Well-capitalized into 2026 with ability to

fully fund lead asset EryDex expected through Phase 3 trial under

special protocol assessment (SPA) and to NDA submission

EryDex utilizes autologous intracellular drug

encapsulation (AIDE) technology designed for slow release of

steroids over several weeks without long-term toxicity typically

associated with chronic administration

Potential for rapid expansion of EryDex to

other rare and debilitating disease indications where chronic

steroid treatment is or could become the standard of care

Quince Therapeutics, Inc. (Nasdaq: QNCX), a biotechnology

company focused on acquiring, developing, and commercializing

innovative therapeutics that transform patients’ lives, today

announced that the company has entered into an agreement to acquire

EryDel SpA, a privately-held, late-stage biotech company, in a

stock-for-stock upfront exchange and potential downstream milestone

cash payments. EryDel has developed an autologous intracellular

drug encapsulation (AIDE) technology and a Phase 3 lead asset,

EryDex, targeting a rare fatal pediatric neurological disease,

Ataxia-Telangiectasia (A-T), which currently has no approved

treatments. Upon completion of the transaction, EryDel stockholders

will own approximately 16.7% of the combined company (subject to

downward adjustment) and will be entitled to up to $485 million

upon the achievement of development, regulatory, and commercial

milestone payments, with no royalties. The transaction, which has

been unanimously approved by the Boards of Directors of both

companies, is subject to certain regulatory approvals and other

closing conditions and is expected to close in the third quarter of

2023.

Dirk Thye, M.D., Quince’s Chief Executive Officer, said, “We are

highly enthusiastic and optimistic about our acquisition of this

unique drug/device combination technology platform and promising

late-stage clinical asset to drive Quince’s next stage of growth.

EryDel’s proprietary AIDE technology enables the autologous

intracellular encapsulation and delivery of dexamethasone in a

controlled, slow-release manner that has the potential to allow

chronic administration of steroids over many months or years with a

favorable safety profile. This represents a tremendous opportunity

to target not only A-T, but also the potential to expand into

several debilitating rare diseases where chronic steroid treatment

is the standard of care – or could be in the absence of long-term

steroid toxicity. Upon the close of the acquisition, we will

quickly focus our considerable development expertise and financial

resources toward advancing the lead asset EryDex for A-T through a

single global Phase 3 clinical trial under a SPA already in place

with the FDA to an anticipated NDA submission, assuming positive

study results.”

Luca Benatti, EryDel’s Chief Executive Officer, said, “EryDel’s

acquisition by Quince offers the opportunity to advance our

innovative, point-of-care autologous intracellular encapsulation

technology through development to commercialization and to fulfill

our mission to provide the first treatment for patients living with

the devastating disease of A-T. Quince’s effort will be supported

by the encouraging Phase 3 data generated from EryDel’s prior

international study of EryDex, which demonstrated a significant

delay in disease progression in A-T patients and further supported

more than 10 years of safety data. Quince is well-positioned to

advance EryDel’s differentiated AIDE technology and development of

our lead asset EryDex to deliver innovative treatments to patients

in need.”

Transformative Acquisition with Value-Creating Clinical

Milestones

Key highlights of the EryDel acquisition include:

Well-capitalized into 2026 with ability to fully fund lead asset

EryDex expected through Phase 3 clinical trial under SPA and to NDA

submission

- Strong balance sheet with approximately $87.6 million in cash,

cash equivalents, and short term investments (unaudited) as of June

30, 2023, to provide funding for operating requirements into

2026.

- Capital efficient development plan allows for funding of EryDex

through global Phase 3 clinical trial under SPA and, assuming

positive study results, to NDA submission, in addition to pursuing

European regulatory activities related to potential MAA

submission.

- Potential to out-license ex-U.S. regional territories to

provide runway through regulatory approval of EryDex.

Plan to enroll first patient in global Phase 3 trial of EryDex

in second quarter of 2024 with NDA submission targeted by end of

2025

- SPA in place with FDA for a single global Phase 3 clinical

trial of EryDex expected to be sufficient for NDA submission,

assuming positive study results.

- EryDex designated as orphan drug for treatment of A-T from both

the FDA and EMA.

- Phase 3 NEAT (Neurologic Effects of EryDex on

Subjects with A-T) clinical trial is a planned double blind,

randomized, placebo controlled, global efficacy study in

approximately 86 A-T patients aged six to nine years-old with up to

an additional 20 patients aged 10 years or older included for

potential broader label support.

- Primary endpoint, as agreed upon with the FDA, to measure

neurological function based on rescored modified International

Cooperative Ataxia Rating Scale (RmICARS) from baseline to month

six of treatment.

- Secondary endpoints to measure Clinical Global Impression

scores for severity (CGI-S) and change (CGI-C), as well as EuroQol

quality of life scoring.

- Plan to enroll first patient in Phase 3 NEAT clinical trial in

the second quarter of 2024.

- Commercial version of EryKit treatment consumables approved in

Europe and currently under partial clinical hold pending response

to FDA query.

- Target EryDex NDA submission with the FDA by the end of 2025,

assuming positive Phase 3 NEAT study results.

EryDex efficacy and safety profile demonstrated in prior Phase 3

clinical trial of A-T patients

- Pursuing European regulatory activities related to potential

MAA submission of EryDex based on prior Phase 3 clinical

trial.

- Completed largest global interventional study of A-T patients

(N=175) in Phase 3 ATTeST (Ataxia Telangiectasia

Trial with the EryDex SysTem) clinical

trial and open label extension (OLE) (N=104).

- Primary endpoint measured modified International Cooperative

Ataxia Rating Scale (mICARS) score from baseline to month six of

treatment.

- Secondary endpoints measured CGI-C, Quality of Life (QOL), and

Vineland Adaptive Behavior Scales (VABS) scores.

- EryDex high dose treatment arm demonstrated slowed neurological

deterioration in A-T disease progression as measured by mICARS in

intent to treat population (ITT) with statistically significant

effect in six to nine year-old subgroup across multiple

endpoints.

- 12-month safety analysis demonstrated EryDex well-tolerated

with no major adverse events typically associated with chronic

steroid administration.

- Sustained therapeutic effect and favorable safety profile

maintained for more than three additional years in high dose

treatment arm in OLE study, in addition to no steroid related

toxicity observed in patients receiving more than 10 years of

treatment.

- Conformité Européene (CE) mark already obtained in Europe for

drug/device combination and commercial version of EryKit treatment

consumables.

$1+ billion estimated peak global sales opportunity for A-T

indication alone with rapid expansion potential for EryDex to other

rare and debilitating diseases

- A-T population estimated to be approximately 10,000 patients in

the U.S., U.K., and EU4 countries with no currently approved

therapies and $1+ billion estimated peak sales opportunity

globally.

- EryDex for A-T indication holds potential to be first-to-market

with attractive pricing comparables and no known late-stage

competition.

- EryDex designated as orphan drug for A-T treatment from the FDA

and EMA.

- Potential for rapid expansion of EryDex to other rare and

debilitating disease indications where chronic steroid

administration is the standard of care – or could be in the absence

of long-term steroid toxicity.

- AIDE platform capable of expansion to other drugs or biologics,

including enzyme replacement therapy.

- Multi-faceted technology protections create high barriers to

entry with intellectual property exclusivity until at least 2034

globally and at least 2035 in the U.S.

Transaction Details

Under the terms of the acquisition transaction, EryDel will

operate as a wholly owned subsidiary of Quince Therapeutics with

plans to retain EryDel’s corporate and manufacturing presence in

Italy. The integrated company will be led by Dirk Thye, M.D.,

Quince’s Chief Executive Officer and member of the Quince Board of

Directors. In addition, David Lamond remains Chairperson of

Quince’s Board of Directors, which will be expanded by one member

with the addition of EryDel representative Luca Benatti following

the close of the transaction.

Upon completion of the stock-for-stock upfront exchange, EryDel

stockholders will own a maximum of approximately 16.7%, or

7,250,352 shares, of the combined company (subject to downward

adjustment). The transaction agreement includes up to $485 million

in potential total downstream cash payments, including up to $5

million in development milestones, $25 million at NDA acceptance,

$60 million in approval milestones, and $395 million in market and

sales milestones, with no royalties paid to EryDel stockholders.

The transaction will include the assumption of EryDel’s $13 million

(€10 million in principal) European Investment Bank (EIB) loan with

scheduled payments beginning in the second half of 2026.

The transaction, which has been unanimously approved by the

Boards of Directors of both companies, is subject to certain

regulatory approvals and other closing conditions and is expected

to close in the third quarter of 2023.

Financial Statements

Quince has not completed preparation of its financial statements

for the second quarter of 2023. The cash, cash equivalents, and

short term investments presented as of June 30, 2023, are

preliminary and unaudited and are, thus, inherently uncertain and

subject to change. The company is in the process of completing its

customary close and review procedures for the second quarter of

2023, and there can be no assurance that final results for this

period will not differ from these preliminary, unaudited amounts.

The company’s independent registered public accounting firm has not

audited, reviewed, compiled, or performed any procedures with

respect to such preliminary data for the second quarter ended June

30, 2023.

Advisors

MTS Health Partners, L.P. is serving as financial advisor and

Cooley LLP is serving as legal counsel to Quince. Perella Weinberg

Partners is serving as financial advisor and Goodwin Procter LLP

and Clifford Chance LLP are serving as legal counsel to EryDel.

Investor Presentation Available

To learn more about the transaction, investors are encouraged to

access an investor presentation provided by Quince management

detailing the EryDel acquisition, which is currently available for

viewing on the company’s Investor Relations website. Please visit

the Events page under the News & Events heading of Quince’s

Investor Relations website at ir.quincetx.com to access the

presentation.

About Quince Therapeutics

Quince Therapeutics is a biotechnology company focused on

acquiring, developing, and commercializing innovative therapeutics

that transform the lives of patients suffering from debilitating

and rare diseases. For more information, visit www.quincetx.com and

follow Quince Therapeutics on LinkedIn and @Quince_Tx on

Twitter.

About EryDel SpA

EryDel SpA is a global late-stage biotech company aimed at

developing and commercializing therapies for the treatment of rare

diseases delivered by its proprietary red blood cell technology.

Its most advanced product, EryDex, is under late-stage development

for the treatment of Ataxia Telangiectasia (A-T), a rare autosomal

recessive neurological disorder for which no established therapy is

currently available. EryDex is an automated outpatient bedside

technology to ex-vivo encapsulate dexamethasone sodium phosphate

(DSP; a pro-drug) into patient’s red blood cells, which are then

re-infused, allowing for the circulation of controlled, slow

release, low doses of dexamethasone (active drug) over the

subsequent several weeks following treatment. EryDex has received

orphan drug designation for the treatment of A-T both from the U.S.

Food and Drug Administration (FDA) and the European Medicines

Agency (EMA). An international multicenter, Phase 3 clinical trial,

ATTeST, and its open label extension have been successfully

completed. In addition to EryDex, EryDel’s technology platform is

capable of expansion to other drugs or biologics, including enzyme

replacement therapy, and has the potential to support a wide range

of therapeutic opportunities.

Forward-looking Statements

Statements in this news release contain “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 as contained in Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended, which are subject to the “safe harbor”

created by those sections. All statements, other than statements of

historical facts, may be forward-looking statements.

Forward-looking statements contained in this news release may be

identified by the use of words such as “believe,” “may,” “should,”

“expect,” “anticipate,” “plan,” “believe,” “estimated,”

“potential,” “intend,” “will,” “can,” “seek,” or other similar

words. Examples of forward-looking statements include, among

others, statements relating to Quince’s acquisition of EryDel; the

timing of the closing of the transaction; the expected benefits of

the transaction, including the continued current and future

clinical development and potential expansion of EryDel assets,

related platform, and related timing and costs; the strategic

development path for EryDex; planned FDA and EMA submissions and

clinical trials and timeline, prospects, and milestone

expectations; the timing and success of the clinical trials and

related data, including plans and the ability to initiate, fund,

conduct and/or complete current and additional studies; the

potential therapeutic benefits, safety, and efficacy of EryDex;

statements about its ability to obtain, and the timing relating to,

further development of EryDex, regulatory submissions and

interactions with regulators; therapeutic and commercial potential;

the integration of EryDel’s business, operations, and employees

into Quince; Quince’s future development plans and related timing;

its cash position and projected cash runway; the company’s focus,

objectives, plans, and strategies; and the ability to execute on

any strategic transactions. Forward-looking statements are based on

Quince’s current expectations and are subject to inherent

uncertainties, risks, and assumptions that are difficult to predict

and could cause actual results to differ materially from what the

company expects. Further, certain forward-looking statements are

based on assumptions as to future events that may not prove to be

accurate. Factors that could cause actual results to differ

include, but are not limited to, the risks and uncertainties

described in the section titled “Risk Factors” in the company’s

Quarterly Report on Form 10-Q filed with the Securities and

Exchange Commission (SEC) on May 15, 2023, and other reports as

filed with the SEC. Forward-looking statements contained in this

news release are made as of this date, and Quince undertakes no

duty to update such information except as required under applicable

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230724507851/en/

Quince Therapeutics: Stacy Roughan Quince Therapeutics,

Inc. Vice President, Corporate Communications & Investor

Relations ir@quincetx.com

Media: Dan Gagnier & Riyaz Lalani Gagnier

Communications quinceGFC@gagnierfc.com

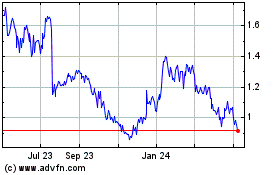

Quince Therapeutics (NASDAQ:QNCX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Quince Therapeutics (NASDAQ:QNCX)

Historical Stock Chart

From Dec 2023 to Dec 2024