Viper Energy Partners LP, a Subsidiary of Diamondback Energy, Inc., Prices Initial Public Offering at $26.00 Per Common Unit

June 17 2014 - 9:08PM

Viper Energy Partners LP ("Viper"), a subsidiary of Diamondback

Energy, Inc. (Nasdaq: FANG) ("Diamondback"), and Diamondback today

announced the pricing of Viper's initial public offering of

5,000,000 common units representing limited partner interests at

$26.00 per common unit. The common units are expected to begin

trading on the NASDAQ Global Select Market on June 18, 2014 under

the ticker symbol "VNOM." In addition, Viper has granted the

underwriters a 30-day option to purchase up to an additional

750,000 common units at the initial public offering price. The

offering is expected to close on June 23, 2014, subject to

customary closing conditions.

Upon the consummation of the offering, the public will own

common units representing an approximate 7% limited partner

interest in Viper (or an approximate 8% limited partner interest if

the underwriters exercise in full their option to purchase

additional common units). Diamondback will own the remaining

approximate 93% limited partner interest in Viper (or an

approximate 92% limited partner interest if the underwriters

exercise in full their option to purchase additional common units)

and the general partner of Viper.

Viper intends to distribute the net proceeds from the offering

to Diamondback. The net proceeds from any exercise of the

underwriters' option to purchase additional common units will also

be distributed to Diamondback.

Barclays, Credit Suisse and Wells Fargo Securities are acting as

joint book-running managers for the offering, Baird, Raymond James,

Scotiabank / Howard Weil, Simmons & Company International,

Stifel and Tudor, Pickering, Holt & Co. are acting as senior

co-managers for the offering, and Northland Capital Markets, Sterne

Agee and Wunderlich Securities are acting as co-managers for the

offering. The offering of these securities is being made only by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended. When available, a copy of the

final prospectus may be obtained from:

| Barclays Capital Inc. |

Credit Suisse Securities (USA) LLC |

| c/o Broadridge Financial Solutions |

Attention: Prospectus Department |

| 1155 Long Island Avenue |

One Madison Avenue, Level 1B |

| Edgewood, NY 11717 |

New York, NY 10010 |

| 1-888-603-5847 |

Telephone: 1-800-221-1037 |

| Email: barclaysprospectus@broadridge.com |

Email:

newyork.prospectus@credit-suisse.com |

| |

|

| Wells Fargo Securities, LLC |

|

| Attn: Equity Syndicate Department |

|

| 375 Park Avenue |

|

| New York, New York 10152 |

|

| Telephone: (800) 326-5897 |

|

| Email: cmclientsupport@wellsfargo.com |

|

You may also obtain a copy of the final prospectus for free by

visiting the U.S. Securities and Exchange Commission's (the "SEC")

website at http://www.sec.gov.

A registration statement relating to these securities has been

filed with and declared effective by the SEC. This press release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities

described above in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Viper Energy Partners LP

Viper Energy Partners LP is a limited partnership formed by

Diamondback Energy, Inc. (Nasdaq: FANG) that is engaged in owning,

acquiring and exploiting oil and natural gas properties in North

America, with an initial focus on the Permian Basin.

About Diamondback Energy, Inc.

Diamondback Energy, Inc. (Nasdaq:FANG) is an independent oil and

natural gas company headquartered in Midland, Texas focused on the

acquisition, development, exploration and exploitation of

unconventional, onshore oil and natural gas reserves in the Permian

Basin in West Texas. Diamondback's activities are primarily

focused on the Wolfcamp, Clearfork, Spraberry, Cline, Strawn and

Atoka formations.

Forward-Looking Statements

This press release may include forward-looking

statements. These forward-looking statements involve risks and

uncertainties. When considering these forward-looking

statements, you should keep in mind the risk factors and other

cautionary statements in Viper's prospectus and SEC filings and

Diamondback's SEC filings, including its Forms 10-K, 10-Q and

8-K. Each of Viper and Diamondback undertakes no obligation

and does not intend to update these forward-looking statements to

reflect events or circumstances occurring after this press

release. You are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

of this press release.

CONTACT: Investor Contact:

Adam Lawlis

+1 432.221.7467

alawlis@diamondbackenergy.com

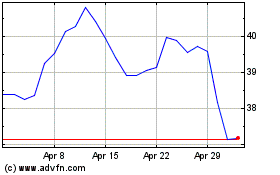

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From Oct 2024 to Nov 2024

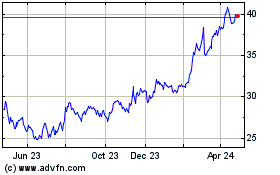

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From Nov 2023 to Nov 2024