Verisk (Nasdaq:VRSK), a leading global data analytics and

technology provider, today announced results for the fourth quarter

and fiscal year ended December 31, 2023.

Lee Shavel, president and CEO, Verisk: "Verisk's 2023

performance exceeded the expectations we set at Investor Day and

demonstrated our potential as an insurance-focused organization. We

achieved these results while implementing strategic,

organizational, and cultural change. As we look ahead, our improved

engagement with clients and ability to act on a more coordinated

basis has expanded opportunities to invest in new innovations and

technologies that deliver value to the industry and support

growth and returns for Verisk shareholders."

Elizabeth Mann, CFO, Verisk: "Verisk delivered solid fourth

quarter 2023 results marked by 6.0% OCC revenue growth, 6.5% OCC

adjusted EBITDA growth and continued margin expansion. This capped

off an excellent 2023 where revenue and adjusted EBITDA growth

exceeded our long-term targets. As we look to 2024, we have

confidence in our ability to achieve consistent and predictable

growth, margin expansion and strong free cash flow generation. We

will continue to allocate our free cash flow toward

investments in order to deliver on our growth strategy while

leaning into our cost discipline to achieve our efficiency

commitments."

Summary of Results (GAAP and Non-GAAP) from Continuing

Operations(in millions, except per share

amounts) Note: Adjusted EBITDA, diluted adjusted EPS, and free

cash flow are non-GAAP measures.

| |

|

Three Months Ended December 31, |

|

|

|

|

|

|

Twelve Months Ended December 31, |

|

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

|

Change |

|

|

2023 |

|

|

2022 |

|

|

Change |

|

| Revenues |

|

$ |

677.2 |

|

|

$ |

630.4 |

|

|

|

7.4 |

% |

|

$ |

2,681.4 |

|

|

$ |

2,497.0 |

|

|

|

7.4 |

% |

| Income from continuing

operations |

|

|

182.3 |

|

|

|

215.8 |

|

|

|

(15.5 |

) |

|

|

768.4 |

|

|

|

1,042.1 |

|

|

|

(26.3 |

) |

| Adjusted EBITDA |

|

|

362.0 |

|

|

|

332.0 |

|

|

|

9.0 |

|

|

|

1,433.5 |

|

|

|

1,284.5 |

|

|

|

11.6 |

|

| Diluted EPS attributable to

Verisk |

|

|

1.25 |

|

|

|

1.37 |

|

|

|

(8.8 |

) |

|

|

5.22 |

|

|

|

6.55 |

|

|

|

(20.3 |

) |

| Diluted adjusted EPS |

|

|

1.40 |

|

|

|

1.43 |

|

|

|

(2.1 |

) |

|

|

5.71 |

|

|

|

5.01 |

|

|

|

14.0 |

|

| Net cash provided by operating

activities |

|

|

252.4 |

|

|

|

249.0 |

|

|

|

1.4 |

|

|

|

1,060.7 |

|

|

|

1,059.0 |

|

|

|

0.2 |

|

| Free cash flow |

|

|

196.1 |

|

|

|

169.3 |

|

|

|

15.8 |

|

|

|

830.7 |

|

|

|

784.3 |

|

|

|

5.9 |

|

Revenues from Continuing Operations

Consolidated revenues were $677.2 million, up 7.4% and

up 6.0% on an OCC basis for the fourth quarter, reflecting

solid growth in underwriting and more moderate growth in

claims. Storm-related revenue (Hurricane Ian) of $5.6 million in

the fourth quarter of 2022 compared to almost no storm activity in

the current year's quarter, negatively impacted our OCC

revenue growth by approximately 90 basis points. For the full

year 2023, consolidated revenues were $2,681.4 million, up 7.4% and

up 8.7% on an OCC basis, reflecting broad-based growth across most

of our businesses.

Revenues and Revenue Growth by Segment(in

millions)Note: OCC revenue growth is a non-GAAP measure.

| |

|

Three Months Ended |

|

|

Three Months Ended |

|

| |

|

December 31, |

|

|

December 31, 2023 |

|

| |

|

2023 |

|

|

2022 |

|

|

Reported |

|

|

OCC |

|

| Underwriting |

|

$ |

479.0 |

|

|

$ |

444.4 |

|

|

|

7.8 |

% |

|

|

7.3 |

% |

| Claims |

|

|

198.2 |

|

|

|

186.0 |

|

|

|

6.6 |

|

|

|

2.8 |

|

|

Insurance |

|

$ |

677.2 |

|

|

$ |

630.4 |

|

|

|

7.4 |

|

|

|

6.0 |

|

| |

|

Twelve Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

December 31, 2023 |

|

| |

|

2023 |

|

|

2022 |

|

|

Reported |

|

|

OCC |

|

| Underwriting |

|

$ |

1,892.7 |

|

|

$ |

1,734.5 |

|

|

|

9.1 |

% |

|

|

8.5 |

% |

| Claims |

|

|

788.7 |

|

|

|

702.5 |

|

|

|

12.3 |

|

|

|

9.3 |

|

|

Insurance |

|

|

2,681.4 |

|

|

|

2,437.0 |

|

|

|

10.0 |

|

|

|

8.7 |

|

|

Specialized Markets |

|

|

- |

|

|

|

22.4 |

|

|

|

N/A |

|

|

|

N/A |

|

|

Financial Services |

|

|

- |

|

|

|

37.6 |

|

|

|

N/A |

|

|

|

N/A |

|

|

Revenues |

|

$ |

2,681.4 |

|

|

$ |

2,497.0 |

|

|

|

7.4 |

|

|

|

8.7 |

|

Insurance segment revenues grew 7.4% in the fourth quarter

of 2023 and 6.0% on an OCC basis. For the full year

2023, insurance segment revenues grew 10.0% and 8.7% on an OCC

basis.

- Underwriting revenues increased 7.8% in the quarter

and 7.3% on an OCC basis, primarily resulting from solid

growth across forms, rules, and loss costs, underwriting

data and analytic solutions, extreme event solutions, and life

insurance solutions.

- Claims revenue grew 6.6% in the quarter and 2.8% on

an OCC basis. The year-over-year increase in revenues was driven by

growth in anti-fraud, casualty, and international.

Storm-related revenue from the prior year negatively impacted OCC

revenue growth by 320 basis points.

There was no Energy and Specialized Markets segment revenue in

the quarter. We closed on the sale of the Energy business on

February 1, 2023, and accounted for it as discontinued

operations. We closed on the sale of 3E on March 11, 2022.

There was no Financial Services segment revenue in the

quarter as we closed the sale of Verisk Financial Services on

April 8, 2022.

Income and Adjusted EBITDA from Continuing

Operations

During fourth-quarter 2023, income from continuing operations

was $182.3 million, a decrease of 15.5%. The

decrease in income from continuing operations was primarily

due to a $19.0 million litigation reserve expense in the

fourth quarter of 2023 associated with an indemnification

for an ongoing inquiry related to our former Financial

Services segment, a one-time tax benefit of approximately $30.3

million in the fourth quarter of 2022, and higher depreciation

expense in the fourth quarter of 2023 associated with the timing of

certain large internally developed projects that were

completed and placed into service during the

year. Adjusted EBITDA increased 9.0%, and 6.5% on an OCC

basis, primarily due to strong revenue growth and cost

discipline. For 2023, income from continuing operations was

$768.4 million, down 26.3%, while adjusted EBITDA was $1,433.5

million, up 11.6%, and up 11.5% on an OCC basis, reflecting strong

revenue growth and cost discipline.

EBITDA and Adjusted EBITDA by Segment(in

millions) Note: Consolidated EBITDA and Adjusted EBITDA

are non-GAAP measures. Margin is calculated as a percentage of

revenues. See "Non-GAAP Reconciliations" below for a reconciliation

to the nearest GAAP measure. All OCC figures exclude

results from recent dispositions, namely 3E, Energy, and

Verisk Financial Services. Segment-level adjusted EBITDA margins

for 2023 reflect a higher level of corporate allocations

resulting from recent dispositions and the impact of foreign

currency fluctuations.

| |

|

Three months ended December 31, |

|

| |

|

EBITDA |

|

|

EBITDA Margin |

|

|

Adjusted EBITDA |

|

|

Adjusted EBITDA Growth |

|

|

Adjusted EBITDA Margin |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 Reported |

|

|

2023 OCC |

|

|

2023 |

|

|

2022 |

|

| Insurance |

|

$ |

356.9 |

|

|

$ |

342.8 |

|

|

|

52.7 |

% |

|

|

54.4 |

% |

|

$ |

362.0 |

|

|

$ |

332.1 |

|

|

|

9.0 |

% |

|

|

6.5 |

% |

|

|

53.4 |

% |

|

|

52.7 |

% |

| Specialized Markets |

|

|

- |

|

|

|

0.5 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

- |

|

|

|

0.1 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

| Financial Services |

|

|

- |

|

|

|

(2.6 |

) |

|

|

N/A |

|

|

|

N/A |

|

|

|

- |

|

|

|

(0.2 |

) |

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

| Total |

|

$ |

356.9 |

|

|

$ |

340.7 |

|

|

|

52.7 |

|

|

|

54.0 |

|

|

$ |

362.0 |

|

|

$ |

332.0 |

|

|

|

9.0 |

|

|

|

6.5 |

|

|

|

53.4 |

|

|

|

52.7 |

|

| |

|

Twelve months ended December 31, |

|

| |

|

EBITDA |

|

|

EBITDA Margin |

|

|

Adjusted EBITDA |

|

|

Adjusted EBITDA Growth |

|

|

Adjusted EBITDA Margin |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 Reported |

|

|

2023 OCC |

|

|

2023 |

|

|

2022 |

|

| Insurance |

|

$ |

1,424.1 |

|

|

$ |

1,303.0 |

|

|

|

53.1 |

% |

|

|

53.5 |

% |

|

$ |

1,433.5 |

|

|

$ |

1,300.0 |

|

|

|

10.3 |

% |

|

|

11.5 |

% |

|

|

53.5 |

% |

|

|

53.3 |

% |

| Specialized Markets |

|

|

- |

|

|

|

426.2 |

|

|

|

N/A |

|

|

|

1,900.8 |

|

|

|

- |

|

|

|

(21.9 |

) |

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

(97.9 |

) |

| Financial Services |

|

|

- |

|

|

|

(89.4 |

) |

|

|

N/A |

|

|

|

(237.6 |

) |

|

|

- |

|

|

|

6.4 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

16.9 |

|

| Total |

|

$ |

1,424.1 |

|

|

$ |

1,639.8 |

|

|

|

53.1 |

|

|

|

65.7 |

|

|

$ |

1,433.5 |

|

|

$ |

1,284.5 |

|

|

|

11.6 |

|

|

|

11.5 |

|

|

|

53.5 |

|

|

|

51.4 |

|

Earnings Per Share and Diluted Adjusted Earnings Per

Share

Diluted EPS attributable to Verisk decreased 8.8%

to $1.25 for the fourth quarter of 2023. Diluted adjusted EPS

decreased 2.1% to $1.40 for the fourth quarter

of 2023. The decrease in diluted EPS attributable to Verisk and

diluted adjusted EPS was the result of a lower tax

expense in the prior year resulting from a one-time tax benefit of

approximately $30.3 million, as well as higher year-over-year

depreciation expense in the fourth quarter of 2023 related

to the timing of certain large internally developed

software projects that were completed and placed into service

during the year. This was offset in part by strong

revenue and profit growth, lower net interest expense, and the

benefit from our accelerated share repurchase program. For the

full year 2023, diluted EPS attributable to Verisk were $5.22, down

20.3% and diluted adjusted EPS were $5.71, up 14.0%.

Cash Flow and Free Cash Flow

Net cash provided by operating activities

was $252.4 million for the fourth quarter of 2023, up

1.4%, and free cash flow was $196.1 million, up

15.8%. The increase in net cash provided by operating

activities reflects an increase in the operating profit of our

insurance segment and lower tax payments in the current year,

offset by the disposition of our Energy business. Cash taxes

paid in the prior year were higher primarily due to the gain on the

sale of 3E. For the full year 2023, net cash provided by operating

activities was $1,060.7 million, up 0.2%, and free cash flow was

$830.7 million, up 5.9%.

Dividend

On December 31, 2023, we paid a cash dividend of

34 cents per share of common stock issued and outstanding to

the holders of record as of December 15, 2023.

On February 14, 2024, our Board of Directors approved a

cash dividend of 39 cents per share of common

stock issued and outstanding, a 15% increase. The dividend is

payable on March 29, 2024, to holders of record as of March

15, 2024.

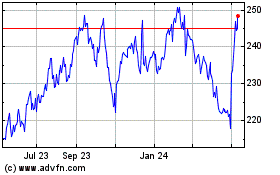

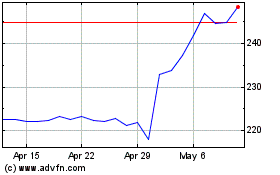

Share Repurchases

During the fourth quarter 2023, we entered into and fully funded

an accelerated share repurchase program (ASR) of $250 million and

received an initial delivery of 0.9 million shares. Upon the

final settlement of this ASR agreement in February 2024, we

received additional shares of 0.2 million as determined by the

daily volume weighted average share price of our common stock of

$237.71 during the term of this ASR agreement.

As of December 31, 2023, we had $641.5 million remaining

under our share repurchase authorization. On February 14, 2024,

our Board of Directors approved an additional $1.0 billion

share repurchase authorization.

Outlook

The Company has established its financial outlook for fiscal

2024 as follows:

| |

|

Fiscal 2024 Guidance |

|

| |

|

($ in millions, except per share amounts) |

|

| |

|

Low |

|

|

High |

|

| Revenue |

|

$ |

2,840 |

|

|

$ |

2,900 |

|

| Adjusted EBITDA |

|

$ |

1,540 |

|

|

$ |

1,600 |

|

| Adjusted EBITDA margin |

|

|

54.0 |

% |

|

|

55.0 |

% |

| Diluted adjusted EPS |

|

$ |

6.30 |

|

|

$ |

6.60 |

|

| |

|

|

|

|

|

|

|

|

| Fixed asset depreciation &

amortization |

|

$ |

210 |

|

|

$ |

240 |

|

| Intangible amortization |

|

$ |

75 |

|

|

$ |

75 |

|

| Effective tax rate |

|

|

23.0 |

% |

|

|

25.0 |

% |

| Capital expenditures |

|

$ |

240 |

|

|

$ |

260 |

|

Conference Call

Our management team will host a live audio webcast to discuss

the financial results and business highlights on Wednesday,

February 21, 2024, at 8:30 a.m. EST (5:30 a.m. PT, 1:30 p.m.

GMT). All interested parties are invited to listen to the live

event via webcast on our investor website

at http://investor.verisk.com. The discussion will also be

available through dial-in number 1-888-660-6191 for U.S./Canada

participants or 929-203-1913 for international participants.

A replay of the webcast will be available for 30 days on our

investor website and through the conference call number

1-800-770-2030 for U.S./Canada participants or 647-362-9199 for

international participants using Conference ID #4026897.

About Verisk

Verisk is a leading strategic data analytics and technology

partner to the global insurance industry. It empowers clients to

strengthen operating efficiency, improve underwriting and claims

outcomes, combat fraud and make informed decisions about global

risks, including climate change, extreme events, political topics

and ESG issues. Through advanced data analytics, software,

scientific research and deep industry knowledge, Verisk helps build

global resilience for individuals, communities and businesses. With

teams across more than 20 countries, Verisk consistently earns

certification by Great Place to Work and fosters

an inclusive culture where all team members feel they

belong. For more, visit Verisk.com.

Verisk is traded on the Nasdaq exchange and is a part of the

S&P 500 Index and the Nasdaq-100 Index.

For more information, please visit www.verisk.com.

Contact:

Investor RelationsStacey BrodbarHead of

Investor RelationsVerisk201-469-4327IR@verisk.com

MediaAlberto CanalVerisk Public

Relations201-469-2618Alberto.Canal@verisk.com

Forward-Looking Statements

This release contains forward-looking statements. These

statements relate to future events or to future financial

performance and involve known and unknown risks, uncertainties, and

other factors that may cause our actual results, levels of

activity, performance, or achievements to be materially different

from any future results, levels of activity, performance, or

achievements expressed or implied by these forward-looking

statements. This includes, but is not limited to,

our expectation and ability to pay a cash dividend on

our common stock in the future, subject to the determination

by our Board of Directors and based on an evaluation of our

earnings, financial condition and requirements, business

conditions, capital allocation determinations, and other factors,

risks, and uncertainties. In some cases, you can identify

forward-looking statements by the use of words such as “may,”

“could,” “expect,” “intend,” “plan,” “target,” “seek,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,” or

“continue” or the negative of these terms or other comparable

terminology. You should not place undue reliance on forward-looking

statements, because they involve known and unknown risks,

uncertainties, and other factors that are, in some cases, beyond

our control and that could materially affect actual results, levels

of activity, performance, or achievements.

Other factors that could materially affect actual results,

levels of activity, performance, or achievements can be found in

our quarterly reports on Form 10-Q, annual reports on Form 10-K,

and current reports on Form 8-K filed with the Securities and

Exchange Commission. If any of these risks or uncertainties

materialize or if our underlying assumptions prove to be incorrect,

actual results may vary significantly from what we projected. Any

forward-looking statement in this release reflects our current

views with respect to future events and is subject to these and

other risks, uncertainties, and assumptions relating to our

operations, results of operations, growth strategy, and liquidity.

We assume no obligation to publicly update or revise these

forward-looking statements for any reason, whether as a result of

new information, future events, or otherwise.

Notes Regarding the Use of Non-GAAP Financial

Measures

We have provided certain non-GAAP financial information as

supplemental information regarding our operating results.

These measures are not in accordance with, or an alternative for,

U.S. GAAP and may be different from non-GAAP measures reported by

other companies. We believe that our presentation of

non-GAAP measures provides useful information to management and

investors regarding certain financial and business trends relating

to our financial condition and results of operations. In addition,

our management uses these measures for reviewing our financial

results, for budgeting and planning purposes, and for

evaluating the performance of senior management.

EBITDA, Adjusted EBITDA, and Adjusted EBITDA

Expenses: EBITDA represents GAAP net income from

continuing operations adjusted for (i) depreciation and

amortization of fixed assets; (ii) amortization of intangible

assets; (iii) interest expense; and (iv) provision for income

taxes. Adjusted EBITDA represents EBITDA adjusted for

acquisition-related costs (earn-outs), gain/loss from dispositions

(which includes businesses held for sale), and nonrecurring

gain/loss. Adjusted EBITDA expenses represent adjusted EBITDA net

of revenues. We believe these measures are useful and

meaningful because they help us allocate resources, make business

decisions, allow for greater transparency regarding our operating

performance, and facilitate period-to-period comparison.

Adjusted Net Income and Diluted Adjusted EPS:

Adjusted net income represents GAAP net income from continuing

operations adjusted for (i) amortization of intangible assets, net

of tax; (ii) acquisition-related costs (earn-outs), net of tax;

(iii) gain/loss from dispositions (which includes businesses held

for sale), net of tax; and (iv) nonrecurring gain/loss, net of tax.

Diluted adjusted EPS represents adjusted net income divided by

weighted-average diluted shares. We believe these measures are

useful and meaningful because they allow evaluation of the

after-tax profitability of our results excluding the after-tax

effect of acquisition-related costs and nonrecurring items.

Free Cash Flow: Free cash flow represents net

cash provided by operating activities determined in accordance with

GAAP minus payments for capital expenditures. We believe free

cash flow is an important measure of the recurring cash generated

by our operations that may be available to repay debt obligations,

repurchase our stock, invest in future growth through new business

development activities, or make acquisitions.

Organic: Organic is defined as operating

results excluding the effect of recent acquisitions and

dispositions (which include businesses held for sale) and

nonrecurring gain/loss associated with cost-based and equity method

investments that have occurred over the past year. An

acquisition is included as organic at the beginning of the calendar

quarter that occurs subsequent to the one-year anniversary of the

acquisition date. Once an acquisition is included in its

current-period organic base, its comparable prior-year-period

operating results are also included to calculate organic growth. A

disposition (which includes a business held for sale) is excluded

from organic at the beginning of the calendar quarter in which the

disposition occurs (or when a business meets the held-for-sale

criteria under U.S. GAAP). Once a disposition is excluded from

its current-period organic base, its comparable prior-year-period

operating results are also excluded to calculate organic growth. We

believe the organic presentation enables investors to assess the

growth of the business without the impact of recent acquisitions

for which there is no prior-year comparison and the impact of

recent dispositions, for which results are removed from all prior

periods presented to allow for comparability.

Organic Constant Currency (OCC) Growth Rate:

Our operating results, such as, but not limited to, revenue and

adjusted EBITDA, reported in U.S. dollars are affected by foreign

currency exchange rate fluctuations because the underlying foreign

currencies in which we transact changes in value over

time compared with the U.S. dollar; accordingly,

we present certain constant currency financial

information to assess how we performed excluding the impact of

foreign currency exchange rate fluctuations. We

calculate constant currency by translating comparable

prior-year-period results at the currency exchange rates used in

the current period. We believe organic constant currency is a

useful and meaningful measure to enhance investors’ understanding

of the continuing operating performance of our business and to

facilitate the comparison of period-to-period performance because

it excludes the impact of foreign exchange rate movements,

acquisitions, and dispositions.

See page 10 for a reconciliation of consolidated adjusted

EBITDA and a segment results summary and a reconciliation of

adjusted EBITDA. See page 11 for a reconciliation of

segment adjusted EBITDA margin, a reconciliation of adjusted

EBITDA expenses, and a reconciliation of diluted adjusted EPS.

See page 12 for a reconciliation of net cash provided by

operating activities to free cash flow.

Attached Financial Statements

Please refer to the full Form 10-K filing for the complete

financial statements and related notes.

VERISK ANALYTICS,

INC.CONSOLIDATED BALANCE SHEETSAs

of December 31, 2023 and 2022

| |

|

2023 |

|

|

2022 |

|

| |

|

(in millions, except for share and per share

data) |

|

|

ASSETS: |

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

302.7 |

|

|

$ |

112.5 |

|

|

Accounts receivable, net |

|

|

334.2 |

|

|

|

290.1 |

|

|

Prepaid expenses |

|

|

84.5 |

|

|

|

83.7 |

|

|

Income taxes receivable |

|

|

23.5 |

|

|

|

44.2 |

|

|

Other current assets |

|

|

65.2 |

|

|

|

32.0 |

|

|

Current assets held-for-sale |

|

|

- |

|

|

|

362.6 |

|

|

Total current assets |

|

|

810.1 |

|

|

|

925.1 |

|

| Noncurrent assets: |

|

|

|

|

|

|

|

|

|

Fixed assets, net |

|

|

604.9 |

|

|

|

541.5 |

|

|

Operating lease right-of-use assets, net |

|

|

191.7 |

|

|

|

182.0 |

|

|

Intangible assets, net |

|

|

471.7 |

|

|

|

504.8 |

|

|

Goodwill |

|

|

1,760.8 |

|

|

|

1,676.0 |

|

|

Deferred income tax assets |

|

|

30.8 |

|

|

|

31.7 |

|

|

Other noncurrent assets |

|

|

496.1 |

|

|

|

371.4 |

|

|

Noncurrent assets held for sale |

|

|

- |

|

|

|

2,728.6 |

|

|

Total assets |

|

$ |

4,366.1 |

|

|

$ |

6,961.1 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY: |

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

340.8 |

|

|

$ |

292.8 |

|

|

Short-term debt and current portion of long-term debt |

|

|

14.5 |

|

|

|

1,392.9 |

|

|

Deferred revenues |

|

|

375.1 |

|

|

|

321.7 |

|

|

Operating lease liabilities |

|

|

33.1 |

|

|

|

29.5 |

|

|

Income taxes payable |

|

|

7.9 |

|

|

|

- |

|

|

Current liabilities held-for-sale |

|

|

- |

|

|

|

282.3 |

|

|

Total current liabilities |

|

|

771.4 |

|

|

|

2,319.2 |

|

| Noncurrent liabilities: |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

|

2,852.2 |

|

|

|

2,343.2 |

|

|

Deferred income tax liabilities |

|

|

210.1 |

|

|

|

145.6 |

|

|

Operating lease liabilities |

|

|

195.6 |

|

|

|

189.9 |

|

|

Other noncurrent liabilities |

|

|

14.6 |

|

|

|

17.9 |

|

|

Noncurrent liabilities held-for-sale |

|

|

- |

|

|

|

177.6 |

|

|

Total liabilities |

|

|

4,043.9 |

|

|

|

5,193.4 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Common stock, $.001 par value; 2,000,000,000 shares authorized;

544,003,038 shares issued; 143,308,729 and 154,701,136 shares

outstanding, respectively |

|

|

0.1 |

|

|

|

0.1 |

|

|

Additional paid-in capital |

|

|

2,872.3 |

|

|

|

2,720.8 |

|

|

Treasury stock, at cost, 400,694,309 and 389,301,902 shares,

respectively |

|

|

(9,037.5 |

) |

|

|

(6,239.5 |

) |

|

Retained earnings |

|

|

6,416.9 |

|

|

|

5,999.1 |

|

|

Accumulated other comprehensive income (losses) |

|

|

58.2 |

|

|

|

(731.2 |

) |

|

Total Verisk stockholders' equity |

|

|

310.0 |

|

|

|

1,749.3 |

|

|

Noncontrolling interests |

|

|

12.2 |

|

|

|

18.4 |

|

|

Total stockholders’ equity |

|

|

322.2 |

|

|

|

1,767.7 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

4,366.1 |

|

|

$ |

6,961.1 |

|

VERISK ANALYTICS,

INC.CONSOLIDATED STATEMENTS OF

OPERATIONSFor the Three and Twelve Months Ended

December 31, 2023 and 2022

| |

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

(in millions, except for share and per share

data) |

|

| Revenues |

|

$ |

677.2 |

|

|

$ |

630.4 |

|

|

$ |

2,681.4 |

|

|

$ |

2,497.0 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues (exclusive of items shown separately below) |

|

|

226.2 |

|

|

|

205.2 |

|

|

|

876.5 |

|

|

|

824.6 |

|

|

Selling, general and administrative |

|

|

114.4 |

|

|

|

80.7 |

|

|

|

391.8 |

|

|

|

381.5 |

|

|

Depreciation and amortization of fixed assets |

|

|

67.6 |

|

|

|

43.0 |

|

|

|

206.8 |

|

|

|

164.2 |

|

|

Amortization of intangible assets |

|

|

18.5 |

|

|

|

17.0 |

|

|

|

74.6 |

|

|

|

74.4 |

|

|

Other operating loss (income) |

|

|

- |

|

|

|

2.0 |

|

|

|

- |

|

|

|

(354.2 |

) |

|

Total operating expenses |

|

|

426.7 |

|

|

|

347.9 |

|

|

|

1,549.7 |

|

|

|

1,090.5 |

|

| Operating income |

|

|

250.5 |

|

|

|

282.5 |

|

|

|

1,131.7 |

|

|

|

1,406.5 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income (loss) and others, net |

|

|

20.3 |

|

|

|

(1.8 |

) |

|

|

11.0 |

|

|

|

(5.3 |

) |

|

Interest expense, net |

|

|

(28.1 |

) |

|

|

(41.2 |

) |

|

|

(115.5 |

) |

|

|

(138.8 |

) |

|

Total other expense, net |

|

|

(7.8 |

) |

|

|

(43.0 |

) |

|

|

(104.5 |

) |

|

|

(144.1 |

) |

| Income from continuing

operations before income taxes |

|

|

242.7 |

|

|

|

239.5 |

|

|

|

1,027.2 |

|

|

|

1,262.4 |

|

| Provision for income

taxes |

|

|

(60.4 |

) |

|

|

(23.7 |

) |

|

|

(258.8 |

) |

|

|

(220.3 |

) |

|

Income from continuing operations |

|

|

182.3 |

|

|

|

215.8 |

|

|

|

768.4 |

|

|

|

1042.1 |

|

|

Loss from discontinued operations, net of tax benefit (expense) of

$(12.4), $139.9, $(12.6) and $131.5, respectively |

|

|

(8.5 |

) |

|

|

(154.6 |

) |

|

|

(154.0 |

) |

|

|

(87.8 |

) |

|

Net income |

|

|

173.8 |

|

|

|

61.2 |

|

|

|

614.4 |

|

|

|

954.3 |

|

|

Less: Net loss (income) attributable to noncontrolling

interests |

|

|

0.2 |

|

|

|

(0.1 |

) |

|

|

0.2 |

|

|

|

(0.4 |

) |

|

Net income attributable to Verisk |

|

$ |

174.0 |

|

|

$ |

61.1 |

|

|

$ |

614.6 |

|

|

$ |

953.9 |

|

| Basic net income per share

attributable to Verisk: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations |

|

$ |

1.26 |

|

|

$ |

1.38 |

|

|

$ |

5.24 |

|

|

$ |

6.60 |

|

|

Loss from discontinued operations |

|

|

(0.06 |

) |

|

|

(0.99 |

) |

|

|

(1.05 |

) |

|

|

(0.56 |

) |

|

Basic net income per share attributable to Verisk: |

|

$ |

1.20 |

|

|

$ |

0.39 |

|

|

$ |

4.19 |

|

|

$ |

6.04 |

|

| Diluted net income per share

attributable to Verisk: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations |

|

$ |

1.25 |

|

|

$ |

1.37 |

|

|

$ |

5.22 |

|

|

$ |

6.55 |

|

|

Loss from discontinued operations |

|

|

(0.06 |

) |

|

|

(0.98 |

) |

|

|

(1.05 |

) |

|

|

(0.55 |

) |

|

Diluted net income per share attributable to Verisk: |

|

$ |

1.20 |

|

|

$ |

0.39 |

|

|

$ |

4.17 |

|

|

$ |

6.00 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

144,618,187 |

|

|

|

156,028,555 |

|

|

|

146,623,989 |

|

|

|

157,905,718 |

|

|

Diluted |

|

|

145,392,678 |

|

|

|

156,974,983 |

|

|

|

147,336,159 |

|

|

|

158,928,942 |

|

VERISK ANALYTICS,

INC.CONSOLIDATED STATEMENTS OF CASH

FLOWSFor the Years Ended December 31,

2023 and 2022

| |

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

(in millions) |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

173.8 |

|

|

$ |

61.2 |

|

|

$ |

614.4 |

|

|

$ |

954.3 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization of fixed assets |

|

|

67.6 |

|

|

|

46.0 |

|

|

|

206.8 |

|

|

|

197.1 |

|

|

Amortization of intangible assets |

|

|

18.5 |

|

|

|

21.9 |

|

|

|

74.6 |

|

|

|

142.9 |

|

|

Amortization of debt issuance costs and original issue discount,

net of original issue premium |

|

|

0.5 |

|

|

|

0.2 |

|

|

|

1.5 |

|

|

|

1.1 |

|

|

Provision for doubtful accounts |

|

|

(0.2 |

) |

|

|

2.6 |

|

|

|

8.7 |

|

|

|

7.0 |

|

|

(Gain) loss on sale of assets |

|

|

(4.2 |

) |

|

|

33.5 |

|

|

|

131.1 |

|

|

|

(393.9 |

) |

|

Impairment of cost-based investments |

|

|

- |

|

|

|

- |

|

|

|

6.5 |

|

|

|

— |

|

|

Stock-based compensation expense |

|

|

7.7 |

|

|

|

6.3 |

|

|

|

54.0 |

|

|

|

56.5 |

|

|

Impairment of long-lived assets |

|

|

- |

|

|

|

303.7 |

|

|

|

— |

|

|

|

377.4 |

|

|

Deferred income taxes |

|

|

78.6 |

|

|

|

(199.7 |

) |

|

|

52.7 |

|

|

|

(261.0 |

) |

|

Loss on disposal of fixed assets, net |

|

|

1.5 |

|

|

|

0.3 |

|

|

|

3.8 |

|

|

|

1.1 |

|

|

Acquisition related liability adjustment |

|

|

2.0 |

|

|

|

- |

|

|

|

(20.0 |

) |

|

|

— |

|

|

Changes in assets and liabilities, net of effects from

acquisitions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

21.3 |

|

|

|

24.6 |

|

|

|

(83.0 |

) |

|

|

(57.7 |

) |

|

Prepaid expenses and other assets |

|

|

(20.1 |

) |

|

|

3.1 |

|

|

|

(56.9 |

) |

|

|

(8.4 |

) |

|

Operating lease right-of-use assets, net |

|

|

5.4 |

|

|

|

11.3 |

|

|

|

26.8 |

|

|

|

46.6 |

|

|

Income taxes |

|

|

(69.3 |

) |

|

|

23.3 |

|

|

|

(55.8 |

) |

|

|

25.6 |

|

|

Accounts payable and accrued liabilities |

|

|

9.1 |

|

|

|

6.0 |

|

|

|

46.5 |

|

|

|

(21.2 |

) |

|

Deferred revenues |

|

|

(49.9 |

) |

|

|

(69.8 |

) |

|

|

81.2 |

|

|

|

64.5 |

|

|

Operating lease liabilities |

|

|

(5.9 |

) |

|

|

(5.7 |

) |

|

|

(27.1 |

) |

|

|

(43.9 |

) |

|

Other liabilities |

|

|

16.0 |

|

|

|

(19.8 |

) |

|

|

(5.1 |

) |

|

|

(29.0 |

) |

|

Net cash provided by operating activities |

|

|

252.4 |

|

|

|

249.0 |

|

|

|

1,060.7 |

|

|

|

1,059.0 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisitions and purchase of controlling interest, net of cash

acquired of $0.0 and $3.6; and $8.0 and $9.3, respectively |

|

|

- |

|

|

|

- |

|

|

|

(83.3 |

) |

|

|

(448.9 |

) |

|

Proceeds from sale of businesses |

|

|

- |

|

|

|

- |

|

|

|

3,066.4 |

|

|

|

1,073.3 |

|

|

Investments in nonpublic companies |

|

|

(0.5 |

) |

|

|

(2.1 |

) |

|

|

(2.2 |

) |

|

|

(46.0 |

) |

|

Escrow funding associated with acquisitions |

|

|

- |

|

|

|

- |

|

|

|

(3.8 |

) |

|

|

(2.3 |

) |

|

Capital expenditures |

|

|

(56.3 |

) |

|

|

(79.7 |

) |

|

|

(230.0 |

) |

|

|

(274.7 |

) |

|

Other investing activities, net |

|

|

(0.2 |

) |

|

|

- |

|

|

|

(0.6 |

) |

|

|

— |

|

|

Net cash (used in) provided by investing activities |

|

|

(57.0 |

) |

|

|

(81.8 |

) |

|

|

2,746.5 |

|

|

|

301.4 |

|

| |

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

(in millions) |

|

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from (repayment of) short-term debt, net |

|

|

— |

|

|

|

50.0 |

|

|

|

(1,265.0 |

) |

|

|

380.0 |

|

|

Repayments of current portion of long-term debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(350.0 |

) |

|

Proceeds from issuance of long-term debt, inclusive of original

issue premium and net of original issue discount |

|

|

— |

|

|

|

— |

|

|

|

495.2 |

|

|

|

— |

|

|

Proceeds from issuance of short-term debt with original maturities

less than three months |

|

|

— |

|

|

|

275.0 |

|

|

|

— |

|

|

|

400.0 |

|

|

Repayment of short-term debt with original maturities greater than

three months |

|

|

— |

|

|

|

— |

|

|

|

(125.0 |

) |

|

|

— |

|

|

Payment of debt issuance costs |

|

|

— |

|

|

|

— |

|

|

|

(6.0 |

) |

|

|

|

|

|

Repurchases of common stock |

|

|

(712.5 |

) |

|

|

(466.2 |

) |

|

|

(2,762.3 |

) |

|

|

(1,662.5 |

) |

|

Net share settlement of taxes from restricted stock and performance

share awards |

|

|

(1.3 |

) |

|

|

(0.3 |

) |

|

|

(15.3 |

) |

|

|

(20.7 |

) |

|

Proceeds from stock options exercised |

|

|

7.6 |

|

|

|

20.9 |

|

|

|

141.9 |

|

|

|

132.5 |

|

|

Treasury stock shares repurchased not yet settled |

|

|

462.5 |

|

|

|

— |

|

|

|

(37.5 |

) |

|

|

— |

|

|

Dividends paid |

|

|

(48.9 |

) |

|

|

(48.0 |

) |

|

|

(196.8 |

) |

|

|

(195.2 |

) |

|

Other financing activities, net |

|

|

(2.5 |

) |

|

|

(0.8 |

) |

|

|

(15.7 |

) |

|

|

(14.3 |

) |

|

Net cash used in financing activities |

|

|

(295.1 |

) |

|

|

(169.4 |

) |

|

|

(3,786.5 |

) |

|

|

(1,330.2 |

) |

|

Effect of exchange rate changes |

|

|

(14.4 |

) |

|

|

18.1 |

|

|

|

(10.7 |

) |

|

|

(17.8 |

) |

|

(Decrease) increase in cash and cash equivalents |

|

|

(114.1 |

) |

|

|

15.9 |

|

|

|

10.0 |

|

|

|

12.4 |

|

|

Cash and cash equivalents, beginning of period |

|

|

416.8 |

|

|

|

276.8 |

|

|

|

292.7 |

|

|

|

280.3 |

|

|

Cash and cash equivalents, end of period |

|

$ |

302.7 |

|

|

$ |

292.7 |

|

|

$ |

302.7 |

|

|

$ |

292.7 |

|

| Supplemental disclosures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes paid |

|

$ |

65.1 |

|

|

$ |

60.1 |

|

|

$ |

276.0 |

|

|

$ |

324.5 |

|

|

Interest paid |

|

$ |

50.3 |

|

|

$ |

60.0 |

|

|

$ |

111.2 |

|

|

$ |

134.3 |

|

| Noncash investing and

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred tax liability established on date of acquisitions |

|

$ |

(0.2 |

) |

|

$ |

(2.5 |

) |

|

$ |

8.7 |

|

|

$ |

14.0 |

|

|

Net assets sold as part of the dispositions, net of cash sold |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

3,211.8 |

|

|

$ |

— |

|

|

Finance lease additions, net of disposals |

|

$ |

1.9 |

|

|

$ |

0.3 |

|

|

$ |

45.6 |

|

|

$ |

5.2 |

|

|

Operating lease additions, net of terminations |

|

$ |

4.9 |

|

|

$ |

5.8 |

|

|

$ |

34.3 |

|

|

$ |

21.7 |

|

|

Fixed assets included in accounts payable and accrued

liabilities |

|

$ |

2.1 |

|

|

$ |

0.2 |

|

|

$ |

2.2 |

|

|

$ |

0.2 |

|

Non-GAAP ReconciliationsConsolidated

EBITDA, Adjusted EBITDA, and Organic Adjusted

EBITDA Reconciliation from Continuing Operations(in

millions)Note: EBITDA, adjusted EBITDA, and organic adjusted EBITDA

are non-GAAP measures. Margin is calculated as a percentage of

consolidated revenues.

| |

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

Total |

|

|

Margin |

|

|

Total |

|

|

Margin |

|

|

Total |

|

|

Margin |

|

|

Total |

|

|

Margin |

|

| Net income |

|

$ |

173.8 |

|

|

|

25.7 |

% |

|

$ |

61.2 |

|

|

|

9.7 |

% |

|

$ |

614.4 |

|

|

|

22.9 |

% |

|

$ |

954.3 |

|

|

|

38.2 |

% |

| Less: Loss from discontinued

operations, net of tax |

|

|

(8.5 |

) |

|

|

(1.2 |

) |

|

|

(154.6 |

) |

|

|

(24.5 |

) |

|

|

(154.0 |

) |

|

|

(5.7 |

) |

|

|

(87.8 |

) |

|

|

(3.5 |

) |

|

Income from continuing operations |

|

|

182.3 |

|

|

|

26.9 |

% |

|

|

215.8 |

|

|

|

34.2 |

% |

|

|

768.4 |

|

|

|

28.6 |

% |

|

|

1,042.1 |

|

|

|

41.7 |

% |

| Depreciation and amortization

of fixed assets |

|

|

67.6 |

|

|

|

10.0 |

|

|

|

43.0 |

|

|

|

6.8 |

|

|

|

206.8 |

|

|

|

7.7 |

|

|

|

164.2 |

|

|

|

6.6 |

|

| Amortization of intangible

assets |

|

|

18.5 |

|

|

|

2.7 |

|

|

|

17.0 |

|

|

|

2.7 |

|

|

|

74.6 |

|

|

|

2.8 |

|

|

|

74.4 |

|

|

|

3.0 |

|

| Interest expense |

|

|

28.1 |

|

|

|

4.2 |

|

|

|

41.2 |

|

|

|

6.5 |

|

|

|

115.5 |

|

|

|

4.3 |

|

|

|

138.8 |

|

|

|

5.6 |

|

| Provision for income

taxes |

|

|

60.4 |

|

|

|

8.9 |

|

|

|

23.7 |

|

|

|

3.8 |

|

|

|

258.8 |

|

|

|

9.7 |

|

|

|

220.3 |

|

|

|

8.8 |

|

|

EBITDA |

|

|

356.9 |

|

|

|

52.7 |

|

|

|

340.7 |

|

|

|

54.0 |

|

|

|

1,424.1 |

|

|

|

53.1 |

|

|

|

1,639.8 |

|

|

|

65.7 |

|

| Impairment loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

73.7 |

|

|

|

3.0 |

|

| Impairment of cost-based

investments |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6.5 |

|

|

|

0.2 |

|

|

|

- |

|

|

|

- |

|

| Litigation reserve |

|

|

19.0 |

|

|

|

2.8 |

|

|

|

- |

|

|

|

- |

|

|

|

38.2 |

|

|

|

1.5 |

|

|

|

- |

|

|

|

- |

|

| Acquisition-related

adjustments (earn-outs) |

|

|

2.0 |

|

|

|

0.3 |

|

|

|

(10.7 |

) |

|

|

(1.6 |

) |

|

|

(19.4 |

) |

|

|

(0.7 |

) |

|

|

(2.9 |

) |

|

|

(0.2 |

) |

| Severance expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1.8 |

|

|

|

0.1 |

|

| (Gain) loss directly related

to dispositions from continuing operations |

|

|

(15.9 |

) |

|

|

(2.4 |

) |

|

|

2.0 |

|

|

|

0.3 |

|

|

|

(15.9 |

) |

|

|

(0.6 |

) |

|

|

(427.9 |

) |

|

|

(17.2 |

) |

|

Adjusted EBITDA |

|

|

362.0 |

|

|

|

53.4 |

|

|

|

332.0 |

|

|

|

52.7 |

|

|

|

1,433.5 |

|

|

|

53.5 |

|

|

|

1,284.5 |

|

|

|

51.4 |

|

| Adjusted EBITDA from

acquisitions and dispositions |

|

|

(0.7 |

) |

|

|

|

|

|

|

0.8 |

|

|

|

|

|

|

|

(8.1 |

) |

|

|

|

|

|

|

(13.2 |

) |

|

|

|

|

|

Organic adjusted EBITDA |

|

$ |

361.3 |

|

|

|

53.9 |

% |

|

$ |

332.8 |

|

|

|

52.8 |

% |

|

$ |

1,425.4 |

|

|

|

54.0 |

% |

|

$ |

1,271.3 |

|

|

|

52.4 |

% |

Segment Results Summary and Adjusted EBITDA

Reconciliation from Continuing Operations(in

millions)Note: Organic revenues, EBITDA, adjusted EBITDA, and

organic adjusted EBITDA are non-GAAP measures.

| |

|

Three Months Ended December 31, 2023 |

|

|

Three Months Ended December 31, 2022 |

|

| |

|

Insurance |

|

|

Insurance |

|

|

Specialized Markets |

|

|

Financial Services |

|

| Revenues |

|

$ |

677.2 |

|

|

$ |

630.4 |

|

|

$ |

- |

|

|

$ |

- |

|

| Revenues from acquisitions and

dispositions |

|

|

(6.9 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Organic revenues |

|

$ |

670.3 |

|

|

$ |

630.4 |

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

356.9 |

|

|

$ |

342.8 |

|

|

$ |

0.5 |

|

|

$ |

(2.6 |

) |

| Litigation reserve |

|

19.0 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| (Gain) loss directly related

to dispositions from continuing operations |

|

|

(15.9 |

) |

|

|

- |

|

|

|

(0.4 |

) |

|

|

2.4 |

|

| Acquisition-related

adjustments (earn-outs) |

|

|

2.0 |

|

|

|

(10.7 |

) |

|

|

- |

|

|

|

- |

|

|

Adjusted EBITDA |

|

|

362.0 |

|

|

|

332.1 |

|

|

|

0.1 |

|

|

|

(0.2 |

) |

| Adjusted EBITDA from

acquisitions and dispositions |

|

|

(0.7 |

) |

|

|

0.7 |

|

|

|

(0.1 |

) |

|

|

0.2 |

|

|

Organic adjusted EBITDA |

|

$ |

361.3 |

|

|

$ |

332.8 |

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

Twelve Months Ended December 31, 2023 |

|

|

Twelve Months Ended December 31, 2022 |

|

| |

|

Insurance |

|

|

Insurance |

|

|

Specialized Markets |

|

|

Financial Services |

|

| Revenues |

|

$ |

2,681.4 |

|

|

$ |

2,437.0 |

|

|

$ |

22.4 |

|

|

$ |

37.6 |

|

| Revenues from acquisitions and

dispositions |

|

|

(42.9 |

) |

|

|

(10.5 |

) |

|

|

(22.4 |

) |

|

|

(37.6 |

) |

|

Organic revenues |

|

$ |

2,638.5 |

|

|

$ |

2,426.5 |

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

1,424.1 |

|

|

$ |

1,303.0 |

|

|

$ |

426.2 |

|

|

$ |

(89.4 |

) |

| Impairment loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

73.7 |

|

| Impairment of cost-based

investments |

|

|

6.5 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Litigation reserve |

|

|

38.2 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Acquisition-related

adjustments (earn-outs) |

|

|

(19.4 |

) |

|

|

(3.0 |

) |

|

|

- |

|

|

|

- |

|

| Severance expense |

|

|

- |

|

|

|

- |

|

|

|

1.8 |

|

|

|

- |

|

| (Gain) loss directly related

to dispositions from continuing operations |

|

|

(15.9 |

) |

|

|

- |

|

|

|

(449.9 |

) |

|

|

22.1 |

|

|

Adjusted EBITDA |

|

|

1,433.5 |

|

|

|

1,300.0 |

|

|

|

(21.9 |

) |

|

|

6.4 |

|

| Adjusted EBITDA from

acquisitions and dispositions |

|

|

(8.1 |

) |

|

|

(28.7 |

) |

|

|

21.9 |

|

|

|

(6.4 |

) |

|

Organic adjusted EBITDA |

|

$ |

1,425.4 |

|

|

$ |

1,271.3 |

|

|

$ |

- |

|

|

$ |

- |

|

Segment Adjusted EBITDA Margin

ReconciliationNote: Segment adjusted EBITDA margin is

calculated as a percentage of respective segment revenues.

| |

|

Three Months Ended December 31, 2023 |

|

|

Three Months Ended December 31, 2022 |

|

| |

|

Insurance |

|

|

Insurance |

|

|

Specialized Markets |

|

|

Financial Services |

|

| EBITDA margin |

|

|

52.7 |

% |

|

|

54.4 |

% |

|

|

— |

% |

|

|

— |

% |

| Gain directly related to

dispositions from continuing operations |

|

|

(2.4 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Litigation reserve |

|

|

2.8 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Acquisition-related

adjustments (earn-outs) |

|

|

0.3 |

|

|

|

(1.7 |

) |

|

|

— |

|

|

|

— |

|

| Adjusted EBITDA margin |

|

|

53.4 |

|

|

|

52.7 |

|

|

|

N/A |

|

|

|

N/A |

|

| |

|

Twelve Months Ended December 31, 2023 |

|

|

Twelve Months Ended December 31, 2022 |

|

| |

|

Insurance |

|

|

Insurance |

|

|

Specialized Markets |

|

|

Financial Services |

|

| EBITDA margin |

|

|

53.1 |

% |

|

|

53.5 |

% |

|

|

1900.8 |

% |

|

|

(237.6 |

)% |

| (Gain) loss directly related

to dispositions from continuing operations |

|

|

(0.6 |

) |

|

|

— |

|

|

|

(2,006.7 |

) |

|

|

58.4 |

|

| Impairment of cost-based

investments |

|

|

0.2 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Litigation reserve |

|

|

1.5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Acquisition-related

adjustments (earn-outs) |

|

|

(0.7 |

) |

|

|

(0.2 |

) |

|

|

— |

|

|

|

— |

|

| Impairment loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

196.1 |

|

| Severance expense |

|

|

— |

|

|

|

— |

|

|

|

8.0 |

|

|

|

— |

|

| Adjusted EBITDA margin |

|

|

53.5 |

|

|

|

53.3 |

|

|

|

(97.9 |

) |

|

|

16.9 |

|

Consolidated Adjusted EBITDA Expense Reconciliation from

Continuing Operations(in millions)Note: Adjusted EBITDA

expense is a non-GAAP measure.

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Operating expenses |

|

$ |

426.7 |

|

|

$ |

347.9 |

|

|

$ |

1,549.7 |

|

|

$ |

1,090.5 |

|

| Depreciation and amortization

of fixed assets |

|

|

(67.6 |

) |

|

|

(43.0 |

) |

|

|

(206.8 |

) |

|

|

(164.2 |

) |

| Amortization of intangible

assets |

|

|

(18.5 |

) |

|

|

(17.0 |

) |

|

|

(74.6 |

) |

|

|

(74.4 |

) |

| Investment (income) loss and

others, net |

|

|

(20.3 |

) |

|

|

1.8 |

|

|

|

(11.0 |

) |

|

|

5.3 |

|

| Litigation reserve |

|

|

(19.0 |

) |

|

|

- |

|

|

|

(38.2 |

) |

|

|

- |

|

| Acquisition-related

adjustments (earn-outs) |

|

|

(2.0 |

) |

|

|

10.7 |

|

|

|

19.4 |

|

|

|

2.9 |

|

|

Impairment loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(73.7 |

) |

| Impairment of cost-based

investments |

|

|

- |

|

|

|

- |

|

|

|

(6.5 |

) |

|

|

- |

|

|

Severance expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1.8 |

) |

|

Gain (loss) directly related to dispositions from continuing

operations |

|

|

15.9 |

|

|

|

(2.0 |

) |

|

|

15.9 |

|

|

|

427.9 |

|

|

Adjusted EBITDA expense |

|

$ |

315.2 |

|

|

$ |

298.4 |

|

|

$ |

1,247.9 |

|

|

$ |

1,212.5 |

|

Diluted Adjusted EPS Reconciliation from Continuing

Operations(in millions, except per share amounts)Note:

Diluted adjusted EPS is a non-GAAP measure.

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net income |

|

$ |

173.8 |

|

|

$ |

61.2 |

|

|

$ |

614.4 |

|

|

$ |

954.3 |

|

| less: Loss from discontinued

operations |

|

|

(8.5 |

) |

|

|

(154.6 |

) |

|

|

(154.0 |

) |

|

|

(87.8 |

) |

| Income from continuing

operations |

|

|

182.3 |

|

|

|

215.8 |

|

|

|

768.4 |

|

|

|

1,042.1 |

|

| plus: Amortization of

intangibles |

|

|

18.5 |

|

|

|

17.0 |

|

|

|

74.6 |

|

|

|

74.4 |

|

| less: Income tax effect on

amortization of intangibles |

|

|

(4.7 |

) |

|

|

(4.2 |

) |

|

|

(18.7 |

) |

|

|

(18.6 |

) |

| plus: Litigation reserve |

|

|

19.0 |

|

|

|

- |

|

|

|

38.2 |

|

|

|

- |

|

| less: Income tax effect on

litigation reserve |

|

|

(0.5 |

) |

|

|

- |

|

|

|

(0.5 |

) |

|

|

- |

|

| plus: Impairment of cost-based

investments |

|

|

- |

|

|

|

- |

|

|

|

6.5 |

|

|

|

- |

|

| less: Income tax effect on

impairment of cost-based investments |

|

|

- |

|

|

|

- |

|

|

|

(0.4 |

) |

|

|

- |

|

| plus: Acquisition-related

adjustments (earn-outs) |

|

|

2.0 |

|

|

|

(7.7 |

) |

|

|

(19.4 |

) |

|

|

(0.1 |

) |

| less: Income tax effect on

acquisition-related adjustments (earn-outs) |

|

|

(0.5 |

) |

|

|

1.9 |

|

|

|

4.9 |

|

|

|

0.1 |

|

| plus: Impairment loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

73.7 |

|

| less: Income tax effect on

impairment loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(16.8 |

) |

| plus: Severance expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1.8 |

|