UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

SEC FILE NUMBER: 0-24626

CUSIP NUMBER: 216844 100

(Check One): [X] Form 10-K [ ] Form 20-F [ ] Form 11-K [ ] Form 10-Q

[ ] Form 10-D [ ] Form N-SAR [ ] Form N-CSR

For Period Ended: DECEMBER 31, 2008

[ ] Transition Report on Form 10-K [ ] Transition Report on Form 10-Q

[ ] Transition Report on Form 20-F [ ] Transition Report on Form N-SAR

[ ] Transition Report on Form 11-K

For the Transition Period Ended:

READ INSTRUCTION (ON BACK PAGE) BEFORE PREPARING FORM. PLEASE PRINT OR

TYPE.

NOTHING IN THIS FORM SHALL BE CONSTRUED TO IMPLY THAT THE COMMISSION

HAS VERIFIED ANY INFORMATION CONTAINED HEREIN.

If the notification relates to a portion of the filing checked above,

identify the Item(s) to which the notification relates:

PART I - REGISTRANT INFORMATION

Full name of Registrant COOPERATIVE BANKSHARES, INC.

Former Name if Applicable

Address of Principal Executive Office (Street and Number) 201 MARKET STREET

City, State and Zip Code WILMINGTON, NORTH CAROLINA 28401

PART II - RULE 12b-25 (b) AND (c)

If the subject report could not be filed without unreasonable effort or

expense and the registrant seeks relief pursuant to Rule 12b-25(b), the

following should be completed. (Check box if appropriate).

(a) The reasons described in reasonable detail in Part III of this

form could not be eliminated without unreasonable effort or

expense;

[ ] (b) The subject annual report, semi-annual report, transition

report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form

N-CSR, or portion thereof, will be filed on or before the

fifteenth calendar day following the prescribed due date; or

the subject quarterly report or transition report on Form 10-Q

or subject distribution report on Form 10-D, or portion

thereof, will be filed on or before the fifth calendar day

following the prescribed due date; and

(c) The accountant's statement or other exhibit required by Rule

12b-25(c) has been attached if applicable.

PART III - NARRATIVE

State below in reasonable detail why the Form 10-K, 20-F, 11-K, 10-Q,

10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be

filed within the prescribed time period.

(Attach extra sheets if needed.)

Cooperative Bankshares, Inc. ("Bankshares," "we," "our" or the

"Company") determined that it was unable to file its Annual Report on Form 10-K

for the year ended December 31, 2008 (the "Form 10-K") with the U.S. Securities

and Exchange Commission (the "SEC") by the March 31, 2009 due date. This notice

contains selected preliminary unaudited financial information about our results

of operations for such period which is subject to change in our Form 10-K.

We are not able to file a timely Form 10-K because we have not

completed our consolidated financial statements and related disclosures for the

year ended December 31, 2008. The deterioration of the economy in general, the

securities markets as well the real estate markets in which the Company conducts

its business specifically, have resulted in additional accounting complexities

and disclosures and has caused the Company to (1) have a third-party perform an

independent assessment of its loan portfolio and the level of its allowance for

loan losses; (2) have a third-party perform an independent impairment analysis

of its goodwill asset; (3) undertake various actions designed to improve its

capital position and to engage an investment banker and financial advisors to

assist with both this effort as well as to evaluate the Company's strategic

options, including a possible sale or merger of the Company; and (4) determine

the necessity of establishing a valuation allowance with respect to its $13.5

million deferred tax asset.

As previously reported in the Company's Form 8-K filed with the SEC on

March 18, 2009, the Company's wholly owned subsidiary, Cooperative Bank (the

"Bank"), entered into a Stipulation and Consent to the Issuance of an Order to

Cease and Desist with the Federal Deposit Insurance Corporation (the "FDIC") and

the North Carolina Commissioner of Banks (the "Commissioner"), whereby the Bank

consented to the issuance of an Order to Cease and Desist (the "Order")

promulgated by the FDIC and the Commissioner. Under the terms of the Order, the

Bank is required to prepare and submit various written plans and/or reports to

the FDIC and the Commissioner and to undertake a number of other corrective

actions, which actions are more fully discussed in the aforementioned Form 8-K.

The combination of these events has resulted in the Company being

required to expend substantial additional time and effort in order to complete

its financial statements and for its independent auditors to complete their

external audit of the Company's financial statements. The Company currently

anticipates filing its Form 10-K for the year ended December 31, 2008 with the

SEC in April 2009.

PART IV -- OTHER INFORMATION

(1) Name and telephone number of person to contact in regard to this

notification

TODD L. SAMMONS (910) 343-0181

(Name) (Telephone Number)

(2) Have all other periodic reports required under Section 13 or 15(d)

of the Securities Exchange Act of 1934 or Section 30 of the Investment Company

Act of 1940 during the preceding 12 months or for such shorter period that the

registrant was required to file such report(s) been filed? If answer is no,

identify report(s). [ X ] Yes [ ] No

(3) Is it anticipated that any significant change in results of

operations from the corresponding period for the last fiscal year will be

reflected by the earnings statements to be included in the subject report or

portion thereof? [ X ] Yes [ ] No

If so: attach an explanation of the anticipated change, both

narratively and quantitatively, and, if appropriate, state the reasons why a

reasonable estimate of the results cannot be made.

The Company expects that its results of operations for the year ended

December 31, 2008 will be significantly different from the results of operations

for the year ended December 31, 2007. The Company expects to report a loss for

fiscal 2008, currently estimated as of the date hereof to amount to

approximately $30.6 million, compared to net income of $8.1 million for fiscal

2007. The loss for 2008 is primarily a result of an estimated provision for loan

losses of $35.7 million, an estimated loss on investments of $9.6 million (which

includes an other-than-temporary impairment charge on available for sale

securities of $9.1 million), estimated goodwill impairment charges of $5.5

million, and estimated lower interest income on loans primarily as a result of

the repricing downward of the yields on the Bank's loans due to the rate changes

implemented by the Board of Governors of the Federal Reserve System combined

with a substantial increase in nonperforming loans, which are expected to be

$80.5 million at December 31, 2008 compared to $5.6 million at December 31,

2007. Actual results for December 31, 2008 may reflect a larger loss than is

estimated above. In particular, the Company may record a larger provision for

loan losses than as estimated above and/or a valuation allowance on its $13.5

million deferred tax asset. Additionally, because of the Company's cumulative

losses and its liquidity and capital positions, the Bank's state and federal

banking regulators may take additional significant regulatory action against the

Bank that could, among other things, materially adversely impact the Company's

shareholders.

As previously reported, the Company believes that it needs to raise a

minimum of $25.0 million of additional capital, assuming no material increase in

the estimated loss for 2008 and no materials change in the amount and

composition of its risk-weighed assets or its capital position, in order to be

capitalized at the levels required by the Order. Also as previously reported,

the Company has engaged an investment banker and financial advisors to assist

with its capital raising efforts and to evaluate the Company's strategic

options. While these efforts remain ongoing, to date, the Company has neither

raised additional capital, nor entered into a binding agreement to raise any

additional capital, nor agreed to a sale, and no assurances can be made as to

when or whether the foregoing will occur, or if a potential acquiror will be

identified. If the Company is unable to enter into a binding agreement to raise

sufficient capital or an agreement pursuant to which it would be acquired, the

Company, in connection with the issuance of its audited consolidated financial

statements for the year ended December 31, 2008, expects receiving from its

independent auditor an opinion expressing substantial doubt about its ability to

continue as a going concern.

Note Regarding Forward-Looking Statements

This document, as well as other written communications made from time

to time by Cooperative Bankshares, Inc. and subsidiaries and oral communications

made from time to time by authorized officers of the Company, may contain

statements relating to the future results of the Company (including certain

projections, such as earnings projections, necessary tax provisions, and

business trends) that are considered "forward looking statements" as defined in

the Private Securities Litigation Reform Act of 1995 (the "PSLRA"). Such

forward-looking statements may be identified by the use of such words as

"intend," "believe," "expect," "should," "planned," "estimated," and

"potential." For these statements, the Company claims the protection of the safe

harbor for forward-looking statements contained in the PSLRA. The Company's

ability to predict future results is inherently uncertain and the Company

cautions you that a number of important factors could cause actual results to

differ materially from those currently anticipated in any forward-looking

statement. These factors include but are not limited to:

o Recent and future bail-out actions by the government;

o A further slowdown in the national and North Carolina economies;

o A further deterioration in asset values locally and nationwide;

o The volatility of rate sensitive deposits;

o Changes in the regulatory environment;

o Governmental action as a result of our inability to comply with

regulatory orders and agreements;

o Increasing competitive pressure in the banking industry;

o Operational risks including data processing system failures or fraud;

o Asset/liability matching risks and liquidity risks;

o Continued access to liquidity sources;

o Changes in our borrowers' performance on loans;

o Changes in critical accounting policies and judgments;

o Changes in accounting policies or procedures as may be required by the

Financial Accounting o Standards Board or other regulatory agencies;

o Changes in the equity and debt securities markets;

o The effect of additional provisions for loan losses;

o The effect of an impairment charge on our deferred tax asset;

o Fluctuations in our stock price;

o The success and timing of implementation of our business strategies;

o The impact of reputation risk created by these developments on such

matters as business generation o and retention, funding and liquidity;

o The impact of regulatory restrictions on our ability to receive

dividends from our subsidiaries; and

o Political developments, wars or other hostilities may disrupt or

increase volatility in securities or otherwise affect economic

conditions.

The consequences of these factors, any of which could hurt our

business, could include, among others:

o Because of the Company's cumulative losses and its liquidity and

capital positions, the FDIC and/or the Commissioner may take additional

significant regulatory action against the Bank;

o Our inability to continue to operate as a going concern;

o Increased loan delinquencies;

o An escalation in problem assets and foreclosures;

o A decline in demand for our products and services;

o A reduction in the value of the collateral for loans made by us,

especially real estate, which, in turn would likely reduce our

customers' borrowing power and the value of assets and collateral

o associated with our existing loans;

o A reduction in the value of certain assets held by us;

o An inability to meet our liquidity needs;

o An inability to raise capital to comply with the requirements of our

regulators and for continued o support of operations;

o An inability to make or defer payments on our trust preferred

securities; and

o An inability to engage in certain lines of business.

Stockholders are cautioned not to place undue reliance on such

statements, which speak only as of the date of those documents. All subsequent

written and oral forward-looking statements attributable to us or any person

acting on our behalf are expressly qualified in their entirety by the cautionary

statements above. Except to the extent required by applicable law or regulation,

the Company does not undertake any obligation to update any forward-looking

statement to reflect circumstances or events that occur after the date the

forward-looking statements are made.

COOPERATIVE BANKSHARES, INC.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned

thereunto duly authorized.

Date April 1, 2009 By: /s/ Todd L. Sammons

--------------------------------------

Todd L. Sammons

Chief Financial Officer and Interim

President and Chief Executive Officer

|

INSTRUCTIONS: The form may be signed by an executive officer of the registrant

or by any other duly authorized representative. The name and title of the person

signing the form shall be typed or printed beneath the signature. If the

statement is signed on behalf of the registrant by an authorized representative

(other than an executive officer), evidence of the representative's authority to

sign on behalf of the registrant shall be filed with the form.

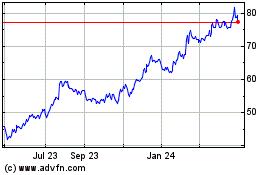

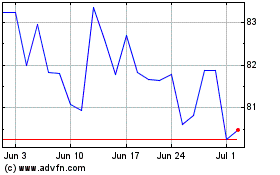

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Sep 2024 to Oct 2024

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Oct 2023 to Oct 2024