Union Bankshares, Inc. (NASDAQ - UNB) today announced results for

the three months and year ended December 31, 2023 and declared a

regular quarterly cash dividend. Consolidated net income for the

three months ended December 31, 2023 was $3.0 million, or

$0.68 per share, compared to $3.4 million, or $0.77 cents per

share, for the same period in 2022, and $11.3 million, or $2.50 per

share, for the year ended December 31, 2023, compared to $12.6

million, or $2.81 per share for the year ended December 31, 2022

Balance Sheet

Total assets were $1.5 billion as of

December 31, 2023 compared to $1.3 billion as of

December 31, 2022, an increase of $132.4 million, or 9.9%.

Asset growth was driven by loan growth and increases in investment

securities and overnight deposits. Total loans outstanding as of

December 31, 2023 were $1.0 billion and included $3.1 million

in loans held for sale, compared to $961.7 million as of

December 31, 2022, with $1.2 million in loans held for sale.

Asset quality remains strong as total net charge-offs for the year

ended December 31, 2023 were $4 thousand compared to net recoveries

of $3 thousand for the year ended December 31, 2022.

Investment securities were $265.9 million at

December 31, 2023 compared to $251.5 million at

December 31, 2022. The Company classifies its investment

portfolio as available-for-sale and is required to report balances

at their fair market value. As a result of the fair market value

adjustment, unrealized losses in the investment portfolio were

$41.0 million as of December 31, 2023. The unrealized losses

in the portfolio are due to the interest rate environment as

current rates remain above the coupon rates on these securities

resulting in fair market values less than current book values. The

offset to recording the unrealized losses is an increase in

deferred taxes included in other assets and accumulated other

comprehensive losses included in total equity as discussed

below.

Total deposits were $1.31 billion as of

December 31, 2023 and include $153.0 million of purchased

brokered deposits compared to deposits of $1.20 billion as of

December 31, 2022 with $32.0 million of purchased deposits.

Borrowed funds, including advances from the Federal Home Loan Bank

and the Federal Reserve’s Bank Term Funding Program, of $65.7

million were outstanding as of December 31, 2023 compared to

$50.0 million outstanding as of December 31, 2022.

The Company had total equity capital of $65.8

million and a book value per share of $14.56 as of

December 31, 2023 compared to $55.2 million and a book value

of $12.25 per share as of December 31, 2022. The increase in

total capital was attributable to net income of $11.3 million for

2023 and a decrease in the accumulated other comprehensive loss of

$5.5 million as it relates to unrealized losses in the investment

portfolio discussed above, partially offset by $6.5 million in

dividends paid to shareholders.

Income Statement

Consolidated net income was $3.0 million for the

fourth quarter of 2023 compared to $3.4 million for the fourth

quarter of 2022, a decrease of $395 thousand, or 11.5%. The

decrease in net income was comprised of a decrease in net interest

income of $1.2 million and an increase in noninterest expenses of

$137 thousand, partially offset by an increase in noninterest

income of $265 thousand, and decreases of $338 thousand in credit

loss expense and $387 thousand in income tax expense.

Net interest income was $9.1 million for the

three months ended December 31, 2023 compared to $10.4 million

for the three months ended December 31, 2022, a decrease of $1.2

million, or 12.1%. Interest income was $15.4 million for the three

months ended December 31, 2023 compared to $12.4 million for

the same period in 2022, an increase of $3.1 million, or 24.8%, due

to the larger earning asset base and higher interest rates on new

loan volume. Interest expense increased $4.3 million to $6.3

million for the three months ended December 31, 2023 compared

to $2.0 million for the same period in 2022 due to customers

seeking higher returns on their savings and utilization of

wholesale funds which often are at higher rates.

Consolidated net income decreased $1.4 million,

or 10.8%, to $11.3 million for the year ended December 31, 2023

compared $12.6 million for the year ended December 31, 2022 due to

a decrease in net interest income of $1.6 million and an increase

in noninterest expenses of $1.7 million, partially offset by an

increase of $451 thousand in noninterest income, a reduction in

credit loss expense of $499 thousand, and a decrease of $1.0

million in income tax expense.

Interest income was $57.1 million for the year

ended December 31, 2023 compared to $43.9 million for the

comparable period in 2022, an increase of $13.2 million, or 30.0%,

due to a larger earning asset base and higher average yields.

Interest expense was $19.3 million for the year ended December 31,

2023 compared to $4.5 million for the same period in 2022, an

increase of $14.7 million, or 325.9%. Rates paid on customer

deposit accounts increased rapidly in the latter half of 2022. The

customer rate increases coupled with utilization of wholesale

funding at higher rates resulted in the significant increase in

interest expense.

Noninterest income was $9.9 million for the year

ended December 31, 2023 compared to $9.5 million for the year ended

December 31, 2022, an increase of $451 thousand, or 4.8%. Sales of

qualifying residential loans to the secondary market for 2023 were

$75.6 million resulting in net gains of $1.2 million, compared to

sales of $78.0 million and net gains on sales of $1.0 million for

the same period in 2022. Noninterest expenses increased $1.7

million, or 5.2%, during the comparison periods due to increases of

$164 thousand in salaries and wages, $331 thousand in employee

benefits, $122 thousand in occupancy expenses, $30 thousand in

equipment expenses, and $1.1 million in other expenses. Income tax

expense decreased $1.0 million.

Dividend Declared

The Board of Directors declared a cash dividend

of $0.36 per share for the quarter payable February 1, 2024 to

shareholders of record as of January 27, 2024.

About Union Bankshares,

Inc.

Union Bankshares, Inc., headquartered in

Morrisville, Vermont, is the bank holding company parent of Union

Bank, which provides commercial, retail, and municipal banking

services, as well as, wealth management services throughout

northern Vermont and New Hampshire. Union Bank operates 19 banking

offices, two loan centers, and multiple ATMs throughout its

geographical footprint.

Since 1891, Union Bank has helped people achieve

their dreams of owning a home, saving for retirement, starting or

expanding a business and assisting municipalities to improve their

communities. Union Bank has earned an exceptional reputation for

residential lending programs and has been recognized by the US

Department of Agriculture, Rural Development for the positive

impact made in lives of low to moderate home buyers. Union Bank is

consistently one of the top Vermont Housing Finance Agency mortgage

originators and has also been designated as an SBA Preferred lender

for its participation in small business lending. Union Bank's

employees contribute to the communities where they work and reside,

serving on non-profit boards, raising funds for worthwhile causes,

and giving countless hours in serving our fellow residents. All of

these efforts have resulted in Union receiving an "Outstanding"

rating for its compliance with the Community Reinvestment Act

("CRA") in its most recent examination. Union Bank is proud to be

one of the few independent community banks serving Vermont and New

Hampshire and we maintain a strong commitment to our core

traditional values of keeping deposits safe, giving customers

convenient financial choices and making loans to help people in our

local communities buy homes, grow businesses, and create jobs.

These values--combined with financial expertise, quality products

and the latest technology--make Union Bank the premier choice for

your banking services, both personal and business. Member FDIC.

Equal Housing Lender.

Forward-Looking Statements

Statements made in this press release that are

not historical facts are forward-looking statements. Investors are

cautioned that all forward-looking statements necessarily involve

risks and uncertainties, and many factors could cause actual

results and events to differ materially from those contemplated in

the forward-looking statements. When we use any of the words

“believes,” “expects,” “anticipates” or similar expressions, we are

making forward-looking statements. The following factors, among

others, could cause actual results and events to differ from those

contemplated in the forward-looking statements: uncertainties

associated with general economic conditions; changes in the

interest rate environment; inflation; political, legislative or

regulatory developments; acts of war or terrorism; the markets'

acceptance of and demand for the Company's products and services;

technological changes, including the impact of the internet on the

Company's business and on the financial services market place

generally; the impact of competitive products and pricing; and

dependence on third party suppliers. For further information,

please refer to the Company's reports filed with the Securities and

Exchange Commission at www.sec.gov or on our investor page at

www.ublocal.com.

Contact: David S.

Silverman(802) 888-660

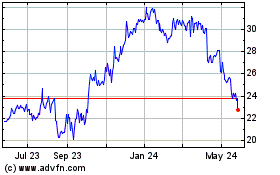

Union Bankshares (NASDAQ:UNB)

Historical Stock Chart

From Dec 2024 to Jan 2025

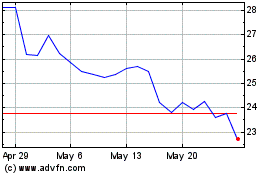

Union Bankshares (NASDAQ:UNB)

Historical Stock Chart

From Jan 2024 to Jan 2025