UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant ☒ |

| |

| Filed by a Party other than the Registrant ☐ |

| |

| Check the appropriate box: |

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

| |

|

| Trevena, Inc. |

| (Name of Registrant as Specified in Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

February 20 , 2024

955 Chesterbrook Boulevard

Suite 110

Chesterbrook, PA 19087

Dear Trevena Stockholder:

We are pleased to invite you to a virtual Special Meeting of Stockholders (the “Special Meeting). The Special Meeting is being called to seek stockholder approval of:

| |

● |

Proposal 1: To authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our common stock, par value $0.001 per share (the

“Common Stock”), underlying certain warrants issued by us pursuant to that certain Securities Purchase Agreement, dated as of December 27, 2023, by and between us and the investor named on the signatory thereto, and that certain Inducement

Letter, dated as of December 27, 2023, by and between us and the investor named on the signatory page thereto, in an amount equal to or in excess of 20% of our Common Stock outstanding immediately prior the issuance of such warrants; and |

| |

|

|

| |

● |

Proposal 2: the adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient

votes to adopt Proposal 1. |

The Special Meeting will be held virtually via the Internet on Thursday, March 21, 2024, at 8:30 a.m. ET. The link for the Special Meeting is:

http://www.virtualshareholdermeeting.com/TRVN2024SM.

These items of business, and the reasons why we believe they are vital to the continued long-term growth of our business, are more fully described in the accompanying Proxy Statement.

After careful consideration, the Board of Directors recommends a vote “FOR” the Issuance Proposal and “FOR” the Adjournment Proposal.

Your Vote is Very Important to Us

Whether or not you plan to attend the virtual Special Meeting, we hope that you will vote as soon as possible. Please review the instructions on each of your voting options described in

the Important Notice Regarding the Availability of Proxy Materials. Additional instructions on how to vote can be found on pages 2 through 5 of the proxy statement.

Thank you for your continued support of Trevena.

| |

Sincerely, |

| |

|

| |

|

| |

Carrie L. Bourdow |

| |

President and Chief Executive Officer |

| NOTICE OF SPECIAL MEETING OF STOCKHOLDERS |

| Date and Time: |

Thursday, March 21, 2024, at 8:30 a.m. Eastern Time |

| Place: |

The Special Meeting will be held virtually at the following website: http://www.virtualshareholdermeeting.com/TRVN2024SM and can

be accessed by entering the 16-digit control number included on the proxy card mailed to you. |

| Items of Business: |

Proposal 1: To authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our common stock, par

value $0.001 per share (the “Common Stock”), underlying certain warrants issued by us pursuant to that certain Securities Purchase Agreement, dated as of December 27, 2023, by and between us and the investor named on the signatory page thereto,

and that certain Inducement Letter, dated as of December 27, 2023, by and between us and the investor named on the signatory page thereto, in an amount equal to or in excess of 20% of our Common Stock outstanding immediately prior the issuance

of such warrants (the “Issuance Proposal”).

Proposal 2: The adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to solicit

additional proxies if there are insufficient votes to adopt the Issuance Proposal.

|

| Record Date: |

Friday, February 9, 2024. Only Trevena stockholders of record holding shares of our Common Stock at the close of business on the record date are entitled to receive this notice and

vote at the Special Meeting and any adjournment or postponement of the Special Meeting.

A list of stockholders of the Company entitled to vote at the Special Meeting will be available for inspection by any stockholder of record upon request during the 10-day period

immediately prior to the date of the Special Meeting. The list will be available during the Special Meeting for inspection by stockholders of record for any legally valid purpose related to the Special Meeting at http://www.virtualshareholdermeeting.com/TRVN2024SM.

|

| Proxy Voting: |

Your vote is very important, regardless of the number of shares you own. We urge you to promptly vote by telephone (1-800-690-6903),

by using the Internet (www.proxyvote.com), or, if you received a proxy card or instruction form, by completing, dating, signing and returning it by mail. For instructions on voting, please see Questions and

Answers about the Special Meeting and Voting beginning on page 2. |

| |

By order of the Board of Directors,

Joel Solomon

Corporate Secretary

|

|

EACH STOCKHOLDER IS URGED TO VOTE BY:

A) COMPLETING, SIGNING AND RETURNING THE PROXY CARD IN THE PROVIDED ENVELOPE, OR

B) VOTING VIA THE INTERNET AT WWW.PROXYVOTE.COM OR VIA TELEPHONE

1-800-690-6903

(DESCRIBED IN THE NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS)

ANY STOCKHOLDER THAT VIRTUALLY ATTENDS THE SPECIAL MEETING MAY REVOKE ANY PROXY AND VOTE THE SHARES OVER THE INTERNET DURING THE SPECIAL MEETING.

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SPECIAL STOCKHOLDER MEETING TO BE HELD ON MARCH 21, 2024

Our Notice of Special Meeting and Proxy Statement to Stockholders are available at www.proxyvote.com.

Please see “Information About the Special Meeting” beginning on page 1 of this Proxy Statement for the following information:

| |

● |

Date and time of the Special Meeting of Stockholders; |

| |

● |

How to access the virtual Special Meeting; |

| |

● |

How to vote via the internet during the Special Meeting if you have not voted prior to the meeting; |

| |

● |

An identification of the matters to be acted on at the Special Meeting; and |

| |

● |

The recommendation of our Board of Directors regarding those matters. |

| |

INFORMATION ABOUT

THE SPECIAL MEETING |

1 |

| |

Questions and Answers About the Proxy Materials |

1 |

| |

Questions and Answers About the Special Meeting and Voting |

2 |

| |

|

|

| |

ITEMS TO BE VOTED ON |

8

|

| |

|

|

| |

PROPOSAL 1. To authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the

issuance of shares of our common stock, par value $0.001 per share (the “Common Stock”), underlying certain warrants issued by us pursuant to that certain Securities Purchase Agreement, dated as of December 27, 2023, by and between us and the

investor named on the signatory page thereto, and that certain Inducement Letter, dated as of December 27, 2023, by and between us and the investor named on the signatory page thereto, in an amount equal to or in excess of 20% of our Common

Stock outstanding immediately prior the issuance of such warrants (the “Issuance Proposal”).

PROPOSAL 2: The adjournment of the Special Meeting to a later date or dates, if necessary or

appropriate, to solicit additional proxies if there are insufficient votes to adopt the Issuance Proposal.

|

14 |

| |

|

|

| |

OWNERSHIP OF TREVENA COMMON

STOCK |

15 |

| |

Security Ownership of Certain Beneficial Owners, Directors and Executive Officers |

15 |

| |

|

|

| |

2024 ANNUAL MEETING AND RELATED

MATTERS |

16 |

This proxy statement is furnished in connection with the solicitation of proxies by our board of directors (the “Board of Directors”) for use at the Special Meeting of Stockholders (the

“Special Meeting”) to be held virtually at http://www.virtualshareholdermeeting.com/TRVN2024SM at 8:30 a.m. Eastern time on Thursday, March 21, 2024, and any postponements or adjournments thereof.

We will hold the Special Meeting in a virtual format only with no physical in-person meeting. Our stockholders will be able to attend, vote, and submit questions at the Special Meeting by

visiting http://www.virtualshareholdermeeting.com/TRVN2024SM. Further information about how to attend the Special Meeting online, vote your shares online during the meeting and submit questions during the meeting is included in this proxy

statement.

As used in this proxy statement, the terms “Trevena,” “the Company,” “we,” “us,” and “our” mean Trevena, Inc. unless the context indicates otherwise.

| INFORMATION ABOUT THE SPECIAL MEETING |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

Why did I receive proxy materials? What is included in the proxy materials?

Our Board is soliciting your proxy to vote at the Special Meeting, and at any adjournment or postponement thereof, for the purpose of considering and acting upon the matters set forth

herein. You received proxy materials because you owned shares of Common Stock at the close of business on February 9, 2024, the record date, and that entitles you to vote at the Special Meeting.

Proxy materials include the notice of Special Meeting and the proxy statement and, if you received paper copies, a proxy card or voting instruction form. The proxy statement describes the

matters on which the Board would like you to vote and provides information about Trevena that we must disclose under Securities and Exchange Commission (“SEC”) regulations when we solicit your proxy.

Your proxy will authorize specified persons, each of whom also is referred to as a proxy, to vote on your behalf at the Special Meeting. By use of a proxy, you can vote whether or not you

attend the Special Meeting. The written document by which you authorize a proxy to vote on your behalf is referred to as a proxy card.

We intend to mail these proxy materials on or about February 20, 2024 to all stockholders of record entitled to vote at the Special Meeting.

How can I get electronic access to the proxy materials?

The proxy materials are available for viewing at www.proxyvote.com. On this website, you may:

| |

● |

vote your shares after you have viewed the proxy materials; and |

| |

● |

select a future delivery preference of paper or electronic copies of the proxy materials. |

You may choose to receive proxy materials electronically in the future. If you choose to do so, you will receive an email with instructions containing an electronic link to the proxy

materials for future stockholder meetings. You also will receive an electronic link to the proxy voting site.

Rules adopted by the SEC allow companies to send stockholders a notice of Internet availability of proxy materials only, rather than mail them full sets of proxy materials. For the Special

Meeting, we chose to mail full packages of proxy materials to stockholders. However, in the future we may take advantage of this alternative “notice only” distribution option. If in the future we choose to send only such notices, they would contain

instructions on how stockholders can access our notice of special meeting and proxy statement via the Internet. It also would contain instructions on how stockholders could request to receive their materials electronically or in printed form on a

one-time or ongoing basis.

If you hold your shares through a bank, broker or other custodian, you also may have the opportunity to receive the proxy materials electronically. Please check the information contained

in the documents provided to you by your bank, broker or other custodian.

| We encourage you to take advantage of the availability of the proxy materials

electronically to help reduce the environmental impact of the Special Meeting. |

| INFORMATION ABOUT THE SPECIAL MEETING (CONTINUED) |

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND VOTING

What am I voting on at the Special Meeting?

The proposals that will be presented at the Special Meeting and the voting recommendations of our Board are set forth in the table below:

| Proposal |

Description |

Board’s Vote Recommendation |

Page |

| 1 |

To authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our Common Stock, underlying certain warrants

issued by us pursuant to that certain Securities Purchase Agreement, dated as of December 27, 2023, by and between us and the investor named on the signatory thereto, and that certain Inducement Letter, dated as of December 27, 2023, by and

between us and the investor named on the signatory page thereto, in an amount equal to or in excess of 20% of our Common Stock outstanding immediately prior the issuance of such warrants (the “Issuance Proposal” or “Proposal 1”).

|

Vote FOR |

8

|

| 2 |

The adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient

votes to adopt the Issuance Proposal (the “Adjournment Proposal” or “Proposal 2”).

|

Vote FOR |

14 |

Could other matters be decided at the Special Meeting?

We are not aware of any other matters that will be presented and voted upon at the Special Meeting. The proxies will have discretionary authority, to the extent permitted by law, on how to

vote on other matters that may come before the Special Meeting.

How many votes can be cast by all stockholders?

The record date to determine the stockholders entitled to notice of and to vote at the Special Meeting is the close of business on February 9, 2024. On the record date, 18,321,101 shares

of Common Stock were issued and outstanding and entitled to vote.

Each holder of record of our Common Stock is entitled to one vote per share of Common Stock on each matter to be acted upon at the Special Meeting.

Holders of Common Stock will vote on the Issuance Proposal and any Adjournment Proposal as a single class. Any shares of Common Stock that are not voted on the Issuance Proposal (Proposal

1) or are voted against Proposal 1 will be cast as votes against Proposal 1. This means that Proposal 1 may be approved, even without the affirmative vote of a majority of the Common Stock outstanding on the record date.

How many votes must be present to hold the Special Meeting?

One-third of the issued and outstanding shares of capital stock entitled to vote, or 6,107,034 shares, present or by proxy, are needed for a quorum to hold the Special Meeting. Abstentions

and broker non-votes (discussed below) are included in determining whether a quorum is present. We urge you to vote by proxy even if you plan to attend the Special Meeting. This will help us know that enough votes will be present to hold the Special

Meeting.

| INFORMATION ABOUT THE SPECIAL MEETING (CONTINUED) |

How many votes are needed to approve each proposal? How do abstentions or broker

non-votes affect the voting results?

Because the voting standard for the Issuance Proposal (Proposal 1) and the Adjournment Proposal (Proposal 2) is a majority of the voting power of the outstanding shares of Common Stock

represented by shares present in person or represented by proxy and entitled to vote on the proposals, abstentions, if any, will have the effect of a vote “AGAINST” each proposal. Broker non-votes, if any, will not have any effect on the outcome of the

proposals.

Under the rules of the New York Stock Exchange (the “NYSE”), which are also applicable to Nasdaq-listed companies, brokers, banks and other securities intermediaries that are subject to

NYSE rules may use their discretion to vote your “uninstructed” shares on matters considered to be “routine” under NYSE rules but not with respect to “non-routine” matters. A broker non-vote occurs when a broker, bank or other custodian has not

received voting instructions from the beneficial owner of the shares and the broker, bank or other agent cannot vote the shares because the matter is considered “non-routine” under NYSE rules. Proposal 1 and Proposal 2 are considered to be

“non-routine” under NYSE rules such that your broker, bank or other custodian may not vote your shares on those proposals in the absence of your voting instructions. If you are a beneficial owner and want to ensure that all of the shares you

beneficially own are voted for or against Proposal 1 and Proposal 2, you must give your broker, bank or other custodian specific instructions to do so.

The following table summarizes the vote threshold required for approval of each proposal and the effect on the outcome of the vote of abstentions and broker non-votes:

| INFORMATION ABOUT THE SPECIAL MEETING (CONTINUED) |

Proposal

Number |

Summary Description |

Vote Required for

Approval |

Effect of

Abstentions |

Effect of Broker Non-Votes |

| 1 |

To authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our Common Stock, underlying certain warrants

issued by us pursuant to that certain Securities Purchase Agreement, dated as of December 27, 2023, by and between us and the investor named on the signatory thereto, and that certain Inducement Letter, dated as of December 27, 2023, by and

between us and the investor named on the signatory page thereto, in an amount equal to or in excess of 20% of our Common Stock outstanding immediately prior the issuance of such warrants (the “Issuance Proposal” or “Proposal 1”).

|

Majority of the votes represented by shares present in person or represented by proxy and entitled to vote thereon at the Special Meeting |

Counted “AGAINST” |

None |

| 2 |

The adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to solicit

additional proxies if there are insufficient votes to adopt the Issuance Proposal (the “Adjournment Proposal” or “Proposal 2”). |

Majority of the votes represented by shares present in person or represented by proxy and entitled to vote thereon at the Special Meeting

|

Counted “AGAINST” |

None

|

Signed but unmarked proxy cards will be voted “FOR” Proposal 1 and “FOR” Proposal 2.

How do I attend the Special Meeting?

The Special Meeting will be held on Thursday, March 21, 2024, at 8:30 a.m. Eastern Time. The Special Meeting will be a virtual stockholder meeting through which you can listen to the

meeting, submit questions and vote online. The Special Meeting can be accessed by visiting http://www.virtualshareholdermeeting.com/TRVN2024SM on March 21, 2024, using the 16-digit control number included on the proxy card mailed to you. We

recommend that you log in a few minutes before the Special Meeting begins to ensure you are logged in when the meeting starts. Online check-in will begin at 8:15 a.m. Eastern Time.

| INFORMATION ABOUT THE SPECIAL MEETING (CONTINUED) |

How does the Board recommend that I vote?

Our Board unanimously recommends that you vote your shares:

| |

● |

“FOR” approval to authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our Common Stock, underlying certain warrants issued by us pursuant to that certain Securities

Purchase Agreement, dated as of December 27, 2023, by and between us and the investor named on the signatory thereto, and that certain Inducement Letter, dated as of December 27, 2023, by and between us and the investor named on the signatory

page thereto, in an amount equal to or in excess of 20% of our Common Stock outstanding immediately prior the issuance of such warrants. |

| |

● |

“FOR” approval of the adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to adopt Proposal 1. |

How do I vote if I own shares as a record holder?

If your name is registered on Trevena’s stockholder records as the owner of shares, you are the “record holder.” If you hold shares as a record holder on the record date, there are four

ways that you can vote your shares.

| |

● |

Over the Internet (before the Special Meeting). Vote at www.proxyvote.com. The Internet voting system is available 24 hours a day until 11:59 p.m.

Eastern Time on Wednesday, March 20, 2024. Once you enter the Internet voting system, you can record and confirm (or change) your voting instructions. You will need your 16-digit control number to vote. |

| |

● |

By telephone (before the Special Meeting). Use the telephone number shown on your proxy card, 1-800-690-6903. The telephone voting system is available 24 hours

a day in the United States until 11:59 p.m. Eastern Time on Wednesday, March 20, 2024. Once you enter the telephone voting system, a series of prompts will tell you how to record and confirm (or change) your voting instructions. |

| |

● |

By mail (before the Special Meeting). If you received a proxy card, mark your voting instructions on the card and sign, date and return it in the postage-paid

envelope provided. If you received only a notice of Internet availability but want to vote by mail, the notice includes instructions on how to request a paper proxy card. For your mailed proxy card to be counted, we must receive it before 8:30

a.m. Eastern Time on Thursday, March 21, 2024. |

| |

● |

Over the Internet (during the Special Meeting). Attend, or have your personal representative with a valid legal proxy attend, the virtual Special Meeting by

logging in to http://www.virtualshareholdermeeting.com/TRVN2024SM on Thursday, March 21, 2024, using the 16-digit control number included on the proxy card that was mailed to you. |

Even if you plan to virtually attend the Special Meeting, we recommend that you also submit your proxy card or follow the voting directions described

below, so that your vote will be counted if you later decide not to attend the Special Meeting.

How do I vote if my Trevena shares are held by a bank, broker or other custodian?

If your shares are held by a bank, broker or other custodian (commonly referred to as shares held “in street name”), the holder of your shares will provide you with a copy of this Proxy

Statement, a voting instruction form and directions on how to provide voting instructions. These directions may allow you to vote over the Internet or by telephone.

| INFORMATION ABOUT THE SPECIAL MEETING (CONTINUED) |

If you are a beneficial owner and want to ensure that all of the shares you beneficially own are voted for or against the Issuance Proposal or the Adjournment Proposal, you must give your

broker, bank, or custodian specific instructions to do so. See the discussion above for the impact in the event that you fail to instruct your broker to vote. If you are a beneficial owner of shares registered in the name of your broker, bank or

other custodian, we strongly encourage you to provide voting instructions to the broker, bank or custodian that holds your shares to ensure that your shares are voted in the manner in which you want them to be voted.

If you hold shares in street name and want to vote over the Internet during the Special Meeting, you will need to ask your bank, broker or custodian to provide you with a valid legal

proxy. You will need the control number printed on your proxy card that accompanies this Proxy Statement in order to vote at the Special Meeting. Please note that if you request a legal proxy from your bank, broker or custodian, any previously executed

proxy will be revoked and your vote will not be counted unless you vote over the Internet during the Special Meeting or appoint another valid legal proxy to vote on your behalf.

Can I change my vote?

Yes. If you are a record holder, you may:

| |

● |

Enter new instructions by telephone or Internet voting before 11:59 p.m. Eastern Time on Wednesday, March 20, 2024; |

| |

● |

Send a new proxy card with a later date than the card submitted earlier. We must receive your new proxy card before 8:30 a.m. Eastern Time on Thursday, March 21, 2024; |

| |

● |

Write to the Corporate Secretary at the address listed on page 17. Your letter should contain the name in which your shares are registered, the date of the proxy you wish to revoke or change, your new voting

instructions, if applicable, and your signature. Your letter must be received by the Corporate Secretary before 8:30 a.m. Eastern Time on Thursday, March 21, 2024; or |

| |

● |

Vote over the internet during the Special Meeting (or have a personal representative with a valid proxy vote). Note that simply attending the Special Meeting without voting will not, by itself, revoke your

proxy. |

If you hold your shares in street name, you may:

| |

● |

Submit new voting instructions in the manner and by the time limit provided by your bank, broker or other custodian; or |

| |

● |

Contact your bank, broker or other custodian to request a proxy to vote over the internet during the Special Meeting. |

Who will count the votes? Is my vote confidential?

Trevena’s Executive Vice President, Chief Operating Officer & Chief Financial Officer, Barry Shin, has been appointed Inspector of Election for the Special Meeting. The Inspector of

Election will determine the number of shares outstanding, the shares represented at the Special Meeting, the existence of a quorum, and the validity of proxies and ballots, and will count all votes and ballots.

All votes are confidential. Your voting records will not be disclosed to us, except as required by law, in contested Board elections or certain other limited circumstances.

| INFORMATION ABOUT THE SPECIAL MEETING (CONTINUED) |

Can I ask questions at the Special Meeting?

If you would like to submit a question, you may do so by joining the virtual Special Meeting at http://www.virtualshareholdermeeting.com/TRVN2024SM and typing your question in the

box in the Special Meeting portal.

What if I need technical assistance accessing or participating in the virtual Special Meeting?

If you encounter any difficulties accessing the virtual Special Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual

Stockholder Meeting log in page. Technical support will be available starting at 8:00 a.m. Eastern Time on Thursday, March 21, 2024.

Who pays for the proxy solicitation and how will Trevena solicit votes?

We pay the cost of preparing our proxy materials and soliciting your vote. Proxies may be solicited on our behalf by our directors, officers, employees and agents, including, but not

limited to, a proxy solicitor should we choose to engage one, by telephone, electronic or facsimile transmission or in person. We may choose to enlist the help of banks and brokerage houses in soliciting proxies from their customers and, in all cases,

will reimburse them for their related out-of-pocket expenses.

Where can I find the voting results of the Special Meeting?

We will publish the voting results of the Special Meeting on a Current Report on Form 8-K filed with the SEC. The Form 8-K will be available online at www.sec.gov within four

business days following the end of our Special Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Special Meeting, we intend to file a Form 8-K to publish preliminary results and,

within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

IMPORTANT INFORMATION IF YOU PLAN TO VIRTUALLY ATTEND THE SPECIAL MEETING

You must be able to show that you owned Trevena Common Stock on the record date, February 9, 2024, in order to gain admission to the

Special Meeting.

When you log in to http://www.virtualshareholdermeeting.com/TRVN2024SM, you will be required to enter the 16-digit control

number contained on your proxy card that evidences that you are a stockholder of record. Registration for the Special Meeting will begin at 8:15 a.m. Eastern Time on Thursday, March 21, 2024.

| PROPOSAL 1: To authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our

Common Stock, underlying certain warrants issued by us pursuant to that certain Securities Purchase Agreement, dated as of December 27, 2023, by and between us and the investor named on the signatory thereto, and that certain Inducement Letter,

dated as of December 27, 2023, by and between us and the investor named on the signatory page thereto, in an amount equal to or in excess of 20% of our Common Stock outstanding immediately prior the issuance of such warrants. |

Background and Description of the Issuance Proposal

On December 27, 2023, we entered into a securities purchase agreement (the “Purchase Agreement”) with an institutional accredited investor (the “Purchaser”), for

the sale and issuance in a private placement of an aggregate of 2,779,906 pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to 2,779,906 shares of Common Stock at a purchase price of $0.699 per share and associated warrant. In addition,

the Company agreed to issue to the Purchaser unregistered common stock purchase warrants (the “Common Warrants”) to purchase up to an aggregate of 2,779,906 shares of Common Stock (the “Common Warrant Shares”). The foregoing transaction is referred to

herein as the “Private Placement.”

Concurrently with the Private Placement, the Company also entered into an inducement letter agreement (the “Inducement Letter”) with the holder (the “Holder”) of

certain of our existing warrants to purchase up to an aggregate of 2,934,380 shares of Common Stock issued to the Holder in July 2022 and November 2022 (collectively, the “Existing Warrants”). Pursuant to the Inducement Letter, the Holder agreed to

exercise for cash its Existing Warrants to purchase an aggregate of 2,934,380 shares of Common Stock at a reduced exercise price of $0.70 per share in consideration of the Company’s agreement to issue new Common Stock purchase warrants (the “New

Warrants” and, together with the Common Warrants, the “Warrants”) to purchase up to an aggregate of 5,868,760 shares of Common Stock (the “New Warrant Shares” and, together with the Common Warrant Shares, the “Warrant Shares”) at an exercise price of

$0.70 per share (as adjusted from time to time). The foregoing transaction is referred to herein as the “Warrant Exercise” and the Warrant Exercise and the Private Placement are collectively referred to herein as the “Offerings.”

We also previously entered into an Engagement Letter, dated as of December 4, 2023 (as amended, the “Engagement Letter”) with H.C. Wainwright & Co., LLC (the

“Placement Agent”), pursuant to which we agreed to pay the Placement Agent, as the exclusive placement agent in connection with the Offerings, a cash fee equal to 6.5% of the aggregate gross proceeds raised in the Offerings. The Company also paid the

Placement Agent approximately $75,000 for non-accountable expenses and $15,950 for clearing fees. The Engagement Letter has indemnity and other customary provisions.

Nasdaq Listing Rule 5635 requires that a listed company seek stockholder approval in certain circumstances, including prior to the issuance, in a transaction other

than a public offering, of 20% or more of the company’s outstanding common stock or voting power outstanding before the issuance at a price that is less than the lower of (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately

preceding the signing of the binding agreement in connection with such transaction, or (ii) the average Nasdaq Official Closing Price of the common stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of such

binding agreement (the “Minimum Price”).

| PROPOSAL 1: AUTHORIZATION TO ISSUE SHARES (CONTINUED) |

Pursuant to the Purchase Agreement and the Inducement Letter, we agreed to seek approval by our stockholders for the issuance of the Warrant Shares. See the “Securities

Purchase Agreement” and “Inducement Letter” below.

Reasons for the Offerings

In approving the Offerings, the Board considered the pros and cons of the Offerings versus other alternatives for raising capital, the working capital needs of the Company, and the

opportunities and risks presented with the Securities Purchase Agreement and the Inducement Letter. We believe the Offerings, which yielded gross proceeds of approximately $4.0 million, was necessary in light of the Company’s cash and funding

requirements at the time. In addition, at the time of the Offerings, our Board considered numerous other alternatives to the transaction, none of which proved to be feasible or, in the opinion of our Board, would have resulted in aggregate terms

equivalent to, or more favorable than, the terms obtained in the Offerings. In light of the foregoing, the Company determined that the Offerings were in the best interests of the Company and its stockholders.

Securities Purchase Agreement

The Purchase Agreement provides that the Purchaser, whose purchase of Common Stock in the Private Placement would result in such Purchaser’s beneficial ownership

exceeding 4.99% (or, at the election of the Purchaser, 9.99%) of the Company’s outstanding Common Stock, the option of purchasing Pre-Funded Warrants in lieu of shares of Common Stock in such manner as to result in the same aggregate purchase price

being paid by such Purchaser to the Company.

In light of the foregoing beneficial ownership limitations, at the closing of the Private Placement, the Company issued to the Purchaser (i) Pre-Funded Warrants to

purchase an aggregate of 2,779,906 shares of Common Stock and (ii) Common Warrants to purchase up to an aggregate of 2,779,906 shares of Common Stock. No shares of Common Stock were issued to the Purchaser in the Private Placement.

The Pre-Funded Warrants have an exercise price of $0.001 per Pre-Funded Warrant and can be exercised at any time from the date and time of issuance until the

Pre-Funded Warrants are exercised in full. The terms of the Pre-Funded Warrants preclude a holder thereof from exercising such holder’s Pre-Funded Warrants, and the Company from giving effect to such exercise, if after giving effect to the issuance of

Common Stock upon such exercise, the holder (together with the holder’s affiliates and any other persons acting as a group together with the holder or any of the holder’s affiliates) would beneficially own in excess of 9.99% of the number of shares of

Common Stock outstanding immediately after giving effect to the issuance of Common Stock upon such exercise.

The Common Warrants issued to the Purchaser in the Private Placement have an exercise price of $0.70 per share, become exercisable upon the date of stockholder

approval and will expire five years thereafter. The terms of the Common Warrants preclude a holder thereof from exercising such holder’s Common Warrant, and the Company from giving effect to such exercise, if after giving effect to the issuance of

Common Stock upon such exercise, the holder (together with the holder’s affiliates and any other persons acting as a group together with the holder or any of the holder’s affiliates) would beneficially own in excess of 4.99% of the number of shares of

Common Stock outstanding immediately after giving effect to the issuance of Common Stock upon such exercise.

A holder may increase or decrease the beneficial ownership thresholds relating to the Pre-Funded Warrants and Common Warrants specified above, except that the

beneficial ownership limitation may not exceed 9.99% in any event.

| PROPOSAL 1: AUTHORIZATION TO ISSUE SHARES (CONTINUED) |

The Company agreed not to effect any variable rate transaction, subject to certain exceptions, until one year after the effective date of the Resale Registration

Statement (as defined below). The Company further agreed not to issue any shares of Common Stock or Common Stock equivalents or to file a registration statement (other than as provided in the Inducement Letter and the Registration Rights Agreement (as

defined herein)) with the SEC (in each case, subject to certain exceptions) until 60 days after the effective date of the Resale Registration Statement.

In addition, the Purchase Agreement provides that the Company shall hold an annual or special meeting of stockholders on or prior to the date that is ninety (90)

days following the closing date of the Private Placement for the purpose of obtaining approval from the Company’s stockholders of the Private Placement pursuant to the rules of the Nasdaq Stock Market. If the Company does not obtain stockholder

approval at the first meeting, the Company shall call a meeting every ninety (90) days thereafter to seek stockholder approval until the earlier of the date on which stockholder approval is obtained or the Common Warrants issued in the Private

Placement to the Purchaser are no longer outstanding. The Issuance Proposal is intended to fulfill this final covenant.

Common Warrants

The Common Warrants issued to the Purchaser in the Private Placement are exercisable for Common Warrant Shares upon the date of stockholder approval and expire five years

from the date of stockholder approval of the issuance of the Common Warrant Shares, pursuant to the applicable rules of the Nasdaq Stock Market. The Common Warrants have an exercise price of $0.70 per share. The exercise price and the number of Common

Warrant Shares issuable upon exercise of the Common Warrants are subject to customary adjustments for stock dividends, stock splits, reclassifications and the like. Upon any such price-based adjustment to the exercise price, the number of Common

Warrant Shares issuable upon exercise of the Common Warrants will be increased proportionately. The Common Warrants may be exercised for cash, provided that, if there is no effective registration statement available registering resale of the Common

Warrant Shares, the Common Warrants may be exercised on a cashless basis.

Inducement Letter

The Inducement Letter contains representations and warranties of us and the Investor, which are typical for transactions of this type. In addition, the Inducement

Letter contains customary covenants on our part that are typical for transactions of this type, as well as the following additional covenants: (i) we agreed not to enter into any variable rate transactions for a period of one year following the closing

date of the Warrant Exercise, subject to certain exceptions, (ii) we agreed not to issue any shares of Common Stock or Common Stock equivalents or to file any registration statements with the SEC (in each case, subject to certain exceptions) until 60

days after the closing date of the Warrant Exercise, (iii) we agreed to file a registration statement on Form S-3 (or other appropriate form, including on Form S-1, if we are not eligible to utilize Form S-3) providing for the resale of the New Warrant

Shares issued or issuable upon the exercise of the New Warrants (the “Resale Registration Statement”), as soon as practicable after the closing date of the Warrant Exercise, and to use commercially reasonable efforts to have such Resale Registration

Statement declared effective by the SEC within 90 days following the date of the Inducement Letter and to keep the Resale Registration Statement effective at all times until no holder of the New Warrants owns any New Warrants or New Warrant Shares, and

(iv) we agreed to hold a meeting of our stockholders no later than 90 days following the date of the Inducement Letter to solicit our stockholders’ affirmative vote for approval of the issuance of the maximum New Warrant Shares upon exercise of the New

Warrants in accordance with the applicable law and rules and regulations of the Nasdaq Stock Market, and to call a meeting every 90 days thereafter if stockholder approval is not obtained at the initial meeting, to seek such stockholder approval until

the earlier of the date on which stockholder approval is obtained or the New Warrants are no longer outstanding. The Issuance Proposal is intended to fulfill this final covenant.

| PROPOSAL 1: AUTHORIZATION TO ISSUE SHARES (CONTINUED) |

Pursuant to the Warrant Exercise, the Holder exercised for cash its Existing Warrants to purchase an aggregate of 2,934,380 shares of Common Stock (1,234,380 of

which shares of Common Stock are being held in abeyance for the benefit of the Holder due to certain beneficial ownership limitations) at a reduced exercise price of $0.70 per share, and in consideration therefor, the Company issued New Warrants to

purchase up to an aggregate of 5,868,760 shares of Common Stock.

The resale of the Common Stock underlying the exercised Existing Warrants is registered pursuant to an effective registration statement on Form S-3 (File No.

333-251006), filed with the SEC on November 27, 2020 and declared effective by the SEC on December 4, 2022 (as supplemented by the prospectus supplements dated as of July 28, 2022 and November 16, 2022, respectively, filed with the SEC pursuant to

Rule 424(b) of the Securities Act).

The Inducement Letter provides that the Company’s obligations with respect to the registration of the New Warrant Shares for resale shall be governed by the

Registration Rights Agreement and the New Warrant Shares are included as Registrable Securities (as defined therein) under the Registration Rights Agreement.

New Warrants

The New Warrants are exercisable for New Warrant Shares upon the date of stockholder approval and expire five years from the date of stockholder approval of the issuance

of the New Warrant Shares, pursuant to the applicable rules of the Nasdaq Stock Market. The New Warrants have an exercise price of $0.70 per share. The exercise price and the number of New Warrant Shares issuable upon exercise of the New Warrants are

subject to customary adjustments for stock dividends, stock splits, reclassifications and the like. Upon any such price-based adjustment to the exercise price, the number of New Warrant Shares issuable upon exercise of the New Warrants will be

increased proportionately. The New Warrants may be exercised for cash, provided that, if there is no effective registration statement available registering resale of the New Warrant Shares, the New Warrants may be exercised on a cashless basis.

Registration Rights Agreement

The Company also entered into a registration rights agreement (the “Registration Rights Agreement”) with the Purchaser requiring the Company to register the resale of the

shares of Common Stock, the shares issuable upon exercise of the Pre-Funded Warrants, the shares issuable upon exercise of the Common Warrants, and the shares issuable upon the exercise of the New Warrants.

Principal Effects of the Issuance of the Warrant Shares

The potential issuance of the Common Warrant Shares and the New Warrant Shares would result in an increase in the number of shares of Common Stock outstanding, and our stockholders would

incur dilution of their percentage ownership to the extent that the holders thereof exercise their Warrants, as applicable.

Reasons for Nasdaq Stockholder Approval

Nasdaq Listing Rule 5635(d) requires us to obtain stockholder approval prior to the issuance of securities in connection with a transaction other than a public offering

involving the sale, issuance or potential issuance by us of our Common Stock (or securities convertible into or exercisable for our Common Stock) at a price less than the Minimum Price. In the case of the Offerings, the 20% threshold is determined

based on the shares of our Common Stock outstanding immediately preceding the signing of the Securities Purchase Agreement and the Inducement Letter, which we signed on December 27, 2023.

Immediately prior to the execution of the Securities Purchase Agreement and the Inducement Letter, we had 15,564,545 shares of Common Stock issued and outstanding.

Therefore, the potential issuance of 8,648,666 shares of our Common Stock (consisting of 2,779,906 Common Warrant Shares and 5,868,760 New Warrant Shares) would have constituted greater than 20% of the shares of Common Stock outstanding immediately

prior to the execution of the Securities Purchase Agreement and the Inducement Letter. We are seeking stockholder approval under Nasdaq Listing Rule 5635(d) for the sale, issuance or potential issuance by us of our Common Stock (or securities

exercisable for our Common Stock) in excess of 3,112,909 shares, which is 20% of the shares of Common Stock outstanding immediately prior to the execution of the Securities Purchase Agreement and the Inducement Letter.

| PROPOSAL 1: AUTHORIZATION TO ISSUE SHARES (CONTINUED) |

We cannot predict whether the Warrant holders will exercise their Warrants. For these reasons, we are unable to accurately forecast or predict with any certainty the

total amount of Warrant Shares that may ultimately be issued. Under certain circumstances, however, it is possible, that we will issue more than 20% of our outstanding shares of Common Stock to the Warrant holders. Therefore, we are seeking stockholder

approval under this proposal to issue more than 20% of our outstanding shares of Common Stock, if necessary, to the Warrant holders.

Approval by our stockholders of this Issuance Proposal is also one of the conditions for us to receive additional proceeds up to $6.1 million upon the exercise of the

Warrants, if exercised for cash. Loss of these potential funds could jeopardize our ability to execute our business plan.

Any transaction requiring approval by our stockholders under Nasdaq Listing Rule 5635(d) would likely result in a significant increase in the number of shares of our

Common Stock outstanding, and, as a result, our current stockholders will own a smaller percentage of our outstanding shares of Common Stock.

Under the Nasdaq Listing Rule 5635(b), we are not permitted (without risk of delisting) to undertake a transaction that could result in a change in control of us without

seeking and obtaining separate stockholder approval. Because the terms of the Warrants include beneficial ownership limitations that prohibit the exercise of the Warrants to the extent that such exercise would result in the holder and its affiliates,

collectively, beneficially owning or controlling more than 4.99% (which percentage can be increased to 9.99%) of the total outstanding shares of our Common Stock the Offerings do not constitute a change of control for the purposes of Nasdaq Listing

Rule 5635(b).

Potential Consequences of Not Approving the Issuance Proposal

The Board is not seeking the approval of our stockholders to authorize our entry into or consummation of the transactions contemplated by the Securities Purchase

Agreement or the Inducement Letter, as the Offerings have already been completed and the Warrants have already been issued. We are only asking for approval to issue the shares of Common Stock underlying the Warrants upon exercise thereof.

The failure of our stockholders to approve the Issuance Proposal will mean that: (i) we cannot permit the exercise of the Warrants and (ii) we may incur substantial

additional costs and expenses, including the costs and expense of seeking stockholder approval until our stockholders approve the issuance of the shares of Common Stock underlying the Warrants pursuant to the Securities Purchase Agreement and the

Inducement Letter.

We would realize an aggregate of up to approximately $6.1 million in gross proceeds if all the Warrants were exercised for cash. If our stockholders do not approve the

Issuance Proposal and the Warrants cannot be exercised, we will not receive any such proceeds, which could adversely impact our ability to fund our operations.

After extensive efforts to raise capital on more favorable terms, we believed the Offerings were the only viable financing alternatives available to us at the time. In

addition, unless we obtain stockholder approval for the Issuance Proposal at the initial meeting, we will be required to incur additional costs in order to hold additional stockholder meetings every 90 days following the initial meeting to seek such

approval. Further, until such time as we receive stockholder approval, we will not be able to issue 20% or more of our outstanding shares of Common Stock to the Warrant holders in connection with the Offerings.

| PROPOSAL 1: AUTHORIZATION TO ISSUE SHARES (CONTINUED) |

Further Information

The terms of the Purchase Agreement, the Inducement Letter, the Registration Rights Agreement and the Warrants are only briefly summarized above. For further information,

please refer to the forms of the Purchase Agreement, Inducement Letter, the Pre-Funded Warrant, the Common Warrants and the New Warrants, which were filed with the SEC as exhibits to our Current Report on Form 8-K, filed with the SEC on December 28,

2023, and are incorporated herein by reference. The discussion herein is qualified in its entirety by reference to the filed documents.

Interests of Directors and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal except to the extent of their

ownership of shares of our Common Stock

Required Vote

Approval of this Proposal 1 requires “FOR” votes, cast either in person or by proxy, of a majority of the voting power of the shares of our Common

Stock as of the record date, present in person or represented by proxy and entitled to vote on the proposal. Abstentions will have the same effect as an “AGAINST” vote on Proposal 1. Proposal 1 is considered to be a “non-routine” matter such that your

broker, bank, or other custodian may not vote your shares on those proposals in the absence of your voting instructions. As a result, the failure to instruct your bank, broker, or other custodian as to how to vote on Proposal 1 will have no effect on

the outcome of Proposal 1.

| The Board of Directors unanimously recommends that stockholders vote “FOR”

the issuance proposal. |

| PROPOSAL 2: APPROVAL OF ADJOURNMENT OF THE SPECIAL MEETING (IF NECESSARY OR APPROPRIATE) |

If at the Special Meeting, the number of votes represented by shares of Common Stock present or represented and voting in favor of the Issuance Proposal (Proposal 1) is

insufficient to approve the proposal or establish a quorum, our management may move to adjourn the Special Meeting in order to enable our Board to continue to solicit additional proxies in favor of Proposal 1.

In this proposal, we are asking our stockholders to authorize the holder of any proxy solicited by our Board to vote in favor of adjourning, postponing or continuing the

Special Meeting and any later adjournments. If our stockholders approve the adjournment, postponement or continuation proposal, we could adjourn, postpone or continue the Special Meeting, and any adjourned session of the Special Meeting, to use the

additional time to solicit additional proxies in favor of Proposal 1, including the solicitation of proxies from stockholders that have previously voted against the proposals. Among other things, approval of the adjournment, postponement or

continuation proposal could mean that, even if proxies representing a sufficient number of votes against Proposal 1 have been received, we could adjourn, postpone or continue the Special Meeting without a vote on Proposal 1 and seek to convince the

holders of those shares to change their votes to votes in favor of the approval of Proposal 1.

Vote Required

The affirmative vote of the majority of votes represented by shares present, either in person or represented by proxy, and entitled to vote on this proposal is required

to approve the adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to approve Proposal 1. Abstentions will be the equivalent of votes “AGAINST” this

proposal. Broker non-votes will not have an effect on the outcome of this proposal.

| The Board unanimously recommends that stockholders vote “FOR” the

Adjournment Proposal. |

| OWNERSHIP OF TREVENA COMMON STOCK |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND EXECUTIVE OFFICERS

The following table provides information as of February 9, 2024 about the amount of Common Stock beneficially owned by (1) all those known by us to be beneficial owners of more than five

percent of our Common Stock; (2) each of our directors; (3) each named executive officer; and (4) all of the directors and executive officers of the Company as of February 9, 2024, as a group. This table is based upon information supplied by officers

and directors as of February 9, 2024. We are not aware of any beneficial owners of more than five percent of our Common Stock as of February 9, 2024.

“Beneficial ownership” includes those shares a director, nominee or executive officer has or shares the power to vote or transfer (even if another person is the record owner), and stock

options that are exercisable as of February 9, 2024 or that become exercisable within 60 days of February 9, 2024. Shares of Common Stock subject to such options are deemed outstanding for calculating the Percent of Shares Beneficially Owned of the

person holding these options but are not deemed outstanding for any other person. The Percent of Shares Beneficially Owned shown below is based on 18,321,010 shares outstanding on February 9, 2024.

Unless otherwise noted, the address for each director and executive officer is c/o Trevena, Inc., 955 Chesterbrook Boulevard, Suite 110, Chesterbrook, PA 19087.

| Name of Beneficial Owner |

Number of Shares

Beneficially Owned |

Percentage of Shares

Beneficially Owned

|

| 5% or Greater Stockholders |

|

|

|

Armistice Capital, LLC (1)

|

1,827,615

|

9.99% |

| Non-employee Directors (2) |

|

|

| Mark H. N. Corrigan, M.D. |

4,281 |

* |

| Scott Braunstein, M.D. |

12,907 |

* |

| Marvin H.

Johnson, Jr. |

8,755 |

* |

| Jake R. Nunn (3) |

13,615 |

* |

| Anne M. Phillips,

M.D. |

13,970 |

* |

| Barbara Yanni |

13,970 |

* |

| Named

Executive Officers (4) |

|

|

| Carrie L. Bourdow |

176,320 |

1.0% |

| Mark A.

Demitrack, M.D. |

60,120 |

* |

| Barry Shin |

58,593 |

* |

| All Directors and Executive Officers as a group, including those named above (11 Persons) (5) |

422,728 |

2.4% |

| * |

Represents beneficial ownership of less than 1%. |

| |

|

(1)

|

The information reported is based on a Schedule 13G/A filed with the SEC on February 14, 2024 reporting, as of December 31, 2023, sole power of Armistice Capital, LLC to vote or direct the vote

of 1,827,615 shares and sole power to dispose or direct the disposition of 1,827,615 shares. The business address of Armistice Capital, LLC is 10 Madison Avenue, 7th Floor, New York, NY 10022.

|

| (2) |

Includes shares of Common Stock issuable upon the exercise of options exercisable within 60 days after February 9, 2024 in

the amount of 13,615 for Mr. Nunn, 13,970 for Dr. Phillips, 13,970 for Ms. Yanni, 12,907 for Dr. Braunstein, 8,755 for Mr. Johnson, and 4,281 for Dr. Corrigan. |

| (3) |

Includes 171 shares of common stock held by the Jake & Dana Nunn Living Trust dated July 7, 2006, for which Mr. Nunn

is a trustee. |

| (4) |

Includes shares of Common Stock issuable upon the exercise of options exercisable within 60 days after February 9, 2024 in

the amount of 83,106 for Ms. Bourdow, 23,420 for Dr. Demitrack, and 19,686 for Mr. Shin. |

| (5) |

Includes shares of Common Stock issuable upon the exercise of options exercisable within 60 days after February 9, 2024 in

the amount of 217,740 for all of the directors, nominees for director and executive officers, as a group. |

| |

|

|

|

| 2024 ANNUAL MEETING AND RELATED MATTERS |

When do you expect to hold the 2024 Annual Meeting of Stockholders?

We currently expect to hold the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) in June 2024. The specific date, time and location of such meeting will be announced at a

later date.

How does a stockholder submit a proposal or nomination of a director candidate for the 2024 Annual Meeting?

The following summarizes the requirements for stockholder proposals to be considered for inclusion in next year’s proxy materials.

| |

● |

If you intend to submit a proposal to be included in next year’s proxy materials pursuant to SEC Rule 14a-8, the Corporate Secretary must have received your proposal on or before December 30, 2023. Submitting a

stockholder proposal does not guarantee that Trevena will include the proposal in the proxy statement if the proposal does not satisfy the SEC’s rules. |

| |

● |

If you want to present your proposal at the 2024 Annual Meeting but are not proposing it pursuant to SEC Rule 14a-8, the Corporate Secretary must receive your proposal by the close of business between February 16,

2024 and March 17, 2024 and it must satisfy the requirements set forth in Article III, Section 5 of our Amended and Restated Bylaws (as amended, the “Bylaws”). |

If you would like to nominate a candidate for director at the 2024 Annual Meeting, you must notify the Corporate Secretary by the close of business between February 16, 2024 and March 17,

2024. The notice must include certain information specified in our Bylaws, including (i) your name and address, (ii) the class and number of shares of our stock which you beneficially own, (iii) the name, age, business address and residence address of

the person, (iv) the principal occupation or employment of the person, (v) the class and number of shares of our stock which are owned of record and beneficially owned by the person, (vi) the date or dates on which such shares were acquired and the

investment intent of such acquisition and (vii) any other information concerning the person as would be required to be disclosed in a proxy statement soliciting proxies for the election of that person as a director in an election contest (even if an

election contest is not involved), or that is otherwise required to be disclosed pursuant to Section 14 of the Securities and Exchange Act of 1934 (as amended, the “Exchange Act”) and the rules and regulations promulgated thereunder (including the

person’s written consent to being named as a nominee and to serving as a director if elected). We may require any proposed nominee to furnish such other information as we may reasonably require to determine the eligibility of such proposed nominee to

serve as an independent director of the Company or that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, of such proposed nominee. Correspondence to the Corporate Secretary may be addressed to:

Corporate Secretary, Trevena, Inc., 955 Chesterbrook Boulevard, Suite 110, Chesterbrook, PA 19087. For more information, and for more detailed requirements, please refer to our Amended and Restated Bylaws, filed as Exhibit 3.2 to our Current Report on

Form 8-K, filed with the SEC on February 5, 2014, and Amendment No. 1 to our Amended and Restated Bylaws, filed as Exhibit 3.3 to our Current Report on Form 8-K, filed with the SEC on August 1, 2022.

In addition, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets

forth the information required by Rule 14a-19 under the Exchange Act no later than April 16, 2024.

| 2024 ANNUAL MEETING AND RELATED MATTERS (CONTINUED) |

How can I communicate with the Board?

Stockholders and interested parties may contact the Board, the Chair, the independent directors, or specific individual directors by sending written correspondence to the Board, Attention:

Corporate Secretary, Trevena, Inc., 955 Chesterbrook Boulevard, Suite 110, Chesterbrook, PA 19087.

The Corporate Secretary will compile all communications other than routine commercial solicitations and opinion surveys sent to Board members and periodically submit them to the Board.

Communications addressed to individual directors at the director address will be promptly submitted to such individual directors. The Corporate Secretary also will promptly advise the appropriate member of management of any concerns relating to

Trevena’s products or services, and the Corporate Secretary will notify the Board of the resolution of those concerns.

How do I obtain copies of Trevena’s corporate governance and other company documents?

The Corporate Governance Guidelines, committee charters and Trevena’s Code of Ethics are posted at www.trevena.com/investors/corporate-governance. In addition, these documents are

available in print to any stockholder who submits a written request to the Corporate Secretary at the address listed above.

| 2024 ANNUAL MEETING AND RELATED MATTERS (CONTINUED) |

Our 2022 Annual Report, including the financial statements and financial statement schedules, has been filed with the SEC and provides additional information about us, which is

incorporated by reference herein. Our filings with the SEC, including our annual report on Form 10-K, are available at www.trevena.com/investors/financial-information/all-sec-filings.

If you are a stockholder and did not receive an individual copy of this year’s proxy statement or annual report, we will promptly send a copy to you if you address a written request to

Investor Relations, Trevena, Inc., 955 Chesterbrook Boulevard, Suite 110, Chesterbrook, PA 19087.

What is householding and how does it affect me?

If you and other residents at your mailing address own shares of Trevena stock in “street name,” your broker, bank or custodian should have notified you that your household will receive

only one proxy statement and annual report or notice of Internet availability of proxy materials, but each stockholder who resides at your address will receive a separate proxy card or voting instruction form. This practice is known as “householding.”

Unless you responded that you did not want to participate in householding, you were deemed to have consented to the process. Householding benefits both you and Trevena because it reduces the volume of duplicate information received at your household

and helps Trevena reduce expenses and conserve natural resources.

If you would like to receive your own set of Trevena’s proxy statement and annual report or, if applicable, your own notice of Internet availability of proxy materials now or in the

future, or if you share an address with another Trevena stockholder and together both of you would like to receive only a single set of Trevena’s proxy materials, please contact Broadridge, Householding Department, 51 Mercedes Way, Edgewood, NY 11717

or (800) 542-1061. The request must be made by each person in the household. Be sure to indicate your name, the name of your brokerage firm or bank, and your account number. The revocation of your consent to householding will be effective 30 days

following its receipt.

18

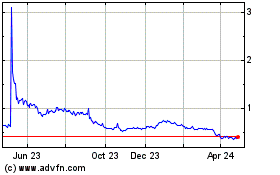

Trevena (NASDAQ:TRVN)

Historical Stock Chart

From Nov 2024 to Dec 2024

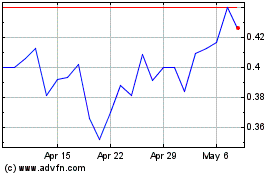

Trevena (NASDAQ:TRVN)

Historical Stock Chart

From Dec 2023 to Dec 2024