false000178740000017874002023-08-102023-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 10, 2023

Nkarta, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-39370 |

47-4515206 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

1150 Veterans Boulevard South San Francisco, CA |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (925) 407-1049

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.0001 par value per share |

|

NKTX |

|

The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02 Results of Operations and Financial Condition.

On August 10, 2023, Nkarta, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the second quarter ended June 30, 2023. A copy of the Company’s press release is attached hereto as Exhibit 99.1.

The information in Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be, or be deemed, incorporated by reference in any filings under the Securities Act of 1933, as amended (the “Securities Act”), unless the Company specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under the Securities Act or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Nkarta, Inc. |

|

|

|

|

Date: August 10, 2023 |

|

By: |

/s/ Alyssa Levin |

|

|

|

Alyssa Levin |

|

|

|

Chief Financial and Business Officer |

2

Exhibit 99.1

Nkarta Reports Second Quarter 2023 Financial Results and Corporate Highlights

•NKX101 clinical update highlights encouraging antileukemic activity in patients with AML using fludarabine/cytarabine (Flu/Ara-C) lymphodepletion regimen

•NKX019 clinical data presented at EHA 2023 and ICML 2023 meetings

•Clinical updates planned for NKX019 in the second half of 2023 and NKX101 in the first half of 2024

•Cash and cash equivalents of $302.2 million on June 30, 2023; cash runway anticipated to fund operations into 2025

SOUTH SAN FRANCISCO, Calif., August 10, 2023 -- Nkarta, Inc. (Nasdaq: NKTX), a clinical-stage biopharmaceutical company developing engineered natural killer (NK) cell therapies, today reported financial results for the second quarter ended June 30, 2023.

“Nkarta remains well positioned to advance allogeneic cell therapy and lead the development of groundbreaking natural killer cell therapy candidates,” said Paul J. Hastings, President and CEO of Nkarta. “We continue to learn, improve and explore potential opportunities for our best-in-class platform. In our June 2023 update on NKX101, we reported complete responses in unusually high-risk and heavily pre-treated patients with AML who received a disease-adapted lymphodepletion regimen. In our other co-lead program, NKX019, we continue to evaluate multiple strategies to treat patients with the most aggressive forms of lymphoma. We look forward to providing further updates as we advance both candidates.”

Pipeline Updates

NKX101

•In June 2023, Nkarta reported updated clinical data from its Phase 1 clinical trial evaluating NKX101 in patients with relapsed or refractory acute myeloid leukemia (AML).

•As of data cut-off on June 10, 2023, in patients that received NKX101 after Flu/Ara-C lymphodepletion (LD), 4 of 6 achieved CR/CRi (67% CR/CRi rate) and 3 of 6 achieved a complete response with hematologic recovery (50% CR rate). Two of the 4 reported CR/CRi were MRD (measurable residual disease) negative.

•As of data cut-off on June 10, 2023, in patients that received the highest doses of NKX101 (3 weekly doses at 1 billion or 1.5 billion cells per dose) after fludarabine/cyclophosphamide (Flu/Cy) LD, 4 of 18 achieved CR/CRi (22% CR/CRi rate) and 3 of 18 achieved a complete response with hematologic recovery CR (17% CR rate). There were no CRs at the lower doses of NKX101.

•NKX101 was well tolerated across dose-levels and LD regimens. There were no dose-limiting toxicities observed across all cohorts.

•Flu/Ara-C LD is expected to be the basis of NKX101 development moving forward.

•As previously announced, Nkarta plans to present an update on the ongoing clinical trial of NKX101 in the first half of 2024. The update is expected to include additional patients treated with NKX101 at 1.5 billion cells/dose x 3 dose regimen following Flu/Ara-C LD, as well as longer-term follow up of patients who were in response as of the June 2023 data cut-off.

NKX019

•In June 2023, Nkarta presented preliminary clinical data based on a November 2022 data cut-off from its Phase 1 dose escalation clinical trial of NKX019 in patients with relapsed or refractory non-Hodgkin lymphoma (NHL) at two scientific meetings: an oral presentation at the annual meeting of the European Hematology Association (EHA) and an encore poster presentation at the International Conference on Malignant Lymphoma (17-ICML).

•Nkarta is evaluating the potential for clinical development of NKX019 in non-malignant, B-cell mediated disease.

•As previously announced, Nkarta plans to present updated results from its ongoing clinical trial of NKX019 in the second half of 2023. The update is expected to include patients enrolled in multiple dose expansion cohorts, as well as longer-term follow-up of patients who were in response as of the November 2022 data cut-off.

Other Corporate Highlights

•In July 2023, Nkarta announced the appointment of Alyssa Levin, CPA, CA, as Chief Financial and Business Officer. Ms. Levin will be responsible for leading Nkarta’s corporate finance, business development, information technology, and human resources functions.

Second Quarter 2023 and Recent Financial Highlights

•As of June 30, 2023, Nkarta had cash, cash equivalents, restricted cash, and investments of $302.2 million.

•Research and development (R&D) expenses were $25.1 million for the second quarter of 2023. Non-cash stock-based compensation expense included in R&D expense was $2.1 million for the second quarter of 2023.

2

•General and administrative (G&A) expenses were $11.7 million for the second quarter of 2023. Non-cash stock-based compensation expense included in G&A expense was $2.5 million for the second quarter of 2023.

•Net loss was $33.3 million, or $0.68 per basic and diluted share, for the second quarter of 2023. This net loss includes non-cash charges of $9.2 million that consisted primarily of share-based compensation of $4.6 million and an impairment charge of $4.1 million against right-of-use assets that Nkarta plans to sublease.

Financial Guidance

•Nkarta expects its current cash and cash equivalents will be sufficient to fund its current operating plan into 2025.

About NKX101

NKX101 is an allogeneic, cryopreserved, off-the-shelf cancer immunotherapy candidate that uses natural killer (NK) cells derived from the peripheral blood of healthy adult donors. It is engineered with a chimeric antigen receptor (CAR) targeting NKG2D ligands on tumor cells. NKG2D, a key activating receptor found on naturally occurring NK cells, induces a cell-killing immune response through the detection of stress ligands that are widely expressed on cancer cells. NKX101 is also engineered with a proprietary membrane-bound form of interleukin-15 (IL-15) for greater persistence and activity without exogenous cytokine support. To learn more about the NKX101 clinical trial in adults with AML, please visit ClinicalTrials.gov.

About NKX019

NKX019 is an allogeneic, cryopreserved, off-the-shelf cancer immunotherapy candidate that uses natural killer (NK) cells derived from the peripheral blood of healthy adult donors. It is engineered with a humanized CD19-directed chimeric antigen receptor (CAR) for enhanced tumor cell targeting and a proprietary, membrane-bound form of interleukin-15 (IL-15) for greater persistence and activity without exogenous cytokine support. CD19 is a biomarker for normal and malignant B cells, and it is a validated target for B cell cancer therapies. To learn more about the NKX019 clinical trial in adults with advanced B cell malignancies, please visit ClinicalTrials.gov.

About Nkarta

Nkarta is a clinical-stage biotechnology company advancing the development of allogeneic, off-the-shelf natural killer (NK) cell therapies. By combining its cell expansion and cryopreservation platform with proprietary cell engineering technologies and CRISPR-based genome engineering capabilities, Nkarta is building a pipeline of future cell therapies engineered for deep anti-tumor activity and intended for broad access in the outpatient treatment setting. For more information, please visit the company’s website at www.nkartatx.com.

Cautionary Note on Forward-Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act

3

of 1995, as amended. Words such as "anticipates," "believes," "expects," "intends," “plans,” “potential,” "projects,” “would” and "future" or similar expressions are intended to identify forward-looking statements. Examples of these forward-looking statements include, but are not limited to, statements concerning Nkarta’s expectations regarding any or all of the following: Nkarta’s position, plans, strategies, and timelines for the continued and future clinical development and commercial potential of NK cell therapies, including NKX101 and NKX019; the therapeutic potential, tolerability and safety profile of NK cell therapies, including NKX101 and NKX019; plans and timelines for the future availability and presentation of NKX101 and NKX019 clinical data; potential opportunities and strategies for Nkarta’s platform and product candidates, including NKX101 and NKX019, and Nkarta’s ability to evaluate and exploit such opportunities and strategies; and Nkarta’s expected cash runway. Interim clinical data for NKX101 included in this press release were reported on June 27, 2023 and are subject to the risk that one or more of the clinical outcomes may materially change as patient enrollment continues and more data on existing patients become available.

Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, among others: Nkarta’s limited operating history and historical losses; Nkarta’s lack of any products approved for sale and its ability to achieve profitability; the risk that the results of preclinical studies and early-stage clinical trials may not be predictive of future results; Nkarta’s ability to raise additional funding to complete the development and any commercialization of its product candidates; Nkarta’s dependence on the clinical success of its two lead product candidates, NKX101 and NKX019; that Nkarta may be delayed in initiating, enrolling or completing any clinical trials; competition from third parties that are developing products for similar uses; Nkarta’s ability to obtain, maintain and protect its intellectual property; Nkarta’s dependence on third parties in connection with manufacturing, clinical trials and pre-clinical studies; the complexity of the manufacturing process for CAR NK cell therapies; the availability of components and supplies necessary for the conduct of our clinical trials; and risks relating to the impact on our business of the COVID-19 pandemic or similar public health crises.

These and other risks and uncertainties are described more fully in Nkarta’s filings with the Securities and Exchange Commission (“SEC”), including the “Risk Factors” section of Nkarta’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 11, 2023, and Nkarta’s other documents subsequently filed with or furnished to the SEC. All forward-looking statements contained in this press release speak only as of the date on which they were made. Except to the extent required by law, Nkarta undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

4

Nkarta, Inc.

Condensed Statements of Operations

(in thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

25,122 |

|

|

$ |

21,049 |

|

|

$ |

51,257 |

|

|

$ |

40,617 |

|

General and administrative |

|

|

11,736 |

|

|

|

6,563 |

|

|

|

19,914 |

|

|

|

13,093 |

|

Total operating expenses |

|

|

36,858 |

|

|

|

27,612 |

|

|

|

71,171 |

|

|

|

53,710 |

|

Loss from operations |

|

|

(36,858 |

) |

|

|

(27,612 |

) |

|

|

(71,171 |

) |

|

|

(53,710 |

) |

Other income, net: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

3,570 |

|

|

|

686 |

|

|

|

7,035 |

|

|

|

798 |

|

Other income, net |

|

|

1 |

|

|

|

3 |

|

|

|

34 |

|

|

|

2 |

|

Total other income, net |

|

|

3,571 |

|

|

|

689 |

|

|

|

7,069 |

|

|

|

800 |

|

Net loss |

|

$ |

(33,287 |

) |

|

$ |

(26,923 |

) |

|

$ |

(64,102 |

) |

|

$ |

(52,910 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.68 |

) |

|

$ |

(0.61 |

) |

|

$ |

(1.31 |

) |

|

$ |

(1.38 |

) |

Weighted average shares used to compute

net loss per share, basic and diluted |

|

|

48,970,391 |

|

|

|

43,841,392 |

|

|

|

48,946,018 |

|

|

|

38,446,956 |

|

Nkarta, Inc.

Condensed Balance Sheets

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30,

2023 |

|

|

December 31,

2022 |

|

Assets |

|

|

|

|

|

|

Cash, cash equivalents, restricted cash and investments |

|

$ |

302,224 |

|

|

$ |

354,886 |

|

Property and equipment, net |

|

|

76,094 |

|

|

|

61,908 |

|

Operating lease right-of-use assets |

|

|

41,071 |

|

|

|

45,749 |

|

Other assets |

|

|

9,649 |

|

|

|

10,395 |

|

Total assets |

|

$ |

429,038 |

|

|

$ |

472,938 |

|

Liabilities and stockholders' equity |

|

|

|

|

|

|

Accounts payable, accrued and other liabilities |

|

$ |

20,563 |

|

|

$ |

17,797 |

|

Operating lease liabilities |

|

|

90,497 |

|

|

|

82,934 |

|

Total liabilities |

|

|

111,060 |

|

|

|

100,731 |

|

Stockholders’ equity |

|

|

317,978 |

|

|

|

372,207 |

|

Total liabilities and stockholders’ equity |

|

$ |

429,038 |

|

|

$ |

472,938 |

|

Nkarta Media/Investor Contact:

Greg Mann

Nkarta, Inc.

gmann@nkartatx.com

5

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

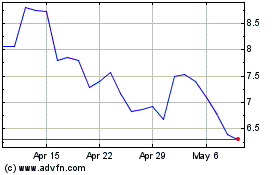

Nkarta (NASDAQ:NKTX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nkarta (NASDAQ:NKTX)

Historical Stock Chart

From Jan 2024 to Jan 2025