0001177702false00011777022024-12-032024-12-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 03, 2024 |

SAIA, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

0-49983 |

48-1229851 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

11465 Johns Creek Parkway Suite 400 |

|

Johns Creek, Georgia |

|

30097 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 770 232-5067 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $.001 per share |

|

SAIA |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On December 3, 2024, Saia, Inc. issued a press release providing its shipment and tonnage data for October and November 2024. A copy of the press release is attached as Exhibit 99.1 to this Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

99.1 Press release of Saia, Inc. dated as of December 3, 2024.

104 Cover Page Interactive Date File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

SAIA, INC. |

|

|

|

|

Date: |

December 3, 2024 |

By: |

/s/ Kelly W. Benton |

|

|

|

Kelly W. Benton

Vice President and Chief Accounting Officer

(Principal Accounting Officer) |

Exhibit 99.1

Saia Provides Fourth Quarter LTL Operating Data

JOHNS CREEK, GA. – December 3, 2024 – Saia, Inc. (Nasdaq: SAIA), a leading transportation provider offering national less-than-truckload (LTL), non-asset truckload, expedited and logistics services, is providing LTL shipment and tonnage data for the first two months of the fourth quarter. In October 2024, LTL shipments per workday increased 4.4%, LTL tonnage per workday increased 6.9% and LTL weight per shipment increased 2.4% to 1,352 pounds compared to 1,321 pounds in October 2023. In November 2024, LTL shipments per workday increased 2.3%, LTL tonnage per workday increased 5.7% and LTL weight per shipment increased 3.3% to 1,357 pounds compared to 1,313 pounds in November 2023.

These changes are summarized in the table below:

|

|

|

|

|

|

|

|

|

October 2024

versus October 2023 |

|

November 2024

versus November 2023 |

|

Quarter to Date (QTD) 2024 versus QTD 2023 |

LTL Shipments per workday |

4.4% |

|

2.3% |

|

3.5% |

LTL Tonnage per workday |

6.9% |

|

5.7% |

|

6.4% |

LTL Weight per shipment |

2.4% |

|

3.3% |

|

2.8% |

Actual fourth quarter and annual shipments, tonnage and weight per shipment could differ materially from the data expressed in this press release, including by reason of the risk factors included in Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and in other filings with the Securities and Exchange Commission. The information herein speaks as of the date of this press release and is subject to change. Saia is under no obligation, and expressly disclaims any obligation to update or alter such information, whether as a result of new information, future events, or otherwise, except as required by law.

Saia, Inc. (Nasdaq: SAIA) offers customers a wide range of less-than-truckload, non-asset truckload, expedited and logistics services. With headquarters in Georgia, Saia LTL Freight operates 214 terminals with service across 48 states. For more information on Saia, Inc. visit the Investor Relations section at www.saia.com/about-us/investor-relations.

Cautionary Note Regarding Forward-Looking Statements

The Securities and Exchange Commission encourages companies to disclose forward-looking information so that investors can better understand the future prospects of a company and make informed investment decisions. This news release may contain these types of statements, which are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “may,” “plan,” “predict,” “believe,” “should,” “potential” and similar words or expressions are intended to identify forward-looking statements. Investors should not place undue reliance on forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, except as required by law. All forward-looking statements reflect the present expectation of future events of our management as of the date of this news release and are subject to a number of important factors, risks, uncertainties and assumptions that could cause actual results to differ materially from those described in any forward-looking statements. These factors, risks, uncertainties and assumptions include, but are not limited to, (1) general economic conditions including downturns or inflationary periods in the business cycle; (2) operation within a highly competitive industry and the adverse impact from downward pricing pressures, including in connection with fuel

Saia, Inc. Fourth Quarter LTL Operating Data

Page 2

surcharges, and other factors; (3) industry-wide external factors largely out of our control; (4) cost and availability of qualified drivers, dock workers, mechanics and other employees, purchased transportation and fuel; (5) inflationary increases in operating expenses and corresponding reductions of profitability; (6) cost and availability of diesel fuel and fuel surcharges; (7) cost and availability of insurance coverage and claims expenses and other expense volatility, including for personal injury, cargo loss and damage, workers’ compensation, employment and group health plan claims; (8) failure to successfully execute the strategy to expand our service geography; (9) unexpected liabilities resulting from the acquisition of real estate assets; (10) costs and liabilities from the disruption in or failure of our technology or equipment essential to our operations, including as a result of cyber incidents, security breaches, malware or ransomware attacks; (11) failure to keep pace with technological developments; (12) liabilities and costs arising from the use of artificial intelligence; (13) labor relations, including the adverse impact should a portion of our workforce become unionized; (14) cost, availability and resale value of real property and revenue equipment; (15) supply chain disruption and delays on new equipment delivery; (16) capacity and highway infrastructure constraints; (17) risks arising from international business operations and relationships; (18) seasonal factors, harsh weather and disasters caused by climate change; (19) economic declines in the geographic regions or industries in which our customers operate; (20) the creditworthiness of our customers and their ability to pay for services; (21) our need for capital and uncertainty of the credit markets; (22) the possibility of defaults under our debt agreements, including violation of financial covenants; (23) inaccuracies and changes to estimates and assumptions used in preparing our financial statements; (24) failure to operate and grow acquired businesses in a manner that support the value allocated to acquired businesses; (25) dependence on key employees; (26) employee turnover from changes to compensation and benefits or market factors; (27) increased costs of healthcare benefits; (28) damage to our reputation from adverse publicity, including from the use of or impact from social media; (29) failure to make future acquisitions or to achieve acquisition synergies; (30) the effect of litigation and class action lawsuits arising from the operation of our business, including the possibility of claims or judgments in excess of our insurance coverages or that result in increases in the cost of insurance coverage or that preclude us from obtaining adequate insurance coverage in the future; (31) the potential of higher corporate taxes and new regulations, including with respect to climate change, employment and labor law, healthcare and securities regulation; (32) the effect of governmental regulations, including hours of service and licensing compliance for drivers, engine emissions, the Compliance, Safety, Accountability (CSA) initiative, regulations of the Food and Drug Administration and Homeland Security, and healthcare and environmental regulations; (33) unforeseen costs from new and existing data privacy laws; (34) costs from new and existing laws regarding how to classify workers; (35) changes in accounting and financial standards or practices; (36) widespread outbreak of an illness or any other communicable disease; (37) international conflicts and geopolitical instability; (38) increasing investor and customer sensitivity to social and sustainability issues, including climate change; (39) provisions in our governing documents and Delaware law that may have anti-takeover effects; (40) issuances of equity that would dilute stock ownership; (41) weakness, disruption or loss of confidence in financial or credit markets; and (42) other financial, operational and legal risks and uncertainties detailed from time to time in the Company’s SEC filings.

As a result of these and other factors, no assurance can be given as to our future results and achievements. Accordingly, a forward-looking statement is neither a prediction nor a guarantee of future events or circumstances and those future events or circumstances may not occur. You should not place undue reliance on the forward-looking statements, which speak only as of the date of this news release. We are under no obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise, except as otherwise required by law.

|

|

CONTACT: |

Saia, Inc. |

|

Matthew Batteh |

|

Executive Vice President and Chief Financial Officer Investors@saia.com |

|

|

v3.24.3

Document And Entity Information

|

Dec. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 03, 2024

|

| Entity Registrant Name |

SAIA, INC.

|

| Entity Central Index Key |

0001177702

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

0-49983

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

48-1229851

|

| Entity Address, Address Line One |

11465 Johns Creek Parkway

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Johns Creek

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30097

|

| City Area Code |

770

|

| Local Phone Number |

232-5067

|

| Entity Information, Former Legal or Registered Name |

No Changes

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $.001 per share

|

| Trading Symbol |

SAIA

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

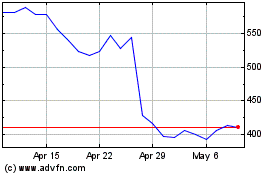

Saia (NASDAQ:SAIA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Saia (NASDAQ:SAIA)

Historical Stock Chart

From Dec 2023 to Dec 2024