UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of report (Date of earliest event reported):

August 7, 2023

TABULA RASA HEALTHCARE, INC.

(Exact Name of Registrant Specified in Charter)

| Delaware |

|

001-37888 |

|

46-5726437 |

(State or

Other

Jurisdiction of

Incorporation)

|

|

(Commission File

Number)

|

|

(I.R.S. Employer

Identification No.)

|

228 Strawbridge Drive, Suite 100

Moorestown, New Jersey | |

08057 |

| (Address of Principal Executive Offices)

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (866) 648-2767

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

x |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading Symbol |

|

Name of each exchange

on which registered: |

| Common Stock, par value $0.0001 per share |

|

TRHC |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On August 7, 2023, Tabula Rasa HealthCare, Inc. (the “Company”)

issued a press release announcing its 2023 second quarter financial results. The press release is being furnished with this Current Report

on Form 8-K as Exhibit 99.1 and is hereby incorporated herein by reference.

The information provided in this Item 2.02 (including Exhibit 99.1)

of this Current Report on Form 8-K is being furnished and shall not be deemed to be “filed” for the purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities thereof. The

information in this Current Report on Form 8-K shall not be deemed to be incorporated by reference in any filing made by the Company

pursuant to the Securities Act of 1933, as amended, or the Exchange Act, other than to the extent that such filing incorporates by reference

any or all of such information by express reference thereto.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

TABULA RASA HEALTHCARE, INC. |

| |

|

|

| |

By: |

/s/ Brian W. Adams |

| |

|

Brian W. Adams |

| |

|

President and Chief Executive Officer |

Dated: August 7, 2023

Exhibit 99.1

Tabula Rasa HealthCare Reports Second Quarter

2023 Financial Results

Continued Strong Organic Revenue Growth of

24%

Second Quarter Adjusted EBITDA of $6.3 Million

Increased More Than 3x Compared to Second Quarter 2022

MOORESTOWN, N.J., August 7, 2023 – Tabula Rasa HealthCare, Inc.®

(Nasdaq:TRHC) (“TRHC” or the “Company”), a leading healthcare company advancing personalized, comprehensive care

for value-based care organizations, today reported financial results for the second quarter ended June 30, 2023.

Highlights from the second quarter ended June 30, 2023 include:

| · | Second

quarter revenue from continuing operations of $90.0 million increased 24%, including medication

revenue growth of 25% and technology-enabled solutions revenue growth of 22% versus the prior

year second quarter. |

| · | Second

quarter GAAP net loss and adjusted EBITDA from continuing operations of $9.7 million and

$6.3 million, respectively, compares with $12.7 million and $2.1 million in the second

quarter of 2022. |

“We delivered another impressive quarter demonstrating the strength

of the underlying organic growth in our core PACE market and our commitment to significantly improve profitability. This is a testament

to the strong performance by our employees who remain focused on serving the most complex and vulnerable individuals in PACE and other

value-based care models,” said Brian Adams, President and Chief Executive Officer.

Key

Financial Results

(in

millions except percentages)

| | |

Q2 | | |

Q2 2023 | |

| | |

2023 | | |

2022 | | |

% Change | | |

Guidance | |

| Revenue from continuing operations | |

$ | 90.0 | | |

$ | 72.6 | | |

| 24 | % | |

$ | 88.0 -

90.0 | |

| Gross margin | |

| 25.0 | % | |

| 22.0 | % | |

| | | |

| | |

| Adjusted gross margin | |

| 25.6 | % | |

| 23.1 | % | |

| | | |

| | |

| GAAP net loss from continuing operations | |

$ | (9.7 | ) | |

$ | (12.7 | ) | |

| 23 | % | |

| | |

| Adjusted net income (loss) from continuing operations | |

$ | 0.7 | | |

$ | (2.7 | ) | |

| 127 | % | |

| | |

| Adjusted EBITDA from continuing operations | |

$ | 6.3 | | |

$ | 2.1 | | |

| 207 | % | |

$ | 3.5

- 4.5 | |

Second Quarter 2023 Financial Results

All comparisons, unless otherwise noted, are to the three months ended

June 30, 2022, and reflect continuing operations.

| · | Revenue

– Revenue of $90.0 million increased 24% compared to $72.6 million in the second

quarter of 2022 and increased 2% as compared to the first quarter of 2023. Medication revenue

of $69.6 million increased 25% due to continued PACE census growth and higher revenue per

PACE participant. Technology-enabled solutions revenue of $20.4 million increased 22% compared

to $16.7 million in the second quarter of 2022 and increased 5% as compared to the first

quarter of 2023. |

| · | Gross

Profit – Gross profit (exclusive of depreciation and amortization) of $22.5 million

(25.0% of revenue) increased 41% as compared to $16.0 million (22.0% of revenue) in the second

quarter of 2022. Adjusted gross profit of $23.0 million (25.6% of revenue) increased 37%

as compared to $16.8 million (23.1% of revenue) a year ago. Both medication and technology-enabled

solutions gross margins increased vs. the year-ago period, driven by increased scale and

operating efficiency improvements. |

| · | GAAP

Net Loss – GAAP net loss from continuing operations of $9.7 million decreased as

compared to a net loss of $12.7 million in the second quarter of 2022. GAAP net loss from

discontinued operations (net of tax) of $0.1 million compared to a net loss of $36.9 million

in the second quarter of 2022. The second quarter of 2022 included the PrescribeWellness,

SinfoníaRx and DoseMe businesses. As previously announced on March 2, 2023, TRHC

completed the sales of SinfoníaRx and DoseMe during the first quarter of 2023. |

| · | Adjusted

EBITDA – Adjusted EBITDA from continuing operations of $6.3 million (7.0% of revenue)

increased 207% vs. $2.1 million (2.8% of revenue) in the second quarter of 2022. The improvement

vs. the prior year was driven by the higher gross profit noted above and disciplined cost

management. |

A

reconciliation of certain financial measures with the most directly comparable financial measures calculated in accordance with generally

accepted accounting principles in the United States (“GAAP”) has been provided in this press release in the accompanying

tables. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

Operational Metrics

To provide transparency into our financial results, we are providing

the following operational metrics.

| | |

As of | |

| | |

June 30, | | |

September 30, | | |

December 31, | | |

March 31, | | |

June 30, | |

| | |

2022 | | |

2022 | | |

2022 | | |

2023 | | |

2023 | |

| PACE

census1: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Medication census | |

| 18,639 | | |

| 19,806 | | |

| 20,555 | | |

| 20,705 | | |

| 21,070 | |

| Technology-enabled solutions census | |

| 50,763 | | |

| 52,230 | | |

| 53,430 | | |

| 54,135 | | |

| 55,804 | |

| Total PACE census | |

| 50,763 | | |

| 52,230 | | |

| 53,430 | | |

| 54,135 | | |

| 55,804 | |

| | |

Three

Months Ended | |

| | |

June 30, | | |

September 30, | | |

December 31, | | |

March 31, | | |

June 30, | |

| | |

2022 | | |

2022 | | |

2022 | | |

2023 | | |

2023 | |

| PACE average revenue per participant per month: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Medication

average revenue per participant per month2 | |

$ | 1,036 | | |

$ | 1,051 | | |

$ | 1,056 | | |

$ | 1,110 | | |

$ | 1,100 | |

| Technology-enabled

solutions revenue per participant per month3 | |

| 91 | | |

| 91 | | |

| 92 | | |

| 98 | | |

| 99 | |

| Total PACE average revenue per participant per month | |

| 459 | | |

| 474 | | |

| 494 | | |

| 523 | | |

| 515 | |

PACE backlog as of June 30, 2023, was valued at $87 million in

annual revenue at maturity, which the Company defines as enrollment of 250 participants for PACE clients. By comparison, PACE backlog

was valued at $84 million as of March 31, 2023.

Cancellation of Q2 Earnings Conference Call

In

a separate press release, Tabula Rasa today announced that it entered into a definitive merger agreement to be acquired by Nautic Partners

(“Nautic”) for $10.50 in cash per share and will combine with ExactCare Pharmacy (“ExactCare”), a portfolio company

of Nautic. A copy of that press release is accessible by visiting the Investor Relations section of the Tabula Rasa corporate website

at ir.tabularasahealthcare.com. In light of the announced transaction, Tabula Rasa has cancelled the earnings conference

call previously scheduled for August 8. In addition, the Company is not providing further financial guidance for 2023 as a result

of the pending transaction.

About

Tabula Rasa HealthCare

Tabula

Rasa HealthCare (TRHC) (NASDAQ: TRHC) enables simplified and individualized care that improves the health of those we serve.

We offer comprehensive pharmacy services that include personalized, precision medication management and delivery as well as a suite of

clinical and business management tools that help health plans and at-risk provider groups optimize utilization and improve patient

health. For more information, visit TRHC.

1 Defined as the number of PACE participants utilizing

at least one of our solution lines.

2 This metric is calculated as quarterly medication revenue

from PACE clients divided by quarterly member months.

3 This metric is calculated as quarterly technology-enabled

solutions revenue from PACE clients across all solution lines divided by quarterly member months.

Non-GAAP Financial Measures

In

addition to reporting certain financial information in accordance with GAAP, TRHC is also reporting gross profit, adjusted EBITDA, adjusted

cost of revenue, adjusted gross profit, adjusted operating expenses, adjusted operating income (loss), and adjusted net income (loss),

in each case from continuing operations, which are considered non-GAAP financial measures. Generally, a non-GAAP financial measure is

a numerical measure of a company’s performance or financial position that either excludes or includes amounts that are not normally

excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. TRHC presents adjusted

EBITDA and the other non-GAAP financial measures in this release because it considers each of them to be an important supplemental measure

of performance. TRHC also intends to provide adjusted EBITDA and the other non-GAAP financial measures in this release as part of the

Company’s future earnings discussions and, therefore, their inclusion should provide consistency in the Company’s financial

reporting.

Adjusted

EBITDA consists of net income (loss) plus certain other expenses, which include interest expense, provision for income tax, depreciation

and amortization, change in fair value of contingent consideration receivable, impairment charges, business optimization expense, severance

costs, executive transition costs, settlement costs, divestiture-related expense, transformation-related expense, stock-based compensation

expense, and net loss on divestiture of businesses. TRHC considers business optimization expense to include employee and non-recurring

vendor costs incurred related to its business optimization initiatives during 2022. TRHC considers severance costs to include severance

costs related to the realignment of its resources. TRHC considers executive transition costs to include nonrecurring costs related to

the hiring and onboarding of new named executive officers. TRHC considers settlement costs to include amounts payable by TRHC or reductions

to amounts owed to TRHC as a result of a contractual settlement. TRHC considers divestiture-related expense to include non-recurring

direct transaction costs. TRHC considers transformation-related expense to include non-recurring advisory fees incurred to assess a variety

of strategic opportunities to increase shareholder value. TRHC considers net loss on divestiture of businesses to include the non-recurring

net loss resulting from the sales of the DoseMe and SinfoníaRx businesses. TRHC uses adjusted EBITDA for planning purposes,

including analysis of the Company’s performance against prior periods, the preparation of operating budgets and determination of

appropriate levels of operating and capital investments. TRHC believes that adjusted EBITDA provides additional insight for analysts

and investors in evaluating the Company’s financial and operational performance.

TRHC defines adjusted cost of revenue as cost of revenue as presented

on the consolidated statements of operations less those certain other expenses which are added to operating income (loss) in calculating

adjusted operating income (loss) (as described below), including stock-based compensation expense and such other expenses, in each case

to the extent that they are included in cost of revenue. TRHC believes adjusted cost of revenue provides analysts and investors more

accurate information regarding the actual cost of products and services provided by TRHC, excluding the impact of certain non-cash charges

like stock-based compensation expense, and costs of revenue that are not recurring components of its core medication and technology-enabled

solutions costs, for better comparability of its cost of revenue between periods.

TRHC

defines gross profit as total revenue less total cost of revenue (exclusive of depreciation and amortization) as presented on

the consolidated statements of operations. TRHC defines gross margin as gross profit as a percentage of total revenue. TRHC defines adjusted

gross profit as total revenue less total cost of revenue (exclusive of depreciation and amortization) as presented on the consolidated

statements of operations, excluding the impact of those certain other expenses which are added to operating income (loss) in calculating

adjusted operating income (loss) (as described below), including stock-based compensation expense and such other expenses, in each case

to the extent that they are included in cost of revenue. TRHC defines adjusted gross margin as adjusted gross profit as a percentage

of total revenue. TRHC believes adjusted gross profit and adjusted gross margin provide analysts and investors more accurate information

regarding its core profit margin on sales, excluding the impact of certain non-cash charges like stock-based compensation expense, and

costs of revenue that are not recurring components of its core medication and technology-enabled solutions costs, for better comparability

of gross profit between periods.

TRHC defines adjusted operating expenses as operating expenses as

presented on the consolidated statements of operations plus or minus (as applicable) the impact those expenses added or subtracted from

operating income (loss) in calculating adjusted operating income (loss), in each case to the extent they are included in operating expense.

TRHC believes adjusted operating expenses provide analysts and investors more accurate information regarding its core operating expenses,

which include research and development costs, sales and marketing costs, general and administrative costs, depreciation of property and

equipment, and amortization of software development costs, excluding the impact of certain non-cash charges like amortization of intangible

assets acquired in prior business acquisitions and stock-based compensation expense, and charges that are not recurring components of

its core operating expenses, for better comparability between periods.

TRHC

defines adjusted operating income (loss) as operating income (loss) plus or minus (as applicable) amortization of acquired intangibles,

change in fair value of contingent consideration receivable, impairment charges, business optimization expense, severance costs, executive

transition costs, divestiture-related expense, transformation-related expense, and stock-based compensation expense. The items included

in the calculation of adjusted EBITDA are determined in calculating adjusted operating income (loss) in the same manner. TRHC believes

adjusted operating income (loss) provides analysts and investors more accurate information regarding its core operating income (loss),

excluding the impact of certain non-cash charges like amortization of intangible assets acquired in prior business acquisitions and stock-based

compensation expense, and charges that are not recurring components of its core operating expenses, for better comparability between

periods.

TRHC

defines adjusted net income (loss) as net income (loss) plus or minus (as applicable) the impact of those expenses added or subtracted

from operating income (loss) in calculating adjusted operating income (loss) along with the impact of amortization of debt discount and

issuance costs, and the tax impact of all those items using an effective statutory tax rate on pre-tax income (loss) adjusted for those

items. TRHC believes adjusted net income (loss) provides analysts and investors more accurate information regarding its core income (loss),

excluding the impact of certain non-cash charges like amortization of intangible assets acquired in prior business acquisitions and stock-based

compensation expense, and charges that are not recurring components of its core product and service costs or core operating expenses,

for better comparability between periods.

In addition to the reasons given above for providing each of the non-GAAP

financial measures included herein, TRHC believes each of these non-GAAP financials measures provides analysts and investors more accurate

information for better comparability to other companies, although such other companies may calculate non-GAAP financial measures differently

than TRHC.

Non-GAAP financial measures have limitations as an analytical tool.

Investors are encouraged to review the reconciliations of adjusted EBITDA, adjusted cost of revenue, adjusted gross profit, adjusted

operating expenses, adjusted operating income (loss), and adjusted net income (loss) to the most directly comparable GAAP measures provided

in the accompanying tables.

Safe Harbor Statement

This

press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended

(“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”),

including our guidance regarding revenue from continuing operations and adjusted EBITDA from continuing operations. Forward-looking statements

may be identified by words such as “believe,” “will,” “may,” “estimate,” “continue,”

“anticipate,” “intend,” “should,” “plan,” “expect,” “predict,”

“could,” “potentially” or the negative of these terms or similar expressions. You should read these statements

carefully because they discuss future expectations, contain projections of future results of operations or financial condition, or state

other “forward-looking” information. These statements relate to, without limitation, our future plans, objectives, expectations,

intentions, financial performance and the proposed acquisition of TRHC by Locke Buyer, LLC, an affiliate of Nautic, and the assumptions that underlie these statements.

These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially

from those anticipated in the forward-looking statements. Factors that might cause such a difference include, but are not limited to:

(i) our expectations regarding industry and market trends, including the expected growth and continued structural change

and consolidation in the market for healthcare in the United States; (ii) our expectations about the growth of Programs of All-Inclusive

Care for the Elderly (“PACE”) organizations; (iii) our expectations about private payers establishing their own at-risk

programs; (iv) the advantages of our solutions as compared to those of competitors; (v) our estimates about our financial performance;

(vi) the visibility into future cash flows from our business model; (vii) our ability to reduce expenses as a result of our

disposition of non-core businesses; (viii) our growth strategy, including our ability to grow our client base; (ix) our plans

to further penetrate existing markets and enter new markets; (x) expectations of earnings, revenue, and other financial items; (xi) plans,

strategies, and objectives of management for future operations; (xii) our ability to establish and maintain intellectual property

rights; (xiii) our ability to retain and hire necessary associates and appropriately staff our operations; (xiv) future capital

expenditures; (xv) future economic conditions or performance; (xvi) our plans to pursue strategic acquisitions and partnerships;

(xvii) our plans to expand and enhance our solutions; (xviii) our estimates regarding capital requirements and needs for additional

financing; (xix) the risk that the proposed transaction may not be completed in a timely manner or at all; (xx) the failure

to receive, on a timely basis or otherwise, the required approval of the proposed transaction by TRHC’s stockholders; (xxi) the

possibility that any or all of the various conditions to the consummation of the proposed transaction may not be satisfied or waived,

including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations

or restrictions placed on such approvals); (xxii) the possibility that competing offers or acquisition proposals for TRHC will be

made; (xxiii) the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive

transaction agreement relating to the proposed transaction, including in circumstances which would require TRHC to pay a termination

fee; (xxiv) the effect of the announcement or pendency of the proposed transaction on TRHC ability to attract, motivate or retain

key executives and employees, its ability to maintain relationships with its customers, vendors, service providers and others with whom

it does business, or its operating results and business generally; (xxv) risks related to the proposed transaction diverting management’s

attention from TRHC’s ongoing business operations; (xxvi) the risk of stockholder litigation in connection with the proposed

transaction, including resulting expense or delay; and (xxvii) the risks described in Part I, Item 1A of our 2022 Form 10-K,

filed with the SEC on March 10, 2023, and our other filings and reports filed with or furnished to the Securities and Exchange Commission.

Filings with the SEC are available on the SEC’s website at http://www.sec.gov. Forward-looking statements are based on our management’s

beliefs and assumptions and on information currently available to our management. These statements, like all statements in this report,

speak only as of their date, and we undertake no obligation to update or revise these statements in light of future developments, except

as required by applicable law. We caution investors that our business and financial performance are subject to substantial risks and

uncertainties.

Additional Information and Where to Find It

This press release may be deemed to be solicitation material in respect

of the proposed acquisition of TRHC by Locke Buyer, LLC, an affiliate of Nautic. In connection with the proposed transaction, TRHC intends to file relevant materials

with the SEC, including TRHC’s proxy statement in preliminary and definitive form. INVESTORS AND STOCKHOLDERS OF TRHC ARE URGED

TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING TRHC’S PROXY STATEMENT (IF AND WHEN AVAILABLE), BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders are or will be able to obtain

the documents (if and when available) free of charge at the SEC’s website at www.sec.gov, or free of charge within the Investor

Relations section of TRHC’s website http://ir.trhc.com or upon request from TRHC’s Investor Relations Department.

Participants in the Solicitation

TRHC and its directors, executive officers and other members of management

and employees, under SEC rules, may be deemed to be “participants” in the solicitation of proxies from stockholders of TRHC

in favor of the proposed transaction. Information about TRHC’s directors and executive officers is set forth in TRHC’s Proxy

Statement on Schedule 14A for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 28, 2023. To the extent

holdings of TRHC’s securities by its directors or executive officers have changed since the amounts set forth in such 2023 proxy

statement, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of

Change in Ownership on Form 4 filed with the SEC. Additional information concerning the interests of TRHC’s participants in

the solicitation, which may, in some cases, be different than those of TRHC’s stockholders generally, will be set forth in TRHC’s

proxy statement relating to the proposed transaction when it becomes available.

No Offer or Solicitation

This press release is not intended to and shall not constitute an

offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall

there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made in the

United States absent registration under the Securities Act, or pursuant to an exemption from, or in a transaction not subject to, such

registration requirements.

TABULA RASA HEALTHCARE, INC.

UNAUDITED CONSOLIDATED BALANCE SHEETS

(In thousands)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 62,811 | | |

$ | 70,017 | |

| Restricted cash | |

| 10,400 | | |

| 12,372 | |

| Accounts receivable, net | |

| 18,610 | | |

| 19,252 | |

| Inventories | |

| 8,659 | | |

| 6,566 | |

| Prepaid expenses | |

| 3,581 | | |

| 4,664 | |

| Client claims receivable | |

| 16,415 | | |

| 16,377 | |

| Divestiture-related note receivable | |

| 3,527 | | |

| — | |

| Other current assets | |

| 22,678 | | |

| 18,187 | |

| Current assets of

discontinued operations | |

| — | | |

| 22,825 | |

| Total current assets | |

| 146,681 | | |

| 170,260 | |

| Property and equipment, net | |

| 9,369 | | |

| 9,158 | |

| Operating lease right-of-use assets | |

| 10,149 | | |

| 10,483 | |

| Software development costs, net | |

| 33,077 | | |

| 32,592 | |

| Goodwill | |

| 115,323 | | |

| 115,323 | |

| Intangible assets, net | |

| 35,129 | | |

| 38,326 | |

| Contingent consideration receivable | |

| — | | |

| 3,350 | |

| Other assets | |

| 6,209 | | |

| 4,657 | |

| Total assets | |

$ | 355,937 | | |

$ | 384,149 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ deficit | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Current operating lease liabilities | |

$ | 2,982 | | |

$ | 2,708 | |

| Accounts payable | |

| 20,623 | | |

| 19,459 | |

| Client claims payable | |

| 10,981 | | |

| 10,781 | |

| Accrued expenses and other liabilities | |

| 59,105 | | |

| 55,745 | |

| Current liabilities

of discontinued operations | |

| — | | |

| 13,389 | |

| Total current liabilities | |

| 93,691 | | |

| 102,082 | |

| Long-term debt, net of discount | |

| 232,603 | | |

| 232,112 | |

| Long-term debt – related party, net of discount | |

| 88,709 | | |

| 88,522 | |

| Noncurrent operating lease liabilities | |

| 12,102 | | |

| 12,786 | |

| Deferred income tax liability, net | |

| 1,507 | | |

| 1,380 | |

| Other long-term liabilities | |

| 5,404 | | |

| 4,298 | |

| Total liabilities | |

| 434,016 | | |

| 441,180 | |

| | |

| | | |

| | |

| Stockholders’ equity (deficit): | |

| | | |

| | |

| Common stock | |

| 3 | | |

| 3 | |

| Treasury stock | |

| (4,049 | ) | |

| (3,391 | ) |

| Additional paid-in capital | |

| 359,573 | | |

| 354,214 | |

| Accumulated deficit | |

| (433,606 | ) | |

| (407,857 | ) |

| Total stockholders’ deficit | |

| (78,079 | ) | |

| (57,031 | ) |

| Total liabilities and stockholders’

deficit | |

$ | 355,937 | | |

$ | 384,149 | |

TABULA RASA HEALTHCARE, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share amounts)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Medication revenue | |

$ | 69,626 | | |

$ | 55,892 | | |

$ | 138,376 | | |

$ | 106,865 | |

| Technology-enabled

solutions revenue | |

| 20,410 | | |

| 16,705 | | |

| 39,937 | | |

| 32,842 | |

| Total revenue | |

| 90,036 | | |

| 72,597 | | |

| 178,313 | | |

| 139,707 | |

| Cost of revenue, exclusive of depreciation and amortization

shown below: | |

| | | |

| | | |

| | | |

| | |

| Cost of medication revenue | |

| 53,554 | | |

| 43,384 | | |

| 106,636 | | |

| 82,936 | |

| Cost of technology-enabled

solutions revenue | |

| 13,953 | | |

| 13,247 | | |

| 28,395 | | |

| 26,416 | |

| Total cost of revenue,

exclusive of depreciation and amortization | |

| 67,507 | | |

| 56,631 | | |

| 135,031 | | |

| 109,352 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 1,777 | | |

| 3,243 | | |

| 3,056 | | |

| 7,208 | |

| Sales and marketing | |

| 2,732 | | |

| 2,172 | | |

| 5,185 | | |

| 4,821 | |

| General and administrative | |

| 17,599 | | |

| 15,150 | | |

| 34,176 | | |

| 31,028 | |

| Change in fair value of contingent consideration

receivable | |

| 3,350 | | |

| — | | |

| 3,750 | | |

| — | |

| Long-lived asset impairment charge | |

| — | | |

| — | | |

| — | | |

| 4,062 | |

| Depreciation and

amortization | |

| 6,103 | | |

| 5,489 | | |

| 12,303 | | |

| 11,231 | |

| Total operating expenses | |

| 31,561 | | |

| 26,054 | | |

| 58,470 | | |

| 58,350 | |

| Loss from operations | |

| (9,032 | ) | |

| (10,088 | ) | |

| (15,188 | ) | |

| (27,995 | ) |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (1,144 | ) | |

| (2,444 | ) | |

| (2,409 | ) | |

| (4,713 | ) |

| Other income | |

| 566 | | |

| — | | |

| 1,018 | | |

| — | |

| Total other expense, net | |

| (578 | ) | |

| (2,444 | ) | |

| (1,391 | ) | |

| (4,713 | ) |

| Loss from continuing operations before income taxes | |

| (9,610 | ) | |

| (12,532 | ) | |

| (16,579 | ) | |

| (32,708 | ) |

| Income tax expense | |

| 133 | | |

| 159 | | |

| 238 | | |

| 375 | |

| Net loss from continuing operations | |

| (9,743 | ) | |

| (12,691 | ) | |

| (16,817 | ) | |

| (33,083 | ) |

| Net loss from discontinued operations,

net of tax | |

| (108 | ) | |

| (36,919 | ) | |

| (8,932 | ) | |

| (44,720 | ) |

| Net loss | |

$ | (9,851 | ) | |

$ | (49,610 | ) | |

$ | (25,749 | ) | |

$ | (77,803 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share: | |

| | | |

| | | |

| | | |

| | |

| Net loss per share from continuing operations, basic and diluted | |

$ | (0.38 | ) | |

$ | (0.53 | ) | |

$ | (0.66 | ) | |

$ | (1.38 | ) |

| Net loss per share from discontinued

operations, basic and diluted | |

| — | | |

| (1.54 | ) | |

| (0.35 | ) | |

| (1.87 | ) |

| Total net loss per share, basic and

diluted | |

$ | (0.38 | ) | |

$ | (2.07 | ) | |

$ | (1.01 | ) | |

$ | (3.25 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding,

basic and diluted | |

| 25,422,032 | | |

| 23,959,726 | | |

| 25,333,137 | | |

| 23,913,050 | |

TABULA RASA HEALTHCARE, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| | |

Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (25,749 | ) | |

$ | (77,803 | ) |

| Adjustments to reconcile net loss to net cash (used in) provided

by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 12,303 | | |

| 18,562 | |

| Amortization of deferred financing costs

and debt discount | |

| 678 | | |

| 939 | |

| Deferred taxes | |

| 127 | | |

| (368 | ) |

| Stock-based compensation | |

| 5,238 | | |

| 15,301 | |

| Change in fair value of contingent consideration

receivable | |

| 3,750 | | |

| — | |

| Impairment charges | |

| 363 | | |

| 40,510 | |

| Net loss on divestiture of businesses | |

| 4,888 | | |

| — | |

| Other noncash items | |

| 292 | | |

| (54 | ) |

| Changes in operating assets and liabilities,

net of effect of divestitures: | |

| | | |

| | |

| Accounts receivable, net | |

| 514 | | |

| 2,979 | |

| Inventories | |

| (2,093 | ) | |

| (354 | ) |

| Prepaid expenses and other current assets | |

| (3,829 | ) | |

| (7,916 | ) |

| Client claims receivables | |

| (38 | ) | |

| (3,162 | ) |

| Other assets | |

| 3 | | |

| (769 | ) |

| Accounts payable | |

| (1,222 | ) | |

| 9,295 | |

| Accrued expenses and other liabilities | |

| 374 | | |

| 9,188 | |

| Client claims payables | |

| 200 | | |

| 353 | |

| Other long-term liabilities | |

| 554 | | |

| 2,139 | |

| Net cash (used in) provided by operating

activities | |

| (3,647 | ) | |

| 8,840 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (1,310 | ) | |

| (471 | ) |

| Software development costs | |

| (7,187 | ) | |

| (17,870 | ) |

| Proceeds from divestiture of businesses | |

| 3,384 | | |

| — | |

| Net cash used in investing activities | |

| (5,113 | ) | |

| (18,341 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from exercise of stock options | |

| 219 | | |

| 60 | |

| Payments for employee taxes for shares withheld | |

| (655 | ) | |

| — | |

| Payments for debt financing costs | |

| — | | |

| (350 | ) |

| Borrowings on line of credit | |

| — | | |

| 27,700 | |

| Net cash (used in) provided by financing

activities | |

| (436 | ) | |

| 27,410 | |

| | |

| | | |

| | |

| Net (decrease) increase in cash, cash equivalents and restricted

cash | |

| (9,196 | ) | |

| 17,909 | |

| Cash, cash equivalents and restricted

cash, beginning of period | |

| 82,407 | | |

| 15,706 | |

| Cash, cash equivalents and restricted

cash, end of period | |

$ | 73,211 | | |

$ | 33,615 | |

TABULA RASA HEALTHCARE, INC.

UNAUDITED RECONCILIATION OF NET LOSS TO ADJUSTED

EBITDA

(In thousands)

| | |

Three

Months Ended June 30, | | |

Six

Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Reconciliation of Net Loss to Adjusted EBITDA from Continuing

Operations | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (9,851 | ) | |

$ | (49,610 | ) | |

$ | (25,749 | ) | |

$ | (77,803 | ) |

| Add: | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| 1,144 | | |

| 2,444 | | |

| 2,409 | | |

| 4,713 | |

| Income tax expense | |

| 133 | | |

| 159 | | |

| 238 | | |

| 375 | |

| Depreciation and amortization | |

| 6,103 | | |

| 5,489 | | |

| 12,303 | | |

| 11,231 | |

| Change in fair value of contingent consideration

receivable | |

| 3,350 | | |

| — | | |

| 3,750 | | |

| — | |

| Impairment charges | |

| — | | |

| — | | |

| — | | |

| 4,062 | |

| Business optimization expense | |

| — | | |

| — | | |

| — | | |

| 787 | |

| Severance costs | |

| 385 | | |

| — | | |

| 776 | | |

| 575 | |

| Executive transition | |

| — | | |

| 150 | | |

| — | | |

| 150 | |

| Divestiture-related expense | |

| 352 | | |

| 1,414 | | |

| 1,368 | | |

| 1,534 | |

| Transformation-related expense | |

| 1,815 | | |

| — | | |

| 1,815 | | |

| — | |

| Stock-based compensation expense | |

| 2,770 | | |

| 5,092 | | |

| 5,200 | | |

| 12,795 | |

| Loss from discontinued

operations | |

| 108 | | |

| 36,919 | | |

| 8,932 | | |

| 44,720 | |

| Adjusted EBITDA from continuing operations | |

$ | 6,309 | | |

$ | 2,057 | | |

$ | 11,042 | | |

$ | 3,139 | |

| Adjusted EBITDA (loss) from discontinued

operations | |

| — | | |

| 1,117 | | |

| (2,676 | ) | |

| 2,557 | |

| Total Adjusted EBITDA | |

$ | 6,309 | | |

$ | 3,174 | | |

$ | 8,366 | | |

$ | 5,696 | |

| | |

Three

Months Ended June 30, | | |

Six

Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Reconciliation of Net Loss from Discontinued Operations,

net of tax to Adjusted EBITDA (Loss) from Discontinued Operations | |

| | | |

| | | |

| | | |

| | |

| Net loss from discontinued operations, net of

tax | |

$ | (108 | ) | |

$ | (36,919 | ) | |

$ | (8,932 | ) | |

$ | (44,720 | ) |

| Add: | |

| | | |

| | | |

| | | |

| | |

| Income tax (benefit) expense | |

| (44 | ) | |

| (686 | ) | |

| 10 | | |

| (568 | ) |

| Depreciation and amortization | |

| — | | |

| — | | |

| — | | |

| 7,331 | |

| Impairment charges | |

| — | | |

| 35,608 | | |

| 363 | | |

| 36,448 | |

| Net loss on divestiture of businesses | |

| 152 | | |

| — | | |

| 4,888 | | |

| — | |

| Severance costs | |

| — | | |

| — | | |

| 957 | | |

| — | |

| Settlement | |

| — | | |

| 1,448 | | |

| — | | |

| 1,448 | |

| Divestiture-related expense | |

| — | | |

| 66 | | |

| — | | |

| 112 | |

| Stock-based compensation

expense | |

| — | | |

| 1,600 | | |

| 38 | | |

| 2,506 | |

| Adjusted EBITDA (loss) from discontinued

operations | |

$ | — | | |

$ | 1,117 | | |

$ | (2,676 | ) | |

$ | 2,557 | |

TABULA RASA HEALTHCARE, INC.

UNAUDITED RECONCILIATION OF STATEMENT OF OPERATIONS

TO NON-GAAP MEASURES

(In thousands)

| | |

Three

Months Ended June 30, 2023 | |

| | |

Cost of

Revenue | | |

Gross

Profit | | |

Gross

Margin

Percentage | | |

Operating

Expenses | | |

Operating

Income

(Loss) | | |

Net

Income

(Loss) | |

| Reconciliation of statement of operations to adjusted

amounts from continuing operations | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Statement of operations amounts | |

$ | 67,507 | | |

$ | 22,529 | | |

| 25.0 | % | |

$ | 31,561 | | |

$ | (9,032 | ) | |

$ | (9,743 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Amortization of acquired intangibles | |

| — | | |

| — | | |

| — | | |

| (1,598 | ) | |

| 1,598 | | |

| 1,598 | |

| Change in fair value of contingent consideration

receivable | |

| — | | |

| — | | |

| — | | |

| (3,350 | ) | |

| 3,350 | | |

| 3,350 | |

| Amortization of debt discount and issuance

costs | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 340 | |

| Severance costs | |

| — | | |

| — | | |

| — | | |

| (385 | ) | |

| 385 | | |

| 385 | |

| Divestiture-related expense | |

| — | | |

| — | | |

| — | | |

| (352 | ) | |

| 352 | | |

| 352 | |

| Transformation-related expense | |

| — | | |

| — | | |

| — | | |

| (1,815 | ) | |

| 1,815 | | |

| 1,815 | |

| Stock-based compensation expense | |

| (505 | ) | |

| 505 | | |

| 0.6 | % | |

| (2,265 | ) | |

| 2,770 | | |

| 2,770 | |

| Impact to income taxes | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (129 | ) |

| Adjusted amounts | |

$ | 67,002 | | |

$ | 23,034 | | |

| 25.6 | % | |

$ | 21,796 | | |

$ | 1,238 | | |

$ | 738 | |

| | |

Three

Months Ended June 30, 2022 | |

| | |

Cost of

Revenue | | |

Gross

Profit | | |

Gross

Margin

Percentage | | |

Operating

Expenses | | |

Operating

Loss | | |

Net Loss | |

| Reconciliation of statement of operations to adjusted

amounts from continuing operations | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Statement of operations amounts | |

$ | 56,631 | | |

$ | 15,966 | | |

| 22.0 | % | |

$ | 26,054 | | |

$ | (10,088 | ) | |

$ | (12,691 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Amortization of acquired intangibles | |

| — | | |

| — | | |

| — | | |

| (1,695 | ) | |

| 1,695 | | |

| 1,695 | |

| Amortization of debt discount and issuance

costs | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 471 | |

| Executive transition | |

| — | | |

| — | | |

| — | | |

| (150 | ) | |

| 150 | | |

| 150 | |

| Divestiture-related expense | |

| — | | |

| — | | |

| — | | |

| (1,414 | ) | |

| 1,414 | | |

| 1,414 | |

| Stock-based compensation expense | |

| (793 | ) | |

| 793 | | |

| 1.1 | % | |

| (4,299 | ) | |

| 5,092 | | |

| 5,092 | |

| Impact to income taxes | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,126 | |

| Adjusted amounts | |

$ | 55,838 | | |

$ | 16,759 | | |

| 23.1 | % | |

$ | 18,496 | | |

$ | (1,737 | ) | |

$ | (2,743 | ) |

| | |

Six Months

Ended June 30, 2023 | |

| | |

Cost of

Revenue | | |

Gross

Profit | | |

Gross

Margin

Percentage | | |

Operating

Expenses | | |

Operating

Income

(Loss) | | |

Net

Income

(Loss) | |

| Reconciliation of statement of operations to adjusted

amounts from continuing operations | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Statement of operations amounts | |

$ | 135,031 | | |

$ | 43,282 | | |

| 24.3 | % | |

$ | 58,470 | | |

$ | (15,188 | ) | |

$ | (16,817 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Amortization of acquired intangibles | |

| — | | |

| — | | |

| — | | |

| (3,197 | ) | |

| 3,197 | | |

| 3,197 | |

| Change in fair value of contingent consideration

receivable | |

| — | | |

| — | | |

| — | | |

| (3,750 | ) | |

| 3,750 | | |

| 3,750 | |

| Amortization of debt discount and issuance

costs | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 678 | |

| Severance costs | |

| — | | |

| — | | |

| — | | |

| (776 | ) | |

| 776 | | |

| 776 | |

| Divestiture-related expense | |

| — | | |

| — | | |

| — | | |

| (1,368 | ) | |

| 1,368 | | |

| 1,368 | |

| Transformation-related expense | |

| — | | |

| — | | |

| — | | |

| (1,815 | ) | |

| 1,815 | | |

| 1,815 | |

| Stock-based compensation expense | |

| (984 | ) | |

| 984 | | |

| 0.5 | % | |

| (4,216 | ) | |

| 5,200 | | |

| 5,200 | |

| Impact to income taxes | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 184 | |

| Adjusted amounts | |

$ | 134,047 | | |

$ | 44,266 | | |

| 24.8 | % | |

$ | 43,348 | | |

$ | 918 | | |

$ | 151 | |

| | |

Six Months

Ended June 30, 2022 | |

| | |

Cost of

Revenue | | |

Gross

Profit | | |

Gross

Margin

Percentage | | |

Operating

Expenses | | |

Operating

Loss | | |

Net Loss | |

| Reconciliation of statement of operations to adjusted

amounts from continuing operations | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Statement of operations amounts | |

$ | 109,352 | | |

$ | 30,355 | | |

| 21.7 | % | |

$ | 58,350 | | |

$ | (27,995 | ) | |

$ | (33,083 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Amortization of acquired intangibles | |

| — | | |

| — | | |

| — | | |

| (3,389 | ) | |

| 3,389 | | |

| 3,389 | |

| Impairment charges | |

| — | | |

| — | | |

| — | | |

| (4,062 | ) | |

| 4,062 | | |

| 4,062 | |

| Amortization of debt discount and issuance

costs | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 939 | |

| Business optimization expense | |

| (433 | ) | |

| 433 | | |

| 0.3 | % | |

| (354 | ) | |

| 787 | | |

| 787 | |

| Severance costs | |

| — | | |

| — | | |

| — | | |

| (575 | ) | |

| 575 | | |

| 575 | |

| Executive transition | |

| — | | |

| — | | |

| — | | |

| (150 | ) | |

| 150 | | |

| 150 | |

| Divestiture-related expense | |

| — | | |

| — | | |

| — | | |

| (1,534 | ) | |

| 1,534 | | |

| 1,534 | |

| Stock-based compensation expense | |

| (1,918 | ) | |

| 1,918 | | |

| 1.4 | % | |

| (10,877 | ) | |

| 12,795 | | |

| 12,795 | |

| Impact to income taxes | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 2,585 | |

| Adjusted amounts | |

$ | 107,001 | | |

$ | 32,706 | | |

| 23.4 | % | |

$ | 37,409 | | |

$ | (4,703 | ) | |

$ | (6,267 | ) |

Contact:

Investors:

Frank Sparacino

fsparacino@trhc.com

Media:

Anthony Mirenda

amirenda@trhc.com

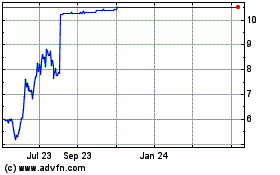

Tabula Rasa HealthCare (NASDAQ:TRHC)

Historical Stock Chart

From Apr 2024 to May 2024

Tabula Rasa HealthCare (NASDAQ:TRHC)

Historical Stock Chart

From May 2023 to May 2024