UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

November

15, 2024

Commission

File Number 001-37974

VIVOPOWER

INTERNATIONAL PLC

(Translation

of registrant’s name into English)

The

Scalpel, 18th Floor, 52 Lime Street

London

EC3M 7AF

United

Kingdom

+44-203-667-5158

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form

20- F ☒ Form 40-F ☐

On

November 12, 2024, VivoPower International PLC (the “Company” or “VivoPower”) received a letter (the “Notice”)

from the Nasdaq Listing Qualifications Department (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) indicating

that, based on the closing bid price of the Company’s common stock for the last 30 consecutive business days, the Company no longer

meets the requirement to maintain a minimum bid price of $1 per share, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum

Bid Price Requirement”). Nasdaq’s notice has no immediate effect on the listing of the Company’s common stock on the

Nasdaq Capital Market.

In

accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has been provided a period of 180 calendar days, or until May 12, 2025,

in which to regain compliance with the Minimum Bid Price Requirement. If at any time ending May 12, 2025, the closing bid price of the

Company’s common stock closes at $1.00 or more for a minimum of 10 consecutive business days as required under the applicable rule,

the Staff will provide written notification to the Company that it has regained compliance with the Minimum Bid Price Requirement.

This

Form 6-K serves as the Company’s public disclosure in accordance with Nasdaq Listing Rule 5810(b). An indicator reflecting the

Company’s non-compliance with the Minimum Bid Price Requirement will be displayed on Nasdaq.com and NasdaqTrader.com. Furthermore,

the Company’s information will appear on Nasdaq’s list of non-compliant companies commencing five business days from the

date of the Notice.

In

the event that the Company does not regain compliance within this 180-day period, the Company may be eligible to seek an additional compliance

period of 180 calendar days (a total of 360 days from November 12, 2024) if it meets the continued listing requirement for market value

of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the Minimum Bid

Price Requirement, and provides written notice to Nasdaq of its intent to cure the deficiency during this second compliance period, by

effecting a reverse stock split, if necessary. As part of its review process, the Staff will make a determination of whether it believes

the Company will be able to cure the deficiency. Should the Staff conclude that the Company will not be able to cure the deficiency,

or if the Company is otherwise not eligible, the Staff will provide written notification to the Company that its common stock will be

subject to delisting. At that time, the Company may appeal the Staff’s delisting determination to a Hearings Panel. There can be

no assurance that the Company will be able to regain compliance with the Minimum Bid Price Requirement or that, if the Company receives

a delisting notice and appeals the delisting determination by the Staff to the panel, such appeal would be successful.

The

Company will monitor the closing bid price of the Company’s common stock and will, if appropriate, consider available options to

regain compliance with the Minimum Bid Price Requirement.

The

information in this Report on Form 6-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933,

as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

This

Report on Form 6-K, is hereby incorporated by reference into the Company’s Registration Statements on Form S-8 (File Nos. 333-227810,

333-251546,

333-268720,

333-273520)

and Form F-3 (File No. 333-276509).

Forward-Looking

Statements

This

communication includes certain statements that may constitute “forward-looking statements” for purposes of the U.S. federal

securities laws. Forward-looking statements include, but are not limited to, statements that refer to projections, forecasts or other

characterisations of future events or circumstances, including any underlying assumptions. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. Forward-looking statements may include, for example, statements about the achievement

of performance hurdles, or the benefits of the events or transactions described in this communication and the expected returns therefrom.

These statements are based on VivoPower’s management’s current expectations or beliefs and are subject to risk, uncertainty,

and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes

in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of VivoPower’s

business. These risks, uncertainties and contingencies include changes in business conditions, fluctuations in customer demand, changes

in accounting interpretations, management of rapid growth, intensity of competition from other providers of products and services, changes

in general economic conditions, geopolitical events and regulatory changes, and other factors set forth in VivoPower’s filings

with the United States Securities and Exchange Commission. The information set forth herein should be read in light of such risks. VivoPower

is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements whether as a result

of new information, future events, changes in assumptions or otherwise.

No

Offer or Solicitation

This

Report on Form 6-K shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect

of the proposed transaction. This Report on Form 6-K shall also not constitute an offer to sell or the solicitation of an offer to buy

any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall

be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption

therefrom.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date:

November 15, 2024 |

VivoPower

International PLC |

| |

|

| |

/s/

Kevin Chin |

| |

Kevin

Chin |

| |

Executive

Chairman |

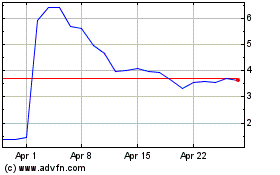

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

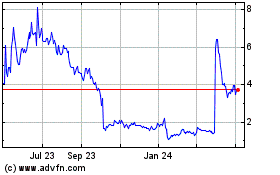

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Dec 2023 to Dec 2024