Passage Bio Reports First Quarter 2020 Financial Results and Recent Business Highlights

May 11 2020 - 7:00AM

Passage Bio, Inc. (Nasdaq: PASG), a genetic medicines company

focused on developing transformative therapies for rare, monogenic

central nervous system disorders, today reported financial results

for the first quarter ended March 31, 2020 and provided recent

business highlights.

“The first quarter was a significant time for Passage Bio and

the patients that we serve. Building upon the strong momentum since

launching the company in 2018, we completed an upsized IPO in March

2020 and are now working to bring our lead program, PBGM01, for the

treatment of infantile GM1 gangliosidosis into the clinic as soon

as possible and advancing the balance of our deep pipeline,” said

Bruce Goldsmith, Ph.D., president and chief executive officer of

Passage Bio. “While the potential impacts of the COVID-19 pandemic

are uncertain, with our deeply experienced management team,

supported by a strong cash position, we are confident in our

ability to continue to execute and remain on-track to meet our 2020

clinical development goals. As a company that aims, above all, to

serve patients and families suffering from rare, life-threatening

CNS diseases with no alternative treatment options, we are

committed to driving our programs forward.”

Recent Business Highlights

- Expansion of gene therapy collaboration with the

University of Pennsylvania (UPenn) – In May 2020, Passage

Bio expanded its research and development collaboration and

licensing agreement with UPenn. The amendment increased the number

of remaining available licensing options for programs to treat rare

monogenic CNS disorders from from six to eleven and extended the

window for the exercise of options by three years. Accordingly, the

window to exercise all eleven remaining options extends to May

2025. The company also received exclusive rights and licenses,

subject to limitations, to certain technologies resulting from

discovery research at Gene Therapy Program (GTP) for Passage Bio

products developed with GTP, such as novel capsids, toxicity

reduction technologies and delivery and formulation

improvements.

- Granted Orphan Drug Designation (ODD) by the U.S. Food

and Drug Administration (FDA) for the lead product candidate

PBGM01 – In April 2020, the FDA granted ODD to PBGM01 for

the treatment of infantile GM1 gangliosidosis (GM1), a rare and

often life-threatening monogenic recessive lysosomal storage

disease caused by mutations in the GLB1 gene that results in

rapidly progressing neurodegeneration. The designation grants the

company certain benefits, including financial incentives to support

clinical development and the potential for up to seven years of

market exclusivity in the U.S. upon regulatory approval.

- Completed upsized Initial Public Offering

(IPO) – In March 2020, Passage Bio completed its IPO of

13,800,000 shares of common stock at a public offering price of

$18.00 per share, including an exercise of the underwriter’s option

to purchase additional shares. The total net proceeds from the

offering, after deducting underwriting discounts, commissions and

offering expenses, were $227.5 million.

- Appointed Bruce Goldsmith, Ph.D. as president and chief

executive officer – In January 2020, Passage Bio announced

the appointment of Bruce Goldsmith, Ph. D., as president and chief

executive officer, succeeding co-founder and interim chief

executive officer Stephen Squinto, Ph.D., who now serves as acting

head of research and development for the company.

- Strengthened company’s Board of Directors (BOD) with

additions of Sandip Kapadia and Athena Countouriotis, M.D.

– In January and March 2020 respectively, Passage Bio appointed

Sandip Kapadia, MBA, CPA, and Athena Countouriotis, M.D., to its

BOD. Mr. Kapadia currently serves as the chief financial officer

and treasurer of Intercept Pharmaceuticals, and Dr. Countouriotis

is currently president and chief executive officer at Turning Point

Therapeutics.

Anticipated Upcoming Milestones

- Initiate a Phase 1/2 trial for the lead program, PBGM01, for

the treatment of patients with infantile GM1 in fourth quarter of

2020.

- Continue to advance the lead programs PBFT02, for the treatment

of frontotemporal dementia (FTD) and PBKR03, for the treatment of

Krabbe disease toward clinical study initiation in the first half

of 2021.

- Continue to advance PBML04, PBLA05 and PBCM06 toward

Investigational New Drug (IND)-enabling studies.

First Quarter 2020 Financial Results

- Cash Position: Cash and

cash equivalents were $366.8 million as of March 31, 2020 as

compared to $158.9 million as of December 31, 2019. In

February 2020, Passage Bio raised $227.5 million in net proceeds

from its IPO.

- Research and Development (R&D)

Expenses: R&D expenses were

$13.1 million for the quarter ended March 31, 2020, compared to

$3.0 million for the quarter ended March 31, 2019. The

increase was primarily due to an increase of $4.8 million in

R&D costs incurred with Penn and were related to the

preparation of several IND filings as well as an increase in other

research costs of $2.9 million as the company prepares for its

clinical trials to begin in the second half of 2020 and early 2021.

The company also had a $2.3 million increase in

personnel‑related costs and a $0.2 million increase in

facility and other costs due to increases in employee headcount in

the R&D function.

- General and Administrative (G&A)

Expenses: G&A expenses were $4.8 million for the

quarter ended March 31, 2020, compared to $1.2 million for the

quarter ended March 31, 2019. The increase was primarily due

to a $2.2 million increase in personnel-related and

share‑based compensation expense due to increases in employee

headcount. The company’s professional fees and facility costs also

increased by $0.6 million and $0.8 million, respectively,

as Passage Bio expanded its operations to support its R&D

efforts.

- Net Loss: Net loss was $17.6 million, or

a net loss of $1.00 per basic and diluted share, for the quarter

ended March 31, 2020, compared to $7.7 million, or a net loss of

$1.83 per basic and diluted share, for the quarter ended March 31,

2019.

Conference Call DetailsPassage Bio will host a

conference call and webcast today at 8:30 a.m. ET. To access

the live conference call, please dial 833-528-0605 (domestic) or

830-221-9711 (international) and reference conference ID number

2588609. A live audio webcast of the event will be available on the

Investors & Media section of Passage Bio’s website at

investors.passagebio.com. The archived webcast will be available on

Passage Bio's website approximately two hours after the completion

of the event and for 30 days following the call.

About Passage Bio Passage Bio is a genetic

medicines company focused on developing transformative therapies

for rare, monogenic central nervous system disorders with limited

or no approved treatment options. The company is based in

Philadelphia, PA and has a research, collaboration and license

agreement with the University of Pennsylvania and its Gene Therapy

Program (GTP). The GTP conducts discovery and IND-enabling

preclinical work and Passage Bio conducts all clinical development,

regulatory strategy and commercialization activities under the

agreement. The company has a development portfolio of six product

candidates, with the option to license eleven more, with lead

programs in GM1 gangliosidosis, frontotemporal dementia and Krabbe

disease.

Forward-Looking StatementsThis press release

contains “forward-looking statements” within the meaning of, and

made pursuant to the safe harbor provisions of, the Private

Securities Litigation Reform Act of 1995, including, but not

limited to: our expectations about timing and execution of

anticipated milestones, including our planned IND submissions,

initiation of clinical trials and the availability of clinical data

from such trials; our cash forecasts, our expectations about our

collaborators’ and partners’ ability to execute key initiatives;

and the ability of our lead product candidates to treat the

underlying causes of their respective target monogenic CNS

disorders. These forward-looking statements may be accompanied by

such words as “aim,” “anticipate,” “believe,” “could,” “estimate,”

“expect,” “forecast,” “goal,” “intend,” “may,” “might,” “plan,”

“potential,” “possible,” “will,” “would,” and other words and terms

of similar meaning. These statements involve risks and

uncertainties that could cause actual results to differ materially

from those reflected in such statements, including: our ability to

develop, obtain regulatory approval for and commercialize our

product candidates; the timing and results of preclinical studies

and clinical trials; the risk that positive results in a

preclinical study or clinical trial may not be replicated in

subsequent trials or success in early stage clinical trials may not

be predictive of results in later stage clinical trials; risks

associated with clinical trials, including our ability to

adequately manage clinical activities, unexpected concerns that may

arise from additional data or analysis obtained during clinical

trials, regulatory authorities may require additional information

or further studies, or may fail to approve or may delay approval of

our drug candidates; the occurrence of adverse safety events;

failure to protect and enforce our intellectual property, and other

proprietary rights; failure to successfully execute or realize the

anticipated benefits of our strategic and growth initiatives; risks

relating to technology failures or breaches; our dependence on

collaborators and other third parties for the development of

product candidates and other aspects of our business, which are

outside of our full control; risks associated with current and

potential delays, work stoppages, or supply chain disruptions

caused by the COVID-19 pandemic; risks associated with current and

potential future healthcare reforms; risks relating to attracting

and retaining key personnel; failure to comply with legal and

regulatory requirements; risks relating to access to capital and

credit markets; and the other risks and uncertainties that are

described in the Risk Factors section in documents the company

files from time to time with the Securities and Exchange Commission

(SEC), and other reports as filed with the SEC. Passage Bio

undertakes no obligation to publicly update any forward-looking

statement, whether written or oral, that may be made from time to

time, whether as a result of new information, future developments

or otherwise.

|

Passage Bio, Inc. |

|

|

|

|

|

Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

(in thousands, except share data) |

|

|

2020 |

|

|

|

2019 |

|

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

366,828 |

|

|

$ |

158,874 |

|

|

Prepaid expenses |

|

|

2,921 |

|

|

|

156 |

|

|

Prepaid research and development |

|

|

12,340 |

|

|

|

6,745 |

|

|

Total current assets |

|

|

382,089 |

|

|

|

165,775 |

|

|

Property and equipment, net |

|

|

1,137 |

|

|

|

1,087 |

|

|

Other assets |

|

|

9,201 |

|

|

|

11,751 |

|

|

Total assets |

|

$ |

392,427 |

|

|

$ |

178,613 |

|

|

Liabilities, convertible preferred stock and stockholders’

equity (deficit) |

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

2,532 |

|

|

$ |

629 |

|

|

Accrued expenses and other current liabilities |

|

|

2,696 |

|

|

|

3,052 |

|

|

Total current liabilities |

|

|

5,228 |

|

|

|

3,681 |

|

|

Deferred rent |

|

|

489 |

|

|

|

504 |

|

|

Other liabilities |

|

|

44 |

|

|

|

76 |

|

|

Total liabilities |

|

|

5,761 |

|

|

|

4,261 |

|

|

Convertible preferred stock, $0.0001 par value: |

|

|

|

|

|

Series A‑1 convertible preferred stock: No shares authorized,

issued and outstanding at March 31, 2020; 63,023,258 shares

authorized, issued and outstanding at December 31, 2019 |

|

|

- |

|

|

|

74,397 |

|

|

Series A‑2 convertible preferred stock: No shares authorized,

issued and outstanding at March 31, 2020; 22,209,301 shares

authorized; issued and outstanding at December 31, 2019 |

|

|

- |

|

|

|

46,311 |

|

|

Series B convertible preferred stock: No shares authorized, issued

and outstanding at March 31, 2020; 33,592,907 shares authorized,

issued and outstanding at December 31, 2019 |

|

|

- |

|

|

|

109,897 |

|

|

Total convertible preferred stock |

|

|

- |

|

|

|

230,605 |

|

|

Stockholders’ equity (deficit) : |

|

|

|

|

|

Common stock, $0.0001 par value: 100,000,000 shares authorized;

45,797,195 shares issued and 45,350,687 shares outstanding at March

31, 2020 and 5,194,518 shares issued and 4,293,039 shares

outstanding at December 31, 2019 |

|

|

4 |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

462,910 |

|

|

|

2,410 |

|

|

Accumulated deficit |

|

|

(76,248 |

) |

|

|

(58,663 |

) |

|

Total stockholders' equity (deficit) |

|

|

386,666 |

|

|

|

(56,253 |

) |

|

Total liabilities, convertible preferred stock and stockholders'

equity (deficit) |

|

$ |

392,427 |

|

|

$ |

178,613 |

|

|

|

|

|

|

|

| |

|

|

|

|

Statements of Operations |

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

| |

Three Months

Ended March 31, |

|

(in thousands, except share and per share

data) |

|

2020 |

|

|

|

2019 |

|

| Operating

expenses: |

|

|

|

|

Research and development |

$ |

13,117 |

|

|

$ |

3,033 |

|

|

General and administrative |

|

4,795 |

|

|

|

1,154 |

|

|

Loss from operations |

|

(17,912 |

) |

|

|

(4,187 |

) |

| Change in

fair value of future tranche right liability |

|

- |

|

|

|

(3,482 |

) |

| Interest

income |

|

327 |

|

|

|

- |

|

| Net

loss |

$ |

(17,585 |

) |

|

$ |

(7,669 |

) |

| Per share

information: |

|

|

|

| Net loss per

share of common stock, basic and diluted |

$ |

(1.00 |

) |

|

$ |

(1.83 |

) |

| Weighted

average common shares outstanding, basic and diluted |

|

17,624,011 |

|

|

|

4,197,604 |

|

| |

|

|

|

For further information, please contact:

Investors:Sarah McCabeStern Investor Relations,

Inc.212-362-1200sarah.mccabe@sternir.com

Media:Emily MaxwellHDMZ312-506-5220emily.maxwell@hdmz.com

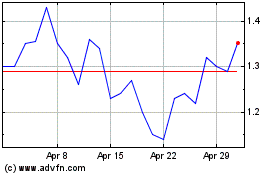

Passage Bio (NASDAQ:PASG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Passage Bio (NASDAQ:PASG)

Historical Stock Chart

From Nov 2023 to Nov 2024