0001459839false00014598392024-08-042024-08-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________

FORM 8-K

____________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 4, 2024

____________________________________________________________________________

SI-BONE, INC.

(Exact name of registrant as specified in its charter)

____________________________________________________________________________ | | | | | | | | | | | | | | |

| Delaware | | 001-38701 | | 26-2216351 |

(State or other jurisdiction of

incorporation or organization) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

471 El Camino Real

Suite 101

Santa Clara, CA 95050

(Address of principal executive offices) (Zip Code)

(408) 207-0700

(Registrant’s telephone number, include area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | SIBN | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 5, 2024, SI-BONE, Inc. (the "Company") issued a press release (the “Press Release”) announcing results for the quarter ended June 30, 2024. A copy of the Press Release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein.

The information under Item 2.02 in this current report on Form 8-K and the related information in the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 4, 2024, the Company’s board of directors (“Board”) elected Daniel Wolf to serve as a director of the Company effective August 5, 2024, until his successor is elected and qualified, or sooner in the event of his death, resignation or removal.

Mr. Wolf has served as Senior Vice President, Chief Strategy and M&A Officer at Baxter International Inc. since August 2022. From July 2010 to August 2022, Mr. Wolf served in various leadership positions with Medtronic plc, including President of Medicrea and Vice President and General Manager of Intelligent Data Solutions, as well as other roles in strategy, business development and healthcare economics, corporate development and national and strategic accounts. Mr. Wolf has also served on the boards of directors of HospitalIQ, Inc. from October 2022 to its acquisition by LeanTaaS, Inc. in January 2023, Blue Wind Medical Ltd. from July 2017 to December 2018, and Inspire Medical Systems, Inc. from July 2017 until its May 2018 initial public offering. Mr. Wolf began his career as a healthcare investment banking analyst at Piper Jaffray. Mr. Wolf received his B.A. in economics, with a minor in mathematics, from Bowdoin College, an M.B.A. from the Harvard Business School and a M.S. in health sciences and technology from the Massachusetts Institute of Technology.

As a non-employee director, Mr. Wolf will receive the following compensation under the Company’s non-employee director compensation policy: (1) an annual cash retainer of $45,000 for serving on the Board; (2) an initial grant of 17,182 restricted stock units (“RSU”), which will vest quarterly over three years beginning on the next quarterly vesting date that follows the grant date, subject to his continuous service with the Company on each applicable vesting date; and (3) on the date of each annual meeting of stockholders, an RSU grant having an approximate value of $120,000 based on the 30-day trailing average of the Company’s closing stock price, which will vest approximately one year from the grant date, subject to his continuous service with the Company on each applicable vesting date. Each RSU will be subject to accelerated vesting in the event of a change in control of the Company. The Company will also enter into its standard form of indemnification agreement with Mr. Wolf. Mr. Wolf does not have a material interest in any transaction that is required to be disclosed under Item 404(a) of Regulation S-K, and there is no arrangement or understanding between Mr. Wolf and any other person pursuant to which he was selected as a director.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Date File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

|

| | | |

| | | SI-BONE, INC. |

| | | |

| Date: | August 5, 2024 | By: | /s/ Anshul Maheshwari |

| | | | Anshul Maheshwari |

| | | Chief Financial Officer |

| | | | (Principal Financial and Accounting Officer) |

Exhibit 99.1

SI-BONE, Inc. Reports Financial Results for the Second Quarter 2024

Increases 2024 revenue guidance to $165 million - $167 million

Expects to achieve positive Adjusted EBITDA in Fourth Quarter 2024

SANTA CLARA, Calif. August 5, 2024 - SI-BONE, Inc. (Nasdaq:SIBN), a medical device company dedicated to solving sacropelvic disorders, today reported financial results for the quarter ended June 30, 2024.

Second Quarter 2024 Financial Highlights (comparisons are to the prior year period)

•Worldwide revenue of $40.0 million, representing growth of ~20%

•U.S. revenue of $37.8 million, representing growth of ~21%

•Gross margin of ~79%

•Net loss of $8.9 million, representing an improvement of ~20%

•Adjusted EBITDA loss of $2.7 million, representing an improvement of ~43%

•Ended the quarter with $151.5 million in cash and equivalents

Recent Operational Highlights (comparisons are to the prior year period)

•Over 1,150 U.S. active physicians in the second quarter 2024, representing an increase of ~23%

•Thomas West, President and CEO at Nalu Medical, Inc., and Dan Wolf, SVP, Chief Strategy and M&A Officer at Baxter International Inc., joined the Board of Directors

•5-year results from SALLY prospective clinical trial reaffirm the significant and sustained reduction in SI joint pain, persistent functional improvement, and 100% bone integration with iFuse-3D

•Early interim results from STACI study confirm the safety and efficacy of lateral transfixing SI joint fusion using TORQ when performed by interventional spine physicians

"I am delighted with our strong operating results as we delivered record revenue in the second quarter, reflecting overall strong demand dynamics including elevated interest in our recently launched Granite 9.5. Given the momentum in the business, we expect revenue growth to accelerate in the second half of 2024,” said Laura Francis, Chief Executive Officer. "Our ability to develop new markets with large unmet clinical needs is driving our U.S. procedure volume growth and expanding physician base. We also continue to make significant progress in improving our profitability and expect to achieve positive adjusted EBITDA in the fourth quarter."

Second Quarter 2024 Financial Results

Worldwide revenue was $40.0 million in the second quarter 2024, a ~20% increase from $33.3 million in the corresponding period in 2023. U.S. revenue for the second quarter 2024 was $37.8 million, a ~21% increase from $31.2 million in the corresponding period in 2023. International revenue for the second quarter 2024 was $2.2 million compared to $2.1 million in the corresponding period in 2023.

Gross profit was $31.6 million in the second quarter 2024, a ~17% increase from $27.0 million in the corresponding period in 2023. Gross margin was ~79% for the second quarter 2024, as compared to ~81% in the corresponding period in 2023. Gross margin in the second quarter 2024 was impacted by procedure and product mix.

Operating expenses increased ~7% to $41.7 million in the second quarter 2024, as compared to $39.0 million in the corresponding period in 2023. The change in operating expenses was primarily driven by increases in sales commissions driven by revenue growth, increase in commercial activities to support new product launches, research and development investments, and higher stock-based compensation.

Operating loss improved by ~16% to $10.1 million in the second quarter 2024, as compared to an operating loss of $12.0 million in the corresponding period in 2023.

Net loss improved by ~20%, to $8.9 million, or $0.22 per diluted share in the second quarter 2024, as compared to a net loss of $11.2 million, or $0.30 per diluted share in the corresponding period in 2023.

Adjusted EBITDA loss improved by ~43% to $2.7 million in the second quarter 2024, as compared to an Adjusted EBITDA loss of $4.7 million in the corresponding period in 2023.

Cash and marketable securities were $151.5 million and borrowings were $36.1 million as of June 30, 2024.

2024 Updated Financial Guidance

SI-BONE is updating 2024 worldwide revenue guidance to be in the range of $165 million to $167 million, an increase from the previous guidance of $164 million to $166 million. Compared to 2023, the updated guidance translates to growth of ~19% to ~20%, versus growth of ~18% to ~20% implied in the earlier guidance. The Company expects to be Adjusted EBITDA positive in the fourth quarter of 2024.

Webcast Information

SI-BONE will host a conference call to discuss the second quarter 2024 financial results after market close on Monday, August 5, 2024 at 4:30 P.M. Eastern Time. The conference call can be accessed live over webcast at https://edge.media-server.com/mmc/p/bdg2s7zw. Live audio of the webcast will be available on the “Investors” section of the company’s website at: www.si-bone.com. The webcast will be archived and available for replay for at least 90 days after the event.

About SI-BONE, Inc.

SI-BONE (NASDAQ: SIBN) is a global leader in developing unique technologies for surgical treatment of sacropelvic disorders. Since pioneering minimally invasive SI joint surgery in 2009, SI-BONE has supported over 3,900 physicians in performing a total of over 100,000 procedures. A unique body of clinical evidence supports the use of SI-BONE’s technologies, including two randomized controlled trials and over 130 peer reviewed publications. SI-BONE has leveraged its leadership in minimally invasive SI joint fusion to commercialize novel solutions for adjacent markets, including adult deformity, sacropelvic fixation and pelvic trauma.

For additional information on the company or the products including risks and benefits, please visit www.si-bone.com.

iFuse Bedrock Granite, iFuse-TORQ and SI-BONE are registered trademarks of SI-BONE, Inc. ©2024 SI-BONE, Inc. All Rights Reserved.

Forward Looking Statements

The statements in this press release regarding expectations of future events or results, including SI-BONE’s expectations of continued revenue and procedure growth and financial outlook, contained in this press release are "forward-looking" statements. These forward-looking statements are based on SI-BONE's current expectations and inherently involve significant risks and uncertainties. These risks include SI-BONE's ability to introduce and commercialize new products and indications, SI-BONE's ability to maintain favorable reimbursement for procedures using its products, the impact of any future economic weakness on the ability and desire of patients to undergo elective procedures including those using SI-BONE's devices, SI-BONE's ability to manage risks to its supply chain, future capital requirements driven by new surgical systems requiring instrument tray and implant inventory investment, and the pace of the re-normalization of the healthcare operating environment including the ability and desire of patients and physicians to undergo and perform procedures using SI-BONE's devices. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these and other risks and uncertainties, many of which are described in the company's most recent filing on Form 10-K, and the company’s other filings with the Securities and Exchange Commission (SEC) available at the SEC's Internet site (www.sec.gov), especially under the caption "Risk Factors." SI-BONE does not undertake any obligation to update forward-looking statements and expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein, except as required by law.

Use of Non-GAAP Financial Measures

SI-BONE uses adjusted EBITDA, a non-GAAP financial measures that excludes from net loss the effects of interest income, interest expense, depreciation and amortization and stock-based compensation. SI-BONE believes the presentation of adjusted EBITDA is useful to management because it allows management to more consistently analyze period-to-period financial performance and provides meaningful supplemental information with respect to core operational activities used to evaluate management's performance. SI-BONE also believes the presentation of adjusted EBITDA is useful to investors and other interested persons as it enables these persons to use this additional

information to assess the company’s performance in using this additional metric that management uses to assess the company’s performance.

Adjusted EBITDA should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. Because adjusted EBITDA excludes the effect of items that increase or decrease SI-BONE's reported results of operations, management strongly encourages investors to review, when they become available, the company's consolidated financial statements and publicly filed reports in their entirety. The company's definition of adjusted EBITDA may differ from similarly titled measures used by others.

Investor Contact

Saqib Iqbal

Sr. Director, FP&A and Investor Relations

investors@SI-BONE.com

SI-BONE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | | | Six Months Ended June 30, |

| 2024 | | 2023 | | | | | | 2024 | | 2023 |

Revenue | $ | 39,969 | | | $ | 33,305 | | | | | | | $ | 77,836 | | | $ | 66,013 | |

Cost of goods sold | 8,393 | | | 6,318 | | | | | | | 16,395 | | | 12,242 | |

| Gross profit | 31,576 | | | 26,987 | | | | | | | 61,441 | | | 53,771 | |

Operating expenses: | | | | | | | | | | | |

| Sales and marketing | 28,970 | | | 27,492 | | | | | | | 58,357 | | | 54,805 | |

| Research and development | 4,352 | | | 3,656 | | | | | | | 8,697 | | | 6,947 | |

| General and administrative | 8,332 | | | 7,802 | | | | | | | 16,508 | | | 15,275 | |

Total operating expenses | 41,654 | | | 38,950 | | | | | | | 83,562 | | | 77,027 | |

Loss from operations | (10,078) | | | (11,963) | | | | | | | (22,121) | | | (23,256) | |

Interest and other income (expense), net: | | | | | | | | | | | |

| Interest income | 2,015 | | | 1,582 | | | | | | | 4,128 | | | 2,515 | |

| Interest expense | (880) | | | (850) | | | | | | | (1,761) | | | (1,689) | |

| Other income (expense), net | 4 | | | 25 | | | | | | | (89) | | | 99 | |

Net loss | $ | (8,939) | | | $ | (11,206) | | | | | | | $ | (19,843) | | | $ | (22,331) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Net loss per share, basic and diluted | $ | (0.22) | | | $ | (0.30) | | | | | | | $ | (0.48) | | | $ | (0.61) | |

Weighted-average number of common shares used to compute basic and diluted net loss per share | 41,317,627 | | | 37,864,185 | | | | | | | 41,126,009 | | | 36,399,309 | |

SI-BONE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 25,577 | | | $ | 33,271 | |

| Short-term investments | 125,950 | | | 132,748 | |

| Accounts receivable, net | 24,796 | | | 21,953 | |

| Inventory | 23,233 | | | 20,249 | |

| Prepaid expenses and other current assets | 2,777 | | | 3,173 | |

| Total current assets | 202,333 | | | 211,394 | |

| | | |

| | | |

| Property and equipment, net | 19,108 | | | 16,000 | |

| Operating lease right-of-use assets | 2,079 | | | 2,706 | |

| Other non-current assets | 323 | | | 325 | |

| TOTAL ASSETS | $ | 223,843 | | | $ | 230,425 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 7,180 | | | $ | 4,588 | |

| Accrued liabilities and other | 13,496 | | | 17,452 | |

| | | |

| Operating lease liabilities, current portion | 1,384 | | | 1,416 | |

| | | |

| Total current liabilities | 22,060 | | | 23,456 | |

| Long-term borrowings | 36,149 | | | 36,065 | |

| Operating lease liabilities, net of current portion | 887 | | | 1,511 | |

| Other long-term liabilities | 14 | | | 18 | |

| TOTAL LIABILITIES | 59,110 | | | 61,050 | |

| | | |

| | | |

| | | |

| Stockholders' Equity: | | | |

| | | |

| | | |

| Common stock and additional paid-in capital | 584,790 | | | 569,481 | |

| Accumulated other comprehensive income | 227 | | | 335 | |

| Accumulated deficit | (420,284) | | | (400,441) | |

| TOTAL STOCKHOLDERS’ EQUITY | 164,733 | | | 169,375 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 223,843 | | | $ | 230,425 | |

SI-BONE, INC.

RECONCILIATION OF NET LOSS TO NON-GAAP ADJUSTED EBITDA

(In thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | | $ | (8,939) | | | $ | (11,206) | | | $ | (19,843) | | | $ | (22,331) | |

| Interest income | | (2,015) | | | (1,582) | | | (4,128) | | | (2,515) | |

| Interest expense | | 880 | | | 850 | | | 1,761 | | | 1,689 | |

| Depreciation and amortization | | 992 | | | 1,236 | | | 2,081 | | | 2,322 | |

| Stock-based compensation | | 6,398 | | | 5,998 | | | 13,428 | | | 12,192 | |

| Adjusted EBITDA | | $ | (2,684) | | | $ | (4,704) | | | $ | (6,701) | | | $ | (8,643) | |

| | | | | | | | |

v3.24.2.u1

Cover

|

Aug. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 04, 2024

|

| Entity Registrant Name |

SI-BONE, INC.

|

| Entity Central Index Key |

0001459839

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38701

|

| Entity Tax Identification Number |

26-2216351

|

| Entity Address, Address Line One |

471 El Camino Real

|

| Entity Address, Address Line Two |

Suite 101

|

| Entity Address, City or Town |

Santa Clara

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95050

|

| City Area Code |

408

|

| Local Phone Number |

207-0700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

SIBN

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

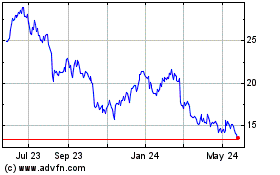

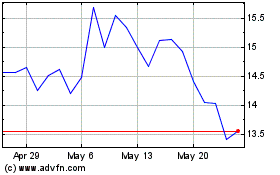

SI BONE (NASDAQ:SIBN)

Historical Stock Chart

From Oct 2024 to Nov 2024

SI BONE (NASDAQ:SIBN)

Historical Stock Chart

From Nov 2023 to Nov 2024