Shockwave Medical, Inc. (Nasdaq: SWAV), a pioneer in the

development and commercialization of transformational technologies

for the treatment of cardiovascular disease, today reported

financial results for the three months ended March 31, 2024.

“The solid growth in the first quarter across

geographies and products is a testament to the continued demand for

our innovative solutions, driven by the unrelenting and

extraordinary performance of our global Shockwave teams,” said Doug

Godshall, President and Chief Executive Officer of Shockwave

Medical. “Our team is looking forward to continuing our mission as

part of Johnson & Johnson and to working together to bring our

life-changing therapies to even more patients across the

globe.”

First Quarter 2024 Financial Results

Revenue for the first quarter ended March 31, 2024, was $218.8

million, a 36% increase from $161.1 million in the same period of

2023. The growth in revenue was primarily driven by increased

adoption of Shockwave products in both the United States and

internationally.

Gross profit for the first quarter of 2024 was $190.6 million

compared to $140.0 million for the first quarter of 2023. Gross

margin percentage was 87% for the three months ended March 31,

2024, consistent with gross margin for the three months ended March

31, 2023.

Total operating expenses for the first quarter of 2024 were

$148.2 million, a 48% increase from $100.2 million in the first

quarter of 2023. The increase was primarily driven by sales force

expansion and higher headcount to support the growth of the

business.

Net income for the first quarter of 2024 was $55.3 million,

compared to net income of $39.1 million in the same period of 2023.

Basic and diluted net income per share for the first quarter of

2024 was $1.48 and $1.44, respectively.

Adjusted EBITDA improved by approximately 19% to $68.5 million,

in the first quarter of 2024, compared to adjusted EBITDA of $57.5

million in the first quarter of 2023. Adjusted EBITDA is a non-GAAP

measure.

Cash, cash equivalents and short-term investments totaled

$1,029.2 million as of March 31, 2024.

2024 Financial Guidance

Given the proposed acquisition of Shockwave Medical by Johnson

& Johnson (NYSE: JNJ), Shockwave Medical is withdrawing its

full year 2024 guidance, previously issued on February 15,

2024.

Conference Call

Given the proposed acquisition of Shockwave Medical by Johnson

& Johnson (NYSE: JNJ), Shockwave Medical will not be hosting

the previously scheduled earnings conference call today.

About Shockwave Medical, Inc.

Shockwave Medical is a leader in the development and

commercialization of innovative products that are transforming the

treatment of cardiovascular disease. Its first-of-its-kind

Intravascular Lithotripsy (IVL) technology has transformed the

treatment of atherosclerotic cardiovascular disease by safely using

sonic pressure waves to disrupt challenging calcified plaque,

resulting in significantly improved patient outcomes. Shockwave

Medical has also recently acquired the Reducer, which is under

clinical investigation in the United States and is CE Marked in the

European Union and the United Kingdom. By redistributing blood flow

within the heart, the Reducer is designed to provide relief to the

millions of patients worldwide suffering from refractory angina.

Learn more at www.shockwavemedical.com.

Forward-Looking Statements

This press release contains statements relating to our

expectations, projections, beliefs, and prospects, which are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. In some cases, you can

identify these statements by forward-looking words such as “may,”

“might,” “will,” “should,” “expects,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential” or “continue,” and

similar expressions, and the negative of these terms.

Forward-looking statements in this press release include, but are

not limited to, statements regarding our pending acquisition by

Johnson & Johnson, our business strategy and plans, our

objectives for future operations and financial performance and

other matters. You are cautioned not to place undue reliance on

these forward-looking statements. Forward-looking statements are

only predictions based on our current expectations, estimates, and

assumptions, valid only as of the date they are made, and subject

to risks and uncertainties, some of which we are not currently

aware.

If underlying assumptions prove inaccurate or known or unknown

risks or uncertainties materialize, actual results could vary

materially from our expectations and projections. Risks and

uncertainties include, but are not limited to: the risk that the

closing conditions for the pending acquisition will not be

satisfied, including the risk that clearance under the

Hart-Scott-Rodino Antitrust Improvements Act or other applicable

antitrust laws will not be obtained; uncertainty as to the

percentage of our stockholders that will vote to approve the

proposed transaction; the possibility that the transaction will not

be completed in the expected timeframe or at all; potential adverse

effects to our business or the business of Johnson & Johnson

during the pendency of the transaction, such as employee departures

or distraction of management from business operations; the risk of

stockholder litigation relating to the transaction, including

resulting expense or delay; the potential that the expected

benefits and opportunities of the acquisition, if completed, may

not be realized or may take longer to realize than expected;

challenges inherent in product research and development, including

uncertainty of clinical success and obtaining regulatory approvals;

uncertainty of commercial success for new products; manufacturing

difficulties and delays; product efficacy or safety concerns

resulting in product recalls or regulatory action; economic

conditions, including currency exchange and interest rate

fluctuations; the risks associated with global operations;

competition, including technological advances, new products and

patents attained by competitors; challenges to patents; changes to

applicable laws and regulations, including tax laws and global

health care reforms; adverse litigation or government action;

changes in behavior and spending patterns or financial distress of

purchasers of health care services and products; and trends toward

health care cost containment. These factors, as well as others, are

discussed in our filings with the Securities and Exchange

Commission (SEC), including in the sections titled “Risk Factors”

in our most recent Annual Report on Form 10-K and subsequently

filed Quarterly Reports on Form 10-Q, and in our other reports

filed with the SEC. Except to the extent required by law, we do not

undertake to update any of these forward-looking statements after

the date hereof to conform these statements to actual results or

revised expectations.

Use of Non-GAAP Financial Measures

This press release contains supplemental financial information

determined by methods other than in accordance with accounting

principles generally accepted in the United States (GAAP),

including references to adjusted EBITDA, a non-GAAP financial

measure that excludes from net income the effects of income tax

(benefit) provision, other (expense) income, net, interest expense,

interest income, income (loss) from equity method investment,

depreciation and amortization, and stock-based compensation. We

believe the presentation of adjusted EBITDA is useful as it

provides visibility to our underlying continuing operating

performance by excluding the impact of certain items that are

non-cash in nature or not related to our core business

operations.

Our definition of adjusted EBITDA may differ from similarly

titled measures used by others. Adjusted EBITDA should be

considered supplemental to, and not a substitute for, financial

information prepared in accordance with GAAP. Because adjusted

EBITDA excludes the effect of items that increase or decrease our

reported results of operations, management strongly encourages

investors to review, when they become available, our consolidated

financial statements and publicly filed reports in their entirety.

A reconciliation of adjusted EBITDA to net income has been provided

in the financial statement tables included in this press release,

and investors are encouraged to review the reconciliation.

Media Contact: Scott

Shadiow+1.317.432.9210sshadiow@shockwavemedical.com

Investor Contact:Debbie Kasterdkaster@shockwavemedical.com

|

SHOCKWAVE MEDICAL, INC. |

|

Balance Sheet Data |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

March 31,2024 |

|

December 31,2023 |

|

|

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

281,674 |

|

|

$ |

328,422 |

|

Short-term investments |

|

|

747,559 |

|

|

|

662,132 |

|

Accounts receivable, net |

|

|

124,440 |

|

|

|

114,552 |

|

Inventory |

|

|

111,215 |

|

|

|

107,587 |

|

Prepaid expenses and other current assets |

|

|

10,462 |

|

|

|

12,567 |

|

Total current assets |

|

|

1,275,350 |

|

|

|

1,225,260 |

| Operating lease right-of-use

assets |

|

|

34,919 |

|

|

|

29,707 |

| Property and equipment,

net |

|

|

78,693 |

|

|

|

68,923 |

| Equity method investment |

|

|

2,356 |

|

|

|

1,643 |

| Intangible assets, net |

|

|

91,960 |

|

|

|

92,857 |

| Goodwill |

|

|

39,568 |

|

|

|

39,568 |

| Deferred tax assets |

|

|

111,900 |

|

|

|

99,169 |

| Other assets |

|

|

9,001 |

|

|

|

9,436 |

| TOTAL ASSETS |

|

$ |

1,643,747 |

|

|

$ |

1,566,563 |

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

Accounts payable |

|

$ |

9,843 |

|

|

$ |

8,868 |

|

Accrued liabilities |

|

|

78,838 |

|

|

|

91,696 |

|

Lease liability, current portion |

|

|

3,653 |

|

|

|

3,641 |

|

Total current liabilities |

|

|

92,334 |

|

|

|

104,205 |

| Lease liability, noncurrent

portion |

|

|

40,336 |

|

|

|

35,103 |

| Convertible debt, noncurrent

portion |

|

|

732,810 |

|

|

|

731,863 |

| Related party contract

liability, noncurrent portion |

|

|

12,273 |

|

|

|

12,273 |

| Deferred tax liabilities |

|

|

3,609 |

|

|

|

3,609 |

| Long-term income tax

liability |

|

|

2,969 |

|

|

|

1,526 |

| Other liabilities |

|

|

7,659 |

|

|

|

9,307 |

| TOTAL LIABILITIES |

|

|

891,990 |

|

|

|

897,886 |

| STOCKHOLDERS’ EQUITY: |

|

|

|

|

| Common stock |

|

|

38 |

|

|

|

37 |

| Additional paid-in

capital |

|

|

586,017 |

|

|

|

557,882 |

| Accumulated other

comprehensive (loss) income |

|

|

(109 |

) |

|

|

293 |

| Retained earnings |

|

|

165,811 |

|

|

|

110,465 |

| TOTAL STOCKHOLDERS’

EQUITY |

|

|

751,757 |

|

|

|

668,677 |

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

$ |

1,643,747 |

|

|

$ |

1,566,563 |

|

SHOCKWAVE MEDICAL, INC. |

|

Statement of Operations Data |

|

(Unaudited) |

|

(in thousands, except share and per share

data) |

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

|

Product revenue |

|

$ |

218,805 |

|

|

$ |

161,066 |

|

| Cost of revenue: |

|

|

|

|

|

Cost of product revenue |

|

|

28,207 |

|

|

|

21,066 |

|

|

Gross profit |

|

|

190,598 |

|

|

|

140,000 |

|

| Operating expenses: |

|

|

|

|

|

Research and development |

|

|

44,466 |

|

|

|

26,971 |

|

|

Sales and marketing |

|

|

74,492 |

|

|

|

54,011 |

|

|

General and administrative |

|

|

29,233 |

|

|

|

19,204 |

|

|

Total operating expenses |

|

|

148,191 |

|

|

|

100,186 |

|

| Income from operations |

|

|

42,407 |

|

|

|

39,814 |

|

| Income (loss) from equity

method investment |

|

|

713 |

|

|

|

(823 |

) |

| Interest income |

|

|

12,318 |

|

|

|

1,740 |

|

| Interest expense |

|

|

(2,943 |

) |

|

|

(636 |

) |

| Other (expense) income,

net |

|

|

(2,496 |

) |

|

|

642 |

|

| Net income before taxes |

|

|

49,999 |

|

|

|

40,737 |

|

| Income tax (benefit)

provision |

|

|

(5,347 |

) |

|

|

1,612 |

|

|

Net income |

|

$ |

55,346 |

|

|

$ |

39,125 |

|

| Net income per share,

basic |

|

$ |

1.48 |

|

|

$ |

1.07 |

|

| Net income per share,

diluted |

|

$ |

1.44 |

|

|

$ |

1.03 |

|

| Shares used in computing net

income per share, basic |

|

|

37,284,946 |

|

|

|

36,427,263 |

|

| Shares used in computing net

income per share, diluted |

|

|

38,472,013 |

|

|

|

37,979,448 |

|

|

SHOCKWAVE MEDICAL, INC. |

|

Reconciliation of GAAP Net Income to Adjusted

EBITDA |

|

(Unaudited) |

|

(in thousands) |

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| GAAP Net Income |

|

$ |

55,346 |

|

|

$ |

39,125 |

|

| Non-GAAP Adjustments |

|

|

|

|

|

Income tax (benefit) provision |

|

|

(5,347 |

) |

|

|

1,612 |

|

|

Other expense (income), net |

|

|

2,496 |

|

|

|

(642 |

) |

|

Interest expense |

|

|

2,943 |

|

|

|

636 |

|

|

Interest income |

|

|

(12,318 |

) |

|

|

(1,740 |

) |

|

(Income) loss from equity method investment |

|

|

(713 |

) |

|

|

823 |

|

|

Depreciation and amortization |

|

|

3,109 |

|

|

|

1,708 |

|

|

Stock-based compensation expense |

|

|

22,937 |

|

|

|

15,967 |

|

| Adjusted EBITDA |

|

$ |

68,453 |

|

|

$ |

57,489 |

|

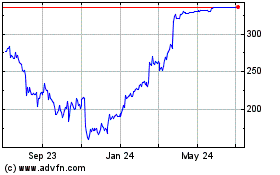

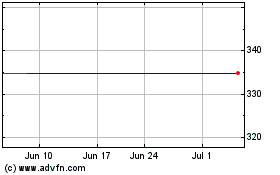

Shockwave Medical (NASDAQ:SWAV)

Historical Stock Chart

From Nov 2024 to Dec 2024

Shockwave Medical (NASDAQ:SWAV)

Historical Stock Chart

From Dec 2023 to Dec 2024