Cooperative Bankshares Reports 17% Increase in Third Quarter Earnings

October 20 2005 - 10:31AM

Business Wire

Cooperative Bankshares, Inc. (NASDAQ:COOP) reported net income for

the quarter ended September 30, 2005, of $1,505,870 or $0.34 per

diluted share, an increase of 17.1% over the same quarter last

year. Net income for the quarter ended September 30, 2004 was

$1,286,429, or $0.30 per diluted share. Net income for the nine

months ended September 30, 2005, was $4,044,419 or $0.92 per

diluted share, an increase of 21.5% over the same period last year.

Net income for the nine months ended September 30, 2004 was

$3,328,482 or $0.76 per diluted share. The increase in net income

was mainly due to a rise in net interest income caused primarily by

an increase in loans. Loans increased 35.7% from December 31, 2004

to September 30, 2005. The majority of the loan growth occurred in

construction and land development loans which grew $86.6 million

and commercial real estate loans which grew $39.9 million during

this period. Per share data for 2004 has been adjusted to reflect a

3-for-2 stock split in the form of a 50% stock dividend. The stock

dividend was paid February 24, 2005 to stockholders of record as of

February 8, 2005. Total assets increased 30.1% since December 31,

2004 and at September 30, 2005, were $715.6 million; stockholders'

equity was $49.9 million or $11.60 per share and represented 6.98%

of assets. Cooperative Bankshares, Inc. is the parent company of

Cooperative Bank. Chartered in 1898, Cooperative offers services

through 20 offices in Eastern North Carolina. The Bank's

subsidiary, Lumina Mortgage, Inc., is a mortgage banking firm,

originating and selling residential mortgage loans through four

offices in North Carolina; and offices in North Myrtle Beach, South

Carolina, and Virginia Beach, Virginia. Statements in this news

release that are not historical facts are forward-looking

statements as defined in the Private Securities Litigation Reform

Act of 1995. Such forward-looking statements, which contain the

words "expects", "intends" and words of similar import, are subject

to numerous risks and uncertainties disclosed from time to time in

documents the company files with the Securities and Exchange

Commission, which could cause actual results to differ materially

from the results currently anticipated. Undue reliance should not

be placed on such forward-looking statements. For Additional

Information: A Form 8-K has been filed with the SEC which contains

additional financial information.

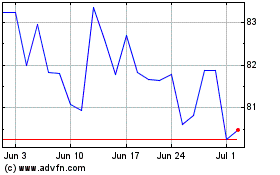

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Aug 2024 to Sep 2024

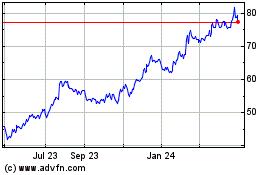

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Sep 2023 to Sep 2024