true0001811115falseX000-000000000018111152024-08-232024-08-230001811115rnlx:AmericanDepositarySharesMember2024-08-232024-08-230001811115dei:FormerAddressMember2024-08-232024-08-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 23, 2024

Renalytix plc

(Exact name of registrant as specified in its Charter)

|

|

|

England and Wales |

001-39387 |

Not Applicable |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

2 Leman Street London E1W 9US United Kingdom |

(Address of principal executive offices) (Zip Code) |

+44 20 3139 2910

(Registrant’s telephone number, including area code)

Finsgate

5-7 Cranwood Street

London EC1V 9EE

United Kingdom

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading

Symbol(s) |

Name of each exchange

on which registered |

Ordinary shares, nominal value £0.0025 per ordinary share |

n/a |

The Nasdaq Stock Market LLC* |

American Depositary Shares, each representing two ordinary shares, nominal value £0.0025 per ordinary share |

RNLX |

The Nasdaq Stock Market LLC |

* Not for trading, but only in connection with the listing of the American Depositary Shares on The Nasdaq Stock Market LLC.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

Renalytix plc (the “Company”) received written notification from the Nasdaq Office of General Counsel on August 23, 2024 that following the presentation of its operating and financing plan, the Company has been granted an extension until October 25, 2024 to regain compliance with the Minimum Bid Price Requirement and other applicable Nasdaq listing requirements as described below.

As previously disclosed, the Company received two written notices from the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that (i) because the closing bid price for the Company’s American Depositary Shares (“ADSs”), each representing two ordinary shares, nominal value £0.0025 per share, was below $1.00 per ADS for at least 30 consecutive business days, the Company did not meet the $1.00 per ADS minimum bid price requirement of Nasdaq Listing Rule 5450(a)(1) the (“Minimum Bid Price Requirement”) and (ii) it was not in compliance with the requirement to maintain a minimum market value of listed securities (the “MVLS”) of $50,000,000 for continued listing on The Nasdaq Global Market, as set forth in Nasdaq Listing Rule 5450(b)(2)(A) (the “MVLS Requirement”). Pursuant to Nasdaq Listing Rule 5810(c)(3)(A) and Nasdaq Listing Rule 5810(c)(3)(C), the Company originally had a compliance period of 180 calendar days, or until June 19, 2024 (the “First Compliance Period”), to regain compliance with the Minimum Bid Price Requirement and the MVLS Requirement. On June 21, 2024, the Company received written notice from Nasdaq notifying the Company that the Nasdaq staff determined that the Company did not regain compliance within the First Compliance Period.

As a result of the foregoing, the Company engaged in an appeal of the delisting determination before a Nasdaq Hearings Panel (the "Panel"), during which the Company presented a strategic plan to regain compliance with the applicable Nasdaq listing requirements. On August 23, 2024, the Company received a written notice (the “Notice”) from the Panel informing the Company that it now has until October 25, 2024 (the “Second Compliance Period”) to regain compliance with the Minimum Bid Price Requirement and other applicable Nasdaq listing requirements.

In addition, as set forth in the Notice, Nasdaq and the Company determined that the Company is better suited to have its securities traded on the Nasdaq Capital Market; accordingly, trading of the Company’s ADSs will be transferred to the Nasdaq Capital Market effective August 27, 2024. As a result of this transfer, and in lieu of satisfaction of the MVLS Requirement, during the Second Compliance Period, (i) the Company must demonstrate compliance with the $1.00 per ADS minimum bid price requirement of Nasdaq Listing Rule 5550(a)(2), (ii) the Company must achieve and demonstrate long-term compliance with the $2,500,000 minimum stockholders’ equity requirement set forth in Nasdaq Listing Rule 5550(b)(1), and (iii) the Company must provide the Panel with income projections for the next 12 months. There can be no assurance that the Company will achieve compliance during the Second Compliance Period. If the Company's ADSs are delisted, it could be more difficult to buy or sell the Company's ADSs or to obtain accurate quotations, and the price of the Company's ADSs could suffer a material decline. Delisting could also impair the Company's ability to raise capital.

Item 7.01 Regulation FD Disclosure

On August 27, 2024, the Company issued a press release announcing the written notification from Nasdaq, which is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

The information in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Forward-Looking Statements

Certain statements contained in this Current Report on Form 8-K are not historical facts and are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. This information includes, without limitation, statements concerning the Company's intention or ability to regain compliance with the applicable Nasdaq listing requirements, the Company's intention to appeal the Nasdaq staff's determination, the Company's expectation that a request for a Panel hearing will stay the suspension of the Company's securities pending the Panel's decision, the timing and nature of any hearing before the Panel, the outcome of the Panel's review of any Company appeal of the Nasdaq staff's determination, and any courses of action to regain compliance with the applicable Nasdaq listing requirements. Words such as "anticipates," "believes," "estimates," "expects," "intends," "plans," "seeks," and similar expressions are intended to identify forward-looking statements. The Company may not actually achieve the plans and objectives disclosed in the forward-looking statements, and you should not place undue reliance on the Company's forward-looking statements. Any forward-looking statements are based on management's current views and assumptions and involve risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. These and other risks are described more fully in the Company's filings with the Securities and Exchange Commission (SEC), including the "Risk Factors" section of its annual report on Form 10-K filed with the SEC on September 28, 2023, and any risks that may be contained in any subsequent filings that the Company makes with the SEC. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

renalytix plc |

|

|

|

Dated: August 27, 2024 |

By: |

/s/ James McCullough |

|

|

James McCullough

Chief Executive Officer |

Exhibit 99.1

Renalytix plc

(“Renalytix” or the “Company”)

Nasdaq Grants Listing Extension

Renalytix’s American Depositary Shares (“ADSs”) will Continue Trading on The Nasdaq Capital Market Effective at the Open of Trading on August 27, 2024

LONDON and NEW YORK, 27 August 2024 – Renalytix plc (NASDAQ: RNLX) (LSE: RENX), an artificial intelligence-enabled in vitro diagnostics company, focused on optimizing clinical management of kidney disease to drive improved patient outcomes and advance value-based care, provides the following update in respect of its Nasdaq listing status.

As previously announced on June 27, 2024, the Company disclosed that it had formally submitted an appeals hearing request to the Nasdaq Hearings Panel (the “Panel”), which request stayed the suspension of the Company’s securities pending the Panel’s decision regarding the continued listing status of Renalytix’s American Depositary Shares (“ADSs”) on The Nasdaq Global Market under the symbol “RNLX”. The appeals hearing on this matter was held on July 30, 2024. Following a review of the Company’s operating and financing plans, on August 23, 2024 the Panel responded with their decision to grant the Company additional time to regain compliance.

The Panel considered all information provided and granted the Company’s request for an exception through October 25, 2024, at which time the Company must evidence compliance with a closing bid price of $1 or more per share, file public disclosure describing transactions undertaken by Renalytix to achieve compliance, and provide the Panel with income projections for the next 12 months. The Panel also agreed that the Company is better suited for The Nasdaq Capital Market at this time. With that and the Panel’s decision to grant the exception, the Company’s ADSs will transfer to the Nasdaq Capital Market effective at the open of trading on August 27, 2024.

As a reminder, the Company confirms that it is in advanced discussions with key stakeholders of the business, who have indicated their support for management to achieve the Company’s goals of the refreshed business plan, with focused expenditure and investment alongside reduced operating costs, and a suitable capital structure and funding. The Company will continue to assess options to maximise value for its shareholders and further updates will be made as appropriate.

Having achieved significant milestones for the business, including FDA approval for KidneyIntelX, and a final Medicare coverage determination for the Company’s kidneyintelX.dkd testing with an established price of $950 per test, Renalytix has made positive progress operationally this year in addition to the financings completed earlier in 2024. The Company believes that the total addressable market opportunity for KidneyIntelX provides potential for significant growth in revenues over the next 3 years, subject to funding and continued development of commercial partnerships.

Subsequent to the financings that were successfully completed earlier in 2024, the Company has cash runway extending into calendar Q4 2024, with an unaudited cash position of $4.7m as at 30 June 2024.

For further information, please contact:

|

|

Renalytix plc |

www.renalytix.com |

James McCullough, CEO |

Via Walbrook PR |

|

|

Stifel (Nominated Adviser, Joint Broker and Sole Financial & Rule 3 Adviser) |

Tel: 020 7710 7600 |

Nicholas Moore / Nick Harland / Ben Good |

|

|

|

Walbrook PR Limited |

Tel: 020 7933 8780 or renalytix@walbrookpr.com |

Paul McManus / Alice Woodings |

Mob: 07980 541 893 / 07407 804 654 |

|

|

CapComm Partners |

|

Peter DeNardo |

Tel: 415-389-6400 or investors@renalytix.com |

About Renalytix

Renalytix (NASDAQ: RNLX) (LSE: RENX) is an in-vitro diagnostics and laboratory services company that is the global founder and leader in the new field of bioprognosis™ for kidney health. The leadership team, with a combined 200+ years of healthcare and in-vitro diagnostic experience, has designed its KidneyIntelX laboratory developed test to enable risk assessment for rapid progressive decline in kidney function in adult patients with T2D and early CKD (stages 1-3). We believe that by understanding how disease will progress, patients and providers can take action early to improve outcomes and reduce overall health system costs. For more information, visit www.renalytix.com.

Forward-Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Examples of these forward-looking statements include statements concerning: the commercial prospects of KidneyIntelX, including whether KidneyIntelX will be successfully adopted by physicians and distributed and marketed, the rate of testing with KidneyIntelX in health care systems, expectations and timing of announcement of real-world testing evidence, the potential for KidneyIntelX to be approved for additional indications, the Company’s expectations regarding the timing and outcome of regulatory and reimbursement decisions, the ability of KidneyIntelX to curtail costs of chronic and end-stage kidney disease, optimize care delivery and improve patient outcomes, the Company’s expectations and guidance related to partnerships, testing volumes and revenue for future periods, the Company’s expectations regarding the Company’s ability to obtain and maintain intellectual property protection for its diagnostic products and the Company’s ability to operate its business without infringing on the intellectual property rights of others, and the forecast of the Company’s cash runway and the implementation and potential for additional financing activities and cost-saving initiatives. Words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “seeks,” “indicates” and other similar expressions are intended to identify forward-looking statements. By their nature, forward‐looking statements are inherently predictive, speculative and involve risks, uncertainties and assumptions that could cause actual results, financial condition, performance, developments, or achievements to differ materially from those expressed or implied by the forward‐looking statements. Accordingly, the Company may not actually achieve the plans and objectives disclosed in the forward-looking statements, and you should not place undue reliance on the Company’s forward-looking statements. Any forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. These risks, uncertainties and assumptions relate to factors that are beyond the Company’s ability to control or estimate precisely, such as changes in taxation or fiscal policy, future market conditions, currency fluctuations, the behaviour of other market participants, the actions of governments or governmental regulators, or other risk factors, such as changes in the political, social and regulatory framework in which the Company operates or in economic or

technological trends or conditions, including inflation, recession and consumer confidence, on a global, regional or national basis. These risks include, among others: that KidneyIntelX is based on novel artificial intelligence technologies that are rapidly evolving and potential acceptance, utility and clinical practice remains uncertain; the Company has only recently commercially launched KidneyIntelX; and risks relating to the impact on the Company’s business of the COVID-19 pandemic or similar public health crises. These and other risks are described more fully in the Company’s filings with the Securities and Exchange Commission (SEC), including the “Risk Factors” section of its annual report on Form 10-K filed with the SEC on September 28, 2023, the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed with the SEC on November 14, 2023, the Company’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2024 filed with the SEC on February 14, 2024 and other filings the Company makes with the SEC from time to time. All information in this press release is as of the date of the release, and the Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. In particular, but without prejudice to the generality of the above, no representation or warranty is given, and no responsibility or liability is accepted, either as to the achievement or reasonableness of any future projections, forecasts, estimates or statements as to any prospects or future returns contained or referred to in this press release or in relation to the basis or assumptions underlying such projections, forecasts, estimates or statements. Except as required by applicable law or regulation, each of the Company and the Joint Brokers expressly disclaim any obligation or undertaking to release any updates or revisions to these forward-looking statements whether as a result of new information, future events or otherwise.

v3.24.2.u1

Document And Entity Information

|

Aug. 23, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 23, 2024

|

| Entity Registrant Name |

Renalytix plc

|

| Entity Central Index Key |

0001811115

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Securities Act File Number |

001-39387

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Address, Address Line One |

2 Leman Street

|

| Entity Address, City or Town |

London

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

E1W 9US

|

| City Area Code |

+44

|

| Local Phone Number |

20 3139 2910

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary shares, nominal value £0.0025 per ordinary share

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NASDAQ

|

| American Depositary Shares [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

American Depositary Shares, each representing two ordinary shares, nominal value £0.0025 per ordinary share

|

| Trading Symbol |

RNLX

|

| Security Exchange Name |

NASDAQ

|

| Former Address [Member] |

|

| Document Information [Line Items] |

|

| Entity Address, Address Line One |

Finsgate

|

| Entity Address, Address Line Two |

5-7 Cranwood Street

|

| Entity Address, City or Town |

London

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

EC1V 9EE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=rnlx_AmericanDepositarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

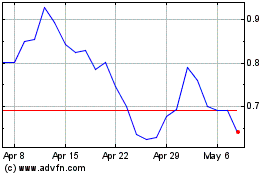

Renalytix (NASDAQ:RNLX)

Historical Stock Chart

From Sep 2024 to Oct 2024

Renalytix (NASDAQ:RNLX)

Historical Stock Chart

From Oct 2023 to Oct 2024