QuantaSing Group Limited (NASDAQ: QSG) (“QuantaSing” or the

“Company”), a leading lifestyle solution provider empowering adults

to live better and longer, today announced its unaudited financial

results for the first quarter of the fiscal year ending June 30,

2025 (the “first quarter of FY 2025”, which refers to the quarter

from July 1, 2024 to September 30, 2024).

Highlights for the First Quarter of FY

2025

- Revenues for the

first quarter of FY 2025 were RMB810.4 million (US$115.5 million),

representing a decrease of 19.0% from the fourth quarter of the

fiscal year ended June 30, 2024 (the “fourth quarter of FY 2024”)

and a decrease of 6.8% from the first quarter of the fiscal year

ended June 30, 2024 (the “first quarter of FY 2024”).

- Gross billings of

individual online learning services1 for

the first quarter of FY 2025 were RMB713.7 million (US$101.7

million), representing a decrease of 7.8% from the fourth quarter

of FY 2024 and a decrease of 6.3% from the first quarter of FY

2024.

- Net income for the

first quarter of FY 2025 was RMB80.7 million (US$11.5 million),

compared with RMB196.6 million in the fourth quarter of FY 2024,

and RMB66.7 million in the first quarter of FY 2024.

- Adjusted net

income2 for the first quarter of FY 2025

was RMB88.0 million (US$12.5 million), compared with RMB193.6

million in the fourth quarter of FY 2024, and RMB94.0 million in

the first quarter of FY 2024.

- Total registered

users increased by 30.2% to approximately 134.6 million as

of September 30, 2024, from 103.3 million as of September 30,

2023.

- Paying learners

increased by 16.8% year over year to approximately 0.4 million in

the first quarter of FY 2025.

Mr. Peng Li, Chairman and Chief Executive

Officer of QuantaSing, commented, “Our first quarter performance

underscores our strategic pivot towards the burgeoning silver

economy in China. This transition is a calculated move designed to

align our offerings with the evolving needs of our aging

population. While we anticipate some short-term revenue

fluctuations as we implement this strategy, we remain committed to

maintaining robust profitability and positive cash flow. Our

partnerships with community centers and the introduction of

integrated products, such as our 'Food as Medicine' line, are

pivotal in creating a holistic ecosystem that addresses the

lifestyle and wellness demands of older adults. As we advance

through fiscal year 2025, our focus will be on establishing

sustainable competitive advantages that contribute to long-term

value for our shareholders.”

Mr. Dong Xie, Chief Financial Officer of

QuantaSing, added, “The financial results for the first quarter

reflect our commitment to profitability during this strategic

transition. We have seen improvements in operational efficiency as

we shift from a traffic-driven to a product-driven business model,

while also scaling back investments in non-core areas. Our

disciplined cost management has resulted in a healthy net margin of

10.0%, and our cash position has strengthened to RMB1,193.7 million

as of September 30, 2024. This solid financial foundation provides

us with the flexibility to pursue growth opportunities within the

silver economy while ensuring we maintain profitability.”

Financial Results for the First Quarter

of FY 2025

Revenues

Revenues were RMB810.4 million (US$115.5

million) in the first quarter of FY 2025, compared to RMB869.1 in

the first quarter of FY 2024. The change was primarily due to a

shift in revenue streams as the Company strategically moved towards

the silver economy.

-

Revenues from individual online learning services decreased by 6.2%

year over year to RMB709.0 million (US$101.0million) in the first

quarter of FY 2025, from RMB755.9 million in the first quarter of

FY 2024. This decrease was primarily due to the decline of RMB82.8

million (US$11.8 million) in revenues from financial literacy

courses and the decline of RMB35.6 million (US$5.1 million) in

revenues from recreation and leisure courses3, partially offset by

the increase of RMB71.5 million (US$10.2 million) in revenues from

skills upgrading courses3.

-

Revenues from enterprise services were RMB47.8 million (US$6.8

million) in the first quarter of FY 2025, compared to RMB68.4

million in the first quarter of FY 2024, representing a year-over

year change of 30.2%, primarily due to a change in revenue streams

from transactions involving a related party and certain other third

parties.

-

Revenues from consumer business4 increased to RMB49.5 million

(US$7.1 million) in the first quarter of FY 2025, representing a

10.4% increase from RMB44.8 million in the first quarter of FY

2024, as a result of the Company’s expansion into wellness

products.

-

Revenues from others4 were RMB4.1 million (US$0.6 million) in the

first quarter of FY 2025, compared to nil in the first quarter of

FY 2024, primarily due to revenue generated from the Company’s

online language education services for children.

Cost of revenues

Cost of revenues was RMB134.4 million (US$19.2

million) in the first quarter of FY 2025, compared to RMB118.2

million in the first quarter of FY 2024, representing a change of

13.8%. This increase was primarily due to increased labor

outsourcing costs of RMB13.8 million (US$2.0 million) and higher

procurement costs of RMB4.3 million (US$0.6 million).

Sales and marketing

expenses

Sales and marketing expenses were RMB515.0

million (US$73.4 million) in the first quarter of FY2025, compared

to RMB620.2 million in the first quarter of FY 2024, representing a

decrease of 17.0%. The decrease was mainly due to declines in

marketing and promotion expenses of RMB81.6 million (US$11.6

million), labor outsourcing costs of RMB11.2 million (US$1.6

million), and staff costs of RMB9.5 million (US$1.4 million), which

includes a decrease in share-based compensation expenses of RMB4.5

million (US$0.6 million).

Research and development

expenses

Research and development expenses were RMB28.1

million (US$4.0 million) in the first quarter of FY 2025, compared

to RMB43.8 million in the first quarter of FY 2024, representing a

decrease of 35.9%. The decrease was primarily due to a decline in

staff costs of RMB13.6 million (US$1.9 million), which includes a

decrease in share-based compensation expenses of RMB3.7 million

(US$0.5 million).

General and administrative

expenses

General and administrative expenses were RMB30.6

million (US$4.4 million) in the first quarter of FY 2025, compared

to RMB42.8 million in the first quarter of FY 2024, representing a

decrease of 28.4%. The decrease was primarily due to a decline in

share-based compensation expenses of RMB10.4 million (US$1.5

million).

Net income and adjusted net

income

Net income was RMB80.7 million (US$11.5 million)

in the first quarter of FY 2025, compared with RMB66.7 million in

the first quarter of FY 2024. Adjusted net income was RMB88.0

million (US$12.5 million) in the first quarter of FY 2025, compared

with RMB94.0 million in the first quarter of FY 2024.

Earnings per share and adjusted earnings

per share5

Basic and diluted net income per share were

RMB0.52 (US$0.07) and RMB0.50 (US$0.07), respectively, in the first

quarter of FY 2025, compared with basic and diluted net income per

share of RMB0.39 and RMB0.38, respectively, in the first quarter of

FY 2024. Basic and diluted adjusted net income per share were

RMB0.56 (US$0.08) and RMB0.55 (US$0.08), respectively, in the first

quarter of FY 2025, compared with basic and diluted adjusted net

income per share of RMB0.56 and RMB0.54, respectively, in the first

quarter of FY 2024.

Balance Sheet

As of September 30, 2024, the Company had cash

and cash equivalents, restricted cash and short-term investments of

RMB1,193.7 million (US$170.1 million), compared with RMB1,026.3

million as of June 30, 2024.

Recent Developments

Payment of a special cash dividend

In October 2024, the Company’s board of

directors declared a special cash dividend in the amount of

US$0.067 per ordinary share, or US$0.201 per American depositary

share (“ADS”). The cash dividend was paid in November 2024 to

shareholders of record at the close of business on October 30,

2024. The aggregate amount of cash dividends paid was US$10.9

million.

Share repurchase program

On June 11, 2024, the Company announced that its

board of directors had approved a share repurchase program of up to

US$20.0 million of the Company’s Class A ordinary shares in the

form of ADSs for a 12-month period beginning on June 11, 2024 (the

“2024 Share Repurchase Program”). As of September 30, 2024, a total

of 1.7 million ADSs had been repurchased for an aggregate

consideration of US$3.5 million under the 2024 Share Repurchase

Program.

Conference Call Information

The Company's management team will hold an

earnings conference call at 07:00 A.M. Eastern Time on Wednesday,

November 27, 2024 (08:00 P.M. Beijing Time on the same day) to

discuss the financial results. Listeners may access the call by

dialing the following numbers:

|

International: |

1-412-902-4272 |

| United States Toll Free: |

1-888-346-8982 |

| Mainland China Toll Free: |

4001-201203 |

| Hong Kong Toll Free: |

800-905945 |

| Conference ID: |

QuantaSing Group Limited |

| |

|

The replay will be accessible through December

4, 2024 by dialing the following numbers:

|

International: |

1-412-317-0088 |

| United States Toll Free: |

1-877-344-7529 |

| Replay Access Code: |

9195244 |

| |

|

A live and archived webcast of the conference

call will be available at the Company's investor relations website

at https://ir.quantasing.com.

Non-GAAP Financial Measures

To supplement the Company’s consolidated

financial statements, which are prepared and presented in

accordance with U.S. GAAP, the Company uses gross billings of

individual online learning services, adjusted net income and basic

and diluted adjusted net income per share as its non-GAAP financial

measures. Gross billings of individual online learning services for

a specific period represents revenues of the Company’s individual

online learning services net of the changes in deferred revenues in

such period, further adjusted by value-added tax in such period.

Adjusted net income represents net income excluding share-based

compensation expense. Basic and diluted adjusted net income per

share represents adjusted net income attributable to ordinary

shareholders of QuantaSing Group Limited divided by weighted

average number of ordinary shares outstanding during the periods

used in computing adjusted net income per share, basic and diluted.

The Company believes that the non-GAAP financial measures provide

useful information about the Company's results of operations,

enhance the overall understanding of the Company's past performance

and future prospects and allow for greater visibility with respect

to key metrics used by the Company's management in its financial

and operational decision-making.

The non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP.

The non-GAAP financial measures have limitations as analytical

tools, and when assessing the Company's operating performance,

investors should not consider them in isolation, or as a substitute

for revenue, net income, net income per share, basic and diluted or

other consolidated statements of operations data prepared in

accordance with U.S. GAAP. The Company's definition of non-GAAP

financial measures may differ from those of industry peers and may

not be comparable with their non-GAAP financial measures.

The Company mitigates these limitations by

reconciling the non-GAAP financial measures to the most comparable

U.S. GAAP performance measures, all of which should be considered

when evaluating the Company's performance. For more information on

these non-GAAP financial measures, please see the table captioned

“QuantaSing Group Limited Unaudited Reconciliation of GAAP and

Non-GAAP Results” near the end of this release.

Exchange Rate Information

This announcement contains translations of

certain Renminbi (“RMB”) amounts into U.S. dollars (“US$”) at

specified rates solely for the convenience of the reader. Unless

otherwise stated, all translations from Renminbi to U.S. dollars

were made at the rate of RMB7.0176 to US$1.00, the exchange rate on

September 30, 2024, set forth in the H.10 statistical release of

the Federal Reserve Board. The Company makes no representation that

the Renminbi or U.S. dollars amounts referred to could be converted

into U.S. dollars or Renminbi, as the case may be, at any

particular rate or at all.

Safe Harbor Statements

This announcement contains forward-looking

statements within the meaning of Section 27A of Securities Act of

1933, as amended and Section 21E of the Securities Exchange Act of

1934, as amended and the Private Securities Litigation Reform Act

of 1955. All statements other than statements of historical or

current fact included in this press release are forward-looking

statements, including but not limited to statements regarding

QuantaSing’s financial outlook, beliefs and expectations. These

statements can be identified by terminology such as “will,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates,” “potential,” “continue,” “ongoing,” “targets,”

“guidance” and similar statements. Among other things, the

Financial Outlook in this announcement contains forward-looking

statements. The Company may also make written or oral

forward-looking statements in its periodic reports to the U.S.

Securities and Exchange Commission (the “SEC”), in its annual

report to shareholders, in press releases, and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to the

following: the Company’s growth strategies; its future business

development, results of operations and financial condition; its

ability to attract and retain new users and learners and to

increase the spending and revenues generated from users and

learners; its ability to maintain and enhance the recognition and

reputation of its brand; its expectations regarding demand for and

market acceptance of its services and products; the expected

growth, trends and competition in the markets that the Company

operates in; changes in its revenues and certain cost or expense

items; PRC governmental policies and regulations relating to the

Company’s business and industry, general economic and political

conditions in China and globally, and assumptions underlying or

related to any of the foregoing. Further information regarding

these and other risks, uncertainties, or factors is included in the

Company’s filings with the SEC, including, without limitation, the

final prospectus related to the IPO filed with the SEC dated

January 24, 2023. You are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

this press release. All forward-looking statements are qualified in

their entirety by this cautionary statement, and the Company

undertakes no obligation to revise or update any forward-looking

statements to reflect events or circumstances after the date

hereof.

About QuantaSing Group Limited

QuantaSing is a leading lifestyle solution

provider empowering adults to live better and longer. Leveraging

its profound understanding of adult users and robust

infrastructure, QuantaSing offers easy-to-understand, affordable,

and accessible online courses to adult learners as well as consumer

products and service in selected areas to address the senior users’

aspirations for wellness.

For more information, please visit:

https://ir.quantasing.com.

Contact

Investor Relations Leah Guo QuantaSing Group Limited Email:

ir@quantasing.com Tel: +86 (10) 6493-7857

Robin Yang, Partner ICR, LLC Email:

QuantaSing.IR@icrinc.com Phone: +1 (212) 537-0429

_________________________________

1 Gross billings of individual online learning

services is a non-GAAP financial measure. For a reconciliation of

revenues of individual online learning services to gross billings

of individual online learning services, see the “Non-GAAP Financial

Measures” section and the table captioned “QuantaSing Group Limited

Unaudited Reconciliation of GAAP and Non-GAAP Results” below.2

Adjusted net income is a non-GAAP financial measure. For a

reconciliation of net income to adjusted net income, see the

“Non-GAAP Financial Measures” section and the table captioned

“QuantaSing Group Limited Unaudited Reconciliation of GAAP and

Non-GAAP Results” below.3 The Company has adopted a new

presentation of its revenues since the second quarter of FY 2024,

which split other personal interest courses into skills upgrading

courses and recreation and leisure courses, to better align with

its business strategies and provide useful and updated information

to investors. Skills upgrading courses mainly include short-video

production courses and memory training courses. Recreation and

leisure courses mainly include personal well-being courses,

electronic keyboard courses and standing meditation courses. The

historical revenues presentation has been conformed to the current

presentation. 4 Effective from the fourth quarter of FY 2024, the

Company has introduced “Revenues from Consumer Business” as a

separate line item. This revenue was previously included in

“Revenues from Others”. The historical revenues presentation has

been conformed to the current presentation.5 Basic and diluted

adjusted net income per share are non-GAAP financial measures. For

a reconciliation of basic and diluted net income per share to basic

and diluted adjusted net income per share, see the “Non-GAAP

Financial Measures” section and the table captioned “QuantaSing

Group Limited Unaudited Reconciliation of GAAP and Non-GAAP

Results” below.

|

|

|

QUANTASING GROUP LIMITEDUNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS(Amounts in

thousands, except for share and per share data) |

| |

| |

As of |

|

|

June 30,2024 |

|

September 30,2024 |

|

September 30,2024 |

| |

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

| ASSETS |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

779,931 |

|

1,027,165 |

|

146,370 |

|

Restricted cash |

160 |

|

250 |

|

36 |

|

Short-term investments |

246,195 |

|

166,299 |

|

23,697 |

|

Accounts receivable, net |

16,676 |

|

17,192 |

|

2,450 |

|

Amounts due from related parties |

4,488 |

|

- |

|

- |

|

Inventory, net |

6,345 |

|

7,584 |

|

1,081 |

|

Prepayments and other current assets |

275,549 |

|

209,870 |

|

29,906 |

| Total current

assets |

1,329,344 |

|

1,428,360 |

|

203,540 |

| |

|

|

|

|

|

| Non-current

assets: |

|

|

|

|

|

|

Property and equipment, net |

6,569 |

|

5,794 |

|

826 |

|

Long-term investments |

9,010 |

|

10,623 |

|

1,514 |

|

Intangible assets, net |

- |

|

59 |

|

8 |

|

Operating lease right-of-use assets |

58,889 |

|

47,816 |

|

6,814 |

|

Deferred tax assets |

847 |

|

2,193 |

|

313 |

|

Other non-current assets |

21,360 |

|

22,009 |

|

3,136 |

| Total non-current

assets |

96,675 |

|

88,494 |

|

12,611 |

| TOTAL

ASSETS |

1,426,019 |

|

1,516,854 |

|

216,151 |

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Accounts payables |

62,066 |

|

61,051 |

|

8,700 |

|

Accrued expenses and other current liabilities |

190,508 |

|

201,159 |

|

28,665 |

|

Income tax payable |

20,399 |

|

45,382 |

|

6,467 |

|

Contract liabilities, current portion |

385,227 |

|

347,744 |

|

49,553 |

|

Advance from customers |

162,257 |

|

163,004 |

|

23,228 |

|

Operating lease liabilities, current portion |

49,099 |

|

56,156 |

|

8,002 |

| Total current

liabilities |

869,556 |

|

874,496 |

|

124,615 |

|

|

|

|

|

|

|

| Non-current

liabilities: |

|

|

|

|

|

|

Contract liabilities, non-current portion |

11,365 |

|

20,221 |

|

2,881 |

|

Operating lease liabilities, non-current portion |

16,989 |

|

2,887 |

|

411 |

|

Deferred tax liabilities |

11,625 |

|

16,528 |

|

2,355 |

| Total non-current

liabilities |

39,979 |

|

39,636 |

|

5,647 |

| TOTAL

LIABILITIES |

909,535 |

|

914,132 |

|

130,262 |

|

QUANTASING GROUP LIMITEDUNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS -

continued(Amounts in thousands, except for share

and per share data) |

| |

| |

As of |

| |

June 30,2024 |

|

September 30,2024 |

|

September 30,2024 |

| |

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

| SHAREHOLDERS’

EQUITY |

|

|

|

|

|

|

Class A ordinary shares |

81 |

|

|

81 |

|

|

12 |

|

|

Class B ordinary shares |

34 |

|

|

34 |

|

|

5 |

|

|

Treasury stock |

(109,257 |

) |

|

(80,430 |

) |

|

(11,461 |

) |

|

Additional paid-in capital |

1,192,474 |

|

|

1,172,743 |

|

|

167,115 |

|

|

Accumulated other comprehensive income |

17,313 |

|

|

13,767 |

|

|

1,962 |

|

|

Accumulative deficit |

(584,161 |

) |

|

(503,473 |

) |

|

(71,744 |

) |

| TOTAL SHAREHOLDERS’

EQUITY |

516,484 |

|

|

602,722 |

|

|

85,889 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

1,426,019 |

|

|

1,516,854 |

|

|

216,151 |

|

|

QUANTASING GROUP LIMITEDUNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME(Amounts in thousands, except for share and

per share data) |

|

|

|

|

For the Three Months Ended September

30, |

|

|

2023 |

|

2024 |

|

2024 |

|

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

Revenues |

869,136 |

|

|

810,404 |

|

|

115,482 |

|

| Cost of revenues |

(118,192 |

) |

|

(134,448 |

) |

|

(19,159 |

) |

|

|

|

|

|

|

|

|

Gross Profit |

750,944 |

|

|

675,956 |

|

|

96,323 |

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

Sales and marketing expenses |

(620,152 |

) |

|

(515,009 |

) |

|

(73,388 |

) |

|

Research and development expenses |

(43,800 |

) |

|

(28,080 |

) |

|

(4,001 |

) |

|

General and administrative expenses |

(42,762 |

) |

|

(30,621 |

) |

|

(4,363 |

) |

|

Total operating expenses |

(706,714 |

) |

|

(573,710 |

) |

|

(81,752 |

) |

|

|

|

|

|

|

|

| Income from

operations |

44,230 |

|

|

102,246 |

|

|

14,571 |

|

| |

|

|

|

|

|

| Other

income: |

|

|

|

|

|

|

Interest income |

3,447 |

|

|

1,939 |

|

|

276 |

|

|

Others, net |

12,257 |

|

|

9,735 |

|

|

1,387 |

|

| |

|

|

|

|

|

|

Income before income tax |

59,934 |

|

|

113,920 |

|

|

16,234 |

|

|

Income tax expense |

6,746 |

|

|

(33,232 |

) |

|

(4,736 |

) |

|

|

|

|

|

|

|

| Net

income |

66,680 |

|

|

80,688 |

|

|

11,498 |

|

| Net income

attributable to ordinary shareholders |

66,680 |

|

|

80,688 |

|

|

11,498 |

|

| |

|

|

|

|

|

|

Other comprehensive income |

|

|

|

|

|

|

Foreign currency translation adjustments, net of nil tax |

(2,005 |

) |

|

(3,546 |

) |

|

(505 |

) |

| Total other

comprehensive income |

(2,005 |

) |

|

(3,546 |

) |

|

(505 |

) |

|

|

|

|

|

|

|

| Total comprehensive

income |

64,675 |

|

|

77,142 |

|

|

10,993 |

|

|

|

|

|

|

|

|

| Net income per

ordinary share |

|

|

|

|

|

|

- Basic |

0.39 |

|

|

0.52 |

|

|

0.07 |

|

|

- Diluted |

0.38 |

|

|

0.50 |

|

|

0.07 |

|

| Weighted average

number of ordinary shares used in computing net income per

share |

|

|

|

|

|

|

- Basic |

169,056,984 |

|

|

156,445,053 |

|

|

156,445,053 |

|

|

- Diluted |

175,003,606 |

|

|

161,309,229 |

|

|

161,309,229 |

|

| Share-based

compensation expenses included in |

|

|

|

|

|

|

Cost of revenues |

(3,778 |

) |

|

(2,303 |

) |

|

(328 |

) |

|

Sales and marketing expenses |

(4,489 |

) |

|

(39 |

) |

|

(6 |

) |

|

Research and development expenses |

(5,610 |

) |

|

(1,898 |

) |

|

(270 |

) |

|

General and administrative expenses |

(13,409 |

) |

|

(3,032 |

) |

|

(432 |

) |

|

QUANTASING GROUP LIMITEDUNAUDITED

RECONCILIATION OF GAAP AND NON-GAAP

RESULTS(Amounts in thousands, except for share and

per share data) |

|

|

| The following

table below sets forth a reconciliation of revenues to gross

billings for the periods indicated: |

|

|

|

|

For the Three Months Ended September

30, |

|

|

2023 |

|

2024 |

|

2024 |

|

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

Revenues of individual online learning

services: |

755,910 |

|

|

709,012 |

|

|

101,033 |

|

| Add: value-added tax |

47,579 |

|

|

40,691 |

|

|

5,798 |

|

| Add: ending deferred revenues

(1) |

619,954 |

|

|

529,054 |

|

|

75,390 |

|

| Less: beginning deferred

revenues (1) |

(661,360 |

) |

|

(565,030 |

) |

|

(80,516 |

) |

| |

|

|

|

|

|

| Gross billings of

individual online learning services |

762,083 |

|

|

713,727 |

|

|

101,705 |

|

| |

| (1) Deferred

revenues include contract liabilities, advance from customers, and

refund liability of individual online learning services included in

“accrued expenses and other current liabilities.” |

|

QUANTASING GROUP LIMITEDUNAUDITED

RECONCILIATION OF GAAP AND NON-GAAP RESULTS -

continued(Amounts in thousands, except for share

and per share data) |

|

|

| The following

table below sets forth a reconciliation of net income to adjusted

net income and basic and diluted net income per share to basic and

diluted adjusted net income per share for the periods

indicated: |

|

|

|

|

For the Three Months Ended September

30, |

|

|

2023 |

|

2024 |

|

2024 |

|

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

| Net

income |

66,680 |

|

80,688 |

|

11,498 |

|

Add: Share-based compensation expenses |

27,286 |

|

7,272 |

|

1,036 |

| Adjusted net

income |

93,966 |

|

87,960 |

|

12,534 |

| |

|

|

|

|

|

| Net income

attributable to ordinary shareholders |

66,680 |

|

80,688 |

|

11,498 |

|

Add: Share-based compensation expenses |

27,286 |

|

7,272 |

|

1,036 |

| Adjusted net income

attributable to ordinary shareholders |

93,966 |

|

87,960 |

|

12,534 |

| |

|

|

|

|

|

| Weighted average

number of ordinary shares used in computing net income per

share |

|

|

|

|

|

|

- Basic |

169,056,984 |

|

156,445,053 |

|

156,445,053 |

|

- Diluted |

175,003,606 |

|

161,309,229 |

|

161,309,229 |

| Weighted average

number of ordinary shares used in computing adjusted net

income per share |

|

|

|

|

|

|

- Basic |

169,056,984 |

|

156,445,053 |

|

156,445,053 |

|

- Diluted |

175,003,606 |

|

161,309,229 |

|

161,309,229 |

| |

|

|

|

|

|

| Net income per

ordinary share |

|

|

|

|

|

|

- Basic |

0.39 |

|

0.52 |

|

0.07 |

|

- Diluted |

0.38 |

|

0.50 |

|

0.07 |

| Non-GAAP adjustments

to net income per ordinary share |

|

|

|

|

|

|

- Basic |

0.17 |

|

0.04 |

|

0.01 |

|

- Diluted |

0.16 |

|

0.05 |

|

0.01 |

| Adjusted net

income per ordinary share |

|

|

|

|

|

|

- Basic |

0.56 |

|

0.56 |

|

0.08 |

|

- Diluted |

0.54 |

|

0.55 |

|

0.08 |

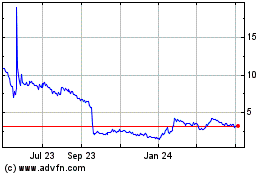

QuantaSing (NASDAQ:QSG)

Historical Stock Chart

From Feb 2025 to Mar 2025

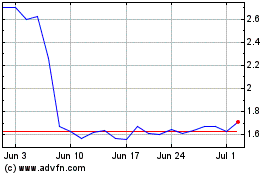

QuantaSing (NASDAQ:QSG)

Historical Stock Chart

From Mar 2024 to Mar 2025