false

0001499717

0001499717

2025-01-15

2025-01-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

January

15, 2025

Date

of Report (Date of earliest event reported)

STAFFING

360 SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37575 |

|

68-0680859 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

| 757

Third Avenue |

|

|

| 27th

Floor |

|

|

| New

York, NY |

|

10017 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(646)

507-5710

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock |

|

STAF |

|

NASDAQ |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

Amendment

No. 37 to Credit and Security Agreement with MidCap

On

January 15, 2025, Staffing 360 Solutions, Inc. (the “Company”) entered into Amendment No. 37 to Credit and

Security Agreement and Limited Waiver (“Amendment No. 37”), effective as of January 10, 2025, by and among

the Company, as Parent, Monroe Staffing Services, LLC, a Delaware limited liability company, Faro Recruitment America, Inc., a New York

corporation, Lighthouse Placement Services, Inc., a Massachusetts corporation, Key Resources, Inc., a North Carolina Corporation, Headway

Workforce Solutions, Inc., a Delaware corporation, Headway Employer Services LLC, a Delaware limited liability company, Headway Payroll

Solutions, LLC, a Delaware limited liability company, Headway HR Solutions, Inc., a New York corporation, and NC PEO Holdings, LLC, a

Delaware limited liability company, collectively, as borrowers (collectively, the “Borrowers”), and MidCap

Funding IV Trust, as agent for the lenders (as successor by assignment to MidCap Funding X Trust, “MidCap”)

and the lenders party thereto from time to time (the “Lenders”), which such Amendment No. 37 amends that certain

Credit and Security Agreement, dated as of April 8, 2015 (as amended and restated, supplemented, or otherwise modified from time to time,

the “Credit and Security Agreement”), by and among the Company, the Borrowers, MidCap and the Lenders. Pursuant

to Amendment No. 37, the Commitment Expiry Date (as defined in the Credit and Security Agreement) is extended to February 1, 2025.

Third

Omnibus Amendment and Reaffirmation Agreement to the Note Documents with Jackson Investment Group, LLC

On

January 15, 2025, the Company entered into that certain Third Omnibus Amendment and Reaffirmation Agreement to the Note Documents (the

“Amendment Agreement”) with Jackson Investment Group, LLC (“Jackson”) and the guarantors

party thereto, which such Amendment Agreement, among other things: (i) extends the maturity date of that certain Third Amended and Restated

Note and Warrant Purchase Agreement, by and between the Company and Jackson, dated as of October 27, 2022, as amended by the First Omnibus

Amendment and Reaffirmation Agreement to the Note Documents, dated as of August 30, 2023, and the Second Omnibus Amendment and Reaffirmation

Agreement to the Note Documents, dated as of September 18, 2024, to the earlier of (a) February 15, 2025, or (b) the date of the acceleration

of the maturity of any of the Notes (as defined below) and (ii) extends the maturity date of that certain (a) Third Amended and Restated

12% Senior Secured Note due October 14, 2024, dated as of October 27, 2022 (the “Third Amended and Restated Note”),

and (b) 12% Senior Secured Promissory Note due October 14, 2024, dated as of August 30, 2023 (the “August 2023 Senior Note”

and together with the Third Amended and Restated Note, the “Notes”), to February 15, 2025.

The

foregoing descriptions of Amendment No. 37 and the Amendment Agreement do not purport to be complete and are qualified in their entirety

by reference to the full text of the Amendment No. 37 and the Amendment Agreement, copies of which are attached hereto as Exhibit 10.1

and Exhibit 10.2, respectively, and incorporated herein by reference.

Limited

Consents to Intercreditor Agreement

On

January 15, 2025, in connection with Amendment No. 37, the Company entered into a Limited Consent (the “Limited Consent”)

to the Intercreditor Agreement, dated as of September 15, 2017, as amended, by and between the Company and Jackson, which such Limited

Consent permits the Company’s entry into Amendment No. 37.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

January 17, 2025 |

STAFFING

360 SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

|

Brendan

Flood |

| |

|

Chairman

and Chief Executive Officer |

Exhibit

10.1

AMENDMENT

NO. 37 TO

CREDIT

AND SECURITY AGREEMENT

THIS

AMENDMENT NO. 37 TO CREDIT AND SECURITY AGREEMENT (this “Amendment”) is made as of the 15 day of January, 2025,

and effective nunc pro tunc as of January 10, 2025, by and among MONROE STAFFING SERVICES, LLC, a Delaware limited liability

company, FARO RECRUITMENT AMERICA, INC., a New York corporation, LIGHTHOUSE PLACEMENT SERVICES, INC., a Massachusetts corporation,

KEY RESOURCES, INC., a North Carolina corporation, HEADWAY WORKFORCE SOLUTIONS, INC., a Delaware corporation, HEADWAY

EMPLOYER SERVICES LLC, a Delaware limited liability company, HEADWAY PAYROLL SOLUTIONS, LLC, a Delaware limited liability

company, HEADWAY HR SOLUTIONS, INC., a New York corporation, and NC PEO HOLDINGS, LLC, a Delaware limited liability company

(each of the foregoing Persons being referred to herein individually as a “Borrower”, and collectively as “Borrowers”),

STAFFING 360 SOLUTIONS, INC., a Delaware corporation (as “Parent”), and MIDCAP FUNDING IV TRUST, a Delaware

statutory trust, as successor-by-assignment to MidCap Funding X Trust (as Agent for Lenders, “Agent”, and individually,

as a Lender), and the other financial institutions or other entities from time to time parties to the Credit Agreement referenced below,

each as a Lender.

RECITALS

A.

Borrowers, Agent and Lenders are party to that certain Credit and Security Agreement dated as of April 8, 2015 (as amended by that certain

Amendment No. 1 and Joinder Agreement to Credit and Security Agreement dated as of July 13, 2015, by that certain Amendment No. 2 to

Credit and Security Agreement dated as of August 31, 2015, by that certain Overadvance Letter dated October 9, 2015, by that certain

Overadvance Letter dated as of November 20, 2015, by that certain Overadvance Letter dated as of February 8, 2016, by that certain Amendment

No. 3 to Credit and Security Agreement and Limited Waiver dated as of February 8, 2016, by that certain Amendment No. 4 and Joinder Agreement

to Credit and Security Agreement dated as of July 11, 2016, by that certain Amendment No. 5 to Credit and Security Agreement dated as

of September 26, 2016, by that certain Amendment No. 6 to Credit and Security Agreement and Limited Consent dated as of January 26, 2017,

by that certain Amendment No. 7 to Credit and Security Agreement and Limited Consent dated as of June 5, 2017, by that certain Amendment

No. 8 and Joinder Agreement to Credit and Security Agreement and Limited Consent dated as of September 15, 2017, by that certain Amendment

No. 9 to Credit and Security Agreement and Limited Consent dated as of June 6, 2018, by that certain Amendment No. 10 and Joinder Agreement

to Credit and Security Agreement and Limited Consent dated as of August 27, 2018, by that certain Overadvance Letter dated as of January

3, 2019, by that certain Amendment No. 11 to Credit and Security Agreement dated as of February 7, 2019, by that certain Overadvance

Letter dated as of April 1, 2019, by that certain Amendment No. 12 to Credit and Security Agreement dated as of April 1, 2019, by that

certain Overadvance Letter dated as of July 15, 2019, by that certain Amendment No. 13 to Credit and Security Agreement dated as of August

2, 2019, by that certain Amendment No. 14 dated as of August 8, 2020, by that certain Amendment No. 15 dated as of September 7, 2020,

by that certain Amendment No. 16 dated as of October 7, 2020, by that certain Amendment No. 18 to Credit and Security Agreement dated

as of February 8, 2021, by that certain Amendment No. 19 to Credit and Security Agreement dated as of December 23, 2021, by that certain

Amendment No. 20 to Credit and Security Agreement and Limited Consent dated as of April 18, 2022, by that certain Amendment No. 21 to

Credit and Security Agreement and Limited Consent dated as of August 30, 2022, by that certain Amendment No. 22 to Credit and Security

Agreement dated as of September 15, 2022, by that certain Amendment No. 23 to Credit and Security Agreement dated as of September 26,

2022, by that certain Amendment No. 24 to Credit and Security Agreement dated as of September 29, 2022, by that certain Amendment No.

25 to Credit and Security Agreement dated as of October 13, 2022, by that certain Amendment No. 26 to Credit and Security Agreement dated

as of October 20, 2022, by that certain Amendment No. 27 and Joinder Agreement to Credit and Security Agreement dated as of October 27,

2022, by that certain Amendment No. 28 to Credit and Security Agreement and Limited Waiver dated as of August 30, 2023, by that certain

Amendment No. 29 to Credit and Security Agreement dated as of July 18, 2024, by that certain Amendment No. 30 to Credit and Security

Agreement dated as of September 11, 2024, by that certain Amendment No. 31 to Credit and Security Agreement dated as of October 9, 2024,

by that certain Amendment No. 32 to Credit and Security Agreement dated as of December 9, 2024, by that certain Amendment No. 33 to Credit

and Security Agreement dated as of December 13, 2024, by that certain Amendment No. 34 to Credit and Security Agreement dated as of December

24, 2024, by that certain Amendment No. 35 to Credit and Security Agreement dated as of January 2, 2025, and by that certain Amendment

No. 36 to Credit and Security Agreement dated as of January 8, 2025 (as so amended, the “Existing Credit Agreement”,

and as amended hereby and as it may be further amended, modified, supplemented and/or restated from time to time, the “Credit

Agreement”)). Capitalized terms used but not otherwise defined in this Amendment shall have the meanings set forth in the Credit

Agreement.

B.

Borrowers have requested that the Agent and the Lenders have agreed to amend the Existing Credit Agreement to extend the Commitment Expiry

Date.

C.

Borrowers, Agent and Lenders have agreed to amend the Credit Agreement as set forth herein.

AGREEMENT

NOW,

THEREFORE, in consideration of the foregoing, the terms and conditions set forth in this Amendment, and other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, Agent, Lenders, Parent and Borrowers hereby agree as follows:

1.

Recitals. This Amendment shall constitute a Financing Document and the Recitals set forth above shall be construed as part

of this Amendment as if set forth fully in the body of this Amendment.

2.

Amendments to Existing Credit Agreement.

(a)

Section 1.1 (Defined Terms). The definition of “Commitment Expiry Date” in Section 1.1 of the Credit Agreement is

hereby amended and restated to read as follows:

“Commitment

Expiry Date” means February 1, 2025.

3.

Confirmation of Representations and Warranties; Reaffirmation of Security Interest.

(a)

Each Borrower hereby confirms that all of the representations and warranties set forth in Article 3 of the Credit Agreement are true

and correct in all material respects with respect to such Borrower as of the date hereof, except to the extent such representations and

warranties specifically relate to an earlier date, and covenants to perform its respective obligations under the Credit Agreement. To

induce Agent and Lender to enter into this Agreement, Borrowers and Parent further represent and warrant that:

(i)

no Default or Event of Default has occurred or is continuing as of the date hereof (excluding those certain Events of Default set forth

in the Reservation of Rights Letters (as defined below)), which has not been waived in writing by the Agent;

(ii)

as of the date hereof and, immediately after giving effect to this Amendment and the transactions contemplated hereby, the representations

and warranties of Borrowers contained in the Financing Documents are true and correct in all material respects (or if any representation

or warranty is qualified with respect to materiality, in all respects) on and as of the date hereof to the same extent as though made

on and as of such date except to the extent such representations and warranties specifically relate to an earlier date; and

(iii)

the execution, delivery and performance by Borrowers and Parent of this Amendment are within each of its corporate powers and have been

duly authorized by all necessary corporate action, and this Amendment is the legal, valid and binding obligation of Borrowers and Parent

enforceable against Borrowers and Parent in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency

or other similar laws relating to the enforcement of creditors’ rights generally and by equitable principles, and neither the execution,

delivery or performance by Borrowers and Parent of this Agreement (A) violates any Law, or any other rule or decree of any Governmental

Authority, (B) conflicts with or results in the breach or termination of, constitutes a default under or accelerates any performance

required by, any indenture, mortgage, deed of trust, lease, agreement or other instrument to which Borrowers or Parent is a party or

by which Borrowers or Parent or any of its property is bound, except for such conflicts, breaches, terminations, defaults or accelerations

that would not reasonably be expected to have a Material Adverse Effect, (C) results in the creation or imposition of any Lien upon any

of the Collateral, (D) violates or conflicts with the by-laws or other organizational documents of Borrowers and Parent, or (E) requires

the consent, approval or authorization of, or declaration or filing with, any other Person, except for those already duly obtained.

(b)

Each Borrower and Parent confirms and agrees that all security interests and Liens granted to Agent continue in full force and effect,

and all Collateral remains free and clear of any Liens, other than those granted to Agent and Permitted Liens. Nothing herein is intended

to impair or limit the validity, priority or extent of Agent’s security interests in and Liens on the Collateral. For the avoidance

of any doubt, the Collateral secures repayment of the Obligations and the Affiliated Obligations, and in furtherance thereof, Borrowers

and Parent hereby reaffirm the grant to Agent, for the benefit of itself and Lenders, of a continuing first priority Lien (subject to

Permitted Liens) on and security interest in all of the Collateral as security for the payment and performance of the Obligations, and

for the payment and performance of all obligations under the Affiliated Financing Documents.

4.

Enforceability. This Amendment constitutes the legal, valid and binding obligation of each Borrower and Parent, and is enforceable

against each Borrower and Parent in accordance with its terms, except as the enforceability thereof may be limited by bankruptcy, insolvency

or other similar laws relating to the enforcement of creditors’ rights generally and by general equitable principles.

5.

Costs and Fees. Borrowers shall be responsible for the payment of all reasonable costs and fees of Agent’s counsel incurred

in connection with the preparation of this Amendment and any related documents. If Agent or any Lender uses in-house counsel for any

of these purposes, Borrowers further agree that the Obligations include reasonable charges for such work commensurate with the fees that

would otherwise be charged by outside legal counsel selected by Agent or such Lender for the work performed. Borrowers hereby authorize

Agent to deduct all of such fees set forth in this Section 5 from the proceeds of one or more Revolving Loans made under the Credit Agreement.

6.

Reaffirmation of Security Interest. Each of the Borrowers and Parent confirms and agrees that: (i) all security interests

and liens granted to Agent continue in full force and effect, and (ii) all Collateral remains free and clear of any liens other than

liens in favor of Agent and Permitted Encumbrances. Nothing herein contained is intended to impair or limit the validity, priority and

extent of Agent’s security interest in and liens upon the Collateral.

7.

Conditions to Effectiveness. This Amendment shall become effective nunc pro tunc as of January 10, 2025 upon the satisfaction

of each of the following conditions (the “Effective Date”):

(a)

Amendment. Borrowers and Parent shall have delivered to Agent this Amendment, duly executed by an authorized officer of each Credit

Party;

(b)

Representations and Warranties. All representations and warranties of Borrowers contained herein shall be true and correct in

all material respects as of the date hereof except to the extent such representations and warranties specifically relate to an earlier

date (and such parties’ delivery of their respective signatures hereto shall be deemed to be their certification thereof);

(c)

JIG Consent. Agent shall have received a duly executed copy of the [Limited Consent to Intercreditor Agreement by JIG];

(d)

JIG Extension. Agent shall have received a duly executed copy of an amendment to the JIG Note Purchase Agreement (and any other

related documents or notes as necessary) in form and substance satisfactory to Agent, which extends the scheduled maturity of the Term

Debt (as defined in the Intercreditor Agreement) to a date acceptable to Agent; and

(e)

Fees and Expenses. Agent shall have received from Borrowers of all of the fees owing pursuant to this Amendment and Agent’s

reasonable out-of-pocket legal fees and expenses.

8.

Release. Each Borrower, voluntarily, knowingly, unconditionally and irrevocably, with specific and express intent, for and

on behalf of itself and all of its respective parents, subsidiaries, affiliates, members, managers, predecessors, successors, and assigns,

and each of their respective current and former directors, officers, shareholders, agents, and employees (collectively, “Releasing

Parties”), does hereby fully and completely release, acquit and forever discharge each Indemnitee (as defined in the Credit

Agreement) of and from any and all actions, causes of action, suits, debts, disputes, damages, claims, obligations, liabilities, costs,

expenses and demands of any kind whatsoever, at law or in equity, whether matured or unmatured, liquidated or unliquidated, vested or

contingent, choate or inchoate, known or unknown that the Releasing Parties (or any of them) has against the Indemnitees (or any of them),

that directly or indirectly arise out of, are based upon or are in any manner connected with any Prior Related Event. “Prior

Related Event” means any transaction, event, circumstance, action, failure to act, occurrence of any type or sort, whether

known or unknown, which occurred, existed, was taken, was permitted or begun in accordance with, pursuant to or by virtue of (a) any

of the terms of this Amendment or any other Financing Document, (b) any actions, transactions, matters or circumstances related hereto

or thereto, (c) the conduct of the relationship between any Indemnitee and any Borrower, or (d) any other actions or inactions by any

Indemnitee, all on or prior to the date hereof. Each Borrower acknowledges that the foregoing release is a material inducement to Agent’s

and Lender’s decision to enter into this Amendment and to agree to the modifications contemplated hereunder.

9.

No Waiver or Novation. The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right,

power or remedy of Agent, nor constitute a waiver of any provision of the Credit Agreement, the Financing Documents or any other documents,

instruments and agreements executed or delivered in connection with any of the foregoing. Nothing herein is intended or shall be construed

as a waiver of any existing Defaults or Events of Default under the Credit Agreement or other Financing Documents or any of Agent’s

rights and remedies in respect of such Defaults or Events of Default. This Amendment (together with any other document executed in connection

herewith) is not intended to be, nor shall it be construed as, a novation of the Credit Agreement. For the avoidance of doubt, nothing

herein shall operate as a waiver of any right, power or remedy of Agent or any Lender (including, without limitation, the right to implement

additional reserves and/or adjustments, and/or increase existing reserves and/or adjustments to the Borrowing Base), nor constitute a

waiver or other modification of any provision set forth in the Reservation of Rights Letter, dated April 12, 2024, the Post-Default Advance

Letter, dated April 16, 2024, or the Reservation of Rights Letter, dated October 18, 2024, each of which shall remain in full force and

effect (collectively, the “Reservation of Rights Letters”).

10.

Affirmation. Except as specifically amended pursuant to the terms hereof, the Credit Agreement and all other Financing Documents

(and all covenants, terms, conditions and agreements therein) shall remain in full force and effect, and are hereby ratified and confirmed

in all respects by Borrowers. Each Borrower covenants and agrees to comply with all of the terms, covenants and conditions of the Credit

Agreement (as amended hereby) and the Financing Documents, notwithstanding any prior course of conduct, waivers, releases or other actions

or inactions on Agent’s or any Lender’s part which might otherwise constitute or be construed as a waiver of or amendment

to such terms, covenants and conditions.

11.

Miscellaneous.

(a)

Reference to the Effect on the Credit Agreement. Upon the effectiveness of this Amendment, each reference in the Credit Agreement

to “this Agreement,” “hereunder,” “hereof,” “herein,” or words of similar import shall

mean and be a reference to the Credit Agreement, as amended by this Amendment. Except as specifically amended above, the Credit Agreement,

and all other Financing Documents (and all covenants, terms, conditions and agreements therein), shall remain in full force and effect,

and are hereby ratified and confirmed in all respects by Borrowers.

(b)

Incorporation of Credit Agreement Provisions. The provisions contained in Section 11.6 (Indemnification), Section 12.8 (Governing

Law; Submission to Jurisdiction) and Section 12.9 (Waiver of Jury Trial) of the Credit Agreement are incorporated herein by reference

to the same extent as if reproduced herein in their entirety.

(c)

Headings. Section headings in this Amendment are included for convenience of reference only and shall not constitute a part of

this Amendment for any other purpose.

(d)

Counterparts. This Amendment may be signed in any number of counterparts, each of which shall be an original, with the same effect

as if the signatures thereto and hereto were upon the same instrument. Signatures by facsimile or by electronic mail delivery of an electronic

version (e.g., .pdf or .tif file) of an executed signature page shall be treated as delivery of an original and shall bind the parties

hereto. This Amendment constitutes the entire agreement and understanding among the parties hereto and supersede any and all prior agreements

and understandings, oral or written, relating to the subject matter hereof.

[SIGNATURES

APPEAR ON FOLLOWING PAGES]

IN

WITNESS WHEREOF, intending to be legally bound, and intending that this document constitute an agreement executed under seal, the

undersigned have executed this Amendment under seal as of the day and year first hereinabove set forth.

| AGENT: |

MIDCAP FUNDING IV TRUST |

| |

|

|

| |

By: |

Apollo Capital Management, L.P., |

| |

|

its investment manager |

| |

|

|

| |

By: |

Apollo Capital Management GP, LLC, |

| |

|

its general partner |

| |

By: |

/s/ Maurice Amsellem |

(SEAL) |

| |

Name: |

Maurice Amsellem |

| |

Title: |

Authorized Signatory |

| LENDER: |

MIDCAP FUNDING IV TRUST |

| |

|

|

| |

By: |

Apollo Capital Management, L.P., |

| |

|

its investment manager |

| |

|

|

| |

By: |

Apollo Capital Management GP, LLC, |

| |

|

its general partner |

| |

By: |

/s/ Maurice Amsellem |

(SEAL) |

| |

Name: |

Maurice Amsellem |

| |

Title: |

Authorized Signatory |

Signature

Page to

Amendment

No. 37 to Credit and Security Agreement

| BORROWERS: |

MONROE STAFFING SERVICES, LLC, |

| |

a Delaware limited liability company |

| |

|

|

| |

By: |

/s/ Brendan Flood |

(Seal) |

| |

Name: |

Brendan Flood |

| |

Title: |

Chairman and Chief Executive Officer |

| LIGHTHOUSE PLACEMENT |

|

FARO RECRUITMENT AMERICA, INC., |

| SERVICES, INC., a Massachusetts

corporation |

|

a New York corporation |

| |

|

|

| By: |

/s/ Brendan Flood |

(Seal) |

|

By: |

/s/ Brendan Flood |

(Seal) |

| Name: |

Brendan Flood |

|

Name: |

Brendan Flood |

| Title: |

Chief Executive Officer |

|

Title: |

Chief Executive Officer |

| HEADWAY WORKFORCE |

|

KEY RESOURCES, INC., |

| SOLUTIONS, INC., a Delaware corporation |

|

a North Carolina corporation |

| |

|

|

| By: |

/s/Brendan

Flood |

(Seal) |

|

By: |

/s/ Brendan

Flood |

(Seal) |

| Name: |

Brendan Flood |

|

Name: |

Brendan Flood |

| Title: |

Chief Executive Officer |

|

Title: |

Chief Executive Officer |

| HEADWAY PAYROLL SOLUTIONS, |

|

HEADWAY EMPLOYER SERVICES LLC, a |

| LLC, a Delaware limited liability

company |

|

Delaware limited liability company |

| |

|

|

|

|

| By: |

/s/ Brendan Flood |

(Seal) |

|

By: |

/s/ Brendan Flood |

(Seal) |

| Name: |

Brendan Flood |

|

Name: |

Brendan Flood |

| Title: |

Chief Executive Officer |

|

Title: |

Chief Executive Officer |

Signature

Page to

Amendment

No. 37 to Credit and Security Agreement

| HEADWAY HR SOLUTIONS, INC., a |

|

NC PEO HOLDINGS, LLC, a Delaware

limited |

| New York corporation |

|

liability company |

| |

|

|

|

|

| By: |

/s/ Brendan

Flood |

(Seal) |

|

By: |

/s/ Brendan

Flood |

(Seal) |

| Name: |

Brendan Flood |

|

Name: |

Brendan Flood |

| Title: |

Chief Executive Officer |

|

Title: |

Chief Executive Officer |

| PARENT: |

STAFFING 360 SOLUTIONS, INC., |

| |

a Delaware corporation |

| |

|

|

| |

By: |

/s/ Brendan

Flood |

(Seal) |

| |

Name: |

Brendan Flood |

| |

Title: |

Chief Executive Officer |

Signature

Page to

Amendment

No. 37 to Credit and Security Agreement

Exhibit

10.2

THIRD

OMNIBUS AMENDMENT AND REAFFIRMATION AGREEMENT TO THE NOTE DOCUMENTS

THIS

THIRD OMNIBUS AMENDMENT AND REAFFIRMATION AGREEMENT TO THE NOTE DOCUMENTS (this “Agreement”), dated as of January

15, 2025 is by and among Staffing 360 Solutions, Inc., a Delaware corporation (the “Company”), Faro Recruitment

America, Inc., a New York corporation (“Faro”), Monroe Staffing Services, LLC, a Delaware limited liability

company (“Monroe”), Lighthouse Placement Services, Inc., a Massachusetts corporation (“Lighthouse”),

Key Resources, Inc., a North Carolina corporation (“Key”), Headway Workforce Solutions, Inc., a Delaware corporation

(“Headway Workforce”), Headway Employer Services, LLC, a Delaware limited liability company (“Headway

Employer”), Headway HR Solutions, Inc., a New York corporation (“Headway HR”), and NC PEO Holdings,

LLC, a Delaware limited liability company (“NC PEO” and together with Faro, Monroe, Lighthouse, Key, Headway

Workforce, Headway Employer and Headway HR, collectively the “Guarantors” and the Guarantors, collectively

with Company, the “Obligors”) and Jackson Investment Group, LLC (the “Purchaser”).

WHEREAS,

pursuant to that certain Third Amended and Restated Note and Warrant Purchase Agreement, dated as of October 27, 2022 (as amended, restated,

supplemented or otherwise modified from time to time prior to the date hereof, the “Existing Purchase Agreement”

and the Existing Purchase Agreement, as amended by this Agreement, the “Purchase Agreement”), by and among

the Obligors and Purchaser, Purchaser agreed to make extensions of credit and other financial accommodations to the Obligors;

WHEREAS,

the Obligations of the Obligors under the Existing Purchase Agreement are further evidenced by that certain (1) Third Amended and Restated

12% Senior Secured Note due October 14, 2024, dated as of October 27, 2022 (as amended, restated, supplemented or otherwise modified

from time to time prior to the date hereof, the “Third Amended and Restated Note”), made and executed by Company

in favor of Purchaser and (2) 12% Senior Secured Promissory Note due October 14, 2023, dated as of August 30, 2023 (as amended, restated,

supplemented or otherwise modified from time to time prior to the date hereof, the “August 2023 Senior Note”;

together with the Third Amended and Restated Note, the “Notes”), made and executed by Company in favor of Purchaser;

WHEREAS,

the Obligations of the Obligors were secured by, among other things, liens, security interests and other encumbrances pursuant to (1)

that certain Amended and Restated Security Agreement, dated as of September 15, 2017 (as amended, restated, supplemented or otherwise

modified from time to time prior to the date hereof, the “Existing Security Agreement” and the Existing Security

Agreement, as amended by this Agreement, the “Security Agreement”), by and among the Obligors and Purchaser,

and (2) that certain Amended and Restated Pledge Agreement, dated as of September 15, 2017 (as amended, restated, supplemented or otherwise

modified from time to time, the “Existing Pledge Agreement” and the Existing Pledge Agreement, as amended by

this Agreement, the “Pledge Agreement”), by and among the Obligors and Purchaser;

WHEREAS,

the Company has requested that the Purchaser make certain amendments to the Purchase Agreement and the Notes and, subject to the terms

and conditions set forth herein, the Purchaser has agreed to such amendments on the terms set forth herein;

NOW

THEREFORE, in consideration of the foregoing and the mutual covenants herein contained, and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1.

Defined Terms. All capitalized terms used but not otherwise defined herein shall have the meanings assigned thereto in the Purchase

Agreement.

2.

Amendments to the Existing Purchase Agreement. Subject to the satisfaction (or waiver in writing by Purchaser) of the conditions

precedent set forth in Section 6 hereof, on the Third Omnibus Amendment Effective Date:

(a)

Section 1.1 of the Existing Purchase Agreement is hereby amended as of, from and subsequent to the Third Omnibus Amendment Effective

Date to amend and restate the following defined term in its entirety with the applicable definitions set forth below:

“Maturity

Date” means the earlier of (a) February 15, 2025, or (b) the date of acceleration of the maturity of any of the Senior Notes

pursuant to Section 9.2 hereof.

(b)

Section 1.1 of the Existing Purchase Agreement is hereby amended as of, from and subsequent to the Third Omnibus Amendment Effective

Date by adding the following new definitions in appropriate alphabetical order:

“Third

Omnibus Amendment Agreement” means that certain Third Omnibus Amendment and Reaffirmation Agreement to the Note Documents,

dated as of the Third Omnibus Amendment Effective Date, by and among the Obligors and Purchaser as may be amended, restated, supplemented

or otherwise modified from time to time.

“Third

Omnibus Amendment Effective Date” shall mean the date upon which all conditions in Section 6 of the Third Omnibus Amendment

Agreement have been satisfied (or waived in writing by Purchaser in its sole discretion).

3.

Amendments to the Notes. Subject to the satisfaction (or waiver in writing by Purchaser) of the conditions precedent set forth

in Section 6 hereof, the Notes are hereby amended as of, from and subsequent to the Third Omnibus Amendment Effective Date to

amend the reference to the date of October 14, 2024 in the first paragraph of each Note, which subsequently is referred to therein as

the Maturity Date, to extend such Maturity Date to February 15, 2025.

4.

Representations and Warranties. Each Obligor represents and warrants, that (a) immediately prior to giving effect to the Third

Omnibus Amendment Effective Date, each representation and warranty contained in the Purchase Agreement and each other Transaction Document

are true and correct in all material respects (other than a representation or warranty qualified by materiality or a Material Adverse

Effect, which representation and warranty are true and correct in all respects) and (b) immediately after giving effect to the Third

Omnibus Amendment Effective Date and the other transactions contemplated herein, each representation and warranty contained in the Purchase

Agreement and each other Transaction Document are true and correct in all material respects (other than a representation or warranty

qualified by materiality or a Material Adverse Effect, which representation and warranty are true and correct in all respects).

5.

Reaffirmation. Each of the Obligors hereby reaffirms (a) all of its obligations under the Transaction Documents, and agrees that

this Agreement and all documents, agreements and instruments executed in connection herewith do not operate to reduce or discharge any

Obligor’s obligations under the Transaction Documents, and (b) the continuing security interests in its respective assets granted

in favor of Purchaser pursuant to the Security Documents. Each of the Obligors hereby (i) acknowledges and agrees that its guarantee

of the Obligations includes, without limitation, all principal, interest, fees and other amounts now or hereafter due by Company under

Notes and the other Transaction Documents, (ii) ratifies all the provisions of, and reaffirms its obligations under, the guarantee set

forth in Article 4 of the Purchase Agreement and each other Transaction Document to which it is a party and confirms that all

provisions of each such document are and shall remain in full force and effect in accordance with its terms, and (iii) reaffirms the

continuing security interests in its assets granted in favor of Purchaser pursuant to the Security Documents.

6.

Conditions Precedent: This Agreement shall be effective as of the Third Omnibus Amendment Effective Date upon the satisfaction

of each of the following conditions precedent in a manner reasonably satisfactory to the Purchaser:

(a)

Documentation. Purchaser shall have received this Agreement, duly executed by the Obligors and the Purchaser.

(b)

Representations and Warranties. The representations and warranties contained in the Purchase Agreement and each other Transaction

Document shall be true and correct in all material respects (or, with respect to representations already qualified by concepts of materiality,

in all respects) on and as of the Third Omnibus Amendment Effective Date.

(c)

No Material Adverse Effect. No Material Adverse Effect has occurred since the period represented by the most recent financial

statements provided to Purchaser.

(d)

No Default, Etc. No Default or Event of Default shall exist.

7.

Reference to and Effect on the Existing Purchase Agreement and the other Transaction Documents.

(a)

On and after the Third Omnibus Amendment Effective Date, (i) each reference in the Purchase Agreement and each of the other Transaction

Documents to the “Purchase Agreement”, “thereunder”, “thereof”

or words of like import referring to the Existing Purchase Agreement shall mean and be a reference to the Purchase Agreement, (ii) each

reference in each of the other Transaction Documents to, as applicable, a “Security Agreement”, “thereunder”,

“thereof” or words of like import referring to, as applicable, the Existing Security Agreements shall mean

and be a reference to, as applicable, the Security Agreement and (iii) each reference in each of the other Transaction Documents to,

as applicable, a “Pledge Agreement”, “thereunder”, “thereof”

or words of like import referring to, as applicable, the Existing Pledge Agreements shall mean and be a reference to, as applicable,

the Pledge Agreement.

(b)

The execution, delivery and effectiveness of this Agreement shall not, except as expressly provided herein, operate as a waiver of any

right, power or remedy of Purchaser under any of the Transaction Documents, or constitute a waiver of any provision of any of the Transaction

Documents.

(c)

This Agreement shall be a “Note Document” and “Transaction Document” for all purposes

under the Purchase Agreement (and for all purposes hereof).

(d)

The parties hereto expressly acknowledge that it is not their intention that this Agreement or any of the other Transaction Documents

executed or delivered pursuant hereto constitute a novation of any of the obligations, covenants or agreements contained in the Existing

Purchase Agreement, the Existing Security Agreement, the Existing Pledge Agreement or any other Transaction Document, but rather constitute

a modification thereof or supplement thereto pursuant to the terms contained herein. The Existing Purchase Agreement, the Existing Security

Agreement and the Existing Pledge Agreement, in each case as amended, modified or supplemented hereby, shall be deemed to be continuing

agreements among the parties thereto, and all documents, instruments, and agreements delivered, as well as all Liens created, pursuant

to or in connection with the Existing Purchase Agreement, the Existing Security Agreement, the Existing Pledge Agreement and the other

Transaction Documents shall remain in full force and effect, each in accordance with its terms (as amended, modified or supplemented

by this Agreement), unless such document, instrument, or agreement has otherwise been terminated or has expired in accordance with or

pursuant to the terms of this Agreement or such document, instrument, or agreement or as otherwise agreed by the required parties hereto

or thereto.

8.

Expenses; Reimbursement. The expense reimbursement provisions set forth in Section 10.3 of the Purchase Agreement are hereby

incorporated by reference and, without limiting the generality of the foregoing, shall be deemed fully applicable the fees, costs and

expenses incurred by Purchaser in connection with the negotiation, execution and delivery of this Agreement.

9.

Severability. Any provision of this Agreement that is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction,

be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining portions hereof or affecting

the validity or enforceability of such provision in any other jurisdiction.

10.

Execution in Counterparts. This Agreement may be executed in counterparts (and by different parties hereto in different counterparts),

each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed

counterpart of a signature page of this Agreement by facsimile or other electronic imaging means (e.g. “pdf”

or “tif”) shall be effective as delivery of a manually executed counterpart of this Agreement.

11.

GOVERNING LAW. THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK (WITHOUT

REGARD TO THE PRINCIPLES THEREOF REGARDING CONFLICTS OF LAWS).

12.

WAIVER OF JURY TRIAL. EACH PARTY HERETO HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT

IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS

CONTEMPLATED HEREBY (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). EACH PARTY HERETO (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT

OR ATTORNEY OF ANY OTHER PERSON HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PERSON WOULD NOT, IN THE EVENT OF LITIGATION,

SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HERETO HAVE BEEN INDUCED TO ENTER INTO THIS AGREEMENT

BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION.

13.

RELEASE. Each obligor hereby acknowledges and agrees that: (a) neither it nor any of its

Subsidiaries has any claim or cause of action against PURCHASER (or any of the directors, officers, employees, agents, attorneys or consultants

of any of the foregoing) on or prior to the Third Omnibus Amendment Effective Date directly arising out of, connected with or related

to this Agreement, the Existing PURCHASE Agreement or any other TRANSACTION Document, or any act, event or transaction related or attendant

thereto, or the agreements of PURCHASER contained therein, or the making of any EXTENSIONS OF CREDIT or other advances, or the management

of such EXTENSIONS OF CREDIT or other advances or the Collateral, and (b) PURCHASER has heretofore properly performed and satisfied in

a timely manner all of its obligations to the obligor, and all of their Subsidiaries and Affiliates. Notwithstanding the foregoing, PURCHASER

wishes (and the obligors agree) to eliminate any possibility that any past conditions, acts, omissions, events or circumstances, that

have taken place on or prior to THE THIRD OMNIBUS AMENDMENT EFFECTIVE DATE directly arising out of, connected with or related to this

Agreement, the Existing purchase Agreement or any other transaction Document, or any act, event or transaction related or attendant thereto,

or the agreements of Purchaser contained therein, or the making of any extensions of credit or other advances, or the management of such

extensions of credit or other advances or the Collateral, would impair or otherwise adversely affect any of their rights, interests,

security and/or remedies. Accordingly, for and in consideration of the agreements contained in this Agreement and other good and valuable

consideration, each obligor (for itself and its Subsidiaries and Affiliates and the successors, assigns, heirs and representatives of

each of the foregoing) (collectively, the “Releasors”) does hereby fully, finally, unconditionally and irrevocably

release, waive and forever discharge Purchaser, together with its respective Affiliates, and each of the directors, officers, employees,

agents, attorneys and consultants of each of the foregoing (collectively, the “Released Parties”), from any

and all debts, claims, allegations, obligations, damages, costs, attorneys’ fees, suits, demands, liabilities, actions, proceedings

and causes of action, in each case, whether known or unknown, contingent or fixed, direct or indirect, and of whatever nature or description,

and whether in law or in equity, under contract, tort, statute or otherwise, which any Releasor has heretofore had or now or hereafter

can, shall or may have against any Released Party by reason of any act, omission or thing whatsoever done or omitted to be done, in each

case, on or prior to the THIRD OMNIBUS AMENDMENT EFFECTIVE DATE directly arising out of, connected with or related to this Agreement,

the Existing purchase Agreement or any other transaction Document, or any act, event or transaction related or attendant thereto, or

the agreements of Purchaser contained therein, or the possession, use, operation or control of any of the assets of any obligor, or the

making of any extensions of credit or other advances, or the management of such extensions of credit or other advances or the Collateral.

Each obligor represents and warrants that it has no knowledge of any claim by any Releasor against any Released Party or of any facts

or acts or omissions of any Released Party which on the date hereof would be the basis of a claim by any Releasor against any Released

Party which would not be released hereby.

[SIGNATURE

PAGES TO FOLLOW]

IN

WITNESS WHEREOF, each of the parties hereto has caused this Third Omnibus Amendment and Reaffirmation to Note Documents to be duly executed

by its authorized officers, and Purchaser, has caused the same to be accepted by its authorized officer, as of the day and year first

above written.

| |

COMPANY: |

| |

|

|

| |

STaffing

360 solutions, inc. |

| |

|

|

| |

By:

|

/s/

Brendan Flood |

| |

Name: |

Brendan

Flood |

| |

Title: |

Chairman

and Chief Executive Officer |

| |

SUBSIDIARY

GUARANTORS: |

| |

|

|

| |

FARO

RECRUITMENT AMERICA, INC. |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

Name: |

Brendan

Flood |

| |

Title: |

President and Chief

Executive Officer |

| |

MONROE

STAFFING SERVICES, LLC |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

Name: |

Brendan

Flood |

| |

Title: |

President

and Chief Executive Officer |

| |

LIGHTHOUSE

PLACEMENT SERVICES, INC. |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

Name: |

Brendan

Flood |

| |

Title: |

President |

| |

KEY

RESOURCES, INC. |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

Name: |

Brendan

Flood |

| |

Title: |

President

and Chief Executive Officer |

| |

HEADWAY

WORKFORCE SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

Name: |

Brendan

Flood |

| |

Title: |

President |

| |

HEADWAY

EMPLOYER SERVICES, LLC |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

Name: |

Brendan

Flood |

| |

Title: |

President |

| |

HEADWAY

PAYROLL SOLUTIONS, LLC |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

Name: |

Brendan

Flood |

| |

Title: |

President |

| |

HEADWAY

HR SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

Name: |

Brendan

Flood |

| |

Title: |

President |

| |

NC PEO

HOLDINGS, LLC |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

Name: |

Brendan

Flood |

| |

Title: |

President |

| |

PURCHASER: |

| |

|

|

| |

JACKSON INVESTMENT GROUP, LLC |

| |

|

|

| |

By: |

/s/

Richard L. Jackson |

| |

Name: |

Richard

L. Jackson |

| |

Title: |

Chief Executive Officer |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

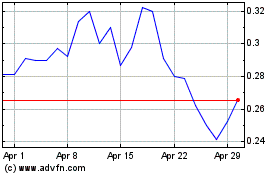

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Jan 2024 to Jan 2025