Roma Financial Corporation Announces Second Quarter 2011 Earnings

July 29 2011 - 12:00PM

Roma Financial Corporation (Nasdaq:ROMA) (the "Company"), the

holding company of Roma Bank, announced today its results of

operation for the three and six months ended June 30, 2011. Net

income attributable to Roma Financial Corporation for the three and

six months ended June 30, 2011 was $1.4 million and $3.2 million,

respectively, or $.05 and $.11 per common and diluted share,

compared to $1.5 million and $3.1 million, or $.05 and $.10 per

common and diluted share, for the same period of the prior year.

At June 30, 2011, the Company's consolidated assets increased

4.0% to $1.89 billion compared to $1.82 billion at December 31,

2010, and $1.46 billion at June 30, 2010. Deposits increased

4.7% to $1.57 billion from December 31, 2010, and $464.8 million

over those at June 30, 2010. In addition to generic growth,

the acquisition of the former Sterling Bank accounted for the

substantial change in year over year total asset and deposit

comparisons. Stockholders' equity ended the quarter at $216.0

million, compared to $212.5 million at December 31, 2010.

"Our company continues to display the capacity to generate core

earnings at a level which permits it to absorb the negative impacts

related to appropriately assessing loan loss probability and the

carrying value of impaired loans. While unchanged on a per

share basis, net income in the current quarter tightened in

comparison to the first quarter of the year, principally due to

higher provisions for loan losses and expenses associated with

problem loan resolutions and acquired collateral

dispositions. Nevertheless, net income for the first half of

this year was nearly 6.0% higher than that reported for the first

half of last year," commented Peter A. Inverso, President and

CEO.

"The protracted low interest rate environment remains an

impediment to improving yields on loans and investments. While

our yields continue to tighten, the growth in our earning assets

and prudent control of our cost of funds benefitted our bottom

line. Our net interest income increased 6.4% in the current

quarter and 30.0% in the six months ended June 30, 2011; with

the latter substantial increase principally attributable to

the assets added in the acquisition," stated

Inverso.

"The economic headwinds are still formidable. Improvement

in credit quality is highly dependent on a more serene economic

climate," concluded Inverso.

Shares of the Company began trading on July 12, 2006, on the

NASDAQ Global Select Market under the symbol "ROMA."

Roma Financial Corporation (Nasdaq:ROMA) is the holding company

of Roma Bank, a community bank headquartered in Robbinsville, New

Jersey, and RomAsia Bank headquartered in South Brunswick, New

Jersey. Roma Bank has been serving families, businesses and

the communities of Central New Jersey for over 91 years with a

complete line of financial products and services, and today Roma

Bank operates branch locations in Mercer, Burlington, Camden and

Ocean counties in New Jersey. Visit Roma online at

www.romabank.com, or RomAsia Bank at

www.romasiabank.com. RomAsia Bank has two branch locations in

Middlesex County, New Jersey.

Forward Looking Statements

The foregoing material contains forward-looking statements

concerning the financial condition, results of operations and

business of the Company. We caution that such statements are

subject to a number of uncertainties and actual results could

differ materially, and, therefore, readers should not place undue

reliance on any forward-looking statements. The Company does

not undertake, and specifically disclaims, any obligation to

publicly release the results of any revisions that may be made to

any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements.

CONTACT: Peter A. Inverso, President & CEO

609-223-8310

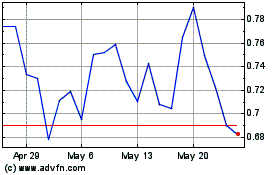

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

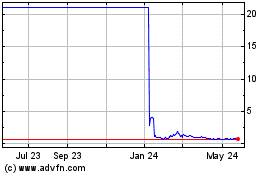

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Dec 2023 to Dec 2024