Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 08 2024 - 8:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-

16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of July 2024

Commission File Number: 001-35126

VNET Group, Inc.

Guanjie Building, Southeast 1st Floor

10# Jiuxianqiao East Road

Chaoyang District

Beijing 100016

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

VNET Group, Inc. |

| |

|

|

| |

By: |

/s/ Qiyu Wang |

| |

Name: Qiyu Wang |

| |

Title: Chief Financial Officer |

| |

|

|

| Date: July 8, 2024 |

|

|

EXHIBIT INDEX

Exhibit 99.1

VNET Announces Certain Updates Regarding the

Refinancing of the Founder’s Personal Loan

BEIJING, July 8,

2024 /PRNewswire/ -- VNET Group, Inc. (Nasdaq: VNET) (“VNET” or the “Company”), a leading carrier- and cloud-neutral

internet data center services provider in China, today announced the refinancing of the margin loan facility provided by Bold Ally (Cayman)

Limited (the “Bold Ally Loan”) to Mr. Josh Sheng Chen (“Mr. Chen”), Founder, Co-Chairperson and interim

Chief Executive Officer of VNET. The Bold Ally Loan was procured by Mr. Chen in or around August 2021 to finance his purchase

of 17,140,898 Class A ordinary shares from another significant shareholder at the time, and was secured by the ordinary shares beneficially

owned by Mr. Chen in the Company.

With reference to the

Amendment No. 8 to the Schedule 13D filing dated July 8, 2024 filed by Mr. Chen (the “Schedule 13D Amendment”),

Mr. Chen and various entities wholly owned by him (the “Corporate Obligors”) have settled all of their obligations under

the Bold Ally Loan. The settlement was funded using proceeds generated from the issuance of a promissory note (the “Note”)

to Shining Rich Holdings Limited and the existing cash reserves of Mr. Chen.

As a result of the

settlement of the Bold Ally Loan, the collateral for the Bold Ally Loan has been released in full pursuant to a deed of undertaking as

disclosed in the Schedule 13D Amendment, and Mr. Chen has restored his beneficial ownership interest in 33,628,926 Class A ordinary

shares of the Company, the ownership of which was previously transferred to Bold Ally (Cayman) Limited.

The Note is secured

by 68,373,133 Class A ordinary shares and 27,757,992 Class B ordinary shares beneficially owned by Mr. Chen and the Corporate

Obligors, representing in the aggregate approximately 6.00% of the issued and outstanding share capital and 18.41% of the total voting

power in the Company as of the date of the Schedule 13D Amendment.

Mr. Chen and the

Corporate Obligors have also made various undertakings with respect to the shares of the Company. These undertakings include procuring

the Company not to issue or grant, in any financial year, equity securities (including rights to acquire shares) representing 5% or more

of the total issued and outstanding capital of the Company (on a fully-diluted basis) to any person, including Mr. Chen and the Corporate

Obligors themselves, subject to exceptions. Details of such undertakings are set forth in the Schedule 13D Amendment.

Considering the voting

power owned by Mr. Chen, his veto rights over certain corporate actions through his beneficial ownership of 60,000 class C ordinary

shares and his executive powers as co-Chairperson and interim Chief Executive Officer of the Company, Mr. Chen holds significant

power to direct or influence the management and policies of the Company as a controlling person.

About VNET

VNET Group, Inc. is

a leading carrier- and cloud-neutral internet data center services provider in China. VNET provides hosting and related

services, including IDC services, cloud services, and business VPN services to improve the reliability, security, and speed of its customers'

internet infrastructure. Customers may locate their servers and equipment in VNET's data centers and connect to China’s internet

backbone. VNET operates in more than 30 cities throughout China, servicing a diversified and loyal base of over 7,500 hosting

and related enterprise customers that span numerous industries ranging from internet companies to government entities and blue-chip enterprises

to small- to mid-sized enterprises.

Safe Harbor Statement

This announcement contains

forward-looking statements. These forward-looking statements are made under the "safe harbor" provisions of the U.S. Private

Securities Litigation Reform Act of 1995. These statements can be identified by terminology such as "will," "expects,"

"anticipates," "future," "intends," "plans," "target," "believes," "estimates"

and similar statements. Among other things, quotations from management in this announcement as well as VNET's strategic and

operational plans contain forward-looking statements. VNET may also make written or oral forward-looking statements in its reports

filed with, or furnished to, the U.S. Securities and Exchange Commission, in its annual reports to shareholders, in press releases

and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are

not historical facts, including statements about beliefs and expectations on the future performance of VNET, are forward-looking

statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement, including but not limited to the following: VNET's goals and

strategies; VNET's liquidity conditions; VNET's expansion plans; the expected growth of the data center services market;

expectations regarding demand for, and market acceptance of, VNET's services; VNET's expectations regarding keeping

and strengthening its relationships with customers; VNET's plans to invest in research and development to enhance its solution

and service offerings; and general economic and business conditions in the regions where VNET provides solutions and services.

Further information regarding these and other risks is included in VNET's reports filed with, or furnished to, the U.S.

Securities and Exchange Commission. All information provided in this press release is as of the date of this press release, and VNET undertakes

no duty to update such information, except as required under applicable law.

Investor Relations

Contact:

Xinyuan Liu

Tel: +86 10 8456 2121

Email: ir@vnet.com

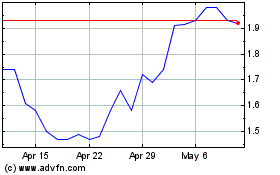

VNET (NASDAQ:VNET)

Historical Stock Chart

From Oct 2024 to Nov 2024

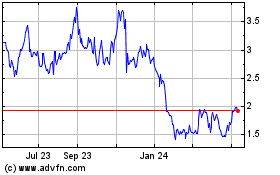

VNET (NASDAQ:VNET)

Historical Stock Chart

From Nov 2023 to Nov 2024