false

0001829794

0001829794

2025-02-21

2025-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13

OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 27, 2025 (February 21, 2025)

__________________________

Volcon, Inc.

(Exact Name of Registrant as Specified in its Charter)

__________________________

| Delaware |

001-40867 |

84-4882689 |

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification Number) |

3121

Eagles Nest Street, Suite 120

Round Rock, TX 78665

(Address of principal executive offices and zip

code)

(512) 400-4271

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

|

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c)). |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.00001 per share |

|

VLCN |

|

NASDAQ |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive Agreement.

On February 25, 2025,

Volcon, Inc. (the “Company”) entered into a Supplier Agreement (the “Agreement”) with Venom-EV (“Venom”).

Pursuant to the terms of the Agreement, the Venom appointed the Company to act as Venom’s supply representative for Venom’s

gold carts (the “Products”) of the Products to the Buyer during the term of Agreement. Pursuant to the Agreement, the Company

will purchase Products, as determined by Venom, from the manufacturer of the Products, of up to $3.0 million in purchases (the “Purchase

Limit”). Payment terms for Products will be net 90 days from date the Products are delivered to Venom, and once payment for Products

is received by the Company, Venom may place additional purchase orders for up to the Purchase Limit. Pursuant to the Agreement, Venom

will pay 3% of the order price to the Company, payable with the repayment for the Products.

Pursuant to the Agreement,

Venom will be responsible for all shipping costs, tariffs, duties and fees to import the Products, and will be responsible for any product

liability claims resulting from the use of the Products by the end user. In addition, Venom will be responsible for all documentation

needed for sale of Products and shall be responsible for the warranty to be provided with respect to the Products sold by Venom.

Pursuant to the Agreement,

at the end of each calendar quarter, the Company agreed to issue Venom shares of Company common stock based on the number of Product units

(the “Units”) purchased by Venom during the quarter as follows: for each 1,000 Units purchased by Venom, the Company shall

issue Venom a number of shares equal to 1% of the Company’s outstanding shares of common stock (the “Shares”) as of

the last day of such quarter that the 1,000 Units were purchased for no additional consideration. The requirement to issue the Shares

shall cease on June 30, 2026 or upon the sale of 5,000 Units, whichever comes first. Notwithstanding the foregoing, to the extent the

issuance of the Shares shall require shareholder approval pursuant to the rules of the Nasdaq Stock Market, such issuances shall be subject

to the receipt of such shareholder approval and the Company agrees to seek such approval within three months of the determination that

the approval is required. If, for any reason, the Company fails to issue such shares to Venom (other than due to the failure to receive

shareholder approval), Venom is entitled to compensatory damages in the amount equal to the value of the Shares that should have been

issued to Venom in that quarter (determined by the closing stock price on the last of that quarter), and to immediately terminate the

Agreement.

The term of the Agreement

is for one year, which can be extended for additional one-year periods by the parties. The Agreement may be terminated immediately by

either party in the event of a breach of the Agreement by the other party, or by either party if the other party: (i) becomes insolvent

or bankrupt, becomes unable to pay its debts as they fall due, or files a petition for voluntary or involuntary bankruptcy or under any

other insolvency law; (ii) makes or seeks to make a general assignment for the benefit of its creditors, seeks reorganization, winding-up,

liquidation, dissolution, or other similar relief with respect to it or its debts; or (iii) applies for, or consents to, the appointment

of a trustee, receiver, or custodian for a substantial part of its property.

On February 25, 2025,

Venom placed a purchase order with the Company for 500 vehicles pursuant to the Agreement for an aggregate purchase price of $2.36 million.

The foregoing description

of the Agreement is not complete and is qualified in its entirety by reference to the full text of the Agreement, a copy of which is filed

as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 is incorporated

by reference herein. The Shares issuable pursuant to the Agreement will be offered in a private placement under Section 4(a)(2) of the

Securities Act of 1933, as amended (the “Securities Act”), and/or Regulation D promulgated thereunder and have not been registered

under the Securities Act or applicable state securities laws.

Item 5.02. Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 21, 2025,

the Board of Directors of the Company approved the following appointments to its Board committees: (i) Audit Committee – Karin-Joyce

Tjon (Chair), Jonathan Foster, and Adrian Solgaard; (ii) Compensation Committee – Jonathan Foster (Chair), Karin-Joyce Tjon, Orn

Olason, and Adrian Solgaard; and (iii) Nominating and Governance Committee – Karin-Joyce Tjon (Chair), Jonathan Foster, and Orn

Olason.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of

the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Volcon, Inc. |

| |

(Registrant) |

| |

|

| Date: February 27, 2025 |

/s/ Greg Endo |

| |

Greg Endo

Chief Financial Officer |

Exhibit 10.1

SUPPLIER AGREEMENT

This Supplier Agreement (this “Agreement”) effective as

of February 25, 2025 (“Effective Date”) is between Venom-EV, a Wisconsin S Corporation with offices at 251 8th Street

Monroe WI 53566 (“Buyer”), and Volcon, Inc., a Delaware C corporation with offices at 3121 Eagles Nest Street Suite 120. Round

Rock, TX 78665 (“Supplier,” and together with Buyer, the “Parties,” and each, a “Party”).

RECITALS

A.

Buyer is in the business of buying the Products (as defined below).

B.

Supplier is in the business of marketing and reselling products similar to the Products in the Territory (as defined below).

C.

Buyer desires to purchase the Products from its designated manufacturer and appoints Supplier as its exclusive representative for

the procurement of the Products for Buyers sales to Customers (as defined below) in accordance with the terms and conditions of this Agreement.

D.

Buyer desires to purchase the Products from Supplier and market and resell the Products to its Customers in accordance with the

terms and conditions of this Agreement.

In consideration of the mutual covenants, terms

and conditions set out in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are hereby

acknowledged, the Parties agree as follows:

AGREEMENT

1. Definitions. Capitalized

terms have the meanings set out in this Section I, or in the section in which they first appear in this Agreement.

1.1. “Affiliate”

of an entity means any other entity or individual that directly or indirectly, through one or more intermediaries, Controls, is Controlled

by, or is under common Control with, such entity.

1.2. “Authorized

Dealer” means an entity that is in the business of reselling the Products that it may purchase or has purchased from Buyer and

that sells such Products to End Users (as defined below).

1.3. “Control”

(and with correlative meanings, the terms “Controlled by” and “under common Control with”) means, regarding any

individual or entity, the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies

of another entity, whether through the ownership of voting securities, by contract, or otherwise.

1.4. “Customer”

means (a) Buyer’s Authorized Dealers; or (b) an End User

1.5. “End

User” means an individual or entity that may purchase or has purchased the Product, directly or indirectly, from the Buyer for

its own and its Affiliates’ internal use or consumption and not for resale.

1.6. “Governmental

Authority” means any federal, state, local, or foreign government or political subdivision thereof, or any agency or instrumentality

of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority, or quasi-governmental

authority (to the extent that the rules, regulations, or orders of this organization or authority have the force of Law), or any arbitrator,

court, or tribunal of competent jurisdiction.

1.7. “Intellectual

Property Rights” means all industrial and other intellectual property rights, including but not limited to: (a) patents, patent

applications, inventions, and trade secrets; (b) trademarks, service marks, trade dress, logos, trade or brand names, domain names, together

with the goodwill symbolized by any of the foregoing; (c) works of authorship, expressions, designs, and design registrations, whether

or not copyrightable, including copyrights and copyrightable works, software, and firmware; and (d) all other intellectual property rights,

and all rights, interests, and protections that are associated with, equivalent or similar to, or required for the exercise of, any of

the foregoing, however arising, in each case whether registered or unregistered and including all registrations and applications for,

and renewals or extensions of, these rights or forms of protection under the Laws of any jurisdiction in any part of the world.

1.8. “Law”

means any statute, law, ordinance, regulation, rule, code, constitution, treaty, common law, order, injunction, judgment, decree, or other

requirement or rule of law, including those promulgated by any Governmental Authority.

1.9. “Manufacturer”

means Whanlong, with manufacturing location in Bangkok, Thailand.

1.10. “Purchase

Limit” means up to $3,000,000 of open purchase orders submitted by Buyer.

1.11. “Purchases”

means the full payment by the Buyer for purchases submitted by Buyer to Supplier for Products.

1.12. “Products”

means those products identified in Schedule 1, as it may be revised pursuant to Section 5.2 from time to time.

2. Appointment; Share Issuance;

Security Interest.

2.1. Appointment.

Buyer hereby appoints Supplier, and Supplier hereby accepts the appointment, to act as Buyer’s supply representative of the Products

to the Buyer during the Term (as defined below) in accordance with the terms and conditions of this Agreement. The Parties will mutually

agree on the pricing for the Products in consultation with the Manufacturer. The Supplier will purchase Products, as determined by the

Buyer, from the Manufacturer, of up to the Purchase Limit based on purchase orders submitted to the Supplier from the Buyer. Payment terms

for Products will be net 90 days from date Products are delivered to Buyer’s delivery address as specified on each purchase order.

Once payment for Products is received by Supplier, Buyer may place additional purchase orders for up to the Purchase Limit. Buyer shall

pay 3% of the order price to Supplier, payable with the repayment for the Products no later than 90 days from the date Products are delivered

to Buyer. The payment obligations of Buyer set forth in this section are referred to as the “Payment Obligations.”

Buyer will be responsible for all shipping costs, tariffs, duties and fees to import the Products to the Buyer’s delivery address

and Supplier will provide all invoices to Buyer for such costs, which shall be paid within 60 days of receipt. Buyer will assist Supplier

with arrangement of shipping including any required documentation required to import the Products into the country specified by the Buyer.

Buyer will be responsible for inspection and acceptance of Products from the Manufacturer and Buyer will be responsible for all costs

associated with such inspection and acceptance. Buyer will be responsible for any regulatory requirements to sell Products to Customers

including any penalties or fees incurred from any Governmental Authority. Buyer will be responsible for any Product liability claims resulting

from the use of the Products by Customers.

The Buyer shall be responsible for all documentation needed for sale of Products to Customers including but not limited to product brochures,

owner’s manual, service manuals, warning labels, product warranty, etc. The Buyer shall be responsible for the warranty to be provided

to Customers with respect to the Products sold by Supplier. Each order of Products by the Buyer shall be made through a separate purchase

order.

2.2. Share

Issuance. At the end of each calendar quarter, Supplier shall issue Buyer shares of Supplier common stock based on the number of Product

units (the “Units”) purchased by Buyer during the quarter as follows:

For each 1,000 units Buyer Purchases, the Supplier shall

issue the Buyer a number of shares equal to 1% of Supplier’s outstanding shares of common stock (the “Shares”) as of

the last day of such quarter that the 1,000 units were Purchased. The shares issued under this provision shall be at no cost and shall

be issued to Buyer within 30 days of the end of each quarter. The requirement to issue the Shares shall cease upon the earlier of June

30, 2026 or the Purchase of 5,000 Units. Notwithstanding the foregoing, to the extent the issuance of the Shares shall require shareholder

approval pursuant to the rules of the Nasdaq Stock Market, such issuances shall be subject to the receipt of such shareholder approval

and the Supplier agrees to seek such approval within three months of the determination that the approval is required. If, for any reason,

Supplier fails to issue such shares to Buyer on time (other than due to the failure to receive shareholder approval), Buyer is entitled

to compensatory damages in the amount equal to the value of the shares that should have been issued to Buyer in that quarter (determined

by the closing stock price on the last of that quarter), and to immediately terminate this Agreement.

2.3 Security

Interest, Pledge and Collateral.

2.3.1. Security

Interest. To secure the prompt and complete payment of the Payment Obligations, the Buyer has hereby granted, conveyed, assigned, pledged,

set over, and granted a continuing security interest in and does hereby grant, convey, assign, pledge, set over and grant a continuing

security interest to the Supplier, and to its successors and assigns, all of its right, title and interest in and to the following, whether

now existing or hereafter arising or acquired (collectively, the “Collateral”):

(a) all

fixtures and personal property of every kind and nature including all accounts, goods (including inventory and equipment), documents (including,

if applicable, electronic documents), instruments, promissory notes, chattel paper (whether tangible or electronic), letters of credit,

letter-of-credit rights (whether or not the letter of credit is evidenced by a writing), securities and all other investment property,

commercial tort claims, if any, general intangibles (including all payment intangibles), money, deposit accounts, and any other contract

rights or rights to the payment of money; and

(b) all

Proceeds as defined in Section 9-102 the Uniform Commercial Code as in effect from time to time (the “UCC”))

and products of each of the foregoing, all books and records relating to the foregoing, all supporting obligations related thereto, and

all accessions of and to, substitutions and replacements for, and rents, profits and products of, each of the foregoing, and any and all

Proceeds of any insurance, indemnity, warranty or guaranty payable to the Buyer from time to time with respect to any of the foregoing.

2.3.2 Perfection

of Pledge and Authorization to File.

(a) The

Buyer shall, from time to time, as may be required by the Supplier with respect to all Collateral, promptly take all actions as may be

requested by the Supplier to perfect the security interest of the Supplier in the Collateral, including, without limitation, with respect

to all Collateral over which control may be obtained within the meaning of Section 8-106 of the UCC, the Buyer shall promptly take all

actions as may be requested from time to time by the Supplier so that control of such Collateral is obtained and at all times held by

the Supplier. All of the foregoing shall be at the sole cost and expense of the Buyer.

(b) The

Buyer hereby irrevocably authorizes the Supplier at any time and from time to time to file in any relevant jurisdiction any financing

statements and amendments thereto that contain the information required by Article 9 of the UCC of each applicable jurisdiction for the

filing of any financing statement or amendment relating to the Collateral, without the signature of the Buyer where permitted by law.

The Buyer agrees to provide all information required by the Supplier pursuant to this section promptly to the Lender upon request.

2.3.3 Further

Assurances. The Buyer will execute and deliver such further documentation and take such further action as may be requested by the Supplier

to carry out the provisions and purposes of this Agreement and to create, preserve, and perfect the liens of the Supplier in the Collateral.

3. Intellectual Property.

The patent and trademark rights for the Products

Purchased by the Buyer shall belong to the Buyer. The Supplier shall not apply for patent registration in any country without authorization.

3.1. Ownership.

| 3.1.1. | Supplier acknowledges that, as between the Parties, Buyer owns and shall retain all right, title and interest in and to all worldwide

Intellectual Property Rights embodied in the Products. Supplier shall not modify, cover, replace, change, or otherwise alter any branding

on the Products, including the vehicle name, the model name, and/or any other logos or names without Buyer’s written approval. Supplier

shall not use any Buyer names, trademarks, or logos (“Buyer Trademarks”) in any way without the prior written authorization

of Buyer; and if provided with such authorization, Supplier shall comply with all Buyer branding guidelines, as provided by Buyer from

time to time. Supplier shall not use any of Buyers’s Intellectual Property Rights, including the Buyers’s Trademarks, in any

manner that may dilute, diminish, or otherwise damage Buyers’s rights and goodwill in any of Buyers’s Trademarks. |

| 3.1.2. | Buyer acknowledges that, as between the Parties, Supplier owns and shall retain all right, title and interest in and to all worldwide

Intellectual Property Rights embodied in the Volcon brand or Volcon products. Buyer shall not use any Supplier names, trademarks, or logos

(“Volcon Trademarks”) in any way without the prior written authorization of Supplier; and if provided with such authorization,

Buyer shall comply with all Supplier branding guidelines, as provided by Supplier from time to time. Buyer shall not use any of Supplier’s

Intellectual Property Rights, including the Volcon Trademarks, in any manner that may dilute, diminish, or otherwise damage Supplier’s

rights and goodwill in any of Volcon Trademarks. Buyer shall not use the term “Volcon” in violation of Supplier’s intellectual

property rights, including in Buyer’s name or associated with the advertising, buying, selling, or servicing of the Products. |

3.2 Not

used

3.3. Trademark

Policies.

| 3.3.1. | Supplier shall comply with all policies and rules for the use of the Buyer Trademarks issued by Buyer from time to time. |

3.4. Prohibited

Acts. Each party shall not:

| 3.4.1. | take any action that interferes with any of the other party’s rights in or to the Trademarks or the other party’s Intellectual

Property Rights or challenge any right, title, or interest of the other party in or to the Trademarks or represent that it owns any rights

in the Trademarks; |

| 3.4.2. | register any domain names that utilize any of the other party’s Trademarks; |

| 3.4.3. | register or apply for registrations, anywhere in the world, for the other party’s Trademarks or any other trademark that is

confusingly similar to the other party’s Trademarks, or use any mark that is confusingly similar to the other party’s Trademarks; |

| 3.4.4. | engage in any action that may disparage, dilute the value of, or reflect negatively on the other party’s Trademarks; |

| 3.4.5. | alter, obscure, or remove any of the Buyer’s Trademarks, or any proprietary rights notices, including trademark or copyright

notices placed on any Products, marketing materials, or other materials that other party provides; and |

| 3.4.6. | use the other party’s Trademarks or in any other way, except as expressly permitted under this Agreement. |

。

4. Term and Termination.

4.1. Term.

The term of this Agreement commences on the Effective Date and continues for a period of one (1) year, unless and until earlier terminated

as provided under this Agreement (the “Initial Term”). Thereafter, it shall renew for additional successive 1-year terms unless

and until either Party provides notice of its intent not to renew at least 90 days before the end of the then-current Term, or unless

and until earlier terminated as provided under this Agreement (each a “Renewal Term” and together with the Initial Term, the

“Term”). If either Party provides timely notice of its intent not to renew this Agreement, then unless earlier terminated

in accordance with its terms, this Agreement terminates on the expiration of the then-current Term.

4.2. Termination.

Any termination under this section does not affect any other rights or remedies to which the terminating Party may be entitled and is

effective on the non-terminating Party’s receipt of notice of termination or any later date set out in such notice. This Agreement

may be terminated immediately upon notice by:

| 4.2.1. | either Party in the event of a breach of this Agreement by the other Party and the non-breaching Party has provided written notice

to the breaching Party of such breach and the breaching Party has failed to cure such breach within 30 days after receipt of such notice;

|

| 4.2.2. | either Party if the other Party: (i) becomes insolvent or bankrupt, becomes unable to pay its debts as they fall due, or files a petition

for voluntary or involuntary bankruptcy or under any other insolvency Law; (ii) makes or seeks to make a general assignment for the benefit

of its creditors, seeks reorganization, winding-up, liquidation, dissolution, or other similar relief with respect to it or its debts;

or (iii) applies for, or consents to, the appointment of a trustee, receiver, or custodian for a substantial part of its property. |

4.3. Effect

of Expiration or Termination.

| 4.3.1. | The expiration or termination of this Agreement does not affect any rights or obligations that: (i) are to survive the expiration

or termination of this Agreement; or (ii) were incurred by the Parties before the expiration or termination (except as expressly provided

herein). |

| 4.3.2. | Subject to Supplier’s rights to sell any remaining Products held by Supplier on the termination date to the Buyer, on the expiration

or termination of this Agreement: |

4.3.2.1.Supplier shall cease to represent

itself as Buyer’s authorized representative for purchase of the Products and shall otherwise desist from all conduct or representations

that might lead the public to believe that Supplier is authorized by Buyer to sell the Products.

5. Confidentiality.

5.1. Confidential

Information. From time to time during the Term, the Parties may disclose (the Party disclosing any information hereunder, the “Disclosing

Party”) or make available to the other Party (the Party receiving any information hereunder, the “Receiving Party”)

information about its or its Affiliates’ business affairs, finances, products, services, forecasts, operations, processes, plans,

confidential information relating to Intellectual Property Rights, trade secrets, third-party confidential information, and other sensitive

or proprietary information; such information, as well as the terms of this Agreement, whether orally or in written, electronic or other

form, and whether or not marked or otherwise identified as “confidential”, constitutes “Confidential Information”

hereunder. Confidential Information excludes information that at the time of disclosure: (a) is or becomes part of the public domain other

than as a result of, directly or indirectly, any breach of this section by Receiving Party or any of its Representatives (as defined below);

(b) was known by or in the possession of Receiving Party or its Representatives at the time of disclosure; (c) is or becomes available

to Receiving Party on a non-confidential basis from a third-party source, provided that such third party is not and was not prohibited

from disclosing such Confidential Information; or (d) was or is independently developed by Receiving Party without reference to or use

of any of Disclosing Party’s Confidential Information.

5.2. Protection

of Confidential Information. Receiving Party shall protect and safeguard the confidentiality of the Disclosing Party’s Confidential

Information with at least the same degree of care as Receiving Party would protect its own Confidential Information, but in no event with

less than a commercially reasonable degree of care. Receiving Party shall not use Disclosing Party’s Confidential Information for

any purpose other than to perform its obligations hereunder and shall not disclose Disclosing Party’s Confidential Information to

any individual or entity at any time during the Term and for a period of 5 years after its expiration or termination. Notwithstanding

the foregoing, Receiving Party may disclose Disclosing Party’s Confidential Information: (a) to Receiving Party’s and its

Affiliates’ employees, officers, directors, shareholders, partners, managers, members, agents, contractors, attorneys, accountants,

and financial advisors (“Representatives”) who have a need to know the Confidential Information for Receiving Party to perform

its obligations hereunder; and (b) as may be required by Law, a court of competent jurisdiction, or any Governmental Authority if Receiving

Party provides Disclosing Party prompt notice of such requirement to the extent legally permitted. Receiving Party shall be responsible

for any breach of this Section caused by any of its Representatives. On the expiration or termination of this Agreement, Receiving Party

shall promptly return to Disclosing Party all copies, whether in written, electronic, or other form or media, of Disclosing Party’s

Confidential Information or destroy all such copies and certify in writing to Disclosing Party that it has complied with the requirements

of this Section. In addition to all other remedies available at Law, Disclosing Party shall be entitled to seek injunctive relief for

any violation or threatened violation of this Section.

6. Indemnification.

6.1. Supplier

Indemnification. Subject to the terms and conditions of this Agreement, Supplier shall, at its sole expense and upon Buyer’s

written request, defend Buyer and its Affiliates, and their respective successors, assigns, directors, officers, employees, agents, consumers,

Affiliates, and distributors of each of the foregoing, from and against any and all third party claims, actions, demands, legal proceedings,

liabilities, damages, losses, judgments, authorized settlements, costs and expenses (“Claims”) arising out of or in connection

with any actual or alleged: (1) Supplier’s breach of this Agreement; or (2) failure by Supplier to comply with any applicable law

or regulation. If Buyer becomes aware of any such Claim for which Buyer shall seek indemnity from Supplier, Buyer shall provide Supplier

with reasonably prompt notice of the Claim and reasonable cooperation in the defense thereof. Supplier shall not settle any such claim

without Manufacturer’s prior written consent, which shall not be unreasonably withheld. Buyer shall have the right to have its own

counsel participate in the defense of any such Claim at Buyer’s own expense.

6.2. Buyer

Indemnification. Buyer shall, at its sole expense and upon Supplier’s written request, defend Supplier and its respective directors,

officers and employees from and against any and all Claims, arising out of or in connection with any actual or alleged: (i) infringement

and/or misappropriation by Buyer or by the Products of any proprietary right of any third party, (ii) Buyer’s breach of this Agreement;

or (iii) product liability Claims arising out of the permitted and intended use of the Products; provided, however, that Buyer’s

indemnity obligations shall not apply if the Claim is primarily based upon or directly related to Supplier’s breach of this Agreement.

If Supplier becomes aware of any such Claim for which Supplier may seek indemnity from Buyer, Supplier shall provide Buyer with reasonably

prompt notice of the Claim and reasonable cooperation in the defense thereof. Buyer shall not settle any such claim without Supplier’s

prior written consent, which shall not be unreasonably withheld. Supplier shall have the right to have its own counsel participate in

the defense of any such Claim at Supplier’s own expense; provided, however, that Buyer shall control the defense of the Claim.

6.3. Indemnification

Exceptions. Notwithstanding anything to the contrary in this Agreement, neither Buyer or Supplier (as “Indemnifying Party”)

is obligated to indemnify or defend a Supplier indemnified party or Buyer indemnified party (collectively, “Indemnified Party”),

as the case may be, against any claim (whether direct or indirect) if the Claim or corresponding losses arise out of or result from, in

whole or in part:

| 6.3.1. | the Indemnified Party’s gross negligence or more culpable act or omission (including recklessness or willful misconduct); or |

| | | |

| 6.3.2. | the Indemnified Party’s bad faith failure to comply with any of its material obligations set out in this Agreement. |

6.4. Indemnification

Procedures. If an Indemnified Party becomes aware of any claim, event, or fact that may give rise to a claim by the Indemnified Party

against the Indemnifying Party for indemnification hereunder, the Indemnified Party shall promptly notify the Indemnifying Party. The

Indemnified Party shall give Indemnifying Party exclusive control over the proceedings and reasonably cooperate in the investigation,

settlement, and defense of such claims at the Indemnifying Party’s expense; provided that the Indemnified Party may, at its own

expense, participate in such defense. The Indemnifying Party shall not enter into a settlement of such claim that does not include a full

release of the Indemnified Party or involves a remedy other than the payment of money, without the Indemnified Party’s consent.

If the Indemnifying Party does not promptly assume control over the defense of a claim as provided in this Section, the Indemnified Party

may defend the claim in such manner as it may deem appropriate, at the cost and expense of the Indemnifying Party.

7. Miscellaneous.

7.1. Force

Majeure. Neither Party shall be liable or responsible, nor be deemed to have defaulted under or breached this Agreement, for any failure

or delay to perform any term under this Agreement due to acts of God; flood, fire, earthquake, pandemic, epidemic, or explosion; war,

invasion, hostilities (whether war is declared or not), terrorist threats or acts; riot or other civil unrest; government order, law,

or actions; embargoes or blockades; national or regional emergency; strikes, labor stoppages or slowdowns, or other industrial disturbances;

shortage of adequate power or transportation facilities; acts or omissions of the other Party; and any actions, events, conditions, inactions

or any other cause beyond such Party’s reasonable control. In the event of any such delay, the date for performance or delivery

shall be extended for a period equal to the time lost by reason of delay.

7.2. Relationship

of the Parties. The Parties are independent contractors, and nothing in this Agreement shall be construed as creating an employer-employee

relationship, a partnership, joint venture or other relationship between the Parties. Neither Party has any authority to assume or create

obligations or liability of any kind on behalf of the other. Neither Party, by virtue of this Agreement, has any right, power, or authority

to act or create an obligation, express or implied, on behalf of the other Party. Each Party assumes responsibility for the actions of

their personnel under this Agreement and is solely responsible for their supervision, daily direction, and control, wage rates, withholding

income taxes, disability benefits, or the manner and means through which the work under this Agreement is to be accomplished. Except as

provided otherwise in this Agreement, Supplier has the sole discretion to determine Supplier’s methods of operation, accounting

practices, personnel practices, and business strategy, practices, and methods.

7.3. Entire

Agreement. This Agreement, including and together with any related exhibits, schedules, and attachments and any purchase orders,

constitutes the sole and entire agreement of the Parties with respect to the subject matter contained in this Agreement and supersedes

all prior and contemporaneous understandings, agreements, representations and warranties, both written and oral.

7.4. Survival.

Sections 1, 3-7 of this Agreement, as well as any other provision that, in order to give proper effect to its intent, should survive such

expiration or termination, shall survive the expiration or termination of this Agreement.

7.5. Notices.

All notices and demands of any kind which either party may be required to serve upon the other party under the terms of this Agreement

shall be in writing and shall be served upon such other party by nationally recognized overnight courier providing a receipt for delivery,

by certified or registered mail, postage prepaid, with return receipt requested, or by personal delivery at the applicable address set

forth below or to such other address as that party may designate in writing. Notices will be deemed effective upon the date of receipt

(or refusal of delivery).

Notice to

251 8th Street

Monroe WI 53566

Attn: Zach Kraus

Notice to

3121 Eagles Nest St., Suite 120

Round Rock, TX 78665

Attn: John Kim

7.6. Headings.

The headings in this Agreement are for reference only and do not affect the interpretation of this Agreement.

7.7. Severability.

The illegality, invalidity, or unenforceability of any provision of this Agreement (as determined by a court of competent jurisdiction)

shall not affect the legality, validity, or unenforceability of the remaining provisions, and this Agreement shall be construed in all

respects as if any illegal, invalid, or unenforceable provision were omitted.

7.8. Amendments.

This Agreement shall not be modified or amended, in whole or in part, except by written amendment signed by both Parties.

7.9. Waiver.

No waiver by either Party of a breach of any provision of this Agreement shall be effective unless made in writing by the waiving Party

and no such waiver shall be construed as a waiver of any subsequent or different breach. No forbearance by a Party to seek a remedy for

noncompliance or breach by the other Party shall be construed as a waiver of any right or remedy with respect to such noncompliance or

breach.

7.10. Cumulative

Remedies. All rights and remedies provided in this Agreement are cumulative and not exclusive, and the exercise by either Party of

any right or remedy does not preclude the exercise of any other rights or remedies that may now or later be available at law, in equity,

by statute, in this or any other agreement between the Parties or otherwise.

7.11. Assignment.

The parties shall not assign all or part of their rights or obligations under this "Agreement" without the prior written consent

of the other party. Any assignment or authorization in violation of this clause shall be void. Any assignment or delegation shall not

relieve the assignor or delegator of any obligations under this Agreement.

7.12. Successors

and Assigns. This Agreement is binding on and inures to the benefit of the Parties and their respective successors and permitted assigns.

7.13. Rights

of Third Parties. Except as expressly provided herein, a person who is not a party to this Agreement has no rights, benefits, obligations,

or liabilities hereunder.

7.14. Governing

Law and Venue. This Agreement will be governed by and construed in accordance with the laws of the State of Texas, excluding its body

of law controlling conflict of laws. Any legal action or proceeding arising under this Agreement will be brought exclusively in the federal

or state courts located in Williamson County, Texas and the parties hereby irrevocably consent to the personal jurisdiction and venue

therein.

7.15. Counterparts.

This Agreement may be executed by facsimile, PDF, or electronic signature and in any number of counterparts, each of which shall be deemed

an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the Parties have caused this Agreement to

be executed as of the Effective Date by their duly authorized representatives.

Venom

By: /s/ Zach Kraus

Name: Zach Kraus

Title: Partner

Volcon, Inc.

By: /s/ John Kim

Name: John Kim

Title: CEO

SCHEDULE 1

PRODUCTS

Venom Golf Carts

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

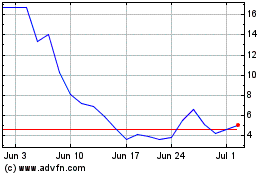

Volcon (NASDAQ:VLCN)

Historical Stock Chart

From Feb 2025 to Mar 2025

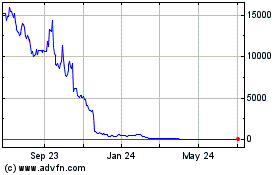

Volcon (NASDAQ:VLCN)

Historical Stock Chart

From Mar 2024 to Mar 2025