Trust Stamp (Nasdaq: IDAI), the Privacy-First Identity Company™

providing AI-powered software used globally across multiple

sectors, announced financial results and provided a business update

for the six months ended June 30, 2024. These included a 100%

year-on-year increase in enrolled customers and increases in Net

Revenue for each of the quarter and six-month periods ending June

30, 2024.

Trust Stamp Chief Executive Officer Gareth N.

Genner commented, “I am pleased to report our progress for the six

months ended June 30, 2024. The relationship with our long-term

customers remains very strong, and we anticipate long-term growth

in the revenue derived from those relationships. In parallel, as we

have previously reported, our SaaS offerings via our Orchestration

Layer are an increasingly important part of our product mix. As of

June 30, 2024, we had 62 financial institutions enrolled on our

SaaS Orchestration Layer compared to 31 financial institutions on

June 30, 2023, a 100% increase year on year. The 2023 focus on our

FIS channel partnership was augmented this year by the acclaimed

ThinkTech program operated by The Independent Community Bankers of

America, which resulted in our tailoring some of our product

offerings for the community banking sector, including the launch of

a new wire/transfer authentication product with four new bank

customers identified for the initial pilot.”

Gareth Genner further commented, “One of the

most commonly asked investor questions is how much recurring

revenue we anticipate from each Orchestration Layer user once they

are in full production. This is a challenging question as we still

do not have a large enough sample size to produce a data-driven

estimation, and the range is likely to be significant. Our first

Orchestration Layer customer is in full production and is

consistently generating over $14k of MRR with gross margins of

83.3%. In contrast, our S&P500 bank customer consistently

generates more than $1.2m of ARR with variable but lower gross

margins. We anticipate both the long-term average revenue and the

gross margins from typical Orchestration Layer customers being

closer to the former than the latter.”

“Our net revenue increased from $919 thousand

for the six months ended June 30, 2023, to $1.07 million for the

six months ended June 30, 2024, despite having applied significant

billable resources to unpaid product enhancements for a major

client in order to maximize future revenue potential from that

relationship.”

“One of the benefits of our broad intellectual

property portfolio, microservice architecture, and Orchestration

Layer infrastructure is the ability of our technology to be

deployed in multiple sectors without significant development work

on our part. During the period ending June 30, 2024, we established

new distribution channels for our financial services products with

NayaOne Marketplace and AWS Marketplace. In the case of AWS, their

existing customers can discover, test, contract, and pay for Trust

Stamp technology through their AWS account and receive AWS usage

credit for the services we provide. During this period, we have

also announced deployment with a strategic partner serving the

automotive dealership market and the release of our AI-powered

age-estimation product, which is supported by a newly filed patent

application.”

“Outside of the United States, we have

contracted with Africa’s largest mobile network provider for a

proof of concept deploying our technology for mobile identity

verification for financial transactions, and through our Master

Services Agreement with a branded card network, we are seeing

planned usage expanding to banks in at least two African countries

by the end of 2024. As examples of new market verticals, we have

entered into two partnerships for implementation in the IOT market

with partners in the UK and Denmark, as well as entering into a

go-to-market collaboration for healthcare focused on the UK, US,

and Scandinavian markets.”

“In addition to go-to-market partnerships that

are intended to grow our geographic and vertical markets, we have

been working to license our intellectual property for

productization in different market sectors, and we anticipate

booking significant license fees as “other income” in Q3 of 2024

and continuing to announce innovative and profitable collaborations

for the licensing of our intellectual property thereafter.”

“Selling, general, and administrative expenses increased by $777

thousand, including a $466 thousand impact from the timing of

stock-based compensation awards and a one-time $108 thousand impact

from the reversal of out-of-period costs associated with carrying

mobile hardware assets incurred during the six months ended June

30, 2023. These increases, with other increases in individual

SG&A expenses, were offset by notable reductions in SG&A

for the six months ended June 30, 2024, including a total reduction

of $540 thousand in professional fees, management consulting and

training, and office rent as a direct result of the Company's

ongoing cost-cutting initiatives.”

“On June 30, 2024, we had 22 issued patents and

15 provisional or pending patents compared to 16 issued patents and

15 provisional or pending patents on the same date in 2023. Our

associated Research and Development (“R&D”) expenses decreased

by $190 thousand, or 15.76%, for the six months ended June 30,

2024, compared to the six months ended June 30, 2023, as we

completed transitioning all R&D work internally.”

“Our operating loss for the six months ended

June 30, 2024 was $5.47 million, increasing from $4.96 million for

the six months ended June 30, 2023, with a corresponding increase

in our net loss. This resulted in a basic and net loss of $0.21 per

share for the three months ended June 30, 2024, compared to $0.32

per share for the three months ended June 30, 2023, and $0.47 per

share for the six months ended June 30, 2024, compared to $0.80 per

share for the six months ended June 30, 2023.”

A copy of the Company’s report on Form 10-Q for

the six months ended June 30, 2024 and 2023, has been filed with

the Securities and Exchange Commission and posted on the Company’s

website at https://investors.truststamp.ai/sec-filings/.

Inquiries

Investors:

shareholders@truststamp.ai

About Trust Stamp

Trust Stamp, the Privacy-First Identity Company

™, is a global provider of AI-powered software and data

transformation services for use in multiple sectors, including

banking and finance, regulatory compliance, government, real

estate, communications, and humanitarian services. Trust Stamp is

located across North America, Europe, Asia, and Africa and trades

on the Nasdaq Capital Market (Nasdaq: IDAI).

Safe Harbor Statement: Caution Concerning Forward-Looking

Remarks

All statements in this release that are not based on historical

fact are “forward-looking statements,” including within the meaning

of the Private Securities Litigation Reform Act of 1995 and the

provisions of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. The information in this announcement may contain

forward-looking statements and information related to, among other

things, the Company, its business plan and strategy, and its

industry. These statements reflect management’s current views with

respect to future events-based information currently available and

are subject to risks and uncertainties that could cause the

Company’s actual results to differ materially from those contained

in the forward-looking statements. Investors are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date on which they are made. The Company does

not undertake any obligation to revise or update these

forward-looking statements to reflect events or circumstances after

such date or to reflect the occurrence of unanticipated events.

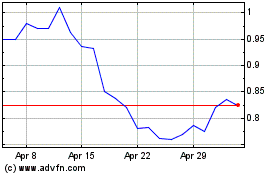

T Stamp (NASDAQ:IDAI)

Historical Stock Chart

From Oct 2024 to Nov 2024

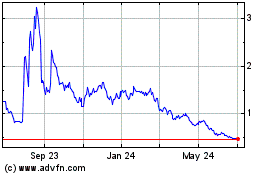

T Stamp (NASDAQ:IDAI)

Historical Stock Chart

From Nov 2023 to Nov 2024