | | 5 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Wix.com Ltd. |

| TOTAL ADJUSTMENTS GAAP TO NON-GAAP |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| (1) Share based compensation expenses: | | | | | | | | | | | (unaudited) | | (unaudited) |

| Cost of revenues | | | | | | | | | | | | | | | | | | | | | $ | 3,675 | | | $ | 4,607 | | | $ | 15,013 | | | $ | 17,811 | |

| Research and development | | | | | | | | | | | | | | | | | | | | | 31,982 | | | 32,335 | | | 119,482 | | | 120,580 | |

| Selling and marketing | | | | | | | | | | | | | | | | | | | | | 11,232 | | | 9,559 | | | 41,277 | | | 38,714 | |

| General and administrative | | | | | | | | | | | | | | | | | | | | | 11,306 | | | 13,416 | | | 48,853 | | | 59,731 | |

| Total share based compensation expenses | | | | | | | | | | | | | | | | | | | | | 58,195 | | | 59,917 | | | 224,625 | | | 236,836 | |

| (2) Amortization | | | | | | | | | | | | | | | | | | | | | 1,489 | | | 1,511 | | | 5,955 | | | 6,246 | |

| (3) Acquisition related expenses | | | | | | | | | | | | | | | | | | | | | 9 | | | 1,656 | | 472 | | | 5,127 | |

| (4) Amortization of debt discount and debt issuance costs | | | | | | | | | | | | | | | | | | | | | 789 | | | 1,305 | | 4,194 | | | 5,213 | |

| (5) Impairment, restructuring and other costs | | | | | | | | | | | | | | | | | | | | | 3,103 | | | — | | | 32,614 | | | — | |

| (6) Sales tax accrual and other G&A expenses (income) | | | | | | | | | | | | | | | | | | | | | 137 | | | 219 | | 748 | | | 763 | |

| (7) Unrealized loss (gain) on equity and other investments | | | | | | | | | | | | | | | | | | | | | (10,296) | | | 3,955 | | (30,608) | | | 200,338 | |

| (8) Non-operating foreign exchange expenses (income) | | | | | | | | | | | | | | | | | | | | | 15,287 | | | 6,220 | | 1,499 | | | 6,403 | |

| (9) Provision for income tax effects related to non-GAAP adjustments | | | | | | | | | | | | | | | | | | | | | 2,368 | | | (176) | | | (4,337) | | | (46,078) | |

| Total adjustments of GAAP to Non GAAP | | | | | | | | | | | | | | | | | | | | | $ | 71,081 | | | $ | 74,607 | | | $ | 235,162 | | | $ | 414,848 | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF GAAP TO NON-GAAP GROSS PROFIT |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | (unaudited) | | (unaudited) |

| Gross Profit | | | | | | | | | | | | | | | | | | | | | $ | 277,658 | | | $ | 226,276 | | | $ | 1,049,137 | | | $ | 861,439 | |

| Share based compensation expenses | | | | | | | | | | | | | | | | | | | | | 3,675 | | | 4,607 | | 15,013 | | | 17,811 | |

| Acquisition related expenses | | | | | | | | | | | | | | | | | | | | | 5 | | | — | | | 229 | | | 140 | |

| Amortization | | | | | | | | | | | | | | | | | | | | | 667 | | | 689 | | 2,669 | | | 2,968 | |

| Non GAAP Gross Profit | | | | | | | | | | | | | | | | | | | | | 282,005 | | | 231,572 | | | 1,067,048 | | | 882,358 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non GAAP Gross margin | | | | | | | | | | | | | | | | | | | | | 70 | % | | 65 | % | | 68 | % | | 64 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | (unaudited) | | (unaudited) |

| Gross Profit - Creative Subscriptions | | | | | | | | | | | | | | | | | | | | | $ | 243,360 | | $ | 206,841 | | $ | 936,492 | | $ | 787,892 |

| Share based compensation expenses | | | | | | | | | | | | | | | | | | | | | 2,695 | | 3,437 | | 11,081 | | 13,933 |

| Non GAAP Gross Profit - Creative Subscriptions | | | | | | | | | | | | | | | | | | | | | 246,055 | | 210,278 | | 947,573 | | 801,825 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non GAAP Gross margin - Creative Subscriptions | | | | | | | | | | | | | | | | | | | | | 83 | % | | 79 | % | | 82 | % | | 77 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | (unaudited) | | (unaudited) |

| Gross Profit - Business Solutions | | | | | | | | | | | | | | | | | | | | | $ | 34,298 | | | $ | 19,435 | | | $ | 112,645 | | | $ | 73,547 | |

| Share based compensation expenses | | | | | | | | | | | | | | | | | | | | | 980 | | | 1,170 | | | 3,932 | | | 3,878 | |

| Acquisition related expenses | | | | | | | | | | | | | | | | | | | | | 5 | | | — | | | 229 | | | 140 | |

| Amortization | | | | | | | | | | | | | | | | | | | | | 667 | | | 689 | | | 2,669 | | | 2,968 | |

| Non GAAP Gross Profit - Business Solutions | | | | | | | | | | | | | | | | | | | | | 35,950 | | | 21,294 | | | 119,475 | | | 80,533 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non GAAP Gross margin - Business Solutions | | | | | | | | | | | | | | | | | | | | | 33 | % | | 24 | % | | 29 | % | | 23 | % |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF OPERATING INCOME (LOSS) TO NON-GAAP OPERATING INCOME (LOSS) |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | (unaudited) | | (unaudited) |

| Operating income (loss) | | | | | | | | | | | | | | | | | | | | | $ | 1,769 | | | $ | (32,603) | | | $ | (24,380) | | | $ | (285,353) | |

| Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share based compensation expenses | | | | | | | | | | | | | | | | | | | | | 58,195 | | | 59,917 | | | 224,625 | | | 236,836 | |

| Amortization | | | | | | | | | | | | | | | | | | | | | 1,489 | | | 1,511 | | | 5,955 | | | 6,246 | |

| Impairment, restructuring and other charges | | | | | | | | | | | | | | | | | | | | | 3,103 | | | — | | | 32,614 | | | — | |

| Sales tax accrual and other G&A expenses | | | | | | | | | | | | | | | | | | | | | 137 | | | 219 | | | 748 | | | 763 | |

| Acquisition related expenses | | | | | | | | | | | | | | | | | | | | | 9 | | | 1,656 | | | 472 | | | 5,127 | |

| Total adjustments | | | | | | | | | | | | | | | | | | | | | $ | 62,933 | | | $ | 63,303 | | | $ | 264,414 | | | $ | 248,972 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non GAAP operating income (loss) | | | | | | | | | | | | | | | | | | | | | $ | 64,702 | | | $ | 30,700 | | | $ | 240,034 | | | $ | (36,381) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non GAAP operating margin | | | | | | | | | | | | | | | | | | | | | 16 | % | | 9 | % | | 15 | % | | (3) | % |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF NET INCOME (LOSS) TO NON-GAAP NET INCOME (LOSS) AND NON-GAAP NET INCOME (LOSS) PER SHARE |

| (In thousands, except per share data) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | (unaudited) | | (unaudited) |

| Net income (loss) | | | | | | | | | | | | | | | | | | | | | $ | 2,954 | | | $ | (38,975) | | | $ | 33,137 | | | $ | (424,863) | |

| Share based compensation expenses and other Non GAAP adjustments | | | | | | | | | | | | | | | | | | | | | 71,081 | | | 74,607 | | | 235,162 | | | 414,848 | |

| Non-GAAP net income (loss) | | | | | | | | | | | | | | | | | | | | | $ | 74,035 | | | $ | 35,632 | | | $ | 268,299 | | | $ | (10,015) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic Non GAAP net income (loss) per share | | | | | | | | | | | | | | | | | | | | | $ | 1.29 | | | $0.61 | | $ | 4.72 | | | $(0.17) |

| Weighted average shares used in computing basic Non GAAP net income (loss) per share | | | | | | | | | | | | | | | | | | | | | 57,317,815 | | | 58,189,246 | | | 56,829,962 | | | 57,993,364 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diluted Non GAAP net income (loss) per share | | | | | | | | | | | | | | | | | | | | | $ | 1.22 | | | $0.61 | | $ | 4.39 | | | $(0.17) |

| Weighted average shares used in computing diluted Non GAAP net income (loss) per share | | | | | | | | | | | | | | | | | | | | | 60,512,505 | | | 58,189,246 | | | 61,106,462 | | | 57,993,364 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW |

| (In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | (unaudited) | | (unaudited) |

| Net cash provided by operating activities | | | | | | | | | | | | | | | | | | | | | $ | 90,380 | | | $ | 53,234 | | | $ | 248,246 | | | $ | 37,152 | |

| Capital expenditures, net | | | | | | | | | | | | | | | | | | | | | (9,990) | | | (14,649) | | | (66,049) | | | (70,664) | |

| Free Cash Flow | | | | | | | | | | | | | | | | | | | | | $ | 80,390 | | | $ | 38,585 | | | $ | 182,197 | | | $ | (33,512) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restructuring and other costs | | | | | | | | | | | | | | | | | | | | | 1,411 | | | — | | 5,915 | | | — | |

| Capex related to HQ build out | | | | | | | | | | | | | | | | | | | | | 8,324 | | | 13,405 | | 57,946 | | | 65,920 | |

| Free Cash Flow excluding HQ build out and restructuring costs | | | | | | | | | | | | | | | | | | | | | $ | 90,125 | | | $ | 51,990 | | | $ | 246,058 | | | $ | 32,408 | |

| | | | | | |

| Wix.com Ltd. |

| RECONCILIATION OF BASIC WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING AND THE DILUTED WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three Months Ended | | Year Ended |

| | | | | | | | | | | | December 31, | | December 31, |

| | | | | | | | | | | | | | | | | | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | (unaudited) | | (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic weighted-average shares used to compute net income (loss) per share | | | | | | | | | | | | | | | | | | | | | 57,317,815 | | | 58,189,246 | | | 56,829,962 | | | 57,993,364 | |

| Effect of dilutive securities (included in the effect of dilutive securities is the assumed conversion of employee stock options, employee RSUs and the Notes) | | | | | | | | | | | | | | | | | | | | | 1,767,942.00 | | | — | | | 1,578,369.00 | | | — | |

| Diluted weighted-average shares used to compute net income (loss) per share | | | | | | | | | | | | | | | | | | | | | 59,085,757 | | | 58,189,246 | | | 58,408,331 | | | 57,993,364 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The following items have been excluded from the diluted weighted average number of shares outstanding because they are anti-dilutive: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock options | | | | | | | | | | | | | | | | | | | | | 2,245,872 | | | 4,332,022 | | | 2,245,872 | | | 4,332,022 |

| Restricted share units | | | | | | | | | | | | | | | | | | | | | 818,288 | | | 3,123,019 | | | 818,288 | | | 3,123,019 |

| Convertible Notes (if-converted) | | | | | | | | | | | | | | | | | | | | | 1,426,728 | | | 3,969,514 | | | 1,426,728 | | | 3,969,514 |

| | | | | | | | | | | | | | | | | | | | | 63,576,645 | | | 69,613,801 | | | 62,899,219 | | | 69,417,919 | |

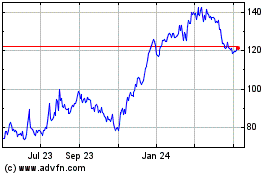

Wix com (NASDAQ:WIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

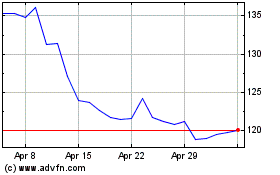

Wix com (NASDAQ:WIX)

Historical Stock Chart

From Apr 2023 to Apr 2024