UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

|

|

|

AMENDMENT

NO. 2

TO

SCHEDULE

TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) or 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

OneSpan

Inc.

(Name of Subject Company (Issuer) and Filing Person (Offeror)) |

|

|

|

Common Stock, par value $0.001 per

share

(Title of Class of Securities)

68287N100

(CUSIP Number of Class of Securities) |

|

|

|

OneSpan Inc.

Attention: Lara Mataac

General Counsel, Chief Compliance

Officer and Corporate Secretary

1 Marina Park Drive, Unit 1410

Boston, Massachusetts 02210

(312) 766-4001

(Name, address and telephone number of

person authorized to receive

notices and communications on behalf of filing person) |

|

|

|

Copy to:

Albert Lung, Esq.

Morgan, Lewis & Bockius

LLP

1400 Page Mill Road

Palo Alto, CA 94304-1124

(650) 843-7263 |

|

|

| ☐ | Check

the box if filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions

to which the statement relates:

| |

☐ |

third-party tender offer subject to Rule 14d-1. |

| |

|

|

| |

☒ |

issuer tender offer subject to Rule 13e-4. |

| |

|

|

| |

☐ |

going-private transaction subject to Rule 13e-3. |

| |

|

|

| |

☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting

the results of the tender offer: ☐

AMENDMENT NO. 2 TO SCHEDULE TO

This Amendment No. 2 (this “Amendment”)

to Tender Offer Statement on Schedule TO amends and supplements the Tender Offer Statement on Schedule TO originally filed by OneSpan,

Inc., a Delaware corporation (the “Company,” “our,” “we,”

or “us”), on November 13, 2023 (the “Original Schedule TO”), as amended on December

1, 2023 (the “Amended Schedule TO” and as may be further supplemented or amended from time to time, the “Tender

Offer Statement”) in connection with the Offer (as defined below) by the Company to purchase up to $20 million in value

of shares of its Common Stock, par value $0.001 per share (the “Shares”), at a price not greater than $11.00 nor less

than $9.50 per Share, to the seller in cash, less any applicable withholding taxes and without interest.

The terms and conditions of the

Offer are described in the Offer to Purchase, dated November 13, 2023, as amended on December 1, 2023 (as so amended, the “Amended

Offer to Purchase”) and as further amended on December 5, 2023 (the “Further Amended Offer to Purchase”),

a copy of which is filed herewith as Exhibit (a)(1)(I), and the related Letter of Transmittal, dated November 13, 2023 (the “Letter

of Transmittal,” which, together with the Amended Offer to Purchase, as each may be amended or supplemented from time to

time, with respect to the Shares, collectively constitute the “Offer”).

This Amendment and the exhibits

hereto should otherwise be read in conjunction with the Original Schedule TO and the Amended Schedule TO. The Tender Offer Statement is

intended to satisfy the reporting requirements of Rule 13e-4(c)(2) promulgated under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”). The information contained in the Further Amended Offer to Purchase and the Letter of Transmittal,

respectively, as each may be amended or supplemented from time to time, is hereby incorporated by reference in response to certain items

of this Amendment.

This Amendment is being filed

to amend and supplement the Original Schedule TO and the Amended Schedule TO for the purpose of amending and restating the first sentence

of the fourth paragraph on page iii of the Amended Offer to Purchase and identical sentences on pages 9 and 14 of the Amended Offer to

Purchase and related disclosures in the Letter to Clients, the further amended version of which is filed herewith as Exhibit (a)(1)(J).

“We are not soliciting any

Shares in the Offer in any jurisdiction where it would be illegal to do so, provided that we will comply with the requirements of Rule

13e-4(f)(8) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).”

In addition, the Amended Schedule

TO is hereby amended and supplemented as follows:

Items 1 through 9 and Item

11

Items 1 through 9 and Item 11

of the Amended Schedule TO are hereby amended and supplemented as set forth below:

“All descriptions and references in respect

of the ‘Amended Offer to Purchase’ in the Amended Schedule TO are hereby amended to refer to the ‘Further Amended Offer

to Purchase.’ Accordingly, all references in the Amended Schedule TO to the ‘Amended Offer to Purchase’ are hereby amended

and replaced with ‘Further Amended Offer to Purchase.’”

Except as amended hereby to the

extent specifically provided herein, all terms of the Offer and all other disclosures set forth in the Original Schedule TO, the Amended

Schedule TO and the exhibits thereto remain unchanged and are hereby expressly incorporated into this Amendment by reference. Capitalized

terms used and not otherwise defined in this Amendment shall have the meanings assigned to such terms in the Original Schedule TO and

the Amended Offer to Purchase.

Item 12. Exhibits

Item 12 of the Amended

Schedule TO is hereby amended and restated in its entirety as set forth below:

“Item 12. Exhibits.

| (a)(1)(C)* |

Notice of Guaranteed Delivery. |

| (a)(1)(D)* |

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated November 13, 2023. |

| (a)(1)(E)* |

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated November 13, 2023. |

| (a)(1)(F)** |

Amended Offer to Purchase, dated December 1, 2023. |

| (a)(1)(G)** |

Amended Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated December 1, 2023. |

| (a)(1)(H)** |

Amended Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated December 1, 2023. |

| (a)(1)(I)*** |

Further Amended Offer to Purchase, dated December 5, 2023. |

| (a)(1)(J)*** |

Further Amended Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated December 5, 2023. |

| (a)(2) |

Not applicable. |

| (a)(3) |

Not applicable. |

| (a)(4) |

Not applicable. |

| (a)(5)(i)* |

Press release announcing the commencement of the Tender Offer, dated November 13, 2023 (incorporated by reference to Exhibit 99.1 to the Company’s Current Report on Form 8-K filed on November 13, 2023). |

| (a)(5)(ii) |

Annual Report on Form 10-K for the year ended December 31, 2022 filed on February 28, 2023. |

| (a)(5)(iii) |

Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 filed on May 4, 2023. |

| (a)(5)(iv) |

Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 filed on August 9, 2023. |

| (a)(5)(v) |

Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed on November 8, 2023. |

| (a)(5)(vi) |

Definitive Proxy Statement on Schedule 14A filed with the SEC on April 25, 2023. |

| (b) |

Not applicable. |

| (d)(1) |

Form of Director and Officer Indemnification Agreement (incorporated by reference to Exhibit 10.1 to the Company’s Annual Report on Form 10-K filed on February 28, 2023). |

| (d)(2)* |

Amended and Restated Employment Agreement, dated February 27, 2023, between the Company and Matthew Moynahan. |

| (d)(3) |

Employment Agreement, dated September 6, 2022, between the Company and Jorge Martell (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed on November 1, 2022). |

| (d)(4) |

Employment Agreement, dated June 13, 2022, between the Company and Lara Mataac (incorporated by reference to Exhibit 10.3 to the Company’s Annual Report on Form 10-K filed on February 28, 2023). |

| (d)(5) |

2022 Management Incentive Plan of the Company (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed on August 4, 2022). |

| (d)(6) |

OneSpan Inc. 2019 Omnibus Incentive Plan (incorporated by reference to Attachment A to the Company’s Definitive Proxy Statement filed on April 26, 2019). |

| (d)(7) |

One-Time Special Grant Award Agreement, dated November 29, 2021, for Time-Based Restricted Stock Units between the Company and Matthew Moynahan under the Company’s 2019 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.7 to the Company’s Annual Report on Form 10-K filed on February 28, 2023). |

| (d)(8) |

One-Time Special Grant Award Agreement, dated November 29, 2021, for Performance-Based Restricted Stock Units between the Company and Matthew Moynahan under the Company’s 2019 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.8 to the Company’s Annual Report on Form 10-K filed on February 28, 2023). |

| (d)(9) |

Time-Based RSU Agreement, dated February 17, 2022, between the Company and Matthew Moynahan (incorporated by reference to Exhibit 10.4 to the Company’s Quarterly Report on Form 10-Q filed on November 1, 2022). |

| (d)(10) |

Form of Performance-Based RSU Agreement under the Company’s 2019 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.5 to the Company’s Quarterly Report on Form 10-Q filed on November 1, 2022). |

| (d)(11) |

Form of Time-Based RSU Agreement (Executive) under the Company’s 2019 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.6 to the Company’s Quarterly Report on Form 10-Q filed on November 1, 2022). |

| (d)(12) |

Form of Time-Based RSU Agreement (General) under the Company’s 2019 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.7 to the Company’s Quarterly Report on Form 10-Q filed on November 1, 2022). |

|

(d)(13)

|

Cooperation Agreement, dated May 28, 2021, by and among the Company, Legion Partners, Christopher S. Kiper and Raymond T. White (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on May 28, 2021). |

| (d)(14) |

Description of 2023 Management Incentive Plan (incorporated by reference to Exhibit 10.1 to the Company's Quarterly Report on Form 10-Q filed on May 4, 2023). |

| (d)(15) |

Special PSU Agreement, dated March 11, 2023, between the Company and Matthew Moynahan (incorporated by reference to Exhibit 10.2 to the Company's Quarterly Report on Form 10-Q filed on May 4, 2023). |

| (d)(16) |

Form of 2023 Performance-Based RSU Agreement under the Company's 2019 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.3 to the Company's Quarterly Report on Form 10-Q filed on May 4, 2023). |

| (d)(17) |

Form of 2023 Time-Based RSU Agreement (General) under the Company's 2019 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.4 to the Company's Quarterly Report on Form 10-Q filed on May 4, 2023). |

| (g) |

Not applicable. |

| (h) |

Not applicable. |

| 107* |

Calculation of Filing Fees. |

* Previously filed on November 13, 2023 as an exhibit to the Original Schedule

TO.

** Previously filed on December 1, 2023 as an exhibit to the Amended Schedule

TO.

***Filed herewith.”

SIGNATURE

After due inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true, complete and correct.

| |

|

|

|

OneSpan Inc. |

| |

|

|

|

|

| |

|

|

By: |

/s/ Lara Mataac |

| |

|

|

|

Lara Mataac |

| |

|

|

|

General Counsel, Chief Compliance Officer and Corporate Secretary |

| |

|

|

|

|

| Date: |

December 5, 2023 |

|

|

|

| |

|

|

|

|

OneSpan Inc. SC TO-I/A

Exhibit (a)(1)(I)

FURTHER AMENDED OFFER TO PURCHASE

BY

ONESPAN INC.

Up to $20 Million of its Shares of Common

Stock, par value $0.001 per share,

at a Cash Purchase Price Not More than $11.00 per Share Nor Less than $9.50 per Share

CUSIP: 68287N100

| THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 12:00 MIDNIGHT, AT THE END OF THE DAY, NEW YORK CITY TIME, ON DECEMBER 11, 2023, UNLESS THE OFFER IS EXTENDED OR TERMINATED (SUCH DATE AND TIME, AS THEY MAY BE EXTENDED, THE “EXPIRATION DATE”). THE OFFER IS SUBJECT TO THE SATISFACTION OR WAIVER OF CERTAIN CONDITIONS AS SET FORTH UNDER THE HEADING “THE OFFER-CONDITIONS OF THE OFFER.” |

OneSpan Inc., a Delaware corporation (“OSPN,”

the “Company,” “we,” “us” or “our”), is offering to

purchase up to $20 million in aggregate purchase price of our issued and outstanding shares of Common Stock, par value $0.001 per

share (each, a “Share” and collectively, the “Shares”), at a price calculated as described

herein that is not greater than $11.00 nor less than $9.50 per Share to the seller in cash, less any applicable withholding taxes

and without interest, upon the terms and subject to the conditions described in this Offer to Purchase (together with any amendments

or supplements thereto, the “Offer to Purchase”), in the related Letter of Transmittal (together with any amendments

or supplements thereto, the “Letter of Transmittal”) and in other related materials as may be amended or supplemented

from time to time (collectively, with this Offer to Purchase and Letter of Transmittal, the “Offer”).

Upon the terms and subject to the conditions of the Offer, we

will determine a single per Share price that we will pay for Shares properly tendered and not properly withdrawn from the Offer,

taking into account the total number of Shares properly tendered and the prices specified, or deemed specified, by tendering shareholders.

We will select this single per Share price (the “Purchase Price”) as the lowest single purchase price (in increments

of $0.10), not greater than $11.00 nor less than $9.50 per Share, that would allow us to purchase the maximum number of Shares

for an aggregate purchase price not to exceed $20 million, or all Shares properly tendered and not properly withdrawn in the event

that less than $20 million in aggregate purchase price of Shares are properly tendered and not properly withdrawn. All Shares purchased

in the Offer will be purchased at the Purchase Price, including Shares tendered at a price lower than the Purchase Price, subject

to “Odd Lot” priority, proration and the conditional tender provisions described in this Offer to Purchase.

Upon the terms and subject to the conditions of the Offer, if,

based on the Purchase Price, Shares having an aggregate value of $20 million or less are properly tendered and not properly withdrawn,

we will purchase all Shares properly tendered at or below the Purchase Price and not properly withdrawn prior to the Expiration

Date (as defined below). All Shares acquired, if any, in the Offer will be acquired at the Purchase Price, including those Shares

tendered at a price lower than the Purchase Price. Only Shares properly tendered at prices at or below the Purchase Price, and

not properly withdrawn, will be purchased; however, because of “Odd Lot” priority, proration, and the conditional tender

provisions described in this Offer to Purchase, we may not purchase all of the Shares tendered at or below the Purchase Price if

Shares having an aggregate purchase price in excess of $20 million are properly tendered (and not properly withdrawn) at or below

the Purchase Price. Shares not purchased in the Offer will be returned to the tendering shareholders promptly after the Expiration

Date.

We reserve the right, in our sole discretion, to change the

per Share purchase price range and to increase or decrease the number of Shares sought in the Offer, subject to applicable law.

In accordance with the rules of the Securities and Exchange Commission (the “SEC”), if more than $20 million

in aggregate purchase price of Shares is tendered in the Offer at or below the Purchase Price, we may increase the number of Shares

accepted for payment in the Offer by no more than 2% of the outstanding Shares without extending the Expiration Date. See Sections

1 and 15.

As of November 9, 2023, we had 39,887,336 issued and outstanding

Shares. Assuming that the Offer is fully subscribed, if the Purchase Price is determined to be $9.50 per Share, the minimum Purchase

Price pursuant to the Offer, the approximate number of Shares that would be purchased pursuant to the Offer is 2,105,263. Assuming

that the Offer is fully subscribed, if the Purchase Price is determined to be $11.00 per Share, the maximum Purchase Price pursuant

to the Offer, the approximate number of Shares that would be purchased pursuant to the Offer is 1,818,181.

THE OFFER IS NOT CONDITIONED ON ANY MINIMUM NUMBER OF SHARES

BEING TENDERED. THE OFFER IS, HOWEVER, SUBJECT TO CERTAIN OTHER CONDITIONS. SEE SECTION 7.

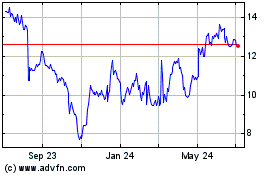

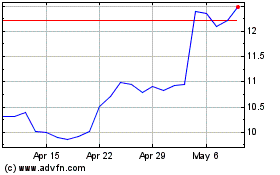

The Shares are listed and traded on the Nasdaq Capital Market

(“Nasdaq”) under the trading symbol “OSPN”. On November 10, 2023 the last full trading day prior

to the commencement of the Offer, the last reported sale price of the Shares was $9.52 per Share, which is above the $9.50 per

Share lower end of the price range for the Offer. Accordingly, an election to accept the Purchase Price determined in the Offer

may lower the Purchase Price to a price below such closing price and could be below the reported closing price on the Expiration

Date. Shareholders are urged to obtain current market quotations for the Shares before deciding whether and at what purchase

price or purchase prices to tender their Shares. See Section 8.

OUR BOARD OF DIRECTORS (THE “BOARD OF DIRECTORS”

OR THE “BOARD”) HAS AUTHORIZED US TO MAKE THE OFFER. HOWEVER, NONE OF THE COMPANY, THE MEMBERS OF OUR BOARD OF DIRECTORS,

B. RILEY SECURITIES, INC., THE DEALER MANAGER FOR THE OFFERING (THE “DEALER MANAGER”) OR BROADRIDGE CORPORATE

ISSUER SOLUTIONS, LLC, THE DEPOSITARY (THE “DEPOSITARY”) AND INFORMATION AGENT (THE “INFORMATION AGENT”)

FOR THE OFFER, MAKES ANY RECOMMENDATION TO YOU AS TO WHETHER YOU SHOULD TENDER OR REFRAIN FROM TENDERING YOUR SHARES OR AS TO THE

PURCHASE PRICE OR PURCHASE PRICES AT WHICH YOU MAY CHOOSE TO TENDER YOUR SHARES. NEITHER WE NOR ANY MEMBER OF OUR BOARD OF DIRECTORS,

THE DEALER MANAGER, THE INFORMATION AGENT OR THE DEPOSITARY HAS AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION WITH RESPECT TO

THE OFFER. YOU MUST MAKE YOUR OWN DECISION AS TO WHETHER TO TENDER YOUR SHARES AND, IF SO, HOW MANY SHARES TO TENDER AND THE PURCHASE

PRICE OR PURCHASE PRICES AT WHICH YOU WILL TENDER THEM. WE RECOMMEND THAT YOU CONSULT YOUR OWN FINANCIAL, LEGAL AND TAX ADVISORS,

AND READ CAREFULLY AND EVALUATE THE INFORMATION IN THIS OFFER TO PURCHASE AND IN THE LETTER OF TRANSMITTAL, INCLUDING OUR REASONS

FOR MAKING THE OFFER, BEFORE TAKING ANY ACTION WITH RESPECT TO THE OFFER. SEE SECTION 2.

THE OFFER HAS NOT BEEN APPROVED BY THE SEC OR ANY STATE SECURITIES

COMMISSION NOR HAS THE SEC OR ANY STATE SECURITIES COMMISSION PASSED UPON THE FAIRNESS OR MERITS OF THE OFFER OR UPON THE ACCURACY

OF THE INFORMATION CONTAINED IN THIS OFFER TO PURCHASE AND ANY RELATED DOCUMENTS, AND ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL

AND MAY BE A CRIMINAL OFFENSE.

If you have questions or need assistance, you should contact

the Information Agent or the Dealer Manager at their respective addresses and telephone numbers set forth on the back cover of

this Offer to Purchase. If you require additional copies of this Offer to Purchase, the Letter of Transmittal, the Notice of Guaranteed

Delivery or other related materials, you should contact the Information Agent.

The Dealer Manager for the Offer is:

B. Riley Securities, Inc.

Offer to Purchase dated November 13,

2023, as amended on December 1, 2023 and as further amended on December 5, 2023

IMPORTANT

If you want to tender all or part of your Shares, you must do

one of the following before the Offer expires at 12:00 Midnight, at the end of the day, New York City time, on December 11, 2023

(unless the Offer is extended):

| ● | if

your Shares are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, contact the nominee

and request that the nominee tender your Shares for you. Beneficial owners should be aware that their broker, dealer, commercial

bank, trust company or other nominee may establish its own earlier deadlines for participation in the Offer. Accordingly, beneficial

owners wishing to participate in the Offer should contact their broker, dealer, commercial bank, trust company or other nominee

as soon as possible in order to determine the times by which such owner must take action in order to participate in the Offer; |

| ● | if

you hold certificates or book-entry Shares registered in your own name, complete and sign a Letter of Transmittal according to

its instructions, and deliver it, together with any required signature guarantees, any certificates for your Shares and any other

documents required by the Letter of Transmittal, to Broadridge Corporate Issuer Solutions, LLC, the depositary for the Offer (the

“Depositary”), at the address appearing on the back cover page of this Offer to Purchase; |

| ● | if

you are an institution participating in The Depository Trust Company, which we call the “Book-Entry Transfer Facility”

in this Offer to Purchase, tender your Shares according to the procedure for book-entry transfer described in Section 3. |

| ● | We

are not offering, as part of the Offer, to purchase time-based restricted stock units (“time-based RSUs”) or

performance-based restricted stock units (“PSUs” and, collectively with time-based RSUs, “restricted

stock units” or “RSUs”) outstanding under the OneSpan Inc. 2019 Omnibus Incentive Plan (as amended,

the “Equity Incentive Plan”) that have not vested or that are subject to restrictions as of the Expiration

Date, and tenders of such unvested restricted stock units will not be accepted. If you are a holder of restricted stock units

outstanding under the Equity Incentive Plan, you may only tender the Shares underlying such awards if they have vested and you

have received the underlying Shares free of restrictions on the transfer of such Shares prior to the Expiration Date. |

If you wish to tender your Shares, but (a) the certificates

for your Shares are not immediately available or cannot be delivered to the Depositary by the Expiration Date, (b) you cannot comply

with the procedure for book-entry transfer by the Expiration Date, or (c) your other required documents cannot be delivered to

the Depositary by the Expiration Date, you can still tender your Shares if you comply with the guaranteed delivery procedures described

in Section 3.

If you wish to maximize the chance that your Shares will be

purchased in the Offer, you should check the box in the section of the Letter of Transmittal captioned “Shares Tendered At

A Price Determined Pursuant to the Offer” (below the subsection captioned “Price (in Dollars) Per Share At Which Shares

Are Being Tendered”). If you check such box, your Shares will be deemed to be tendered at $9.50 per Share, which is the low

end of the price range in the Offer, for the purpose of determining the Purchase Price. You should understand that this election

may lower the Purchase Price paid to you for your Shares and could result in your Shares being purchased at $9.50 per Share, which

is the low end of the price range in the Offer, less any applicable fees or withholding taxes and without interest.

We are not soliciting any Shares in the Offer in any jurisdiction where

it would be illegal to do so, provided that we will comply with the requirements of Rule 13e-4(f)(8) promulgated under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). Validly tendered shares will be accepted from all holders wherever

located. We may, at our discretion, take any actions necessary for us to make the Offer to holders of Shares in any such jurisdiction

in compliance with applicable laws. In any jurisdiction where the securities or blue sky laws require the Offer to be made by a licensed

broker or dealer, the Offer is being made on our behalf by the Dealer Manager or one or more registered brokers or dealers, which are

licensed under the laws of such jurisdiction.

You may contact the Information Agent, the Dealer Manager or

your broker, dealer, commercial bank, trust company or other nominee for assistance. The contact information for the Information

Agent and the Dealer Manager is set forth on the back cover of this Offer to Purchase.

OUR BOARD OF DIRECTORS HAS AUTHORIZED US TO MAKE THE OFFER.

HOWEVER, NONE OF THE COMPANY, THE MEMBERS OF OUR BOARD OF DIRECTORS, THE DEALER MANAGER, THE INFORMATION AGENT OR THE DEPOSITARY

HAS MADE ANY RECOMMENDATION AS TO WHETHER YOU SHOULD TENDER OR REFRAIN FROM TENDERING YOUR SHARES OR AS TO THE PURCHASE PRICE OR

PURCHASE PRICES AT WHICH YOU MAY CHOOSE TO TENDER YOUR SHARES. NONE OF THE COMPANY, THE MEMBERS OF OUR BOARD OF DIRECTORS, THE

DEALER MANAGER, THE INFORMATION AGENT OR THE DEPOSITARY HAS AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION ON OUR BEHALF AS TO

WHETHER YOU SHOULD TENDER OR REFRAIN FROM TENDERING YOUR SHARES OR AS TO THE PURCHASE PRICE OR PURCHASE PRICES AT WHICH YOU MAY

CHOOSE TO TENDER YOUR SHARES. NONE OF THE COMPANY, THE MEMBERS OF OUR BOARD OF DIRECTORS, THE DEALER MANAGER, THE INFORMATION AGENT

OR THE DEPOSITARY HAS AUTHORIZED ANY PERSON TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION IN CONNECTION WITH THE OFFER

OTHER THAN THOSE CONTAINED IN THIS OFFER TO PURCHASE OR IN THE LETTER OF TRANSMITTAL. YOU SHOULD NOT RELY ON ANY RECOMMENDATION,

OR ANY SUCH REPRESENTATION OR INFORMATION, AS HAVING BEEN AUTHORIZED BY US, ANY MEMBER OF OUR BOARD OF DIRECTORS, THE DEALER MANAGER,

THE INFORMATION AGENT OR THE DEPOSITARY.

THE STATEMENTS MADE IN THIS OFFER TO PURCHASE ARE MADE AS

OF THE DATE ON THE COVER PAGE, AND THE STATEMENTS INCORPORATED BY REFERENCE ARE MADE AS OF THE DATE OF THE DOCUMENTS INCORPORATED

BY REFERENCE. THE DELIVERY OF THIS OFFER TO PURCHASE AND THE RELATED LETTER OF TRANSMITTAL SHALL NOT UNDER ANY CIRCUMSTANCES CREATE

ANY IMPLICATION THAT THE INFORMATION CONTAINED HEREIN OR INCORPORATED BY REFERENCE IS CORRECT AS OF A LATER DATE OR THAT THERE

HAS NOT BEEN ANY CHANGE IN SUCH INFORMATION OR IN OUR AFFAIRS SINCE SUCH DATES, except

that we will, to the extent required by Rule 13e-4 under the Exchange Act, amend the Tender Offer Statement on Schedule TO (the

“Schedule TO”), of which this Offer to Purchase forms a part, to reflect any material change in the information previously

disclosed, including any information incorporated by reference into this schedule to.

The Dealer Manager is acting exclusively for the Company

and no one else in connection with this Offer to Purchase and the Offer and will not regard any other person (whether or not a

recipient of this Offer to Purchase) as its client in relation to this Offer to Purchase or the Offer and accordingly will not

be responsible to anyone other than the Company for providing the protections afforded to its clients, or for providing advice

in connection with the Offer, the contents of this Offer to Purchase or any other transaction, arrangement or other matter referred

to in this Offer to Purchase as relevant. Neither the Dealer Manager nor any persons associated or affiliated with the Dealer Manager

accepts any responsibility whatsoever or makes any warranty or representation, express or implied, in relation to the contents

of this Offer to Purchase, including its accuracy, completeness or verification, or for any other statement made or purported to

be made by or on behalf of it, the Company or the Company’s directors in connection with the Company and/or the Offer, and

the Dealer Manager accordingly disclaims, to the fullest extent permitted by law, any and all liability whatsoever, whether arising

in tort, contract or otherwise (save as referred to above) which it might otherwise be found to have in respect of this Offer to

Purchase or any such statement.

TABLE OF CONTENTS

| |

|

Page |

| |

|

|

| 1. |

Number of Shares; Price; Proration. |

14 |

| |

|

|

| 2. |

Purpose of the Offer; Certain Effects of the Offer; Plans and Proposals |

17 |

| |

|

|

| 3. |

Procedures for Tendering Shares |

18 |

| |

|

|

| 4. |

Withdrawal Rights |

22 |

| |

|

|

| 5. |

Purchase of Shares and Payment of Purchase Price |

23 |

| |

|

|

| 6. |

Conditional Tender of Shares |

24 |

| |

|

|

| 7. |

Conditions of the Offer |

24 |

| |

|

|

| 8. |

Price Range of Shares; Dividends |

26 |

| |

|

|

| 9. |

Source and Amount of Funds |

27 |

| |

|

|

| 10. |

Certain Information Concerning Us |

27 |

| |

|

|

| 11. |

[Reserved.] |

29 |

| |

|

|

| 12. |

Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares |

29 |

| |

|

|

| 13. |

Certain Legal Matters; Regulatory Approvals |

36 |

| |

|

|

| 14. |

United States Federal Income Tax Consequences |

36 |

| |

|

|

| 15. |

Extension of the Offer; Termination; Amendment |

41 |

| |

|

|

| 16. |

Fees and Expenses |

42 |

| |

|

|

| 17. |

Miscellaneous |

43 |

SUMMARY TERM SHEET

We are providing this summary term sheet for your convenience.

The information contained in this Summary Term Sheet is a summary only and is not meant to be a substitute for the more detailed

description and information contained in the remainder of this Offer to Purchase, the accompanying Letter of Transmittal and other

related materials as may be amended or supplemented from time to time. To understand the Offer fully and for a more complete

description of the terms of the Offer, we urge you to read carefully this Offer to Purchase, the Letter of Transmittal and the

other related materials that constitute part of the Offer in their entirety. We have included references to the sections of

this Offer to Purchase where you will find a more complete description of the topics in this summary.

Who is offering to purchase my Shares?

The issuer of the Shares, OneSpan Inc., a Delaware corporation,

is offering to purchase your Shares. See Section 1.

What is OSPN offering to purchase?

We are offering to purchase up to $20 million of our Shares

based on the Purchase Price. See Section 1.

In accordance with the rules of the SEC, if more than $20 million

in aggregate purchase price of Shares is tendered in the Offer at or below the Purchase Price, we may increase the number of Shares

accepted for payment in the Offer by no more than 2% of the outstanding Shares without extending the Expiration Date. See Section

1.

What is the purpose of the Offer?

We believe that the repurchase of Shares pursuant to the Offer

will allow us to return value to our shareholders and that doing so for this purpose is a prudent use of our financial resources.

The Offer is also consistent with our current operational model and strategic direction, including our plans to return excess capital

to our shareholders. In addition, the Offer is being conducted as part of the $50 million share repurchase program previously approved

by our Board of Directors in May 2022. The Offer provides a mechanism for completing a sizeable repurchase of Shares more rapidly

than would be possible through open market repurchases under such program.

The modified Dutch auction tender offer set forth in this Offer

to Purchase provides our shareholders with the opportunity to tender all or a portion of their Shares and thereby receive a return

of some or all of their investment in the Company, if they so elect.

The Offer also provides our shareholders with an efficient way

to sell their Shares without incurring brokerage fees or commissions associated with open market sales; however, shareholders who

hold Shares through nominees are urged to consult their nominees to determine whether transaction costs may apply.

If we complete the Offer, shareholders who do not participate

in the Offer and who otherwise do not sell their shares will automatically increase their relative percentage ownership interest

in the Company and its future operations at no additional cost to them. These shareholders will also bear the attendant risks and

rewards associated with owning the equity securities of the Company. See Section 2.

How many Shares will we purchase in the Offer?

Upon the terms and subject to the conditions of the Offer, we

will purchase up to $20 million of Shares based on the Purchase Price in the Offer or a lower amount depending on the number of

Shares properly tendered and not properly withdrawn pursuant to the Offer. Because the Purchase Price will be determined after

the Expiration Date, the exact number of Shares that will be purchased will not be known until after that time. We will select

the lowest single purchase price, not greater than $11.00 nor less than $9.50 per Share, that will allow us to purchase the maximum

number of Shares for an aggregate purchase price not exceeding $20 million. All Shares purchased in the Offer will be purchased

at the Purchase Price, including Shares tendered at a price lower than the Purchase Price, subject to “Odd Lot” priority,

proration and the conditional tender provisions described in this Offer to Purchase.

As of November 9, 2023, we had 39,887,336 issued and outstanding

Shares. At the minimum Purchase Price of $9.50 per Share, we would purchase 2,105,263 Shares if the Offer is fully subscribed,

which would represent approximately 5.3% of our outstanding Shares as of November 9, 2023. At the maximum Purchase Price of $11.00

per Share, we would purchase 1,818,181 Shares if the Offer is fully subscribed, which would represent approximately 4.6% of our

outstanding Shares as of November 9, 2023. If the Offer is fully subscribed at the minimum Purchase Price, we would have approximately

37,782,073 Shares outstanding immediately following the purchase of Shares tendered in the Offer. If the Offer is fully subscribed

at the maximum Purchase Price, we would have approximately 38,069,155 Shares outstanding immediately following the purchase of

Shares tendered in the Offer. The actual number of Shares outstanding immediately following completion of the Offer will depend

on the number of Shares tendered and purchased in the Offer, as well as the Purchase Price for such Shares. As of November 9, 2023,

an aggregate of approximately 562,362 Shares remained available for future awards under the Equity Incentive Plan. See Section

12.

We reserve the right to purchase additional Shares in the Offer,

subject to applicable law. See Section 1. In accordance with the rules of the SEC, if more than $20 million purchase price of Shares

is tendered in the Offer at or below the Purchase Price, we may increase the number of Shares accepted for payment in the Offer

by no more than 2% of the outstanding Shares without extending the Expiration Date. See Section 1.

The Offer is not conditioned on any minimum number of Shares

being tendered; however, the Offer is subject to certain other conditions. See Section 7.

What will be the purchase price for the Shares and what will

be the form of payment?

We are conducting the Offer through a procedure commonly called

a modified “Dutch auction.” This procedure allows you to select the price, within a price range specified by us, at

which you are willing to tender your Shares. The price range for the Offer is $9.50 to $11.00 per Share. We will select the single

lowest purchase price (in increments of $0.10), not greater than $11.00 nor less than $9.50 per Share, that will allow us to purchase

up to $20 million in value of Shares at such price, based on the number of Shares tendered, or, if fewer Shares are properly tendered,

all Shares that are properly tendered and not properly withdrawn. We will purchase all Shares at the Purchase Price, even if you

have selected a purchase price lower than the Purchase Price, but we will not purchase any Shares tendered at a price above the

Purchase Price. However, because of the “Odd Lot” priority, proration and conditional tender provisions described in

this Offer to Purchase, it is possible that not all of the Shares tendered at or below the Purchase Price will be purchased if

Shares having an aggregate purchase price in excess of $20 million are properly tendered at or below the Purchase Price and not

properly withdrawn.

If you wish to maximize your chances of having your Shares purchased

in the Offer, you should check the box in the subsection captioned “Shares Tendered At A Price Determined Pursuant to the

Offer” (below the subsection captioned “Price (in Dollars) Per Share At Which Shares Are Being Tendered”) in

the Letter of Transmittal, which will indicate that you will accept the Purchase Price as determined by us in accordance with the

terms and subject to the conditions of the Offer. If you agree to accept the Purchase Price, your Shares will be deemed to have

been tendered at the minimum price of $9.50 per Share. You should understand that this election may have the effect of lowering

the Purchase Price and could result in your Shares being purchased at $9.50 per Share, which is the low end of the price range

in the Offer, less any applicable withholding taxes and without interest, a price that is below the last reported sale price of

the Shares on Nasdaq on November 10, 2023, the last full trading day prior to the commencement of the Offer, which was $9.52 per

Share, and could be below the last reported sale price of the Shares on Nasdaq on the Expiration Date. Accordingly, an election

to accept the Purchase Price determined in the Offer may lower the Purchase Price to a price below such closing price and could

be below the reported closing price on the Expiration Date. Under no circumstances will we pay interest on the Purchase Price,

even if there is a delay in making payment. See the Introduction, Section 1 and Section 3.

We will publicly announce the Purchase Price promptly after

we have determined it. On the terms and subject to the conditions of the Offer (including the “Odd Lot” priority, proration

and conditional tender provisions), as promptly as practicable following the Expiration Date, we will pay the Purchase Price in

cash, less any applicable withholding taxes and without interest, to all holders of Shares who have properly tendered (and have

not properly withdrawn) their Shares that have been accepted for payment at prices equal to or less than the Purchase Price. See

Section 1.

Shareholders are urged to obtain current market quotations

for the Shares before deciding whether and at what price or prices to tender their Shares. See Section 8.

How will we fund the purchase of the Shares?

The maximum value of Shares purchased in the Offer will be $20

Million. We expect that the maximum aggregate cost of this purchase, including all fees and expenses applicable to the Offer, to

be approximately $20.5 million. We expect to use our existing cash reserve to fund the purchase of the Shares. See Section 9.

In accordance with the SEC rules, we may increase the number

of Shares accepted for payment in the Offer by no more than 2% of the outstanding Shares without extending the Expiration Date.

See Section 1.

How long do I have to tender my Shares?

You may tender your Shares until the Offer expires. The Offer

will expire at 12:00 Midnight, at the end of the day, New York City time, on December 11, 2023, unless we extend or terminate the

Offer. The term Expiration Date refers to the specific time and date on which the Offer expires. See Section 1. We may choose to

extend the Offer at any time and for any reason, subject to applicable laws. We cannot assure you, however, that we will extend

the Offer or, if we extend it, for how long. See Section 1 and Section 15.

Beneficial owners holding their Shares through a broker, dealer,

commercial bank, trust company or other nominee should be aware that their broker, dealer, commercial bank, trust company or other

nominee may establish its own earlier deadlines for you to instruct it to accept the Offer on your behalf. Accordingly, beneficial

owners wishing to participate in the Offer should contact their broker, dealer, commercial bank, trust company or other nominee

as soon as possible in order to determine the times by which such owner must take action in order to participate in the Offer.

We urge you to contact the broker, dealer, commercial bank, trust company or other nominee that holds your Shares to find out its

deadline. See Section 3.

Can the Offer be extended, amended or terminated, and if

so, under what circumstances?

Yes. We can extend or amend the Offer in our sole discretion

at any time, subject to applicable laws. If we extend the Expiration Date for the Offer, we will delay the acceptance of any Shares

that have been tendered. See Section 15. We can also terminate the Offer under certain circumstances, as provided in this Offer

to Purchase, and subject to applicable law. See Section 7.

How will I be notified if you extend the Offer or amend the

terms of the Offer?

If we extend the Offer, we will issue a press release not later

than 9:00 a.m., New York City time, on the first (1st) business day after the previously scheduled Expiration Date. If we extend

the Offer, you may withdraw your Shares until the Expiration Date, as extended. We will announce any amendment to the terms of

the Offer by making a public announcement of the amendment and filing our Issuer Tender Offer Statement on Schedule TO (the “Schedule

TO”). See Section 15.

Are there any conditions to the Offer?

Yes. Our obligation to accept for payment and pay for your

tendered Shares depends upon a number of conditions that must be satisfied in our reasonable judgement or waived on or prior to the

Expiration Date, including but not limited to:

| ● | no

legal action shall have been threatened, pending or taken that might adversely affect the Offer; |

| ● | no

general suspension of trading in, or limitation on prices for, securities on any United States national securities exchange or

in the over-the-counter market, declaration of a banking moratorium or any suspension of payments in respect of banks in the United

States shall have occurred; |

| ● | no

decrease of more than 10% in the sale price of the Shares on Nasdaq or in the general level of market prices for equity securities

in the United States of the New York Stock Exchange Index, the Dow Jones Industrial Average, the Nasdaq Global Market Composite

Index or Standard & Poor’s Composite Index of 500 Industrial Companies, in each case measured as of the close of trading

and from the close of trading on November 10, 2023, the last full trading day prior to the commencement of the Offer, shall have

occurred; |

| ● | no

commencement of a war, armed hostilities or other similar national or international calamity, including, but not limited to, an

act of terrorism, directly or indirectly involving the United States, on or after November 10, 2023 shall have occurred nor shall

any material escalation of any war or armed hostilities which had commenced prior to November 10, 2023 have occurred; |

| ● | no

limitation, whether or not mandatory, by any governmental, regulatory or administrative agency or authority on, or any event that, in our reasonable judgement,

could materially affect, the extension of credit by banks or other lending institutions in the United States shall have occurred; |

| ● | no

change in the general political, market, economic or financial conditions, domestically or internationally, that is reasonably

likely to materially and adversely affect our business or the trading in the Shares shall have occurred or, in the case of any

of the foregoing existing at the time of the commencement of the Offer, shall have materially accelerated or worsened; |

| ● | no

person shall have proposed, announced or taken certain actions that could lead to the acquisition of us or a change of control

transaction; |

| ● | no change or changes in

our or our subsidiaries’ business, condition (financial or otherwise), properties, assets, income, operations or prospects

shall have occurred or shall have been threatened on or after November 10, 2023 that, in our reasonable judgment, has or could have

a material adverse effect on us or any of our subsidiaries or that could materially adversely affect the benefits of the Offer to

us; |

| ● | any

approval, permit, authorization, favorable review or consent of any governmental entity required to be obtained in connection

with the Offer shall have been obtained on terms satisfactory to us in our reasonable discretion; and |

| ● | we

shall not have determined that as a result of the consummation of the Offer and the purchase of Shares that there will be a reasonable

likelihood that the Shares will be delisted from Nasdaq or be eligible for deregistration under the Exchange Act. |

For a more detailed discussion of these and other conditions

to the Offer, please see Section 7.

The Offer is not conditioned on any minimum number of Shares

being tendered.

How do I tender my Shares?

If you want to tender all or part of your Shares, you must do

one of the following by the Expiration Date:

|

● |

if your Shares are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, contact the nominee and request that the nominee tender your Shares for you. Beneficial owners should be aware that their broker, dealer, commercial bank, trust company or other nominee may establish its own earlier deadlines for participation in the Offer. Accordingly, beneficial owners wishing to participate in the Offer should contact their broker, dealer, commercial bank, trust company or other nominee as soon as possible in order to determine the times by which such owner must take action in order to participate in the Offer; |

|

● |

if you hold certificates or book-entry Shares registered in your own name, complete and sign a Letter of Transmittal according to its instructions, and deliver it, together with any required signature guarantees, the certificates for your Shares and any other documents required by the Letter of Transmittal, to Broadridge Corporate Issuer Solutions, LLC, the Depositary for the Offer, at the address appearing on the back cover page of this Offer to Purchase; |

|

● |

if you are a Book-Entry Transfer Facility, tender your Shares according to the procedure for book-entry transfer described in Section 3; or |

|

● |

we are not offering, as part of the Offer, to purchase restricted stock units outstanding under the Equity Incentive Plan that have not vested or that are subject to restrictions as of the Expiration Date, and tenders of such unvested restricted stock units will not be accepted. If you are a holder of restricted stock units outstanding under an Equity Incentive Plan, you may only tender the Shares underlying such awards if they have vested and you have received the underlying Shares free of restrictions on the transfer of such Shares prior to the Expiration Date. |

If you wish to tender your Shares, but (a) the certificates

for your Shares are not immediately available or cannot be delivered to the Depositary by the Expiration Date, (b) you cannot comply

with the procedure for book-entry transfer by the Expiration Date, or (c) your other required documents cannot be delivered to

the Depositary by the Expiration Date, you can still tender your Shares if you comply with the guaranteed delivery procedures described

in Section 3.

We are not soliciting any Shares in the Offer in any jurisdiction where

it would be illegal to do so, provided that we will comply with the requirements of Rule 13e-4(f)(8) promulgated under the Exchange Act.

Validly tendered shares will be accepted from all holders wherever located. We may, at our discretion, take any actions necessary for

us to make the Offer to holders of Shares in any such jurisdiction in compliance with applicable laws. In any jurisdiction where the securities

or blue sky laws require the Offer to be made by a licensed broker or dealer, the Offer is being made on our behalf by the Dealer Manager

or one or more registered brokers or dealers, which are licensed under the laws of such jurisdiction.

You may contact the Information Agent, the Dealer Manager or

your broker, dealer, commercial bank, trust company or other nominee for assistance. The contact information for the Information

Agent and the Dealer Manager is set forth on the back cover of this Offer to Purchase. See Section 3 and the Instructions to the

Letter of Transmittal.

If you are in any doubt as to the action you should take, it

is recommended that you seek your own personal financial advice from your stockbroker, bank manager, lawyer, accountant or other

independent professional financial adviser immediately.

Once I have tendered Shares in the Offer, may I withdraw

my tendered Shares?

Yes. You may withdraw any Shares you have tendered at any time

prior to the Expiration Date. If, following the Expiration Date, we have not accepted for payment the Shares you have tendered

to us, you may also withdraw such previously tendered Shares at any time after 12:00 Midnight, at the end of the day, New York

City time, on January 8, 2023. See Section 4.

How do I withdraw Shares I previously tendered?

If you are a registered holder of Shares, to properly withdraw

your Shares, you must deliver on a timely basis a written notice of your withdrawal to the Depositary at one of the addresses appearing

on the back cover of this Offer to Purchase. Your notice of withdrawal must specify your name, the number of Shares to be withdrawn

and the name of the registered holder of the Shares. Some additional requirements apply if the certificates for Shares to be withdrawn

have been delivered to the Depositary or if your Shares have been tendered under the procedure for book-entry transfer set forth

in Section 3. If you hold Shares through a broker, dealer, commercial bank, trust company or similar institution, you should consult

that institution on the procedures you must comply with and the time by which such procedures must be completed in order for that

institution to provide a written notice of withdrawal. See Section 4.

May I tender only a portion of the Shares that I hold?

Yes. You do not have to tender all or any minimum amount of

the Shares that you own to participate in the Offer. However, to qualify for the priority in case of proration, an Odd Lot Holder

(as defined below) must tender all Shares owned by any such Odd Lot Holder, as described in Section 1. In addition, if as a result

of proration the Company accepts conditional tenders by random lot, a holder making a conditional tender must have tendered all

of its shares to qualify for such random selection.

In what order will you purchase the tendered Shares?

If the terms and conditions of the Offer have been satisfied

or waived and $20 million in aggregate purchase price of Shares or less is properly tendered and not properly withdrawn prior to

the Expiration Date, we will buy all Shares properly tendered at prices at or below the Purchase Price and not properly withdrawn.

If the conditions to the Offer have been satisfied or waived

and more than $20 million in aggregate purchase price of Shares has been properly tendered and not properly withdrawn prior to

the Expiration Date, we will purchase Shares on the following basis:

|

● |

first, we will purchase Odd Lots (as defined in Section 1) of fewer than 100 Shares at the Purchase Price from shareholders who properly tender all of their Shares at or below the Purchase Price and who do not properly withdraw them before the Expiration Date. Tenders of less than all of the Shares owned, beneficially or of record, by such Odd Lot Holder (as defined in Section 1) will not qualify for this preference; |

|

● |

second, after purchasing all Odd Lots that were properly tendered at or below the Purchase Price, subject to the conditional tender provisions described in Section 6 (whereby a holder may specify a minimum number of such holder’s Shares that must be purchased if any such Shares are purchased), we will purchase all Shares properly tendered at or below the Purchase Price on a pro rata basis with appropriate adjustment to avoid purchases of fractional Shares; and |

|

● |

third, only if necessary to permit us to purchase $20 million in aggregate purchase price of Shares (or such greater amount as we may elect to purchase, subject to applicable law), we will purchase Shares conditionally tendered (for which the condition was not initially satisfied) at or below the Purchase Price, by random lot, to the extent feasible. To be eligible for purchase by random lot, shareholders whose Shares are conditionally tendered must have tendered all of their Shares at or below the Purchase Price. |

Therefore, because of “Odd Lot” priority, proration

and conditional tender provisions described above, we may not purchase all of the Shares that you tender even if you tender them

at or below the Purchase Price if Shares having an aggregate purchase price in excess of $20 million are properly tendered (and

not properly withdrawn) at or below the Purchase Price. See Section 1 and Section 6.

Has the Company or its Board of Directors adopted a position

on the Offer?

Our Board of Directors has authorized us to make the Offer.

However, none of the Company, the members of our Board of Directors, the Dealer Manager, the Information Agent or the Depositary

makes any recommendation to you as to whether you should tender or refrain from tendering your Shares or as to the purchase price

or purchase prices at which you may choose to tender your Shares. We cannot predict how the Shares will trade after the Expiration

Date, and it is possible that the price of our Shares will trade above the Purchase Price after the Expiration Date. You must make

your own decision as to whether to tender your Shares and, if so, how many Shares to tender and the purchase price or purchase

prices at which you will tender them. We recommend that you carefully read the information in this Offer to Purchase, the Letter

of Transmittal and the other related materials that constitute part of the Offer, including our reasons for making the Offer, before

taking any action with respect to the Offer. See Section 2. In addition, you should discuss whether to tender your Shares with

your broker or other financial, legal or tax advisors.

If I decide not to tender, how will the Offer affect my Shares?

Shareholders who decide not to tender will own a greater percentage

interest in the outstanding Shares following the consummation of the Offer. See Section 2.

Following the Offer, will you continue as a public company?

Yes. The Shares will continue to be listed on Nasdaq and we

will continue to be subject to the periodic reporting requirements of the Exchange Act. See Section 2.

When and how will you pay me for the Shares I tender?

If your Shares are accepted for purchase in the Offer, we will

pay the Purchase Price to you, in cash, less applicable withholding taxes and without interest, promptly after the Expiration Date.

We will announce the preliminary results of the Offer, including price and preliminary information about any expected proration,

on the next business day following the Expiration Date. We do not expect, however, to announce the final results of any proration

or the Purchase Price and to begin paying for tendered Shares until after the Expiration Date and the guaranteed delivery period.

We will pay for the Shares accepted for purchase by depositing the aggregate purchase price with the Depositary promptly after

the Expiration Date. The Depositary will act as your agent and will transmit to you the payment for all of your Shares accepted

for payment. See Section 1 and Section 5.

If I am a holder of restricted stock units, how do I participate

in the Offer?

We are not offering, as part of the Offer, to purchase restricted

stock units outstanding under any Equity Incentive Plan that have not vested or that are subject to restrictions as of the Expiration

Date, and tenders of such unvested restricted stock units will not be accepted. If you are a holder of restricted stock units outstanding

under an Equity Incentive Plan, you may only tender the Shares underlying such awards if they have vested and you have received

the underlying Shares free of restrictions on the transfer of such Shares prior to the Expiration Date. See Section 3.

What is the last reported sale price of my Shares?

The Shares are listed and traded on Nasdaq under the symbol

“OSPN.” On November 10, 2023 the last full trading day before the commencement of the Offer, the last reported sale

price of the Shares on Nasdaq was $9.52 per Share, which is above the $9.50 per Share lower end of the price range for the Offer.

Accordingly, an election to accept the Purchase Price determined in the Offer may lower the Purchase Price to a price below such

closing price and could be below the reported closing price on the Expiration Date. You are urged to obtain current market quotations

for the Shares before deciding whether and at what purchase price or purchase prices to tender your Shares. See Section 8.

Will I have to pay brokerage commissions if I tender my Shares?

If you are a registered shareholder and you tender your Shares

directly to the Depositary, you will not incur any brokerage commissions. If you hold Shares through a broker, dealer, commercial

bank, trust company or other nominee, we urge you to consult your broker, dealer, commercial bank, trust company or other nominee

to determine whether any transaction costs are applicable. See the Introduction and Section 3.

Will I have to pay share transfer tax if I tender my Shares?

If you instruct the Depositary in the Letter of Transmittal

to make the payment for tendered Shares to the registered holder of such Shares, you will not incur any share transfer tax. If

you give special instructions to the Depositary in connection with your tender of Shares, or if tendered certificates for Shares

are registered in the name of someone other than the person signing the Letter of Transmittal, then share transfer taxes may apply.

See Section 5.

What are the U.S. federal income tax consequences if I tender

my Shares?

Generally, if you are a U.S. Holder (as defined in Section 14),

your receipt of cash from us in exchange for the Shares you tender will be a taxable transaction for U.S. federal income tax purposes.

The cash you receive for your tendered Shares will generally be treated for U.S. federal income tax purposes either as consideration

received in respect of a sale or exchange of the Shares purchased by us or as a distribution from us in respect of Shares. See

Section 14 for a more detailed discussion of the tax treatment of the Offer. We urge you to consult your tax advisor as to the

particular tax consequences to you of the Offer. If you are a Non-U.S. Holder (as defined in Section 14), because it is unclear

whether the cash you receive in connection with the Offer will be treated (i) as proceeds of a sale or exchange or (ii) as a distribution,

the Depositary or other applicable withholding agent may treat such payment as a dividend distribution for withholding purposes.

Accordingly, if you are a Non-U.S. Holder, you may be subject to withholding on payments to you at a rate of 30% of the gross proceeds

paid, unless you establish an entitlement to a reduced or zero rate of withholding by timely completing, under penalties of perjury,

the applicable Form W-8. See Section 14 for a more detailed discussion of the tax treatment of the Offer. Non-U.S. Holders are

urged to consult their tax advisors regarding the application of U.S. federal income tax withholding and backup withholding, including

eligibility for a withholding tax reduction or exemption and the refund procedure.

What is the accounting treatment of the Offer?

The accounting for our purchase of Shares in the Offer will

result in a reduction of our total equity in an amount equal to the aggregate purchase price of the Shares we purchase plus the

fees and any estimated excise taxes due, a corresponding reduction in cash and cash equivalents and a reduction in the weighted

average number of outstanding Shares for the purposes of calculating earnings per Share in an amount equal to the weighted average

number of Shares that we repurchase pursuant to the Offer. See Section 2.

Does the Company or any of its affiliates intend to repurchase

any Shares other than pursuant to the Offer during or after the Offer?

Rule 13e-4(f) under the Exchange Act prohibits us and our affiliates

from purchasing any Shares, other than in the Offer, until at least ten (10) business days have elapsed after the Expiration Date.

Accordingly, any additional purchases outside the Offer may not be consummated until at least ten (10) business days have elapsed

after the Expiration Date. To our knowledge, none of our affiliates intend to tender any shares in the Offer; however, there can

be no assurance that such intent will not change prior to the termination of the Offer.

What will happen to the Company’s existing share repurchase

program?

Our Board of Directors has authorized the repurchase of up to

$50 million Shares under our share repurchase program. As of November 9, 2023, $40.8 million Shares remained available for repurchase

under the program, and the Offer is being conducted as part of the repurchase program.

Prior to the eleventh business day after the Expiration Date,

we will not repurchase any Shares under the share repurchase program except repurchases pursuant to the Offer. After such date,

we may make Share repurchases from time to time on the open market and/or in private transactions, including accelerated share

repurchase transactions. Whether we make additional repurchases will depend on many factors, including, without limitation, the

number of Shares, if any, that we purchase in this Offer, our business and financial performance and situation, the business and

market conditions at the time, including the price of the Shares, and such other factors as we may consider relevant. Any of these

repurchases may be on the same terms or on terms that are more or less favorable to the selling stockholders in those transactions

than the terms of the Offer.

Whom should I contact with questions about the Offer?

The Information Agent or the Dealer Manager can help answer

your questions. The Information Agent is Broadridge Corporate Issuer Solutions, LLC and the Dealer Manager is B. Riley Securities,

Inc. Their contact information is set forth below.

The Information Agent for the Offer is:

Broadridge Corporate Issuer Solutions,

LLC

(855) 793-5068 (toll-free)

shareholder@Broadridge.com

The Dealer Manager for the Offer is:

B. Riley Securities, Inc.

11100 Santa Monica Boulevard #800

Los Angeles, CA 90025

Phone: (310) 966-1444

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING

STATEMENTS

This Offer to Purchase and other documents we file with the

SEC that are incorporated by reference in this Offer to Purchase contain “forward-looking statements.” Forward-looking

statements can be identified by words such as “believe,” “estimate,” “expect,” “intend,”

“plan,” “project,” “may,” “will,” “might,” “should,” “could,”

“would,” “seek,” “pursue,” and “anticipate” or the negative or other variation

of these or similar words or may include discussions of strategy or risks and uncertainties. We describe certain risks, uncertainties

and assumptions that could affect the outcome or results of operations in the “Risk Factors” section of (i) our Annual

Report on Form 10-K for the fiscal year ended December 31, 2022 and (ii) any subsequently filed Annual Report on Form 10-K, Quarterly

Report on Form 10-Q, and Current Reports on Form 8-K.

Forward-looking statements are based on our current expectations

and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Our actual

results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical

fact nor guarantees or assurances of future performance. Therefore, we caution you against relying on any of these forward-looking

statements.

For further information on factors that could cause actual results

to materially differ from expectations, please see the Company’s publicly available SEC filings, including the Company’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on February 28, 2023 and Quarterly Reports

on Form 10-Q for the fiscal periods ended March 31, 2023, June 30, 2023 and September 30, 2023, filed with the SEC on May 4, 2023,

August 9, 2023 and November 8, 2023, respectively. The Company does not update any of its forward-looking statements except as

required by law.

INTRODUCTION

To the holders of our Shares:

We are offering to purchase up to $20 million in aggregate purchase

price of our Shares at a price calculated as described herein that is a price not greater than $11.00 nor less than $9.50 per Share

to the seller in cash, less any applicable withholding taxes and without interest, upon the terms and subject to the conditions

described in this Offer to Purchase, in the related Letter of Transmittal and in other related materials as may be amended or supplemented

from time to time.

Upon the terms and subject to the conditions of the Offer, we

will determine a single per Share price that we will pay for Shares properly tendered and not properly withdrawn from the Offer,

taking into account the total number of Shares properly tendered and the prices specified, or deemed specified, by tendering shareholders.

This Purchase Price will be the lowest single purchase price (in increments of $0.10), not greater than $11.00 nor less than $9.50

per Share, that would allow us to purchase the maximum number of Shares for an aggregate purchase price not exceeding $20 million,

or all Shares properly tendered and not properly withdrawn in the event that less than $20 million in aggregate purchase price

of Shares is properly tendered and not properly withdrawn.

We may not purchase all of the Shares tendered at or below the

Purchase Price because of proration, “Odd Lot” priority and conditional tender provisions described in this Offer to

Purchase.

Upon the terms and subject to the conditions of the Offer, if

$20 million in aggregate purchase price of Shares or less is properly tendered and not properly withdrawn, we will purchase all

Shares properly tendered at or below the Purchase Price and not properly withdrawn prior to the Expiration Date. Shares not purchased

in the Offer, including Shares tendered at prices in excess of the Purchase Price and Shares not purchased because of proration

or conditional tender, will be returned to the tendering shareholders promptly after the Expiration Date. See Section 1.

We reserve the right, in our sole discretion, to change the

per Share purchase price range and to increase or decrease the number of Shares sought in the Offer, subject to applicable law.

In accordance with the rules of the SEC, if more than $20 million in aggregate purchase price of Shares is tendered in the Offer

at or below the Purchase Price, we may increase the number of Shares accepted for payment in the Offer by no more than 2% of the

outstanding Shares without extending the Expiration Date. See Section 1.

THE OFFER IS NOT CONDITIONED ON ANY MINIMUM NUMBER OF SHARES

BEING TENDERED. THE OFFER IS, HOWEVER, SUBJECT TO CERTAIN OTHER CONDITIONS. SEE SECTION 7.

OUR BOARD OF DIRECTORS HAS AUTHORIZED US TO MAKE THE OFFER.

HOWEVER, NONE OF THE COMPANY, THE MEMBERS OF OUR BOARD OF DIRECTORS, THE DEALER MANAGER, THE INFORMATION AGENT OR THE DEPOSITARY,

MAKES ANY RECOMMENDATION TO YOU AS TO WHETHER YOU SHOULD TENDER OR REFRAIN FROM TENDERING YOUR SHARES OR AS TO THE PURCHASE PRICE

OR PURCHASE PRICES AT WHICH YOU MAY CHOOSE TO TENDER YOUR SHARES. NEITHER WE NOR ANY MEMBER OF OUR BOARD OF DIRECTORS, THE DEALER

MANAGER, THE INFORMATION AGENT OR THE DEPOSITARY HAS AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION WITH RESPECT TO THE OFFER.

YOU MUST MAKE YOUR OWN DECISION AS TO WHETHER TO TENDER YOUR SHARES AND, IF SO, HOW MANY SHARES TO TENDER AND THE PURCHASE PRICE

OR PURCHASE PRICES AT WHICH YOU WILL TENDER THEM. WE RECOMMEND THAT YOU CONSULT YOUR OWN FINANCIAL, LEGAL AND TAX ADVISORS, AND

READ CAREFULLY AND EVALUATE THE INFORMATION IN THIS OFFER TO PURCHASE AND IN THE LETTER OF TRANSMITTAL, INCLUDING OUR REASONS FOR

MAKING THE OFFER, BEFORE TAKING ANY ACTION WITH RESPECT TO THE OFFER. SEE SECTION 2.

We will pay all reasonable out-of-pocket fees and expenses incurred

in connection with the Offer by the Dealer Manager, the Information Agent and the Depositary. See Section 16.

As of November 9, 2023, we had 39,887,336 issued and outstanding

Shares. At the minimum Purchase Price of $9.50 per Share, we would purchase 2,105,263 Shares if the Offer is fully subscribed,

which would represent approximately 5.3% of our outstanding Shares as of November 9, 2023. At the maximum Purchase Price of $11.00

per Share, we would purchase 1,818,181 Shares if the Offer is fully subscribed, which would represent approximately 4.6% of our

outstanding Shares as of November 9, 2023. If the Offer is fully subscribed at the minimum Purchase Price, we would have approximately

37,782,073 Shares outstanding immediately following the purchase of Shares tendered in the Offer. If the Offer is fully subscribed

at the maximum Purchase Price, we would have approximately 38,069,155 Shares outstanding immediately following the purchase of

Shares tendered in the Offer. The actual number of Shares outstanding immediately following completion of the Offer will depend

on the number of Shares tendered and purchased in the Offer, as well as the Purchase Price for such Shares. As of November 9, 2023,

an aggregate of approximately 562,362 Shares remained available for future awards under the Equity Incentive Plan. See Section

12.

The Shares are listed and traded on Nasdaq under the symbol

“OSPN.” On November 10, 2023, the last full trading day prior to the commencement of the Offer, the last reported sale

price of the Shares was $9.52 per Share, which is above the $9.50 per Share lower end of the price range for the Offer. Accordingly,

an election to accept the Purchase Price determined in the Offer may lower the Purchase Price to a price below such closing price

and could be below the reported closing price on the Expiration Date. Shareholders are urged to obtain current market quotations

for the Shares before deciding whether and at what purchase price or purchase prices to tender their Shares. See Section 8 and

Section 12.

We are not soliciting any Shares in the Offer in any jurisdiction where

it would be illegal to do so, provided that we will comply with the requirements of Rule 13e-4(f)(8) promulgated under the Exchange Act.

Validly tendered shares will be accepted from all holders wherever located. We may, at our discretion, take any actions necessary for

us to make the Offer to holders of Shares in any such jurisdiction in compliance with applicable laws. In any jurisdiction where the securities

or blue sky laws require the Offer to be made by a licensed broker or dealer, the Offer is being made on our behalf by the Dealer Manager

or one or more registered brokers or dealers, which are licensed under the laws of such jurisdiction.

The address of the Company’s principal executive office

is 1 Marina Park Drive, Unit 1410, Boston, MA 02210 and the telephone number of the Company’s principal executive office

is (312) 766-4001.

THE OFFER

|

1. |

Number of Shares; Price; Proration. |

Upon the terms and subject to the conditions of the Offer, we

will purchase $20 million in aggregate purchase price of Shares, or all Shares properly tendered and not properly withdrawn in

the event that less than $20 million in aggregate purchase price of Shares is properly tendered and not properly withdrawn. Upon

the terms and subject to the conditions of the Offer, if $20 million in aggregate purchase price of Shares or less is properly

tendered at or below the Purchase Price and not properly withdrawn prior to the Expiration Date, we will purchase all Shares properly

tendered and not properly withdrawn.

The term “Expiration Date” means 12:00 Midnight,

at the end of the day, New York City time, on December 11, 2023 unless and until we, in our sole discretion, shall have extended

the period of time during which the Offer will remain open, in which event the term “Expiration Date” shall refer to

the latest time and date at which the Offer, as so extended by us, shall expire or unless we terminate the Offer. The term Expiration

Date refers to the specific time and date on which the Offer expires. See Section 15 for a description of our right to extend,

delay, terminate or amend the Offer.

In accordance with Instruction 3 of the Letter of Transmittal,

shareholders desiring to tender Shares must either (i) specify that they are willing to sell their Shares to us at the Purchase

Price (which could result in the tendering shareholder receiving a purchase price per Share as low as $9.50, the low end of the

price range in the Offer, less any applicable withholding taxes and without interest) or (ii) specify the price or prices, not

greater than $11.00 nor less than $9.50 per Share, at which they are willing to sell their Shares to us pursuant to the Offer.

In the event that a shareholder specifies such a purchase price or purchase prices that exceeds the Purchase Price, the Company

will not purchase the Shares of such shareholder. Prices may be specified in multiples of $0.10. Promptly following the Expiration

Date, we will determine the Purchase Price that we will pay for Shares properly tendered and not properly withdrawn, taking into

account the number of Shares tendered and the prices specified, or deemed specified, by tendering shareholders. The Purchase Price

will be a single per Share price, equal to the lowest single purchase price, not greater than $11.00 nor less than $9.50 per Share,

that would allow us to purchase the maximum number of Shares for an aggregate purchase price not exceeding $20 million, or all