false000149229800014922982023-08-072023-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 7, 2023

SABRA HEALTH CARE REIT, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-34950 | | 27-2560479 |

(State of

Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 18500 Von Karman Avenue | | Suite 550 | | Irvine | | CA | | 92612 |

| (Address of principal executive offices) | | | | | | | | (Zip Code) |

Registrant's telephone number including area code: (888) 393-8248

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

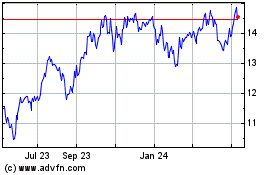

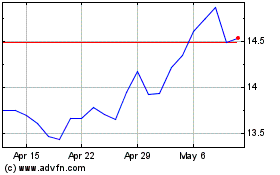

| Common stock, $0.01 par value | SBRA | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On August 7, 2023, Sabra Health Care REIT, Inc. (“Sabra”) issued a press release reporting its results of operations for the three month period ended June 30, 2023. The press release refers to the Reconciliations of Non-GAAP Financial Measures that is available on the Investors section of Sabra’s website, free of charge, at www.sabrahealth.com. The text of the press release and the Reconciliations of Non-GAAP Financial Measures are furnished herewith as Exhibits 99.1 and 99.3, respectively, and are specifically incorporated by reference herein.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

The press release furnished herewith as Exhibit 99.1 refers to a supplemental information package that is available on the Investors section of Sabra’s website, free of charge, at www.sabrahealth.com. The text of the supplemental information package is furnished herewith as Exhibit 99.2 and is specifically incorporated by reference herein.

Sabra intends to present the materials attached to this report as Exhibit 99.4 in investor presentations. The furnishing of these materials is not intended to constitute a representation that such furnishing is required by Regulation FD or other securities laws, or that the presentation materials include material investor information that is not otherwise publicly available. In addition, Sabra does not assume any obligation to update such information in the future.

The information in Items 2.02 and 7.01 of this Form 8-K and the information in Exhibits 99.1, 99.2, 99.3 and 99.4 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be incorporated by reference into any filing of Sabra under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in any such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

| (d) | | Exhibits. |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 99.3 | | |

| | |

| 99.4 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| SABRA HEALTH CARE REIT, INC. |

| |

| Date: August 7, 2023 | /S/ MICHAEL COSTA |

| Name: | | Michael Costa |

| Title: | | Chief Financial Officer, Secretary and Executive Vice President |

FOR IMMEDIATE RELEASE

SABRA REPORTS SECOND QUARTER 2023 RESULTS

IRVINE, CA, August 7, 2023 — Sabra Health Care REIT, Inc. (“Sabra,” the “Company” or “we”) (Nasdaq: SBRA) today announced its results of operations for the second quarter of 2023.

SECOND QUARTER 2023 RESULTS AND RECENT EVENTS

•Results per diluted common share for the second quarter of 2023 were as follows:

•Net Income: $0.09

•FFO: $0.32

•Normalized FFO: $0.33

•AFFO: $0.33

•Normalized AFFO: $0.34

•EBITDARM Coverage Summary:

•Skilled Nursing/Transitional Care: 1.65x (1.57x excluding Provider Relief Funds)

•Senior Housing - Leased: 1.15x

•Behavioral Health: 1.87x

•Specialty Hospitals & Other: 6.68x

•During the second quarter of 2023, Sabra generated $18 million of gross proceeds from the disposition of four skilled nursing facilities.

•On July 6, 2023, Sabra successfully transitioned 11 wholly-owned managed senior housing properties formerly managed by Enlivant to Inspirit Senior Living, an existing Sabra operator.

•As illustrated in the Supplemental Information presentation we issued today, we believe the Annualized Cash NOI upside opportunity for Sabra’s portfolio is attractive. The upside is a result of the Company's internal growth initiatives over the past several years, as well as the benefits of the broader healthcare industry's continued recovery from the pandemic.

•On August 7, 2023, Sabra’s Board of Directors declared a quarterly cash dividend of $0.30 per share of common stock. The dividend will be paid on August 31, 2023 to common stockholders of record as of the close of business on August 17, 2023.

1

1

BUSINESS UPDATE

Update on Reimbursement Trends

Reimbursement trends continue to move in a positive direction. In terms of Medicare Part A, which accounts for nearly 25% of revenue for Sabra’s skilled nursing tenants, CMS recently finalized a 4.0% rate increase that goes into effect on October 1, 2023.

In addition, and in recognition of skilled nursing’s vital role of providing high-quality, high-acuity care at a relatively low cost, many states have also increased support for the industry through various means, including Medicaid base rate increases, Federal Medical Assistance Percentage (“FMAP”) add-on extensions, and rebasing cost measures to better capture inflationary pressures. Notable examples include Texas, which increased its Medicaid rate to more than offset the expiration of FMAP, while Kentucky recently passed an 8% rate increase, which will have a significant positive impact on Sabra’s largest tenant, Signature Healthcare. In addition, Avamere (Sabra’s third largest tenant), will benefit from a blended 6% base rate increase in Oregon and Washington. Medicaid accounts for nearly half of the revenue received by Sabra’s skilled nursing tenants, and while not all states have finalized rates for the upcoming year, we estimate the increase in Medicaid rates across Sabra’s portfolio will average over 5%.

Commenting on the second quarter’s results, Rick Matros, CEO and Chair, said, “Sabra's portfolio continues to strengthen as occupancy gains and easing labor pressures drive improved rent coverages. Reimbursement trends also remain encouraging, highlighted by Medicaid rate increases that are trending higher than they have been in many years. We recently held an operators’ conference and while our operators are not yet where they want to be, these encouraging operating trends underpinned a sense of optimism among attendees that was evident and appreciated. Additionally, we are pleased we were able to expeditiously transition the 11 wholly-owned properties that were formerly managed by Enlivant to an existing operator. Our progress this year gives us increased confidence that we are moving past the pandemic, and have greater clarity on future earnings growth as illustrated in the Supplemental Information presentation we issued today.”

LIQUIDITY

As of June 30, 2023, we had approximately $926.7 million of liquidity, consisting of unrestricted cash and cash equivalents of $27.2 million and available borrowings of $899.5 million under our revolving credit facility. As of June 30, 2023, we also had $500.0 million available under the ATM program.

CONFERENCE CALL AND COMPANY INFORMATION

A conference call with a simultaneous webcast to discuss the 2023 second quarter results will be held on Tuesday, August 8, 2023 at 10:00 am Pacific Time. The webcast URL is https://events.q4inc.com/attendee/659208545. The dial-in number for U.S. participants is (888) 880-4448. For participants outside the U.S., the dial-in number is (646) 960-0572. The conference ID number is 1382596. A digital replay of the call will be available on the Company’s website at www.sabrahealth.com. The Company’s supplemental information package for the second quarter will also be available on the Company’s website in the “Investors” section.

ABOUT SABRA

As of June 30, 2023, Sabra’s investment portfolio included 392 real estate properties held for investment (consisting of (i) 253 Skilled Nursing/Transitional Care facilities, (ii) 45 senior housing communities (“Senior Housing - Leased”), (iii) 61 senior housing communities operated by third-party property managers pursuant to property management agreements (“Senior Housing - Managed”), (iv) 18 Behavioral Health facilities and (v) 15 Specialty Hospitals and Other facilities), 13 investments in loans receivable (consisting of two mortgage loans and 11 other loans), five preferred equity investments and two investments in unconsolidated joint ventures. As of June 30, 2023, Sabra’s real estate properties held for investment included 38,899 beds/units, spread across the United States and Canada.

2

2

FORWARD-LOOKING STATEMENTS SAFE HARBOR

This release contains “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. Any statements that do not relate to historical or current facts or matters are forward-looking statements. These statements may be identified, without limitation, by the use of “expects,” “believes,” “intends,” “should” or comparable terms or the negative thereof. Examples of forward-looking statements include all statements regarding our expectations regarding reimbursement rates and trends; our expectations regarding the upside opportunity for Sabra’s portfolio; our expectations regarding labor and occupancy trends; our expectations regarding the transition of the Enlivant facilities; our expectations regarding continued recovery from the pandemic; and our other expectations regarding our future financial position, results of operations, cash flows, liquidity, business strategy, growth opportunities, potential investments and dispositions, and plans and objectives for future operations and capital raising activity.

Our actual results may differ materially from those projected or contemplated by our forward-looking statements as a result of various factors, including, among others, the following: pandemics or epidemics, including COVID-19, and the related impact on our tenants, borrowers and Senior Housing - Managed communities; increased labor costs and historically low unemployment; increases in market interest rates and inflation; operational risks with respect to our Senior Housing - Managed communities; competitive conditions in our industry; the loss of key management personnel; uninsured or underinsured losses affecting our properties; potential impairment charges and adjustments related to the accounting of our assets; the potential variability of our reported rental and related revenues as a result of Accounting Standards Update (“ASU”) 2016-02, Leases, as amended by subsequent ASUs; risks associated with our investment in our unconsolidated joint ventures; catastrophic weather and other natural or man-made disasters, the effects of climate change on our properties and a failure to implement sustainable and energy-efficient measures; increased operating costs and competition for our tenants, borrowers and Senior Housing - Managed communities; increased healthcare regulation and enforcement; our tenants’ dependency on reimbursement from governmental and other third-party payor programs; the effect of our tenants, operators or borrowers declaring bankruptcy or becoming insolvent; our ability to find replacement tenants and the impact of unforeseen costs in acquiring new properties; the impact of litigation and rising insurance costs on the business of our tenants; the impact of required regulatory approvals of transfers of healthcare properties; environmental compliance costs and liabilities associated with real estate properties we own; our tenants’, borrowers’ or operators’ failure to adhere to applicable privacy and data security laws, or a material breach of our or our tenants’, borrowers’ or operators’ information technology; our concentration in the healthcare property sector, particularly in skilled nursing/transitional care facilities and senior housing communities, which makes our profitability more vulnerable to a downturn in a specific sector than if we were investing in multiple industries; the significant amount of and our ability to service our indebtedness; covenants in our debt agreements that may restrict our ability to pay dividends, make investments, incur additional indebtedness and refinance indebtedness on favorable terms; adverse changes in our credit ratings; our ability to make dividend distributions at expected levels; our ability to raise capital through equity and debt financings; changes and uncertainty in macroeconomic conditions and disruptions in the financial markets; risks associated with our ownership of property outside the U.S., including currency fluctuations; the relatively illiquid nature of real estate investments; our ability to maintain our status as a real estate investment trust (“REIT”) under the federal tax laws; compliance with REIT requirements and certain tax and tax regulatory matters related to our status as a REIT; changes in tax laws and regulations affecting REITs; the ownership limits and takeover defenses in our governing documents and under Maryland law, which may restrict change of control or business combination opportunities; and the exclusive forum provisions in our bylaws.

Additional information concerning risks and uncertainties that could affect our business can be found in our filings with the Securities and Exchange Commission (the “SEC”), including in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2022. We do not intend, and we undertake no obligation, to update any forward-looking information to reflect events or circumstances after the date of this release or to reflect the occurrence of unanticipated events, unless required by law to do so.

TENANT AND BORROWER INFORMATION

This release includes information regarding certain of our tenants that lease properties from us and our borrowers, most of which are not subject to SEC reporting requirements. The information related to our tenants and borrowers that is provided in this release has been provided by, or derived from information provided by, such tenants and borrowers. We have not independently verified this information. We have no reason to believe that such information is inaccurate in any material respect. We are providing this data for informational purposes only.

3

3

NOTE REGARDING NON-GAAP FINANCIAL MEASURES

This release includes the following financial measures defined as non-GAAP financial measures by the SEC: Annualized Cash NOI, funds from operations (“FFO”), Normalized FFO, Adjusted FFO (“AFFO”), Normalized AFFO, FFO per diluted common share, Normalized FFO per diluted common share, AFFO per diluted common share and Normalized AFFO per diluted common share. These measures may be different than non-GAAP financial measures used by other companies, and the presentation of these measures is not intended to be considered in isolation or as a substitute for financial information prepared and presented in accordance with U.S. generally accepted accounting principles. An explanation of these non-GAAP financial measures is included under “Reporting Definitions” in this release, and reconciliations of these non-GAAP financial measures to the GAAP financial measures we consider most comparable are included on the Investors section of our website at https://ir.sabrahealth.com/investors/financials/quarterly-results.

CONTACT

Investor & Media Inquiries: (888) 393-8248 or investorinquiries@sabrahealth.com

4

4

SABRA HEALTH CARE REIT, INC.

CONSOLIDATED STATEMENTS OF INCOME

(dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

Rental and related revenues (1) | $ | 94,274 | | | $ | 103,168 | | | $ | 190,144 | | | $ | 213,054 | |

| Resident fees and services | 58,428 | | | 44,136 | | | 115,149 | | | 86,363 | |

| Interest and other income | 8,464 | | | 8,653 | | | 17,197 | | | 19,645 | |

| | | | | | | |

| Total revenues | 161,166 | | | 155,957 | | | 322,490 | | | 319,062 | |

| | | | | | | |

| Expenses: | | | | | | | |

| Depreciation and amortization | 44,142 | | | 45,172 | | | 96,969 | | | 90,428 | |

| Interest | 28,328 | | | 25,530 | | | 56,868 | | | 50,502 | |

| Triple-net portfolio operating expenses | 4,771 | | | 4,852 | | | 8,939 | | | 9,863 | |

| Senior housing - managed portfolio operating expenses | 43,964 | | | 34,026 | | | 87,601 | | | 67,130 | |

| General and administrative | 9,532 | | | 8,649 | | | 20,034 | | | 19,045 | |

| | | | | | | |

| Provision for (recovery of) loan losses and other reserves | 429 | | | (270) | | | 221 | | | 205 | |

| Impairment of real estate | — | | | 11,745 | | | 7,064 | | | 11,745 | |

| | | | | | | |

| Total expenses | 131,166 | | | 129,704 | | | 277,696 | | | 248,918 | |

| | | | | | | |

| Other (expense) income: | | | | | | | |

| Loss on extinguishment of debt | — | | | — | | | (1,541) | | | (271) | |

| Other (expense) income | — | | | (2,163) | | | 341 | | | (2,095) | |

| Net loss on sales of real estate | (7,833) | | | (4,501) | | | (29,348) | | | (4,501) | |

| | | | | | | |

| Total other expense | (7,833) | | | (6,664) | | | (30,548) | | | (6,867) | |

| | | | | | | |

| Income before loss from unconsolidated joint ventures and income tax expense | 22,167 | | | 19,589 | | | 14,246 | | | 63,277 | |

| | | | | | | |

| Loss from unconsolidated joint ventures | (653) | | | (2,529) | | | (1,491) | | | (5,331) | |

| Income tax expense | (326) | | | (255) | | | (1,054) | | | (539) | |

| | | | | | | |

| Net income | $ | 21,188 | | | $ | 16,805 | | | $ | 11,701 | | | $ | 57,407 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income, per: | | | | | | | |

| | | | | | | |

| Basic common share | $ | 0.09 | | | $ | 0.07 | | | $ | 0.05 | | | $ | 0.25 | |

| | | | | | | |

| Diluted common share | $ | 0.09 | | | $ | 0.07 | | | $ | 0.05 | | | $ | 0.25 | |

| | | | | | | |

| Weighted average number of common shares outstanding, basic | 231,204,531 | | | 230,967,163 | | | 231,184,355 | | | 230,913,462 | |

| | | | | | | |

| Weighted average number of common shares outstanding, diluted | 232,244,588 | | | 231,681,536 | | | 232,214,443 | | | 231,641,958 | |

| | | | | | | |

| | | | | | | |

(1) See page 6 for additional details regarding Rental and related revenues.

5

5

SABRA HEALTH CARE REIT, INC.

CONSOLIDATED STATEMENTS OF INCOME - SUPPLEMENTAL INFORMATION

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cash rental income | $ | 87,381 | | | $ | 95,209 | | | $ | 177,038 | | | $ | 195,566 | |

| Straight-line rental income | 1,503 | | | 2,342 | | | 2,850 | | | 5,036 | |

| Straight-line rental income receivable write-offs | — | | | (323) | | | (518) | | | (462) | |

| Above/below market lease amortization | 1,568 | | | 1,568 | | | 3,136 | | | 3,161 | |

| Above/below market lease intangible write-offs | — | | | — | | | — | | | 326 | |

| Operating expense recoveries | 3,822 | | | 4,372 | | | 7,638 | | | 9,427 | |

| | | | | | | |

| Rental and related revenues | $ | 94,274 | | | $ | 103,168 | | | $ | 190,144 | | | $ | 213,054 | |

6

6

SABRA HEALTH CARE REIT, INC.

CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except per share data)

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| | | |

| Assets | | | |

Real estate investments, net of accumulated depreciation of $992,222 and $913,345 as of June 30, 2023 and December 31, 2022, respectively | $ | 4,751,898 | | | $ | 4,959,343 | |

| Loans receivable and other investments, net | 417,019 | | | 411,396 | |

| Investment in unconsolidated joint ventures | 140,402 | | | 134,962 | |

| Cash and cash equivalents | 27,234 | | | 49,308 | |

| Restricted cash | 5,146 | | | 4,624 | |

| | | |

| Lease intangible assets, net | 35,990 | | | 40,131 | |

| Accounts receivable, prepaid expenses and other assets, net | 146,641 | | | 147,908 | |

| Total assets | $ | 5,524,330 | | | $ | 5,747,672 | |

| | | |

| Liabilities | | | |

| Secured debt, net | $ | 48,273 | | | $ | 49,232 | |

| Revolving credit facility | 100,517 | | | 196,982 | |

| Term loans, net | 536,391 | | | 526,129 | |

| Senior unsecured notes, net | 1,734,855 | | | 1,734,431 | |

| | | |

| Accounts payable and accrued liabilities | 121,865 | | | 142,259 | |

| Lease intangible liabilities, net | 38,685 | | | 42,244 | |

| | | |

| Total liabilities | 2,580,586 | | | 2,691,277 | |

| | | |

| Equity | | | |

Preferred stock, $0.01 par value; 10,000,000 shares authorized, zero shares issued and outstanding as of June 30, 2023 and December 31, 2022 | — | | | — | |

Common stock, $0.01 par value; 500,000,000 shares authorized, 231,218,658 and 231,009,295 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | 2,312 | | | 2,310 | |

| Additional paid-in capital | 4,489,107 | | | 4,486,967 | |

| Cumulative distributions in excess of net income | (1,579,914) | | | (1,451,945) | |

| Accumulated other comprehensive income | 32,239 | | | 19,063 | |

| | | |

| | | |

| Total equity | 2,943,744 | | | 3,056,395 | |

| Total liabilities and equity | $ | 5,524,330 | | | $ | 5,747,672 | |

7

7

SABRA HEALTH CARE REIT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | | | | | | | | | | |

| | Six Months Ended June 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 11,701 | | | $ | 57,407 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 96,969 | | | 90,428 | |

| Non-cash rental and related revenues | (5,469) | | | (8,061) | |

| Non-cash interest income | (388) | | | (1,094) | |

| Non-cash interest expense | 6,091 | | | 5,502 | |

| Stock-based compensation expense | 3,233 | | | 3,250 | |

| | | |

| | | |

| Loss on extinguishment of debt | 1,541 | | | 271 | |

| Provision for loan losses and other reserves | 221 | | | 205 | |

| Net loss on sales of real estate | 29,348 | | | 4,501 | |

| Impairment of real estate | 7,064 | | | 11,745 | |

| | | |

| Loss from unconsolidated joint ventures | 1,491 | | | 5,331 | |

| Distributions of earnings from unconsolidated joint ventures | 1,112 | | | — | |

| Other non-cash items | — | | | 2,167 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, prepaid expenses and other assets, net | (6,277) | | | (6,074) | |

| Accounts payable and accrued liabilities | (8,019) | | | (25,895) | |

| | | |

| Net cash provided by operating activities | 138,618 | | | 139,683 | |

| Cash flows from investing activities: | | | |

| Acquisition of real estate | (39,630) | | | (20,573) | |

| Origination and fundings of loans receivable | (9,050) | | | — | |

| Origination and fundings of preferred equity investments | (10,676) | | | (4,990) | |

| Additions to real estate | (37,995) | | | (19,495) | |

| Escrow deposits for potential investments | — | | | (836) | |

| Repayments of loans receivable | 8,062 | | | 4,466 | |

| Repayments of preferred equity investments | 4,130 | | | 1,333 | |

| Investment in unconsolidated joint ventures | (4,797) | | | (128,007) | |

| Net proceeds from the sales of real estate | 168,904 | | | 40,003 | |

| Net proceeds from sales-type lease | 25,490 | | | — | |

| | | |

| Distributions in excess of earnings from unconsolidated joint ventures | 544 | | | — | |

| | | |

| Net cash provided by (used in) investing activities | 104,982 | | | (128,099) | |

| Cash flows from financing activities: | | | |

| Net (repayments of) borrowings from revolving credit facility | (98,857) | | | 142,353 | |

| | | |

| | | |

| Proceeds from term loans | 12,188 | | | — | |

| Principal payments on term loans | — | | | (40,000) | |

| Principal payments on secured debt | (983) | | | (16,547) | |

| Payments of deferred financing costs | (18,128) | | | (6) | |

| | | |

| | | |

| Payment of contingent consideration | (17,900) | | | — | |

| Issuance of common stock, net | (2,153) | | | (3,803) | |

| Dividends paid on common stock | (138,711) | | | (138,565) | |

| | | |

| Net cash used in financing activities | (264,544) | | | (56,568) | |

| | | |

| Net decrease in cash, cash equivalents and restricted cash | (20,944) | | | (44,984) | |

| Effect of foreign currency translation on cash, cash equivalents and restricted cash | (608) | | | 619 | |

| Cash, cash equivalents and restricted cash, beginning of period | 53,932 | | | 115,886 | |

| | | |

| Cash, cash equivalents and restricted cash, end of period | $ | 32,380 | | | $ | 71,521 | |

| Supplemental disclosure of cash flow information: | | | |

| Interest paid | $ | 52,591 | | | $ | 49,968 | |

| | | |

| Supplemental disclosure of non-cash investing activities: | | | |

| | | |

| | | |

| | | |

| Decrease in loans receivable and other investments due to acquisition of real estate | $ | 4,644 | | | $ | 5,623 | |

| | | |

8

8

SABRA HEALTH CARE REIT, INC.

FUNDS FROM OPERATIONS (FFO), NORMALIZED FFO,

ADJUSTED FUNDS FROM OPERATIONS (AFFO) AND NORMALIZED AFFO

(dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 21,188 | | | $ | 16,805 | | | $ | 11,701 | | | $ | 57,407 | |

| Add: | | | | | | | |

| Depreciation and amortization of real estate assets | 44,142 | | | 45,172 | | | 96,969 | | | 90,428 | |

| | | | | | | |

| Depreciation, amortization and impairment of real estate assets related to unconsolidated joint ventures | 2,202 | | | 5,133 | | | 4,250 | | | 9,766 | |

| Net loss on sales of real estate | 7,833 | | | 4,501 | | | 29,348 | | | 4,501 | |

| Net gain on sales of real estate related to unconsolidated joint ventures | — | | | (220) | | | — | | | (220) | |

| Impairment of real estate | — | | | 11,745 | | | 7,064 | | | 11,745 | |

| | | | | | | |

| FFO | $ | 75,365 | | | $ | 83,136 | | | $ | 149,332 | | | $ | 173,627 | |

| | | | | | | |

| | | | | | | |

| Write-offs of cash and straight-line rental income receivable and lease intangibles | — | | | 709 | | | 540 | | | 180 | |

| Lease termination income | — | | | — | | | — | | | (2,338) | |

| Loss on extinguishment of debt | — | | | — | | | 1,541 | | | 271 | |

| Provision for (recovery of) loan losses and other reserves | 429 | | | (270) | | | 221 | | | 205 | |

| | | | | | | |

Support payments paid to joint venture manager (1) | — | | | 3,626 | | | — | | | 3,626 | |

Other normalizing items (2) | 1,301 | | | 2,699 | | | 2,069 | | | 2,651 | |

| Normalized FFO | $ | 77,095 | | | $ | 89,900 | | | $ | 153,703 | | | $ | 178,222 | |

| | | | | | | |

| FFO | $ | 75,365 | | | $ | 83,136 | | | $ | 149,332 | | | $ | 173,627 | |

| Stock-based compensation expense | 1,004 | | | 794 | | | 3,233 | | | 3,250 | |

| Non-cash rental and related revenues | (3,071) | | | (3,587) | | | (5,469) | | | (8,061) | |

| Non-cash interest income | 4 | | | (547) | | | (388) | | | (1,094) | |

| Non-cash interest expense | 3,077 | | | 2,804 | | | 6,091 | | | 5,502 | |

| Non-cash portion of loss on extinguishment of debt | — | | | — | | | 1,541 | | | 271 | |

| Provision for (recovery of) loan losses and other reserves | 429 | | | (270) | | | 221 | | | 205 | |

| | | | | | | |

| | | | | | | |

| Other adjustments related to unconsolidated joint ventures | 169 | | | (692) | | | 238 | | | (1,678) | |

Other adjustments (3) | 57 | | | 2,211 | | | 163 | | | 2,394 | |

| AFFO | $ | 77,034 | | | $ | 83,849 | | | $ | 154,962 | | | $ | 174,416 | |

| | | | | | | |

| Cash portion of lease termination income | — | | | — | | | — | | | (2,338) | |

| | | | | | | |

| Write-off of cash rental income | — | | | 404 | | | — | | | 71 | |

Support payments paid to joint venture manager (1) | — | | | 3,626 | | | — | | | 3,626 | |

Other normalizing items (2) | 1,286 | | | 516 | | | 2,038 | | | 330 | |

| Normalized AFFO | $ | 78,320 | | | $ | 88,395 | | | $ | 157,000 | | | $ | 176,105 | |

| Amounts per diluted common share: | | | | | | | |

| Net income | $ | 0.09 | | | $ | 0.07 | | | $ | 0.05 | | | $ | 0.25 | |

| FFO | $ | 0.32 | | | $ | 0.36 | | | $ | 0.64 | | | $ | 0.75 | |

| Normalized FFO | $ | 0.33 | | | $ | 0.39 | | | $ | 0.66 | | | $ | 0.77 | |

| AFFO | $ | 0.33 | | | $ | 0.36 | | | $ | 0.66 | | | $ | 0.75 | |

| Normalized AFFO | $ | 0.34 | | | $ | 0.38 | | | $ | 0.67 | | | $ | 0.76 | |

| Weighted average number of common shares outstanding, diluted: | | | | | | |

| | | | | | | |

| Net income, FFO and Normalized FFO | 232,244,588 | | | 231,681,536 | | | 232,214,443 | | | 231,641,958 | |

| AFFO and Normalized AFFO | 233,586,255 | | | 232,708,975 | | | 233,560,237 | | | 232,713,843 | |

| | | | | | | |

(1) Funding for support payments did not require capital contributions from Sabra but rather were funded with proceeds received by our Enlivant unconsolidated joint venture from TPG for the issuance of senior preferred interests.

(2) Other normalizing items for FFO for the three and six months ended June 30, 2022 includes $2.2 million of foreign currency transaction loss related to our Canadian borrowings. In addition, other normalizing items for FFO and AFFO include triple-net operating expenses, net of recoveries and certain adjustments for amounts recorded in the current period that relate to a prior period.

(3) Other adjustments for the three and six months ended June 30, 2022 includes $2.2 million of foreign currency transaction loss related to our Canadian borrowings.

9

9

Annualized Cash Net Operating Income (“Annualized Cash NOI”)*

The Company believes that net income as defined by GAAP is the most appropriate earnings measure. The Company considers Annualized Cash NOI an important supplemental measure because it allows investors, analysts and its management to evaluate the operating performance of its investments. The Company defines Annualized Cash NOI as Annualized Revenues less operating expenses and non-cash revenues and expenses. Annualized Cash NOI excludes all other financial statement amounts included in net income.

Annualized Revenues

The annual contractual rental revenues under leases and interest and other income generated by the Company’s loans receivable and other investments based on amounts invested and applicable terms as of the end of the period presented. Annualized Revenues do not include tenant recoveries or additional rents and are adjusted to (i) reflect actual payments received related to the twelve months ended at the end of the respective period for leases no longer accounted for on an accrual basis, (ii) exclude residual rents due to Sabra from prior asset sales under the Company’s 2017 memorandum of understanding with Genesis and (iii) reflect the February 1, 2023 transition of four real estate properties formerly operated by North American Health Care to Avamere.

Behavioral Health

Includes behavioral hospitals that provide inpatient and outpatient care for patients with mental health conditions, chemical dependence or substance addictions and addiction treatment centers that provide treatment services for chemical dependence and substance addictions, which may include inpatient care, outpatient care, medical detoxification, therapy and counseling.

EBITDARM

Earnings before interest, taxes, depreciation, amortization, rent and management fees (“EBITDARM”) for a particular facility accruing to the operator/tenant of the property (not the Company), for the period presented. The Company uses EBITDARM in determining EBITDARM Coverage. EBITDARM has limitations as an analytical tool. EBITDARM does not reflect historical cash expenditures or future cash requirements for facility capital expenditures or contractual commitments. In addition, EBITDARM does not represent a property’s net income or cash flows from operations and should not be considered an alternative to those indicators. The Company utilizes EBITDARM to evaluate the core operations of the properties by eliminating management fees, which may vary by operator/tenant and operating structure, and as a supplemental measure of the ability of the Company’s operators/tenants and relevant guarantors to generate sufficient liquidity to meet related obligations to the Company.

EBITDARM Coverage

Represents the ratio of EBITDARM to cash rent for owned facilities (excluding Senior Housing - Managed communities) for the period presented. EBITDARM Coverage is a supplemental measure of a property’s ability to generate cash flows for the operator/tenant (not the Company) to meet the operator’s/tenant’s related cash rent and other obligations to the Company. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDARM. EBITDARM Coverage includes only Stabilized Facilities and excludes facilities for which data is not available or meaningful.

Funds From Operations (“FFO”) and Adjusted Funds from Operations (“AFFO”)*

The Company believes that net income as defined by GAAP is the most appropriate earnings measure. The Company also believes that funds from operations, or FFO, as defined in accordance with the definition used by the National Association of Real Estate Investment Trusts (“Nareit”), and adjusted funds from operations, or AFFO (and related per share amounts) are important non-GAAP supplemental measures of the Company’s operating performance. Because the historical cost accounting convention used for real estate assets requires straight-line depreciation (except on land), such accounting presentation implies that the value of real estate assets diminishes predictably over time. However, since real estate values have historically risen or fallen with market and other conditions, presentations of operating results for a real estate investment trust that uses historical cost accounting for depreciation could be less informative. Thus, Nareit created FFO as a supplemental measure of operating performance for real estate investment trusts that excludes historical cost depreciation and amortization, among other items, from net income, as defined by GAAP. FFO is defined as net income, computed in accordance with GAAP, excluding gains or losses from real estate dispositions and the Company’s share of gains or losses from real estate dispositions related to its unconsolidated joint ventures, plus real estate depreciation and amortization, net of amounts related to noncontrolling interests, plus the Company’s share of depreciation and amortization related to its unconsolidated joint ventures, and real estate impairment charges of both consolidated and unconsolidated entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. AFFO is defined as FFO excluding merger and acquisition costs, stock-

10

10

based compensation expense, non-cash rental and related revenues, non-cash interest income, non-cash interest expense, non-cash portion of loss on extinguishment of debt, provision for loan losses and other reserves, non-cash lease termination income and deferred income taxes, as well as other non-cash revenue and expense items (including ineffectiveness gain/loss on derivative instruments, and non-cash revenue and expense amounts related to noncontrolling interests) and the Company’s share of non-cash adjustments related to its unconsolidated joint ventures. The Company believes that the use of FFO and AFFO (and the related per share amounts), combined with the required GAAP presentations, improves the understanding of the Company’s operating results among investors and makes comparisons of operating results among real estate investment trusts more meaningful. The Company considers FFO and AFFO to be useful measures for reviewing comparative operating and financial performance because, by excluding the applicable items listed above, FFO and AFFO can help investors compare the operating performance of the Company between periods or as compared to other companies. While FFO and AFFO are relevant and widely used measures of operating performance of real estate investment trusts, they do not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. FFO and AFFO also do not consider the costs associated with capital expenditures related to the Company’s real estate assets nor do they purport to be indicative of cash available to fund the Company’s future cash requirements. Further, the Company’s computation of FFO and AFFO may not be comparable to FFO and AFFO reported by other real estate investment trusts that do not define FFO in accordance with the current Nareit definition or that interpret the current Nareit definition or define AFFO differently than the Company does.

Normalized FFO and Normalized AFFO*

Normalized FFO and Normalized AFFO represent FFO and AFFO, respectively, adjusted for certain income and expense items that the Company does not believe are indicative of its ongoing operating results. The Company considers Normalized FFO and Normalized AFFO to be useful measures to evaluate the Company’s operating results excluding these income and expense items to help investors compare the operating performance of the Company between periods or as compared to other companies. Normalized FFO and Normalized AFFO do not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. Normalized FFO and Normalized AFFO also do not consider the costs associated with capital expenditures related to the Company’s real estate assets nor do they purport to be indicative of cash available to fund the Company’s future cash requirements. Further, the Company’s computation of Normalized FFO and Normalized AFFO may not be comparable to Normalized FFO and Normalized AFFO reported by other real estate investment trusts that do not define FFO in accordance with the current Nareit definition or that interpret the current Nareit definition or define FFO and AFFO or Normalized FFO and Normalized AFFO differently than the Company does.

Senior Housing

Senior Housing communities include independent living, assisted living, continuing care retirement and memory care communities.

Senior Housing - Managed

Senior Housing communities operated by third-party property managers pursuant to property management agreements.

Skilled Nursing/Transitional Care

Skilled Nursing/Transitional Care facilities include skilled nursing, transitional care, multi-license designation and mental health facilities.

Specialty Hospitals and Other

Includes acute care, long-term acute care and rehabilitation hospitals, facilities that provide residential services, which may include assistance with activities of daily living, and other facilities not classified as Skilled Nursing/Transitional Care, Senior Housing or Behavioral Health.

Stabilized Facility

At the time of acquisition, the Company classifies each facility as either stabilized or non-stabilized. In addition, the Company may classify a facility as non-stabilized after acquisition. Circumstances that could result in a facility being classified as non-stabilized include newly completed developments, facilities undergoing major renovations or additions, facilities being repositioned or transitioned to new operators, and significant transitions within the tenants’ business model. Such facilities are typically reclassified to stabilized upon the earlier of maintaining consistent occupancy (85% for Skilled Nursing/Transitional Care facilities and 90% for Senior Housing communities) or 24 months after the date of classification as non-stabilized.

11

11

Stabilized Facilities exclude (i) facilities held for sale, (ii) strategic disposition candidates, (iii) facilities being transitioned to a new operator, (iv) facilities being transitioned from being leased by the Company to being operated by the Company and (v) leased facilities acquired during the three months preceding the period presented.

*Non-GAAP Financial Measures

Reconciliations, definitions and important discussions regarding the usefulness and limitations of the Non-GAAP Financial Measures used in this release can be found at https://ir.sabrahealth.com/investors/financials/quarterly-results.

12

12

Exhibit 99.2

2 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 03 COMPANY INFORMATION 04 OVERVIEW 05 PORTFOLIO Triple-Net Portfolio Top 10 Relationships Senior Housing - Managed Portfolio Loans and Other Investments NOI Concentrations Geographic Concentrations - Consolidated Portfolio Triple-Net Lease Expirations 13 INVESTMENTS Summary Illustrative Annualized Cash NOI Upside 15 CAPITALIZATION Overview Indebtedness Debt Maturity Credit Metrics and Ratings 19 FINANCIAL INFORMATION Consolidated Financial Statements - Statements of Income Consolidated Financial Statements - Balance Sheets Consolidated Financial Statements - Statements of Cash Flows FFO, Normalized FFO, AFFO and Normalized AFFO Components of Net Asset Value (NAV) 25 APPENDIX Disclaimer Reporting Definitions Discussion and Reconciliation of Certain Non-GAAP Financial Measures: CONTENT https://ir.sabrahealth.com/investors/financials/quarterly-results

3 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 SENIOR MANAGEMENT Rick Matros Michael Costa Talya Nevo-Hacohen Chief Executive Officer, President Chief Financial Officer, Secretary Chief Investment Officer, Treasurer and Chair and Executive Vice President and Executive Vice President BOARD OF DIRECTORS Rick Matros Michael Foster Jeffrey Malehorn Chief Executive Officer, President Lead Independent Director Director and Chair Craig Barbarosh Lynne Katzmann Clifton Porter II Director Director Director Katie Cusack Ann Kono Director Director CONTACT INFORMATION Sabra Health Care REIT, Inc. Transfer Agent 18500 Von Karman Avenue American Stock Transfer & Trust Suite 550 Company, LLC Irvine, CA 92612 6201 15th Avenue 888.393.8248 Brooklyn, NY 11219 sabrahealth.com COMPANY INFORMATION

4 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 Financial Metrics Dollars in thousands, except per share data June 30, 2023 Three Months Ended Six Months Ended Revenues $ 161,166 $ 322,490 Net operating income 115,112 230,657 Cash net operating income 112,103 224,917 Diluted per share data: EPS $ 0.09 $ 0.05 FFO 0.32 0.64 Normalized FFO 0.33 0.66 AFFO 0.33 0.66 Normalized AFFO 0.34 0.67 Dividends per common share 0.30 0.60 Capitalization and Market Facts Key Credit Metrics (1) June 30, 2023 June 30, 2023 Common shares outstanding 231.2 million Net Debt to Adjusted EBITDA 5.61x Common equity Market Capitalization $2.7 billion Interest Coverage 4.26x Consolidated Debt $2.4 billion Fixed Charge Coverage Ratio 4.18x Consolidated Enterprise Value $5.1 billion Total Debt/Asset Value 36 % Secured Debt/Asset Value 1 % Common stock closing price $11.77 Unencumbered Assets/Unsecured Debt 272 % Common stock 52-week range $10.08 - $16.60 Common stock ticker symbol SBRA Portfolio Dollars in thousands, units and Cash NOI reflect Sabra's pro rata share Three Months Ended June 30, 2023As of June 30, 2023 Property Count Investment Beds/Units Cash NOI Investment in Real Estate Properties, gross Triple-Net Portfolio: Skilled Nursing / Transitional Care 253 $ 3,181,828 27,857 $ 62,195 Senior Housing - Leased 45 579,927 3,532 10,216 Behavioral Health 18 487,466 1,077 9,488 Specialty Hospitals and Other 15 225,443 392 4,591 Total Triple-Net Portfolio 331 4,474,664 32,858 Senior Housing - Managed 61 1,268,360 6,041 14,464 Consolidated Real Estate Investments 392 5,743,024 38,899 Unconsolidated Joint Venture Senior Housing - Managed 16 206,404 1,256 2,681 Total Equity Investments 408 5,949,428 40,155 Investments in Loans Receivable, gross (2) 13 361,380 Preferred Equity Investments, gross (3) 5 55,735 Includes 67 relationships in 41 U.S. states and CanadaTotal Investments 426 $ 6,366,543 (1) See page 17 of this supplement for important information about these credit metrics. (2) Our loans receivable investments include one investment which has a right of first offer on six addiction treatment centers with 928 beds. (3) Our preferred equity investments include investments in entities owning four Senior Housing developments with 544 aggregate units and one Skilled Nursing/Transitional Care development with 120 beds. OVERVIEW

5 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 Operating Statistics (1) Twelve Months Ended March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 Occupancy Skilled Nursing/Transitional Care 72.8 % 72.9 % 73.5 % 73.7 % 74.4 % Senior Housing - Leased 79.7 % 81.8 % 84.4 % 86.4 % 87.8 % Behavioral Health 83.3 % 83.1 % 84.0 % 83.5 % 85.9 % Specialty Hospitals and Other 80.0 % 79.7 % 77.4 % 76.9 % 76.5 % Skilled Mix Skilled Nursing/Transitional Care 37.8 % 33.9 % 34.3 % 35.0 % 34.4 % PORTFOLIO Triple-Net Portfolio (1) Occupancy Percentage and Skilled Mix (together, “Operating Statistics”) and EBITDARM Coverage for each period presented include only Stabilized Facilities owned by the Company as of the end of the quarter following the period presented and only for the duration such facilities were owned by the Company and classified as Stabilized Facilities. EBITDARM Coverage (1) Twelve Months Ended March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 Skilled Nursing/Transitional Care 1.80x 1.83x 1.77x 1.63x 1.65x Senior Housing - Leased 1.09x 1.13x 1.19x 1.14x 1.15x Behavioral Health 1.83x 1.72x 1.71x 1.71x 1.87x Specialty Hospitals and Other 7.07x 7.30x 6.95x 6.40x 6.68x

6 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 PORTFOLIO Top 10 Relationships Top 10 Relationships Tenant/Borrower Credit Exposure Senior Housing - Managed Operator Exposure As of June 30, 2023 EBITDARM Coverage Twelve Months Ended (1) As of June 30, 2023 Relationship Primary Property Type Number of Sabra Investments % of Annualized Cash NOI March 31, 2023 December 31, 2022 Number of Sabra Investments % of Annualized Cash NOI Signature Healthcare Skilled Nursing 44 9.0 % 1.22x 1.11x — — The Ensign Group Skilled Nursing 31 8.2 % N/A N/A — — Avamere Family of Companies Skilled Nursing 28 7.4 % 1.49x 1.47x — — Signature Behavioral Behavioral Hospitals 5 7.0 % 1.48x 1.30x — — Recovery Centers of America Addiction Treatment 3 5.4 % N/A N/A — — Holiday AL Holdings LP Independent Living — — N/A N/A 21 5.2 % Leo Brown Group Assisted Living 5 2.8 % 1.28x 1.23x 4 2.2 % The McGuire Group Skilled Nursing 8 3.8 % 1.32x 1.38x — — CommuniCare Skilled Nursing 11 3.7 % 1.91x 2.07x — — Healthmark Group Skilled Nursing 16 3.4 % 1.49x 1.57x — — Top 10 relationships 151 50.7 % 1.43x 1.38x 25 7.4 % Remaining 57 relationships 198 33.9 % 2.48x 2.46x 52 8.0 % Total 349 84.6 % 1.93x 1.87x 77 15.4 % (1) EBITDARM Coverage is presented for Stabilized Facilities operated by the applicable tenant and is presented one quarter in arrears. (2) Pro forma EBITDARM Coverage excludes Provider Relief Funds and illustrates the impact of the February 1, 2023 transition of 20 real estate properties formerly operated by North American Health Care to Ensign on our historical trailing twelve-month EBITDARM Coverages. Pro Forma EBITDARM Coverage Pro Forma EBITDARM Coverage Twelve Months Ended March 31, 2023 December 31, 2022 The Ensign Group (2) 1.68x 1.72x

7 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 PORTFOLIO Senior Housing - Managed Portfolio (1) (1) Excludes our Enlivant unconsolidated joint venture. Sabra withdrew and resigned its membership in the Enlivant Joint Venture effective May 1, 2023. (2) Same store Senior Housing - Managed portfolio includes Stabilized Facilities owned as the same property type for the full period in all comparison periods. Resident fees and services, Cash NOI and REVPOR have been adjusted for changes in the foreign currency exchange rate where applicable by applying the average exchange rate for the current period to prior period results. Operating Performance Dollars in thousands Three Months Ended June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 Consolidated Portfolio Number of Properties 50 54 59 59 61 Number of Units 5,266 5,669 5,942 5,973 6,041 Resident fees and services $ 44,136 $ 47,610 $ 52,699 $ 56,721 $ 58,428 Cash NOI $ 10,110 $ 10,905 $ 13,544 $ 13,084 $ 14,464 Cash NOI Margin % 22.9 % 22.9 % 25.7 % 23.1 % 24.8 % Unconsolidated Portfolio Number of Properties 12 12 15 16 16 Number of Units (Pro Rata) 617 617 1,011 1,258 1,256 Resident fees and services (Pro Rata) $ 2,812 $ 5,592 $ 6,580 $ 8,831 $ 9,760 Cash NOI (Pro Rata) $ 673 $ 1,377 $ 1,122 $ 2,026 $ 2,681 Cash NOI Margin % 23.9 % 24.6 % 17.1 % 22.9 % 27.5 % Same Store Operating Performance (2) Dollars in thousands, except REVPOR Three Months Ended June 30, 2022 September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 Consolidated Portfolio Number of Properties 39 39 39 39 39 Number of Available Units 4,039 4,038 4,039 4,040 4,040 REVPOR AL $ 6,161 $ 6,197 $ 6,544 $ 6,490 $ 6,537 IL $ 2,653 $ 2,700 $ 2,744 $ 2,775 $ 2,811 Total $ 3,516 $ 3,550 $ 3,686 $ 3,702 $ 3,762 Occupancy AL 79.4 % 79.5 % 81.2 % 80.7 % 81.9 % IL 80.8 % 82.1 % 81.7 % 80.5 % 79.2 % Total 80.4 % 81.5 % 81.5 % 80.6 % 79.9 % Resident fees and services $ 34,264 $ 35,040 $ 36,417 $ 36,148 $ 36,438 Cash NOI $ 8,256 $ 8,463 $ 10,576 $ 10,064 $ 9,942 Cash NOI Margin % 24.1 % 24.2 % 29.0 % 27.8 % 27.3 %

8 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 PORTFOLIO Loans and Other Investments Loans Receivable and Other Investments Dollars in thousands As of June 30, 2023 Loan Type Number of Loans Property Type Principal Balance Book Value Weighted Average Contractual Interest Rate Weighted Average Annualized Effective Interest Rate Interest Income Three Months Ended June 30, 2023 (1) Maturity Date Mortgage 2 Behavioral Health $ 319,000 $ 319,000 7.6 % 7.6 % $ 6,105 11/01/26 - 01/31/27 Other 11 Multiple 52,538 49,116 7.5 % 7.0 % 751 08/31/23 - 05/01/29 13 371,538 368,116 7.6 % 7.6 % $ 6,856 Allowance for loan losses — (6,832) $ 371,538 $ 361,284 Other Investment Type Number of Investments Property Type Total Funding Commitments Total Amount Funded Book Value Rate of Return Other Income Three Months Ended June 30, 2023 (1) Preferred Equity 5 Skilled Nursing / Senior Housing $ 49,574 $ 49,574 $ 55,735 10.9 % $ 1,445 (1) Includes income related to loans receivable and other investments held as of June 30, 2023.

9 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 The Ensign Group: 8.2% Avamere Family of Companies: 7.4% Signature Behavioral: 7.0% Recovery Centers of America: 5.4% Managed (No Operator Credit Exposure): 15.4% Other: 47.6% Signature Healthcare: 9.0% RELATIONSHIP CONCENTRATION PROPERTY TYPE CONCENTRATION PAYOR SOURCE CONCENTRATION (2) PORTFOLIO NOI Concentrations (1) As of June 30, 2023 (1) Relationship and asset class concentrations include real estate investments and investments in loans receivable and other investments. Relationship concentrations use Annualized Cash NOI, and asset class concentrations use Annualized Cash NOI, as adjusted to reflect Annualized Cash NOI from our mortgage and construction loans receivable and preferred equity investments in the related asset class of the underlying real estate. Payor source concentration excludes Annualized Cash NOI from investments in loans receivable and other investments. (2) Tenant payor source allocation presented one quarter in arrears. Holiday 5.2% Sienna 2.5% Other 7.7% Behavioral Health: 13.6% Senior Housing - Leased: 10.5% Specialty Hospital and Other: 4.0% Other: 0.8% Skilled Nursing/Transitional Care: 55.7% Senior Housing - Managed: 15.4% Private Pay: 43.8% Non-Private: 56.2%

10 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 PORTFOLIO Geographic Concentrations - Consolidated Portfolio Property Type As of June 30, 2023 Location Skilled Nursing/ Transitional Care Senior Housing - Leased Senior Housing - Managed Consolidated Behavioral Health Specialty Hospitals and Other Total % of Total Texas 35 5 5 — 13 58 14.8 % California 24 — 2 3 1 30 7.7 Kentucky 24 1 — 2 1 28 7.1 Oregon 15 1 3 — — 19 4.8 Indiana 12 4 1 2 — 19 4.8 Washington 14 — 2 — — 16 4.1 North Carolina 13 — 2 — — 15 3.8 Missouri 12 — 1 1 — 14 3.6 Massachusetts 12 — — — — 12 3.1 New York 9 — 1 — — 10 2.6 Other (31 states & Canada) 83 34 44 10 — 171 43.6 Total 253 45 61 18 15 392 100.0 % % of Total 64.5 % 11.5 % 15.6 % 4.6 % 3.8 % 100.0 % Distribution of Beds/Units As of June 30, 2023 Property Type Location Total Number of Properties Skilled Nursing/ Transitional Care Senior Housing - Leased Senior Housing - Managed Consolidated Behavioral Health Specialty Hospitals and Other Total % of Total Texas 58 4,419 470 736 — 325 5,950 15.3 % Kentucky 28 2,486 142 — 172 40 2,840 7.3 California 30 2,058 — 160 313 27 2,558 6.6 Indiana 19 1,411 545 169 138 — 2,263 5.8 Oregon 19 1,520 215 162 — — 1,897 4.9 North Carolina 15 1,454 — 237 — — 1,691 4.3 New York 10 1,566 — 107 — — 1,673 4.3 Washington 16 1,507 — 165 — — 1,672 4.3 Massachusetts 12 1,469 — — — — 1,469 3.8 Virginia 10 894 60 186 — — 1,140 2.9 Other (31 states & Canada) 175 9,073 2,100 4,119 454 — 15,746 40.5 Total 392 27,857 3,532 6,041 1,077 392 38,899 100.0 % % of Total 71.6 % 9.1 % 15.5 % 2.8 % 1.0 % 100.0 %

11 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 PORTFOLIO Geographic Concentrations - Consolidated Portfolio Continued Investment Dollars in thousands As of June 30, 2023 Property Type Location Total Number of Properties Skilled Nursing/ Transitional Care Senior Housing - Leased Senior Housing - Managed Consolidated Behavioral Health Specialty Hospitals and Other Total % of Total Texas 58 $ 348,663 $ 55,818 $ 166,481 $ — $ 187,387 $ 758,349 13.2 % California 30 435,612 — 58,395 217,764 7,743 719,514 12.5 Oregon 19 261,316 33,002 54,017 — — 348,335 6.1 Indiana 19 158,666 120,197 47,836 12,155 — 338,854 5.9 New York 10 297,637 — 20,574 — — 318,211 5.5 Kentucky 28 243,163 23,668 — 14,888 30,313 312,032 5.4 Washington 16 184,285 — 39,501 — — 223,786 3.9 North Carolina 15 124,448 — 72,017 — — 196,465 3.4 Arizona 5 — 10,348 39,566 121,757 — 171,671 3.0 Canada (1) 9 — — 158,103 — — 158,103 2.8 Other (32 states) 183 1,128,038 336,894 611,870 120,902 — 2,197,704 38.3 Total 392 $ 3,181,828 $ 579,927 $ 1,268,360 $ 487,466 $ 225,443 $ 5,743,024 100.0 % % of Total 55.4 % 10.1 % 22.1 % 8.5 % 3.9 % 100.0 % (1) Investment balance in Canada is based on the exchange rate as of June 30, 2023 of $0.7548 per 1 CAD.

12 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 PORTFOLIO Triple-Net Lease Expirations Triple-Net Lease Expirations Dollars in thousands Skilled Nursing/ Transitional Care Senior Housing - Leased Behavioral Health Specialty Hospitals and Other Total Annualized RevenuesAs of June 30, 2023 % of Total 07/01/23 - 12/31/23 $ 2,319 $ — $ — $ — $ 2,319 0.6 % 2024 8,430 — — — 8,430 2.4 % 2025 6,666 3,330 — 1,442 11,438 3.2 % 2026 17,231 1,389 — — 18,620 5.3 % 2027 26,649 4,171 — — 30,820 8.7 % 2028 20,986 6,884 — 3,370 31,240 8.8 % 2029 45,941 4,917 — 5,988 56,846 16.1 % 2030 — — — 3,158 3,158 0.9 % 2031 74,847 6,030 1,114 — 81,991 23.2 % 2032 5,453 1,667 32,821 3,657 43,598 12.3 % Thereafter 46,099 14,360 4,159 725 65,343 18.5 % Total Annualized Revenues $ 254,621 $ 42,748 $ 38,094 $ 18,340 $ 353,803 100.0 %

13 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 INVESTMENTS Summary Investment Activity Dollars in thousands Investment Initial Investment Date Property Type Number of Properties Beds/Units 2023 Amounts Invested (1) Expected Cash Yield Real Estate Traditions at Camargo (2) 02/01/23 Senior Housing - Managed 1 151 $ 48,025 8.00 % Wickshire Norman 02/01/23 Senior Housing - Leased 1 70 3,250 8.00 % Additions to Real Estate (3) Various Multiple N/A N/A 22,128 8.71 % Total Real Estate Investments 73,403 8.21 % Unconsolidated Joint Venture Marlin Spring Joint Venture (4) 02/20/23 Senior Housing - Managed 1 290 18,939 8.00 % Preferred Equity Preferred Equity Fundings Various Multiple N/A N/A 10,658 12.00 % Loans Receivable Loans Receivable Fundings Various Multiple N/A N/A 9,405 9.34 % All Investments through June 30, 2023 $ 112,405 8.63 % (1) Excludes capitalized acquisition costs and origination fees. (2) Amount invested reflects the gross investment, of which $4.6 million was used to repay our preferred equity investment. (3) Excludes capital expenditures for the Senior Housing - Managed portfolio and recurring capital expenditures for the Triple-Net portfolio. (4) Amount invested relates to the acquisition of one additional property and reflects Sabra's 85% pro rata share of the gross investment of CAD $30.0 million and is based on the exchange rate as of the investment date. In addition, the Marlin Spring Joint Venture financed and assumed an aggregate CAD $23.6 million of debt associated with this additional acquisition. Sabra's equity investment in the additional property was CAD $6.1 million.

14 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 INVESTMENTS Illustrative Annualized Cash NOI Upside As of June 30, 2023 (1) Incremental Annualized Cash NOI assuming pre-COVID Occupancy Percentage of ~87% and Cash NOI Margin of~33%, as compared to Occupancy Percentage of ~79% and Cash NOI Margin of ~25% in 2Q 2023. (2) Assumes transitions/conversions occurred on the first day of 2Q 2023. Annualized Cash NOI Upside Opportunity Dollars in millions Annualized Cash NOI - 2Q 2023 $ 458 Recovery in Senior Housing - Managed portfolio (1) ~29 Previously disclosed transition of 25 properties (2) ~5 Previously disclosed Behavioral Health conversions (2) ~8 Annualized Cash NOI including upside opportunity $ ~500 As illustrated in the table below, the Annualized Cash NOI upside opportunity for Sabra’s portfolio is attractive as the broader healthcare industry continues to recover from the pandemic.

15 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 CAPITALIZATION Overview Consolidated Debt Dollars in thousands As of June 30, 2023 Secured debt $ 49,140 Revolving credit facility 100,517 Term loans 543,220 Senior unsecured notes 1,750,000 Total 2,442,877 Deferred financing costs and premiums/discounts, net (22,841) Total, net $ 2,420,036 Revolving Credit Facility Dollars in thousands As of June 30, 2023 Credit facility availability $ 899,483 Credit facility capacity 1,000,000 Enterprise Value Dollars in thousands, except per share amounts As of June 30, 2023 Shares Outstanding Price Value Common stock 231,218,658 $ 11.77 $ 2,721,444 Consolidated Debt 2,442,877 Cash and cash equivalents (27,234) Consolidated Enterprise Value $ 5,137,087 Common Stock and Equivalents Weighted Average Common Shares Three Months Ended June 30, 2023 Six Months Ended June 30, 2023 EPS, FFO and Normalized FFO AFFO and Normalized AFFO EPS, FFO and Normalized FFO AFFO and Normalized AFFO Common stock 231,197,641 231,197,641 231,177,465 231,177,465 Common equivalents 6,890 6,890 6,890 6,890 Basic common and common equivalents 231,204,531 231,204,531 231,184,355 231,184,355 Dilutive securities: Restricted stock units 1,040,057 2,381,724 1,030,088 2,375,882 Diluted common and common equivalents 232,244,588 233,586,255 232,214,443 233,560,237

16 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 CAPITALIZATION Indebtedness Fixed | Variable Rate Debt Dollars in thousands Weighted Average Interest Rate (1)As of June 30, 2023 Principal % of Total Fixed Rate Debt Secured debt $ 49,140 3.34 % 2.0 % Senior unsecured notes 1,750,000 4.04 % 71.6 % Total fixed rate debt 1,799,140 4.02 % 73.6 % Variable Rate Debt (2) Revolving credit facility 100,517 6.34 % 4.1 % Term loans 543,220 3.65 % 22.3 % Total variable rate debt 643,737 4.07 % 26.4 % Consolidated Debt $ 2,442,877 4.04 % 100.0 % Secured | Unsecured Debt Dollars in thousands Weighted Average Interest Rate (1)As of June 30, 2023 Principal % of Total Secured Debt Secured debt $ 49,140 3.34 % 2.0 % Unsecured Debt Senior unsecured notes 1,750,000 4.04 % 71.6 % Revolving credit facility 100,517 6.34 % 4.1 % Term loans 543,220 3.65 % 22.3 % Total unsecured debt 2,393,737 4.05 % 98.0 % Consolidated Debt $ 2,442,877 4.04 % 100.0 % (1) Weighted average interest rate includes private mortgage insurance and impact of interest rate hedges. (2) Variable rate debt includes $430.0 million subject to interest rate swaps and interest rate collars that fix and set a cap and floor, respectively, for SOFR at a weighted average rate of 1.51%, and $113.2 million (CAD $150.0 million) subject to swap agreements that fix CDOR at 1.63%. Excluding these amounts, variable rate debt was 4.1% of Consolidated Debt as of June 30, 2023.

17 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 CAPITALIZATION Debt Maturity Debt Maturity Schedule Dollars in thousands Secured Debt Senior Unsecured Notes Term Loans Revolving Credit Facility (1) Consolidated Debt As of June 30, 2023 Principal Rate (2) Principal Rate (2) Principal Rate (2) Principal Rate (2) Principal Rate (2) 07/01/23 - 12/31/23 $ 996 2.85 % $ — — $ — — $ — — $ 996 2.85 % 2024 2,034 2.85 % — — — — — — 2,034 2.85 % 2025 2,089 2.86 % — — — — — — 2,089 2.86 % 2026 2,147 2.86 % 500,000 5.13 % — — — — 502,147 5.12 % 2027 2,206 2.87 % 100,000 5.88 % — — 100,517 6.34 % 202,723 6.08 % 2028 2,266 2.88 % — — 543,220 6.46 % — — 545,486 6.44 % 2029 2,328 2.89 % 350,000 3.90 % — — — — 352,328 3.89 % 2030 2,392 2.90 % — — — — — — 2,392 2.90 % 2031 2,093 2.92 % 800,000 3.20 % — — — — 802,093 3.20 % 2032 1,887 2.92 % — — — — — — 1,887 2.92 % Thereafter 28,702 3.09 % — — — — — — 28,702 3.09 % Total 49,140 1,750,000 543,220 100,517 2,442,877 Discount, net — (3,895) — — (3,895) Deferred financing costs, net (867) (11,250) (6,829) — (18,946) Total, net $ 48,273 $ 1,734,855 $ 536,391 $ 100,517 $ 2,420,036 Wtd. avg. maturity/years 21.5 6.2 4.5 3.5 6.0 Wtd. avg. interest rate (3) 3.34 % 4.04 % 3.65 % 6.34 % 4.04 % (1) Revolving Credit Facility is subject to two six-month extension options. (2) Represents actual contractual interest rates excluding private mortgage insurance and impact of interest rate hedges. (3) Weighted average interest rate includes private mortgage insurance and impact of interest rate hedges.

18 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 Key Credit Metrics (1) June 30, 2023 Net Debt to Adjusted EBITDA (2) 5.61x Interest Coverage (2) 4.26x Fixed Charge Coverage Ratio (2) 4.18x Total Debt/Asset Value 36 % Secured Debt/Asset Value 1 % Unencumbered Assets/Unsecured Debt 272 % Cost of Permanent Consolidated Debt (3) 3.94 % Unsecured Notes Ratings S&P (Stable outlook) BBB- Fitch (Stable outlook) BBB- Moody's (Stable outlook) Ba1 CAPITALIZATION Credit Metrics and Ratings (1) Key credit statistics (except Net Debt to Adjusted EBITDA) are calculated in accordance with the credit agreement relating to the revolving credit facility and the indentures relating to our senior unsecured notes. In addition, key credit statistics give effect to dispositions and acquisitions completed after the period presented as though such dispositions and acquisitions occurred at the beginning of the period. (2) Based on the trailing twelve-month period ended as of the date indicated. (3) Excludes revolving credit facility balance that had an interest rate of 6.34% as of June 30, 2023.

19 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 FINANCIAL INFORMATION Consolidated Financial Statements Consolidated Statements of Income Dollars in thousands, except per share data Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Revenues: Rental and related revenues (1) $ 94,274 $ 103,168 $ 190,144 $ 213,054 Resident fees and services 58,428 44,136 115,149 86,363 Interest and other income 8,464 8,653 17,197 19,645 Total revenues 161,166 155,957 322,490 319,062 Expenses: Depreciation and amortization 44,142 45,172 96,969 90,428 Interest 28,328 25,530 56,868 50,502 Triple-net portfolio operating expenses 4,771 4,852 8,939 9,863 Senior housing - managed portfolio operating expenses 43,964 34,026 87,601 67,130 General and administrative 9,532 8,649 20,034 19,045 Provision for (recovery of) loan losses and other reserves 429 (270) 221 205 Impairment of real estate — 11,745 7,064 11,745 Total expenses 131,166 129,704 277,696 248,918 Other (expense) income: Loss on extinguishment of debt — — (1,541) (271) Other (expense) income — (2,163) 341 (2,095) Net loss on sales of real estate (7,833) (4,501) (29,348) (4,501) Total other expense (7,833) (6,664) (30,548) (6,867) Income before loss from unconsolidated joint ventures and income tax expense 22,167 19,589 14,246 63,277 Loss from unconsolidated joint ventures (653) (2,529) (1,491) (5,331) Income tax expense (326) (255) (1,054) (539) Net income $ 21,188 $ 16,805 $ 11,701 $ 57,407 Net income, per: Basic common share $ 0.09 $ 0.07 $ 0.05 $ 0.25 Diluted common share $ 0.09 $ 0.07 $ 0.05 $ 0.25 Weighted average number of common shares outstanding, basic 231,204,531 230,967,163 231,184,355 230,913,462 Weighted average number of common shares outstanding, diluted 232,244,588 231,681,536 232,214,443 231,641,958 (1) See page 19 for additional details regarding Rental and related revenues.

20 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 FINANCIAL INFORMATION Consolidated Financial Statements Consolidated Statements of Income - Supplemental Information Dollars in thousands Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Cash rental income $ 87,381 $ 95,209 $ 177,038 $ 195,566 Straight-line rental income 1,503 2,342 2,850 5,036 Straight-line rental income receivable write-offs — (323) (518) (462) Above/below market lease amortization 1,568 1,568 3,136 3,161 Above/below market lease intangible write-offs — — — 326 Operating expense recoveries 3,822 4,372 7,638 9,427 Rental and related revenues $ 94,274 $ 103,168 $ 190,144 $ 213,054

21 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 FINANCIAL INFORMATION Consolidated Financial Statements Consolidated Balance Sheets Dollars in thousands, except per share data June 30, 2023 December 31, 2022 (unaudited) Assets Real estate investments, net of accumulated depreciation of $992,222 and $913,345 as of June 30, 2023 and December 31, 2022, respectively $ 4,751,898 $ 4,959,343 Loans receivable and other investments, net 417,019 411,396 Investment in unconsolidated joint ventures 140,402 134,962 Cash and cash equivalents 27,234 49,308 Restricted cash 5,146 4,624 Lease intangible assets, net 35,990 40,131 Accounts receivable, prepaid expenses and other assets, net 146,641 147,908 Total assets $ 5,524,330 $ 5,747,672 Liabilities Secured debt, net $ 48,273 $ 49,232 Revolving credit facility 100,517 196,982 Term loans, net 536,391 526,129 Senior unsecured notes, net 1,734,855 1,734,431 Accounts payable and accrued liabilities 121,865 142,259 Lease intangible liabilities, net 38,685 42,244 Total liabilities 2,580,586 2,691,277 Equity Preferred stock, $0.01 par value; 10,000,000 shares authorized, zero shares issued and outstanding as of June 30, 2023 and December 31, 2022 — — Common stock, $0.01 par value; 500,000,000 shares authorized, 231,218,658 and 231,009,295 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively 2,312 2,310 Additional paid-in capital 4,489,107 4,486,967 Cumulative distributions in excess of net income (1,579,914) (1,451,945) Accumulated other comprehensive income 32,239 19,063 Total equity 2,943,744 3,056,395 Total liabilities and equity $ 5,524,330 $ 5,747,672

22 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 FINANCIAL INFORMATION Consolidated Financial Statements Consolidated Statements of Cash Flows Dollars in thousands Six Months Ended June 30, 2023 2022 Cash flows from operating activities: Net income $ 11,701 $ 57,407 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 96,969 90,428 Non-cash rental and related revenues (5,469) (8,061) Non-cash interest income (388) (1,094) Non-cash interest expense 6,091 5,502 Stock-based compensation expense 3,233 3,250 Loss on extinguishment of debt 1,541 271 Provision for loan losses and other reserves 221 205 Net loss on sales of real estate 29,348 4,501 Impairment of real estate 7,064 11,745 Loss from unconsolidated joint ventures 1,491 5,331 Distributions of earnings from unconsolidated joint ventures 1,112 — Other non-cash items — 2,167 Changes in operating assets and liabilities: Accounts receivable, prepaid expenses and other assets, net (6,277) (6,074) Accounts payable and accrued liabilities (8,019) (25,895) Net cash provided by operating activities 138,618 139,683 Cash flows from investing activities: Acquisition of real estate (39,630) (20,573) Origination and fundings of loans receivable (9,050) — Origination and fundings of preferred equity investments (10,676) (4,990) Additions to real estate (37,995) (19,495) Escrow deposits for potential investments — (836) Repayments of loans receivable 8,062 4,466 Repayments of preferred equity investments 4,130 1,333 Investment in unconsolidated joint ventures (4,797) (128,007) Net proceeds from the sales of real estate 168,904 40,003 Net proceeds from sales-type lease 25,490 — Distributions in excess of earnings from unconsolidated joint ventures 544 — Net cash provided by (used in) investing activities 104,982 (128,099) Cash flows from financing activities: Net (repayments of) borrowings from revolving credit facility (98,857) 142,353 Proceeds from term loans 12,188 — Principal payments on term loans — (40,000) Principal payments on secured debt (983) (16,547) Payments of deferred financing costs (18,128) (6) Payment of contingent consideration (17,900) — Issuance of common stock, net (2,153) (3,803) Dividends paid on common stock (138,711) (138,565) Net cash used in financing activities (264,544) (56,568) Net decrease in cash, cash equivalents and restricted cash (20,944) (44,984) Effect of foreign currency translation on cash, cash equivalents and restricted cash (608) 619 Cash, cash equivalents and restricted cash, beginning of period 53,932 115,886 Cash, cash equivalents and restricted cash, end of period $ 32,380 $ 71,521 Supplemental disclosure of cash flow information: Interest paid $ 52,591 $ 49,968 Supplemental disclosure of non-cash investing activities: Decrease in loans receivable and other investments due to acquisition of real estate $ 4,644 $ 5,623

23 SABRA 2Q 2023 SUPPLEMENTAL INFORMATION June 30, 2023 FINANCIAL INFORMATION FFO, Normalized FFO, AFFO and Normalized AFFO (1) Funding for support payments did not require capital contributions from Sabra but rather were funded with proceeds received by our Enlivant unconsolidated joint venture from TPG for the issuance of senior preferred interests. (2) Other normalizing items for FFO for the three and six months ended June 30, 2022 includes $2.2 million of foreign currency transaction loss related to our Canadian borrowings. In addition, other normalizing items for FFO and AFFO include triple-net operating expenses, net of recoveries and certain adjustments for amounts recorded in the current period that relate to a prior period. (3) Other adjustments for the three and six months ended June 30, 2022 includes $2.2 million of foreign currency transaction loss related to our Canadian borrowings. FFO, Normalized FFO, AFFO and Normalized AFFO Dollars in thousands, except per share data Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Net income $ 21,188 $ 16,805 $ 11,701 $ 57,407 Add: Depreciation and amortization of real estate assets 44,142 45,172 96,969 90,428 Depreciation, amortization and impairment of real estate assets related to unconsolidated joint ventures 2,202 5,133 4,250 9,766 Net loss on sales of real estate 7,833 4,501 29,348 4,501 Net gain on sales of real estate related to unconsolidated joint ventures — (220) — (220) Impairment of real estate — 11,745 7,064 11,745 FFO $ 75,365 $ 83,136 $ 149,332 $ 173,627 Write-offs of cash and straight-line rental income receivable and lease intangibles — 709 540 180 Lease termination income — — — (2,338) Loss on extinguishment of debt — — 1,541 271 Provision for (recovery of) loan losses and other reserves 429 (270) 221 205 Support payments paid to joint venture manager (1) — 3,626 — 3,626 Other normalizing items (2) 1,301 2,699 2,069 2,651 Normalized FFO $ 77,095 $ 89,900 $ 153,703 $ 178,222 FFO $ 75,365 $ 83,136 $ 149,332 $ 173,627 Stock-based compensation expense 1,004 794 3,233 3,250 Non-cash rental and related revenues (3,071) (3,587) (5,469) (8,061) Non-cash interest income 4 (547) (388) (1,094) Non-cash interest expense 3,077 2,804 6,091 5,502 Non-cash portion of loss on extinguishment of debt — — 1,541 271 Provision for (recovery of) loan losses and other reserves 429 (270) 221 205 Other adjustments related to unconsolidated joint ventures 169 (692) 238 (1,678) Other adjustments (3) 57 2,211 163 2,394 AFFO $ 77,034 $ 83,849 $ 154,962 $ 174,416 Cash portion of lease termination income — — — (2,338) Write-off of cash rental income — 404 — 71 Support payments paid to joint venture manager (1) — 3,626 — 3,626 Other normalizing items (2) 1,286 516 2,038 330 Normalized AFFO $ 78,320 $ 88,395 $ 157,000 $ 176,105 Amounts per diluted common share: Net income $ 0.09 $ 0.07 $ 0.05 $ 0.25 FFO $ 0.32 $ 0.36 $ 0.64 $ 0.75 Normalized FFO $ 0.33 $ 0.39 $ 0.66 $ 0.77 AFFO $ 0.33 $ 0.36 $ 0.66 $ 0.75 Normalized AFFO $ 0.34 $ 0.38 $ 0.67 $ 0.76 Weighted average number of common shares outstanding, diluted: Net income, FFO and Normalized FFO 232,244,588 231,681,536 232,214,443 231,641,958 AFFO and Normalized AFFO 233,586,255 232,708,975 233,560,237 232,713,843