Roma Financial Corporation Announces Third Quarter 2010 Earnings

November 09 2010 - 4:00PM

Roma Financial Corporation (Nasdaq:ROMA) (the "Company"), the

holding company of Roma Bank, announced today its results of

operation for the three and nine months ended September 30, 2010.

Net income attributable to Roma Financial Corporation for the three

and nine months ended September 30, 2010 was $823 thousand and $3.9

million, respectively, or $.03 and $.13 per common and diluted

share, compared to $1.1 million and $2.5 million, or $.04 and $.08

per common and diluted share, for the same period of the prior

year.

At September 30, 2010 the Company's consolidated assets

increased 39.1% to $1.8 billion compared to $1.3 billion at

December 31, 2009, deposits increased 46.1% to $1.5 billion and

equity increased to $217.7 million from $216.2 million at December

31, 2009.

"In comparison to this year's second quarter and last year's

third quarter, financial performance in the current quarter was

adversely affected primarily by the expenses associated with the

acquisition of Sterling Bank, including the additive expenses of

its branch operations and personnel; a sizeable increase in the

provisions for impaired loans; expenses for repossessed properties

and, to a lesser degree, the opening of RomAsia's second retail

branch. Aggregated, these expenses negated a significant

comparative improvement in net interest income. Nevertheless,

earnings for the current nine months continue to be better than

earnings in the comparable nine months in 2009; achieving a 54%

increase," stated Peter A. Inverso, President and CEO.

"The merger of Sterling Bank was consummated on July 16th,

accordingly, its assets and liabilities and branch operating

components are included in our financial statements for the first

time this quarter. Notably, without considering the deposits and

assets acquired in the merger, our deposits and assets continued to

establish new records," added Inverso.

"Unprecedented low interest rates have fueled significant

residential loan refinancing activity, providing more attractive

investment options as opposed to other investment

opportunities. However, commercial loan demand remains

sluggish and rate reduction requests are also causing a tightening

of overall portfolio yield. By closely managing our deposit

products and rates, we have been able to improve our net interest

margin and our net interest income.

"Loan quality, principally in the commercial portfolio, remains

under pressure as there is little positive change in the economy

and collateral valuations continue to diminish. Non-performing

loans, exclusive of those assumed in the merger, increased during

the quarter to 2.58% of total assets at the end of the

quarter. Appropriate loan loss provisions are being

recorded. Additional loan risk mitigation steps have been

taken and management is squarely focused on the resolution of these

loans so as to minimize losses," commented Inverso.

"Despite the unsatisfactory level of non-performing loans, our

overall asset quality is very good and our capital ratios remain

strong," concluded Inverso.

Shares of the Company began trading on July 12, 2006, on the

NASDAQ Global Select Market under the symbol "ROMA."

Roma Financial Corporation (Nasdaq:ROMA) is the holding company

of Roma Bank, a community bank headquartered in Robbinsville, New

Jersey. Roma Bank has been serving families, businesses and

the communities of Central New Jersey for over 90 years with a

complete line of financial products and services, and today Roma

Bank operates branch locations in Mercer, Burlington, Camden, and

Ocean counties in New Jersey. Visit Roma online at

www.romabank.com.

Forward Looking Statements

The foregoing material contains forward-looking statements

concerning the financial condition, results of operations and

business of the Company. We caution that such statements are

subject to a number of uncertainties and actual results could

differ materially, and, therefore, readers should not place undue

reliance on any forward-looking statements. The Company does

not undertake, and specifically disclaims, any obligation to

publicly release the results of any revisions that may be made to

any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements.

CONTACT: Roma Financial Corporation

Peter A. Inverso, President & CEO

609 223-8310

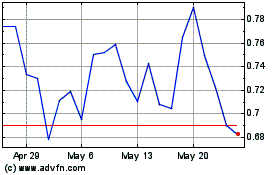

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

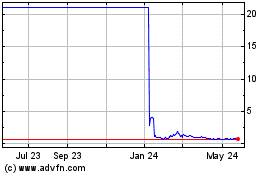

Roma Green Finance (NASDAQ:ROMA)

Historical Stock Chart

From Dec 2023 to Dec 2024