Sensus Healthcare, Inc. (Nasdaq: SRTS), a medical

device company specializing in highly effective, non-invasive,

minimally-invasive and cost-effective treatments for oncological

and non-oncological skin conditions, announces financial results

for the three and nine months ended September 30, 2024.

Highlights from the third quarter of 2024 and

recent weeks include the following:

- Revenues increased 127% over the

comparable 2023 quarter to $8.8 million, reflecting higher

superficial radiotherapy (SRT and IG-SRT) unit sales

- Shipped 27 systems including one

SRT-100 unit to an international customer, compared with 11 systems

shipped in the 2023 quarter

- Entered into Fair Deal Agreements

for seven SRT-100 Vision (IG-SRT) units, bringing the total to 22

units since the program’s introduction in March

- Net income was $1.2 million, or

$0.07 per diluted share, compared with a net loss of $1.5 million,

or $0.09 per share, for the 2023 quarter

- Exited the quarter with $22.6

million in cash and cash equivalents, and no debt

- Sold an SRT system to the radiation

oncology department of Providence Swedish Hospital in Seattle

- Attended the American Society for

Radiation Oncology (ASTRO) 66th annual meeting, where non-melanoma

skin cancer treatment continues to show increased

interest

- Expects to have more than 50 IG-SRT

Systems signed under the Fair Deal Agreement recurring-revenue

program by the end of the year

Management Commentary

“Continued growth in revenues and earnings

reflects our success in engaging customers with both existing and

new sales options. Our revenues more than doubled year-over-year

for the second consecutive quarter, and we maintained profitability

despite the summer seasonality of our business,” said Joe Sardano,

chairman and chief executive officer of Sensus Healthcare. “Our

revenue-sharing Fair Deal Agreement, which allows customers to

deploy capital elsewhere in their businesses, continues to attract

significant attention. Since our launch at the American Academy of

Dermatology meeting in March, we signed 22 agreements as of

September 30th.”

Mr. Sardano added, “We have exceeded our goal of

having up to 50 Fair Deal Agreements signed by the end of 2024, and

we expect to be generating recurring revenue from these SRT-100

Vision (IG-SRT) systems in 2025. Given the growing utilization of

SRT to treat non-melanoma skin cancer and keloid scars, and the

interest we have generated to date, we expect this model to

contribute to our growth for years to come. This model would not be

possible without Sentinel IT, our proprietary HIPAA-compliant

software with clinical billing and asset management utility that

also allows us to track utilization in real time. We believe this

intellectual property is a very valuable asset to Sensus.”

Mr. Sardano concluded, “The market for

non-melanoma skin cancer treatments is enormous, with an estimated

one in five Americans developing skin cancer during their lifetime,

representing some 70 million people. Globally, more than 1.2

million people develop non-melanoma skin cancer annually. Clearly

SRT is becoming the ‘people’s choice’ on how they wish to be

treated.”

Third Quarter Financial

Results

Revenues for the third quarter of 2024 were $8.8

million, compared with $3.9 million for the third quarter of 2023,

an increase of $4.9 million, or 127%. The increase was primarily

driven by a higher number of SRT systems sold to a large

customer.

Cost of sales was $3.6 million for the third

quarter of 2024, compared with $1.9 million for the prior-year

quarter. The increase was primarily related to a higher number of

units sold in the 2024 quarter.

Gross profit was $5.2 million for the third

quarter of 2024, or 59.3% of revenues, compared with $2.0 million,

or 51.0% of revenues, for the third quarter of 2023. The increase

was primarily driven by the higher number of units sold in the 2024

quarter.

Selling and marketing expense was $1.3 million

for the third quarter of 2024, unchanged from the third quarter of

2023.

General and administrative expense was $1.6

million for the third quarter of 2024, compared with $1.5 million

for the third quarter of 2023. The increase was primarily due to

higher compensation and bad debt expense, which were offset by a

reduction in bank fees.

Research and development expense was $0.9

million for the third quarter of 2024, compared with $1.1 million

for the third quarter of 2023. The decrease was primarily due to

expenses, mostly incurred in the 2023 quarter, related to a project

to develop a drug delivery system for aesthetic use.

Other income of $0.3 million for the third

quarter of 2024 was mostly related to interest income, and was

unchanged from the prior-year quarter.

Net income for the third quarter of 2024 was

$1.2 million, or $0.07 per diluted share, compared with a net loss

of $1.5 million, or $0.09 per share, for the third quarter of

2023.

Adjusted EBITDA for the third quarter of 2024

was $1.6 million, compared with negative $1.7 million for the third

quarter of 2023. Adjusted EBITDA, a non-GAAP financial measure, is

defined as earnings before interest, taxes, depreciation,

amortization and stock-compensation expense. Please see below for a

reconciliation between GAAP and non-GAAP financial measures, and

the reasons these non-GAAP financial measures are provided.

Cash and cash equivalents were $22.6 million as

of September 30, 2024, compared with $23.1 million as of December

31, 2023. The Company had no outstanding borrowings under its

revolving line of credit. Accounts receivable were $17.0 million as

of September 30, 2024, compared with $10.6 million as of December

31, 2023, with the increase reflecting the increase in sales and

concentration of sales to a large customer that is subject to

extended payment terms.

Nine Month Financial

Results

Revenues for the nine months ended September 30,

2024 were $28.7 million, compared with $11.8 million for the nine

months ended September 30, 2023, an increase of $16.9 million, or

143%. The increase was primarily driven by a higher number of units

sold to a large customer.

Cost of sales was $11.4 million for the nine

months ended September 30, 2024, compared with $5.6 million for the

nine months ended September 30, 2023. The increase was primarily

related to higher sales in the 2024 period.

Gross profit was $17.3 million, or 60.3% of

revenues, for the nine months ended September 30, 2024, compared

with $6.2 million, or 52.6% of revenues, for the nine months ended

September 30, 2023. The increase was primarily driven by a higher

number of units sold in the 2024 period.

Selling and marketing expense was $3.6 million

for the nine months ended September 30, 2024, compared with $5.0

million for the nine months ended September 30, 2023. The decrease

was primarily attributable to a decline in marketing agency

expense, travel expense and lower headcount.

General and administrative expense was $4.7

million for the nine months ended September 30, 2024, compared with

$4.2 million for the nine months ended September 30, 2023. The

increase was primarily due to higher compensation and bad debt

expense, which were offset by a reduction in bank fees and

insurance expense.

Research and development expense was $2.7

million for the nine months ended September 30, 2024, compared with

$3.0 million for the nine months ended September 30, 2023. The

decrease was primarily due to a project to develop a drug delivery

system for aesthetic use.

Other income of $0.7 million and $0.8 million

for the nine months ended September 30, 2024 and 2023,

respectively, relates primarily to interest income.

Net income for the nine months ended September

30, 2024 was $5.1 million, or $0.31 per diluted share, compared

with a net loss of $3.7 million, or $0.23 per share, for the nine

months ended September 30, 2023.

Adjusted EBITDA for the nine months ended

September 30, was $6.7 million, compared with negative $5.4 million

for the nine months ended September 30, 2023.

Use of Non-GAAP Financial

Information

This press release contains supplemental

financial information determined by methods other than in

accordance with accounting principles generally accepted in the

United States (GAAP). Sensus Healthcare management uses Adjusted

EBITDA, a non-GAAP financial measure, in its analysis of the

Company’s performance. Adjusted EBITDA should not be considered a

substitute for GAAP basis measures, nor should it be viewed as a

substitute for operating results determined in accordance with

GAAP. Management believes the presentation of Adjusted EBITDA,

which excludes the impact of interest, income taxes, depreciation,

amortization and stock-compensation expense, provides useful

supplemental information that is essential to a proper

understanding of the financial results of Sensus Healthcare.

Non-GAAP financial measures are not formally defined by GAAP, and

other entities may use calculation methods that differ from those

used by Sensus Healthcare. As a complement to GAAP financial

measures, management believes that Adjusted EBITDA assists

investors who follow the practice of some investment analysts who

adjust GAAP financial measures to exclude items that may obscure

underlying performance and distort comparability. A reconciliation

of the GAAP net loss to Adjusted EBITDA is provided in the schedule

below.

| |

|

|

|

|

| SENSUS

HEALTHCARE, INC. |

|

|

|

|

| GAAP TO

NON-GAAP RECONCILIATION |

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended |

|

For the Nine

Months Ended |

| |

|

September 30, |

|

September 30, |

|

(in thousands) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

income (loss), as reported |

|

$ |

1,215 |

|

|

$ |

(1,451 |

) |

|

$ |

5,101 |

|

|

$ |

(3,725 |

) |

| Add: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

53 |

|

|

|

60 |

|

|

|

154 |

|

|

|

216 |

|

|

Stock compensation expense |

|

|

45 |

|

|

|

67 |

|

|

|

201 |

|

|

|

276 |

|

|

Income tax expense (benefit) |

|

|

559 |

|

|

|

(125 |

) |

|

|

1,965 |

|

|

|

(1,428 |

) |

|

Interest income, net |

|

|

(279 |

) |

|

|

(277 |

) |

|

|

(702 |

) |

|

|

(764 |

) |

|

Adjusted EBITDA, non GAAP |

|

$ |

1,593 |

|

|

$ |

(1,726 |

) |

|

$ |

6,719 |

|

|

$ |

(5,425 |

) |

| |

|

|

|

|

|

|

|

|

Conference Call and Webcast

Sensus Healthcare held an investment community conference call

on November 14, 2024 during which management discussed these

financial results, provided a business update and answered

questions.

A replay will be available until December 14, 2024 and can be

accessed by dialing 877-344-7529 (U.S. Toll Free), 855-669-9658

(Canada Toll Free) or 412-317-0088 (International), using replay

code 3932512. An archived webcast of the call will also be

available in the Investors section of the Company’s website.

About Sensus Healthcare

Sensus Healthcare, Inc. is a global pioneer in

the development and delivery of non-invasive treatments for skin

cancer and keloids. Leveraging its cutting-edge superficial

radiotherapy (SRT and IG-SRT) technology, the company provides

healthcare providers with a highly effective, patient-centric

treatment platform. With a dedication to driving innovation in

radiation oncology, Sensus Healthcare offers solutions that are

safe, precise, and adaptable to a variety of clinical settings. For

more information, please visit www.sensushealthcare.com.

Forward-Looking Statements

This press release includes statements that are,

or may be deemed, ''forward-looking statements.'' In some cases,

these statements can be identified by the use of forward-looking

terminology such as "believes," "estimates," "anticipates,"

"expects," "plans," "intends," "may," "could," "might," "will,"

"should," “approximately,” "potential" or negative or other

variations of those terms or comparable terminology, although not

all forward-looking statements contain these words.

Forward-looking statements involve risks and

uncertainties because they relate to events, developments, and

circumstances relating to Sensus, our industry, and/or general

economic or other conditions that may or may not occur in the

future or may occur on longer or shorter timelines or to a greater

or lesser degree than anticipated. In addition, even if future

events, developments, and circumstances are consistent with the

forward-looking statements contained in this press release, they

may not be predictive of results or developments in future periods.

Although we believe that we have a reasonable basis for each

forward-looking statement contained in this press release,

forward-looking statements are not guarantees of future

performance, and our actual results of operations, financial

condition and liquidity, and the development of the industry in

which we operate may differ materially from the forward-looking

statements contained in this press release, as a result of the

following factors, among others: our ability to maintain

profitability; our ability to sell the number of SRT units we

anticipate for the balance of 2024; the possibility that

inflationary pressures continue to impact our sales; the level and

availability of government and/or third party payor reimbursement

for clinical procedures using our products, and the willingness of

healthcare providers to purchase our products if the level of

reimbursement declines; the regulatory requirements applicable to

us and our competitors; our ability to efficiently manage our

manufacturing processes and costs; the risks arising from doing

business in China and other foreign countries; legislation,

regulation, or other governmental action that affects our products,

taxes, international trade regulation, or other aspects of our

business; concentration of our customers in the U.S. and China,

including the concentration of sales to one particular customer in

the U.S.; the performance of the Company’s information technology

systems and its ability to maintain data security; our ability to

obtain and maintain the intellectual property needed to adequately

protect our products, and our ability to avoid infringing or

otherwise violating the intellectual property rights of third

parties; and other risks described from time to time in our filings

with the Securities and Exchange Commission, including our Annual

Report on Form 10-K and Quarterly Reports on Form 10-Q.

To date, we do not expect that the Middle East

conflict, the Russian invasion of Ukraine and global geopolitical

uncertainties have had any particular impact on our business, but

we continue to monitor developments and will address them in future

disclosures, if applicable.

Any forward-looking statements that we make in

this press release speak only as of the date of such statement, and

we undertake no obligation to update such statements to reflect

events or circumstances after the date of this press release,

except as may be required by applicable law. You should read

carefully our "Introductory Note Regarding Forward-Looking

Information" and the factors described in the "Risk Factors"

section of our periodic reports filed with the Securities and

Exchange Commission to better understand the risks and

uncertainties inherent in our business.

Contact: Alliance Advisors IR

Kim Sutton Golodetz212-838-3777kgolodetz@allianceadvisors.com

| SENSUS

HEALTHCARE, INC. |

|

|

|

|

|

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended |

|

For the Nine

Months Ended |

| |

|

September 30, |

|

September 30, |

|

(in thousands, except share and per share data) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

(unaudited) |

|

|

(unaudited) |

|

(unaudited) |

|

|

(unaudited) |

|

Revenues |

|

$ |

8,839 |

|

|

$ |

3,898 |

|

|

$ |

28,741 |

|

|

$ |

11,838 |

|

|

Cost of sales |

|

|

3,599 |

|

|

|

1,909 |

|

|

|

11,416 |

|

|

|

5,609 |

|

|

Gross profit |

|

|

5,240 |

|

|

|

1,989 |

|

|

|

17,325 |

|

|

|

6,229 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

| Selling and

marketing |

|

|

1,309 |

|

|

|

1,290 |

|

|

|

3,575 |

|

|

|

4,983 |

|

| General and

administrative |

|

|

1,573 |

|

|

|

1,511 |

|

|

|

4,731 |

|

|

|

4,204 |

|

|

Research and development |

|

|

863 |

|

|

|

1,083 |

|

|

|

2,655 |

|

|

|

3,001 |

|

|

Total operating expenses |

|

|

3,745 |

|

|

|

3,884 |

|

|

|

10,961 |

|

|

|

12,188 |

|

|

Income (loss) from operations |

|

|

1,495 |

|

|

|

(1,895 |

) |

|

|

6,364 |

|

|

|

(5,959 |

) |

|

Other income: |

|

|

|

|

|

|

|

|

|

|

| Gain on sale

of assets |

|

|

- |

|

|

|

42 |

|

|

|

- |

|

|

|

42 |

|

| Interest

income, net |

|

|

279 |

|

|

|

277 |

|

|

|

702 |

|

|

|

764 |

|

|

Other income, net |

|

|

279 |

|

|

|

319 |

|

|

|

702 |

|

|

|

806 |

|

|

Income (loss) before income tax |

|

|

1,774 |

|

|

|

(1,576 |

) |

|

|

7,066 |

|

|

|

(5,153 |

) |

|

Provision for (benefit from) income tax |

|

|

559 |

|

|

|

(125 |

) |

|

|

1,965 |

|

|

|

(1,428 |

) |

|

Net Income (loss) |

|

$ |

1,215 |

|

|

$ |

(1,451 |

) |

|

$ |

5,101 |

|

|

$ |

(3,725 |

) |

| Net

income (loss) per share – basic |

|

$ |

0.07 |

|

|

$ |

(0.09 |

) |

|

$ |

0.31 |

|

|

$ |

(0.23 |

) |

| –

diluted |

|

$ |

0.07 |

|

|

$ |

(0.09 |

) |

|

$ |

0.31 |

|

|

$ |

(0.23 |

) |

|

Weighted average number of shares used in computing net

income (loss) per share – basic |

|

|

16,321,131 |

|

|

|

16,270,403 |

|

|

|

16,304,913 |

|

|

|

16,255,263 |

|

| –

diluted |

|

|

16,345,749 |

|

|

|

16,270,403 |

|

|

|

16,332,485 |

|

|

|

16,255,263 |

|

| |

|

|

|

|

|

|

|

|

|

|

| SENSUS

HEALTHCARE, INC. |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| |

|

|

|

|

|

|

| |

|

As of

September 30, |

|

As of

December 31, |

|

(in thousands, except shares and per share data) |

|

2024 |

|

2023 |

| |

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

22,558 |

|

|

$ |

23,148 |

|

| Accounts

receivable, net |

|

|

16,961 |

|

|

|

10,645 |

|

|

Inventories |

|

|

11,968 |

|

|

|

11,861 |

|

| Prepaid

inventory |

|

|

1,723 |

|

|

|

2,986 |

|

| Other

current assets |

|

|

1,596 |

|

|

|

888 |

|

|

Total current assets |

|

|

54,806 |

|

|

|

49,528 |

|

| Property and

equipment, net |

|

|

1,635 |

|

|

|

464 |

|

| Deferred tax

asset |

|

|

2,197 |

|

|

|

2,140 |

|

| Operating

lease right-of-use assets, net |

|

|

630 |

|

|

|

774 |

|

| Other

noncurrent assets |

|

|

590 |

|

|

|

804 |

|

|

Total assets |

|

$ |

59,858 |

|

|

$ |

53,710 |

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

| Accounts

payable and accrued expenses |

|

$ |

3,973 |

|

|

$ |

2,793 |

|

| Product

warranties |

|

|

351 |

|

|

|

538 |

|

| Operating

lease liabilities, current portion |

|

|

200 |

|

|

|

187 |

|

| Income tax

payable |

|

|

- |

|

|

|

37 |

|

| Deferred

revenue, current portion |

|

|

686 |

|

|

|

657 |

|

|

Total current Liabilities |

|

|

5,210 |

|

|

|

4,212 |

|

| Operating

lease liabilities, net of current portion |

|

|

451 |

|

|

|

596 |

|

| Deferred

revenue, net of current portion |

|

|

66 |

|

|

|

60 |

|

|

Total liabilities |

|

|

5,727 |

|

|

|

4,868 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

| Preferred

stock, 5,000,000 shares authorized and none issued and

outstanding |

|

|

- |

|

|

|

- |

|

| Common

stock, $0.01 par value – 50,000,000 authorized; 16,930,845 issued

and 16,390,051 outstanding at September 30, 2024; 16,907,095 issued

and 16,374,171 outstanding at December 31, 2023 |

|

|

169 |

|

|

|

169 |

|

| Additional

paid-in capital |

|

|

45,640 |

|

|

|

45,405 |

|

| Treasury

stock, 540,794 and 532,924 shares at cost, at September 30, 2024

and December 31, 2023, respectively |

|

|

(3,566 |

) |

|

|

(3,519 |

) |

| Retained

earnings |

|

|

11,888 |

|

|

|

6,787 |

|

|

Total stockholders’ equity |

|

|

54,131 |

|

|

|

48,842 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

59,858 |

|

|

$ |

53,710 |

|

| |

|

|

|

|

|

|

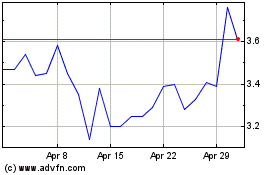

Sensus Healthcare (NASDAQ:SRTS)

Historical Stock Chart

From Oct 2024 to Nov 2024

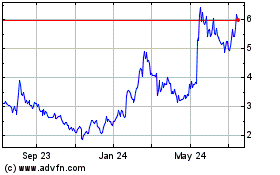

Sensus Healthcare (NASDAQ:SRTS)

Historical Stock Chart

From Nov 2023 to Nov 2024