Ultragenyx Pharmaceutical Inc. (NASDAQ: RARE), a biopharmaceutical

company focused on the development and commercialization of novel

products for serious rare and ultrarare genetic diseases, today

reported preliminary unaudited 2024 revenue results, cash and

investments at year end 2024, and provided financial guidance for

2025. The company also provided key program updates including that

the UX143 (setrusumab) Phase 3 Orbit study is progressing with the

second interim analysis in mid-2025.

“In 2024 we grew our business with four products in five

indications globally, exceeding the updated revenue guidance we

provided in August, and continuing our path toward profitability,”

said Emil D. Kakkis, M.D., Ph.D., chief executive officer and

president of Ultragenyx. “In 2025, we will continue to expand our

commercial base of business while we also prepare for the potential

launch of our first gene therapy, in Sanfilippo syndrome, and to

file a BLA for our second gene therapy, in Glycogen Storage Disease

Type Ia. We are also executing on one of the most valuable

late-stage pipelines in rare disease as we anticipate important

pivotal Phase 3 results in osteogenesis imperfecta and completion

of enrollment in our Phase 3 trial in Angelman syndrome. This

progress puts us in the unique position to potentially launch three

to four new therapies over the next couple of years, accumulating a

total of eight to nine approved products over a 10-year

period.”

Ultragenyx will present at the 43ᵗʰ annual J.P. Morgan

Healthcare Conference on Monday, January 13, 2025 at 10:30 AM PT.

The live and archived webcast of the presentation will be

accessible from the company’s website at

https://ir.ultragenyx.com/events-presentations.

Financial Update2024 Preliminary Revenue

(unaudited) and 2025 Revenue GuidanceTotal revenue for 2024 is

estimated to be $555 million to $560 million, which exceeds the

updated guidance range provided in August 2024, and represents

approximately 29% growth versus 2023. Crysvita revenue for 2024 is

estimated to be $405 million to $410 million, which also exceeds

the guidance range, and represents approximately 24% growth versus

2023. Dojolvi revenue for 2024 is estimated to be $87 million to

$89 million, also exceeding the guidance range, and represents

approximately 25% growth versus 2023.

In 2025, total revenue is expected to be between $640 million

and $670 million and the company expects to provide guidance on

2025 Crysvita and Dojolvi revenue as part of its fourth quarter and

fiscal year 2024 financial disclosures in February 2025.

2024 Ending Cash Position (unaudited) and Decreasing 2025 Net

Cash Used in OperationsCash, cash equivalents, and

available-for-sale investments were approximately $745 million as

of December 31, 2024. In 2025, revenues are expected to grow

approximately 14-20% compared to 2024 and the company will continue

to prioritize expense management, leading to a decline in 2025 net

cash used in operations compared to 2024.

The 2024 revenues and cash position included in this release are

preliminary and are therefore subject to adjustment. The

preliminary revenue results are based on management’s initial

analysis of operations for the year ended December 31, 2024. The

Company expects to issue full financial results for the fourth

quarter and fiscal year 2024 in February 2025.

Recent Updates and 2025 Clinical Milestones

UX143 (setrusumab) monoclonal antibody for osteogenesis

imperfecta (OI): Phase 3 Orbit study progressing to second interim

analysis (IA2) expected in mid-2025 Patients are

being dosed in the ongoing Phase 3 Orbit and Cosmic clinical

trials, which evaluate setrusumab in pediatric and young adult

patients with OI. The randomized, placebo-controlled Phase 3

portion of the Orbit study is progressing towards the second

interim analysis in mid-2025 and a potential final analysis in the

fourth quarter 2025. Patients in the Cosmic study also are

continuing to be treated with either setrusumab or intravenous

bisphosphonates (IV-BP) therapy and will be evaluated in parallel

with the Orbit interim and final analyses.

GTX-102 an antisense oligonucleotide for Angelman

syndrome: Phase 3 study enrolling; expect enrollment completion in

second half of 2025 Enrollment in the global Phase

3 Aspire study began in December 2024 and is expected to

enroll approximately 120 children ages four to 17 with Angelman

syndrome with a genetically confirmed diagnosis of full

maternal UBE3A gene deletion. Participants will be

randomized 1:1 to receive GTX-102 by intrathecal injection via

lumbar puncture or to the sham comparator group during the 48-week

primary efficacy analysis period. The primary endpoint will be

improvement in cognition assessed by Bayley-4 cognitive raw score,

and the key secondary endpoint (with a 10% allocation of alpha)

will be the Multi-domain Responder Index (MDRI) across the five

domains of cognition, receptive communication, behavior, gross

motor function, and sleep. Enrollment in the Phase 3

Aspire study is expected to complete in the second half of

2025.

The Phase 2/3 Aurora study, which will evaluate GTX-102 in other

Angelman syndrome genotypes and ages, is expected to initiate in

2025.

UX111 AAV gene therapy for Sanfilippo syndrome type A

(MPS IIIA): Biologics license application (BLA) submitted; expect

Prescription Drug User Fee Act (PDUFA) decision on the application

and launch in second half of 2025 In December 2024,

Ultragenyx submitted a BLA to the U.S. Food and Drug Administration

for UX111 supported by the available data, including from the

ongoing pivotal Transpher A study, demonstrating

treatment with UX111 resulted in rapid and sustained decreased

levels of heparan sulfate (HS) in cerebral spinal fluid (CSF) in

patients with Sanfilippo syndrome type A. The sustained reduction

in CSF HS exposure over time was correlated with improved long-term

cognitive development compared to the decline observed during the

same period of time in natural history data. A PDUFA decision and

launch are expected in the second half of 2025.

DTX401 AAV gene therapy for Glycogen Storage Disease

Type Ia (GSDIa): BLA filing expected in

mid-2025 Ultragenyx previously announced positive

topline results from the Phase 3 GlucoGene study for the treatment

of patients aged eight years and older. The study achieved its

primary endpoint, demonstrating that treatment with DTX401 resulted

in a statistically significant and clinically meaningful reduction

in daily cornstarch intake compared with placebo at Week 48.

After the 48-week primary efficacy analysis period, crossover

patients (previously treated with placebo) were eligible to receive

DTX401. These patients were able to titrate cornstarch much more

rapidly once they were confirmed to have been treated and had

timely direct access to their glucose levels. Patients from the

original DTX401 treatment arm who have reached 78 weeks also

continued to reduce their daily cornstarch intake, while

maintaining glycemic control. DTX401 has demonstrated a consistent

and acceptable safety profile with no new safety concerns

identified as of the data cut-off.

These results have been discussed with regulatory authorities in

a pre-BLA meeting and will be included as part of a BLA submission

in mid-2025.

UX701 AAV gene therapy for Wilson Disease: Phase 1/2/3

study ongoing; expect Cohort 4 enrollment completion in second half

of 2025 In Stage 1 of the Phase 1/2/3 Cyprus2+ study,

15 patients across three sequential dose cohorts were enrolled and

demonstrated clinical activity as well as improvements in copper

metabolism. Multiple responders completely tapered off their

standard-of-care treatment with responses seen in all three dose

cohorts.

The company expects to enroll a fourth cohort in Stage 1 at a

moderately increased dose and with an optimized immunomodulation

regimen to enhance the efficiency and efficacy of the gene therapy,

with the objective of having the majority of patients come off

standard-of-care treatment before selecting a dose for the

randomized placebo-controlled stage of the study. Enrollment in

Cohort 4 is expected to complete in the second half of 2025.

DTX301 AAV gene therapy for Ornithine Transcarbamylase

(OTC) Deficiency: Phase 3 study dosing patients; expect enrollment

completion in early 2025 Ultragenyx is randomizing

and dosing patients in the ongoing Phase 3 study. The pivotal,

64-week study will include up to 50 patients, randomized 1:1 to

DTX301 or placebo. The primary endpoints are response as measured

by change in 24-hour ammonia levels and removal of

ammonia-scavenger medications and protein-restricted diet.

Enrollment is expected to be completed in early 2025.

About Ultragenyx Ultragenyx is a

biopharmaceutical company committed to bringing novel products to

patients for the treatment of serious rare and ultrarare genetic

diseases. The company has built a diverse portfolio of approved

therapies and product candidates aimed at addressing diseases with

high unmet medical need and clear biology for treatment, for which

there are typically no approved therapies treating the underlying

disease.

The company is led by a management team experienced in the

development and commercialization of rare disease therapeutics.

Ultragenyx’s strategy is predicated upon time- and cost-efficient

drug development, with the goal of delivering safe and effective

therapies to patients with the utmost urgency.

For more information on Ultragenyx, please visit the company's

website at: www.ultragenyx.com.

Forward-Looking Statements and Use of Digital

Media Except for the historical information contained

herein, the matters set forth in this press release, including

statements related to Ultragenyx's expectations and projections

regarding its future operating results and financial performance,

anticipated cost or expense reductions, the timing, progress and

plans for its clinical programs and clinical studies, future

regulatory interactions, and the components and timing of

regulatory submissions are forward-looking statements within the

meaning of the "safe harbor" provisions of the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements

involve substantial risks and uncertainties that could cause the

Company’s clinical development programs, commercial success of its

products and product candidates, continued collaboration with third

parties, future results, performance or achievements to differ

significantly from those expressed or implied by the

forward-looking statements. Such risks and uncertainties include,

among others, the uncertainty of clinical drug development and

unpredictability and lengthy process for obtaining regulatory

approvals, risks related to serious or undesirable side effects of

our product candidates, the company’s ability to achieve its

projected development goals in its expected timeframes, risks

related to reliance on third party partners to conduct certain

activities on the company’s behalf, our limited experience in

generating revenue from product sales, risks related to product

liability lawsuits, our dependence on Kyowa Kirin for the

commercial supply of Crysvita, fluctuations in buying or

distribution patterns from distributors and specialty pharmacies,

the transition back to Kyowa Kirin of our exclusive rights to

promote Crysvita in the United States and Canada and unexpected

costs, delays, difficulties or adverse impact to revenue related to

such transition, smaller than anticipated market opportunities for

the company’s products and product candidates, manufacturing risks,

competition from other therapies or products, and other matters

that could affect sufficiency of existing cash, cash equivalents

and short-term investments to fund operations, the company’s future

operating results and financial performance, the timing of clinical

trial activities and reporting results from same, and the

availability or commercial potential of Ultragenyx’s products and

drug candidate. Ultragenyx undertakes no obligation to update or

revise any forward-looking statements. For a further description of

the risks and uncertainties that could cause actual results to

differ from those expressed in these forward-looking statements, as

well as risks relating to the business of Ultragenyx in general,

see Ultragenyx's Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission (SEC) on November 6, 2024, and

its subsequent periodic reports filed with the SEC.

In addition to its SEC filings, press releases and public

conference calls, Ultragenyx uses its investor relations website

and social media outlets to publish important information about the

company, including information that may be deemed material to

investors, and to comply with its disclosure obligations under

Regulation FD. Financial and other information about Ultragenyx is

routinely posted and is accessible on Ultragenyx’s Investor

Relations website (https://ir.ultragenyx.com/) and LinkedIn website

(https://www.linkedin.com/company/ultragenyx-pharmaceutical-inc-/).

Contacts Ultragenyx Pharmaceutical

Inc.InvestorsJoshua

Higair@ultragenyx.com

MediaCarolyn Wang media@ultragenyx.com

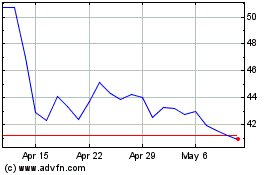

Ultragenyx Pharmaceutical (NASDAQ:RARE)

Historical Stock Chart

From Dec 2024 to Jan 2025

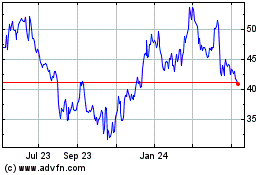

Ultragenyx Pharmaceutical (NASDAQ:RARE)

Historical Stock Chart

From Jan 2024 to Jan 2025