Oaktree Specialty Lending Corporation Completes Merger with Oaktree Strategic Income II, Inc.

January 23 2023 - 8:50AM

Oaktree Specialty Lending Corporation (NASDAQ:OCSL) (“OCSL”) is

pleased to announce the closing of the previously announced merger

with Oaktree Strategic Income II, Inc. (“OSI II”), with OCSL as the

surviving company. Based on December 31, 2022 financial

information, the combined company has more than $3.3 billion of

assets on a pro forma basis.

Armen Panossian, Chief Executive Officer and Chief Investment

Officer of OCSL, said, “We are pleased to have completed this

merger and would like to thank all our stakeholders for their

strong support throughout this process. We look forward to

leveraging the benefits provided by the combined company’s greater

scale and financial flexibility while maintaining our strategy to

invest in opportunities that align with Oaktree’s value-driven

investment approach.”

In connection with the merger, former OSI II stockholders will

receive 0.9115 shares of OCSL for each share of OSI II based on the

final exchange ratio, subject to payment of cash in lieu of

fractional shares. As a result of the merger, legacy OCSL

stockholders and former OSI II stockholders own approximately 79.4%

and 20.6%, respectively, of the combined company at closing.

In addition, in connection with the closing of the merger, and

as previously announced, OCSL and Oaktree Fund Advisers, LLC

(“Oaktree”) amended the existing investment advisory agreement to

provide that Oaktree will waive $9.0 million of OCSL’s base

management fees as follows: $6.0 million at a rate of $1.5 million

per quarter (with such amount appropriately prorated for any

partial quarter) in the first year following closing of the merger

and $3.0 million at a rate of $750,000 per quarter (with such

amount appropriately prorated for any partial quarter) in the

second year following closing of the merger.

Houlihan Lokey served as financial advisor and Stradley Ronon

Stevens & Young, LLP served as the legal counsel to the special

committee of OCSL. Keefe, Bruyette & Woods, a Stifel Company,

served as financial advisor and Sullivan & Cromwell LLP served

as the legal counsel to OSI II and its special committee. Kirkland

& Ellis LLP served as the legal counsel to OCSL and

Oaktree.

About Oaktree Specialty Lending Corporation

Oaktree Specialty Lending Corporation (NASDAQ:OCSL) is a

specialty finance company dedicated to providing customized

one-stop credit solutions to companies with limited access to

public or syndicated capital markets. OCSL’s investment objective

is to generate current income and capital appreciation by providing

companies with flexible and innovative financing solutions

including first and second lien loans, unsecured and mezzanine

loans, and preferred equity. OCSL is regulated as a business

development company under the Investment Company Act of 1940, as

amended, and is managed by Oaktree Fund Advisors, LLC, an affiliate

of Oaktree Capital Management, L.P. For additional information,

please visit OCSL’s website at www.oaktreespecialtylending.com.

Forward-Looking Statements

Some of the statements in this press release constitute

forward-looking statements because they relate to future events,

future performance or financial condition. The forward-looking

statements may include statements as to: future operating results

of OCSL and distribution projections; business prospects of OCSL;

and the impact of the merger. In addition, words such as

“anticipate,” “believe,” “expect,” “seek,” “plan,” “should,”

“estimate,” “project” and “intend” indicate forward-looking

statements, although not all forward-looking statements include

these words. The forward-looking statements contained in this press

release involve risks and uncertainties. Certain factors could

cause actual results and conditions to differ materially from those

projected, including the uncertainties associated with (i) changes

in the economy, financial markets and political environment; (ii)

risks associated with possible disruption in the operations of OCSL

or the economy generally due to terrorism, natural disasters or the

COVID-19 pandemic; (iii) future changes in laws or regulations

(including the interpretation of these laws and regulations by

regulatory authorities); (iv) conditions in OCSL’s operating areas,

particularly with respect to business development companies or

regulated investment companies; and (v) other considerations that

may be disclosed from time to time in OCSL’s publicly disseminated

documents and filings. OCSL has based the forward-looking

statements included in this press release on information available

to it on the date of this press release, and OCSL assumes no

obligation to update any such forward-looking statements. Although

OCSL undertakes no obligation to revise or update any

forward-looking statements, whether as a result of new information,

future events or otherwise, you are advised to consult any

additional disclosures that OCSL may make directly to you or

through reports that OCSL in the future may file with the

Securities and Exchange Commission, including annual reports on

Form 10-K, quarterly reports on Form 10-Q and current reports on

Form 8-K.

Contacts

Investor Relations:Michael Mosticchio(212)

284-7869mmosticchio@oaktreecapital.com

Media Relations:Financial Profiles, Inc.Moira Conlon(310)

478-2700mediainquiries@oaktreecapital.com

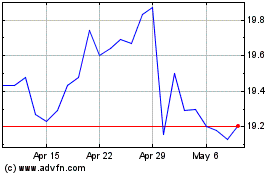

Oaktree Specialty Lending (NASDAQ:OCSL)

Historical Stock Chart

From Oct 2024 to Nov 2024

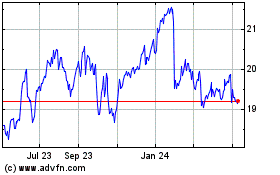

Oaktree Specialty Lending (NASDAQ:OCSL)

Historical Stock Chart

From Nov 2023 to Nov 2024