Amended Current Report Filing (8-k/a)

March 09 2022 - 8:47AM

Edgar (US Regulatory)

0001653653 0001653653 2022-03-03 2022-03-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2022

Red Rock Resorts, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-37754 |

|

47-5081182 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

1505 South Pavilion Center Drive, Las Vegas, Nevada 89135

(Address of principal executive offices)

Registrant’s telephone number, including area code: (702) 495-3000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A Common Stock, $0.01 par value |

|

RRR |

|

NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On March 1, 2022, Red Rock Resorts, Inc. and Station Casinos LLC (together, the “Company”) filed a Current Report on Form 8-K (the “Initial Form 8-K”) reporting that the Company had appointed Scott Kreeger to the position of President, effective as of February 28, 2022. At the time the Initial Form 8-K was filed, the Compensation Committee of the Board of Directors had not yet approved a compensation package for Mr. Kreeger. This Current Report on Form 8-K/A amends the Initial Form 8-K to include the compensation information required by Item 5.02(c)(3) and should be read in conjunction with the Initial Form 8-K.

Item 5.02. Departure of Directors or Certain Officers; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(c) In connection with Mr. Kreeger’s appointment to the position of President, the Company and Mr. Kreeger entered into an employment agreement, effective as of March 3, 2022 (the “Employment Agreement”). The Employment Agreement provides for a fixed five-year term, unless the agreement is otherwise terminated pursuant to its terms. The Employment Agreement provides that Mr. Kreeger will receive an annual base salary of not less than $1,100,000 and an annual bonus opportunity with a targeted amount equal to 125% of Mr. Kreeger’s annual base salary. Pursuant to the Employment Agreement, Mr. Kreeger received an initial equity award with a grant date value equal to $8,650,000 (the “Initial Award”), consisting of stock options and restricted shares. The stock options will vest on each of the first four anniversaries of March 3, 2022 and the restricted shares will vest on each of the third and fourth anniversaries of March 3, 2022, subject to Mr. Kreeger’s continued employment (other than in the event of certain involuntary termination events).

In the event of termination of employment for any reason, Mr. Kreeger will be entitled to accrued and unpaid obligations under the Employment Agreement, such as unpaid salary, any annual bonus awarded but not yet paid and reimbursement for previously-incurred expenses. Mr. Kreeger will not be entitled to any additional payments or benefits if his employment is terminated by the Company for “cause” or by Mr. Kreeger, except with “good reason” following a change in control of the Company. If Mr. Kreeger’s employment is terminated by the Company without “cause” or by Mr. Kreeger for “good reason” following a change in control of the Company, he will be entitled to receive additional payments consisting of a pro-rated annual bonus for the year of termination and a cash payment equal to the annual base salary in effect at the time of termination (paid in 12 equal monthly installments) and continuation of group health and long-term disability insurance coverage for 12 months (or a cash payment made in lieu of continued coverage). Receipt of the additional payments is subject to Mr. Kreeger’s execution of a release of claims against the Company. The Employment Agreement also contains certain restrictive covenant obligations, including indefinite confidentiality obligations and non-competition and non-solicitation restrictions with respect to a defined “restricted area” through the first anniversary of termination of employment.

The foregoing description of the Employment Agreement is qualified by reference to the full text of the Employment Agreement, a copy of which is attached to this Form 8-K/A as Exhibit 10.1 and is incorporated by reference in its entirety.

(e) On March 3, 2022, the Compensation Committee of the Board of Directors approved employment agreement extensions for Messrs. Fertitta, Cootey and Welch, such that the agreements were extended for a five-year term from March 3, 2022 (unless terminated earlier pursuant to the terms of the applicable employment agreement).

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 9, 2022

|

|

|

| Red Rock Resorts, Inc. |

|

|

| By: |

|

/s/ Jeffrey T. Welch |

|

|

Jeffrey T. Welch |

|

|

Executive Vice President and Chief Legal Officer |

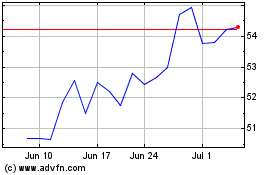

Red Rock Resorts (NASDAQ:RRR)

Historical Stock Chart

From Sep 2024 to Oct 2024

Red Rock Resorts (NASDAQ:RRR)

Historical Stock Chart

From Oct 2023 to Oct 2024