Seanergy Maritime Holdings Corp. (“Seanergy” or the “Company”)

(NASDAQ: SHIP), announced today its financial results for the third

quarter and nine months ended September 30, 2024. The Company also

declared a quarterly cash dividend of $0.26 per common share for

the third quarter of 2024 pursuant to its updated dividend policy

announced during the last quarter.

For the quarter ended September 30, 2024, the

Company generated Net Revenues of $44.4 million, compared to $24.5

million in the third quarter of 2023, representing an increase of

81%. Adjusted EBITDA for the quarter was $26.8 million, 182% higher

than $9.5 million in the same period of 2023. Net Income and

Adjusted Net Income for the quarter were $12.5 million and $14.1

million, respectively, compared to Net Loss of $5.0 million and

Adjusted Net Loss of $2.6 million in the third quarter of 2023. The

daily TCE rate of the fleet for the third quarter of 2024 was

$26,529, compared to $15,298 in the same period of 2023.

For the nine-month period ended September 30,

2024, the Company generated Net Revenues of $125.8 million,

compared to $70.8 million in the same period of 2023, marking an

increase of 78%. Net Income and Adjusted Net Income for the nine

months were $36.8 million and $41.7 million, respectively, compared

to Net Loss of $8.5 million and Adjusted Net Income of $0.4 million

in the respective period of 2023. Adjusted EBITDA for the nine

months was $78.0 million, compared to $29.1 million for the same

period of 2023. The daily TCE rate of the fleet for the nine-month

period of 2024 was $25,762, compared to $14,935 in the same period

of 2023. The average daily OPEX was $6,873 compared to $6,942 in

the respective period of 2023.

Cash and cash-equivalents and restricted cash,

as of September 30, 2024, stood at $41.3 million. Shareholders’

equity at the end of the third quarter was $262.6 million.

Long-term debt (senior loans, finance lease liability and other

financial liabilities) net of deferred charges stood at $238.1

million, while the book value of the fleet, including a

chartered-in vessel and the advance for vessel acquisition, was

$462.9 million.

Stamatis Tsantanis, the Company’s

Chairman & Chief Executive Officer, stated:

“In the third quarter, Seanergy sustained its

profitable trajectory by continuing to execute on our focused

strategy as a dedicated Capesize operator. During this period, the

Capesize segment led the dry bulk sector in performance, with the

BCI averaging $24,900. Seanergy’s fleet achieved a notable TCE rate

of $26,500, outperforming the BCI by approximately 7%. This

outperformance highlights the effectiveness of our hedging

strategy, which has been instrumental in reducing charter rate

volatility and increasing our revenue visibility. Our objective

remains to maintain a balanced risk-return profile throughout the

market cycle, ensuring stability and resilience in our

earnings.

“As evidenced by our recently implemented

updated dividend policy, which targets a distribution of

approximately 50% of our operating cash flow after debt service, we

are committed to delivering strong capital returns to our

shareholders, consistent with our earnings performance, while

continuing to grow our fleet and maintain a healthy balance sheet.

In line with this policy, the Board has approved a quarterly

dividend of $0.26 per share for the third quarter of 2024. We have

also continued stock repurchases since our last update and into the

fourth quarter. Buybacks continue to be an important part of our

capital allocation strategy and we remain committed to optimizing

the ways in which we return capital to our shareholders.

“In October, as anticipated, we welcomed the

2012-built M/V Kaizenship to our fleet. This vessel, along with the

2013-built M/V Iconship also acquired in 2024, has reduced our

fleet's average age and both vessels have been chartered at a

premium over the BCI, outperforming our fleet-wide average. These

younger, high-performing additions align with our disciplined

growth strategy and strengthen our competitive edge in the Capesize

sector.

“Our balance sheet remains robust, reflecting

our commitment to sustainable leverage as we expand our fleet. With

positive Capesize market trends, we are well-positioned to continue

delivering strong returns, while advancing our growth strategy.

“For the fourth quarter of the year, our TCE

guidance is approximately $23,400, reflecting current FFA levels

and our effective hedging strategy. Notably, we have secured 42% of

our available days at a fixed average daily rate of around $28,000,

outperforming the BCI which has averaged $20,900 quarter-to-date.

Looking ahead to 2025, we have locked in daily earnings for two

vessels at an average rate of $24,000, with one agreement

incorporating a 50-50 profit-sharing scheme on top of the fixed

hire rate, based on a premium over the BCI. These initiatives

position us to capture stable, high returns while optimizing

earnings potential in line with market movements.

“The Capesize market has performed relatively

strong in 2024, with the BCI averaging around $24,000. Key drivers

include a 6% rise in Brazilian iron ore exports, a 17% increase in

Guinea's bauxite exports, and higher seaborne coal trade as demand

in India and China outpaces local production. Geopolitical factors

and the shift toward distant sourcing regions, such as West Africa,

have further boosted ton-mile demand.

“Limited new vessel deliveries, as well as

increased global fleet drydockings in 2025, are likely to constrain

supply in 2025, supporting continued Capesize rate strength. With

these favorable dynamics, Seanergy is well-positioned to continue

to deliver robust returns for shareholders.

“Finally, we are pleased with the recent

decision by the High Court of the Republic of the Marshall Islands

to dismiss the litigation brought against the Company by Sphinx

Investment Corp., an entity of G. Economou. This outcome reaffirms

our adherence to good corporate governance processes. We are also

pleased with the strong support for our Board demonstrated by our

recent annual meeting results. We remain fully focused on executing

our value-creating strategy, reinforcing our commitment to

delivering strong returns for our shareholders.”

Company

Fleet:

|

Vessel Name |

Capacity (DWT) |

YearBuilt |

Yard |

Scrubber Fitted |

Employment Type |

FFA conversion option(1) |

Minimum time charter (“T/C”) expiration |

Maximum T/C expiration(2) |

Charterer |

|

Titanship |

207,855 |

2011 |

NACKS |

- |

T/C Index Linked |

Yes |

09/2026 |

03/2027 |

Costamare |

|

Patriotship |

181,709 |

2010 |

Imabari |

Yes |

T/C Index Linked |

Yes |

01/2025 |

04/2025 |

Glencore |

|

Dukeship |

181,453 |

2010 |

Sasebo |

- |

T/C Index Linked |

Yes |

06/2025 |

09/2025 |

NYK |

|

Paroship |

181,415 |

2012 |

Koyo -Imabari |

Yes |

T/C Index Linked |

Yes |

08/2025 |

01/2026 |

Oldendorff |

|

Worldship |

181,415 |

2012 |

Koyo – Imabari |

Yes |

T/C Index Linked |

Yes |

10/2025 |

02/2026 |

NYK |

|

Kaizenship |

181,396 |

2012 |

Koyo Dock |

- |

T/C Index Linked |

Yes |

07/2025 |

10/2025 |

MOL |

|

Iconship |

181,392 |

2013 |

Imabari |

- |

T/C Index Linked |

Yes |

03/2026 |

06/2026 |

Costamare |

|

Hellasship |

181,325 |

2012 |

Imabari |

- |

T/C Index Linked |

Yes |

12/2024 |

04/2025 |

NYK |

|

Honorship |

180,242 |

2010 |

Imabari |

- |

T/C Index Linked |

Yes |

03/2025 |

07/2025 |

NYK |

|

Fellowship |

179,701 |

2010 |

Daewoo |

- |

T/C Index Linked |

Yes |

06/2026 |

11/2026 |

Anglo American |

|

Championship |

179,238 |

2011 |

Sungdong SB |

Yes |

T/C Index Linked |

Yes |

04/2025 |

11/2025 |

Cargill |

|

Partnership |

179,213 |

2012 |

Hyundai |

Yes |

T/C Index Linked |

Yes |

09/2024 |

12/2024 |

Uniper |

|

Knightship |

178,978 |

2010 |

Hyundai |

Yes |

T/C Index Linked |

Yes |

11/2025 |

01/2026 |

Glencore |

|

Lordship |

178,838 |

2010 |

Hyundai |

Yes |

T/C Index Linked |

Yes |

01/2026 |

05/2026 |

Costamare |

|

Friendship |

176,952 |

2009 |

Namura |

- |

T/C Index Linked |

Yes |

12/2024 |

04/2025 |

NYK |

|

Flagship |

176,387 |

2013 |

Mitsui |

- |

T/C Index Linked |

Yes |

05/2026 |

07/2026 |

Cargill |

|

Geniuship |

170,057 |

2010 |

Sungdong SB |

- |

T/C Index Linked |

Yes |

06/2025 |

09/2025 |

NYK |

|

Premiership |

170,024 |

2010 |

Sungdong SB |

Yes |

T/C Index Linked |

Yes |

03/2025 |

05/2025 |

Glencore |

|

Squireship |

170,018 |

2010 |

Sungdong SB |

Yes |

T/C Index Linked |

Yes |

04/2025 |

06/2025 |

Glencore |

|

Total /Average age |

3,417,608 |

13.5 years |

- |

- |

- |

- |

- |

- |

- |

(1) The

Company has the option to convert the index-linked rate to fixed

for periods ranging between 1 and 12 months, based on the

prevailing Capesize FFA Rate for the selected period.

(2) The

latest redelivery date does not include any additional optional

periods.

Fleet Data:

(U.S. Dollars in thousands)

|

|

|

Q3 2024 |

|

|

Q3 2023 |

|

|

9M 2024 |

|

|

9M 2023 |

|

|

Ownership days (1) |

|

1,656 |

|

|

1,472 |

|

|

4,770 |

|

|

4,467 |

|

|

Operating days (2) |

|

1,604 |

|

|

1,460 |

|

|

4,703 |

|

|

4,423 |

|

|

Fleet utilization (3) |

|

96.9% |

|

|

99.2% |

|

|

98.6% |

|

|

99.0% |

|

|

TCE rate (4) |

$26,529 |

|

$15,298 |

|

$25,762 |

|

$14,935 |

|

|

Daily Vessel Operating Expenses (5) |

$6,637 |

|

$6,985 |

|

$6,873 |

|

$6,942 |

|

(1) Ownership days are the

total number of calendar days in a period during which the vessels

in a fleet have been owned or chartered in. Ownership days are an

indicator of the size of the Company’s fleet over a period and

affect both the amount of revenues and the amount of expenses that

the Company recorded during a period.

(2) Operating days are the

number of available days in a period less the aggregate number of

days that the vessels are off-hire due to unforeseen circumstances.

Available days are the number of ownership days less the aggregate

number of days that our vessels are off-hire due to major repairs,

dry-dockings, lay-up or special or intermediate surveys. Operating

days include the days that our vessels are in ballast voyages

without having finalized agreements for their next employment. The

Company’s calculation of operating days may not be comparable to

that reported by other companies.

(3) Fleet utilization is the

percentage of time that the vessels are generating revenue and is

determined by dividing operating days by ownership days for the

relevant period. Fleet Utilization is used to measure a company’s

ability to efficiently find suitable employment for its vessels and

minimize the number of days that its vessels are off-hire for

unforeseen events. We believe it provides additional meaningful

information and assists management in making decisions regarding

areas where we may be able to improve efficiency and increase

revenue and because we believe that it provides useful information

to investors regarding the efficiency of our operations.

(4) TCE rate is defined as the

Company’s net revenue less voyage expenses during a period divided

by the number of the Company’s operating days during the period.

Voyage expenses include port charges, bunker (fuel oil and diesel

oil) expenses, canal charges and other commissions. The Company

includes the TCE rate, which is not a recognized measure under U.S.

GAAP, as it believes it provides additional meaningful information

in conjunction with net revenues from vessels, the most directly

comparable U.S. GAAP measure, and because it assists the Company’s

management in making decisions regarding the deployment and use of

our vessels and because the Company believes that it provides

useful information to investors regarding our financial

performance. The Company’s calculation of TCE rate may not be

comparable to that reported by other companies. The following table

reconciles the Company’s net revenues from vessels to the TCE

rate.

(In thousands of U.S. Dollars, except operating days and TCE

rate)

|

|

Q3 2024 |

Q3 2023 |

9M 2024 |

9M 2023 |

|

Vessel revenue, net |

|

43,369 |

|

23,105 |

|

123,735 |

|

68,135 |

| Less: Voyage expenses |

|

816 |

|

770 |

|

2,576 |

|

2,078 |

| Time charter equivalent

revenues |

|

42,553 |

|

22,335 |

|

121,159 |

|

66,057 |

| Operating days |

|

1,604 |

|

1,460 |

|

4,703 |

|

4,423 |

| TCE rate |

$26,529 |

$15,298 |

$25,762 |

$14,935 |

(5) Vessel operating expenses

include crew costs, provisions, deck and engine stores, lubricants,

insurance, maintenance and repairs. Daily Vessel Operating Expenses

are calculated by dividing vessel operating expenses, excluding pre

delivery costs, by ownership days for the relevant time periods.

The Company’s calculation of daily vessel operating expenses may

not be comparable to that reported by other companies. The

following table reconciles the Company’s vessel operating expenses

to daily vessel operating expenses.

(In thousands of U.S. Dollars, except ownership days and Daily

Vessel Operating Expenses)

|

|

Q3 2024 |

Q3 2023 |

9M 2024 |

9M 2023 |

|

Vessel operating expenses |

|

11,366 |

|

10,282 |

|

33,620 |

|

31,371 |

| Less: Pre-delivery expenses |

|

375 |

|

- |

|

835 |

|

362 |

| Vessel operating expenses before

pre-delivery expenses |

|

10,991 |

|

10,282 |

|

32,785 |

|

31,009 |

| Ownership days |

|

1,656 |

|

1,472 |

|

4,770 |

|

4,467 |

| Daily Vessel Operating

Expenses |

$6,637 |

$6,985 |

$6,873 |

$6,942 |

| |

Net income / (loss) to EBITDA and Adjusted EBITDA

Reconciliation:

(In thousands of U.S. Dollars)

|

|

Q3 2024 |

|

Q3 2023 |

|

9M 2024 |

|

9M 2023 |

|

|

Net income / (loss) |

12,546 |

|

(5,040 |

) |

36,834 |

|

(8,547 |

) |

|

Interest and finance cost, net |

5,055 |

|

4,983 |

|

14,290 |

|

15,185 |

|

|

Depreciation and amortization |

7,645 |

|

7,110 |

|

21,556 |

|

21,290 |

|

|

EBITDA |

25,246 |

|

7,053 |

|

72,680 |

|

27,928 |

|

|

Stock based compensation |

1,533 |

|

2,474 |

|

4,550 |

|

8,601 |

|

|

Loss on extinguishment of debt |

- |

|

- |

|

649 |

|

540 |

|

|

Loss on forward freight agreements, net |

30 |

|

4 |

|

134 |

|

148 |

|

|

Gain on sale of vessels, net |

- |

|

- |

|

- |

|

(8,094 |

) |

|

Adjusted EBITDA |

26,809 |

|

9,531 |

|

78,013 |

|

29,123 |

|

|

|

Earnings Before Interest, Taxes, Depreciation

and Amortization ("EBITDA") represents the sum of net income /

(loss), net interest and finance costs, depreciation and

amortization and, if any, income taxes during a period. EBITDA is

not a recognized measurement under U.S. GAAP. Adjusted EBITDA

represents EBITDA adjusted to exclude stock-based compensation,

loss on forward freight agreements, net, loss on extinguishment of

debt, and the non-recurring gain on sale of vessels, net, which the

Company believes are not indicative of the ongoing performance of

its core operations.

EBITDA and adjusted EBITDA are presented as we

believe that these measures are useful to investors as a widely

used means of evaluating operating profitability. Management also

uses these non-GAAP financial measures in making financial,

operating and planning decisions and in evaluating the Company’s

performance. EBITDA and adjusted EBITDA as presented here may not

be comparable to similarly titled measures presented by other

companies. These non-GAAP measures should not be considered in

isolation from, as a substitute for, or superior to, financial

measures prepared in accordance with U.S. GAAP.

Adjusted Net Income / (Loss) Reconciliation and

calculation of Adjusted Earnings Per Share

(In thousands of U.S. Dollars, except for share and per share

data)

|

|

Q3 2024 |

|

Q3 2023 |

|

9M 2024 |

|

9M 2023 |

|

|

Net income / (loss) |

12,546 |

|

(5,040 |

) |

36,834 |

|

(8,547 |

) |

|

Stock based compensation |

1,533 |

|

2,474 |

|

4,550 |

|

8,601 |

|

|

Loss on extinguishment of debt (non-cash) |

- |

|

- |

|

304 |

|

300 |

|

|

Adjusted net income / (loss) |

14,079 |

|

(2,566 |

) |

41,688 |

|

354 |

|

|

Dividends to non-vested participating securities |

(215 |

) |

(38 |

) |

(428 |

) |

(114 |

) |

|

Undistributed earnings to non-vested participating securities |

(310 |

) |

- |

|

(1,117 |

) |

- |

|

|

Adjusted net income / (loss) – common

shareholders |

13,554 |

|

(2,604 |

) |

40,143 |

|

240 |

|

|

Adjusted earnings / (loss) per common share, basic |

0.69 |

|

(0.14 |

) |

2.05 |

|

0.02 |

|

|

Adjusted earnings / (loss) per common share, diluted |

0.69 |

|

(0.14 |

) |

2.04 |

|

0.02 |

|

|

Weighted average number of common shares outstanding, basic |

19,637,290 |

|

18,138,600 |

|

19,568,430 |

|

18,177,002 |

|

|

Weighted average number of common shares outstanding, diluted |

19,786,887 |

|

18,138,600 |

|

19,702,128 |

|

18,177,002 |

|

| |

To derive Adjusted Earnings Per Share, a

non-GAAP financial measure, from Net Income, we adjust for

dividends and undistributed earnings to non-vested participating

securities and exclude non-cash items, as provided in the table

above. We believe that Adjusted Net Income and Adjusted Earnings

Per Share assist our management and investors by increasing the

comparability of our performance from period to period since each

such measure eliminates the effects of such non-cash items as loss

on extinguishment of debt, stock based compensation and other items

which may vary from year to year, for reasons unrelated to overall

operating performance. In addition, we believe that the

presentation of the respective measure provides investors with

supplemental data relating to our results of operations, and

therefore, with a more complete understanding of factors affecting

our business than with GAAP measures alone. Our method of computing

Adjusted Net Income and Adjusted Earnings Per Share may not

necessarily be comparable to other similarly titled captions of

other companies due to differences in methods of calculation.

Fourth Quarter 2024 TCE Rate Guidance:

As of the date hereof, approximately 62% of the

Company fleet’s expected operating days in the fourth quarter of

2024 have been fixed at an estimated TCE rate of approximately

$25,827. Assuming that for the remaining operating days of our

index-linked time charters, the respective vessels’ TCE rate will

be equal to the average Forward Freight Agreement (“FFA”) rate of

$19,866 per day (based on the FFA curve as of October 29, 2024),

our estimated TCE rate for the fourth quarter of 2024 will be

approximately $23,3905. The following table provides the breakdown

of index-linked charters and fixed-rate charters in the fourth

quarter of 2024:

|

|

Operating Days |

TCE |

|

TCE - fixed rate (incl. FFA conversions) |

730 |

$26,316 |

|

TCE – index-linked |

1,012 |

$21,279 |

|

Total / Average |

1,742 |

$23,390 |

______________________________5 This guidance is

based on certain assumptions and there can be no assurance that

these TCE rate estimates, or projected utilization will be

realized. TCE estimates include certain floating (index) to fixed

rate conversions concluded in previous periods. For vessels on

index-linked T/Cs, the TCE rate realized will vary with the

underlying index, and for the purposes of this guidance, the TCE

rate assumed for the remaining operating days of the quarter for an

index-linked T/C is equal to the average FFA rate of $19,866 based

on the curve of October 29, 2024. Spot estimates are provided using

the load-to-discharge method of accounting. The rates quoted are

for days currently contracted. Increased ballast days at the end of

the quarter will reduce the additional revenues that can be booked

based on the accounting cut-offs and therefore the resulting TCE

rate will be reduced accordingly.

Third Quarter and Recent Developments:

Dividend Distribution for Q2 2024 and

Declaration of Q3 2024 Dividend

On October 10, 2024, the Company paid a

quarterly dividend of $0.25 per share for the second quarter of

2024, to all shareholders of record as of September 27, 2024.

The Company has declared a quarterly cash

dividend of $0.26 per common share for the third quarter of 2024

payable on or about January 10, 2025, to all shareholders of record

as of December 27, 2024. The $0.26 dividend per share corresponds

to approximately 50.0% of the operating cash flow after debt

service.

Buyback of Common Shares

Since our last update in the Company’s earnings

release for the second quarter of 2024, the Company repurchased

121,826 common shares in open market transactions at an average

price of $10.36 per share for an aggregate consideration of $1.3

million pursuant to the $25.0 million share repurchase program

commenced in December 2023. Year to date, the Company has

repurchased 404,041 common shares, at an average price of $9.58 per

share for a total amount of $3.9 million. All the abovementioned

shares were cancelled and removed from our share capital as of the

date of this release. As of November 1, 2024, the Company had

20,489,165 common shares issued and outstanding.

Vessel Transactions and Commercial

Updates

M/V Kaizenship – Delivery and New T/C

agreement

In October 2024, the Company took delivery of

the M/V Kaizenship, a 181,396 dwt Capesize bulk carrier, built in

2012 in Japan. At the same time, the M/V Kaizenship commenced its

T/C employment with Mitsui O.S.K. Lines, Ltd. (“MOL”), for a

duration of minimum 11 months to maximum 12 months. The daily hire

is based at a premium over the BCI. The Company has the option to

convert the daily hire from index-linked to fixed for a period of 2

to 10 months based on prevailing Capesize FFA curve. The

acquisition of the vessel has been financed with cash on hand and

proceeds from the Hinode Sale & leaseback agreement mentioned

below.

M/V Titanship – Exercise of purchase

option and New T/C agreement

In October 2024, the Company exercised its

purchase option and took delivery of the M/V Titanship, for an

aggregate price of $20.2 million. The exercise of the purchase

option has been financed with proceeds from the Alpha Bank Facility

agreement mentioned below. Meanwhile, in September 2024, the M/V

Titanship commenced employment under a new time charter agreement

with Costamare Bulkers Inc. (“Costamare”). The gross daily rate of

the time charter agreement has a fixed floor rate and a

profit-sharing scheme on top of the fixed rate based on a

significant premium over the BCI. The time charter has a duration

of minimum 24 to maximum 30 months.

Financing Updates

M/V Kaizenship – Hinode Sale &

leaseback agreement

In August 2024, the Company entered into a $28.5

million sale and leaseback agreement with Hinode Kaiun Co., Ltd., a

Japanese unaffiliated third party, to partially finance the

acquisition of the M/V Kaizenship. The vessel was sold and

chartered back on a bareboat basis for a six-year period which

commenced in October 2024. The Company has continuous options to

repurchase the vessel at predetermined prices, following the fourth

anniversary of the delivery date. At the end of the bareboat

period, Seanergy has the obligation to purchase the vessel for an

amount of approximately $8.3 million. The financing bears interest

of 1-month term SOFR plus 2.50% per annum and will amortize through

72 monthly instalments of approximately $0.3 million.

M/Vs Paroship & Titanship - Alpha

Bank Facility agreement

In October 2024, the Company entered into a

$34.0 million loan facility to finance the exercise of the $20.2

million purchase option for the M/V Titanship and to refinance the

existing $13.2 million indebtedness of the M/V Paroship. The

facility has a term of five years, while the interest rate is term

SOFR plus 2.4% per annum. It will amortize through four quarterly

instalments of $1.2 million, followed by sixteen instalments of

$0.9 million and a $14.8 million balloon payment at maturity.

Sphinx Investment Corp.

Litigation

On October 28, 2024, the High Court of the

Republic of the Marshall Islands issued a decision dismissing the

litigation brought by G. Economou through his entity Sphinx

Investment Corp. against Seanergy and its Board members.

2024 Annual Meeting of

Shareholders

At the 2024 Annual Meeting of Shareholders held

on November 4, 2024 the Company’s shareholders approved the

election of Mr. Dimitrios Anagnostopoulos and Mr. Ioannis Kartsonas

to serve until the 2027 Annual Meeting of Shareholders as Class C

directors and the ratification of the appointment of Deloitte

Certified Public Accountants S.A. to serve as the Company’s

independent auditors for the fiscal year ending December 31, 2024.

The Company’s unaffiliated common shareholders overwhelmingly

supported Seanergy’s incumbent directors and rejected the proposals

put forth by G. Economou through his entity Sphinx Investment

Corp.

Conference

Call:

The Company’s management will host a conference

call to discuss financial results on November 5, 2024 at 10:00 a.m.

Eastern Time.

Audio Webcast and Earnings

Presentation:

There will be a live, and then archived, webcast

of the conference call available and accompanying presentation

available through the Company’s website. To access the presentation

and listen to the archived audio file, visit our website, following

the Webcast & Presentations section under our Investor

Relations page. Participants to the live webcast should register on

Seanergy’s website approximately 10 minutes prior to the start of

the webcast, following this link.

Conference Call

Details:

Participants have the option to register for the

call using the following link. You can use any number from the list

or add your phone number and let the system call you right

away.

|

Seanergy Maritime Holdings Corp.Unaudited

Condensed Consolidated Balance Sheets(In thousands of U.S.

Dollars) |

|

|

|

|

|

September 30,2024 |

|

|

December 31,2023* |

|

| ASSETS |

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash |

|

41,285 |

|

|

24,928 |

|

|

Vessels, net, right-of-use asset and advance for vessel

acquisition |

|

462,948 |

|

|

440,038 |

|

|

Other assets |

|

23,352 |

|

|

12,911 |

|

| TOTAL

ASSETS |

|

527,585 |

|

|

477,877 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Long-term debt, finance lease liability and other financial

liabilities, net of deferred finance costs |

|

238,076 |

|

|

232,568 |

|

|

Other liabilities |

|

26,937 |

|

|

16,864 |

|

|

Stockholders’ equity |

|

262,572 |

|

|

228,445 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

527,585 |

|

|

477,877 |

|

* Derived from the audited consolidated financial statements as

of that date

|

Seanergy Maritime Holdings Corp.Unaudited

Condensed Consolidated Statements of Operations (In thousands of

U.S. Dollars, except for share and per share data, unless otherwise

stated) |

|

|

| |

|

Three months endedSeptember 30, |

|

Nine months endedSeptember 30, |

|

|

|

|

|

2024 |

|

2023 |

|

2024 |

|

|

2023 |

|

|

|

Vessel revenue, net |

|

43,369 |

|

23,105 |

|

123,735 |

|

|

68,135 |

|

|

|

Fees from related parties |

|

987 |

|

1,347 |

|

2,047 |

|

|

2,671 |

|

|

| Revenue,

net |

|

44,356 |

|

24,452 |

|

125,782 |

|

|

70,806 |

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Voyage expenses |

|

(816 |

) |

(770 |

) |

(2,576 |

) |

|

(2,078 |

) |

|

|

Vessel operating expenses |

|

(11,366 |

) |

(10,282 |

) |

(33,620 |

) |

|

(31,371 |

) |

|

|

Management fees |

|

(187 |

) |

(161 |

) |

(546 |

) |

|

(535 |

) |

|

|

General and administrative expenses |

|

(6,590 |

) |

(6,104 |

) |

(15,522 |

) |

|

(16,785 |

) |

|

|

Depreciation and amortization |

|

(7,645 |

) |

(7,110 |

) |

(21,556 |

) |

|

(21,290 |

) |

|

|

Loss on forward freight agreements, net |

|

(30 |

) |

(4 |

) |

(134 |

) |

|

(148 |

) |

|

|

Gain on sale of vessels, net |

|

- |

|

- |

|

- |

|

|

8,094 |

|

|

| Operating

income |

|

17,722 |

|

21 |

|

51,828 |

|

|

6,693 |

|

|

| Other income /

(expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and finance costs |

|

(5,400 |

) |

(5,133 |

) |

(15,116 |

) |

|

(15,528 |

) |

|

|

Loss on extinguishment of debt |

|

- |

|

- |

|

(649 |

) |

|

(540 |

) |

|

|

Interest and other income |

|

350 |

|

76 |

|

840 |

|

|

958 |

|

|

|

Other, net |

|

(126 |

) |

(4 |

) |

(69 |

) |

|

(130 |

) |

|

| Total other expenses,

net: |

|

(5,176 |

) |

(5,061 |

) |

(14,994 |

) |

|

(15,240 |

) |

|

| Net income /

(loss) |

|

12,546 |

|

(5,040 |

) |

36,834 |

|

|

(8,547 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income / (loss)

per common share, basic |

|

0.61 |

|

(0.28 |

) |

1.80 |

|

|

(0.48 |

) |

|

| Net income / (loss)

per common share, diluted |

|

0.61 |

|

(0.28 |

) |

1.79 |

|

|

(0.48 |

) |

|

| Weighted average number of

common shares outstanding, basic |

|

19,637,290 |

|

18,136,600 |

|

19,568,430 |

|

|

18,177,002 |

|

|

| Weighted average number of

common shares outstanding, diluted |

|

19,786,887 |

|

18,136,600 |

|

19,702,128 |

|

|

18,177,002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Seanergy Maritime Holdings Corp.Unaudited

Condensed Consolidated Cash Flow Data (In thousands of U.S.

Dollars, except for share and per share data, unless otherwise

stated) |

|

|

| |

|

Nine months endedSeptember 30, |

|

|

|

|

|

2024 |

|

2023 |

|

|

| Net cash provided by

operating activities |

|

55,434 |

|

11,050 |

|

|

| |

|

|

|

|

|

|

|

Vessels acquisitions and improvements |

|

(34,191 |

) |

(146 |

) |

|

|

Advance for vessel acquisition |

|

(7,100 |

) |

- |

|

|

|

Finance lease prepayments and other initial direct costs |

|

(305 |

) |

(3,500 |

) |

|

|

Proceeds from sale of assets |

|

- |

|

23,910 |

|

|

|

Deposits assets, non-current |

|

- |

|

1,325 |

|

|

|

Other fixed assets, net |

|

- |

|

(176 |

) |

|

| Net cash (used in) /

provided by investing activities |

|

(41,596 |

) |

21,413 |

|

|

|

|

|

|

|

|

|

|

|

Proceeds from long-term debt and other financial liabilities |

|

58,279 |

|

53,750 |

|

|

|

Repayments of long-term debt and other financial liabilities |

|

(49,829 |

) |

(79,374 |

) |

|

|

Payments of finance lease liabilities |

|

(1,635 |

) |

- |

|

|

|

Repayments of convertible notes |

|

- |

|

(8,000 |

) |

|

|

Payments of financing and stock issuance costs |

|

(1,810 |

) |

(1,318 |

) |

|

|

Payments for repurchase of common stock |

|

(2,709 |

) |

(1,583 |

) |

|

|

Dividend payments |

|

(5,600 |

) |

(5,539 |

) |

|

|

Payments for repurchase of warrants |

|

- |

|

(808 |

) |

|

|

Payments for fractional shares of reverse stock split |

|

- |

|

(23 |

) |

|

|

Proceeds from issuance of common stock and warrants, net of

underwriters fees and commissions |

|

5,823 |

|

- |

|

|

| Net cash provided by /

(used in) financing activities |

|

2,519 |

|

(42,895 |

) |

|

|

|

|

|

|

|

|

|

| SUPPLEMENTAL CASH FLOW

INFORMATION |

|

|

|

|

|

|

|

Cash paid during the period for interest |

|

14,891 |

|

13,652 |

|

|

| |

|

|

|

|

|

|

| Noncash investing

activities |

|

|

|

|

|

|

|

Vessels acquisitions and improvements |

|

123 |

|

- |

|

|

| |

|

|

|

|

|

|

| Noncash financing

activities |

|

|

|

|

|

|

|

Dividends declared but not paid |

|

5,150 |

|

491 |

|

|

|

Financing and stock issuance costs |

|

1,473 |

|

- |

|

|

|

|

About Seanergy Maritime Holdings Corp.

Seanergy Maritime Holdings Corp. is a prominent

pure-play Capesize shipping company publicly listed in the U.S.

Seanergy provides marine dry bulk transportation services through a

modern fleet of Capesize vessels. The Company’s operating fleet

consists of 19 vessels (1 Newcastlemax and 18 Capesize) with an

average age of approximately 13.5 years and an aggregate cargo

carrying capacity of approximately 3,417,608 dwt.

The Company is incorporated in the Republic of

the Marshall Islands and has executive offices in Glyfada, Greece.

The Company's common shares trade on the Nasdaq Capital Market

under the symbol “SHIP”.

Please visit our Company website at:

www.seanergymaritime.com.

Forward-Looking Statements

This press release contains forward-looking

statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events, including with respect

to the declaration of dividends, market trends and shareholder

returns. Words such as “may”, “should”, “expects”, “intends”,

“plans”, “believes”, “anticipates”, “hopes”, “estimates” and

variations of such words and similar expressions are intended to

identify forward-looking statements. These statements involve known

and unknown risks and are based upon a number of assumptions and

estimates, which are inherently subject to significant

uncertainties and contingencies, many of which are beyond the

control of the Company. Actual results may differ materially from

those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially

include, but are not limited to, the Company’s operating or

financial results; the Company’s liquidity, including its ability

to service its indebtedness; competitive factors in the market in

which the Company operates; shipping industry trends, including

charter rates, vessel values and factors affecting vessel supply

and demand; future, pending or recent acquisitions and

dispositions, business strategy, impacts of litigation, areas of

possible expansion or contraction, and expected capital spending or

operating expenses; risks associated with operations outside the

United States; broader market impacts arising from trade disputes

or war (or threatened war) or international hostilities, such as

between Israel and Hamas or Iran and between Russia and Ukraine;

risks associated with the length and severity of pandemics

(including COVID-19), including their effects on demand for dry

bulk products and the transportation thereof; and other factors

listed from time to time in the Company’s filings with the SEC,

including its most recent annual report on Form 20-F. The Company’s

filings can be obtained free of charge on the SEC’s website at

www.sec.gov. Except to the extent required by law, the Company

expressly disclaims any obligations or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in the Company’s

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based.

For further information please contact:

Seanergy Investor RelationsTel: +30 213 0181 522E-mail:

ir@seanergy.gr

Capital Link, Inc.Paul Lampoutis230 Park Avenue Suite 1540New

York, NY 10169Tel: (212) 661-7566E-mail:

seanergy@capitallink.com

A photo accompanying this announcement is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/8272e49a-88b8-4539-9b96-98071aaaa1da

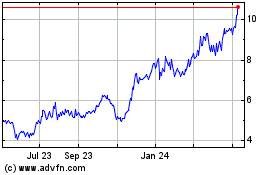

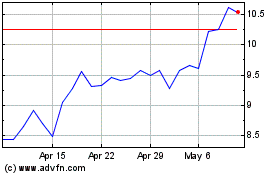

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Dec 2023 to Dec 2024