Current Report Filing (8-k)

February 07 2019 - 5:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 7, 2019

______________________

PENN NATIONAL GAMING, INC.

______________________

Commission file number 0-24206

Incorporated Pursuant to the Laws of the Commonwealth of Pennsylvania

IRS Employer Identification No. 23-2234473

825 Berkshire Blvd., Suite 200

Wyomissing, PA 19610

610-373-2400

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b-2).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.02 Results of Operations and Financial Condition.

On

February 7, 2019

, Penn National Gaming, Inc., issued a press release announcing its financial results for the three months and year ended December 31, 2018. In the press release, in the Adjusted EBITDAR by segment table, the amounts reported for each reportable segment and the Other category under the columns “Pinnacle, Pre-Acquisition” and “Combined” were incorrectly reported. The Total amounts reported in each column were reported correctly. The correct amounts for the “Pinnacle, Pre-Acquisition” column were $74,105 for the Northeast segment, $183,164 for the South segment, $77,230 for the West segment, $113,722 for the Midwest segment and $(46,078) for the Other category. The correct amounts for the “Combined” column were $657,896 for the Northeast segment, $302,126 for the South segment, $191,497 for the West segment, $408,054 for the Midwest segment and $(114,189) for the Other category. A copy of the press release, as corrected, is being furnished as Exhibit 99.1 to this Form 8-K. In addition, a copy of the press release, as corrected, has been posted to the “Investors” section of the Company’s website.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

99.1

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

Dated:

|

February 7, 2019

|

PENN NATIONAL GAMING, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ William J. Fair

|

|

|

|

Name:

|

William J. Fair

|

|

|

|

Title:

|

Executive Vice President and Chief Financial Officer

|

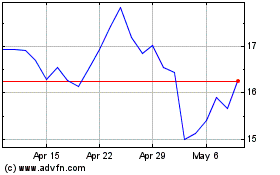

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Oct 2024 to Nov 2024

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Nov 2023 to Nov 2024