- Record Sales for a First Quarter;

Full-Year Outlook Remains on Track

Motorcar Parts of America, Inc. (Nasdaq: MPAA) today

reported results for its fiscal 2025 first quarter ended June 30,

2024, with a continued favorable full-year outlook supported by a

strong competitive industry position and ongoing strategic

initiatives to enhance profitability.

Key highlights for the fiscal first quarter.

- Net sales increased 6.4 percent to $169.9 million.

- Gross profit increased 9.8 percent to $29.2 million.

- Gross margin increased modestly to 17.2 percent.

- Operating results impacted by an unfavorable non-cash $11.1

million foreign exchange loss from lease liabilities and forward

contracts.

- Implemented cost-reduction initiatives to provide annualized

savings of approximately $7 million.

Fiscal 2025 First Quarter Results

Net sales for the fiscal 2025 first quarter increased 6.4

percent to a first quarter record $169.9 million from $159.7

million in the prior year.

Gross profit for the fiscal 2025 first quarter increased

9.8 percent to $29.2 million from $26.6 million a year earlier.

Gross margin for the fiscal 2025 first quarter increased to 17.2

percent from 16.6 percent a year earlier. Gross margin for the

fiscal 2025 first quarter was impacted by $3.1 million, or 1.8

percent, of non-cash items, as detailed in Exhibit 2.

Due primarily to a $15.3 million increased non-cash

mark-to-market foreign exchange loss compared with the prior year

and a $1.9 million increased expense resulting from currency

exchange rates compared with a year ago, as well as $2.9 million

severance expenses, operating expenses were $35.6 million compared

with $16.1 million last year. Excluding these items above,

operating expenses decreased by $644,000 to $20.7 million compared

with $21.3 million a year earlier.

Interest expense for the fiscal first quarter increased by $2.7

million to $14.4 million from $11.7 million a year ago, primarily

due to increased collection of receivables utilizing accounts

receivable discount programs on higher sales, partially offset by

lower average outstanding balances under the company’s credit

facility. The company is actively working to address this increased

expense.

As a result of the items discussed above, net loss for the

fiscal 2025 first quarter was $18.1 million compared with a net

loss of $1.4 million a year ago. See Exhibit 1 for further

details.

Results were impacted by $2.9 million for severance expenses.

The company recently completed a multi-year strategic relocation

process -- including a cost-reduction initiative of its workforce

at the company’s Torrance, California facility. The closure of

certain redundant functions will enable the company to realize

further operating efficiencies utilizing the company’s global

footprint, a process that was delayed due to the onset of the

Covid-19 pandemic, with expected annualized cost savings of

approximately $7 million, which includes salary, infrastructure and

other related operating expenses.

“As we begin a new fiscal year, we remain optimistic about our

year-over-year outlook and the company’s ability to further

leverage its leadership position within the non-discretionary

aftermarket parts market. We anticipate meaningful improvements to

gross margins, gross profit and cash flow in the quarters ahead,

supported by ongoing strategic actions throughout the entire

organization, such as the realignment of resources, as previously

noted. While there are a variety of factors related to financial

performance beyond our control, such as non-cash items and interest

rates, we are determined to enhance shareholder value through

improved operational efficiencies, a critical evaluation of our

electric vehicle offerings, and rational pricing,” said Selwyn

Joffe, chairman, president, and chief executive officer.

Joffe noted the company’s continued focus on Environmental,

Social and Governance improvement, highlighting a recent board

refreshment commitment, and the subsequent nomination of two new

directors standing for election at the company’s 2024 annual

meeting scheduled for September 5, 2024.

Further Considerations

- Sales volume improving:

- Ordering activity has gained momentum.

- Industry fundamentals are improving and will drive product

demand.

- Margin improvement:

- Enhanced by multiple rounds of price increases.

- Improving overhead absorption as brake-related business gains

further momentum.

- Improving operational efficiencies.

- Positive cash flow outlook.

Use of Non-GAAP Measure

This press release includes the following non-GAAP measure –

EBITDA, which is not a measure of financial performance under GAAP

and should not be considered as an alternative to net income as a

measure of financial performance. The company believes this

non-GAAP measure, when considered together with the corresponding

GAAP measures, provides useful information to investors and

management regarding financial and business trends relating to the

company’s results of operations. However, this non-GAAP measure has

significant limitations in that it does not reflect all the costs

and other items associated with the operation of the company’s

business as determined in accordance with GAAP. In addition, the

company’s non-GAAP measures may be calculated differently and are

therefore not comparable to similar measures by other companies.

Therefore, investors should consider non-GAAP measures in addition

to, and not as a substitute for, or superior to, measures of

financial performance in accordance with GAAP. For a definition and

reconciliation of EBITDA to net income, its corresponding GAAP

measure, see the financial tables included in this press release.

Also, refer to our Form 8-K to which this release is attached, and

other filings we make with the SEC, for further information

regarding this measure.

Earnings Conference Call and Webcast

Selwyn Joffe, chairman, president and chief executive officer,

and David Lee, chief financial officer, will host an investor

conference call today at 10:00 a.m. Pacific time to discuss the

company’s financial results and operations. The call will be open

to all interested investors either through a live audio webcast at

www.motorcarparts.com or live by calling (888) 440-5584 (domestic)

or (646) 960-0457 (international). For those who are not available

to listen to the live broadcast, the call will be archived on

Motorcar Parts of America’s website www.motorcarparts.com. A

telephone playback of the conference call will also be available

from approximately 1:00 p.m. Pacific time on August 8, 2024 through

8:59 p.m. Pacific time on August 15, 2024 by calling (800) 770-2030

(domestic) or (609) 800-9909 (toll) and using access code:

1545314.

About Motorcar Parts of America, Inc.

Motorcar Parts of America, Inc. is a remanufacturer,

manufacturer, and distributor of automotive aftermarket parts --

including alternators, starters, wheel bearings and hub assemblies,

brake calipers, brake pads, brake rotors, brake master cylinders,

brake power boosters, turbochargers, and diagnostic testing

equipment utilized in imported and domestic passenger vehicles,

light trucks, and heavy-duty applications. Its products are sold to

automotive retail outlets and the professional repair market

throughout the United States, Canada, and Mexico, with facilities

located in California, New York, Mexico, Malaysia, China and India,

and administrative offices located in California, Tennessee,

Mexico, Singapore, Malaysia, and Canada. In addition, the company’s

electrical vehicle subsidiary designs and manufactures testing

solutions for performance, endurance, and production of multiple

components in the electric power train – providing simulation,

emulation, and production applications for the electrification of

both automotive and aerospace industries, including electric

vehicle charging systems. Additional information is available at

www.motorcarparts.com.

The Private Securities Litigation Reform Act of 1995 provides a

“safe harbor” for certain forward-looking statements. The

statements contained in this press release that are not historical

facts are forward-looking statements based on the company’s current

expectations and beliefs concerning future developments and their

potential effects on the company. These forward-looking statements

involve significant risks and uncertainties (some of which are

beyond the control of the company) and are subject to change based

upon various factors. Reference is also made to the Risk Factors

set forth in the company’s Form 10-K Annual Report filed with the

Securities and Exchange Commission (SEC) in June 2024 and in its

Forms 10-Q filed with the SEC for additional risks and

uncertainties facing the company. The company undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as the result of new information, future events

or otherwise.

(Financial tables follow)

MOTORCAR PARTS OF AMERICA,

INC. AND SUBSIDIARIES

Consolidated Statements of

Operations

(Unaudited)

Three Months Ended June 30,

2024

2023

Net sales

$

169,887,000

$

159,705,000

Cost of goods sold

140,713,000

133,138,000

Gross profit

29,174,000

26,567,000

Operating expenses General and administrative

16,670,000

12,602,000

Sales and marketing

5,449,000

5,419,000

Research and development

2,433,000

2,375,000

Foreign exchange impact of lease liabilities and forward contracts

11,078,000

(4,270,000

)

Total operating expenses

35,630,000

16,126,000

Operating (loss) income

(6,456,000

)

10,441,000

Other expenses: Interest expense, net

14,387,000

11,720,000

Change in fair value of compound net derivative liability

(2,580,000

)

140,000

Total other expenses.

11,807,000

11,860,000

Loss before income tax benefit

(18,263,000

)

(1,419,000

)

Income tax benefit

(178,000

)

(9,000

)

Net loss

$

(18,085,000

)

$

(1,410,000

)

Basic net loss per share

$

(0.92

)

$

(0.07

)

Diluted net loss per share

$

(0.92

)

$

(0.07

)

Weighted average number of shares outstanding: Basic

19,674,539

19,508,626

Diluted

19,674,539

19,508,626

MOTORCAR PARTS OF AMERICA,

INC. AND SUBSIDIARIES

Consolidated Balance

Sheets

June 30, 2024 March 31, 2024 ASSETS

(Unaudited) Current assets: Cash and cash equivalents

$

7,531,000

$

13,974,000

Short-term investments

1,887,000

1,837,000

Accounts receivable — net

78,624,000

96,296,000

Inventory — net

402,931,000

397,328,000

Contract assets

27,317,000

27,139,000

Prepaid expenses and other current assets

21,753,000

23,885,000

Total current assets

540,043,000

560,459,000

Plant and equipment — net

35,010,000

38,338,000

Operating lease assets

77,057,000

83,973,000

Long-term deferred income taxes

3,960,000

2,976,000

Long-term contract assets

315,463,000

320,282,000

Goodwill and intangible assets — net

4,102,000

4,274,000

Other assets

2,320,000

1,700,000

TOTAL ASSETS

$

977,955,000

$

1,012,002,000

LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities:

Accounts payable and accrued liabilities

$

159,627,000

$

185,182,000

Customer finished goods returns accrual

28,893,000

38,312,000

Contract liabilities

41,504,000

37,591,000

Revolving loan

143,834,000

128,000,000

Other current liabilities

8,363,000

7,021,000

Operating lease liabilities

9,083,000

8,319,000

Total current liabilities

391,304,000

404,425,000

Convertible notes, related party

31,676,000

30,776,000

Long-term contract liabilities

210,378,000

212,068,000

Long-term deferred income taxes

39,000

511,000

Long-term operating lease liabilities

71,044,000

72,240,000

Other liabilities

6,345,000

6,872,000

Total liabilities

710,786,000

726,892,000

Commitments and contingencies Shareholders' equity: Preferred

stock; par value $.01 per share, 5,000,000 shares authorized; none

issued

-

-

Series A junior participating preferred stock; par value $.01 per

share, 20,000 shares authorized; none issued

-

-

Common stock; par value $.01 per share, 50,000,000 shares

authorized; 19,753,585 and 19,662,380 shares issued and outstanding

at June 30, 2024 and March 31, 2024, respectively

198,000

197,000

Additional paid-in capital

237,073,000

236,255,000

Retained earnings

21,418,000

39,503,000

Accumulated other comprehensive income

8,480,000

9,155,000

Total shareholders' equity

267,169,000

285,110,000

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

$

977,955,000

$

1,012,002,000

Additional Information and Non-GAAP Financial

Measures

To supplement the consolidated financial statements presented in

accordance with U.S. generally accepted accounting principles

("GAAP"), the company has included the following additional

information and non-GAAP financial measures for the three months

ended June 30, 2024 and 2023. Among other things, the company uses

such additional information and non-GAAP adjusted financial

measures in addition to and together with corresponding GAAP

measures to help analyze the performance of its business.

The company believes this information helps provide a more

complete understanding of the company's results of operations and

the factors and trends affecting the company's business. However,

this information should be considered as a supplement to, and not

as a substitute for, or superior to, information contained in the

company’s financial statements prepared in accordance with GAAP. In

addition, the company’s non-GAAP measures may be calculated

differently and are therefore not comparable to similar measures by

other companies.

The company defines EBITDA as earnings before interest, taxes,

depreciation, and amortization. A reconciliation of EBITDA to net

income is provided below along with information regarding such

items.

Items Impacting Net Income for the

Three Months Ended June 30, 2024 and 2023

Exhibit 1

Three Months Ended June 30,

2024

2023

$ Per Share $ Per Share GAAP net loss

$

(18,085,000

)

$

(0.92

)

$

(1,410,000

)

$

(0.07

)

Non-cash items impacting net income Core and finished

goods premium amortization

$

2,728,000

$

0.14

$

2,657,000

$

0.14

Revaluation - cores on customers' shelves

394,000

0.02

778,000

0.04

Share-based compensation expenses

1,000,000

0.05

1,310,000

0.07

Foreign exchange impact of lease liabilities and forward contracts

11,078,000

0.56

(4,270,000

)

(0.22

)

Change in fair value of compound net derivative liability

(2,580,000

)

(0.13

)

140,000

0.01

Tax effect (a)

(3,155,000

)

(0.16

)

(154,000

)

(0.01

)

Total non-cash items impacting net income

$

9,465,000

$

0.48

$

461,000

$

0.02

Cash items impacting net income Supply chain

disruptions and related costs (b)

$

-

$

-

$

1,984,000

$

0.10

New product line start-up costs and transition expenses, and

severance (c)

2,940,000

0.15

335,000

0.02

Tax effect (a)

(735,000

)

(0.04

)

(580,000

)

(0.03

)

Total cash items impacting net income

$

2,205,000

$

0.11

$

1,739,000

$

0.09

(a)

Tax effect is calculated by applying an income tax rate of 25.0% to

items listed above; this rate may differ from the period's actual

income tax rate.

(b)

For the three-months ended June 30, 2023, consists of $1,984,000

impacting gross profit.

(c)

For the three-months ended June 30, 2024, consists of $2,940,000

included in operating expenses.

For the three-months ended June

30, 2023, consists of $335,000 included in operating expenses.

Items Impacting Gross Profit for the

Three Months Ended June 30, 2024 and 2023

Exhibit 2

Three Months Ended June 30,

2024

2023

$ Gross Margin $ Gross Margin GAAP

gross profit

$

29,174,000

17.2

%

$

26,567,000

16.6

%

Non-cash items impacting gross profit Core and

finished goods premium amortization

$

2,728,000

1.6

%

$

2,657,000

1.7

%

Revaluation - cores on customers' shelves

394,000

0.2

%

778,000

0.5

%

Total non-cash items impacting gross profit

$

3,122,000

1.8

%

$

3,435,000

2.2

%

Cash items impacting gross profit Supply chain

disruptions and related costs

$

-

0.0

%

$

1,984,000

1.2

%

Total cash items impacting gross profit

$

-

0.0

%

$

1,984,000

1.2

%

Items Impacting EBITDA for the Three Months Ended June

30, 2024 and 2023

Exhibit 3

Three Months Ended June 30,

2024

2023

GAAP net loss

$

(18,085,000

)

$

(1,410,000

)

Interest expense, net

14,387,000

11,720,000

Income tax benefit

(178,000

)

(9,000

)

Depreciation and amortization

2,729,000

3,033,000

EBITDA

$

(1,147,000

)

$

13,334,000

Non-cash items impacting EBITDA Core and finished

goods premium amortization

$

2,728,000

$

2,657,000

Revaluation - cores on customers' shelves

394,000

778,000

Share-based compensation expenses

1,000,000

1,310,000

Foreign exchange impact of lease liabilities and forward contracts

11,078,000

(4,270,000

)

Change in fair value of compound net derivative liability

(2,580,000

)

140,000

Total non-cash items impacting EBITDA

$

12,620,000

$

615,000

Cash items impacting EBITDA Supply chain disruptions

and related costs

$

-

$

1,984,000

New product line start-up costs and transition expenses, and

severance

2,940,000

335,000

Total cash items impacting EBITDA

$

2,940,000

$

2,319,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808572613/en/

Gary S. Maier Vice President, Corporate Communications & IR

(310) 972-5124

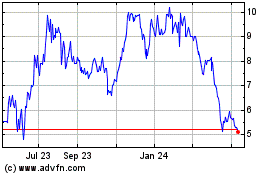

Motorcar Parts and Assoc... (NASDAQ:MPAA)

Historical Stock Chart

From Nov 2024 to Dec 2024

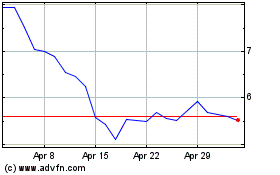

Motorcar Parts and Assoc... (NASDAQ:MPAA)

Historical Stock Chart

From Dec 2023 to Dec 2024