Maroussi, Greece – February 15, 2024 – Pyxis

Tankers Inc. (NASDAQ Cap Mkts: PXS), an international shipping

company, announced today that it has completed the acquisition of

an 82,013 dwt dry bulk vessel built in 2015 at Jiangsu New Yangzi

Shipbuilding. The $26.625 million purchase of the eco-efficient

Kamsarmax, fitted with a ballast water treatment system and

scrubber, was funded by a combination of secured bank debt of $14.5

million and cash on hand. The five year amortizing bank loan is

priced at Term SOFR +2.35% and is secured by, among other things,

the vessel. The vessel has been named the “Konkar Asteri” and is

expected to commence commercial operations shortly. As of December

31, 2023, on a pro-forma basis for the acquisition of the vessel,

including payment of transaction fees and expenses and application

of vessel working capital, consolidated total cash would have been

$45.6 million, inclusive of restricted cash of $2.15 million, and

total funded debt would have been $76.0 million.

In addition, Valentios Valentis, our Chairman

and CEO, provided the following brief commercial update:

“As previously disclosed, we completed the sale

of our 2015 built product tanker, the “Pyxis Epsilon”, in

Mid-December, 2023 and at year-end, the Company was operating three

medium range product tankers (each an “MR”). For the fourth quarter

of 2023, we expect to report a preliminary daily average time

charter equivalent charter rate (“TCE”) *1 of

approximately $30,500 per MR. The product tanker chartering

environment continues to be constructive, especially given recent

geo-political events. As of February 15, 2024, 75% of the available

days in the first quarter of 2024 for our MR’s were booked at an

estimated average TCE of $29,200 per vessel. Two of our MRs

continue to operate under time charters (“T/C”) and one MR in the

spot market.

The acquisition of the “Konkar Asteri” provides

the opportunity to expand our commercial footprint with a fleet of

eco-efficient, scrubber-fitted mid-sized dry bulk carriers.

The Company has a controlling interest in a 2015-built Ultramax,

the “Konkar Ormi”. Shortly after the acquisition, “Konkar

Ormi” commenced commercial operations in October 2023 under a

short-term T/C. For the fourth quarter of 2023, we expect to report

an estimated daily TCE of $16,900 for this vessel. So far in 2024,

we have not experienced the usual seasonal slowdown in the dry bulk

sector. Global demand for many dry bulk commodities has been

supported by solid GDP growth and certain atypical events, such as

transit restrictions through the Panama Canal due to extreme

drought conditions. As of February 15, 2024, 75% of available days

in the first quarter of 2024 were booked for the Ultramax at an

average TCE of $20,900. We expect to employ our dry bulk vessels

under a mix of T/C’s and spot voyages.”

|

Vessel Name |

Shipyard |

Vessel type |

Carrying Capacity (dwt) |

Year Built |

Type of charter |

Charter(1) Rate (per day) |

Anticipated Earliest Redelivery Date |

|

| |

| |

| Product

Tanker

Fleet |

|

|

|

|

|

|

| Pyxis Lamda |

SPP / S. Korea |

MR2

Tanker |

50,145 |

2017 |

Spot |

n/a |

n/a |

|

| Pyxis Theta (2) |

SPP / S. Korea |

MR2

Tanker |

51,795 |

2013 |

Time |

29,000 |

Aug

2024 |

|

| Pyxis Karteria (3) |

Hyundai / S. Korea |

MR2

Tanker |

46,652 |

2013 |

Time |

30,000 |

Mar

2024 |

|

| |

|

|

148,592 |

|

|

|

|

|

|

Dry-bulk

Fleet |

|

|

|

|

|

|

|

|

| Konkar Ormi (4) |

SKD / Japan |

Ultramax |

63,520 |

2016 |

Time |

23,750 |

Mar

2024 |

|

| Konkar Asteri |

JNYS / China |

Kamsarmax |

82,013 |

2015 |

TBD |

n/a |

n/a |

|

| |

|

|

145,533 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1) These tables are as of February 15, 2024 and present gross

rates in U.S.$ and do not reflect any commissions payable. 2)

“Pyxis Theta” is fixed on a time charter for min 11 max 15 months,

at $29,000 per day.3) “Pyxis Karteria” was fixed on a time charter

for min 150 max 240 days, at $30,000 per day. 4) “Konkar Ormi” was

fixed on a time charter for 60 – 70 days, at $23,750 per day.

*[1] Daily TCE rate is a

standard shipping industry performance measure of the average daily

revenue performance of a vessel on a per voyage basis. TCE is not

calculated in accordance with U.S. GAAP. We utilize TCE

because we believe it is a meaningful measure to compare

period-to-period changes in our performance despite changes in the

mix of charter types (i.e., spot charters, time charters and

bareboat charters) under which our vessels may be employed between

the periods. Our management also utilizes TCE to assist them in

making decisions regarding the employment of the vessels. We

believe that our method of calculating TCE is consistent with

industry standards and is calculated by dividing voyage revenues

after deducting voyage expenses, including commissions, by

operating days for the relevant period. Voyage expenses primarily

consist of brokerage commissions, port, canal and bunker costs that

are unique to a particular voyage, which would otherwise be paid by

the charter under a time charter contract.

About Pyxis Tankers Inc.

The Company currently owns a modern fleet of

mid-sized vessels consisting of three product tankers, one

Kamsarmax bulk carrier and a controlling interest in a single ship

Ultramax dry bulk venture engaged in seaborne transportation of

refined petroleum products and other bulk commodities. The Company

is positioned to opportunistically expand and maximize its fleet of

eco-efficient vessels due to significant capital resources,

competitive cost structure, strong customer relationships and an

experienced management team whose interests are aligned with those

of its shareholders. For more information, visit:

http://www.pyxistankers.com. The information on the Company’s

website is not incorporated into and does not form a part of this

release.

Forward Looking Statements

The Company has not finalized the closing

process of its financial statements for the year ended December 31,

2023. During this process, the Company may identify items that

would require it to make adjustments, which may be material to the

information provided above. As a result, the above information

constitutes “forward-looking statements” and is subject to risks

and uncertainties, including possible adjustments to the

preliminary results herein.

This press release

includes forward-looking statements intended to qualify for the

safe harbor from liability established by the Private Securities

Litigation Reform Act of 1995 in order to encourage companies to

provide prospective information about their business. These

statements include statements about our plans, strategies, goals

financial performance, prospects or future events or performance

and involve known and unknown risks that are difficult to predict.

As a result, our actual results, performance or achievements may

differ materially from those expressed or implied by these

forward-looking statements. In some cases, you can identify

forward-looking statements by the use of words such as “may,”

“could,” “expects,” “seeks,” “predict,” “schedule,” “projects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,”

“targets,” “continue,” “contemplate,” “possible,” “likely,”

“might,” “will, “should,” “would,” “potential,” and variations of

these terms and similar expressions, or the negative of these terms

or similar expressions. All statements that are not statements of

either historical or current facts, including among other things,

our expected financial performance, expectations or objectives

regarding future and market charter rate expectations and, in

particular, the effects of the war in the Ukraine and the Red Sea

conflict, on our financial condition and operations as well as the

nature of the product tanker and dry bulk industries, in general,

are forward-looking statements. Such forward-looking statements are

necessarily based upon estimates and assumptions. Although the

Company believes that these assumptions were reasonable when made,

because these assumptions are inherently subject to significant

uncertainties and contingencies which are difficult or impossible

to predict and are beyond the Company’s control, the Company cannot

assure you that it will achieve or accomplish these expectations,

beliefs or projections. The Company’s actual results may differ,

possibly materially, from those anticipated in these

forward-looking statements as a result of certain factors,

including changes in the Company’s financial resources and

operational capabilities and as a result of certain other factors

listed from time to time in the Company’s filings with the U.S.

Securities and Exchange Commission. The Company is reliant on

certain independent and affiliated managers for its operations,

including most recently an affiliated private company, Konkar

Shipping Agencies, S.A., for the management of its dry bulk

vessels. For more information about risks and uncertainties

associated with our business, please refer to our filings with the

U.S. Securities and Exchange Commission, including without

limitation, under the caption “Risk Factors” in our Annual Report

on Form 20-F for the fiscal year ended December 31, 2022. We

caution you not to place undue reliance on any forward-looking

statements, which are made as of the date of this press release. We

undertake no obligation to update publicly any information in this

press release, including forward-looking statements, to reflect

actual results, new information or future events, changes in

assumptions or changes in other factors affecting forward-looking

statements, except to the extent required by applicable laws.

CompanyPyxis Tankers Inc. 59 K. Karamanli

Street Maroussi, 15125 Greece info@pyxistankers.com

Visit our website at www.pyxistankers.com

Company ContactHenry Williams Chief Financial

Officer Tel: +30 (210) 638 0200 / +1 (516) 455-0106

Email: hwilliams@pyxistankers.com

Source: Pyxis Tankers Inc.

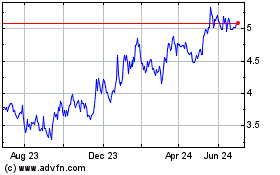

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Jan 2025 to Feb 2025

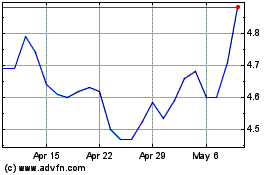

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Feb 2024 to Feb 2025