Post-effective Amendment Filed Solely to Add Exhibits to a Registration Statement (pos Ex)

January 23 2023 - 8:11AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on January 23, 2023

Registration No. 333-267988

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

|

|

|

| Pre-Effective Amendment No. |

|

☐ |

| Post-Effective Amendment No. 1 |

|

☒ |

(Check appropriate box or

boxes)

Oaktree

Specialty Lending Corporation

(Exact Name of Registrant as Specified in Charter)

333 South Grand Avenue, 28th Floor

Los Angeles, CA 90071

(Address of Principal Executive Offices)

(213) 830-6300

(Area Code and Telephone Number)

Mary Gallegly

Oaktree

Specialty Lending Corporation

333 South Grand Avenue, 28th Floor

Los Angeles, CA 90071

(Name and Address of Agent for Service)

Copies to:

|

|

|

| William J. Tuttle

Erin M. Lett

Kirkland & Ellis LLP

1301 Pennsylvania Avenue, NW

Washington, DC 20004

Telephone: (202) 389-5000 |

|

William G. Farrar

Melissa Sawyer

Sullivan & Cromwell LLP

125 Broad Street New

York, NY 10004 Telephone: (212) 558-4000 |

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 to the Registration Statement on Form N-14 (File No. 333-267988) of Oaktree Specialty Lending Corporation (as amended, the “Registration Statement”) is being filed solely for the purpose of updating certain exhibits to the Registration Statement.

Other than Item 16 of Part C of the Registration Statement, no changes have been made to the Registration Statement. Accordingly, this Post-Effective Amendment No. 1 consists only of the facing page, this explanatory note and Part C of the

Registration Statement. The other contents of the Registration Statement are hereby incorporated by reference.

PART C

Other Information

Item 15.

Indemnification.

Section 145 of the DGCL empowers a Delaware corporation to indemnify its officers and directors and specific

other persons to the extent and under the circumstances set forth therein.

Section 102(b)(7) of the DGCL allows a Delaware corporation to eliminate

the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liabilities arising (a) from any breach of the director’s duty of loyalty to the

corporation or its stockholders; (b) from acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (c) under Section 174 of the DGCL; or (d) from any transaction from which the

director derived an improper personal benefit.

Subject to the Investment Company Act or any valid rule, regulation or order of the SEC thereunder,

OCSL’s certificate of incorporation provides that OCSL will indemnify any person who was or is a party or is threatened to be made a party to any threatened action, suit or proceeding whether civil, criminal, administrative or investigative, by

reason of the fact that he or she is or was a director or officer of OCSL, or is or was serving at the request of OCSL as a director or officer of another corporation, partnership, limited liability company, joint venture, trust or other enterprise,

in accordance with provisions corresponding to Section 145 of the DGCL. The Investment Company Act provides that a company may not indemnify any director or officer against liability to it or its security holders to which he or she might

otherwise be subject by reason of his or her willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his or her office unless a determination is made by final decision of a court, by vote of a

majority of a quorum of directors who are disinterested, non-party directors or by independent legal counsel that the liability for which indemnification is sought did not arise out of the foregoing conduct.

In addition, OCSL’s certificate of incorporation provides that the indemnification described therein is not exclusive and shall not exclude any other rights to which the person seeking to be indemnified may be entitled under statute, any bylaw,

agreement, vote of stockholders or directors who are not interested persons, or otherwise, both as to action in his or her official capacity and to his or her action in another capacity while holding such office.

The above discussion of Section 145 of the DGCL and OCSL’s certificate of incorporation is not intended to be exhaustive and is respectively

qualified in its entirety by such statute and OCSL’s certificate of incorporation.

OCSL has obtained primary and excess insurance policies insuring

its directors and officers against some liabilities they may incur in their capacity as directors and officers. Under such policies, the insurer, on OCSL’s behalf, may also pay amounts for which OCSL has granted indemnification to its directors

or officers.

Insofar as indemnification for liability arising under the Securities Act may be permitted to directors, officers and controlling persons of

OCSL pursuant to the foregoing provisions, or otherwise, OCSL has been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a

claim for indemnification against such liabilities (other than the payment by OCSL of expenses incurred or paid by a director, or officer of OCSL in the successful defense of any action, suit or proceeding) is asserted by such director, officer or

controlling person in connection with the securities being registered, OCSL will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such

indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

Item 16. Exhibits.

C-1

|

|

|

| (1)(c) |

|

Certificate of Correction to the Certificate of Amendment to the Registrant’s Restated Certificate of Incorporation (incorporated by

reference to Exhibit (a)(3) filed with the Registrant’s Registration Statement on Form N-2 (File No. 333-146743) filed on June 6, 2008). |

|

|

| (1)(d) |

|

Certificate of Amendment to Registrant’s Restated Certificate of Incorporation (incorporated by reference to Exhibit 3.1 filed with the Registrant’s

Quarterly Report on Form 10-Q (File No. 001-33901) filed on May 5, 2010). |

|

|

| (1)(e) |

|

Certificate of Amendment to the Registrant’s Certificate of Incorporation (incorporated by reference to Exhibit (a)(5) filed with the Registrant’s

Registration Statement on Form N-2 (File No. 333-180267) filed on April 2, 2013). |

|

|

| (1)(f) |

|

Certificate of Amendment to the Registrant’s Certificate of Incorporation (incorporated by reference to Exhibit (a)(5) filed with the Registrant’s

Registration Statement on Form N-2 (File No. 333-180267) filed on April 2, 2013). |

|

|

| (1)(g) |

|

Certificate of Amendment to the Registrant’s Certificate of Incorporation (incorporated by reference to Exhibit 3.7 filed with the Registrant’s

Current Report on Form 8-K (File No. 001-33901) filed on January 20, 2023). |

|

|

| (2) |

|

Fourth Amended and Restated Bylaws of the Registrant (incorporated by reference to Exhibit 3.1 filed with the Registrant’s Form 8-K (File No. 814-00755) filed on January 29, 2018). |

|

|

| (3) |

|

Not applicable |

|

|

| (4) |

|

Agreement and Plan of Merger among Oaktree Strategic Income II, Inc., the Registrant, Project Superior Merger Sub, Inc. and Oaktree Fund Advisors,

LLC (for the limited purposes set forth therein), dated as of September 14, 2022 (incorporated by reference to Exhibit 2.1 filed with the Registrant’s Current Report on Form 8-K (File No. 814-00755) filed on September 15, 2022). |

|

|

| (5)(a) |

|

Form of Common Stock Certificate (incorporated by reference to Exhibit 4.1 filed with the Registrant’s Form 8-A (File No. 001-33901) filed on January 2, 2008). |

|

|

| (5)(b) |

|

Indenture, dated April

30, 2012, between the Registrant and Deutsche Bank Trust Company Americas, as trustee (incorporated by reference to Exhibit (d)(4) filed with the Registrant’s Registration Statement on Form N-2 (File No. 333-180267) filed on July 27, 2012). |

|

|

| (5)(c) |

|

Fourth Supplemental Indenture, dated as of October

17, 2017, between the Registrant and Deutsche Bank Trust Company Americas, as trustee (incorporated by reference to Exhibit 4.1 filed with the Registrant’s Form 8-K (File No. 814-00755)

filed on October 17, 2017). |

|

|

| (5)(d) |

|

Fifth Supplemental Indenture, dated as of February

25, 2020, relating to the 3.500% Notes due 2025, between the Registrant and Deutsche Bank Trust Company Americas, as trustee (incorporated by reference to Exhibit 4.1 filed with the Registrant’s Form 8-K (File

No. 814-00755) filed on February 25, 2020). |

|

|

| (5)(e) |

|

Form of 3.500% Notes due 2025 (included as Exhibit A to Exhibit 5(d) hereto). |

|

|

| (5)(f) |

|

Sixth Supplemental Indenture, dated as of May

18, 2021, relating to the 2.700% Notes due 2027, between the Registrant and Deutsche Bank Trust Company Americas, as trustee (incorporated by reference to Exhibit 4.1 filed with the Registrant’s Current Report on Form 8-K (File No. 814-00755) filed on May 18, 2021). |

|

|

| (5)(g) |

|

Form of 2.700% Notes due 2027 (contained as Exhibit A to Exhibit 5(f) hereto). |

C-2

|

|

|

| (6) |

|

Amended and Restated Investment Advisory Agreement, dated as of March

19, 2021, between the Registrant and Oaktree Fund Advisors, LLC (incorporated by reference to Exhibit 10.1 filed with the Registrant’s Current Report on Form 8-K (File No. 814-00755)

filed on March 19, 2021). |

|

|

| (7) |

|

Not applicable. |

|

|

| (8) |

|

Not applicable. |

|

|

| (9) |

|

Custody Agreement (incorporated by reference to Exhibit 10.1 filed with the Registrant’s Form 10-Q (File

No. 001-33901) filed on January 31, 2011). |

|

|

| (10) |

|

Not applicable |

|

|

| (11) |

|

Opinion and Consent of Kirkland

& Ellis LLP with respect to the legality of shares (incorporated by reference to Exhibit 11 filed with the Registrant’s Registration Statement on Form N-14 (File No. 333-267988)

filed on October 24, 2022). |

|

|

| (12)(a) |

|

Opinion and Consent of Kirkland & Ellis LLP supporting tax matters and consequences to stockholders discussed in the joint proxy statement/prospectus. * |

|

|

| (12)(b) |

|

Opinion and Consent of Sullivan & Cromwell LLP supporting tax matters and consequences to stockholders discussed in the joint proxy statement/prospectus. * |

|

|

| (13) |

|

Amended and Restated Dividend Reinvestment Plan (incorporated by reference to Exhibit 10.1 filed with the Registrant’s Form 8-K (File No. 001-33901) filed on October 28, 2010). |

|

|

| (13)(b) |

|

Administration Agreement, dated as of September

30, 2019 between the Registrant and Oaktree Administrator (incorporated by reference to Exhibit 10.2 filed with the Registrant’s Form 8-K (File No.

814-00755) filed on October 2, 2019). |

|

|

| (13)(c) |

|

Amended and Restated Senior Secured Revolving Credit Agreement, dated as of February

25, 2019, among the Registrant, as Borrower, the lenders party thereto, ING Capital LLC, as administrative agent, ING Capital LLC, JPMorgan Chase Bank, N.A. and Merrill Lynch, Pierce, Fenner

& Smith Incorporated as joint lead arrangers and joint bookrunners, and JPMorgan Chase Bank, N.A. and Bank of America, N.A., as syndication agents (incorporated by reference to Exhibit 10.1 filed with the Registrant’s Current Report on Form 8-K (File No. 814-00755) filed on February 26, 2019). |

|

|

| (13)(d) |

|

Amendment No. 1 to Amended and Restated Senior Secured Revolving Credit Agreement, dated as of December

13, 2019, among the Registrant, as Borrower, the lenders party thereto from time to time and ING Capital LLC, as administrative agent for the lenders thereunder (incorporated by reference to Exhibit 10.1 filed with the Registrant’s Current Report on

Form 8-K (File No. 814-00755) filed on December 17, 2019). |

|

|

| (13)(e) |

|

Amendment No. 2 to Amended and Restated Senior Secured Revolving Credit Agreement, dated as of May

6, 2020, among the Registrant, as Borrower, the lenders party thereto from time to time and ING Capital LLC, as administrative agent for the lenders thereunder (incorporated by reference to Exhibit 10.2 filed with the Registrant’s Form 10-Q (File No. 814-00755) filed on May 7, 2020). |

|

|

| (13)(f) |

|

Incremental Commitment and Assumption Agreement, dated as of October

28, 2020, made by the Registrant, as Borrower, the assuming lender party hereto, as assuming lender, and ING Capital LLC, as administrative agent and issuing bank relating to the Amended and Restated Senior Secured Revolving Credit Agreement, dated as of

February 25, 2019 among Oaktree Specialty Lending Corporation, as Borrower, the lenders party thereto, ING Capital LLC, as administrative agent, ING Capital LLC, JPMorgan Chase Bank, N.A. and Merrill Lynch, Pierce, Fenner & Smith

Incorporated as joint lead arrangers and joint bookrunners, and JPMorgan Chase Bank, N.A. and Bank of America, N.A., as syndication agents (incorporated by reference to Exhibit 10.1 filed with the Registrant’s Current Report on Form 8-K (File No. 814-00755) filed on October 29, 2020). |

|

|

| (13)(g) |

|

Amendment No. 3 to Amended and Restated Senior Secured Revolving Credit Agreement, dated as of December

10, 2020, among Registrant, as Borrower, the lenders party thereto from time to time and ING Capital LLC, as administrative agent for the lenders thereunder (incorporated by reference to Exhibit 10.1 filed with the Registrant’s Current Report on Form

8-K (File No. 814-00755) filed on December 14, 2020). |

C-3

|

|

|

| (13)(h) |

|

Incremental Commitment Agreement, dated as of December

28, 2020, made by Oaktree Specialty Lending Corporation, as Borrower, MUFG Union Bank, N.A., as increasing lender, and ING Capital LLC, as administrative agent and issuing bank relating to the Amended and Restated Senior Secured Revolving Credit Agreement,

dated as of February 25, 2019 among Oaktree Specialty Lending Corporation, as Borrower, the lenders party thereto, ING Capital LLC, as administrative agent, ING Capital LLC, JPMorgan Chase Bank, N.A. and Merrill Lynch, Pierce,

Fenner & Smith Incorporated as joint lead arrangers and joint bookrunners, and JPMorgan Chase Bank, N.A. and Bank of America, N.A., as syndication agents (incorporated by reference to Exhibit 10.1 filed with the Registrant’s Current

Report on Form 8-K (File No. 814-01013) filed on December 29, 2020). |

|

|

| (13)(i) |

|

Amendment No. 4 to Amended and Restated Senior Secured Revolving Credit Agreement and Amendment No.

1 to Amended and Restated Guarantee, Pledge and Security Agreement, dated May

4, 2021, among the Registrant, as borrower, OCSL SRNE, LLC, as subsidiary guarantor, FSFC Holdings, Inc., as subsidiary guarantor, the lenders party thereto, and ING Capital LLC, as administrative agent (incorporated by reference to Exhibit 10.1 filed with

the Registrant’s Form 10-Q (File No. 814-00755) filed on August 4, 2021). |

|

|

| (13)(j) |

|

Incremental Commitment Agreement, dated as of December

10, 2021, made by Oaktree Specialty Lending Corporation, as Borrower, BNP Paribas, as assuming lender, and ING Capital LLC, as administrative agent and issuing bank relating to the Amended and Restated Senior Secured Revolving Credit Agreement, dated as

of February 25, 2019 among Oaktree Specialty Lending Corporation, as Borrower, the lenders party thereto, ING Capital LLC, as administrative agent, ING Capital LLC, JPMorgan Chase Bank, N.A. and Merrill Lynch, Pierce, Fenner & Smith

Incorporated as joint lead arrangers and joint bookrunners, and JPMorgan Chase Bank, N.A. and Bank of America, N.A., as syndication agents (incorporated by reference to Exhibit 10.1 filed with the Registrant’s Current Report on Form 8-K (File No. 814-01013) filed on December 13, 2021). |

|

|

| (13)(k) |

|

Loan Sale Agreement by and between Registrant and FS Senior Funding II LLC, dated as of January

15, 2015 (incorporated by reference to Exhibit 10.2 filed with the Registrant’s Current Report on Form 8-K (File No. 814-00755) filed on March 19, 2021).

|

|

|

| (13)(l) |

|

Amended and Restated Loan and Security Agreement, dated as of January

31, 2018, by and among Registrant, OCSL Senior Funding II LLC (formerly OCSI Senior Funding II LLC), the lenders referred to therein, Citibank, N.A., and Wells Fargo Bank, National Association (incorporated by reference to Exhibit 10.3 filed with the Registrant’s

Current Report on Form 8-K (File No. 814-00755) filed on March 19, 2021). |

|

|

| (13)(m) |

|

First Amendment to the Amended and Restated Loan and Security Agreement by and among the Registrant, as collateral manager, OCSL Senior Funding

II LLC (formerly OCSI Senior Funding II LLC), as borrower, and Citibank, N.A., as administrative agent and sole lender, dated as of May 14, 2018 (incorporated by reference to Exhibit 10.4 filed with the Registrant’s Current Report on Form

8-K (File No. 814-00755) filed on March 19, 2021). |

|

|

| (13)(n) |

|

Second Amendment to the Amended and Restated Loan and Security Agreement by and among Registrant, as collateral manager, OCSL Senior Funding

II LLC (formerly OCSI Senior Funding II LLC), as borrower, and Citibank, N.A., as administrative agent and sole lender, dated as of July 18, 2018 (incorporated by reference to Exhibit 10.5 filed with the Registrant’s Current Report on

Form 8-K (File No. 814-00755) filed on March 19, 2021). |

|

|

| (13)(o) |

|

Third Amendment to the Amended and Restated Loan and Security Agreement by and among Registrant, as collateral manager, OCSL Senior Funding II

LLC (formerly OCSI Senior Funding II LLC), as borrower, and Citibank, N.A., as administrative agent and sole lender, dated as of September 17, 2018 (incorporated by reference to Exhibit 10.6 filed with the Registrant’s Current Report on

Form 8-K (File No. 814-00755) filed on March 19, 2021). |

C-4

|

|

|

| (13)(p) |

|

Fourth Amendment to the Amended and Restated Loan and Security Agreement by and among Registrant, as collateral manager, OCSL Senior Funding

II LLC (formerly OCSI Senior Funding II LLC), as borrower, and Citibank, N.A., as administrative agent and sole lender, dated as of September 20, 2019 (incorporated by reference to Exhibit 10.7 filed with the Registrant’s Current Report

on Form 8-K (File No. 814-00755) filed on March 19, 2021). |

|

|

| (13)(q) |

|

Fifth Amendment to the Amended and Restated Loan and Security Agreement by and among the Registrant, as collateral manager, OCSL Senior Funding

II LLC (formerly OCSI Senior Funding II LLC), as borrower, and Citibank, N.A., as administrative agent and sole lender, dated as of October 27, 2020 (incorporated by reference to Exhibit 10.8 filed with the Registrant’s Current Report on

Form 8-K (File No. 814-00755) filed on March 19, 2021). |

|

|

| (13)(r) |

|

Sixth Amendment to the Amended and Restated Loan and Security Agreement by and among the Registrant, as collateral manager, OCSL Senior Funding

II LLC, as borrower, and Citibank, N.A., as administrative agent and sole lender, dated as of July 2, 2021 (incorporated by reference to Exhibit 10.1 filed with the Registrant’s Current Report on Form

8-K (File No. 814-00755) filed on July 9, 2021). |

|

|

| (13)(s) |

|

Seventh Amendment to the Amended and Restated Loan and Security Agreement by and among the Registrant, as collateral manager, OCSL Senior Funding

II LLC, as borrower, and Citibank, N.A., as administrative agent and sole lender, dated as of July 2, 2021 (incorporated by reference to Exhibit 10.1 filed with the Registrant’s Current Report on Form

8-K (File No. 814-00755) filed on November 22, 2021). |

|

|

| (13)(t) |

|

Letter Agreement, dated as of September

14, 2022, by and between the Registrant and Oaktree Fund Advisors, LLC (incorporated by reference to Exhibit 10.22 filed with the Registrant’s Annual Report on Form 10-K (File No. 814-00755) filed on November 15, 2022). |

|

|

| (14)(a) |

|

Consent of Ernst & Young LLP (Oaktree Specialty Lending Corporation) (incorporated by reference to Exhibit 14(a) filed with Pre-Effective Amendment No. 1 to the Registrant’s Registration Statement on Form N-14 (File No.

333-267988) filed on November 29, 2022). |

|

|

| (14)(b) |

|

Consent of Ernst & Young LLP (Oaktree Strategic Income II, Inc.) (incorporated by reference to Exhibit 14(b) filed with Pre-Effective Amendment No. 1 to the Registrant’s Registration Statement on Form N-14 (File No.

333-267988) filed on November 29, 2022). |

|

|

| (15) |

|

Not applicable |

|

|

| (16) |

|

Power of Attorney (incorporated by reference to the signature page to the Registrant’s Registration Statement on Form N-14 (File No. 333-267988) filed on October 24, 2022). |

|

|

| (17)(a) |

|

Form of Proxy Card of Oaktree Specialty Lending Corporation (incorporated by reference to Exhibit 17(a) filed with the Registrant’s Registration

Statement on Form N-14 (File No. 333-267988) filed on October 24, 2022). |

|

|

| (17)(b) |

|

Form of Proxy Card of Oaktree Strategic Income II, Inc. (incorporated by reference to Exhibit 17(b) filed with the Registrant’s Registration

Statement on Form N-14 (File No. 333-267988) filed on October 24, 2022). |

|

|

| (17)(c) |

|

Consent of Houlihan Lokey Capital, Inc. (incorporated by reference to Exhibit 17(c) filed with Pre-Effective

Amendment No. 1 to the Registrant’s Registration Statement on Form N-14 (File No. 333-267988) filed on November 29, 2022). |

|

|

| (17)(d) |

|

Consent of Keefe, Bruyette and Woods, Inc. (incorporated by reference to Exhibit 17(d) filed with Pre-Effective

Amendment No. 1 to the Registrant’s Registration Statement on Form N-14 (File No. 333-267988) filed on November 29, 2022). |

|

|

| (18) |

|

Filing Fees Table (incorporated by reference to Exhibit 18 filed with the Registrant’s Registration Statement on Form N-14 (File No. 333-267988) filed on October 24, 2022). |

C-5

Item 17. Undertakings.

| (1) |

The undersigned registrant agrees that prior to any public reoffering of the securities registered through the

use of a prospectus which is a part of this registration statement by any person or party who is deemed to be an underwriter within the meaning of Rule 145(c) of the Securities Act, the reoffering prospectus will contain the information called for

by the applicable registration form for the reofferings by persons who may be deemed underwriters, in addition to the information called for by the other items of the applicable form. |

| (2) |

The undersigned registrant agrees that every prospectus that is filed under paragraph (1) above will be

filed as a part of an amendment to the registration statement and will not be used until the amendment is effective, and that, in determining any liability under the Securities Act, each post-effective amendment will be deemed to be a new

registration statement for the securities offered therein, and the offering of the securities at that time will be deemed to be the initial bona fide offering of them. |

C-6

SIGNATURES

As required by the Securities Act of 1933, this registration statement has been signed on behalf of the registrant, in the City of Los Angeles, and State of

California, on the 23rd day of January, 2023.

|

|

|

| OAKTREE SPECIALTY LENDING CORPORATION |

|

|

| By: |

|

/s/ Armen Panossian |

|

|

Armen Panossian |

|

|

Chief Executive Officer |

As required by the Securities Act of 1933, this registration statement has been signed by the following persons in the

capacities and on the dates indicated:

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ Armen Panossian

Armen Panossian |

|

Chief Executive Officer

(Principal Executive Officer) |

|

January 23, 2023 |

|

|

|

| /s/ Christopher McKown

Christopher McKown |

|

Chief Financial Officer and Treasurer

(Principal Financial and Accounting Officer) |

|

January 23, 2023 |

|

|

|

| * John B.

Frank |

|

Director and Chairman |

|

January 23, 2023 |

|

|

|

| * Phyllis R.

Caldwell |

|

Director |

|

January 23, 2023 |

|

|

|

| * Deborah A.

Gero |

|

Director |

|

January 23, 2023 |

|

|

|

| * Craig A.

Jacobson |

|

Director |

|

January 23, 2023 |

|

|

|

| * Bruce

Zimmerman |

|

Director |

|

January 23, 2023 |

|

|

|

| * By: |

|

/s/ Christopher McKown |

|

|

Name: Christopher McKown |

|

|

Title: Attorney-in-fact |

C-7

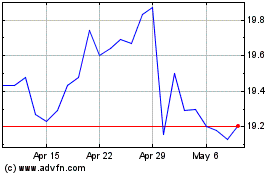

Oaktree Specialty Lending (NASDAQ:OCSL)

Historical Stock Chart

From Oct 2024 to Nov 2024

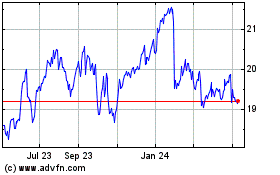

Oaktree Specialty Lending (NASDAQ:OCSL)

Historical Stock Chart

From Nov 2023 to Nov 2024