urban-gro, Inc. (Nasdaq: UGRO) (“urban-gro” or the “Company”), an

integrated professional services consulting firm, today reported

its financial results for the quarter ended September 30, 2023 and

provided fourth quarter 2023 guidance.

Bradley Nattrass, Chairman and CEO, commented,

“Since launching our sector diversification initiative just over a

year ago, urban-gro has successfully evolved into a multi-sector

focused professional services consulting firm. Our strengthening

revenue and Adjusted EBITDA1 performance in the

third quarter reflects a solid improvement on both a sequential and

year-over-year basis. Given our strengthening pipeline and backlog,

we continue to anticipate sequential quarterly improvement as we

work to recapture positive Adjusted EBITDA1

generation. This has been the result of our steps to insulate our

business from Cannabis market headwinds by diversifying our revenue

streams into additional sectors outside of Controlled Environment

Agriculture (“CEA”) while being proactive with expense optimization

and resource allocation to drive efficiencies and scale in our

model.”

Third Quarter 2023 Financial

Results

Revenue was $20.9 million, as compared to $18.8

million in the second quarter, representing a sequential

improvement of $2.1 million, or 11%, and $12.4 million in the prior

year period, representing an increase of $8.6 million, or 69%. The

sequential improvement was due to a $3.8 million increase in

construction design-build revenue and a $0.1 million increase in

professional services revenue, partially offset by a $1.6 million

decrease in equipment systems revenue. As compared to the prior

year period, revenue increased $8.6 million or 69%, primarily

driven by a $9.4 million increase in revenue associated with a

substantial increase in construction design-build revenues. This

increase was partially offset by a decrease in equipment systems

revenue of $0.8 million reflecting reduced equipment demand in the

U.S. cannabis market as a result of ongoing state-level regulatory

delays in the license-awarding process, as well as the lack of

movement on passing key legislation impacting the industry.

Gross profit was $2.9 million, or 14% of

revenue, as compared to $2.9 million in the second quarter, or 15%

of revenue, and $2.6 million, or 21% of revenue in the prior year

period. The slight increase in gross profit from the prior year

period relative to the much larger increase in revenue was

primarily driven by the net effects of a decrease in higher margin

equipment revenue offset by an increase in lower margin

construction design-build revenue.

Operating expenses were $6.0 million as compared

to $6.8 million in the second quarter, representing a sequential

decrease of $0.8 million. The decrease sequentially was primarily

due to a reduction in general and administrative expenses. As

compared to the prior year period, operating expenses decreased

$3.5 million primarily due to a one-time business development

expense of $3.3 million that was incurred in the prior year.

Non-operating expenses were $0.3 million, as

compared to non-operating expenses of $1.8 million in the prior

year.

Net loss was $3.4 million, or $0.29 loss per

share as compared to a net loss of $8.7 million, or $0.81 loss per

share in the prior year period. Adjusted net loss was $2.4 million,

or $0.20 loss per share as compared to an adjusted net loss of $2.7

million, or $0.26 loss per share in the prior year period.

Adjusted EBITDA1 improved by $0.7 million on a

sequential basis to negative $1.3 million, which is an improvement

of $1.0 million compared to the prior year period. The improvement

in Adjusted EBITDA1 compared to the prior year was

driven primarily by lower run-rate operating expenses predominantly

associated with the Company’s expense optimization and resource

reallocation initiative.

Cash position at the end of the third quarter of

2023 was $4.8 million. To support the strong performance of our

Construction operations, subsequent to September 30 we entered into

a non-dilutive, asset-based lending facility in order to better

manage our working capital. To date, the facility remains

undrawn.

Summary First Nine Months 2023 Financial

Results

Revenue was $56.5 million for the first nine

months of 2023 compared to $49.7 million in the prior year period,

representing an increase of $6.8 million, or 14%.

Net loss was $14.0 million, or $1.29 per share,

for the first nine months of 2023 compared to a net loss of $11.1

million, or $1.05 per share, in the prior year period. Adjusted net

loss was $9.7 million, or $0.89 per share, for the first nine

months of 2023 compared to an adjusted net loss of $4.8 million, or

$0.45 per share, in the prior year period.

Adjusted EBITDA1 was negative

$6.8 million for the first nine months of 2023 compared to negative

$2.2 million in the prior year period.

Backlog as of September 30,

2023

Consolidated backlog is unrealized revenue

represented by signed construction design-build, equipment systems,

and service orders. As of September 30, 2023, total backlog was

approximately $84 million in contracts, comprised of $77 million in

construction design-build, $5 million of professional services, and

$2 million of equipment systems.

The following table summarizes the change in

backlog for the current quarter:

| |

Equipment Systems |

|

Services |

|

Construction Design-Build |

|

Total Backlog |

| |

|

|

|

|

|

|

|

| |

(in millions) |

|

Beginning backlog as of June 30, 2023 |

$ |

5 |

|

|

$ |

4 |

|

|

$ |

70 |

|

|

$ |

79 |

|

|

Revenue recognized |

|

(3 |

) |

|

|

(3 |

) |

|

|

(15 |

) |

|

|

(21 |

) |

|

Net backlog additions/(reductions) |

|

— |

|

|

|

4 |

|

|

|

22 |

|

|

$ |

26 |

|

| Ending backlog as of

September 30, 2023 |

$ |

2 |

|

|

$ |

5 |

|

|

$ |

77 |

|

|

$ |

84 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue and Adjusted

EBITDA1 Guidance - Fourth Quarter

2023

For the Fourth Quarter 2023, the Company is

providing guidance as follows:

Consolidated revenue: Approximately $30 million,

representing a 43% sequential improvement, and a 73% increase

versus the prior year period

Adjusted EBITDA1: Achievement of breakeven to

slightly positive adjusted EBITDA, representing a sequential

improvement from negative $1.3 million, and an improvement from the

prior year period of negative $1.7 million.

Conference Call Details

urban-gro will host a conference call and live

audio webcast to discuss the operational and financial results

today, November 9, 2023 at 4:30 p.m. Eastern time. Interested

participants and investors may access the conference call by

dialing 877-407-3982 (U.S.), or 201-493-6780 (International). The

live webcast will be accessible on the Events page of the Investors

section of the urban-gro website, ir.urban-gro.com, and will be

archived for 90 days following the event. Availability of the call

replay posted on the Company’s website is at the Company’s

discretion and may be discontinued at any time.

1Adjusted EBITDA is a non-GAAP financial

measure. Please see the information under “Use of Non-GAAP

Financial Information” below for a description of Adjusted EBITDA

and the table at the end of this press release for a reconciliation

of this non-GAAP financial information to GAAP results.

Use of Non-GAAP Financial

Information

We define Adjusted EBITDA as net income (loss)

attributable to urban-gro, determined in accordance with U.S.

generally accepted accounting principles ("GAAP"), excluding the

effects of certain operating and non-operating expenses including,

but not limited to, interest income and expense, income taxes,

depreciation of tangible assets, amortization of intangible assets,

impairment of investments, exchange gains and losses, debt

forgiveness and extinguishment, stock-based compensation expense,

one-time and non-recurring expenses, and acquisition costs that we

do not believe reflect our core operating performance. We use

Adjusted EBITDA as a measure of our operating performance. Adjusted

EBITDA is a supplemental non-GAAP financial measure, and it is not

a substitute for net income (loss), income (loss) from operations,

cash flows from operating activities or any other measure

prescribed by GAAP.

Our Board of Directors and management team focus

on Adjusted EBITDA as a key performance and compensation measure.

We believe that Adjusted EBITDA assists us in comparing our

performance over various reporting periods because it removes from

our operating results the impact of items that our management

believes do not reflect our core operating performance.

There are limitations to using non-GAAP measures

such as Adjusted EBITDA. Although we believe that Adjusted EBITDA

can make an evaluation of our operating performance more consistent

because it removes items that do not reflect our core operations,

other companies in our industry may define Adjusted EBITDA

differently than we do. As a result, it may be difficult to use

Adjusted EBITDA to compare the performance of those companies to

our performance. Adjusted EBITDA should not be considered as a

measure of the income generated by our business or discretionary

cash available to us to invest in the growth of our business.

About urban-gro, Inc.

urban-gro, Inc.® (Nasdaq: UGRO) is an integrated

professional services consulting firm delivering professional

services and solutions across architecture, design, engineering,

equipment integration, and construction management. Our

multi-sector expertise encompasses a diverse set of projects across

a host of industries such as Controlled Environment Agriculture

(“CEA”), light industrial, healthcare, hospitality, laboratories

and more. Our dedicated and innovative team is fueled by a

commitment to empower our clients by providing exceptional customer

experiences throughout the project lifecycle and beyond, including

post-operational support. With offices across North America and in

Europe, we deliver Your Vision – Built. Learn more by visiting

www.urban-gro.com.

Safe Harbor Statement

This press release contains forward looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. When used in this release, terms such as

“believes,” “will,” “expects,” “anticipates,” “continue,” “expect,”

“may,” “projects” and similar expressions and variations as they

relate to the Company or its management are intended to identify

forward-looking statements. The forward-looking statements in this

press release include, without limitation, financial projections,

financial guidance, future events, business strategy, future

performance, future operations, future demand, backlog, financial

position, estimated revenues, losses, adjusted EBITDA, prospects,

plans and objectives of management, including expense optimization,

working capital management, and the future ability to position the

Company for growth. These and other forward-looking statements are

based on current expectations, forecasts, and assumptions that

involve risks and uncertainties that could cause actual outcomes

and results to differ materially from those anticipated or

expected, including, among others, our ability to successfully

manage and integrate acquisitions, our ability to accurately

forecast revenues and costs, competition for projects in our

markets, our ability to predict and respond to new laws and

governmental regulatory actions, including delays granting licenses

to clients or potential clients and delays in passage of

legislation expected to benefit our clients or potential clients,

our ability to successfully develop new and/or enhancements to our

product offerings and develop a product mix to meet demand, risks

related to adverse weather conditions, supply chain issues, rising

interest rates, economic downturn or other factors that could cause

delays or the cancellation of projects in our backlog or our

ability to secure future projects, our ability to maintain

favorable relationships with suppliers, risks associated with

reliance on key customers and suppliers, our ability to attract and

retain key personnel, results of litigation and other claims and

insurance coverage issues, risks related to our information

technology systems and infrastructure, risks associated with

climate change and ESG matters, our ability to maintain effective

internal controls, our ability to execute on our strategic plans,

our ability to achieve and maintain cost savings, the sufficiency

of our liquidity and capital resources, and our ability to achieve

our key initiatives for 2023, particularly our growth initiatives.

A more detailed description of these and certain other factors that

could affect actual results is included in the Company’s filings

with the Securities and Exchange Commission. Readers are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof. The Company undertakes no

obligation to update any forward-looking statements to reflect

events or circumstances after the date hereof, except as may be

required by law.

|

|

|

URBAN-GRO, INC.CONDENSED CONSOLIDATED

BALANCE SHEETS (unaudited) |

|

|

| |

September 30, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash |

$ |

4,770,430 |

|

|

$ |

12,008,003 |

|

|

Accounts receivable, net |

|

18,341,489 |

|

|

|

15,380,292 |

|

|

Contract receivables |

|

8,378,657 |

|

|

|

3,004,282 |

|

|

Prepaid expenses and other assets |

|

3,268,279 |

|

|

|

4,164,960 |

|

|

Total current assets |

|

34,758,855 |

|

|

|

34,557,537 |

|

| Non-current assets: |

|

|

|

|

Property and equipment, net |

|

1,456,009 |

|

|

|

1,307,146 |

|

|

Operating lease right of use assets, net |

|

2,217,738 |

|

|

|

2,618,825 |

|

|

Investments |

|

— |

|

|

|

2,559,307 |

|

|

Goodwill |

|

15,572,050 |

|

|

|

15,572,050 |

|

|

Intangible assets, net |

|

4,634,672 |

|

|

|

5,450,687 |

|

|

Total non-current assets |

|

23,880,469 |

|

|

|

27,508,015 |

|

| Total

assets |

$ |

58,639,324 |

|

|

$ |

62,065,552 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

22,194,304 |

|

|

$ |

9,960,364 |

|

|

Accrued expenses |

|

4,074,098 |

|

|

|

3,196,961 |

|

|

Contract liabilities |

|

1,981,728 |

|

|

|

1,294,452 |

|

|

Customer deposits |

|

969,888 |

|

|

|

2,571,161 |

|

|

Contingent consideration |

|

161,947 |

|

|

|

2,799,287 |

|

|

Promissory notes |

|

1,964,775 |

|

|

|

3,832,682 |

|

|

Operating lease liabilities |

|

598,447 |

|

|

|

600,816 |

|

|

Total current liabilities |

|

31,945,187 |

|

|

|

24,255,723 |

|

| Non-current liabilities: |

|

|

|

|

Operating lease liabilities |

|

1,666,138 |

|

|

|

2,044,782 |

|

|

Deferred tax liability |

|

865,802 |

|

|

|

1,033,283 |

|

|

Total non-current liabilities |

|

2,531,940 |

|

|

|

3,078,065 |

|

| Total

liabilities |

|

34,477,127 |

|

|

|

27,333,788 |

|

| Stockholders’ equity |

|

|

|

|

Preferred stock, $0.10 par value; 10,000,000 shares authorized; 0

shares issued and outstanding |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 30,000,000 shares authorized;

13,120,413 issued and 11,670,580 outstanding as of September 30,

2023, and 100,000,000 shares authorized; 12,220,593 issued and

10,770,760 outstanding as of December 31, 2022 |

|

13,120 |

|

|

|

12,221 |

|

|

Additional paid-in capital |

|

88,268,286 |

|

|

|

84,882,982 |

|

|

Treasury shares, cost basis: 1,449,833 shares as of September 30,

2023 and as of December 31, 2022 |

|

(12,045,542 |

) |

|

|

(12,045,542 |

) |

|

Accumulated deficit |

|

(52,073,667 |

) |

|

|

(38,117,897 |

) |

|

Total stockholders’ equity |

|

24,162,197 |

|

|

|

34,731,764 |

|

| Total liabilities and

stockholders’ equity |

$ |

58,639,324 |

|

|

$ |

62,065,552 |

|

|

|

|

URBAN-GRO, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(unaudited) |

|

|

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

Equipment systems |

$ |

3,043,659 |

|

|

$ |

3,879,272 |

|

|

$ |

10,575,367 |

|

|

$ |

31,024,187 |

|

|

Services |

|

2,898,739 |

|

|

|

2,839,338 |

|

|

|

9,403,968 |

|

|

|

9,505,396 |

|

|

Construction design-build |

|

14,813,486 |

|

|

|

5,384,267 |

|

|

|

36,068,435 |

|

|

|

8,301,588 |

|

|

Other |

|

178,439 |

|

|

|

265,416 |

|

|

|

489,482 |

|

|

|

871,488 |

|

|

Total revenues and other income |

|

20,934,323 |

|

|

|

12,368,293 |

|

|

|

56,537,252 |

|

|

|

49,702,659 |

|

| Cost of

revenues: |

|

|

|

|

|

|

|

|

Equipment systems |

|

2,766,116 |

|

|

|

3,212,285 |

|

|

|

9,287,704 |

|

|

|

26,132,828 |

|

|

Services |

|

1,768,164 |

|

|

|

1,796,968 |

|

|

|

5,715,548 |

|

|

|

4,677,887 |

|

|

Construction design-build |

|

13,413,067 |

|

|

|

4,570,506 |

|

|

|

32,605,681 |

|

|

|

7,263,206 |

|

|

Other |

|

130,258 |

|

|

|

195,938 |

|

|

|

355,121 |

|

|

|

632,181 |

|

|

Total cost of revenues |

|

18,077,605 |

|

|

|

9,775,697 |

|

|

|

47,964,054 |

|

|

|

38,706,102 |

|

| Gross

profit |

|

2,856,718 |

|

|

|

2,592,596 |

|

|

|

8,573,198 |

|

|

|

10,996,557 |

|

| |

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

General and administrative |

|

5,000,846 |

|

|

|

5,792,418 |

|

|

|

17,974,049 |

|

|

|

14,758,506 |

|

|

Stock-based compensation |

|

722,647 |

|

|

|

96,767 |

|

|

|

1,824,835 |

|

|

|

1,860,767 |

|

|

Intangible asset amortization |

|

241,832 |

|

|

|

304,339 |

|

|

|

816,015 |

|

|

|

773,063 |

|

|

Business development |

|

— |

|

|

|

3,299,864 |

|

|

|

— |

|

|

|

3,299,864 |

|

|

Total operating expenses |

|

5,965,325 |

|

|

|

9,493,388 |

|

|

|

20,614,899 |

|

|

|

20,692,200 |

|

| Loss from

operations |

|

(3,108,607 |

) |

|

|

(6,900,792 |

) |

|

|

(12,041,701 |

) |

|

|

(9,695,643 |

) |

| |

|

|

|

|

|

|

|

| Non-operating income

(expense): |

|

|

|

|

|

|

|

|

Interest expense |

|

(39,928 |

) |

|

|

(7,088 |

) |

|

|

(158,134 |

) |

|

|

(22,270 |

) |

|

Interest income |

|

19,461 |

|

|

|

94,200 |

|

|

|

167,652 |

|

|

|

221,329 |

|

|

Write-down of investment |

|

(258,492 |

) |

|

|

(1,710,358 |

) |

|

|

(258,492 |

) |

|

|

(1,710,358 |

) |

|

Contingent consideration |

|

— |

|

|

|

— |

|

|

|

(160,232 |

) |

|

|

— |

|

|

Loss on settlement |

|

— |

|

|

|

— |

|

|

|

(1,500,000 |

) |

|

|

— |

|

|

Other income (expense) |

|

(28,605 |

) |

|

|

(210,399 |

) |

|

|

(172,344 |

) |

|

|

(147,528 |

) |

|

Total non-operating income (expense) |

|

(307,564 |

) |

|

|

(1,833,645 |

) |

|

|

(2,081,550 |

) |

|

|

(1,658,827 |

) |

| Loss before income

taxes |

|

(3,416,171 |

) |

|

|

(8,734,437 |

) |

|

|

(14,123,251 |

) |

|

|

(11,354,470 |

) |

| |

|

|

|

|

|

|

|

| Income tax benefit |

|

48,383 |

|

|

|

73,654 |

|

|

|

167,481 |

|

|

|

258,166 |

|

| Net loss |

$ |

(3,367,788 |

) |

|

$ |

(8,660,783 |

) |

|

$ |

(13,955,770 |

) |

|

$ |

(11,096,304 |

) |

| |

|

|

|

|

|

|

|

| Comprehensive

loss |

$ |

(3,367,788 |

) |

|

$ |

(8,660,783 |

) |

|

$ |

(13,955,770 |

) |

|

$ |

(11,096,304 |

) |

| |

|

|

|

|

|

|

|

| Loss per share - basic and

diluted |

$ |

(0.29 |

) |

|

$ |

(0.81 |

) |

|

$ |

(1.29 |

) |

|

$ |

(1.05 |

) |

| Weighted average shares -

basic and diluted |

|

11,649,790 |

|

|

|

10,674,796 |

|

|

|

10,859,820 |

|

|

|

10,577,453 |

|

|

|

|

URBAN-GRO, INC.NET LOSS (GAAP)

RECONCILIATION TO ADJUSTED EBITDA (NON-GAAP) |

|

|

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net loss

(GAAP) |

$ |

(3,367,788 |

) |

|

$ |

(8,660,783 |

) |

|

$ |

(13,955,770 |

) |

|

$ |

(11,096,304 |

) |

|

Interest expense |

|

39,928 |

|

|

|

7,088 |

|

|

|

158,134 |

|

|

|

22,270 |

|

|

Interest income |

|

(19,461 |

) |

|

|

(94,200 |

) |

|

|

(167,652 |

) |

|

|

(221,329 |

) |

|

Federal and state income tax (benefit) expense |

|

(48,383 |

) |

|

|

(73,654 |

) |

|

|

(167,481 |

) |

|

|

(258,166 |

) |

|

Depreciation and amortization |

|

372,969 |

|

|

|

526,750 |

|

|

|

1,201,201 |

|

|

|

1,116,585 |

|

| EBITDA

(non-GAAP) |

$ |

(3,022,735 |

) |

|

$ |

(8,294,799 |

) |

|

$ |

(12,931,568 |

) |

|

$ |

(10,436,944 |

) |

| |

|

|

|

|

|

|

|

|

Non-recurring legal fees |

|

284,641 |

|

|

|

205,486 |

|

|

|

769,252 |

|

|

|

276,246 |

|

|

Contingent consideration - change in fair value |

|

— |

|

|

|

— |

|

|

|

160,232 |

|

|

|

— |

|

|

Contingent consideration - DVO acquisition |

|

78,181 |

|

|

|

— |

|

|

|

204,878 |

|

|

|

— |

|

|

One time business development expenses |

|

— |

|

|

|

3,299,864 |

|

|

|

— |

|

|

|

3,299,864 |

|

|

Reduction in force costs |

|

31,987 |

|

|

|

— |

|

|

|

334,540 |

|

|

|

— |

|

|

One-time employee expenses |

|

— |

|

|

|

670,095 |

|

|

|

— |

|

|

|

787,691 |

|

|

Impairment loss |

|

258,492 |

|

|

|

1,710,358 |

|

|

|

258,492 |

|

|

|

1,710,358 |

|

|

Loss on settlement |

|

— |

|

|

|

— |

|

|

|

1,500,000 |

|

|

|

— |

|

|

Retention incentive |

|

300,000 |

|

|

|

|

|

942,000 |

|

|

|

— |

|

|

Stock-based compensation |

|

722,647 |

|

|

|

96,767 |

|

|

|

1,824,835 |

|

|

|

1,860,767 |

|

|

Transaction costs |

|

29,141 |

|

|

|

39,182 |

|

|

|

91,079 |

|

|

|

258,111 |

|

| Adjusted EBITDA

(non-GAAP) |

$ |

(1,317,646 |

) |

|

$ |

(2,273,047 |

) |

|

$ |

(6,846,260 |

) |

|

$ |

(2,243,907 |

) |

| |

|

|

|

|

|

|

|

|

|

|

URBAN-GRO, INC.NET LOSS (GAAP)

RECONCILIATION TO ADJUSTED NET LOSS (NON-GAAP) AND

EPS |

|

|

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net loss

(GAAP) |

$ |

(3,367,788 |

) |

|

$ |

(8,660,783 |

) |

|

$ |

(13,955,770 |

) |

|

$ |

(11,096,304 |

) |

| Non-recurring

adjustments, net of taxes: |

|

|

|

|

|

|

|

|

Non-recurring legal fees |

|

284,641 |

|

|

|

205,486 |

|

|

|

769,252 |

|

|

|

276,246 |

|

|

Contingent consideration - change in fair value |

|

— |

|

|

|

— |

|

|

|

160,232 |

|

|

|

— |

|

|

Contingent consideration - DVO acquisition |

|

78,181 |

|

|

|

— |

|

|

|

204,878 |

|

|

|

— |

|

|

One time business development expenses |

|

— |

|

|

|

3,299,864 |

|

|

|

— |

|

|

|

3,299,864 |

|

|

Reduction in force costs |

|

31,987 |

|

|

|

— |

|

|

|

334,540 |

|

|

|

— |

|

|

One-time employee expenses |

|

— |

|

|

|

670,095 |

|

|

|

— |

|

|

|

787,691 |

|

|

Impairment loss |

|

258,492 |

|

|

|

1,710,358 |

|

|

|

258,492 |

|

|

|

1,710,358 |

|

|

Loss on settlement |

|

— |

|

|

|

— |

|

|

|

1,500,000 |

|

|

|

— |

|

|

Retention incentive |

|

300,000 |

|

|

|

— |

|

|

|

942,000 |

|

|

|

— |

|

|

Transaction costs |

|

29,141 |

|

|

|

39,182 |

|

|

|

91,079 |

|

|

|

258,111 |

|

| Adjusted net loss

(non-GAAP) |

$ |

(2,385,346 |

) |

|

$ |

(2,735,798 |

) |

|

$ |

(9,695,297 |

) |

|

$ |

(4,764,034 |

) |

| |

|

|

|

|

|

|

|

| Weighted average

shares - basic and diluted |

|

11,649,790 |

|

|

|

10,674,796 |

|

|

|

10,859,820 |

|

|

|

10,577,453 |

|

| Loss per share

(GAAP) |

$ |

(0.29 |

) |

|

$ |

(0.81 |

) |

|

$ |

(1.29 |

) |

|

$ |

(1.05 |

) |

| Adjusted loss per

share (non-GAAP) |

$ |

(0.20 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.89 |

) |

|

$ |

(0.45 |

) |

| |

|

|

|

|

|

|

|

Investor Contacts:

Dan Droller – urban-gro, Inc.-or-Jeff Sonnek –

ICR, Inc.(720) 730-8160investors@urban-gro.com

Media Contact:

Barbara Graham – urban-gro, Inc.(720)

903-1139media@urban-gro.com

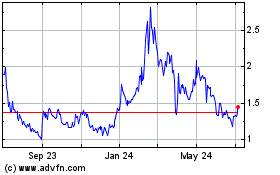

Urban Gro (NASDAQ:UGRO)

Historical Stock Chart

From Apr 2024 to May 2024

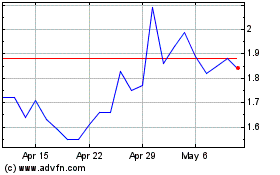

Urban Gro (NASDAQ:UGRO)

Historical Stock Chart

From May 2023 to May 2024