Report of Foreign Issuer (6-k)

April 17 2020 - 4:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2020

Commission File Number: 000-38511

SOHU.COM LIMITED

(Exact

name of registrant as specified in its charter)

Level 18, Sohu.com Media Plaza

Block 3, No. 2 Kexueyuan South Road, Haidian District

Beijing 100190, People’s Republic of China

+86-10-6272-6666

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐ No ☒

On April 17, 2020, the registrant announced the completion of its previously announced

going private transaction with respect to Changyou.com Limited (“Changyou”) (the “Changyou Merger”). A copy of the press release issued by the registrant regarding the foregoing is furnished herewith as Exhibit 99.1.

Funds for the registrant’s consummation of the Changyou Merger are being provided by Industrial and Commercial Bank of China Limited,

Tokyo Branch (“ICBC Tokyo”) pursuant to a facility agreement (the “Facility Agreement”) entered into as of April 3, 2020 between ICBC Tokyo, the registrant’s indirect wholly-owned subsidiary Sohu.com (Game) Limited

(“Sohu Game”) as borrower and the registrant as guarantor. The Facility Agreement provides for a term loan facility of up to $250 million (the “Term Facility”), subject to customary conditions, consisting of (i) a one-year term facility for term loans of up to $100 million (the “One-Year Facility”) and (ii) a four-year term facility for term loans of up to

$150 million (the “Four-Year Facility”). The outstanding principal amount of the loans under the One-Year Facility will be due in full on the one-year

anniversary of the date of the first utilization of the One-Year Facility. The outstanding principal amount of the loans under the Four-Year Facility will be due in installments, with $7.5 million due and

payable at the end of each of the second and third calendar years during the term of the Four-Year Facility and the remaining outstanding principal amount due and payable on the fourth anniversary of the date of the first utilization of the One-Year Facility.

The Term Facility bears interest at a rate of LIBOR plus a margin of 1.75%, with

Three Month LIBOR to be determined by ICBC on the basis of the London InterBank Offered Rate published two business days before the first day of each three calendar month interest period. Accrued interest will be due every three calendar months on

the first day after the end of each such three-month interest period.

The obligations of Sohu Game as borrower under the Term Facility

are initially fully guaranteed by the registrant, and are initially secured by first priority share pledges or mortgages over 97.9% of the outstanding equity interests in Changyou. In addition, Sohu Game is required to cause Changyou, within one

(1) month after the initial funding under the Term Facility, to pledge a deposit certificate evidencing a Renminbi, the legal currency of China (“RMB”), deposit equivalent to not less $125 million at an exchange rate of $1.00 =

RMB7.20 and, within three months after the initial funding under the Term Facility, to pledge RMB deposit certificates evidencing amounts equivalent to the Facility Agreement amount (including the initial $125 million-equivalent deposit

certificate). Upon the effectiveness of such additional pledge, the registrant’s guarantee and all share pledges or mortgages over the outstanding equity interests in Changyou will be released and discharged.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

Sohu.com Limited

|

|

|

|

|

By:

|

|

/s/ Joanna Lv

|

|

Name:

|

|

Joanna Lv

|

|

Title:

|

|

Chief Financial Officer

|

Date: April 17, 2020

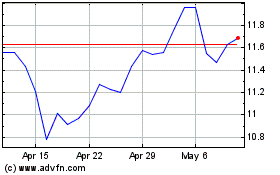

Sohu com (NASDAQ:SOHU)

Historical Stock Chart

From Aug 2024 to Sep 2024

Sohu com (NASDAQ:SOHU)

Historical Stock Chart

From Sep 2023 to Sep 2024