Current Report Filing (8-k)

May 16 2022 - 6:44AM

Edgar (US Regulatory)

false 0001760173 --12-31 0001760173 2022-05-16 2022-05-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 16, 2022

SURGALIGN HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-38832 |

|

83-2540607 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 520 Lake Cook Road, Suite 315, Deerfield, Illinois |

|

60015 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (877) 343-6832

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of exchange on which registered |

| common stock, $0.001 par value |

|

SRGA |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 3.03 |

Material Modification to Rights of Security Holders. |

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

As previously disclosed, Josh DeRienzis resigned as Chief Legal Officer and Corporate Secretary of Surgalign Holdings, Inc. and its subsidiaries (the “Company”) effective as of the close of business on May 10, 2022. Mr. DeRienzis agreed to continue to provide legal advisory services to the Company as a non-executive at-will employee until June 10, 2022.

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws. |

On May 10, 2022, the stockholders of the Company approved the proposal to authorize the Company’s Board of Directors (the “Board”) to amend the Company’s Amended and Restated Certificate of Incorporation to affect a reverse stock split of the Company’s common stock, at a ratio of 1-for-15, 1-for-20 or 1-for-30, such ratio to be determined by the Board of Directors (the “Reverse Stock Split”). On May 11, 2022, the Board adopted resolutions approving the Reverse Stock Split at a ratio of 1-for-30 and authorized the Chief Executive Officer and the Chief Financial Officer (the “Proper Officers”) of the Company to file a Certificate of Amendment (the “Certificate of Amendment”) with the Secretary of State of the State of Delaware to amend the Company’s Amended and Restated Certificate of Incorporation, as amended, to effect the Reverse Stock Split at a date determined by the Proper Officers as appropriate and necessary. The Certificate of Amendment was filed by the Company on May 13, 2022 and the Reverse Stock Split became effective as of the effective date of the Certificate of Amendment, May 16, 2022.

As a result of the Reverse Stock Split, every thirty (30) shares of the Company’s common stock issued or outstanding or held by the Company as treasury stock will be automatically reclassified into one new share of common stock without any action on the part of the holders. The Reverse Stock Split does not modify any rights or preferences of the shares of the Company’s common stock. Proportionate adjustments will be made to the exercise prices and the number of shares underlying the Company’s outstanding equity awards, as applicable, and warrants, as well as to the number of shares issued and issuable under the Company’s equity incentive plans. The common stock issued pursuant to the Reverse Stock Split remain fully paid and non-assessable. The Reverse Stock Split did not affect the number of authorized shares of common stock or the par value of the common stock.

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders who would otherwise be entitled to receive fractional shares as a result of the Reverse Stock Split will be entitled to a cash payment in lieu thereof at a price equal to the fraction to which the stockholder would otherwise be entitled multiplied by the closing trading price per share of the common stock (as adjusted for the Reverse Stock Split) on the Nasdaq Global Select Market on the trading day immediately preceding the effective time of the Reverse Stock Split.

The Reverse Stock Split is primarily intended to bring the Company into compliance with the minimum bid price requirements for maintaining its listing on the Nasdaq Global Select Market. Trading of the Company’s common stock on the Nasdaq Global Select Market is expected to continue on a split-adjusted basis when the markets open on May 17, 2022, under the existing trading symbol “SRGA”. The new CUSIP number following the Reverse Stock Split is 86882C 204. The foregoing description of the Certificate of Amendment is qualified in its entirety by reference to the Certificate of Amendment, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On May 16, 2022, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

SURGALIGN HOLDINGS, INC. |

|

|

|

|

| Date: May 16, 2022 |

|

|

|

By: |

|

/s/ David B. Lyle |

|

|

|

|

Name: |

|

David B. Lyle |

|

|

|

|

Title: |

|

Chief Financial Officer |

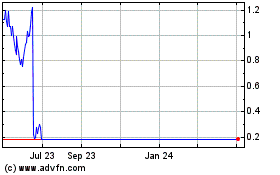

Surgalign (NASDAQ:SRGA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Surgalign (NASDAQ:SRGA)

Historical Stock Chart

From Sep 2023 to Sep 2024