0001686850

false

0001686850

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2023

MOTUS

GI HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38389 |

|

81-4042793 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

1301

East Broward Boulevard, 3rd Floor

Ft.

Lauderdale, FL |

|

33301 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (954) 541-8000

| Not

Applicable |

| (Former

name or former address, if changed since last report.) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchanged on Which Registered |

| Common

Stock, $0.0001 par value per share |

|

MOTS |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02. Results of Operations and Financial Condition.

Motus

GI Holdings, Inc. (the “Company”) issued a press release on August 11, 2022, disclosing financial information and operating

metrics for its fiscal quarter ended June 30, 2022 and discussing its business outlook. A copy of the Company’s press release is

attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item

7.01. Regulation FD Disclosure.

See

“Item 2.02 Results of Operations and Financial Condition” above.

The

information in this Current Report on Form 8-K under Items 2.02 and 7.01, including the information contained in Exhibit 99.1, is being

furnished to the Securities and Exchange Commission, and shall not be deemed to be “filed” for the purposes of Section 18

of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated

by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set

forth by a specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

The following exhibit is furnished with this report:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized

| |

MOTUS

GI HOLDINGS, INC. |

| |

|

|

| Dated:

August 14, 2023 |

By:

|

/s/

Mark Pomeranz |

| |

Name:

|

Mark

Pomeranz |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Motus GI Reports Second Quarter 2023 Financial

Results

and Provides Corporate Update

| |

■ |

On track to submit planned special 510(k) for Pure-Vu Gen 4 Gastro

and Colon to the FDA in Q4 2023; |

| |

|

|

| |

■ |

Received system wide approval in the Banner Medical Hospital

Network and installed the first system at the Banner Dessert Medical Center in Mesa, Ariz. |

| |

|

|

| |

■ |

The Company continues its exploration process to target strategic

and financing alternatives aimed at accelerating commercialization of the Pure-Vu System and maximizing stockholder value |

FORT LAUDERDALE, FL, August 14, 2023 –

Motus GI Holdings, Inc., (NASDAQ: MOTS) (“Motus GI” or the “Company”), a medical technology company focused

on improving endoscopic outcomes and experiences, today reported its financial results for the second quarter ended June 30, 2023, and

provided a corporate update.

Mark Pomeranz, Chief Executive Officer,

commented, “We remain on track with the planned submission of a special 510(k) to the FDA in the coming months, which will

bring us one step closer to being able to bring our next generation system to the market, expanding upon the Pure-Vu

platform’s capabilities into supporting upper GI procedures. The Pure-Vu Gen 4 Gastro and Colon will offer several

enhancements compared to our current system, resulting in minimized training requirements and reducing the cost of goods by

approximately 50%. In order to support the expected commercial launch of the Pure-Vu Gen 4 Gastro and Colon, pending regulatory

clearance, we are working with well-respected research hospitals both in the U.S. and abroad to generate preclinical and clinical

data that show the value this system offers patients and hospitals. This includes Dr. Carlos Robles-Medranda, Head of the Endoscopy

Service at the Ecuadorian Institute of Digestive Diseases and Director of the Pentax Training Center Ecuador, who recently helped

highlight the Pure-Vu Gen 4 Gastro and Colon system during the 9th Ecuadorian Institute of Digestive Diseases (IECED) Live Endoscopy

Course 2023.”

Second Quarter and Recent Business Highlights

| |

■ |

The Company continues to advance the development of the Pure-Vu

Gen 4 Gastro, which is on track to be submitted to the FDA via the special 510(k) process before the end of this year. A special

510(k), according to FDA guidance, is usually reviewed within 30 days of receipt, rather than the 90 days for a traditional 510(k).

Pure-Vu Gen 4 Gastro brings upper GI capabilities to the new Pure-Vu platform through key enhancements, including a larger and more

powerful suction channel, more efficient irrigation jets, and a smaller profile distal tip that offers enhanced flexibility during

insertion, as well as a reduction in the cost-of-goods of approximately 50% and reduction in the training requirements for both the sales

team and the customer. |

| |

|

|

| |

■ |

The Company is leveraging its Gen 4 technology to enhance the Pure-Vu

device in the colon, called Pure-Vu Gen 4 Colon, which is on track to be submitted to the FDA via the special 510(k) process before

the end of this year. Both the Pure-Vu Gen 4 Gastro and Colon will utilize the same workstation to create an effective platform to

improve visualization in both the upper and lower GI tract to facilitate use in multiple indications. |

| |

|

|

| |

■ |

Article published in the July 2023 issue of Gastroenterology &

Endoscopy News discussed the clinical data from a 12-month study assessing the Pure-Vu® EVS at the University of Minnesota

and Minneapolis VA Medical Center (MVA), which show a hospital-wide improvement in the rate of incomplete bowel prep (IBP) for colonoscopies

during. The article is titled, “Intraprocedural Cleansing System Lowers Rate of Inadequate Bowel Prep,” and was authored

by Tessa Herman, MD, at the University of Minnesota. Topline data from this study were first presented in an oral presentation during

Digestive Disease Week 2023. |

| |

■ |

Pure-Vu

Gen 4 Gastro and Colon system featured during the 9th Ecuadorian Institute of Digestive Diseases

(IECED) Live Endoscopy Course 2023 at the Pentax Learning Center, which is considered one

of the most important digestive medicine annual events held in the Latin American region

with over 1,000 physicians registered. During a live case conducted at the event, the Pure-Vu

system was used to support an underwater endoscopic mucosal resection (UEMR), which is a

polypectomy technique where the colon lumen is filled with distilled water or saline solution

instead of air or carbon dioxide as used in a conventional EMR, and resection is then performed

without submucosal fluid injection. The Pure-Vu Gen 4 system will have a new mode called

“fluid only” that the user can select when needed to support this new use case

of UEMR.

The

Pure-Vu Gen 4 Gastro, which is designed for use in upper gastrointestinal (GI) procedures, was also featured during the IECED Live

Endoscopy Course in a hands-on demonstration area that allowed several hundred physicians to get experience with this next generation

system. |

| |

|

|

| |

■ |

The

Company received approval from the Israeli Ministry of Health, Medical Device Division (“AMAR”) to initiate commercial

sales of the Pure-Vu EVS System in Israel, one of the largest colonoscopy markets in the Middle East. The Company continues to evaluate

potential strategic agreements with medical device companies and distributors who have an existing commercial footprint in Israel

and across Europe. |

| |

|

|

| |

■ |

In

July, the Company announced that Banner Desert Medical Center purchased and initiated the implementation of the Pure-Vu®

System with the aim of improving efficiencies and clinical outcomes of inpatient colonoscopy procedures for patients who present

with inadequate bowel preparation. This is part of the Company’s strategy to get administrative approval in various hospital

systems to help advance the roll out of Pure Vu Gastro and Gen 4 Colon and support our strategic initiatives. |

| |

|

|

| |

■ |

To

date in 2023, the Company has completed two rounds of cost-cutting measures that are expected to reduce operating expense cash burn

by more than 50% in order to aggressively preserve capital. The primary cuts are attributable to reductions in the Company’s

executive management, workforce, and clinical expenses. The Company incurred non-recurring charges related to these cost-cutting

measures of approximately $1.5 million in the first half of 2023. |

Financial

Results for the Second Quarter Ended June 30, 2023

The

Company reported revenue of $113,000 for the second quarter 2023, compared to $185,000 for the same period last year. Revenues for this

past quarter were primarily derived from disposable sleeve sales and limited workstation sales.

For

the three months ended June 30, 2023, the Company reported a net loss attributable to common shareholders of $3.0 million, or $0.40 per

basic and diluted share, which includes the impact of restructuring charges of $0.3 million during the second quarter related to the

strategic restructuring program. This is comparable to a net loss attributable to common shareholders of $5.1 million, or $1.86 per basic

and diluted share, for the same period last year.

During

the second quarter 2023, net cash used in operating activities and for the purchase of fixed assets was $2.6 million compared to $4.6

million for the same period of 2022.

The

Company reported $8.5 million in cash and cash equivalents as of June 30, 2023. This balance included the fully funded credit facility

with Kreos Capital, which has approximately $10.6 million due and outstanding. The Company believes that its cash and cash equivalents

as of June 30, 2023 will be sufficient to allow the Company to fund its commercial, R&D and corporate operations through the first

quarter of 2024.

About

Motus GI

Motus

GI Holdings, Inc. is a medical technology company, with subsidiaries in the U.S. and Israel, providing endoscopy solutions that improve

clinical outcomes and enhance the cost-efficiency associated with the diagnosis and management of gastrointestinal conditions.

For

more information, visit www.motusgi.com and connect with the Company on Twitter, LinkedIn and Facebook.

Forward-Looking

Statements

This

press release contains certain forward-looking statements. Forward-looking statements are based on the Company’s current expectations

and assumptions. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. These statements

may be identified by the use of forward-looking expressions, including, but not limited to, “expect,” “anticipate,”

“intend,” “plan,” “believe,” “estimate,” “potential,” “predict,”

“project,” “should,” “would” and similar expressions and the negatives of those terms, including

without limitation, statements relating to risks related to market and other conditions, risks inherent in the development

and commercialization of potential products, possible or assumed future results of operations, business strategies, potential grow opportunities,

uncertainty in the timing and results of clinical trials or regulatory approvals, maintenance of intellectual property rights or other

risks discussed in the Company’s quarterly and annual reports filed with the Securities and Exchange Commission, and its other

filings with the Securities and Exchange Commission. Prospective investors are cautioned not to place undue reliance on such forward-looking

statements, which speak only as of the date hereof. The Company undertakes no obligation to publicly update any forward-looking statement,

whether as a result of new information, future events or otherwise, except as required by law.

Investor

Contact:

Troy

Williams

LifeSci

Advisors

(518)

221-0106

twilliams@lifesciadvisors.com

Motus

GI Holdings, Inc. and Subsidiaries

Condensed

Consolidated Balance Sheets

(Unaudited,

in thousands, except share and per share amounts)

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

(unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

8,521 |

|

|

$ |

14,042 |

|

| Accounts receivable |

|

|

106 |

|

|

|

59 |

|

| Inventory, current |

|

|

446 |

|

|

|

488 |

|

| Prepaid expenses and other current assets |

|

|

737 |

|

|

|

781 |

|

| Total current assets |

|

|

9,810 |

|

|

|

15,370 |

|

| |

|

|

|

|

|

|

|

|

| Fixed assets, net |

|

|

1,209 |

|

|

|

1,325 |

|

| Inventory, non-current |

|

|

377 |

|

|

|

511 |

|

| Right-of-use assets |

|

|

332 |

|

|

|

428 |

|

| Other non-current assets |

|

|

13 |

|

|

|

13 |

|

| Total assets |

|

$ |

11,741 |

|

|

$ |

17,647 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Shareholders’ (Deficiency) Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Current portion of long-term debt, net of unamortized debt discount

of $151 and $182, respectively |

|

$ |

2,694 |

|

|

$ |

2,532 |

|

| Accounts payable and accrued expenses |

|

|

1,470 |

|

|

|

1,969 |

|

| Operating lease liabilities – current |

|

|

243 |

|

|

|

245 |

|

| Other current liabilities |

|

|

44 |

|

|

|

53 |

|

| Total current liabilities |

|

|

4,451 |

|

|

|

4,799 |

|

| |

|

|

|

|

|

|

|

|

| Convertible note, net of unamortized debt discount of $80 and $108, respectively |

|

|

3,920 |

|

|

|

3,892 |

|

| Long-term debt, net of unamortized debt discount of $70 and $135, respectively |

|

|

3,198 |

|

|

|

4,589 |

|

| Contingent royalty obligation |

|

|

1,056 |

|

|

|

1,212 |

|

| Operating lease liabilities - non-current |

|

|

79 |

|

|

|

178 |

|

| Total liabilities |

|

|

12,704 |

|

|

|

14,670 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and contingent liabilities |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Shareholders’ (deficiency) equity |

|

|

|

|

|

|

|

|

| Common stock $0.0001 par value; 115,000,000 shares authorized; 5,305,441

and 4,659,769 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively |

|

|

1 |

|

|

|

- |

|

| Additional paid-in capital |

|

|

147,770 |

|

|

|

144,328 |

|

| Accumulated deficit |

|

|

(148,734 |

) |

|

|

(141,351 |

) |

| Total shareholders’ (deficiency) equity |

|

|

(963 |

) |

|

|

2,977 |

|

| Total liabilities and shareholders’ (deficiency) equity |

|

$ |

11,741 |

|

|

$ |

17,647 |

|

Motus

GI Holdings, Inc. and Subsidiaries

Condensed

Consolidated Statements of Comprehensive Loss

(Unaudited,

in thousands, except share and per share amounts)

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

113 |

|

|

$ |

185 |

|

|

$ |

169 |

|

|

$ |

205 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue - sales |

|

|

31 |

|

|

|

68 |

|

|

|

40 |

|

|

|

83 |

|

| Cost of revenue - impairment of inventory |

|

|

30 |

|

|

|

- |

|

|

|

195 |

|

|

|

159 |

|

| Research and development |

|

|

759 |

|

|

|

1,413 |

|

|

|

2,213 |

|

|

|

2,688 |

|

| Sales and marketing |

|

|

337 |

|

|

|

1,222 |

|

|

|

1,179 |

|

|

|

2,205 |

|

| General and administrative |

|

|

1,638 |

|

|

|

2,075 |

|

|

|

3,583 |

|

|

|

4,189 |

|

| Total costs and expenses |

|

|

2,795 |

|

|

|

4,778 |

|

|

|

7,210 |

|

|

|

9,324 |

|

| Loss from Operations |

|

|

(2,682 |

) |

|

|

(4,593 |

) |

|

|

(7,041 |

) |

|

|

(9,119 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain (loss) on change in estimated fair value of contingent royalty obligation |

|

|

(64 |

) |

|

|

(92 |

) |

|

|

156 |

|

|

|

(63 |

) |

| Finance expense, net |

|

|

(246 |

) |

|

|

(359 |

) |

|

|

(485 |

) |

|

|

(691 |

) |

| Foreign currency loss |

|

|

(5 |

) |

|

|

(96 |

) |

|

|

(13 |

) |

|

|

(78 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(2,997 |

) |

|

$ |

(5,140 |

) |

|

$ |

(7,383 |

) |

|

$ |

(9,951 |

) |

| Basic and diluted loss per common share: |

|

$ |

(0.40 |

) |

|

$ |

(1.86 |

) |

|

$ |

(1.20 |

) |

|

$ |

(3.72 |

) |

| Weighted average number of common shares outstanding, basic and diluted |

|

|

7,555,903 |

|

|

|

2,758,457 |

|

|

|

6,167,271 |

|

|

|

2,674,536 |

|

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-38389

|

| Entity Registrant Name |

MOTUS

GI HOLDINGS, INC.

|

| Entity Central Index Key |

0001686850

|

| Entity Tax Identification Number |

81-4042793

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1301

East Broward Boulevard

|

| Entity Address, Address Line Two |

3rd Floor

|

| Entity Address, City or Town |

Ft.

Lauderdale

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33301

|

| City Area Code |

(954)

|

| Local Phone Number |

541-8000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

MOTS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

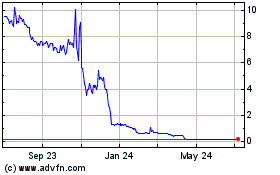

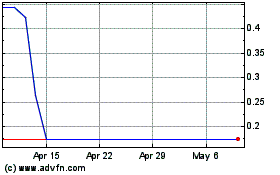

Motus GI (NASDAQ:MOTS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Motus GI (NASDAQ:MOTS)

Historical Stock Chart

From Sep 2023 to Sep 2024