By Jeff Brown

Back in 2008, many investors looking ahead to retirement in two

years had a shock when "target-date funds" designed for them

plummeted in value. Many had assumed those funds, targeted to a

2010 retirement, were safe from large moves that late in the

game.

Despite the jolt to investor confidence, target-date funds have

flourished in the decade since, becoming a staple in workplace

retirement plans such as 401(k)s, as a net $532 billion in investor

money poured in during that time, according to data from the

Investment Company Institute trade group.

Whether that is a good thing remains a matter of debate. Some

financial experts question the value of target-date funds, saying

their one-size-fits-all approach to investing isn't suitable for

every investor. Others say the funds can be a good way to save for

both retirement and college -- as long as investors pay attention

to the products' risk profile, fees and performance, especially as

market conditions change.

Of course, the idea behind target-date funds, or TDFs, is to

make investing as simple as possible by gradually adjusting to a

more conservative investment mix as a target date approaches. As

the default option in many workplace retirement plans, TDFs attract

investors who don't want to choose and rebalance their own

investments and may not be aware that the funds can still own lots

of risky stocks close to and even after the target date

arrives.

"There is a common misconception among many target-date holders

that the portfolio is completely de-risked at retirement, and that

simply isn't true," says Robert R. Johnson, professor of finance at

Creighton University's Heider College of Business in Omaha,

Neb.

Still, to some, the benefits of target funds being the default

option in retirement plans outweigh the negatives." One of the

biggest problems 401(k) participants have had over the years is

when they allocate their own portfolios," says Daniel Milan,

managing partner of Cornerstone Financial Services in Birmingham,

Mich.

A growing business

Introduced in the early 1990s, TDFs are funds that own other

funds. Investors choose a TDF with a date matching their retirement

or the start of a child's college years. (A fund with 2020 in its

name, for example, is geared for someone retiring next year.) For

young investors, the funds emphasize growth by loading up on stock

funds. As the years go by, assets are automatically shifted to

safer fixed-income investments -- in other words, bond funds.

Target funds also rebalance every year to keep the desired

stock-to-bond ratio as markets gyrate, relieving investors of an

important chore many might otherwise neglect.

The idea is to simplify investing. But that doesn't mean

eliminating risk.

"While 2010 target-date funds had been gradually shifting their

allocations toward bonds, as they were designed to do, many were

still holding 50% equity or more when the 2008 financial crisis

hit," says Nicole Tanenbaum, chief investment strategist at

Chequers Financial Management, a financial-planning firm in San

Francisco.

"The funds were down less than the stock market during the

crash, thanks to their bond component, but the performance still

took many retirement-ready individuals by surprise as they watched

their portfolio losses balloon into double-digit territory," she

says.

Despite that disappointment, TDFs' total assets have grown to

$1.10 trillion at year-end 2018 from $158 billion in 2008,

according to ICI and Morningstar Inc. Target-date funds held 21% of

the assets under management in 401(k) plans as of year-end 2016, up

from 5% in 2006, according to the most recent data from the

Employee Benefit Research Institute and ICI.

A big factor in that growth was Obama-era legislation that

encouraged employers to automatically enroll new employees in

retirement plans and use target-date funds as the default for those

who don't choose their own investments. Previously, investors who

were inattentive -- a notorious problem with workplace retirement

plans -- simply accumulated cash, which doesn't provide enough

growth to build a nest egg that will last for decades.

"It's certainly a good thing" to use TDFs as the default, says

Dennis Shirshikov, financial analyst at FitSmallBusiness.com, an

advice service for small-business owners and managers. "This has

brought a great deal of consistency to a retirement portfolio,

especially since most investors with a 401(k) do not manage their

investment actively."

Another factor in TDF growth, Morningstar says, is the growing

popularity of index investing as most TDFs invest in index funds,

rather than actively managed funds. In 2017, 95% of new employee

contributions to TDFs went to one relying on index funds, according

to Morningstar.

Investors can buy target-date funds for their individual

retirement accounts and taxable accounts, as well, and most big

fund companies offer them. The biggest player is Vanguard Group

with about $381 billion in TDF assets in 2017, 34% of the market,

Morningstar says. Fidelity Investments had a 20.5% share, and the

third-biggest player, T. Rowe Price, had a 14.9% share.

The downsides

Retirement experts have mixed views about TDFs' value in a

portfolio. Most say TDFs are better than not investing at all, or

putting retirement savings in cash, but the funds can't take into

account each investor's unique situation. Two investors the same

age would get the same fund, even if they have different needs due

to dependents, availability of other assets, life expectancy and

risk tolerance.

"In an attempt to simplify planning and saving for retirement --

certainly a noble endeavor -- the entire concept of target-date

funds likely is a bridge too far," Prof. Johnson says. "Individuals

are unique, and one parameter, the anticipated retirement date,

cannot and should not dictate the appropriate asset-allocation mix

and the change in that mix over time."

Another concern: The automatic investing strategy ignores

changing conditions. Patrick R. McDowell, investment analyst at

Arbor Wealth Management in Miramar Beach, Fla., says low bond

yields in recent years have reduced TDF income after the target

date, and increased the risk of losses on bondholdings if rates

rise. (Higher rates hurt bond values because investors favor newer

bonds that pay more.)

What's more, he says, stocks and bonds have often moved in

tandem in recent years, reducing the benefit from diversification,

which assumes one asset goes up when the other falls.

Know your rights

Retirement savers who are automatically put into TDFs have the

right to switch to other funds in their retirement plan as they

learn more or conditions change, and Mr. McDowell recommends that

investors get more involved as retirement nears. He says he often

recommends investors nearing retirement leave the target-date fund

and buy a mix of stock and stable-value funds -- which contain

bonds insured against loss and are designed to preserve capital

while generating returns similar to a fixed-income investment -- to

reduce danger from a potential market plunge.

"In that strategy, a big drop in equity and fixed-income prices

won't hurt a soon-to-be retiree in the same way it would in a TDF

strategy," he says. "It also helps investors defend against a

rising interest-rate scenario" harmful to bonds.

Experts say TDF investors should keep abreast of performance and

not just assume they are on track to a comfortable retirement.

Morningstar provides data on average performance by target date, as

well as details on individual funds.

The 2050 funds, for today's 30-somethings planning to retire

that year, averaged annual returns of 7.12% over the five years

ended April 26, for example. That trails the nearly 12% return of

the typical S&P 500 index fund, but the TDF is considered to be

safer because it has 10% in bonds.

A Morningstar analysis found that in the 15 years through 2017,

funds with a 2020 target date lost less than the S&P 500 in 87%

of the quarters that the index fell. In an up market, however, a

diversified fund like a TDF will always do worse than the hottest

asset it owns because its other holdings won't do as well. It is

the price paid for taking less risk.

Experts say investors are wise to compare fees, which can vary

considerably.

"Any fund of funds adds one more layer of fees," says Nathan

Yates, adjunct professor of economics and finance at the College of

Online and Continuing Education at Southern New Hampshire

University in Manchester. He notes, though, that TDFs don't charge

for annual rebalancing that could involve commissions for investors

who manage their own portfolios.

Advisers also urge investors to examine the TDF's "glide path"

-- its investing policy for shifting from stocks to bonds over time

-- and pick one that suits their willingness to take risk. Some

fund companies provide more than one glide path to the same date,

ranging from aggressive paths that rely more on stocks to

conservative ones heavier on bonds.

"To" funds are designed to hit their final mix at the target

date, often with little or nothing in stocks. They work best for

investors who want safety because they expect to cash out or switch

to another investment at the target date.

"Through" funds are meant to be held throughout a long

retirement and typically hold more stocks at the target date. That

offers more growth to offset inflation and withdrawals, but also

more risk.

Simple, but...

Experts say TDFs can be a good starting point for inexperienced

investors, though they shouldn't assume a given fund will work well

in all conditions forever.

"A target-date fund can be a very useful retirement tool for

individual investors, as there is elegance in its simplicity," Ms.

Tanenbaum of Chequers Financial Management says.

"However, it is crucial for investors to understand how a

particular fund is designed to shift over time and make sure it

carries the appropriate risk profile, so there are no unwelcome

surprises down the road."

Mr. Brown is a writer in Livingston, Mont. He can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

May 05, 2019 22:23 ET (02:23 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

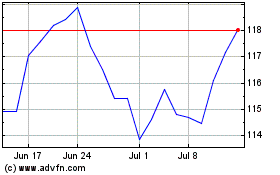

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Aug 2024 to Sep 2024

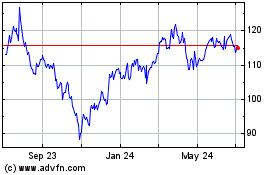

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Sep 2023 to Sep 2024