UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-40786

Sigma

Lithium Corporation

(Translation of registrant’s name into English)

2200 HSBC Building

885 West Georgia Street

Vancouver, British Columbia

V6C 3E8

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨

Form 40-F x

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Sigma Lithium Corporation |

| |

|

(Registrant) |

| |

|

|

| Date: November 15, 2023 |

|

|

| |

|

Ana Cristina Cabral Gardner |

| |

|

Chief Executive Officer |

Exhibit 99.1

SIGMA LITHIUM

REPORTS 3Q 2023 RESULTS; POSTING 37% NET PROFIT MARGIN IN ITS FIRST OPERATIONAL QUARTER

SAO PAOLO –

(November 14, 2023) – SIGMA Lithium Corporation (“Sigma Lithium” or the “Company”)

(NASDAQ: SGML, TSXV: SGML, BVMF: S2GM34), a leading global lithium producer dedicated to powering the next generation of electric vehicles

with carbon neutral, responsibly sourced chemical grade lithium concentrate, today announced its results for the third quarter ended

September 30, 2023. The Quarterly Filings and accompanying Management Discussion and Analysis (“MD&A”) are available

on SEDAR+ (www.sedarplus.ca), EDGAR (www.sec.gov) and the Company's corporate website.

THIRD QUARTER 2023 AND RECENT HIGHLIGHTS

($ USD)

| · | Sigma

Lithium reported third-quarter revenue of USD $97 million, marking the Company’s first

revenue-generating quarter as it successfully transitioned to a leading global lithium producer. |

| · | Low

production cost resulting from operational efficiency and overall discipline drives significant

financial margins and the ability to generate free cash flow. |

| · | 56%

Adjusted EBITDA Margin |

| · | Third

quarter average adjusted cash operating cost (1) of $505/tonne at mine gate

and $577/tonne FOB Vitoria (ex-royalties). Adjusted EBITDA totaled USD $54.6 million. |

| · | Greentech

Plant production ramp continues to sustain capacity of 270,000 tonnes of concentrate. Since

September achieving regular shipments of 20,000 tonnes per month. |

| · | Expects

production to approach 130,000 tonnes through sale of Triple Zero Green Lithium and equivalent

By-Products by December 2023. |

| · | Continue

to successfully market Green By-Products, achieving consistent pricing at 10% of concentrate,

a testament to ore product quality despite soft market backdrop. |

| · | Announced

positive results from the Phase 4 and Phase 5 exploration program that could potentially

increase mineral resources to 130 Mt. |

| · | Strategic

review is ongoing and the process advanced to final rounds on November 1, 2023. |

CEO Remarks:

"In our first quarter of revenue

generation, Sigma Lithium has achieved positive operating profit, enabled by our impressive cost-efficient operating model,” said

Company Co-Chairperson and CEO Ana Cabral. “Looking ahead we expect to deliver increasing production volumes at a lower cost

with a high standard of quality and purity. Our cost and purity advantages, combined with our industry-leading sustainability practices,

provide Sigma Lithium with a preferential position in the marketplace. We believe this gives us the flexibility to expand our production

capacity regardless of evolving market conditions to more efficiently utilize our existing cost structure. As production increases, so

too should shareholder value as we continue our mission to sustainably power the next generation of electric vehicle batteries.”

Key Performance

Metrics for Quarter Ended 30 September 2023 ($ USD)

| |

Unit |

Q3

2023 |

1Q

– 3Q 2023 |

| Concentrate

produced |

tonnes |

38,823 |

45,203 |

| Concentrate

grade produced |

% |

5.7% |

5.6% |

| Concentrate

sold |

tonnes |

38,000 |

38,000 |

| Average

realized selling price |

$/t |

2,488 |

2,488 |

| Revenue |

$

000s |

96.9 |

96.9 |

| Unit

operating cost (1) |

$/t |

505 |

N/A |

| Adjusted

EBITDA |

$

000s |

$54.6 |

$33.9 |

| Net

Income |

$

000s |

$36.4 |

-$18.8 |

| Cash

and cash equivalents |

$

000s |

$28.2 |

N/A |

Sigma Lithium generated

its first revenue from the sale of its Triple Zero Green Lithium concentrate (zero tailings, zero hazardous chemicals, zero carbon) and

associated Green By-Products in the third quarter, marking a major milestone in the Company’s journey to become one of the largest

lithium ore producers globally. In total, revenues generated in the third quarter were USD$96.9 million (C$130 million) from the sale

of 38,000 tonnes of its Triple Zero Green lithium concentrate and 16,500 tonnes of lithiated Green By-products. The average realized

price for Sigma Lithium’s concentrate in the quarter was $2,488/tonne.

Adjusted cash operating

costs(1) for lithium concentrate produced at the Company’s Grota do Cirilo operations averaged $505/tonne in the

quarter. The adjusted FOB Vitoria cost for the third quarter (which includes transportation, and warehousing) totaled $577/ tonne (or

$649/tonne with royalties). Operating leverage in the quarter was impacted by the ramp process, particularly in July, when Greentech

Plant throughput was minimal. For the month of October, the Company’s on-site operating ash costs per tonne were $425, while the

FOB Vitoria cost was $485/tonne. While Sigma Lithium expects month-to-month variability in costs, it is providing early October data

as an indication of its anticipated cost trend as production ramps. The Company expects additional traction on lowering its cash operating

costs per tonne from these levels.

EBITDA for the

third quarter totaled USD $53 million. This includes $3.4 million of non-recurring expenditures, including those associated with the

ongoing strategic review, partially offset by the reversal of a $1.8 million tailwind from stock-based compensation. Excluding these

costs, the Company delivered third quarter adjusted EBITDA of USD $54.6 million. Net income in the quarter totaled USD $36.4 million,

or $0.33 per diluted share outstanding.

Operational

Update

In the third quarter,

Sigma Lithium continued to build on its track record of achieving operational milestones on schedule. Dense Media Separation (DMS) plant

recoveries averaged 49%, with results impacted by lower plant throughput, particularly exiting the second quarter and into July. The

Company has taken additional steps to boost throughput and continues to target sustained plant recovery rates of 65%. In October, throughput

averaged 61.5%, with results boosted by a daily record production volume of 890 tonnes of Triple Zero Green Lithium concentrate. For

the full year, the Company continues to expect lithium concentrate production of 130,000 tonnes, as ongoing production is supplemented

by the sale of Green By-products.

During the third quarter, Sigma Lithium

made two shipments of Triple Zero Green Lithium concentrate, totaling 38,000 tonnes. As previously reported, the Company successfully

delivered its third shipment to port in October, trucking 20,000 tonnes of Triple Zero Green Lithium, to be shipped to Glencore as part

of a collaboration to create a low carbon, environmentally and socially sustainable global lithium supply chain for electric vehicles.

Sigma Lithium achieved operational net-zero carbon emissions for all three of its shipments to-date through the implementation of its

environmentally sustainable production methods and the purchase of carbon credits from Carbonext (as verified through Verra Verified

Carbon Standard).

Sales of lithium

concentrate were supplemented by the sale of 16,500 tonnes of ultra-fine tailings to Yahua International Investment and Development Co.

(“Yahua”).

Sigma Lithium continues

to progress towards completing its Definitive Feasibility Study (DFS) and Final Investment Decision (FID) for its Phase 2 and 3 expansions.

The expansion would lift Greentech Plant nameplate throughput potential to 766,000 tonnes (104,000 tonnes lithium carbonate equivalent)

from the current level of 270,000 tonnes (37,000 tonnes lithium carbonate equivalent). The Company plans to update the market on its

expansion progress as soon as the DFS has been completed and the FID has been made. Given Sigma Lithium’s high purity Triple Zero

Green Lithium concentrate and ESG credentials, we believe the Company’s material has priority at converter customers. Together

with our low operating cost model, Sigma Lithium remains confident in its decision to continue expanding its production capacity in the

current market conditions.

Exploration

Update

On November 1

Sigma Lithium announced a likely increase of its mineral resource estimate to over 110 million tonnes, representing a 25% potential increase

to the prior estimate. Notably, the Company increased the exploration potential of Phase 4 to approximately 26 to 30Mt, with ore body

extensions continuing to the east, based on the drilling results received to date. This is a significant potential increase to the Grota

do Cirilo mineral resource estimate, delivering further consistent high grade assay results which are to be incorporated into an updated

NI 43-101 compliant technical report expected to be released in the fourth quarter of 2023.

As part of the

Exploration Program, Sigma Lithium has also identified additional pegmatites that could potentially yield up to 20 Mt of incremental

mineral resource in a potential Phase 5.

The Company is

conducting significant exploration RC drilling, trench work and sampling, in 57 mineralized pegmatites (out of the 200 pegmatites mapped

within the Company’s mineral concessions). The Exploration Program defined the surface area and the weathered mineralogy for these

57 pegmatites. The Accelerated Plan will include drilling exploratory core diamond drill holes into each of these targets.

Strategic Review

Process

Sigma Lithium recently

announced that its strategic review process has advanced to the final round and is expected to reach a decision by the end of 2023. Remaining

interested parties have “agreed-in-principle” to preserve the Company’s environmental and social sustainability centered

business model in a potential strategic transaction. This update follows Sigma Lithium’s announcement in September that its

Board of Directors had received and is reviewing multiple strategic proposals, including from global industry leaders in the energy,

auto, batteries and lithium refining industries. The Board of Directors is committed to maximizing value for Sigma Lithium’s shareholders,

employees and communities of Sigma Brazil at Vale do Jequitinhonha through the strategic review process.

Balance Sheet &

Liquidity

Sigma Lithium ended

the third quarter with USD $28.2 million in cash and cash equivalents. This represents a modest draw from the $33 million in cash at

the quarter ended June 30, 2023. Positive earnings contributions were offset as the Company built working capital balances on account

of the first commercial shipments. Capital expenditures spent during the third quarter were under $7mn as the Company made incremental

investments to its Greentech Plant. In regard to the Phase 2 & 3 expansion, Sigma Lithium is finalizing the detailed engineering,

but plans to fund the expansion through free cash flow generation and additional debt financing agreements.

Conference Call Information

The Company will conduct a conference

call to discuss its financial results for the third quarter, and its outlook for the fourth quarter and full year 2023, at 8:00 a.m. EST

on Wednesday, November 15, 2023. Participating on the call will be Co-Chairperson and Chief Executive Officer, Ana Cabral. To register

for the call, please proceed through the following link Register here.

Sigma Lithium's

Triple Zero Green Lithium: The foundation of a globally sustainable supply chain

Sigma Lithium

has effectively lowered its carbon footprint with a series of pioneering initiatives, paving the way forward for the metals and mining

sector.

The Company’s

Triple Zero Green Lithium is produced at its state-of-the-art Greentech lithium plant at its Grota do Cirilo Project in Brazil,

the first lithium project in the world without a tailings dam. With 100% dry-stacked tailings and the absence of hazardous chemical products

for processing lithium, the Company is preventing water and soil contamination and contributing to the preservation of rivers and forests

in the region.

The Company's

main achievements towards abating its carbon footprint include:

| · | Zero

tailings: 100% dry stacked tailings, with all by-products eliminated through sales

or upcycling to pave roads. |

| · | Zero

hazardous chemicals: Utilizes Dense Medium Separation ("DMS") at the Greentech

plant, which does not utilize hazardous chemicals. |

| · | Water

efficiency: Utilizes 100% sewage water for its plant, fully recirculated. |

| · | Water

preservation: Preserves 100% of the Piaui Creek source of drinking water for the

communities living around Sigma Lithium. |

| · | Clean

renewable energy: Utilizes 100% clean renewable energy for its Greentech Plant via

"behind the meter" supply agreements. |

| · | Biodiesel:

Utilizes biodiesel fuel in some of its trucking fleet, with plans to increase to up to 50%

by 2025. |

| · | Explosives

/ ANFO: Decreased explosives load with computerized load simulation strategies. |

ABOUT SIGMA

LITHIUM

Sigma Lithium (NASDAQ:

SGML, TSXV: SGML, BVMF: S2GM34) is a leading global lithium producer dedicated to powering the next generation of electric vehicle batteries

with carbon neutral, socially and environmentally sustainable chemical-grade lithium concentrate.

Sigma Lithium has

been at the forefront of environmental and social sustainability in the EV battery materials supply chain for six years and it is currently

producing Triple Zero Green Lithium from its Grota do Cirilo Project in Brazil. Phase 1 of the project is expected to produce 270,000

tonnes of Triple Zero Green Lithium annually (36,700 LCE annually). If it is determined to proceed after completion of an ongoing feasibility

study, Phase 2 & 3 of the project are expected to increase production to 766,000 tonnes annually (or 104,200 LCE annually).

The project produces Triple Zero Green Lithium in its state-of-the-art Greentech lithium plant that uses 100% renewable energy, 100%

recycled water and 100% dry-stacked tailings.

Please refer to

the Company’s National Instrument 43-101 technical report titled “Grota do Cirilo Lithium Project Araçuaí and

Itinga Regions, Minas Gerais, Brazil, Amended and Restated Technical Report” issued June 12, 2023, which was prepared

for Sigma Lithium by Homero Delboni Jr., MAusIMM, Promon Engenharia; Marc-Antoine Laporte, P.Geo, SGS Canada Inc; Jarrett

Quinn, P.Eng., Primero Group Americas; Porfirio Cabaleiro Rodriguez, (MEng), FAIG, GE21 Consultoria Mineral; and Noel O’Brien,

B.E., MBA, F AusIMM (the “Updated Technical Report”). The Updated Technical Report is filed on SEDAR and is also available

on the Company’s website.

For more information

about Sigma Lithium, visit https://www.sigmalithiumresources.com/

FOR ADDITIONAL INFORMATION PLEASE

CONTACT

Jamie Flegg, Director, Business

Development

+1 (647) 706-1087

jamie.flegg@sigmalithium.com.br

Daniel Abdo, Director, Investor

Relations

+55 11 2985-0089

daniel.abdo@sigmalithium.com.br

Sigma Lithium

|

Sigma

Lithium |

|

@sigmalithium |

|

@SigmaLithium |

FORWARD-LOOKING STATEMENTS

This news release includes certain "forward-looking

information" under applicable Canadian and U.S. securities legislation, including but not limited to statements relating to timing

and costs related to the general business and operational outlook of the Company, the environmental footprint of tailings and positive

ecosystem impact relating thereto, donation and upcycling of tailings, timing and quantities relating to tailings and Green Lithium,

achievements and projections relating to the Zero Tailings strategy, achievement of ramp-up volumes, production estimates and the operational

status of the Grota do Cirilo Project, and other forward-looking information. All statements that address future plans, activities, events,

estimates, expectations or developments that the Company believes, expects or anticipates will or may occur is forward-looking information,

including statements regarding the potential development of mineral resources and mineral reserves which may or may not occur. Forward-looking

information contained herein is based on certain assumptions regarding, among other things: general economic and political conditions;

the stable and supportive legislative, regulatory and community environment in Brazil; demand for lithium, including that such demand

is supported by growth in the electric vehicle market; the Company’s market position and future financial and operating performance;

the Company’s estimates of mineral resources and mineral reserves, including whether mineral resources will ever be developed into

mineral reserves; and the Company’s ability to operate its mineral projects including that the Company will not experience any

materials or equipment shortages, any labour or service provider outages or delays or any technical issues. Although management believes

that the assumptions and expectations reflected in the forward-looking information are reasonable, there can be no assurance that these

assumptions and expectations will prove to be correct. Forward-looking information inherently involves and is subject to risks and uncertainties,

including but not limited to that the market prices for lithium may not remain at current levels; and the market for electric vehicles

and other large format batteries currently has limited market share and no assurances can be given for the rate at which this market

will develop, if at all, which could affect the success of the Company and its ability to develop lithium operations. There can be no

assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated

in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company disclaims any intention

or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, except

as required by law. For more information on the risks, uncertainties and assumptions that could cause our actual results to differ from

current expectations, please refer to the current annual information form of the Company and other public filings available under the

Company’s profile at www.sedarplus.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy

or accuracy of this news release.

Figure 1: Statement of Consolidated Income

| Profit and Loss

- Management P&L ($000) | |

Three

Months Ended

September 30, | | |

Nine

Months Ended

September 30, | | |

Three

Months Ended

September 30, | | |

Nine

Months Ended

September 30, | |

| |

| CAD | | |

| CAD | | |

| USD | | |

| USD | |

| Revenue from contracts with customers | |

| 129,925 | | |

| 129,925 | | |

| 96,902 | | |

| 96,902 | |

| Cost of goods sold | |

| (46,006 | ) | |

| (46,006 | ) | |

| (34,311 | ) | |

| (34,311 | ) |

| Distribution costs | |

| (1,090 | ) | |

| (1,090 | ) | |

| (814 | ) | |

| (814 | ) |

| Gross Profit | |

| 82,829 | | |

| 82,829 | | |

| 61,776 | | |

| 61,776 | |

| | |

| | | |

| | | |

| | | |

| | |

| General & administrative | |

| (16,581 | ) | |

| (43,060 | ) | |

| (12,364 | ) | |

| (32,029 | ) |

| Stock-based compensation | |

| 2,392 | | |

| (46,626 | ) | |

| 1,783 | | |

| (34,617 | ) |

| Sales expenses | |

| (63 | ) | |

| (331 | ) | |

| (46 | ) | |

| (246 | ) |

| Other net expenses (net) | |

| (1,879 | ) | |

| (4,789 | ) | |

| (1,403 | ) | |

| (3,555 | ) |

| Total Operating Expenses | |

| (16,131 | ) | |

| (94,806 | ) | |

| (12,030 | ) | |

| (70,447 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Financial Income (expenses), net | |

| (10,664 | ) | |

| (6,379 | ) | |

| (7,962 | ) | |

| (4,789 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Income Before Taxes | |

| 56,034 | | |

| (18,356 | ) | |

| 41,783 | | |

| (13,460 | ) |

| Income tax Expense | |

| (7,149 | ) | |

| (7,149 | ) | |

| (5,336 | ) | |

| (5,336 | ) |

| Net Income (loss) for the period | |

| 48,885 | | |

| (25,505 | ) | |

| 36,447 | | |

| (18,796 | ) |

Figure 2: Consolidated Balance Sheet

| |

September 30, | | |

December 31, | | |

September 30 , | | |

December 31, | |

| Balance Sheet ($000) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| |

CAD | | |

USD | |

| ASSET | |

| | |

| | |

| | |

| |

| Current assets | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalent | |

| 38,142 | | |

| 96,354 | | |

| 28,180 | | |

| 71,094 | |

| Customers | |

| 73,492 | | |

| - | | |

| 54,298 | | |

| - | |

| Inventories | |

| 21,797 | | |

| - | | |

| 16,104 | | |

| - | |

| Due from related party | |

| 370 | | |

| 4,881 | | |

| 273 | | |

| 3,601 | |

| Advance to suppliers | |

| 9,441 | | |

| 1,727 | | |

| 6,975 | | |

| 1,274 | |

| Tax to recovery | |

| 3,252 | | |

| 419 | | |

| 2,403 | | |

| 309 | |

| Prepaid expenses and other assets | |

| 6,869 | | |

| 11,113 | | |

| 5,075 | | |

| 8,200 | |

| Total current assets | |

| 153,363 | | |

| 114,494 | | |

| 113,308 | | |

| 84,479 | |

| Non-current assets | |

| - | | |

| - | | |

| | | |

| | |

| Due from related party | |

| 7,962 | | |

| - | | |

| 5,883 | | |

| - | |

| Prepaid expenses and other assets | |

| 85 | | |

| 204 | | |

| 63 | | |

| 151 | |

| Deferred income tax and social contribution | |

| 1,757 | | |

| - | | |

| 1,298 | | |

| - | |

| Property, plant and equipment | |

| 232,138 | | |

| 158,574 | | |

| 171,509 | | |

| 117,003 | |

| Exploration and evaluation assets | |

| 59,706 | | |

| 35,636 | | |

| 44,112 | | |

| 26,294 | |

| Total assets | |

| 455,011 | | |

| 308,908 | | |

| 336,174 | | |

| 227,926 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | | |

| | |

| Suppliers | |

| 37,425 | | |

| 24,307 | | |

| 27,651 | | |

| 17,935 | |

| Financing and export prepayment agreement | |

| 27,642 | | |

| - | | |

| 20,423 | | |

| - | |

| Customer advance | |

| 2,127 | | |

| 1,571 | | |

| - | | |

| | |

| Taxes payable - short term | |

| 4,594 | | |

| 3,070 | | |

| 3,394 | | |

| 2,265 | |

| Income tax and social contribution | |

| 8,800 | | |

| - | | |

| 6,502 | | |

| - | |

| Account payable | |

| 9,399 | | |

| 1,936 | | |

| 6,944 | | |

| 1,428 | |

| Royal agreement option | |

| - | | |

| 5,081 | | |

| - | | |

| 3,749 | |

| Payroll and related charges | |

| 2,902 | | |

| 409 | | |

| 2,144 | | |

| 302 | |

| Royalties | |

| 1,112 | | |

| 822 | | |

| - | | |

| | |

| Lease liability | |

| 2,089 | | |

| 680 | | |

| 1,543 | | |

| 502 | |

| Accrued social projects | |

| 2,173 | | |

| - | | |

| 1,605 | | |

| - | |

| Accrued liabilities and other liabilities | |

| 1,513 | | |

| 1,959 | | |

| 1,118 | | |

| 1,445 | |

| Total current liabilities | |

| 99,776 | | |

| 37,442 | | |

| 73,717 | | |

| 27,626 | |

| Non-Current Liabilities | |

| | | |

| | | |

| | | |

| | |

| Financing and export prepayment agreement | |

| 122,768 | | |

| 77,438 | | |

| 90,704 | | |

| 57,137 | |

| Taxes payable - long term | |

| 136 | | |

| - | | |

| 100 | | |

| - | |

| Accrued liabilities | |

| 2,354 | | |

| 1,386 | | |

| 1,739 | | |

| 1,023 | |

| Lease liability | |

| 4,131 | | |

| 2,989 | | |

| 3,052 | | |

| 2,205 | |

| Asset retirement obligations | |

| 7,216 | | |

| 6,547 | | |

| 5,331 | | |

| 4,831 | |

| Related party loan | |

| - | | |

| - | | |

| - | | |

| - | |

| Total Non-Current liabilities | |

| 136,605 | | |

| 88,360 | | |

| 100,927 | | |

| 65,196 | |

| Total liabilities | |

| 236,381 | | |

| 125,802 | | |

| 174,644 | | |

| 92,822 | |

| Shareholders' equity | |

| | | |

| | | |

| | | |

| | |

| Share capital | |

| 373,043 | | |

| 276,711 | | |

| 275,614 | | |

| 204,170 | |

| Contributed surplus | |

| 64,680 | | |

| 103,936 | | |

| 47,787 | | |

| 76,689 | |

| Accumulated other comprehensive loss | |

| 923 | | |

| (3,030 | ) | |

| 443 | | |

| (2,236 | ) |

| Accumulated deficit | |

| (220,016 | ) | |

| (194,511 | ) | |

| (162,315 | ) | |

| (143,519 | ) |

| Total shareholders' equity | |

| 218,630 | | |

| 183,106 | | |

| 161,529 | | |

| 135,104 | |

| Total liabilities and shareholders'

equity | |

| 455,011 | | |

| 308,908 | | |

| 336,174 | | |

| 227,926 | |

Figure 3: Selected Consolidated Cash Flow

Statement

| Nine Months

Ended September 30, 2023 (000) | |

CAD | | |

USD | |

| Operating activities | |

| | | |

| | |

| Net loss for the period | |

| (25,505 | ) | |

| (18,796 | ) |

| Adjustments for: | |

| | | |

| | |

| Depreciation | |

| 4,339 | | |

| 3,291 | |

| Income tax and social contribution - current

and deferred | |

| 7,149 | | |

| 5,336 | |

| Stock-based compensation | |

| 46,626 | | |

| 34,617 | |

| Accrual social projects | |

| 2,173 | | |

| 1,601 | |

| Accrual for contingencies | |

| 683 | | |

| 503 | |

| Cost transactions | |

| 790 | | |

| 582 | |

| Interest due loans and leases | |

| 2,880 | | |

| 2,122 | |

| Accretion due asset retirement obligation | |

| 308 | | |

| 227 | |

| Foreign exchange loss

(gain) on other assets and liabilities | |

| (7,403 | ) | |

| (5,456 | ) |

| Adjusted income

(loss) for the period | |

| 32,040 | | |

| 24,028 | |

| Changes in non-cash working capital items: | |

| | | |

| | |

| Customers | |

| (74,669 | ) | |

| (55,167 | ) |

| Prepaid expenses and other assets | |

| (8,799 | ) | |

| (6,501 | ) |

| Inventories | |

| (20,345 | ) | |

| (15,031 | ) |

| Advance to suppliers | |

| (7,613 | ) | |

| (5,625 | ) |

| Related parties | |

| (9,176 | ) | |

| (6,779 | ) |

| Suppliers | |

| 7,468 | | |

| 5,518 | |

| Advance from customers | |

| 1,757 | | |

| 1,298 | |

| Amounts payable and other liabilities | |

| (1,663 | ) | |

| (1,229 | ) |

| Payroll and other taxes | |

| 2,364 | | |

| 1,747 | |

| Interest payment of

leases | |

| (1,683 | ) | |

| (1,243 | ) |

| Net cash used in operating activities | |

| (80,319 | ) | |

| (58,985 | ) |

| Investing activities | |

| | | |

| | |

| Addition to exploration and evaluation assets | |

| (12,443 | ) | |

| (9,193 | ) |

| Purchase of property, plant and equipment | |

| (49,475 | ) | |

| (36,553 | ) |

| Net cash used in investing activities | |

| (61,918 | ) | |

| (45,747 | ) |

| Financing activities | |

| | | |

| | |

| Loans and leasings | |

| 80,958 | | |

| 59,814 | |

| Net cash provided by financing activities | |

| 80,958 | | |

| 59,814 | |

| Effect of exchange rate changes

on cash held in foreign currency | |

| 3,067 | | |

| 2,004 | |

| Net (decrease)increase in cash | |

| (58,212 | ) | |

| (42,914 | ) |

| Cash, beginning of period | |

| 96,354 | | |

| 71,094 | |

| Cash, end of period | |

| 38,142 | | |

| 28,180 | |

Reconciliation

To provide investors and others with additional

information regarding the financial results of Sigma Lithium, we have disclosed in this release certain non-U.S. GAAP operating performance

measures of EBITDA, EBITDA margin, Adjusted EBITDA, and Adjusted EBITDA margin. These non-U.S. GAAP financial measures are a supplement

to and not a substitute for or superior to, the Company's results presented in accordance with U.S. GAAP. The non-U.S. GAAP financial

measures presented by the Company may be different from non-U.S. GAAP financial measures presented by other companies. Specifically,

the Company believes the non-U.S. GAAP information provides useful measures to investors regarding the Company's financial performance

by excluding certain costs and expenses that the Company believes are not indicative of its core operating results. The presentation

of these non-U.S. GAAP financial measures is not meant to be considered in isolation or as a substitute for results or guidance prepared

and presented in accordance with U.S. GAAP. A reconciliation of the non-U.S. GAAP financial measures to U.S. GAAP results is included

herein.

Endnotes:

| (1) | Unit Cash Operating Costs

per ton include mining, processing, crushing, and site administration expenses. When shown

as Free on Board (FOB), these expenses include transport and port charges. For clarity, inventory

adjustments, by-product credits, non-site G&A, carbon credits, and royalty costs are

excluded. |

Figure 4: Adjusted EBITDA Calculation

| Profit and Loss - Management P&L | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | | |

Three

Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| |

| CAD | | |

| CAD | | |

| USD | | |

| USD | |

| Revenue from contracts with customers | |

| 129,925 | | |

| 129,925 | | |

| 96,902 | | |

| 96,902 | |

| Operating cost (excl. depreciation expense) | |

| (41,714 | ) | |

| (41,714 | ) | |

| (31,110 | ) | |

| (31,110 | ) |

| Distribution cost | |

| (1,090 | ) | |

| (1,090 | ) | |

| (814 | ) | |

| (814 | ) |

| Gross margin | |

| 87,121 | | |

| 87,121 | | |

| 64,977 | | |

| 64,977 | |

| General and administration expense (excl. depreciation expense) | |

| (16,534 | ) | |

| (42,939 | ) | |

| (12,329 | ) | |

| (31,939 | ) |

| Sales expenses | |

| (63 | ) | |

| (331 | ) | |

| (46 | ) | |

| (246 | ) |

| Stock-based compensation | |

| 2,392 | | |

| (46,626 | ) | |

| 1,783 | | |

| (34,617 | ) |

| Other net expenses (net) | |

| (1,879 | ) | |

| (4,789 | ) | |

| (1,403 | ) | |

| (3,555 | ) |

| EBITDA | |

| 71,037 | | |

| (7,564 | ) | |

| 52,982 | | |

| (5,380 | ) |

| EBITDA (%) | |

| 55 | % | |

| -6 | % | |

| 55 | % | |

| -6 | % |

| Non-recurring general and administration expense | |

| 4,569 | | |

| 6,282 | | |

| 3,415 | | |

| 4,717 | |

| Legal & Consultant (1) | |

| 2,858 | | |

| 4,300 | | |

| 2,130 | | |

| 3,222 | |

| Others (2) | |

| 1,711 | | |

| 1,982 | | |

| 1,285 | | |

| 1,495 | |

| Stock-based compensation (3) | |

| (2,392 | ) | |

| 46,626 | | |

| (1,783 | ) | |

| 34,617 | |

| Adjusted EBITDA | |

| 73,214 | | |

| 45,344 | | |

| 54,614 | | |

| 33,953 | |

| Adjusted EBITDA (%) | |

| 56 | % | |

| 35 | % | |

| 56 | % | |

| 35 | % |

Notes:

| 1) | Legal & Consultation

costs are primarily fees associated with the ongoing strategic review process. |

| 2) | Other expenses include certain

non-recurring operational charges. Charges in 3Q23 include a CAD$1,425mn demurrage expense. |

| 3) | Represents non-cash stock-based

compensation. |

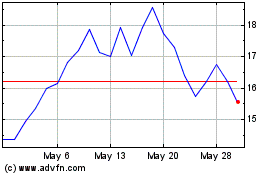

Sigma Lithium (NASDAQ:SGML)

Historical Stock Chart

From Apr 2024 to May 2024

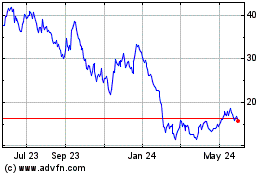

Sigma Lithium (NASDAQ:SGML)

Historical Stock Chart

From May 2023 to May 2024